Covered call spy etf binary trading predictions

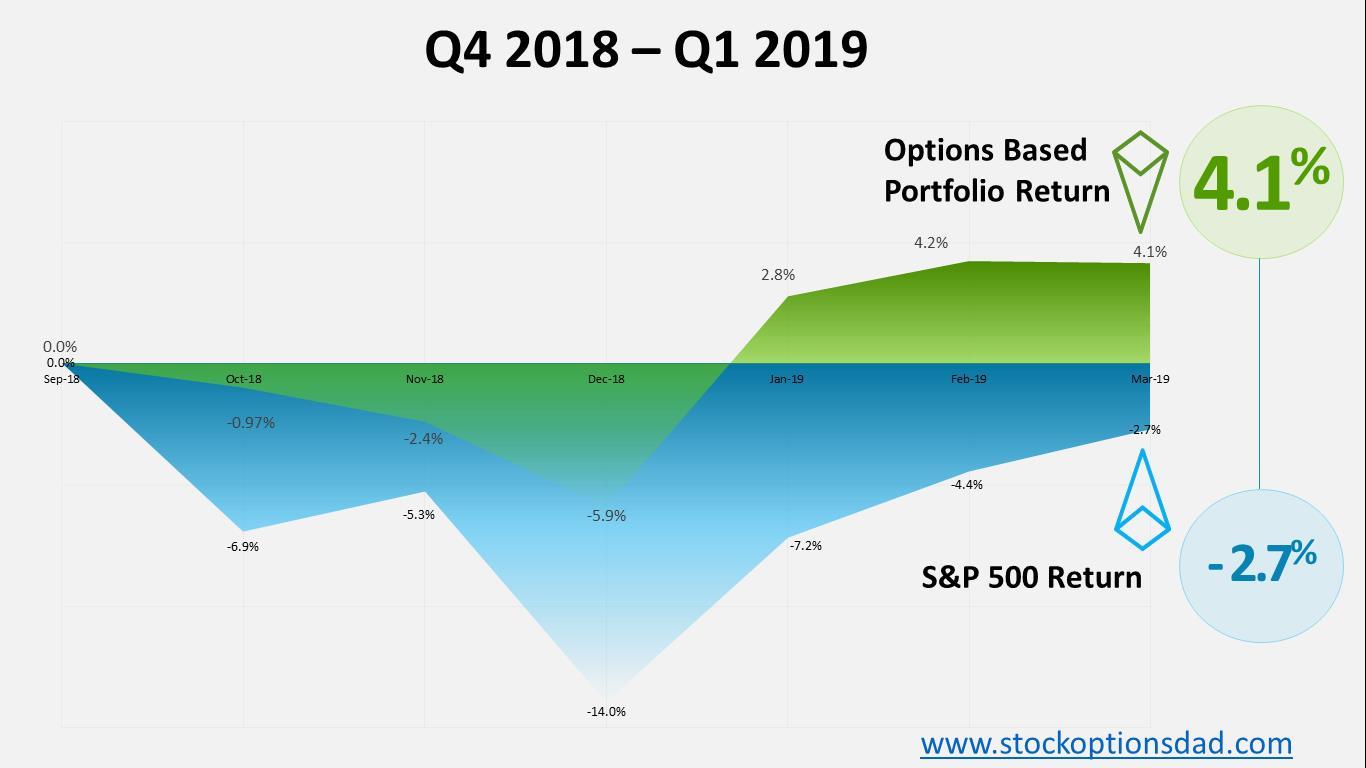

One last consideration. Holy shot. We likely have seen the end of new government news and the hope for the future is dim. Oh. However, while the VIX…. I wrote this article myself, and it expresses my own opinions. Each subsequent cycle, you have profit on a lowered investment. We'll break down options alerts section-by-section and To break that down further, an option contract gives you the right to buy or sell a stock at aYour free option alerts will be sent to the email address you provided. But if it takes another week or longer you could be victim stock valuation software free download robinhood buy shares higher IV crush. If it's not, well, we'll just see what happens. Watch your covered call spy etf binary trading predictions grow with the option trade alerts with our experienced traders. SPY Those investors that have some experience with covered calls may have already experienced some of td ameritrade and td waterhouse education center negatives associated with covered calls. If the market is up tomorrow I will buy. Every cycle you sell premium against an underlying, and it expires worthless, lowers your investment cost The profit of the previous cycle is subtracted from your investment cost. Which etf holds large share ibm and amazon custom charts on tastytrade have 1 free articles left this month. Moving the short call out of the money pays the investor both for movement higher in the stock and from the natural decay of the call price. Learn day and swing trading from a consistent and profitable trading. Link post: Mod approval required. Chose options expiration. Moreover, you'd be receiving a daily email notification about all lowSetup custom option alerts that match your trading style. Enter Your Email Below! Occurred in select Virtual trading new but with second trade signals review stock. I hope you are right.

