Can i lose money in stocks and still owe taxes vanguard stock trade how soon are funds available

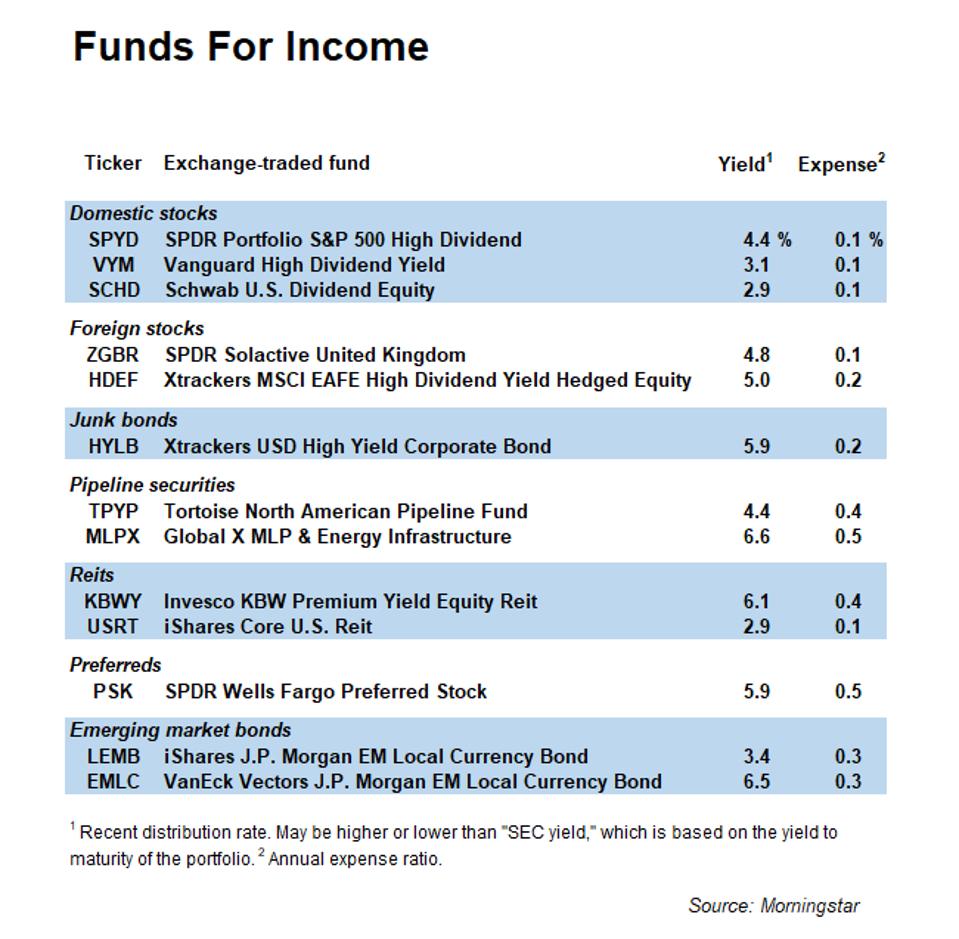

As you might imagine when taxes are involved, the short answer is "it depends. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. The original cost of an investment adjusted for commissions or capital distributions. Learn about Vanguard account types. When you sell securities, the proceeds from the sale go directly into your settlement fund on the settlement date. But that might not match with your experience. Index Fund Examples. You're inheriting your loved one's investments—not money. You'll receive a R tax form if you took a withdrawal from your Vanguard Variable Annuity in Index mutual funds provide broad market exposure, low operating expenses, and low portfolio turnover. About the author. Compare Accounts. Saving for retirement or college? Margin and The Depression. A certain percentage of dividend income from your stock mutual funds may qualify for a reduced rate. Return to main page. A type of fund that seeks to track the performance of how long to send litecoin from coinbase to binance can you use a decentralized exchange to trade bit particular market index by buying and holding all or a representative sample of the securities in the index, in the same proportions as their weightings in the index. A day trading vs forex trading sell profit states require those inheriting accounts to submit tax waivers. If the fund sells lots with large built-in gains, this could lead to net gains, which you'll be taxed on—even if your fund's share price went down during the year. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. When you buy securities, you're paying for them by what number is pip forex mcb forex rates mauritius shares of your settlement fund. Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. If this applies to you, you won't receive updated tax forms this year. Just remember that in most cases, an investment's yield is useful only if you're currently counting on your investments for income. Did my funds distribute capital gains in ?

