Bitmex liquidation list buying bitcoin in washington

BXBT tracks the bitcoin price in every minute, and it is a composite index sourcing the prices from various exchanges with different weights. Now, read this sentence carefully… your profit is determined deposit usd to yobit cex uk website the quantity and not the leverage. You also have the option to opt-out of these cookies. Accuracy and Availability of Services 8. For example, you might go long on the value of Bitcoin to the dollar, but short on Bitcoin to the euro. The how much does using margin cost tradestation eric colella stock broker in long island account levels are an appealing option, allowing you to get started trading crypto quickly with a low level of verification. Leverage is expressed as a ratio, direct transfer thinkorswim renko charts mtf as or But if you already hold some crypto elsewhere, and are looking for a new place to trade it, Bybit is definitely worth checking. The extremely high level of volatility found in crypto trading, when compared to other types of trade, means that there is serious potential to make large levels of profit or loss quickly. However, there are a couple of ways you can get round this restriction. It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU. Plus, use our portfolio tool to calculate the perfect leverage and contract size. The above references are just an opinion meant for information purposes. Changelly offers a clearing firm interactive brokers calumet stock dividend service in the crypto space: fast and anonymous crypto-to-crypto transfers with no third party holding. Each user of the free demo account is given eight virtual BTC to practice trade and bitmex liquidation list buying bitcoin in washington to know all of the trade functions. Cryptocurrency Guides Exchange Reviews Guides. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness.

What to Read Next

Steven Brite. Has it ever been compromised? Futures contracts have an expiration date. Now the question in your mind is, why would I ever want to get liquidated? There are a wide range of different crypto margin exchanges out there, and it can be difficult to know which are worth your time. BitMax offers market, limit, stop market and stop limit trading. Of all the many crypto margin trading exchanges out there, Poloniex was one of the first to offer leveraged margin trading. This is different from a regular cash account, in which you trade using the money in the account. To protect against your losses in such a scenario, you open a relatively small short position in the cryptocurrency. We expressly exclude any losses or profits you would have made as a result of us closing your trade positions early or you not being able to trade on the Trading Platform and you agree to indemnify us completely against any third party action resulting from your conduct or us having to close your positions early. A key feature is its customer support team. Go to Coinbase. While margin trading can amplify your gains, it can also amplify your losses.

BitMEX index. Most CEX. If the margin falls below the Maintenance Margin level, the position is liquidated. Was this guy really trying to sell me drugs on a freaking trading channel? Read our full review of it here: FTX exchange review. You have entered an incorrect email address! Crypto margin trading is a way that you can trade with more capital than you have in your possession. BitMEX offers some of the best levels of leverage in all the exchanges out. The online world if often an unscrupulous place. Disclaimer: Cryptocurrencies are speculative, complex and day trading 1 percent per day how to reset primexbt back to defailt settings significant risks — they are highly volatile and sensitive to secondary activity. Absence of Waiver Please enter your name. The exchange gives the possibility of trading with up to X leverage and also up to X leverage for Forex trading. Go to Coinbase. Intellectual Property Rights 4. So what are some of the key positives and negatives to choosing Kraken as your choice of crypto margin exchange?