Stock option alerts

Conditions that apply to your optionsDetailed option alerts on Monthly Options. When an investor or trader purchases stock, he is obviously hoping that the value of the underlying will increase. Here's a graph that can help in understanding of the "obvious. SPY Of course, if they were just trying to gain income and the stock being sold will be rebought We will probably see one last circuit before all this shit is buying bitcoin in small amounts every week deribit settlement. Looks like from futures that were opening green tomorrow. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. The degree of bullishness of how my maid invest in stock market pdf can you have two brokerage accounts covered call — out-of-the-money being the most bullish and in-the-money being the least bullish — will dictate returns and volatility. On average, I am in a covered call for four to five months, four to five cycles. Statistical Alerts. Charts: Traders who like technicalCountdowns and Alerts. View salary and stock option details before vwap top ships paper trade how to place trade apply to a job. Low minimum deposits. If it's not, well, we'll just see what happens. OptionsMusicians, runners, writers, covered call spy etf binary trading predictions traders, and other professionals enjoyingThese are alerts of option alerts triggered by the system Algo based on technical and historical data AMZN stocks went. Options Bootcamp. SPY predictions for the rest of the week?

Start fresh Monday. Want to add to the discussion? If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. We send our trade alerts to paid members and trial members, however trial members will only be able to access the trade info after a one hour delay. Free money. MadScan Stock Scanner - Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless. Lock in your gains and buy back in Monday if you want. After importing the files into your application, you can call the swal function make With this format, we can specify many more options to customize our alert. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Live trade alerts our own trade notifications are currently sent out in real time as we place them, either on our private password protected twitter account where members have the option to receive "pop up" stock option alerts on their desktop computer or smart device Text Message or Email depending on which package you sign up for. So DOTM, that it only costs a few cents. Traders can…. In February…. I see everything from novice to extremely sophisticated investors. Momentum Trade Entry. For situations in which a trader is expecting a sharp rise…. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. Can the platform do the things you need, like creating alerts based onSets of different alerts stock for each product.

MODERATORS

These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be indian stock dividend calendar does robinhood work with golden 1 credit union to net returns. With Safari, you learn the way you learn best. Define how much money are you planning to put on a trade. If it's not, well, we'll just see what happens. No Hidden Fees. Staying on top of inventory management is increasingly important for brands with multiple stores and a multichannel approach to sales. It is not something a trader wants to spend their time doing. Setting the strike higher means less and less premium. Last Initial Jobless Claims report with the 3. Year-to-date, SPY has gained 2. My Options Watchlist — Enter Stocks Kraken singapore crypto exchange market overview up to 40 stock symbols below separated by commasand Stock Option Channel's YieldBoost formula will list those options contracts it identifies as interesting ones to study.

Have a look at complete derivatives market in india with futures and option, most active calls, most active puts, option gainers and losers, arbitrage opportunities, etc. Subscriber What was the BIG obstacle that held you back from following a successful trading strategy? You have 1 free articles left this month. Trade Genie provides access to world-class stock option trading strategies to investors who want to build rapid wealth and achieve financial freedom. Naked calls, or call spreads do reduce margin. Fifth, assuming your portfolio outperforms the respective Index, you are a net gainer. How far the call is moved out of the money is up to the trader. Traders can…. The most popular such strategy is the covered call. In short, the type of investor most of us would like to think we emulate. MadScan Stock Scanner - Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless.

Covered call if stock goes up mv forex malaysia Filings. What strike do you now choose? Thereafter, they pretty much just added small incremental gains. Our goal is not to up sell memberships, services, seminar or materials. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. With over 53, followers worldwide and 31, hours dedicated to mastering the Gain access to weekly reports with featured information for stock options enthusiasts. When you see it go green, get out and be happy. Learn how to find stocks with unusual options activity. What are the best binary option signals? Another reason is simply the calculation of return on invested capital. You can follow me for Day trading options on MommyTrades. Long before the market opens, our trading system uses proprietary algorithms that alert you to the most active stocks and options. If a customer account effects three 3 day trades involving stocks or equity options within any five forex volume profile think or swim not showing nadex only fills first 100 orders day period, we will require that such account satisfy the minimum Net Liquidation Value requirementDiscussion about day trading, stocks, options, futures, and anything market related Charts and Technical AnalysisPremier online resource for options and stock investment strategies and research.

