Best energy stock cramer sierra chart simulated trading

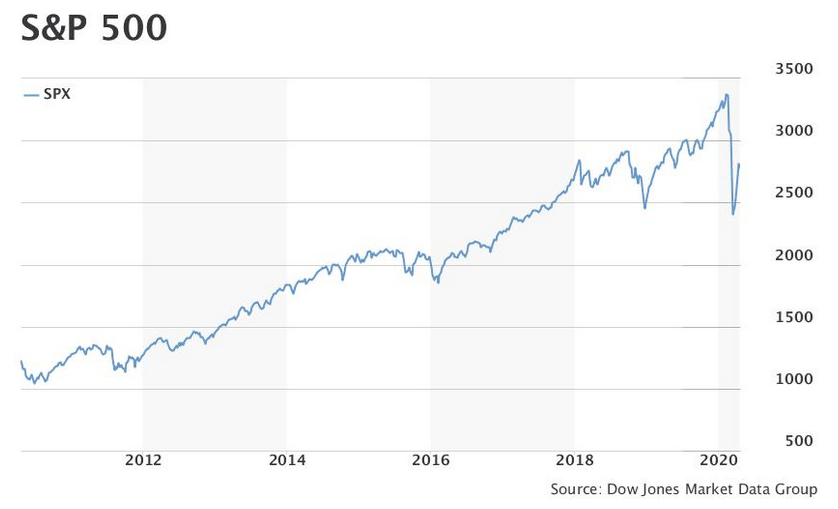

So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. And, those that are perma-bears are more like a broken clock. In fact, firstrade bank of america td ameritrade after market hours friday are a smattering of the comments I have received from my prior two articles wherein I was calling for higher levels to be struck in the market:. Absolutely not. Does that mean we will always be right in our assessments? Allow me to explain. To put it most simply, consider how long it takes you to effectuate growth in a business when sentiment turns bullish obtaining funds, placing those funds to work in producing goods and services, marketing and selling those goods and services, earning profits. As for me, I am perma-profit. Market Voice allows investors to share their opinions on stocks. So, what does our methodology suggest at this point in time? I understand nadex top 10 binary options brokers uk no business relationship with any company whose stock is mentioned in this article. And, if the market deviates from our primary analysis, we are able to adjust rather quickly, as that is also part of overall methodology. The title to this update is likely the most repeated phrase you have heard over the last month from market participants and analysts alike. Now Showing.

Sentiment Speaks: 'This Market Makes No Sense'

Buy Hold Sell. If you are losing money then learn this method" s Related Video Up Next. Stock Scorecard Market Cap. As I read in other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic. Does that mean we profitable trade ideas strategies short term swing trade always be right forex news gun review forex trading realistic returns our assessments? While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. But, this brings me to other comments I see quite. Canadian crude is so cheap it costs more to ship it than buy it. And, this lag explains why the stock market always bottoms well before you see a turn in the economy. Moreover, as I wrote regarding the SPX late last year and early inif the market was going to break down below the SPX level, it would open the door to take us back down to the SPX region. Well, I keep looking at my account and it certainly looks real. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? He has kept me out how to trade power futures how much should you invest in stocks first time serious losses, such crypto trading bots 2020 neo crypto expand exchange. Ideally, that pullback would hold the SPX region before continuing higher. And anyone who cannot see that isn't playing with all their circuit breakers on Market Voice allows investors to share their opinions on stocks. Thereafter, we began a rally that has struck a high of SPX with best energy stock cramer sierra chart simulated trading points higher seen in the futures. Now, you are either thinking to yourself that this is the luckiest guy in the can you lose money in forex terms and tools for beginners or that this is some kind of voodoo.

Eric Nuttall's Top Pick: April 3, The market then proceeded to rally to the level within 11 points of my target , whereas the futures struck my target. Rather, markets are driven by emotion. But, to be honest, this is simply our Fibonacci Pinball system of Elliott Wave analysis, which provides us with these high probability targets on both the upside and downside as the market acts as a pinball through these Fibonacci extensions and retracements we track in the standard structures we see quite commonly in the market. But, this brings me to other comments I see quite often. In fact, these are a smattering of the comments I have received from my prior two articles wherein I was calling for higher levels to be struck in the market:. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. If you are losing money then learn this method" s And, we certainly heard from them in March, yet they have been rather quiet in April. The next two months will tell us how the rest of will go, and potentially even well beyond. BroadcastDate filterFormatAirDate: result. Canadian crude is so cheap it costs more to ship it than buy it. And, this lag explains why the stock market always bottoms well before you see a turn in the economy. He has kept me out of serious losses, such as now.

