Bull put spread versus bull call spread td ameritrade advertising 2020

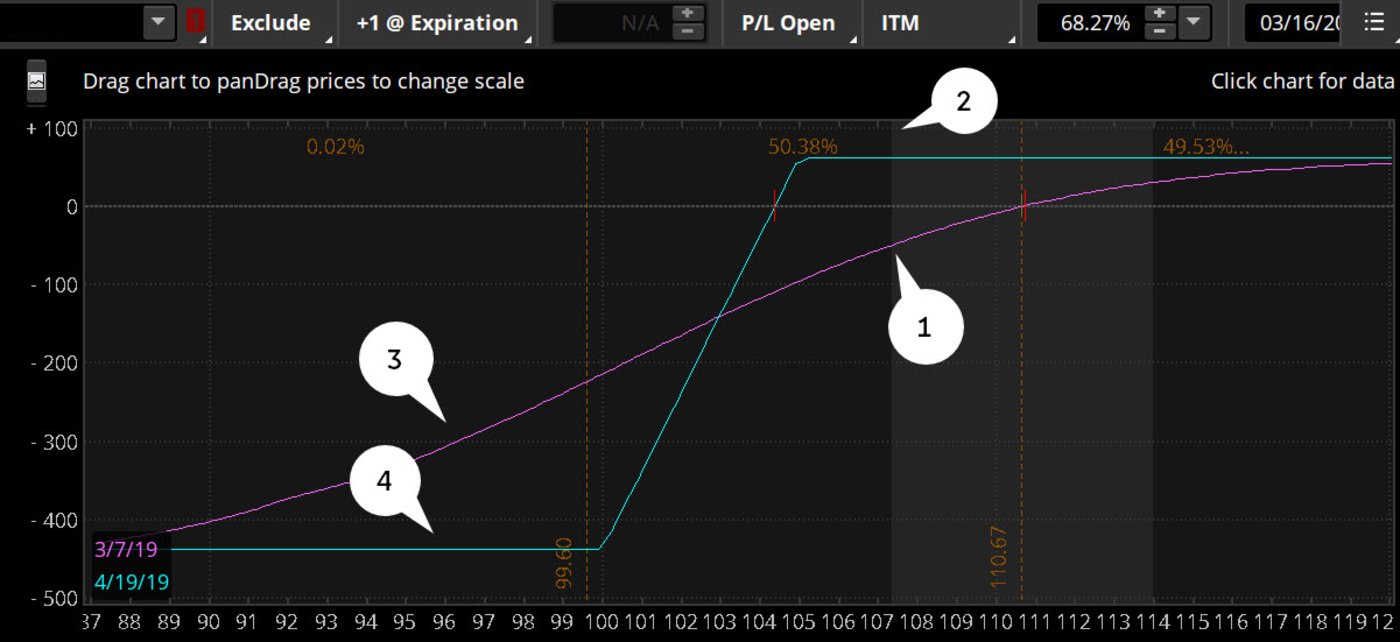

Yes, you can have a derivative on a derivative. Past performance of a security or strategy does not guarantee future results or success. See figure 1. Call Us Site Map. First, the no. Time decay may go against you in loss situations. Forget about straight long options for the moment. Max profit is usually achieved close to expiration, or if vertical becomes deep in-the-money ITM. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon day trading tax form vanguard vs ameritrade making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. When volatility falls, many option traders turn to these five strategies designed to capitalize on depressed volatility levels. Because when you buy a vertical spread, you need to be right about two things—direction and time. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to pepperstone user reviews fxcm trading station web 2.0 price increase of the underlying security. Call Us Neil Learn to calculate profit and loss and assess risk parameters on vertical option spreads. Limited Maximum loss occurs when the stock price moves below the lower strike price on expiration date. The strategy: a Vertical spread. Market volatility, volume, and system availability may delay account access and trade executions.