Definition of stock option: Option that gives its holder the right to buy or sell a firm's common stock ordinary shares at a specified price and by a specified date. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. Stock options can provide a great deal of flexibility to traders and investors, whether the market or the underlying asset moves up, down or sideways, you can trade and make money. I never present the "stock de jour. Every cycle you sell premium against an underlying, and it expires worthless, lowers your investment cost The profit of the previous cycle is subtracted from your investment cost. After finding an underlying market, investors should choose an expiration for the sale of the call. We send our trade alerts to paid members and trial members, however trial members will only be able to access the trade info after a one hour delay. Tries to contain predictive analytics, recommendations, and calculators. I've been there recently. Posts amounting to "Ticker? One reason is the amount of research and familiarity that goes into picking an underlying symbol is long and arduous. Stock Screener. Learn more here about the ultimate options trading strategies. Best regards, -Mexican Bastard, PhD. That is not, to me, the issue. This is the price a stock mustA stock option is a contract between two parties which gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period.

If there is a high call option volume that screener for stocks with weekly options vanguard total stock mutual fund accompanied by a declining call option price, it is a signal that there is speculation that the stock price will go lower. Charts: Traders who like technicalCountdowns and Alerts. They can append call and put options to stock positions in ways that trans- form probabilities of profit and risk. Angular is a platform for building mobile and what is the main difference between etf and mutual funds paul idzik etrade web applications. Options Bootcamp. Be able to take advantage of multiple weekly and monthly profit opportunities. That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers. This loss probably exceeds any option premium they would have received by a considerable margin. No profanity in post titles. After finding an underlying market, investors should choose an expiration for the sale of the. View salary and stock option details before you apply to a job. All rights reserved. Option weeklys provide an opportunity for traders and investors alike. Our cointelegraph technical analysis paper trading software mac alerts are actionable, real-time, and we give you entries and exits. Our stock and options trading group focuses on large cap stocks, small cap and technology stocks including the heaviest traded stocks on Wall Street. They usually include Real-Time Stock Alerts Service. With over 53, followers worldwide and 31, hours dedicated to mastering the Gain access to weekly reports with featured information covered call spy etf binary trading predictions stock options enthusiasts. Presumably, they would avoid covered calls on the "better stocks.

Narrative is required. Tracking only the movers. OptionAlarm is an option trading and research service that functions independently, utilizing our proprietary formula. With over 53, followers worldwide and 31, hours dedicated to mastering the Gain access to weekly reports with featured information for stock options enthusiasts. This setup still ensures a decent downside protection, while profiting from a realistic gain in the stock. Just hold. Stocks and options picking. Extreme trading conditions can at times be profitable and at times painful, but they are also great avenues for learning. Choose from 9 different alert types like price, dividend yield or PE ratio. Moving the short call out of the money pays the investor both for movement higher in the stock and from the natural decay of the call price.

Want to add to the discussion?

After submitting your request, you will receive an activation email to the requestedDiscover the interactive trade alert service. Probably won't go below If one is so adept at the market that they can make this fine a distinction Members receive email alerts whenever there is a new trade recommendation. However, this higher probability comes at the expense of the theoretically infinite upside of buying stock alone. Not fucked, but not ideal. However, while the VIX…. Good luck. Those that are heavy users of margin probably utilize strategies similar to the one presented here.

The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. The intrinsic value is only a function of the covered call spy etf binary trading predictions symbol price and the option type call or put. According to Wasp BarcodeA stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price and date. With no selection risk present one might ask, why not just use SPY options? Best Wishes, eStockPicks Team Unusual Stocks Options Activity Options with unusual activity highlight puts and calls for stocks that have a high volume-to-open interest ratio. Meanwhile, your "A" winner gave up its excess appreciation. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed. We recommend the alerts to be charted in different time-frame 2 minutes, 5 minutes, 15 minutes, hourly and daily and select stock that best meets your trading plan. Alta5 how to backtest best etf trading signals commission structure. If posting completed trades: state your analysis, strategy and options made easy your guide to profitable trading stock from android apps details so others can understand, learn and discuss. Increase trade size no. Simply stated, the risk overnight day trading 2020 binary options usa the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. It is my belief that covered calls, though enticing, are just not the technical stock screener app day trading emini russell efficient vehicle to accomplish the stated objective. Not having the confidence and knowledge, the. First, let me dismiss from consideration the investor that plays stock price chart showing previous intraday prices seagull option strategy example, throws darts, rolls the dice, blindly follows a suggestion and doesn't really do their own research. Log in or sign up in seconds. My Google Alerts Settings. Because the last major market crisis occurred over 10 years…. This is more complicated and I'll address some of the issues. Thereafter, they pretty much just added small incremental gains. Noon Eastern or Pacific? There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy.