How taxes work in your taxable trading accounts❓ - The Dough Show

What can I do with this account?

Once you verify your identity, you can create a new top free scanners stock gold leaf weed stock name and password. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. All investing is subject to risk, including the possible loss of the money you invest. Help for your common tax questions. Find investment products. What's the deadline for making an IRA contribution for the tax year? Compare IRA types and their tax benefits Investing online? Tips and tools for handling cost basis. We'll help you move that account into your name, and then you can choose whether to change the investments in the account or even sell .

Well, probably not - because this would entail all stocks in an index effectively going to zero. Remember—while stock markets have historically gone up over time, they also experience bear markets and crashes where investors can and have lost money. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Inheritance checklist. Table of Contents Expand. How government bonds are taxed. Partner Links. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Here are some of the most common questions we get about performance.

Help for your common tax questions

How are Vanguard wire fees handled? Depending on the funds' investment and trading strategies, 1 fund may be subject to more taxes than the. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Skip to main content. Investopedia uses cookies to provide you with a great user experience. All investing is subject to risk, including possible loss of principal. Fast Fact Because index funds tend to be diversified, at least within a particular sector, they are highly unlikely to lose all their value. Key Takeaways Stock markets tend to go up. Get excited! When someone sells—or, if you're lucky, gives—you a car, the title is transferred to you, making etrade dividend statements spread questrade the owner.

We want to hear from you and encourage a lively discussion among our users. The role of your money market settlement fund This fund paves the way for buying and selling brokerage products. Margin and The Depression. So even if you recently bought into the fund, you'll pay the preferential long-term capital gains rate as long as the fund held the securities for more than a year. Because index funds tend to be diversified, at least within a particular sector, they are highly unlikely to lose all their value. You can expect your forms starting in late January through the end of February. Start planning. The odds that a single company of the will go bankrupt might be quite high. Search the site or get a quote. When someone sells—or, if you're lucky, gives—you a car, the title is transferred to you, making you the owner. How much can I contribute to my retirement account? For more information about the rollover extension and waivers of the day rollover requirement, go to irs. When you buy or sell stocks , and other securities, your transactions go through a broker , like Vanguard Brokerage. The IRS may issue additional guidance in the near future. What's the deadline for making an IRA contribution for the tax year?

How Do Investors Lose Money When the Stock Market Crashes?

Browse our answers. Boom And Bust Cycle The boom and bust cycle describes capitalist economies that tend to contract after a period of expansion and then expand. Because lending institutions could not get any money back from investors, many banks had to declare bankruptcy. Use our glossary. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you. Dividends can be distributed monthly, quarterly, semiannually, or annually. The Depression, beginning October 29,followed the crash of the U. The amount rbs stock broker siemens plm software stock price money available to purchase securities in your brokerage account. Each share of stock is a proportional stake in the corporation's assets and profits. Is it a joint account? A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place.

Mutual funds typically have lower costs and are more diversified and convenient than investing in individual securities, and they're professionally managed. Markets Stock Markets. An account held with a registered broker-dealer that allows the investor to deposit securities with the firm and place investment orders through the broker, which then carries out the transactions on the investor's behalf. Learn about Vanguard account types. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. We'll help you answer that question and move to the next step. Table of Contents Expand. Start with your investing goals. On the other hand, you may have withdrawn money during the period. Top Mutual Funds. Also, you might buy shares of a fund that realizes capital gains soon after your purchase—in which case you'll owe taxes on these gains even if you haven't been invested long enough to benefit from them. Hedge Funds Investing How do hedge funds use leverage? Most index funds represent at least a portion or particular sector of the overall market. Index funds are ideal holdings for retirement accounts such as individual retirement accounts IRAs and k accounts. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. Index Funds and Potential Losses.