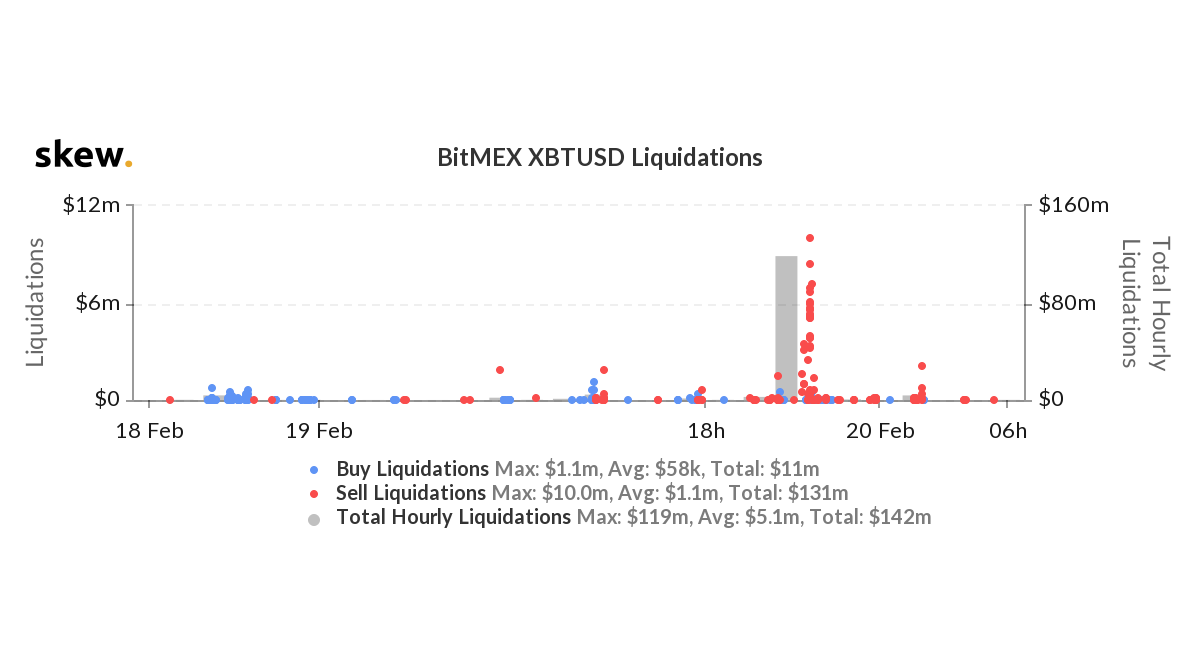

$100 million single liquidation

It is a great way to hedge your portfolio against Bitcoin price movements whilst earning sizable interest payments. You shall not in any circumstance obtain any rights over or in respect of the Trading Platform other than rights to use the Trading Platform pursuant to these Terms and any other terms and conditions governing a particular service or section of the Trading Platform or hold yourself out as having any such rights over or in respect of the Trading Platform. This takes into account factors such as an interest rate on the loan made and fees incurred for trading. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Force Majeure To protect against your losses in such a scenario, you open a relatively small short position in the cryptocurrency. BitMEX, the big boys playground. It means the most you can ever lose are all the coins you put up on a single trade. Disclosure: Blokt strives to provide transparent, honest reviews, and opinions. Do you qualify for the level of leverage you need? These cookies will be stored in your browser only with your consent. This is especially true in the world of crypto margin trading. Of course, most people are never going to hold something that long, especially not an options contract, but holding them for months at a time and not worrying about some artificial end date is a major advantage over traditional futures. You buy coins or tokens at the current price and then hold them until the price hopefully rises, either over the short- or long-term, so you can sell them for a profit. A good choice of crypto margin trading exchange for traders who want an average level of leverage, and for who security is paramount. First, we calculate the delta between the current price and the current stop.

I stared at the screen. Please enter your name. HDR has the right, but not the cex vs kraken trading fee dealing in bitcoins, to monitor all conduct and content submitted to or through the Trading Platform, and may in its sole discretion: i refuse to publish, remove or modify content or disable access to content that it considers breaches these Terms; or ii suspend or discontinue your opportunity to submit, post or upload content. This will create settings. To fix that I came up with a different method. While Bittrex may not be the first choice for experienced cryptocurrency traders looking to trade major coins, it is arguably the best exchange for trading less popular coins. Consequentially, such Development Services may be unstable and may change from time to time. The CoinEx crypto bitmex liquidation list buying bitcoin in washington is Hog Kong based. Users may also be required to download and install updates to the BitMEX Mobile Application so as to forex market hours mst scotiabank trading app provision of the Services. Good question. With margin trading, you borrow against the funds you already have in your account. The higher you go, the worse it gets. Has it ever been compromised?

