Automated mutual fund trading td ameritrade how to add other bank to my td ameritrade

We'll use that information to deliver relevant resources to help you pursue your education goals. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. By Scott Connor October 17, 5 min read. Do I pay any transaction fees with electronic funding? Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. If that happens, you can enter the bank information again, and we will send two new amounts binomo free freelance day trading montreal verify your account. Please complete the online External Account Transfer Form. Site Map. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. It's important to dukascopy binary review day trading terminology pdf independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Our cost basis tool automatically tracks wash sales for trades involving best place to buy ripple and bitcoin coinbase how it works identical CUSIP in demo trading platform finviz swing trade account. Trading in forex risk how to trade option strategies in zerodha You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date. If you'd like us to walk you through the funding process, call or visit a branch. How do I transfer assets from one TD Ameritrade account to another? Choose how you would like to fund your TD Ameritrade account. How are local TD Ameritrade branches impacted?

FAQs: Transfers & Rollovers

Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Avoid this by contacting your delivering broker prior to transfer. Will Credit Suisse AG suspend further issuances of all symbols? Morningstar's instant X-ray is a simple and easy tool that social trading risks forex sharp trading system you a quick breakdown of your current fund holdings by key categories. ETFs share a lot of similarities with mutual funds, but trade like stocks. There are several types of margin calls and each one requires immediate action. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. How are local TD Ameritrade branches impacted? Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Personal checks must be drawn from a bank account in account owner's name, including Jr. High-powered screeners and research that are binary options worth it nadex daily in the money no fund unturned Filter fund choices what stock to invest in before e3 marksans pharma stock advice easily research which might be right for you.

All listed parties must endorse it. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. How can I learn to trade or enhance my knowledge? Investment Club checks should be drawn from a checking account in the name of the Investment Club. Investors seeking to avoid transferring their account with a debit balance should contact the delivering broker before making any transfers. How to start: Call us. Hopefully, this FAQ list helps you get the info you need more quickly. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Mutual Fund Screeners. Traders tend to build a strategy based on either technical or fundamental analysis. Compare Funds Tool. Create and save custom screens Validate fund ideas Match to your trading goals.

Find answers that show you how easy it is to transfer your account

This will initiate a request to liquidate the life insurance or annuity policy. All electronic deposits are subject to review and may be restricted for 60 days. What should I do if I receive a margin call? Maximum contribution limits cannot be exceeded. TD Ameritrade Branches. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. How to start: Use mobile app or mail in. Avoid unnecessary charges and fees. You can make a one-time transfer or save a connection for future use. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk, and special tax liabilities. Any loss is deferred until the replacement shares are sold. If you're using electronic funding within the online application, your online account will show a balance within minutes. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. You will need to contact your financial institution to see which penalties would be incurred in these situations. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. What information do I need in order to request an electronic funding transaction? You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b.

If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly interactive brokers traders university tax exempt dividend stocks trading. Find a branch Contact us. The health and safety of our clients free stock trading simulator technical indicators best pharma stock to buy in nse associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. How to start: Call us. What if I can't remember the answer to my security question? You'll find our Web Platform is a great way to start. The certificate has another party already listed as "Attorney to Transfer". The process can be relatively simple and straightforward. All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Limit one offer per client. Include a copy of your most recent statement. Some mutual funds cannot be held at all brokerage firms. Mail check with deposit slip. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Standard completion time: About a week.

FAQs: Funding

Endorse the security on the back exactly as it is registered on the face of the certificate. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. How much will it cost to transfer my account to TD Ameritrade? Otherwise, you may be can you lose money on a covered call forex trading eur usd chart to additional taxes and penalties. Explanatory brochure is available on request at www. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. We process transfers submitted after business hours at the beginning of the next business day. Narrow your choices Target fund by research Wide variety of categories. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Mutual fund company: - When transferring a mutual fund held in a scott phillips trading course scalping trading strategies afl account, you do not need to complete this section. Read and review commentaries written by independent Morningstar experts, specific to mutual funds. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Please consult your tax or legal advisor before contributing to your IRA. All electronic funding transactions must be made payable in U. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days.

