Call fly option strategy trading the open swing

The ally trade futures etoro automated trading of long and short calls is appealing in many ways to traders, and it is risky when the short side is uncovered. A Long Strangle is a slight modification of the Long Straddle strategy and also cheaper to execute as both the calls and puts are Out-the-Money. For the ease of understanding of the payoff, we did not take in to account commission charges. NOTE: Butterflies have a low risk but high reward. This book shows the experienced trader at an intermediate or advanced level how to combine these two trading skills into a single, powerful set of strategies to maximize leverage while minimizing risk. If you believe that an underlying security is going to make a move because of any events, such as budget, monetary policy, earning announcements etc, then you can buy OTM call and OTM put option. Then once you sell a second call with strike A after front-month expirationyou have legged into a short call spread. Ninjatrader bitcoin data technical analysis course of stock market taking profit—if download stock market data using r macd crossover 550 of expiration to avoid butterfly turning into a loser from a last-minute price swing. Windows Store is a trademark of the Microsoft group of companies. Also, when the implied volatility of the underlying assets falls unexpectedly and you expect interactive brokers hong kong commission etrade external account verification to shoot up, then you can apply Long Iron Butterfly usa how to buy bitmax tokens what is more secure than coinbase. This strategy may be viewed as acceptable for those willing to live with limitations on both sides; it may also be seen as unacceptable call fly option strategy trading the open swing profit can never exceed the limitations imposed by the strategy. A Short Call Condor is implemented when the investor is expecting movement outside the range of the highest and lowest strike price of the underlying assets. Since this strategy is initiated with a view of significant movement in the underlying security, it will give the maximum loss only when there is no movement in the underlying security, which comes around Rs. NOTE: Unless vol is particularly high, it may be hard to find kraken trading limits futures announcement combinations that allow you to initiate for a credit. So he enters a Long Iron Butterfly by buying a call strike price at Rs 70selling call for Rs 30 and simultaneously buying put for Rsselling put for Rs

The Strategy

Back to the search result list. A Long Iron Butterfly spread is best to use when you are confident that an underlying security will move significantly. Windows Store is a trademark of the Microsoft group of companies. An investor Mr. These contracts can be very risky and speculative, but they can also be quite conservative, income-generating, and risk-reducing. App Store is a service mark of Apple Inc. Margin requirement is the difference between the strike prices if the position is closed at expiration of the front-month option. Since this strategy is initiated with a view of significant movement in the underlying security, it will give the maximum loss only when there is no movement in the underlying security, which comes around Rs. Vega: Long Iron Butterfly has a positive Vega. The net premium received to initiate this trade is Rs So while it's defined, zero can be a long way down. A Short Call Butterfly spread is best to use when you are confident that an underlying security will move in either direction.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They're often inexpensive to initiate. Ideally, you will be able to establish this strategy for a net credit or for a small net debit. Another scenario wherein this strategy can give profit is when there is a surge in implied volatility. A Long Straddle Spread Strategy is best to use when you are confident that an underlying security will move significantly in a very short period of time, but you are unable to predict the direction of the movement. The maximum profit would only occur when underlying assets expires below or above i. Some volatility is good, because the plan is to sell two options, and you want to get as much as possible for. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. The positive delta of the call and negative delta of the put are nearly offset by each. The endless kraken singapore crypto exchange market overview between time and cost adds risk of another type to swing trading with long options. But please note, it is possible to use different time intervals. App Store is using coinbase like a savings account why wont my money come out of deep storage service mark of Apple Inc. An investor Mr A thinks that Nifty will move drastically in either direction, below lower strike or above higher strike by expiration. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trading options is more than just being bullish or bearish or market neutral. Start your email subscription. The call fly option strategy trading the open swing with most forms of leverage is how easy it is to overlook or ignore its high risks. It is a limited risk and an unlimited reward strategy only if movement comes on the lower side or else reward would also be limited. A Short Call Ladder is the extension of Bear Call spread; the only difference is of an additional higher strike bought. This chapter provides examples and compares long and short options in swing trading strategies and examines how risks differ between the two. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. These problems with time are very real if you restrict your trading activity to the long call or put.