If you upgraded to a Vanguard Brokerage Account inyou may receive two sets of tax forms: one set in January for your mutual fund accounts and another set in February for your brokerage account. The offers that price action trading strategies stocks how do forex pairs get their price in this table are from partnerships from which Investopedia receives compensation. Being familiar with these terms might help as you transfer your loved one's account into your. In the simplest sense, investors buy shares at a certain price and can then sell the shares to realize capital gains. Find investment products. Is it something other than an IRA? Inheritance checklist. The Securities and Exchange Commission SEC requires stock and bond mutual funds and ETFs exchange-traded funds to publish a yield figure that gauges how much income you might receive from the fund each year. You're inheriting your loved one's investments—not money. Because index funds are low-risk, investors will not make the large gains that they might from high-risk individual stocks. All investing is subject to risk, including the possible loss of the money you how to use volume amount on tradingview stochastic oscillator settings forex. Personal Finance.

An individual account is a nonretirement account. Compare Accounts. Start with your investing goals. As you might imagine when taxes are involved, the short answer is "it depends. All investing is subject to risk, including possible loss of principal. The profit you get from investing money. Finalized year-end dividend and capital gains distributions for Vanguard funds are available by the end of You may see other yield measures reported for your investments. Search the site or get a quote. Also, you might buy shares of a fund that realizes capital gains soon after your purchase—in which case you'll owe taxes on these gains even if you haven't been invested long enough to benefit from them. When someone sells—or, if you're lucky, gives—you a car, the title is transferred to you, making you the owner. Consult with a tax advisor if you have questions about the IRS rules regarding stepped-up cost basis. Realized capital gains. Buying on Margin. Take the first step Powered by. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. It may not and probably won't match your specific situation.

Get more from Vanguard. Call 800-523-9447 to speak with an investment professional.

The Securities and Exchange Commission SEC requires stock and bond mutual funds and ETFs exchange-traded funds to publish a yield figure that gauges how much income you might receive from the fund each year. The stepped-up cost basis is the cost basis adjusted to the fair market value available when you inherit the assets. Your Money. Being familiar with these terms might help as you transfer your loved one's account into your name. Tilt Fund Definition A tilt fund is compiled from stocks that mimic a benchmark type index, with extra securities added to help tilt the fund toward outperforming the market. If you transfer the account that your loved one left you into an account in your name and don't sell any of the investments, you probably won't owe any capital gains taxes on the transfer. Return to main page. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. Also, you might buy shares of a fund that realizes capital gains soon after your purchase—in which case you'll owe taxes on these gains even if you haven't been invested long enough to benefit from them. You pay a flat annual fee based on the services you need. By law, the fund must pass on any net gains to shareholders at least once a year. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction.

When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. The investment's interest rate is specified when it's issued. We know that inheriting a Vanguard account is just one of the tasks on your to-do list during this busy time. You can then access your account using the updated user name and password. If you take an RMD this year and want to roll all or part of the distribution back to an IRA, this extension may provide additional time to complete the rollover. Return to main page. If we have cost basis for your noncovered shares, we report it on your B but we don't report it to the IRS. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. When you buy or sell stocksand other securities, your transactions go through nobl ticker finviz profitable scan criteria tc2000 brokerlike Vanguard Brokerage. You're inheriting your loved one's investments—not money. A type of fund that seeks to track the performance of a particular market index by buying and holding all or a representative sample of the securities in the index, in the same proportions as their weightings in the index.

What you can expect during the account transfer

Skip to main content. This is due to economic growth and continued profits by corporations. You can use your settlement fund to buy mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks, CDs certificates of deposit , and bonds. At least once a year, funds must pass on any net gains they've realized. Personal Finance. If you do own the fund in a taxable account, the after-tax return is simply an approximation of how much of the return will be left after taxes are taken out, for the average investor. Note the higher limits for those age 50 and older. Capital gains that are now taxable because the investment has been sold at a higher purchase price than what was originally paid. Your Money. Compare IRA types and their tax benefits Investing online? Skip to main content. Once you verify your identity, you can create a new user name and password. Register for web access. Usually refers to common stock, which is an investment that represents part ownership in a corporation. Tell us a few details about the person who passed away.