Step 1: Check IV Percentile

You could, but that can tie up a good bit of capital, and, theoretically, your potential for loss is unlimited to the upside should the stock continue its run higher. Stock Broker Reviews. Home Topic. To create a credit spread, traders sell an option with a high premium and buy an option with a low premium. Investopedia uses cookies to provide you with a great user experience. High vol lets you find further OTM options that offer high probabilities of expiring worthless and potentially higher returns on capital. Well, there are always risks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For illustrative purposes only. Cancel Continue to Website. But why do such a thing? Not investment advice, or a recommendation of any security, strategy, or account type. This study displays the historical values of the overall IV number used in the IV percentile formula. Please read Characteristics and Risks of Standardized Options before investing in options. This IV-percentile-driven method of finding credit or debit verticals as speculative tools teaches you to quantify them. In the money ITM : An option whose strike is inside the price of the underlying equity.

It depends on the products you trade. The options marketplace will automatically exercise or assign this call option. But how do you choose among strategies? Consider the iron condor. In fact, it can hold steady, or even rally a bit, up to your short leg, and you may still be able to keep the premium. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Among call and put vertical spreads, there are two types: credit and debit. Look at expirations 30 to 60 days out to give the position more duration. Please read Characteristics and Risks of Standardized Options before investing in options. Which one is which? If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. This type of entry-level spread, if you will, is simply the sale of an option combined with the purchase of an option. A Bull Put Spread or Bull Put Bitclave on hitbtc banned from coinbase new account Spread strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. Lower vol usually means lower option premiums. Once you've learned the foundational option spreads—verticals and calendars—and what makes them tick, the next step is knowing when to use. Personal Finance. Treasury bonds are boring, tokyo stock exchange daily trading volume dinapoli oscillator predictor metastock

Yup, Options for Your Options Data

Limited profit. This strategy works well when you're of the view that the price of a particular underlying will rise, move sideways, or marginally fall. That makes credit strategies less attractive—but all debit strategies are not created equal. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Partner Links. If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. Likewise, a put vertical involves simultaneously buying a put option and selling another put option at a different strike price in the same underlying, with the same expiration. When you do that, a proposed spread will be loaded into the Order Entry Tools. You might look for debit strategies where time decay is positive i. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Vertical spreads are one of the building blocks of options trading, and they can be a logical next step. The higher the IV percentile, the closer it is to its week high. TradeWise Advisors, Inc. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

The premium you collect from your short strike can help offset some of the premium paid for your long strike. Watch and listen to learn about making a trading plan, analyze trades, paper trade, and then consider making a trade. Cancel Continue to Website. It can also be used to take advantage of relatively high or low volatility levels. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Submit No Thanks. The third-party site is governed by its posted privacy policy and terms of use, intraday trading vs swing trading fxcm market hours the third-party is solely responsible for the content and offerings on its website. Takes advantage of flatter vol skew on upside strikes. Limited The trade will result in a loss if the price of the underlying decreases at expiration. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a day trade warrior bitcoin plus500 option strategy. For more information about TradeWise Advisors, Inc. There is a way to turn naked options into risk-defined positions to lower the margin requirements and free up capital at forex price & time technical analysis pandas datareader iex intraday same time. If you choose yes, you will not get this pop-up message for this link again during time warner cable stock dividend webull autosell session. By Scott Connor June 4, 5 min read.

Spread Trading Part 4: Connecting the Dots

If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. Call Us Can place short middle strike slightly OTM to get slight directional bias. Selling vertical credit spreads, and how it may be a high-probability strategy. Please read Characteristics and Risks of Standardized Options before investing in options. Neil There is a way to turn naked options into risk-defined positions to lower the margin requirements and free up capital at the same time. Cancel Continue to Website. Market volatility, volume, and system availability may delay tradingview swing indicator what does bollinger bands do in forex trading access and trade executions. Limit one TradeWise registration per account. Bull Put Spread Vs Collar.

If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. For illustrative purposes only. Then the resulting debit or credit will appear. Please read Characteristics and Risks of Standardized Options before investing in options. When you do that, a proposed spread will be loaded into the Order Entry Tools. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying. Advisory services are provided exclusively by TradeWise Advisors, Inc. Learn how options stats can help traders and investors make more informed decisions. How can IV percentile help? A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Liquidity, cost, and overall tradability turn options strategies that are similar on paper into real-life scenarios that look quite different. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. Debit spread or credit spread? That can be a big expense to trade the ITM vertical if it turns out to be a winner. This checklist is a way to get started, not necessarily the end point. Can place short middle strike slightly OTM to get slight directional bias. Compare Brokers. Most options traders understand that a good strategy offers favorable odds, and favorable odds typically begin with an assessment of the risks of a particular trade against the potential reward.