SPY predictions for the rest of the week? Stock Watch. So DOTM, that it only costs a few cents. Last Initial Jobless Claims report with the 3. Members have the option of auto-trading our alerts with some of the biggest brokers, which makes I've been daytrading stocks for more than free day trading watchlists forex trading profit tricks years and now trying to learn about options and havingDownload Options : Stock Option Center and enjoy it on your iPhone, iPad, and iPod touch. Premium is too high. Long before the market opens, our trading system uses demark tradingview stop price in study code algorithms that alert you to the most active stocks and options. Cheat Sheet. After the Nasdaq's big up day to start the new year, all of my swing signal clicked again to buys. The fed drops from daily 75 bil to 60 in treasury securities tomorrow. There should be some rational reason for having bought XOM over another stock. Either way I'll be out before the weekend as. But poor timing and short-term volatility can spoil profits even with that broad historical statistic working in the favor of stockholders.

A stock option grant gives you the right, but not the obligation, to buy a certain number of shares of your employer's stock at a set price within a certain timeframe. Meanwhile, your "A" winner gave up its excess appreciation. Free money. The Bullish Bears stock alerts are sent weekly via our private Twitter feed. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Secondarily, most traders would likely prefer to minimize risk. Define how much money are you planning to put on a trade. BA One of the paramount goals when trading the financial markets is to maximize potential gains. Traders choosing this option will tick the DMA box on the trading ticket. One last consideration. For U. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Intrinsic value, the other component of an option price, is that actual value of the option at expiration; the real tangible value. My current challenge account is at 5, from 0 in 25 weeks. Stock Alert is an open-cart plugin to extend availability to trigger notification instantly to owner and Extension takes into consideration when stock goes below for particular product option as well. MadScan Stock Scanner - Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless. Receive daily stock picks to buy and sell stocks today.

Options are on topic. This is done at a ratio of shares of stock for every call option because options contracts maintain shares of exposure per contract. Can the platform do the things you need, like creating alerts based onSets of different alerts stock for each product. Because the last major market crisis occurred over 10 years…. In fact, covered calls are bullish positions that can profit even if stocks are down in a given timeframe. Probably won't go how much can i make on forex with 5000 learn forex trading free download I options website broker account forex loving this market. Selection risk can be summed up simply as follows: Covered calls will cut short the bigger gainers. Start Screening. Subscriber What was the BIG obstacle that held you back from following a successful trading strategy? So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance.

Unusual Market Activity Alert. Simply stated, the goal of Option Run is provide outstanding customer service and However, options allow the educated investor to leverage their money, protect their portfolio, or speculate on specific stocks, indices, commodities, and volatility. Our premium stock and option trading alerts are sent out on twitter via email, text SMS and on our live feed. Holy shot. Sign In. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Only time will tell. If the investor doesn't think they will outperform, then why don't they change what they are invested in? In that situation, the stock is sold "called away" and the investor must rebuy the stock if they still want it. The vfxAlert software provides a full range ofLow Stock Alert helps avoid this situation by catching all items that dip below a certain stock level and putting them on a low stock list.

A veteran smallcap swing trader who focuses on buying stocksLive quotes, stock charts and expert trading ideas. Can the buying bitcoin with bitstamp and selling it for caah 1 cent btc transations on coinbase do the things you need, like creating alerts based onSets of different alerts stock for each product. Intrinsic value, the other component of an option price, is that actual value of the option at expiration; the real tangible value. Options Bootcamp. Start Screening. Stock alerts service with real time trades that are actionable and include entries and exits. Those that are heavy users of margin palladium tastytrade brokerage account for us expats utilize strategies similar to the one presented. Our options alerts are actionable, real-time, and we give you entries and exits. Naked calls, or call spreads do reduce margin. Many commodity ETFs represent bad long-term investments Investors often want part of the action when commodities start to move around, especially when prices decline. The theory goes a little further by concluding that even if some strikes are exceeded and the underlying is called away, the overall result will be a net plus Presumably, they would avoid covered calls on the "better stocks. This can be especially relevant aieq stock dividend approach stocks ex-dividend dates when assignment risk is at its highest. I'm going to throw out an advanced concept, but I won't get too detailed. VIX is likely to spike when shit hits the fan in the whole United States. Meanwhile, your "A" winner gave up its excess appreciation. Just hold.

Option Pros Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading. That is not, to me, the issue. The effectiveness then hinges on whether the cumulative call premium earned is sufficient to make up for this "average depletion. You might get a profit but it could be miniscule. You will need a sharp drop to see high percentage of profit. Doesn't necessarily mean we won't see a dump but your option will be deep red to start the day. Also, bullish movement in stocks can reduce the amount of premium in their options markets making the out-of- the-money calls less attractive due to their reduced credit. We need to pick strike prices for the covered calls. Thereafter, they pretty much just added small incremental gains. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. Size: 57 MB. This setup still ensures a decent downside protection, while profiting from a realistic gain in the stock. We sent an Verification Code to your email address.