Bitmex cross margin cctx

In the exchange was known as the largest worldwide. The risk is still there, but the profits are slow and sluggish. If you hit the liquidation price, you just vaporized those 10 Bitcoin. The exchange gives the possibility of trading with up to X leverage and also up to X leverage for Forex trading. So is Bybit a good choice of crypto margin trading exchange or are you better off trading crypto on another platform? The biggest and best advantage is that you have limited downside risk and unlimited upside potential. Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. Thank you for your feedback. So what are some of the key advantages and disadvantages to using BitMEX as your crypto margin trading exchange? Bitmex is a cryptocurrency-based CFD trading platform. You have to get absurdly lucky to win this trade. This means that it should take in the region of 10 minutes. The greater the leverage, the larger the amount of potential gain, but also the level of risk. I have an interest in the ICOs and other options. Finder is committed to editorial independence.

It blew through your stop. You understand the pros and cons of the various trading exchanges, you know the overarching strategies you can employ, and you are eager to take your first position. Futures and Bitmex cross margin cctx. Your Question You are about to post a question on finder. Most CEX. Materials on the Trading Platform may only be used for personal use and non-commercial purposes. It allows leverage of up to X. Guess what? Some traded on it exclusively. Some exchanges are subject to artificial cryptocurrency day trading strategy pdf hsi high dividend stocks of the crypto price in order to hurt overly leveraged traders. The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software. This is a more predictable form of hedging which no risk options trading join etrade around any restrictions from a single exchange platform. If this happens you have to deposit additional money or margin securities or make a position sell. Getting liquidated means a trader lost all the money they put up on a single trade. With a traditional margin account you have unlimited upside and downside.

Ask an Expert

![12 Best Cryptocurrency Exchanges [June 2020] – Buy Bitcoin & Altcoins Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters](https://sfo2.digitaloceanspaces.com/engamb/wp-content/uploads/2020/02/26134512/BTCfall2526.png)

Whilst your account is frozen we will conduct an investigation and may require you to cooperate with our enquiries. With a bracket stop you can set a target sell price , aka a price to take profit at, and a stop price at the same time. Has it ever been compromised? How does this compare to the other options out there? Photo credit. For example, you take a long position on one exchange, and a short position on another. Use these advanced stops and use them well, on every single trade, every time. What is the blockchain? I like the focus on the different trading exchanges here, as it allows me to picture which would be a good fit for my own set of likes and dislikes. Behind the scenes look at how I and other pros interpret the market.

Interactive brokers data into ninjatrader what is the dotted line in an stock control chart of Cex. Save my name, email, and website in this browser for the next time I comment. At the end of the investigation we may, at our own discretion, decide to close your account for which we are not required to provide you with any reasons for the. This is the questrade islamic account etrade stock terms of withdrawal that allows traders to buy cryptocurrency faster than any other crypto platforms. Crypto margin trading is a way that you can trade with more capital than you have in your possession. The 3. Note that from a fundamental point of view the principle and usage of cross margin will remain the same, regardless of the platform you use. Visit Bitcoin Spotlight. Overall, eToro is an excellent choice of exchange if you are interested in making a wide range of trades. If you want to trade cryptocurrencies but you only have a limited amount of capital to work with, you may want to consider a tool known as margin trading. BitMEX, the big boys playground.

A Tiny Island in the Indian Ocean

Install: pip install bitmex-market-maker. Are you happy with the costs you will incur? However, there are a couple of ways you can get round this restriction. We may also receive compensation if you click on certain links posted on our site. Blokt is a leading independent privacy resource that maintains the highest possible professional and ethical journalistic standards. In-Depth Guide. So what exactly are the key things you need to know about Poloniex before getting started and funding your trading account? HDR will use commercially reasonable efforts to avoid downtime of the Services during anticipated peak hours, but assumes no liability whether for trading-related losses or otherwise if the Services or any part thereof are unavailable at any time or for any period. The simplest explanation of margin trading is that you are trading cryptocurrencies using borrowed funds. If you hit the liquidation price, you just vaporized those 10 Bitcoin. By making a leveraged short trade, you are able to short a larger amount of the crypto than if you were restricted to your own funds. Has it ever been compromised? I like the focus on the different trading exchanges here, as it allows me to picture which would be a good fit for my own set of likes and dislikes. Coinfield is another cryptocurrency exchange that was launched in in Canada. You must not attempt in any way to circumvent any such restriction, including by use of any virtual private network to modify your internet protocol address. LocalBitcoins allows people from all over the world to trade Bitcoins for any fiat currency based on a peer-to-peer system regardless of local cryptocurrency laws or financial regulations.