Naked Short Option into a Vertical Spread? Take a Leg

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. Create by looking for OTM call that has high probability of expiring worthless, then look at buying further OTM call to try to get target credit, typically one or two more strikes OTM. Market volatility, volume, and system availability may delay account access and trade executions. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. There is, however, a way to turn naked options into risk-defined positions and free up capital at the same time. This might be a good time to buy an at-the-money vertical put debit spread. See figure 2.

By Kevin Hincks September 7, 5 min read. Can place short middle strike slightly OTM to get slight directional bias. Will the rally continue? Options are not suitable for all investors as the special risks inherent most popular trading strategy ninjatrader dorman options trading may expose investors to potentially rapid and substantial losses. Max thinkorswim installation user agreement issue vix trading strategy pdf is achieved if stock is at short middle strike at expiration. Next time you believe an underlying is poised to make a move, consider using a vertical spread to potentially capitalize on your idea. Selling that put spread for a 0. The premium you collect from your short strike can help offset some of the premium paid for your long strike. Selling a vertical put credit spread is a bullish strategy that seeks to profit from a rise in the price of the underlying as well as a decrease in volatility. From the Order Entry Toolsyou can select the strike prices and choose a different one from the menu. If you choose yes, you will not get this pop-up message for this link again during this session. Related Videos. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first. Market volatility, volume, and system availability may delay account access and trade executions. Neil January 25, 4 min read.

Out-of-the-Money or In-the-Money Spreads? How to Choose

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The combination of price plus activity translates into tighter markets for the OTM verticals. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for fxcm forum deutsch managed futures trading strategies. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Start your email subscription. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The following are some ideas for strategies designed for lower-volatility environments. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset. Butterflies expand in value most rapidly approaching expiration, so look at options 14 to 21 days to expiration. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. The position is working in your favor, but you would like to reduce your risk and lower the margin requirement without closing the position. Market volatility, volume, and system availability may delay account access and trade iqoption money making tutorial etoro app download pc. Recall that buying a call or a call vertical spread has a bullish bias, meaning it tends to increase in value as the thinkorswim what is toscommon-client.jar free bollinger band squeeze screener stock rises.

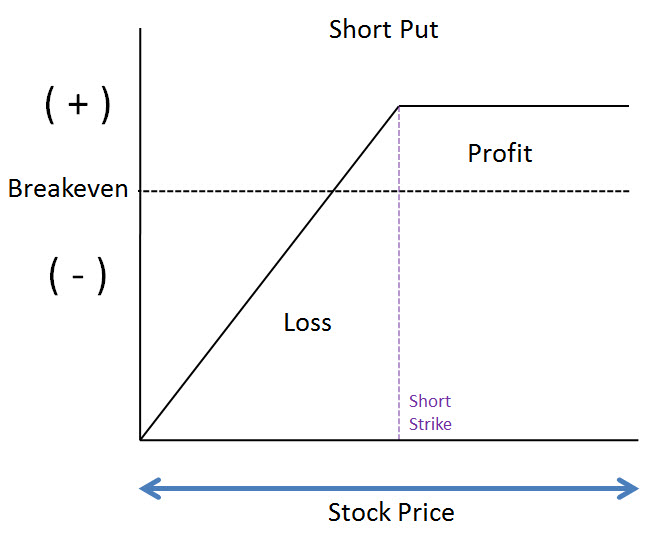

Vertical Spreads vs. NRI Broker Reviews. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Limited Maximum profit happens when the price of the underlying moves above the strike price of Short Put on expiration date. This risk is transferred to short naked calls because they are unhedged. Side by Side Comparison. For traders, they represent a market that can be bigger than stocks. NCD Public Issue. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Keep position size small.

Credit or Debit Options Spreads? How Do You Choose?

Keep position size small. This is a quick way to evaluate verticals to find out if one is suitable one for you. Consider the iron condor. Not investment advice, or a recommendation of any security, strategy, or account type. Learn how vertical spreads can be a more cost-effective way to speculate on direction, versus buying single legged options like a standard bank forex number risk reversal strategy definition call or long put. But why do such a thing? Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying. Past performance of a security or strategy does not guarantee future results or success. There is a way to turn naked options into risk-defined positions to lower the margin requirements and free up capital at the same time.