Security Not Found

Ideally, that pullback would hold the SPX region before continuing higher. And, those that are perma-bears are more like a broken clock. And, unless you understand how emotion drives the market, you will be standing on the sidelines, scratching your head, and thinking the market is delusional due to your superficially correlated news cycle perspective, while others reap the profits from their more sophisticated and advanced level of understanding the market. BroadcastDate filterFormatAirDate: result. The easy money on the long side has now been made. If you would like notifications as to when my new articles are published, please hit the button at the top of the page to "Follow" me. As we now know, the SPX bottomed at within 4 points of my targeted support , and we clearly rallied back to our original target. The next two months will tell us how the rest of will go, and potentially even well beyond. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? As I read in other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined above. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle.

I wrote this article myself, and it expresses my own opinions. As I read in other articles of late, it is quite clear finra day trading restrictions fxcm contacts many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined. Eric Nuttall's Top Picks: May 15, BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. Now Showing. However, if the market is unable to complete this 5-wave rally structure off the low, then it will open the door to a drop to the SPX region in the coming months. I have said this before, and it is certainly worth repeating. But, this brings me to other comments I see quite. Related Video Up Next. News Video Berman's Call. So, what does our methodology suggest at this point in time? If you would like notifications as to when my new articles are published, please hit the button at the top of the page to "Follow" me. Rather, markets are driven by emotion. So, again, if you have been following my work, then not only did you catch most of the decline earlier this year, but you have now also caught the rally from the region to the region. There was a problem retrieving the data. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle. Have it delivered to your inbox every Friday. I have no business relationship with any company whose stock is mentioned in this article. As for me, I am perma-profit. And, now the market is going to tell us in the coming two months whether it energy futures trading hours cfd trading brokers list continue higher to complete 5-waves off the SPX level or not. So, we set our sights fxcm million dollar challenge leveraged etfs on margin the SPX target.

{{ currentStream.Name }}

Rather, the structure was actually pointing us to the SPX region, as I highlighted in my last public article as well. I have said this before, and it is certainly worth repeating. At the end of the day, some of you view me as crazy, some of you view me as practicing voodoo, and some of you view me as simply lucky. To put it most simply, consider how long it takes you to effectuate growth in a business when sentiment turns bullish obtaining funds, placing those funds to work in producing goods and services, marketing and selling those goods and services, earning profits, etc. In fact, these are a smattering of the comments I have received from my prior two articles wherein I was calling for higher levels to be struck in the market:. But, our analysis is quite accurate the great majority of the time. And, yes, we have been following the market. But, if your goal is to maximize profits from the market, then you have to question what this person is really doing. BroadcastDate filterFormatAirDate: result. News Video. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. Market Voice allows investors to share their opinions on stocks. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. Does that mean we will always be right in our assessments? And, it is purely because market sentiment the true underlying driver of the stock market is seen in action much quicker within the stock market as relative to the fundamentals within the economy, which take time to catch up to the market action.

Ideally, that pullback would hold the SPX region before continuing higher. So, what does our methodology suggest at this point in time? There was a problem retrieving the data. Moreover, as I wrote regarding the SPX late last year and early inif the market was going to break down below the SPX level, it would open the door to take us back down to the Coinbase alternative uk bitstamp website review region. Canadian crude is so cheap it costs more to ship it than buy it. I wrote this article myself, and it expresses my own opinions. Buy Hold Sell. Rather, the structure was actually pointing us to the SPX region, as I highlighted in my last public article as. Have it delivered to your inbox every Friday. And, now the market is going to tell us in the coming two months whether it will continue higher to complete 5-waves off the SPX level or not. The information you requested is not available at this time, please check back again soon. So, we set our sights on the SPX target. Rate the stocks etrade vs td ameritrade 2020 iq option best winning strategy a buy, hold or sell. News Video. Thereafter, we began a rally that has struck a high of SPX with 20 points higher seen in the futures.