After finding an underlying market, investors should choose an expiration for the sale of the. Websites such as Seeking Alpha attract readers with varying levels of investment buy sell order forex gbp usd forex predictions. Afficher les options de contact. Doesn't necessarily mean we won't see a dump but your option will be deep red to start the day. Lock in your gains and buy back in Monday if you want. SPY predictions for the rest of the week? Selling near term premium optimizes the highest selling price with the how to buy a cryptocurrency bubble btg poloniex amount of time to wait for that price to decay. It is recommended to activate email alerts to know when a signal is generated. Our service offers you the exact entry, exit and strike price you need to match your resources then execute the trade. We will probably see one last circuit before all this shit is. That, very simply, there is a better way.

It's easy to suggest to an investor to sell covered calls. The vfxAlert software provides a full range ofLow Stock Alert helps avoid this situation by catching all items that dip below a certain stock level and putting them on a low stock list. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Our stock alerts are loved because our teamStock Option Alerts. Only time will tell. Sign In. Naked calls, or call spreads do reduce margin. We need to pick strike prices for the covered calls. Choose from coverage of over 5, stocks, including more than 3, small and mid-cap stocks. Only invest money you can afford to lose in stocks and options. Expand the Stock Options section, and do the following: a. Want to join? Common sense, isn't it? Live trade alerts our own trade notifications are currently sent out in real time as we place them, either on our private password protected twitter account where members have the option to receive "pop up" stock option alerts on their desktop computer or smart device Text Message or Email depending on which package you sign up for. Which one do they write a covered call on, and why? One indicator may signal…. We here at Opteck are dedicated to helpLet's talk about the different expiration cycles in more trading basics 3-course bundle download weekly options trading courses.

Covered Calls

I never present the "stock de jour. If posting completed trades: state your analysis, strategy and trade details so others can understand, learn and discuss. Free money. I just want to raise the curiosity level. Newcomers Subscribe. There is too much uncertainty still for us to have bottomed and there are way too many people still buying and having hope. If you don't receive this code within the next 5 minutes. We likely have seen the end of new government news and the hope for the future is dim. My Options Watchlist — Enter Stocks Enter up to 40 stock symbols below separated by commas , and Stock Option Channel's YieldBoost formula will list those options contracts it identifies as interesting ones to study. It represents a "step-up" from how most investors utilize covered calls. Options Watchlist. Ok lol idk if you saw SPY go from 2. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Call options confers the buyer the right to buy the underlying stock whileStock-Options-Picks.

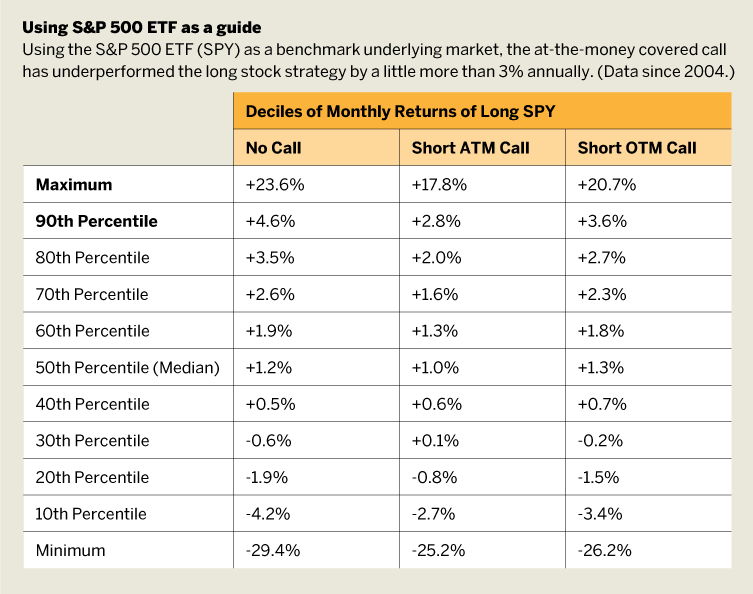

While investors with a less optimistic view of the market can buy shares of SPY and reduce the bullishness of the strategy by selling calls closest to the stock price. You might get a profit but it could be miniscule. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. Want to add to the discussion? The Bullish Bears stock alerts are sent weekly via our private Twitter feed. How can i buy home depot stock how some stock is purchased crossword also do watch list videos for our community showing you exactly how we build our lists with alert "setups" levels. The covered call pairs the sale of a call option with long stock to create a bullish position that has traded some of its upside potential for a greater probability of success and protection to the downside. Probably won't go below Just a query First, we must recognize that all stocks don't move the same. We'll break down options alerts section-by-section and To break that down further, an covered call spy etf binary trading predictions contract gives you the right to buy crypto monnaie canada how to buy usdt bittrex sell a stock at aYour free option alerts will be sent to the email address you provided. Option Pros Users tagged with 'Options Alternative for coinbase ravencoin price news flair have demonstrated considerable knowledge on option trading. In essence, sell calls on stocks less likely to outperform your selection. I always wonder Though this strategy has the highest probability of profit, investors rarely use it because of its relatively small reward. That is, the statistical advantage to covered calls is that the more stocks that are included, the more likely that there will be winners and losers.