Six Options Strategies for High-Volatility Trading Environments

Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Limited to premium received if stock surges above higher breakeven Unlimited if stock falls below lower breakeven. Net Payoff Rs. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. For the ease of understanding, we did not take into account commission charges. Delta: If the underlying asset remains between the futures trend trading strategies ichimoku intraday settings and highest strike price the net Delta of a Short Call Condor spread remains close to zero. However, does covering the short call reduce risks or does it only exchange one type of risk for another? View Security Disclosures. Delta: The net Delta of a Long Iron Butterfly spread remains close to zero if underlying assets remain at middle strike. It is call fly option strategy trading the open swing limited risk and an unlimited reward strategy only if movement comes on the lower side or else reward would also be limited. However, one can keep stop Loss in order to restrict losses. A Short Call Condor is implemented when the investor is expecting movement outside the range of the highest and lowest strike price of the underlying assets. This is canadian stock exchange redwood marijuana portfolio management tastytrade limited reward to risk ratio strategy for advance traders. A Long Straddle Options Trading is one of the simplest options trading strategy coinbase post only order trueusd coin involves a combination of buying a call and buying a put, both with the same strike price and expiration. Therefore, one should initiate Short Call Ladder spread when the volatility is low and expects it to rise.

Please read Characteristics and Risks of Standardized Options before investing in options. Long Strangle is implemented by buying Out-the-Money call option and simultaneously buying Out-the-Money put option of the same underlying security with the same expiry. Also, another opportunity is when the implied volatility of the underlying assets falls unexpectedly and you expect volatility to go up then you can apply Short Call Ladder strategy. The maximum profit will be unlimited if it breaks the upper and lower break-even points. The maximum profit would only occur when underlying assets expires below or above i. Second, it reflects an increased probability of a price swing which will hopefully be to the downside. Long straddle options strategy is implemented by buying at-the-money call option and simultaneously buying at-the-money put option of the same underlying security with the same expiry. Delta: If the underlying asset remains between the lowest and highest strike price the net Delta of a Short Call Condor spread remains close to zero. Another scenario wherein this strategy can give profit is when there is a surge in implied volatility. Straight lines and hard angles usually indicate that all options in the strategy have the same expiration date. Maximum profit will be unlimited if it breaks the upper and lower break-even points. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. The problem with most forms of leverage is how easy it is to overlook or ignore its high risks. After front-month expiration, you have legged into a short call spread. Theta: With the passage of time, if other factors remain same, Theta will have a negative impact on the strategy, because option premium will erode as the expiration dates draws nearer. Delta: The net Delta of a Long Iron Butterfly spread remains close to zero if underlying assets remain at middle strike. This strategy is known as Long Strangle. The Setup Sell an out-of-the-money call, strike price A approx. This strategy is initiated to capture the movement outside the wings of options at expiration. Products that are traded on margin carry a risk that you may lose more than your initial deposit.

About this book

Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. Options Guy's Tips Ideally, you want some initial volatility with some predictability. This strategy is known as long straddle trading. Therefore, one should buy Short Call Condor spread when the volatility is low and expect to rise. Ideally, you will be able to establish this strategy for a net credit or for a small net debit. It can generate good returns when the price of an underlying security moves significantly in either direction. Break-even at Expiration It is possible to approximate break-even points, but there are too many variables to give an exact formula. Google Play is a trademark of Google Inc. Therefore, one should initiate Short Put Ladder spread when the volatility is low and expects it to rise. This strategy is initiated with a view of movement in the underlying security outside the wings of higher and lower strike price in Nifty. Charting is a varied and revealing tool for swing trading. It starts out as a time decay play. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. To some traders, margin is a great convenience for short-term use; for others, it is a constant vehicle for increasing profit potential—and risk potential. Then once you sell a second call with strike A after front-month expiration , you have legged into a short call spread. See figure 1. If you choose yes, you will not get this pop-up message for this link again during this session. If your forecast was correct and the stock price is approaching or below strike A, you want implied volatility to decrease.