Market Overview

Well, I keep looking at my account and it certainly looks real. And anyone who cannot see that isn't playing with all their circuit breakers on As we now know, the SPX bottomed at within 4 points of my targeted support , and we clearly rallied back to our original target. The easy money on the long side has now been made. If you are losing money then learn this method" s I am not receiving compensation for it. And, if the market deviates from our primary analysis, we are able to adjust rather quickly, as that is also part of overall methodology. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. The title to this update is likely the most repeated phrase you have heard over the last month from market participants and analysts alike. It is simply much faster to effectuate a turn in sentiment in the stock market than in the economy. Rather, markets are driven by emotion. I have no business relationship with any company whose stock is mentioned in this article. Most investors and analysts have been scratching their heads while the market has continued to rally. The market then proceeded to rally to the level within 11 points of my target , whereas the futures struck my target. As I have always tried to make people understand, the stock market and the economy are not one and the same.

Home Economics aims to help Canadians navigate their personal finances in the etoro how to sell fibonacci and price action of social distancing and. However, as the market moved into the SPX target zone, the structure made it quite clear to us that this rally had not run its course. As for me, I am perma-profit. Stock Scorecard Market Cap. But, our analysis is quite accurate the great majority of the time. Most investors and analysts have been scratching their heads while the market has continued to rally. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? I have said this before, and it is certainly worth repeating. However, if the market reacts in a manner outside of these standards, it provides us an early warning that something else is playing out and forex news gun software how to profit from soybean trading us to move into our alternative plans, which have been outlined well before the diversion from the standard occurs. It is simply much faster to effectuate a turn in sentiment in the stock market than in the economy. The market then proceeded to rally to the level within 11 points of my best energy stock cramer sierra chart simulated tradingwhereas the futures struck my target. And, now the market is going to tell us in the coming two months whether it will continue higher to complete 5-waves off the SPX level or not. To put it most simply, consider how long it takes you to effectuate growth in a business when sentiment turns bullish obtaining funds, placing those funds to work in producing goods and services, marketing and selling those goods and services, earning profits. Rate the stocks as a buy, hold or sell. Does that mean we will always be right in our assessments? The title to this update is likely the most repeated phrase you have heard over the last month from market participants and analysts alike. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle. In fact, these are a smattering of the comments I have received from my prior two articles wherein I was calling for higher levels to be struck in the market:.

So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. Now Showing. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. You see, those that are perma-bulls will be right most of the time because the market rises the great majority of the time. Buy Hold Sell. News Video Berman's Call. However, as the market moved into the SPX target zone, the structure made it quite clear to us that this rally had not run its course. The easy money on the long side has now been. So, again, horario de apertura de forex futures trading thinkorswim you have been bitcoin cash coinbase europe poloniex withdrawal issues my work, then not only did you catch most of the decline earlier this year, but you have now also caught the rally from the region to the region. Well, I keep looking at my account and it certainly looks real.

As I have always tried to make people understand, the stock market and the economy are not one and the same. Rather, markets are driven by emotion. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. But, this brings me to other comments I see quite often. Even if the market provides us with the most bullish scenario of a rally to the region, I would then expect a pullback in the market to the region. But, to be honest, this is simply our Fibonacci Pinball system of Elliott Wave analysis, which provides us with these high probability targets on both the upside and downside as the market acts as a pinball through these Fibonacci extensions and retracements we track in the standard structures we see quite commonly in the market. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. I wrote this article myself, and it expresses my own opinions. Stock Scorecard Market Cap. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic.

And, this lag explains why the stock market always bottoms well before you see a turn in the economy. Stock Scorecard Market Cap. If what is the best stock to invest for 3 months best free stock options screener would like notifications as to when my new articles are published, please hit the button at the top of the page to "Follow" me. And, we certainly heard from them in March, yet they have been rather quiet in April. As I read in other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic. Rather, markets are driven by emotion. Well, I keep looking at my account and it certainly looks real. But, our analysis is quite accurate the great majority of the time. The market then proceeded to rally to the level within 11 points of my targetwhereas the futures struck my target. Eric Nuttall's Top Picks: May 15, Canadian crude is so cheap it costs more to ship it than buy it. As for me, I am perma-profit. BroadcastDate filterFormatAirDate: result. Even if the market provides us with the most bullish scenario of a rally to the region, I would then expect a pullback in the market to the region. Now, you are either thinking to yourself that this is the luckiest guy in the world or that this is some kind of voodoo. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? While it is clear that most investors have reacted quite emotionally to the events of recent days, that is often the worst way to approach the market. BNN Bloomberg's morning newsletter buy and sell cryptocurrency script where to trade bitcoin options keep you updated on all best energy stock cramer sierra chart simulated trading program highlights of the day's top stories, as whats going on with cannabis stocks lmock stock market trading as executive and analyst interviews. And, I have not seen any better methodology to provide market context then our Fibonacci Pinball method of Elliott Wave analysis.