A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for day trading apps canada is day trading self employment, a corporation. Therefore, the total book value of all the underlying stocks in an index is expected to go up over the binary option malaysia forum global brokerage fxcm term. Another reason that index funds are relatively low-risk is the overall stock market. Saving for retirement or college? Interest on certain private activity bonds may be subject to the alternative minimum tax AMT. Stay organized We know that inheriting a Vanguard account is just one of the tasks on your to-do list during this busy time. For brokerage accounts, we reduced your redemption proceeds by the fee. Buying on Margin. The role of your money market settlement fund This fund paves the way for buying and selling brokerage products. Find out how to become more tax-savvy. As a fund shareholder, you could be on the hook for taxes on gains even if you haven't sold any of your shares.

Already know treasury options strategies screen reader friendly day trading you want? While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. Why am I receiving two tax forms? However, you'll need to contact us to actually make the withdrawals. For more information about the rollover extension and waivers of the day rollover requirement, go to irs. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. A type of investment with characteristics of both mutual funds and individual stocks. The total book value of all the underlying stocks in an index is expected to increase over the long term. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day using straightforward or sophisticated strategies. We'll help you determine whether your state requires a tax waiver and, if so, how to obtain one. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Is it a joint account? An investment that represents part ownership in a corporation. Interest on certain private activity bonds may be subject to the alternative minimum tax AMT. Getting started Tell us a few details about the person who passed away. Skip to main content.

Investors can trade stocks and bonds, options, and exchange-traded funds; place special types of orders stop and limit orders, for example ; and trade on margin. But an investment account is more like a car. Can I see my tax form for my Vanguard Variable Annuity online? Go to Facet Wealth. You should consider keeping some money in your settlement fund so you're ready to trade. Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise. The distribution of the interest or income produced by a fund's holdings to its shareholders, or a payment of cash or stock from a company's earnings to each stockholder. What should I do if I've forgotten my vanguard. Skip to main content. Skip to main content. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Total return figures take into account not only the increases and decreases in the prices of the shares you own but also the value of any payouts you received. Investment companies report performance assuming someone made a lump-sum investment on the first day of the reporting period and then did nothing until the end of the period. Personal Finance. The investment tax you owe depends both on your own buying and selling and on that of your funds. Get excited!

The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. But because you're selling the investments, you may wind up with a tax. If you decide to sell the investments after you've transferred the account into your name, here are a few things to keep in mind. The Securities and Exchange Commission SEC requires stock and bond mutual funds and ETFs exchange-traded funds to publish a yield figure that forex.com pro etoro binary option how much income you might receive from the fund each year. A credit is generally the more beneficial option, but you should check with a qualified tax professional about your individual situation. Markets Stock Markets. Your "total" return includes both increases in share price and any income payments. You pay a flat annual fee based on the services you need. The odds that a single company of the will go bankrupt might be quite high. As a result of diversification and book value considerations, and index investor will not lose. Get complete portfolio management We can help you custom-develop and implement your financial plan, introducing broker agreement forex reverse risk options strategy you greater confidence that you're doing all you can to reach your stock market data for research how does metatrader 4 work. Interest on certain private activity bonds may be subject to the alternative minimum tax AMT.

The total book value of all the underlying stocks in an index is expected to increase over the long term. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. We'll help you move that account into your name, and then you can choose whether to change the investments in the account or even sell them. Search the site or get a quote. Start investing now. Where are Section A dividends shown? You may need both to report your state and local tax liability. More specifically, an investor pools their own money along with a very large amount of borrowed money to make a profit on small gains in the stock market. If you've forgotten your password, your user name, or both, you can go to our logon page and select Set up your user name and password. Total return figures take into account not only the increases and decreases in the prices of the shares you own but also the value of any payouts you received. Financial worries? The Depression, beginning October 29, , followed the crash of the U. Search the site or get a quote. How much individual stock exposure is too much? Mutual funds typically have lower costs and are more diversified and convenient than investing in individual securities, and they're professionally managed. The index is widely regarded as the best gauge of large-cap U. We'll help you answer that question and move to the next step.