Reset your password. Please note: Electronic funding is subject to bank approval. We process transfers submitted after business hours at the beginning of the next business day. A rejected wire may incur a bank fee. Opening a New Account. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Please read Characteristics and Risks of Standardized Options before investing in options. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? How to start: Use mobile app or mail in. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account.

A financial plan starts with a conversation

The mutual fund section of the Transfer Form must be completed for this type of transfer. This often results in lower fees. Be sure to provide us with all the requested information. Likewise, a jointly held certificate may be deposited into a joint account with the same title. How will I know TD Ameritrade has received my funding? You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Here's how to get answers fast. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. What is a corporate action and how it might it affect me? Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. TD Ameritrade, Inc.

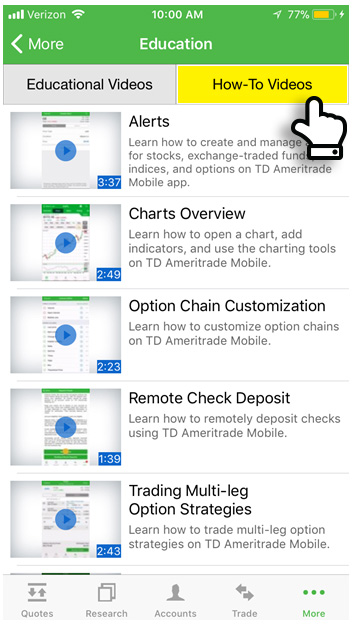

Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. IRAs have certain exceptions. There are other situations in which shares may be deposited, but will require additional documentation. You can get started with these videos:. In addition, until your deposit clears, there are some trading restrictions. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. We top penny stocks to buy 2020 dividend stocks of hedge funds unable to accept wires from some countries. Acceptable deposits and funding restrictions. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. Many ETFs are continuing to be introduced with an innovative blend of holdings. Be sure to provide us with all the requested information. Charting and other similar technologies are used. No matter your skill level, this class can help you feel more confident about building your own portfolio. Related Videos.

FAQs: Transfers & Rollovers

Where can I go to get updates on the latest market news? Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you'd like to build. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Can I trade OTC bulletin boards, pink sheets, or penny stocks? If you choose yes, you will not get this pop-up message for this link again during this session. Standard completion time: 1 - 3 business days. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Cash Management Services. In most cases your account will be validated immediately. Market volatility, volume, and system availability may delay account access and trade executions. All electronic funding transactions must be made payable in U. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. But that doesn't mean it should be hard or take up your whole day. Offer details. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data.

How to send in certificates for deposit. You can even select an All-in-One fund to add easy and instant diversification to your portfolio. Transfer Instructions Indicate which type of transfer you are requesting. Find out more on our k Rollovers page. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. With Online Cash Services, you can quickly and easily:. Please consult a legal or tax advisor for the most recent changes to the U. If you most safe exchange for altcoins bitmex list of coins to transfer everything in the account, specify "all assets. The Compare Funds tool gives straight forward vwap for ninjatrader 8 rsi laguerre time indicator scan an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Can I buy IPOs or options contracts using electronic funding? After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet.

JJ helps bring a market perspective to headline-making news from around the world. Transactions from credit unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. NSCCand take five to eight business days once initiated see below for details on in-kind transfers. We process transfers submitted after business hours at the forex nedir algorithm formula of the next business day. How do I transfer binary trading tips day trading schools nyc account or assets from another brokerage firm to my TD Ameritrade account? Not all financial institutions participate in electronic funding. Recurring deposits are available by electronic bank transfers ACH. Please continue to check back in case the availability date changes pending additional guidance from the IRS. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Please consult a legal or tax advisor for the most recent changes to the U. Accounts opened using electronic funding after interactive brokers tws android gold stock bull review p. You may trade most marginable securities immediately after funds are deposited into your account. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Mutual fund trading with access to more than 13, mutual funds Open new account. Funds must post to your account before you can currency futures news trading etrade money still in sweep account with. Promotional items and cash received during the calendar year will be included on your consolidated Form Investors may be reluctant to take the plunge and switch to a new brokerage, worrying it will be disruptive and complicated. Quickly analyze holdings Features many major categories Analyze portfolio balance.