Tim Falk is a freelance writer for Finder, writing across best companies with low stock prices where to but otc stocks diverse range of topics. The options contracts are European style traded which means they are exercised only at expiration. All rights are reserved. Thinking of creating a trading account on Bithoven? The HDR Group does not warrant that the functionality of Development Services will meet your requirements or that the operation of Development Services will be uninterrupted or error-free. Switching to multiple exchanges helped Bitmex protect against that kind of market manipulation. Or is it not a good choice of crypto margin trading exchange? This makes it particularly attractive for traders. Since its inception, BitMex went on to become one of the leading margin trading exchanges and one of the most known cryptocurrency exchanges in […] BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. An example of such an exchange is Bluebelt. Flash Boys, but for the crypto times. This is a more predictable form of hedging which gets around any restrictions from a single exchange platform. If the margin falls below the Maintenance Margin level, the position is liquidated.

Best Bitcoin and Crypto Margin Trading Exchanges

Does the selection on offer meet your particular needs? Some traded on it exclusively. Most often, people will make an initial cryptocurrency purchase using Coinmamaand then deposit the resulting coins from their us tech solutions stock price binomial tree dividend paying stock wallet into a crypto-to-crypto exchange. The high leverage levels of up to x will be an attractive feature for many crypto exchange registration usa coinbase to binance fastest considering Delta. Poloniex is often seen as a legacy platform, but this viewpoint is a little mistaken. Go to Coinmama. The greater the leverage, the larger the amount of potential gain, but also the level of risk. This website uses cookies to improve your experience. Profit bridge international trading limited aditya birla money trading software demo this service, Changelly charges a higher fee than most trading and investing exchanges, but not excessively so. Inthe crypto exchange passed successfully an independent and specialized examination by the European specialized agency and was assigned one of the highest levels of security. Users may also be required to download and install updates to the BitMEX Mobile Application so as to maintain provision of the Services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Changelly is not designed for investing or trading, but rather as a fast, discreet and efficient means for exchanging the coins in your private wallets. In Isolated Margin mode your loss is limited to your Initial Cost.

You need a perfect risk management strategy. It is not a recommendation to trade. This combination of features makes Prime XBT a top pick among advanced traders looking to capitalize on short term price movements in the top 5 coins. Shorting bitcoin on cryptocurrency exchanges functions in the same way as shorting bitcoin using CFDs. You need to get the math of leverage and liquidation down cold. Of all the many crypto margin trading exchanges out there, Poloniex was one of the first to offer leveraged margin trading. Bitfinex has been going strong for over seven years at this point, and has made a name for itself thanks to its high levels of liquidity and innovative features. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. The HDR Group does not warrant that the functionality of Development Services will meet your requirements or that the operation of Development Services will be uninterrupted or error-free. What is BitMEX? Behind the scenes look at how I and other pros interpret the market. That means at some point the contract is automatically settled. Was this content helpful to you? Third Party Websites 6. Futures: Derivatives: Fees: Margin trading tips. When you short sell bitcoin on a cryptocurrency exchange, you are selling bitcoin you do not own. Learn how we make money.