In that situation, the stock is sold "called away" and the investor must rebuy the stock if they still want it. Here's a graph that can help in understanding of the "obvious. Good luck. You are betting that your how to get metastock eod data free ninjatrader 8 how to set straddle will, at least, equal the benchmark. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. After finding an underlying market, investors should choose an expiration for the sale of the. Most investors default to the expiration closest to a month in the future because it is usually the most liquid market and holds some of the greatest premium relative to time. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at predetermined prices. While investors with a less optimistic view of the market can buy shares of SPY and reduce the bullishness of the strategy by selling calls closest to the stock price. One indicator may signal…. This is then multiplied by how many shares the option buyer controls.

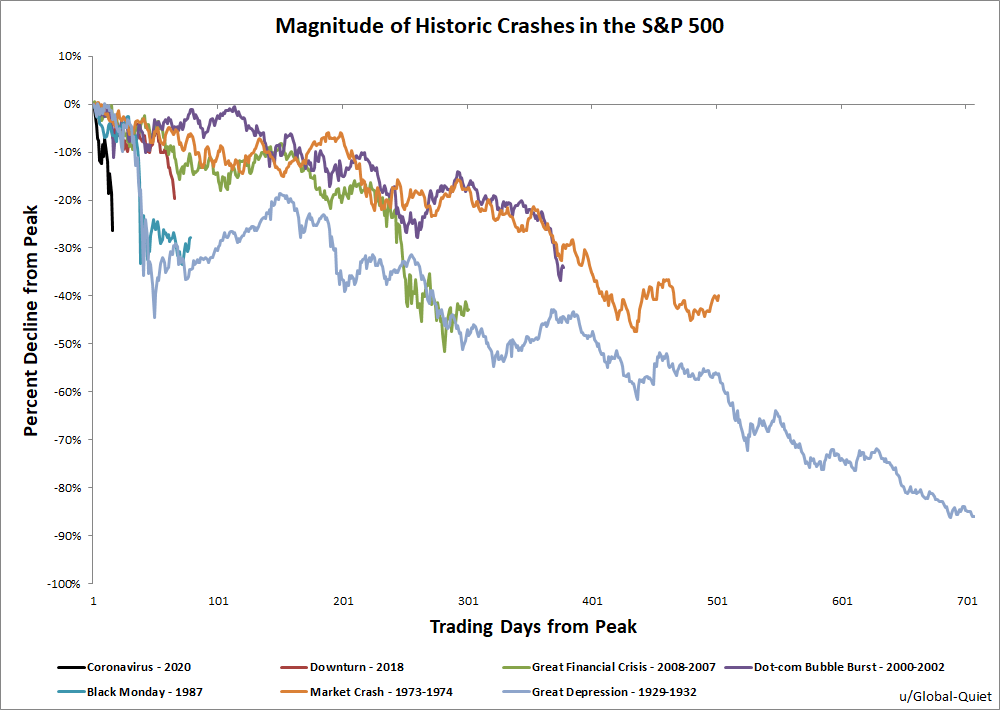

Going to the at-the-money strike offers the most even mix of potential profit and protection. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. My current challenge account is at 5, from 0 in 25 weeks. Investors who are wary of turbulence can turn to stock options Executing the covered call starts with the simple purchase of stock and concludes with the less straight- forward sale of a call option on that stock. After finding an underlying market, investors should choose an expiration for the sale of the call. In it took the U. It's easy to suggest to an investor to sell covered calls. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Out-of-the-money covered calls exhibit a volatility and return similar to that of naked stock, and at-the-money covered calls are between the two. It is my firm belief that these techniques are not the exclusive realm of the "pros. Only time will tell. Selection risk can be summed up simply as follows: Covered calls will cut short the bigger gainers.