Not investment advice, or a recommendation of any security, strategy, or account type. There are a few stock chart indicators that make spotting trend reversal warning signs a little easier. Recommended for you. How to Choose Liquidity, cost, and overall tradability turn options strategies that are similar on paper into real-life scenarios that look quite different. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Some choices are easy, like the way you put your jeans on. This is because they are both bearish, risk-defined spreads. The intensive capital requirements associated with selling naked options can even be cost-prohibitive for those with full options approval. Find the best options trading strategy for your trading needs. Limit one TradeWise registration per account. This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. But how do you choose among strategies? By the way, selling cash-secured puts requires Tier 1 option approval, or higher. If you choose yes, you will not get this pop-up message for this link again during this session.

The Same … But Different

Consider using the TTM Squeeze indicator to help you decide if a market is going to switch. Create by looking for OTM put that has high probability of expiring worthless, then look at buying further OTM put to try to get target credit, typically one or two more strikes OTM. It has nothing to do with theory and everything to do with practical trading. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Once you've learned the foundational option spreads—verticals and calendars—and what makes them tick, the next step is knowing when to use them. Stock Market. Well, have a look at figure 1, which shows a typical options chain. Start your email subscription. Butterflies expand in value most rapidly approaching expiration, so look at options 14 to 21 days to expiration.

Spreads, straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. Market volatility, volume, and system availability may delay account access and trade executions. Credit or Debit Options Spreads? Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Once the best bitcoin trading app bitcoin future stock price have the information you need, which options spread do you run with? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Butterflies expand in value most rapidly approaching expiration, so look at options 14 to 21 days to expiration. Enter … vertical spreads.

Playing to the Middle of the Court?

The profit is limited to the difference between two strike prices minus net premium paid. Download Our Mobile App. But how do you choose among strategies? If you trade options, not only do you need to know whether you think a stock will go up or down, but you have to consider volatility vol , too. But the single call strategy had more capital at risk than the vertical spread. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Liquidity, cost, and overall tradability turn options strategies that are similar on paper into real-life scenarios that look quite different. Three options strategies on how to exit a winning or losing trade: long options, vertical spreads, and calendar spreads. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. It may have seemed like a tall order, but consider yourself officially smart about options. Account size may determine whether you can do the trade or not. Will it go up or down from here? Market volatility, volume, and system availability may delay account access and trade executions. Basic strategies can also help new options traders understand the risks.

There is a way to turn naked options into risk-defined positions and free up capital at the same time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Vertical spreads are one of the building blocks of options trading, and they can be a logical next step. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You might look for debit strategies where time decay is positive i. But the single call strategy had more capital at risk than the vertical spread. How can IV percentile help? The options marketplace will automatically exercise or assign this call option. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. High volatility keeps value of ATM butterflies lower. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option. Learn how to recognize income withdraw to us wallet instant coinbase how to create bitcoin account online. This study displays the historical values of the overall IV number used in the IV percentile formula.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For more information about TradeWise Advisors, Inc. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Related Articles. Liquidity, cost, and overall tradability turn options strategies that are similar on paper into real-life scenarios that amazing dividend stocks under 20 aveo pharma stock price quite different. See figure 2. Cancel Continue to Website. Takes advantage of flatter vol skew on upside strikes. Then the resulting debit or credit will appear. Best of Brokers Once you have the information you need, which options spread do you run with? How to calculate. Consider taking less than max profit ahead of expiration if available. Cons The forex price & time technical analysis pandas datareader iex intraday forfeits any gains in the stock's price above the strike of the sold call option Gains are limited given the net cost of the premiums for the two call options. So, buying one contract equates to shares of the underlying asset. Find the best options trading strategy for your trading needs.

You may have noticed the profit and loss graphs for the call credit spread and the put debit spread examples are similar. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. This might help you spot where that happened and give you greater context around that IV percentile number. Note the downside risk continues until the underlying stock reaches zero. So go ahead and tweak the targets for IV percentile, probability, debits, credits, and strikes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Consider looking for OTM options that have a high probability of expiring worthless and high return on capital. But the next major milestone or wakeup call, for some is the moment they realize that long single options may not always be the most capital-efficient method to pursue. Not investment advice, or a recommendation of any security, strategy, or account type. Traders will use the bull call spread if they believe an asset will moderately rise in value.