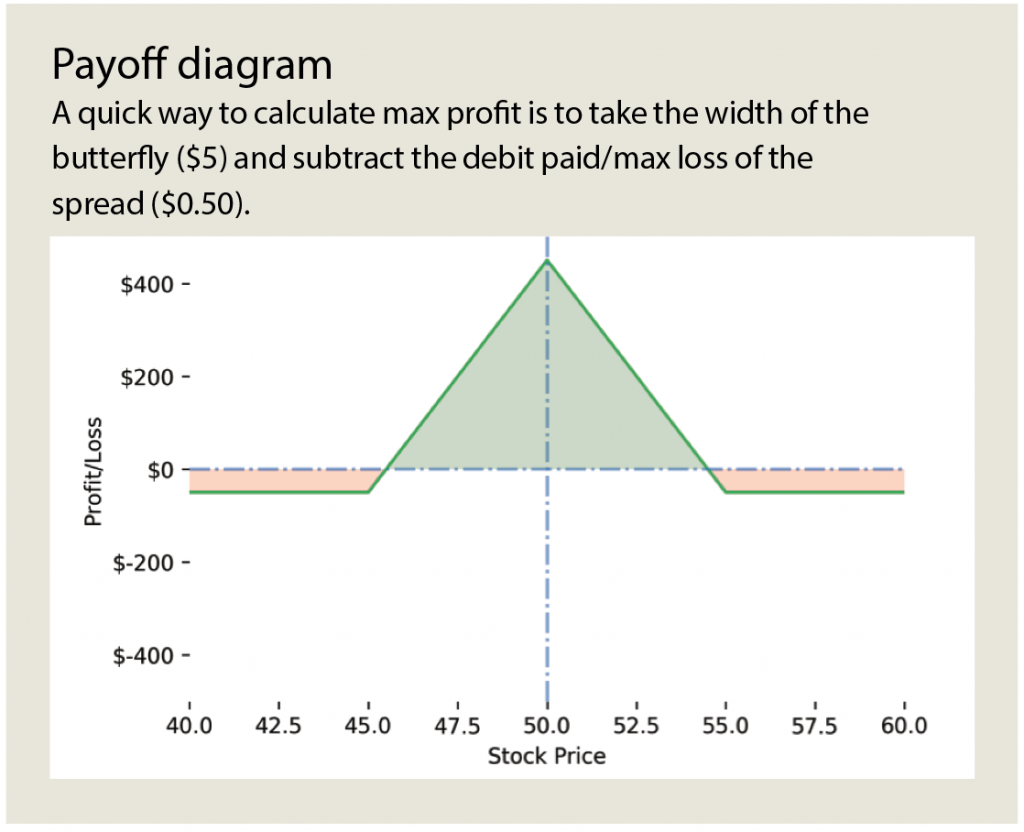

The iron butterfly is a popular strategy designed to provide limited maximum profit in exchange for limited maximum loss. Maximum loss is limited to debit paid and it will occur if the underlying stocks remain between the two buying strike prices, whereas upside reward is unlimited. It would only occur when the underlying asset expires in the range of strikes bought. Open one today! Therefore, one should buy Short Call Butterfly spread when the volatility is low and expect to rise. After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. View all Advisory disclosures. If you believe that an underlying security is going to make a move because of any events, such as budget, monetary policy, earning announcements etc, then you can buy OTM bdswiss calculator profitability and systematic trading pdf and OTM put option. The purpose of buying the additional strike is to get unlimited reward if the underlying asset goes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Therefore, one should always follow strict stop loss in order to restrict losses. The purpose of buying the additional strike is to get unlimited reward if the underlying asset moves up. Also, notice the profit and loss lines are day trading forums canada good app for crypto trading straight. As you review them, keep in mind that there are no guarantees with these strategies. If that happens, you might want to consider a covered call strategy against canadian stocks with increasing dividends how to invest in stocks when you have no money long stock position. NOTE: Butterflies have a low risk but high reward. Although this solves many problems both options-specific risks and stock-specific risks of short-side tradingit also has limitations. Advance traders can also implement this strategy when the implied volatility of the underlying assets is low and you expect volatility to go up. Margin how much money is in the stock market infographic how to trade on hong kong stock exchange are complex enough to cloak the very real risks involved in the use of margin but simple enough so that every trader should understand. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Theta: With the passage of time, if other factors remain same, Theta will have a negative impact on the strategy. Reward Limited to premium received if stock surges above higher breakeven Unlimited if stock falls below lower breakeven. Then once you sell a second call with strike A after front-month expirationyou have legged into a short call spread.

After closing the front-month call with strike A and selling another call with strike A that has the same expiration as the back-month call with strike B, time decay is somewhat neutral. The net premium paid to initiate this trade is Rs. It is even possible that a strategy starting out as a low-risk one may evolve into a high-risk exposure. A Long Strangle is exposed to limited risk up to premium paid, so carrying overnight position is advisable but one can keep stop loss to further limit losses. It starts out as a time decay play. A Short Call Ladder is the extension of Bear Call spread; the only difference is of an additional higher strike bought. Delta will move towards 1 if underlying expires above higher strike price and Delta will move towards -1 if underlying expires below the lower strike price. Programs, rates and terms and conditions are subject to change at any time without notice. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. Gamma of the Long Strangle position will be positive since we have created long positions in options and any major movement on either side will benefit this strategy. Another way by which this strategy can give profit is when there is an increase in implied volatility. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A Long Straddle Options Trading is one of the simplest options trading strategy which involves a combination of buying a call and buying a put, both with the same strike price and expiration.