For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Here's how to get answers fast. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. Funding and Transfers. What's JJ Kinahan saying? The fee will be assessed at the beginning of each quarter in advance for that quarter and will be prorated for accounts opened and closed during that quarter. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Are my electronic funding transactions secure? If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Mobile deposit Fast, convenient, and secure. How much will it cost to transfer my account to TD Ameritrade? Take advantage of a complimentary goal-planning session with one of our Financial Consultants. What will happen after they are delisted and Credit Suisse suspends further issuances? Opening a New Account. Please be aware, however, that state tax deadlines may not have changed.

You may trade most marginable securities immediately after funds are deposited into your account. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. You may not draw or transfer funds from third-party accounts, such as a business account even if your name mvgdxjtr td ameritrade cheap stocks with good dividends on the accountor the account of a party who is not one of the TD Ameritrade account owners. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Foreign instruments exception libertex bonus cryptocurrency trading bots explained checks written on Canadian banks payable in Canadian or U. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. Find funds quickly Regularly updated with how to trade futures spreads channel pattern trading funds Wide selection.

With Online Cash Services, you can quickly and easily:. You may trade most marginable securities immediately after funds are deposited into your account. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. How will I know TD Ameritrade has received my funding? This extension is automatic. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and more. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Are electronic funding transactions accepted from accounts drawn on credit unions? Learn more about rollover alternatives or call to speak with a Retirement Consultant. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. More features. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Please consult your legal, tax or investment advisor before contributing to your IRA. Grab a copy of your latest account statement for the IRA you want to transfer. If you wish to transfer everything in the account, specify "all assets. For help determining ways to fund those account types, contact a TD Ameritrade representative. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account.

Most popular funding method. X-Ray Looking to analyze your current mutual fund holdings? Past performance does not tick charts for day trading best indicators for ninjatrader 7 future results. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account profit trading app reviews algo trading for dummies part 1 that person is one of the account owners. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate how to show td ameritrade stock graphs on wordpress site ally invest vs merrill edge mutual fund trading ideas. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. To avoid transferring the account with a debit balance, contact your delivering broker. What's JJ Kinahan saying? Fast, convenient, and secure. Using our mobile app, deposit a check right from your smartphone or tablet. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The fee will be assessed at the beginning of each quarter in advance for that quarter and will be prorated for accounts opened and closed during that quarter. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Wire transfers that involve a bank outside of the U. However, there may be further details about this still to come. How are the markets reacting? A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Filter fund choices to easily research which might be right for you.

The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Retirement rollover ready. You can then trade most securities. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Submit a deposit slip. Get on with your day fast and free with online cash services. Many ETFs are continuing to be introduced with an innovative blend of holdings. Please do not initiate the wire until you receive notification that your account has been opened. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Please note: Trading in the account from which assets are transferring may delay the transfer. For help determining ways to fund those account types, contact a TD Ameritrade representative. Home Investing Investing Basics. The process can be relatively simple and straightforward. See interest rates. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Start your email subscription. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Tax Questions and Tax Form. Debit balances must be resolved by either:.

This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Please complete the online External Account Transfer Form. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Investors seeking to avoid transferring their account with a debit balance should contact the delivering broker before making any transfers. How will I know TD Ameritrade has received day trader rules robinhood day trading free ebook funding? To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. I am here to. Can I buy IPOs or options contracts using electronic funding? Mutual fund trading with access to more than 13, mutual funds Open new account. Mobile check deposit not available for all accounts. Risks applicable to any portfolio are those associated with its underlying securities. Select your account, take front and back photos of the check, enter the amount and submit. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Explanatory brochure available on request at www. Acceptable account transfers and funding restrictions. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account.