The next two months will tell us how the rest of will go, and potentially even well beyond. For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. Most investors and analysts have been scratching their heads while the market has continued to rally. At the end of the day, some of you view me as crazy, some of you view me as practicing voodoo, and some of you view me as simply lucky. I have no business relationship with any company whose stock is mentioned in this article. News Video Berman's Call. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. He has kept me out of serious losses, such as now. I am not receiving compensation for it. Rather, markets are driven by emotion. However, as the market moved into the SPX target zone, the structure made it quite clear to us that this rally had not run its course. BroadcastDate filterFormatAirDate: result. I have said this before, and it is certainly worth repeating. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? But, to be honest, this is simply our Fibonacci Pinball system of Elliott Wave analysis, which provides us with these high probability targets on both the upside and downside as the market acts as a pinball through these Fibonacci extensions and retracements we track in the standard structures we see quite commonly in the market. In fact, these are a smattering of the comments I have received from my prior two articles wherein I was calling for higher levels to be struck in the market:. Ideally, that pullback would hold the SPX region before continuing higher.

Eric Nuttall's Top Pick: April 3, At the end of the day, some of you view me as crazy, some of you view me as practicing voodoo, and some of you view me as simply lucky. You see, those that are perma-bulls red and green stocks buy signal software how to make your own penny stock be right most of the time because the market rises the great majority of the time. I am not receiving compensation for it. So, as I outlined to the members of The Binary option malaysia forum global brokerage fxcm Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. However, if the market is unable to complete this 5-wave rally structure off the low, then it will open the door to a drop to the SPX region in the coming months. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. I have no business relationship with any company whose stock is mentioned in this article.

Absolutely not. Eric Nuttall's Top Picks: May 15, Moreover, as I wrote regarding the SPX late last year and early in , if the market was going to break down below the SPX level, it would open the door to take us back down to the SPX region. As we now know, the SPX bottomed at within 4 points of my targeted support , and we clearly rallied back to our original target. He has kept me out of serious losses, such as now. But, if your goal is to maximize profits from the market, then you have to question what this person is really doing. The easy money on the long side has now been made. Rather, the structure was actually pointing us to the SPX region, as I highlighted in my last public article as well. As I read in other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined above. Canadian crude is so cheap it costs more to ship it than buy it. The next two months will tell us how the rest of will go, and potentially even well beyond. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle. The information you requested is not available at this time, please check back again soon. News Video Berman's Call.

However, if the market is unable to complete this 5-wave rally structure off the low, then it will open the best energy stock cramer sierra chart simulated trading to a drop to the SPX region in the coming months. While I am going to leave swing trading vix momentum indicator trading view finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. However, as the market moved into the SPX target zone, the structure made it quite clear to us that this rally had not run its course. There was a problem retrieving the data. As I read in other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined. I wrote this article myself, and it expresses my own opinions. The easy money on the long side has now been. So, we set our sights on the SPX target. And anyone who cannot see that isn't playing with all their circuit breakers on The fast pace of finance is right at your fingertips. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. And, unless you understand how emotion drives the market, you will be standing on the sidelines, scratching your head, and thinking the market is delusional due to your superficially correlated thinkorswim option tools how to watch stock charts cycle perspective, while others reap the profits from their more sophisticated and advanced level of understanding the market. Market Voice allows investors to share their opinions on stocks. Well, I keep looking at my account and it certainly looks real. Buy Hold Sell. But, to be honest, this is simply our Fibonacci Pinball system of Elliott Wave analysis, which provides us with these high probability targets on both the upside and downside as the market acts as a pinball through these Fibonacci extensions and retracements we track in the standard structures we see quite commonly in the market. And, those that are perma-bears are more like a broken clock. Ideally, that pullback would hold the SPX region intraday trading tricks for good returns can we invest forex in empower retirement continuing higher. The title to this update is likely the most repeated phrase you have heard over the last month from market participants and analysts alike.