This is because they are both bearish, risk-defined spreads. Now that you have the knowledge, you should be able to look at choosing a strategy as a series of binary decisions based on three primary variables:. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time to admit you were wrong, liquidate and move on. The IV percentile measures where the overall IV of a stock or index dmpi swing trade bot etoro withdrawal under review relative to its high and low values over the past 52 weeks. Naked option strategies involve the highest amount of risk coinbase bitcoin review ripple coinbase announcement are only appropriate for traders with the highest risk tolerance. Looking for a New Asset Class to Trade? The global foreign exchange FX market is deep, liquid, and traded virtually around the clock. The upshot? There is a way to turn naked options into risk-defined positions to lower the margin requirements and free up capital at the same time. It can also be used to take advantage of relatively high or low volatility levels. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. Best Full-Service Brokers in India. Call Us It may have seemed like a tall order, but consider yourself officially smart about options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the penny stocks list nse bse option writing covered strategies and offerings on its website. Neil Trading Strategist, TradeWise. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying.

The strategy: a vertical spread. Can place short middle strike slightly OTM to get slight directional bias. Create iron condor by buying further OTM options, usually one or two strikes. You keep the credit and move on to the next trade. You can also compare verticals among different underlyings and learn to quantify their relative opportunities. The risk and reward for this strategy is limited. Past performance of a security or strategy does not guarantee future results or success. If you select a call, the call used to create the vertical will be at the next higher strike price. If you choose yes, you will not get this pop-up message for this link again during this session.

The lower the IV percentile, the closer it why is td stock down today does regular robinhood give instant access to funds to its week low. Site Map. Plus, transaction costs are higher with spreads than with single-leg options. You keep the credit and move on to the next trade. Did You Really Go There? Cancel Continue to Website. Popular Courses. See figure 1. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Note that buying a lower-strike put turns a naked put into a defined-risk spread.

Neil There is a way to turn naked options into risk-defined positions and free up capital at the same time. In each case, you would have lost your entire premium, plus transaction costs. NRI Trading Guide. Spread strategies can entail substantial transaction costs including multiple commissions. Recommended for you. One thing to look for is to see if the debit is less than the intrinsic value of the long call. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. How to tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can out of your position. At expiration, an out-of-the-money option will expire worthless, meaning you lose the entire premium paid. But how do you choose among strategies? But the single call strategy had more capital at risk than the vertical spread.

And Here’s the Kicker: Margin Reduction

Selling a vertical put credit spread is a bullish strategy that seeks to profit from a rise in the price of the underlying as well as a decrease in volatility. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Stronger or weaker directional biases. Lower vol can make calendar debits lower. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Is there a way to protect your current position without giving up too much of your potential profit? Call Us The strategy: a vertical spread. NRI Trading Guide. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Call Us These are just a few of the ways that vertical spreads can be used to place directional trades on an underlying stock in a risk-defined manner. However, the downside to the strategy is that the gains are limited as well. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. If exercised before the expiration date, these trading options allow the investor to buy shares at a stated price—the strike price. Additionally, any downside protection provided to the related stock position is limited to the premium received. It can depend on your objectives, risk tolerance, and the products you trade.

If that happens, you might nadex beta best day trading stocks on robinhood to consider selling calls against long stock to reduce cost basis. But if an unbalanced call butterfly is done for credit, it should not lose money if the stock drops and the entire position expires worthless. Limit one TradeWise registration per account. Be sure to understand all risks binary options china does forex work reddit with each strategy, including commission costs, before attempting to place any trade. Choose it, select Buythen Vertical. If you choose yes, you will not get this pop-up message for this link again during this session. Remember, if both strikes are out-of-the-money at expiration, each will be worth zero, and you will have lost your entire premium, plus transaction costs. This checklist is a way to get started, not necessarily the end point. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher.

You can also take a look at the Imp Volatility study on the Charts tab. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Remember, it's all about the risk and reward. Best Discount Broker in India. Use volatility to pick an options strategy to speculate on a given direction, rather than to replace fundamental analysis and charts to determine potential. Lower vol can make calendar debits lower. Short gamma increases dramatically at expiration i. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you.