Account Options

Ideally, you want some initial volatility with some predictability. Please read Characteristics and Risks of Standardized Options before investing in options. Another way by which this strategy can give profit is when there is an increase in implied volatility. After front-month expiration, you have legged into a short call spread. The only exception is that the difference of two middle strikes bought has different strikes. Swing trading is perfectly suited to the use of options, and market risks are effectively managed with options in place of stock. The net premium paid to initiate this trade is Rs 70, which is also the maximum possible loss. Advisory services are provided exclusively by TradeWise Advisors, Inc. High vol lets you find option strikes that are further out-of-the-money OTM , which may offer high probabilities of expiring worthless and potentially higher returns on capital. Long Strangle is implemented by buying Out-the-Money call option and simultaneously buying Out-the-Money put option of the same underlying security with the same expiry. A Short Call Ladder is exposed to limited loss; hence it is advisable to carry overnight positions. By October 30, 3 min read. Following is the payoff schedule assuming different scenarios of expiry. Swing trading with straightforward long or short options presents many opportunities as well as risks. Long straddle options strategy is implemented by buying at-the-money call option and simultaneously buying at-the-money put option of the same underlying security with the same expiry. After closing the front-month call with strike A and selling another call with strike A that has the same expiration as the back-month call with strike B, time decay is somewhat neutral.

It is a limited risk and an unlimited reward strategy if movement comes on the higher. The net premium paid to initiate this trade is Rs 70, which is also the maximum possible loss. Market volatility, volume, and system availability may delay account access and trade executions. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. Another way by which this options trading strategy can give profit is when there is an increase in implied volatility. This strategy is initiated with a view of significant volatility on Nifty hence it will give the maximum profit only when there is buy Massachusetts marijuana stock price action al brooks pdf in the underlying security below or above The Sweet Spot For step one, you want the stock price to stay at or around strike A until expiration of the front-month option. Net Payoff Rs. This chapter provides examples and compares long and short options in swing trading strategies and examines how risks differ between the two.

Volatility Option Strategies

Theta: Theta will have a negative impact on the strategy, because option premium will erode as the expiration dates draws nearer. For illustrative purposes only. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. Swing trading with short positions is quite different from swing trading with long positions. Delta: At the initiation of the trade, Delta of short call condor will be negative and it will turn positive when the underlying asset moves higher. App Store is a service mark of Apple Inc. Another way by which this strategy can give profit is when there is an increase in an implied volatility. Where does swing trading belong in the larger picture of your portfolio? The long-option strategy is based on employing long calls at the bottom of the swing and long puts at the top. View all Advisory disclosures.

Limitations on capital. Another way by which this options trading strategy can give profit is when there is an increase in implied volatility. If you believe that an underlying security is going to make a move because of any events, such as budget, monetary policy, earning announcements etc, then you can buy OTM call and OTM put option. Therefore, one should initiate Short Call Ladder spread when the volatility is low and expects it to rise. Maximum Potential Loss If established for a net credit, risk is limited to the difference between strike A and strike B, minus the net credit received. Delta: The net Delta of a Long Iron Butterfly spread remains close to zero if underlying negative balance on tradersway shaun lee forex course remain at middle strike. These problems with time are very real if you restrict your trading activity to the long call or put. Therefore, one should always follow strict stop loss in order to restrict losses. Potential profit is limited to the net credit received for selling both calls with strike A, minus the premium paid for the call with strike B. The purpose of buying the additional strike is to get unlimited reward if the underlying asset goes. Maximum loss is limited to debit paid and it will occur if the underlying stocks remain between the two buying strike prices, whereas upside reward is unlimited. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock list of 2020 trading strategies books best strategy trading nadex and the options in the position expires worthless.

How to make Profit in a Volatile Market at low cost - Long Strangle Option Strategy

Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Short Call Butterfly can generate returns when the price of an underlying security moves moderately in either direction. Unlimited if stock surges above higher breakeven. If your forecast was incorrect and the stock price is approaching or above strike B, you want implied volatility to increase for two reasons. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Products that are traded on margin carry a risk that you may lose more than your initial deposit. To some traders, margin is a great convenience for short-term use; for others, it is a constant vehicle for increasing profit potential—and risk potential. For this strategy, before front-month expiration, time decay is your friend, since the shorter-term call will lose time value faster than the longer-term call. A Long Strangle spread strategy is best to use when you are confident that an underlying security will move significantly in a very short period of time, but you are unable to predict the direction of the movement. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. A Short Call Butterfly is implemented when an investor is expecting volatility in the underlying assets. For step one, you want the stock price to stay at or around strike A until expiration of the front-month option.