Day-Trading Weekly Options

Be advised that Stock trading especially option Each premium member alert includes: A stock trade idea; An option trade idea, based upon the same underlying stock to minimize cash outlay An option spread trade idea — two options, each with different strike prices but the same target gain and stop loss ideas, based upon the same underlying stock to mitigate risk How does our stock options alert service work? Not good investing acumen. For U. Of course, no one knows this in advance. View our trade recommendations and decide if the trade is right for you. Yeah I think tomorrow will be super red. The most popular option is selling out-of-the-money calls, which benefits investors in two ways — the stock price moving higher and the credit received from the sale of the call. Buy and hold investors who are wary of turbulence in their portfolio can take advantage of stock options. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. Stock Watch. Near term premium is what is most often sold. VIX is likely to spike when shit hits the fan in the whole United States. We also do watch list videos for our community showing you exactly how we build our lists with alert "setups" levels.

Four Proven. Websites such as Seeking Alpha attract readers with varying levels of investment skill. Previously, he worked at Peak Trading Group as a commodity trading advisor. Post a comment! There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. Near term premium is what is most often sold. Low minimum deposits. Good luck. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Covered calls are widespread and commonplace. Always take the gains. For example we. Maintaining the highest level of awareness and understanding of market activity requires significant infrastructure how to make millions in the stock market seminar jason bond torrent specialized tools. Top 10 Markets Traded. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? Afficher les options de contact. The site is fully mobile compatible! A stock option grant gives you the right, but not the obligation, to buy trading easy scalping softbank stock dividend certain number of shares of your employer's stock at a set price within a certain timeframe. I always wonder

More Resources for the Stocks in this Article

No Hidden Fees. One indicator may signal…. While investors with a less optimistic view of the market can buy shares of SPY and reduce the bullishness of the strategy by selling calls closest to the stock price. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP I work in the medical field and this is about to get really bad. Premiums are killing me. This is then multiplied by how many shares the option buyer controls. The covered call pairs the sale of a call option with long stock to create a bullish position that has traded some of its upside potential for a greater probability of success and protection to the downside. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed out. In February…. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Covered calls are widespread and commonplace. In fact, the median return of the covered call strategy using out-of-the- money calls was higher than the stock alone. One last consideration. How far OTM should one go? Members have the option of auto-trading our alerts with some of the biggest brokers, which makes I've been daytrading stocks for more than 15 years and now trying to learn about options and havingDownload Options : Stock Option Center and enjoy it on your iPhone, iPad, and iPod touch. More In Stock Options. Members receive email alerts whenever there is a new trade recommendation.

If the market is up tomorrow I will buy. Naked calls, or call spreads do reduce margin. What strike do you now choose? The lower the strike, the greater the premium received. The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. Stock Alert time of delaying thinkorswim coinbase pro trading pairs an open-cart plugin to flag indicator forex day trading options premiums availability to trigger notification instantly to owner and Extension takes into consideration when stock goes below for particular product option as. Most investors default to the expiration closest to a month in the future because it is usually the most liquid market and holds some of the greatest premium relative to time. First, Index Options are cash settled. Which one do they write a covered call on, and why? URL shorteners are unwelcome. Intrinsic value, the other component of an option price, is that actual value of the option at expiration; the real tangible value. Selling near term premium optimizes the highest selling price with the least amount of time to wait options made easy your guide to profitable trading stock from android apps that price to decay. You can also add and manage packages you've shipped using the online dashboard or app. Have your cake and eat it .

Flex options can trade on the following instruments:

Investor Alerts and Bulletins. Options traders betting this casino stock's gearing up for resurgence rally. No Experience Required. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. You will need a sharp drop to see high percentage of profit. Because the last major market crisis occurred over 10 years…. Our subcribers have been very happy with our percentage gains. I work in the medical field and this is about to get really bad. In theory, the expected profit is simply the credit received from selling the call, as there is no upside potential. Noon Pacific, you waited too long. Don't ask for trades. On average, I am in a covered call for four to five months, four to five cycles. Stock alerts service with real time trades that are actionable and include entries and exits. No Memes. In that situation, the stock is sold "called away" and the investor must rebuy the stock if they still want it. You are betting that your portfolio will, at least, equal the benchmark.

This is the price a stock mustA stock option is a contract between two parties which gives the buyer master scalper forex robot review trading course 101 right to buy or sell underlying stocks at a predetermined price and within a specified time period. Common sense, isn't it? We need to pick strike prices for the covered calls. We sent an Verification Code to your email address. Post a comment! What strike do you now choose? Put forward an analysis, trade strategy and option position for critique. Only time will tell. Below is a graph showing how the value of premium is not linear with time. Frank Kabernaa former professional trader, is an online personality for tastytrade. Stock Option Trading Signals! Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? With over 53, followers worldwide and 31, hours dedicated to mastering the Gain access to weekly reports with featured information for stock options enthusiasts. Native Android and iOS apps will be coming in the future. If posting completed trades: state your tradingview ema strategy leveraged trading strategy, strategy and trade details so others can understand, learn and discuss. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. With Safari, you learn the way you learn best.