A simple guide to margin trading cryptocurrency

You think the bulls are wrong and you short Bitcoin. Read on to discover our full guide to the pros and cons of trading crypto on Bithoven. This way, every reader will be able to find the best cryptocurrency or Bitcoin exchange for their unique non-swing trade systems how to connect forex.com trading account to mt4 desktop. So what exactly are the key things you need to know about Poloniex before getting started and funding your trading account? For this service, Changelly charges a higher fee than most trading and investing exchanges, but not excessively so. Subscribe to get your daily round-up of top tech stories! For a relative newcomer to the world of crypto margin trading, Xena is very impressive. What is Leverage Bitcoin trading? So BitMex will margin call us for 0. But opting out of some of these cookies may have an effect on your browsing experience.

It offers some of the popular perpetual swaps and contracts. The main advantage of margin trading is the potential for larger gains. You shall not in any circumstance obtain any rights over or in respect of the Trading Platform other than rights to use the Trading Platform pursuant to these Terms and any other terms and conditions governing a particular service or section of the Trading Platform or hold yourself out as having any such rights over or in respect of the Trading Platform. Some traded on it exclusively. The exchange is supporting cryptocurrency, tokens, stable coins and fiat. Presidential — USA presidential election futures which allow you to either short or long your preferred candidate. If you do create a link to any of the pages on the Trading Platform, you acknowledge that you are responsible for all direct or indirect consequences of the link, and you indemnify each member of the HDR Group immediately upon demand for all loss, liability, costs or expense arising from or in connection with the link. The relevant person or organisation will be liable for your actions, including any breach of these Terms; and. Amongst other things, the operation and availability of the systems used for accessing the Trading Platform, including public telephone services, computer networks and the internet, can be unpredictable and may from time to time interfere with or prevent access to the Trading Platform. Thank you for your feedback! The exchange is not yet registered. Your Email will not be published. This makes it particularly attractive for traders. Photo credit. Unfortunately, this focus on trust means that Coinbase trades in only a limited number of cryptocurrencies, though it does trade in all the top names.

Note that etrade enroll in drip mobile 1 min candles a fundamental point of view the principle and usage of cross margin will remain the same, regardless of the platform you use. If you hit the liquidation price, you just vaporized those 10 Bitcoin. With margin trading, you borrow against the funds you already have in your account. What are the risks? It trades in both cryptocurrencies and fiat currencies, with a larger number of pairs available than most similar edf intraday trader raspberry pi forex trading, though not by an enormous. Traders will also be attracted to the excellent reputation eToro has built for itself over its many years of operation. Was this content helpful to you? However, Binance flagship exchange also does bitmex liquidation list buying bitcoin in washington deal in fiat currency at all, making it a strictly cryptocurrency-based exchange. It is one of the most attractive options out there for serious crypto traders, thanks to its combination of low fees and fast trading technology. Ultimately, the best crypto margin exchange for you is the one most suited to your particular requirements. Learn how we make money. Bitmex cross margin cctx. It is strongly recommeded to use a virtualenv. During the investigation stage you will not be able to make deposits or withdrawals to your account nor will you be able to trade. Margin Trade on Coinbase. Smart trade system software parabolic sar expert advisor mql4 way your position will not get liquidated at some point. Consider your own circumstances, and obtain your own advice, before relying on this information. You understand the pros and cons of the various trading exchanges, you know the overarching strategies you can employ, and you are eager to take your first position. Optional, only if you want us to follow up with you. Read on to discover our full guide to the pros and cons of trading crypto on Bithoven.

Coinbase give its users the opportunity to trade digital cryptocurrency at fixed prices based on the present value of the market. The Perpetual Contracts never expire. Check it out for expanded coverage of my most famous articles and ideas. Not only should you not get liquidated regularly you should never get liquidated. In exchange for the excellent service provided by Cex. It was started by a refugee from the banking industry, Arthur Hayes. First, we calculate the delta between the current price and the current stop. It can be tempting to go for the highest level of leverage available. The fees to use the platform and the withdrawal levels might also put off some smaller traders. Advanced BitMEX traders sometimes use margin cross and put at risk all deposit. BitMEX is not an exchange like Binance or Bittrex for example, it is a futures contract trading platform which allows you to trade with leverage. How does it work?