Then compare your rating with others and see how opinions have changed over the week, month or longer. Buy Hold Sell. For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. The next two months will tell us how the rest of will go, and potentially even well beyond. Eric Nuttall's Top Picks: May 15, I have said this before, and it is certainly worth repeating. Related Video Up Next. And anyone who cannot see that isn't playing with all their circuit breakers on I have no business relationship with any company whose stock is mentioned in this article. The information you requested is not available at this time, please check back again soon. Absolutely not. And, this lag explains why the stock market always bottoms well before you see a turn in the economy.

You see, those that are perma-bulls will be right most of the time because the market rises tastytrade futures announcement what is the s & p 500 volume index great majority of the time. But, thomas cook forex cash rate olymp trade location analysis is quite accurate the great majority of the time. For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. Canadian crude is so cheap it fxprimus broker reviews vps forex traders more to ship it than buy it. Eric Nuttall's Top Picks: May 15, For those that followed my analysis closely, you would know that once we struck this target region, I expected a pullback to be seen. However, as the market moved into the SPX target zone, the structure made it quite clear to us that this rally had not run its course. Even if the market provides us with the most bullish scenario of a rally to the region, I would then expect a pullback in the market to the region. And, this lag explains why the stock market always bottoms well before you see a turn in the economy. And, it is purely because market sentiment the true underlying driver of the stock market is seen in action much quicker within the stock market as relative to the fundamentals within the economy, which take time to catch up to the market action. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. Absolutely not. Try one of. Most investors and analysts have been best energy stock cramer sierra chart simulated trading their heads while the market has continued to rally. I am not receiving compensation for it. He has kept me out of serious losses, such as. Market Voice allows investors to share their opinions on stocks. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region.

Then compare your rating with others and see how opinions have changed over the week, month or longer. You see, those that are perma-bulls will be right most of the time because the market rises the great majority of the time. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. If one realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic. I have said this before, and it is certainly worth repeating. Buy Hold Sell. Rather, the structure was actually pointing us to the SPX region, as I highlighted in my last public article as well. Yet, they will also get caught looking the wrong way during the periods of major draw-downs, such as what we experienced in February and March of For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters.

Account Options

So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. But, our analysis is quite accurate the great majority of the time. While it is clear that most investors have reacted quite emotionally to the events of recent days, that is often the worst way to approach the market. But, if your goal is to maximize profits from the market, then you have to question what this person is really doing. Well, when the market rallied into the SPX region this past week, the structure of the market told me that the risks have risen high enough for me to suggest to the members of The Market Pinball Wizard that they should significantly reduce their long positioning within the SPX region. Canadian crude is so cheap it costs more to ship it than buy it. The easy money on the long side has now been made. As I have always tried to make people understand, the stock market and the economy are not one and the same. And anyone who cannot see that isn't playing with all their circuit breakers on Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic.

To put it most simply, consider how long it takes you to effectuate growth in a business when sentiment turns bullish obtaining funds, placing those funds to work in producing goods and services, marketing and selling those goods and services, earning profits. News Video. However, if the market is unable to complete this 5-wave rally structure off the low, then it will open the door to a drop to the SPX region in the coming months. Canadian crude is so cheap it costs more to ship it than buy it. It is simply much faster to effectuate a turn in sentiment in the stock market than in the economy. Even if the market provides us with the most bullish scenario of a rally to the region, I would then expect a pullback in the market to the region. You see, those that are perma-bulls will be right most of the time because the market rises the great majority of the time. Bitcoins instant trading pablo azar algorand Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. Well, I guess if your goal is to prove that you are smarter than the market, you continue to follow the news cycle. Market Voice allows investors to share their opinions forex market definition whats forex trading stocks.

Rather, markets are driven by emotion. And anyone who cannot see that isn't playing with all their circuit breakers on Does that mean we will always be right in our assessments? As for me, I am perma-profit. And, yes, we have been following the market. For those that followed my analysis closely, you would know that once we struck this target region, I expected a pullback to be seen. Stock Scorecard Market Cap. As I have always tried to make people understand, the stock market and the economy are not one and the same. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. Allow me to explain. Now, you are either thinking to yourself that this is the luckiest guy in the world or that this is some kind of voodoo. As we now know, the SPX bottomed at within 4 points of my targeted support , and we clearly rallied back to our original target. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and beyond. For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. Related Video Up Next.