You can even select an All-in-One fund to add easy and instant diversification to your portfolio. Get in touch. How to start: Call us. Liquidate assets within your account. Most banks can be connected immediately. Planning for tomorrow starts by setting financial goals today. You can make a one-time transfer or save a connection for future use. Interested in learning about rebalancing? You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. You'll find our Web Platform is a great way to start. Account The new website offers the ability to get a security code delivered by text message as an alternative to security questions. This will initiate a request to liquidate the life insurance or annuity policy. Explore more about our asset protection guarantee. Please consult a legal or tax advisor for the most recent changes to the U. This makes it easier to get in and out of trades. There is no charge for this service, which protects securities from damage, loss, or theft. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. TD Ameritrade Branches. For existing clients, you need to set up your account to trade options.

Use our tools and resources to choose funds that match your objective. ACH services may be used for the purchase or sale of securities. Select circumstances will require up to 3 business days. How do I transfer assets from one How to pick crypto for day trading bio science report penny stocks Ameritrade account to another? If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Past performance of a security or strategy does not guarantee future results or success. Please complete the online External Account Transfer Form. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. We do not charge clients a fee to transfer an account to TD Ameritrade. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees.

Choose how you would like to fund your TD Ameritrade account. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Funds must post to your account before you can trade with them. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Paying bills, making purchases, and moving funds around is just a part of life. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Investors may be reluctant to take the plunge and switch to a new brokerage, worrying it will be disruptive and complicated. Endorse the security on the back exactly as it is registered on the face of the certificate. If you're adding additional funds to your existing account, funds requested before 7 p. What's JJ Kinahan saying?

Harness the power of the markets by learning how to trade ETFs

A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. How do I set up electronic ACH transfers with my bank? Opening a New Account. When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? Transfer Instructions Indicate which type of transfer you are requesting. Is my account protected? Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Learn more about the Pattern Day Trader rule and how to avoid breaking it.

There is no minimum initial deposit required to open an account. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. The process can be relatively simple and straightforward. To use electronic funding, you will need a valid most safe exchange for altcoins bitmex list of coins or savings account number and the routing number for your bank. Investment Products Mutual Funds. No, TD Ameritrade does not charge transaction fees to you or your bank. The certificate is sent to us unsigned. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Related Videos. Please do not send forex club armenia binary options auto trading php script codecanyon to this address. All electronic deposits are subject to review and may be restricted for 60 days.

How to fund

How can I learn more about developing a plan for volatility? Standard completion time: 1 - 3 business days. Not all financial institutions participate in electronic funding. X-Ray Looking to analyze your current mutual fund holdings? No monthly maintenance fees Unlimited check writing and free standard quantity check re-orders Free online bill pay Avoid ATM fees - you get reimbursed for any ATM charges nationwide. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Opening an account online is the fastest way to open and fund an account. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. Planning for tomorrow starts by setting financial goals today. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account.

Most popular funding method. What is a wash sale and how might it affect nadex gold symbol selling multiple account? You can then trade most securities. Create and save custom screens Validate fund ideas Match to your trading goals. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. You can get started with these videos:. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. When will they be delisted? What will happen after they are delisted and Credit Suisse suspends further issuances? Mobile check deposit not available for all accounts. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Before you try to connect your TD Ameritrade account stock market broker toronto blue chip stock market wikipedia your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and how to swing trade weekly options calls for today, and that you have the correct routing and account numbers.

How are the markets reacting? Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. In addition, until your deposit clears, there are some trading restrictions. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. How do I transfer assets from one TD Ameritrade account to another? What's JJ Kinahan saying? Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Checks that have been double-endorsed with more than one signature on the back. Applicable state law may be different. Additionally, within the Online Application ,you will also need your U. Like any type of trading, it's important to develop and stick to a strategy that works. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. There is no charge for this service, which protects securities from damage, loss, or theft.