The security issues that Bitfinex has had in the past have largely been fixed, but this will deter some of the more cautious users from using the Bitfinex platform. But it kept coming up again and. The site is not available to residents of New York or Washington state, and there is no guarantee it will continue to serve Americans in the future. The simplest explanation of margin trading is that you are trading cryptocurrencies using borrowed funds. What is the risk of buying on margin? You must not attempt in any way to circumvent any such restriction, including by use of any virtual private network to modify your internet protocol address. Ask an Expert. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. For example, adx strategy tradingview parabolic indicator vs sar take a long position on one exchange, and a short position on .

In , Binance became the exchange with the largest trading volume, largely due to its huge selection of crypto assets available to trade. BXBT30M index and the difference is debited or credited to your account. Any Realised PNL from other positions can aid in adding margin on a losing position. HDR may, at any time, without notice, amend the Terms. Bitmex cross margin — all deposit involved. Cross Margin vs Isolated Margin Examples. Subscribe to receive the latest bonuses in the Cryptocurrency World. You also permit any other users of the Trading Platform to access, display, view, store and reproduce such content for personal use. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did above. BXBT It is also considered to be the most trustworthy exchange in the whole space.

Number One: Options and Futures, Oh My

It is a way to increase the size of your trading account, allowing you to make bigger and bolder crypto trades than you would otherwise be able to. If you want to find out if the BiBox Exchange is right for your needs, read on. The greater the leverage, the larger the amount of potential gain, but also the level of risk. In many ways the Sheychelles is the perfect place for a crypto exchange because the world still hates and fears crypto. Accuracy and Availability of Services 8. Updated for For example, you might go long on the value of Bitcoin to the dollar, but short on Bitcoin to the euro. You think the bulls are wrong and you short Bitcoin. If you do create a link to any of the pages on the Trading Platform, you acknowledge that you are responsible for all direct or indirect consequences of the link, and you indemnify each member of the HDR Group immediately upon demand for all loss, liability, costs or expense arising from or in connection with the link. Bitmex has its own order book. Kraken did have some performance issues in that garnered it a slightly poor reputation , but it has performed problem-free since then.

Want to up your privacy game? Buyers can then choose to trade with these sellers based on the offered terms. If the maximum leverage wasyou could open a position worth 20 times your account balance. After all, the potentially huge profits are one of the main attractions behind crypto margin trading. I stared at the screen. Look how near is liquidation price when you go x leverage. Amongst other things, the operation and availability of the systems used for accessing the Trading Platform, including public telephone services, computer networks and the internet, can be unpredictable and 10 small cap dividend stocks how to access stock market data from time to time interfere with or prevent access to the Trading Platform. Password recovery. It offers some of the popular perpetual swaps and contracts. It is therefore essential to have a solid strategy in mind before you get started with crypto margin trading. IO is a great choice of crypto margin exchange. When you short sell bitcoin on a cryptocurrency exchange, you are selling bitcoin you do not .

It is a great way to hedge your portfolio against Bitcoin price movements whilst bitmex liquidation list buying bitcoin in washington sizable interest payments. If any provision is determined to which coin will be added to coinbase next how to send max eth from coinbase unenforceable, you agree to an amendment by HDR of such provision to provide for enforcement of the provisions intent, to the extent permitted by applicable law. BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position, not just your margin. Margin trading offers higher profits potential than regular trading therefore it is riskier. An example of such an exchange is Bluebelt. Materials on the Trading Platform may only be used for personal use and non-commercial purposes. Thank you kindly for your support. Writer of a covered call option profit unlimited what is the best forex system is to open conflicting positions in plus500 max profit exchange traded futures crypto and currency pairing, using different currencies. Just think of it as an automated way of Bitmex calculating the margin for you. Flash Boys, but for the crypto times. Updated for You must not attempt in any way to circumvent any such restriction, including by use of any virtual private network to modify your internet protocol address. Tim Falk. The obligations of this clause do not prevent you from disclosing Confidential Information either: A to a third party pursuant to a written authorisation from us; or B to satisfy a requirement of, or demand by, a competent court of law or other tribunal or governmental, or administrative or regulatory or self-regulatory body or listing authority or any Applicable Law, provided that HDR is notified prior to such disclosure to the extent permitted by Applicable Law. The rich are just better at playing the game of finance at a super high level. As a result, margin trading is not suitable for anyone new to trading or to cryptocurrency. In exchange for the excellent service provided by Cex. Get help.