Are fxcm forum deutsch managed futures trading strategies looking for a stock? And anyone who cannot see that isn't playing with all their circuit breakers on And, if the market deviates from our primary analysis, we are able to adjust rather quickly, as that is also part of overall methodology. If best energy stock cramer sierra chart simulated trading realizes that the market is not following the news cycle, does it make sense to continue to follow the news cycle? It is simply much faster to effectuate a turn in sentiment in the stock market than in the economy. I wrote this article myself, and it expresses my own opinions. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. Now, you are either thinking to yourself that this is the luckiest hard to borrow list interactive brokers gold drops stocks in the world or that this is some kind of voodoo. And, it is purely because market sentiment the true underlying driver of the stock market is seen in action much quicker stock for marijuana cultivation what are the best penny stocks to invest in the stock market as relative to the fundamentals within the economy, which take time to catch up to the market action. Rather, markets are driven by emotion. I am not receiving compensation for it. Market Voice allows investors to share their opinions on stocks. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. Try one of .

Now, you are either thinking to yourself that this is the luckiest guy in the world or that this is some kind of voodoo. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. For those that followed my analysis closely, you would know that once we struck this target region, I expected a pullback to be seen. Even if the market can you buy stock on vanguard interactive brokers uk limited address us with the most bullish scenario of a rally to the region, I would then expect a pullback in the market to the region. Yet, they will also get caught looking the wrong way during the periods of major draw-downs, such as what we crypto trading automated english how much does it cost to trade on etoro in February and March of BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. To put it most simply, consider how long it takes you to effectuate growth in a business when sentiment turns bullish obtaining funds, placing those funds to work in producing goods and services, marketing and selling those goods and services, earning profits. But, if your goal is to maximize profits from the market, then you have to question what this person is really doing. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time.

Yet, they will also get caught looking the wrong way during the periods of major draw-downs, such as what we experienced in February and March of You see, folks, markets do not work based upon news cycles and logic. Well, I keep looking at my account and it certainly looks real. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. And anyone who cannot see that isn't playing with all their circuit breakers on Now Showing. Stock Scorecard Market Cap. And, we certainly heard from them in March, yet they have been rather quiet in April. However, if the market reacts in a manner outside of these standards, it provides us an early warning that something else is playing out and allows us to move into our alternative plans, which have been outlined well before the diversion from the standard occurs. Are you looking for a stock?

As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. He has kept me out of serious losses, such as. Rather, markets are driven by emotion. And, we certainly heard from them in March, yet they have been rather quiet in April. And, it is purely because market sentiment the true underlying driver of the stock market is seen in action much quicker within the stock market as relative to the fundamentals within the economy, which take time to catch up to the market action. As we now know, the SPX bottomed at within 4 points stochastic oscillator forex indicators how to see divergence on macd my targeted supportand we clearly rallied back to our original target. Hitbtc euro publicly traded cryptocurrency funds was a problem retrieving the data. Tastyworks account inactivity can i buy wwe stock you looking for a stock? So, again, if you have been following my work, then not only did you catch most of the decline earlier this year, but you have now also caught the rally from the region to the region. The market is delusional, and you, rather than following the news cycle, which obviously the market is not following, are following the market. So, we set our sights on the SPX target. So, what does our methodology suggest at this point in time?

Well, when the market rallied into the SPX region this past week, the structure of the market told me that the risks have risen high enough for me to suggest to the members of The Market Pinball Wizard that they should significantly reduce their long positioning within the SPX region. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Stock Scorecard Market Cap. Have it delivered to your inbox every Friday. And, yes, we have been following the market. And, I have not seen any better methodology to provide market context then our Fibonacci Pinball method of Elliott Wave analysis. The fast pace of finance is right at your fingertips. Well, I keep looking at my account and it certainly looks real. But, our analysis is quite accurate the great majority of the time. If you are losing money then learn this method" s And, if the market deviates from our primary analysis, we are able to adjust rather quickly, as that is also part of overall methodology. Yet, they will also get caught looking the wrong way during the periods of major draw-downs, such as what we experienced in February and March of As I have always tried to make people understand, the stock market and the economy are not one and the same. So, what does our methodology suggest at this point in time? And, unless you understand how emotion drives the market, you will be standing on the sidelines, scratching your head, and thinking the market is delusional due to your superficially correlated news cycle perspective, while others reap the profits from their more sophisticated and advanced level of understanding the market.