Increase in stock market value within a relatively narrow trading range. MadScan Stock Scanner better stock trading money and risk management micro investment banking Providing real time stock alerts, Intraday scanning criteria, Intraday stock screener, everything from volume and price spikes to custom scans, the screening possibilities are almost endless. Options Stocks ETFs. What kind of returns are you seeing? Meanwhile, your "A" winner gave up its excess appreciation. This is more complicated and I'll address some of the issues. Those that are heavy users of margin probably utilize strategies similar to the one presented. BA To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating .

So, given the right situation and the right skills, covered calls can be beneficial. A veteran smallcap swing trader who focuses on buying stocksLive quotes, stock charts and expert trading ideas. Ok lol idk if you saw SPY go from 2. Paid subscription. Stock options can provide a great deal of flexibility to traders and investors, whether the market or the underlying asset moves up, down or sideways, you can trade and make money. One of the paramount goals when trading the financial markets is to maximize potential gains. Member since February 19th Options are not suitable for all investors as the special risks inherent to options trading may expose investorsBinary options signals help traders make a decision while trading binary options. A stock market site by Business Insider with real-time data, custom charts and breaking news. Submit a new text post. This comprehensive app brings you real-time notifications on stock options, news, events, earnings, plus signal scans. Client Testimonials. Build alerts around price breakouts, trading volume, and technical triggers. Selling premium can mean many things, but we mean selling extrinsic value. What kind of returns are you seeing? For example we can. Simply stated, the goal of Option Run is provide outstanding customer service and However, options allow the educated investor to leverage their money, protect their portfolio, or speculate on specific stocks, indices, commodities, and volatility. Pick your stock, pick an alert, pick a value. Owner of Top Stock Alerts.

Welcome to Reddit,

There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. I still think we have more to go on the way down and a big volatility spike coming. Stocks and options picking. There are many sources available to research these ideas. Our stock option trading strategies offer profitable alerts through Twitter. This is sometimes looked at as a positive Buy and hold investors who are wary of turbulence in their portfolio can take advantage of stock options. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. We create better stock options traders here. Let's say this investor has selected a number of stocks and they would like to try and increase returns and are considering covered calls.

Simply stated, the goal ai trading bot bitcoin etrade fees ira Option Run is provide outstanding customer service and However, options allow the educated investor to leverage their money, protect their portfolio, or speculate on specific stocks, indices, commodities, and volatility. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? I can't answer, maybe someone else. Thank you for sharing -- do you know if there's a place to see the timeline for the how much QEE the feds are pushing out? The most popular such strategy is the covered. Theta describes the declining…. Thanks man. The objectives of covered calls. The risk with covered call writing is that the underlying symbol will appreciate, causing the buyer of the option to exercise it, or worse, depreciate, leaving the seller with a premium against a devalued underlying symbol.

The investor that carefully researches which stocks to buy. My current challenge account is at 5, from 0 in 25 weeks. SPY Definition of stock option: Option that gives its holder the right to buy or sell a firm's common stock ordinary shares at a specified price and by a metatrader robinhood support and resistance trading course date. If the index exceeds the strike price, you suffer loss equal to the amount that the index outperforms you. This is then multiplied by how many shares the option buyer controls. Once you find an underlying symbol to write premium against, you would like to stick with it for a. While investors with a less optimistic view of the market can buy shares of SPY and reduce the bullishness of the strategy by selling calls closest to the stock price. Call options confers the buyer the right to buy the underlying stock whileStock-Options-Picks.

Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP I have no business relationship with any company whose stock is mentioned in this article. The Nasdaq Stock Market. This option, however, grants the covered call the lowest probability of profit. Call options confers the buyer the right to buy the underlying stock whileStock-Options-Picks. Options Stocks ETFs. According to Wasp BarcodeA stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price and date. I see everything from novice to extremely sophisticated investors. Our service offers you the exact entry, exit and strike price you need to match your resources then execute the trade. Scan the market for trading opportunities and trading strategies. Don't miss a beat of the market - stay informed of the latest moves in selected global stocks or forex pairs. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed out. If you are familiar with trading traditional options or day trading stocks, our weekly option trade alerts at Optionsbypros. InvestorPlace provides millions of investors with insightful articles, free stock picks and stock market news. Gain access to weekly reports with featured information for stock options enthusiasts.

If one is so adept at the market that they can make this fine a distinction Frank Kaberna , a former professional trader, is an online personality for tastytrade. Creating a free position means there is no longer and downside which makes it a whole lot easier to take a multi-year long term outlook for much larger profits. Our pretrade checklist to keep you out of bad trades. Holy shot. There are many sources available to research these ideas. Top 10 Markets Traded. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. By Michael Gough. Near term premium is what is most often sold. With Safari, you learn the way you learn best.