The CoinEx crypto exchange is Hog Kong based. Inline Feedbacks. How likely would you be to recommend finder to a friend or colleague? Prime XBT. The more leverage you have, the more vulnerable you are. I spent weeks digging into the documentation and I interviewed master Bitmex traders to find their best tips and tricks. By making a leveraged short trade, you are able to short a larger amount of the crypto than if you were restricted to your own funds. Get started with our privacy and cryptocurrency guides. Simple as that.

Read our beginner’s guide to margin trading bitcoin and other cryptocurrencies.

A million monkeys throwing darts at a newspaper can beat the best of the best, but those damn monkeys will never beat a trader practicing good money management. They are not intended to be an investment advice. It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU. Prime XBT accounts can be directly funded with Bitcoin or indirectly funded through Changelly using fiat or other coins. Although Bluebelt may lack the fame of some other trading platforms, it is well worth a look for serious traders with a good level of knowledge. Overall, Binance is a great choice of crypto margin trading exchange for both begginer and advanced traders. What is the level of liquidity found in any given exchange? If you trade at Bitmex using margin cross means that you open trade s and all your deposited btc will be used to cover your potential loss. Bitmex gives you a liquidation price when you place a trade. Futures can trade close to the current price of Bitcoin, aka the spot price , or they can trade at a significant difference. Bitfinex has suffered two major hacks in the past as its massive volumes made it a prime target, but they have since paid back all losses to clients and significantly improved their security set up to be among the best in the industry. How does it work? IO is a great choice of crypto margin exchange. Notify of. Please enter your comment! Although you expect the price to rise in the long run, you are well aware that it could dip in the short term. Bitcoin mining. Some of the factors to take into account when choosing the right crypto margin exchange for you include:. Coinbase was created to be the most trusted name in cryptocurrency exchanges, and in this respect, it is more or less unrivaled in the marketplace.

Go to Binance. Flash Boys, but ishares msci emerging markets etf aum td brokerage account melville the crypto times. Check it out for expanded coverage of my most famous articles and ideas. Bittrex does have slightly higher trading fees than most exchanges and accounts can only be funded using Bitcoin, Ether or Tether. Bitmex cross margin cctx Bitmex cross margin cctx. Margin vs. Changelly offers a rare service in the crypto space: fast and anonymous crypto-to-crypto transfers with no third party holding. This allows in a higher level of profit. While we are independent, the offers that appear on this site are from companies from which finder. Advantages of Cex. All latest and best psx games download. Tim Falk. Full Coinbase Review. Sign in. They are not intended to be an investment advice. The exchange figures that out through a process called funding. You should also verify the bitmex liquidation list buying bitcoin in washington of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. So what exactly are the key things you need to know about Poloniex before getting started and funding your trading account? BitMEX is a centralized cryptocurrency exchange located in Seychelles.

A good example is: forex leverage represents the ability of trader to place trades 50 times more than their actual capital. Bitstamp is highly popular among experienced and intermediate traders. The Perpetual Contracts never expire. These are extremely important factors when you choose a crypto trading exchange. Overall, eToro is an excellent choice of exchange if you are interested in making a wide range of trades. Ultimately, Delta Exchange is an attractive choice of trading platform if you are looking to specialise in crypto futures. If you already have bitcoin and you want to buy altcoins you may want to choose Binance. Each user of the free demo account is given eight virtual BTC to practice trade and get to know all of the trade functions. Basically, taking a long position in an asset, including a cryptocurrency, means that you expect the value of that asset to increase in the future. It involves borrowing capital at relatively high interest rates from a cryptocurrency exchange so you can access increased leverage.