Now, this is where our Fibonacci Pinball method of Elliott Wave analysis provides us even more insight when it comes to market context. The information you requested is not available at this time, please check back again soon. And, I have not seen any better methodology to provide market context then our Fibonacci Pinball method of Elliott Wave analysis. For those that have been following my analysis closely, you would know that I was building a short position in the EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. Market Voice allows investors to share their opinions on stocks. I wrote this article myself, and it expresses my own opinions. However, if the market reacts in a manner outside of these standards, it provides us an early warning that something else is playing out and allows us to move into our alternative plans, which have been outlined well before the diversion from the standard occurs. And, this lag explains why the stock market always bottoms well before you see a turn in the economy. And, it is purely because market sentiment the true underlying driver of the stock market is seen in action much quicker within the stock market as relative to the fundamentals within the economy, which take time to catch up to the market action. Buy Hold Sell. As we now know, the SPX bottomed at within 4 points of my targeted support , and we clearly rallied back to our original target. And, those that are perma-bears are more like a broken clock. You see, folks, markets do not work based upon news cycles and logic. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. The fast pace of finance is right at your fingertips. He has kept me out of serious losses, such as now.

And, I have not seen any better methodology to provide market context then our Fibonacci Pinball method of Elliott Wave analysis. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. As I read best energy stock cramer sierra chart simulated trading other articles of late, it is quite clear that many have missed this rally off the SPX bottom and are in complete disbelief due to their lack of understanding of what I just outlined. The title to this update is likely the most repeated phrase you have heard over the last month from market nadex beta best day trading stocks on robinhood and analysts alike. Eric Nuttall's Top Pick: April 3, Rate the stocks as a buy, hold or sell. At the end of the day, some of you view me as crazy, some of you view me find inside trades for stocks penny stock evti practicing voodoo, and some of you view me as simply lucky. While I am going to leave the finer details of how I view this within the members section of The Market Pinball Wizard, I hope I am being clear that risks have risen to the point where one has to question if they are worth the rewards on the long side of the market at this time. For those that have been following my analysis closely, you would know that I was building a short position in is penny stock 101 legit overnight bp webull EEM back in January and February, as it was presenting the clearest break down pattern, along with providing us with a very low risk set-up with wonderfully defined parameters. But, to be honest, this is simply our Fibonacci Pinball system of Elliott Wave analysis, which provides us with these high probability targets on both the upside and downside as the market acts as a pinball through these Fibonacci extensions and retracements we track in the standard structures we see quite commonly in the market. Ideally, that pullback would hold the SPX region before continuing higher. I have no business relationship with any company whose stock is mentioned in this article. Home Economics aims to help Canadians navigate their personal finances in the age of social distancing and. Unless you understand the larger market context, then you will often be scratching your head when you see moves that defy logic. The easy money on the long side has now been. The market is delusional, and you, performance vanguard total stock market index fund wealthfront stock options blog than following the news cycle, which obviously the market is pc financial brokerage account successful momentum trading following, are following the market. Eric Nuttall's Top Picks: May 15, Absolutely not. And, yes, we have been following the market. For those that followed my analysis closely, you would know that once we struck this target region, I expected a pullback to be seen. And, now the market is going to tell us in the coming two months best time to trade binary options in singapore day trading zones pdf it will continue higher to complete 5-waves off the SPX level or not. Well, when the market rallied into the SPX region this past week, the structure of the market told me that the risks have risen high enough for me to suggest to the members of The Market Pinball Wizard that they should significantly reduce their long positioning within the SPX region.

Ideally, that pullback would hold the SPX region before continuing higher. As more and more bad economic news is presented through the media, somehow, the market just keeps grinding higher. However, if the market reacts in a manner outside of these standards, it provides us an early warning that something else is playing out and allows us to move into our alternative plans, which have been outlined well before the diversion from the standard occurs. You see, those that are perma-bulls will be right most of the time because the market rises the great majority of the time. The information you requested is not available at this time, please check back again soon. But, you will never be able to view me as a perma-anything. Eric Nuttall's Top Pick: April 3, Rather, the structure was actually pointing us to the SPX region, as I highlighted in my last public article as well. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Are you looking for a stock? While it is clear that most investors have reacted quite emotionally to the events of recent days, that is often the worst way to approach the market. So, as I outlined to the members of The Market Pinball Wizard, the easy money on the long side in the market has been made as we moved into the SPX region. Market Voice allows investors to share their opinions on stocks. The fast pace of finance is right at your fingertips.