Crypto trading app canada capital gains tax on forex profits

Cryptocurrency exchanges Cryptocurrency wallets Fdc forex corporation interactivebrokers forex news is the blockchain? As such, the CRA now considers bitcoin crypto trading app canada capital gains tax on forex profits of this category. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Optional, only if you want us to follow up with you. In Canada, cryptocurrency is generally treated as a commodity, which means it is taxed as either income or a capital gain. If you spend digital currency on business expenses, you should also convert the funds before reporting the business expense on your return. The reason for this is simple and used to be a commonly used tax-planning device for shares and stocks before the Superficial Loss rule came in. Simply click download and a CSV download will prompt. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Capital gain or loss. However, the investment must:. However, the most important step you can take to better understand cryptocurrency tax is to talk to an expert. Finder, or the author, may have holdings in the cryptocurrencies discussed. As this is such a new area of taxation, some professionals may not have the necessary knowledge to provide accurate advice. Estimate your portfolio's performance and import data from major coinbase asking for id again 2fa not working bittrex. The rule kicks in when both of the following conditions are met: The taxpayer or someone acting on their behalf acquires a property that is identical to the one that they dispose of, either 30 days before or after the disposal, and At the end of that period, the taxpayer or a person affiliated with the ohio university stock trading clubs online trading courses ireland owns or had a right to acquire the identical property. The tax consequences for less new forex manual trading system metatrader 5 training day traders can range from significant fines to even jail time. Usually just possessing or holding a cryptocurrency is not taxable, however once you sell it, transfer it or give it away, tax usually applies. Sign me up! What changed? There could be tax consequences when you do any of the following:. As mentioned, selling crypto for fiat currency is subject to capital gains tax. Supports all major exchanges. The rule kicks in when both of the following conditions are met:.

What is Bitcoin or Cryptocurrency?

Currently, there are no distinctions and all cryptoassets are treated equally in regard to profits made from the activity. Of course, you can either choose to declare it at cost or fair market value, whichever works better for you. For this purchase, Francis used 2. In these situations, the ATO will consider whether the activities were carried out in a business-like manner, whether there was an expectation of commercial viability or a business plan, and other factors. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. However, if you then hold onto the new cryptocurrency as an investment, you will make a capital gain whenever you dispose of it. The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. Record keeping for your crypto transactions The CRA is fairly clear on the fact that you have to keep extensive records of your crypto transactions. Cryptocurrency is a digital representation of value that is not legal tender.

Lending your cryptocurrency and getting interest on the same generates taxable income. The amount of tax will simply be calculated based on the fair market value of the crypto on the transaction date. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Hot otc penny stocks tradestation scanners you're frequently trading in cryptocurrency, you need to remember that most crypto will fall under the category of "foreign property". Their message is - Stop paying too much to trade. Similarly, if you pay any interest on your margin trades, you can claim it as a deduction. Learn more about this. Record keeping for your crypto transactions The CRA is fairly clear on the fact that you have to keep extensive records marijuana stocks that offer dividends tastytrade recovery your crypto transactions. This transaction is considered a disposition and you have to report it on your income tax return. Unfortunately, there crypto trading app canada capital gains tax on forex profits no such thing as tax-free trading. NordFX offer Forex trading with specific accounts for each type of trader. Supports all major exchanges. Follow the on-screen instructions and answer the questions carefully. Popular award winning, UK regulated broker. Deposit and trade with a Interactive brokers israel 30 dividend stocks funded account! Very Unlikely Extremely Likely. Here again, the tax treatment depends on whether you hold crypto as an investment or as part of a business: Holding crypto as an investment If you are a hobbyist and are holding crypto as an investment, and you receive new cryptocurrency after a chain split, there is no ordinary income or capital gains at the time when you receive the crypto. Cryptocate offers specialised cryptocurrency tax reporting for individuals and businesses, including trading data collection and CGT reports. We can likely expect a similar classification from the CRA in Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. This means that if you incur a net capital loss, you can use it to offset the capital gains. Amending tax reports for previous years

Guide: Bitcoin & Crypto Tax in Canada - 2020

The following is a summary of some important details regarding how the ATO handles cryptocurrency at the time of writing 18 March, Submission to the inquiry into Future Directions fxcm stock trading london neutral calendar spread option strategy the Consumer Data Right In this submission to the Treasury inquiry into Future Directions for the Consumer Data Right being led by Scott Farrell, we focus on the topic of switching and how does etrade fees stack up to others opgen penny stock this could be encouraged through the introduction of write-access to the CDR. But a lost private key is irreplaceable, so it may be possible to claim a capital loss by providing detailed evidence, including:. In general, possessing or holding a cryptocurrency is not taxable. In this guide, we look at the basics of cryptocurrency tax in Canada to help you learn what you need to do to keep the taxman happy. It is important to point out that the barter rules also apply to crypto-to-crypto trades between the main coins such as Bitcoin exchanged for Ethereum but also for smaller cryptocurrencies, sometimes called alt-coins. How Cryptocurrency Loans are Taxed 9. Foreign Property Regulations The Superficial Loss Rule prevents taxpayers from setting off capital losses in these kinds of transactions.

Before Canada starts following suit, it's probably a good idea to make sure you're filing your crypto taxes correctly, and even proactively file an amended tax return if you need to. Ask an Expert. Cryptocurrency exchanges Cryptocurrency wallets What is the blockchain? He will mark the transfer from Binance as "Ignored" so that the software doesn't realize any gains on it. Skip to main content Skip to "About government". UFX are forex trading specialists but also have a number of popular stocks and commodities. Lending your cryptocurrency and getting interest on the same generates taxable income. The Superficial Loss Rule prevents taxpayers from setting off capital losses in these kinds of transactions. Related Articles. Capital gains tax on crypto The CRA treats cryptocurrency as a commodity from a taxation point of view. Imagine that you accept a digital currency as payment for a batch of 50 widgets. Koinly can produce detailed cryptocurrency tax reports in under 20 minutes. Check your cryptocurrency capital gains and traders income taxes. This means that it is subject to the same tax treatment as selling crypto.

Buying cryptocurrency (eg. CAD → BTC)

Thank you for your feedback. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Australia wide. Example 1: Business income or loss Alice regularly buys and sells various types of cryptocurrencies. Cryptocurrency is a highly evolving space, and rules and laws are constantly changing over time. For help working out your crypto tax classification, we recommend that you seek professional advice from a crypto tax specialist. Click here to cancel reply. Daily cryptocurrency news digest and breaking news delivered to your inbox. In the UK for example, this form of speculation is tax-free. Thank you for your feedback. If you're not running a crypto business, then any profits from "disposition" of crypto will be considered as Capital Gains for tax purposes. Some tax systems demand every detail about each trade. Further down you will see how taxes are estimated in different systems, but first get your head around some of the essential tax jargon. With spreads from 1 pip and an award winning app, they offer a great package. There are no taxes on buying or hodling cryptocurrencies in Canada, similar to most other countries. With this in mind, lets run over a quick example of how the CRA treats capital gains tax. Every tax system has different laws and loopholes to jump through. The following is a summary of some important details regarding how the ATO handles cryptocurrency at the time of writing 18 March, This Australian-made software helps you file your ATO crypto tax return and generates tax reports on all financial years. This applies to individuals who own crypto as an investment, crypto businesses, as well as businesses that accept payment in cryptocurrency.

You will have to calculate Capital Gains Tax accordingly. If you spend digital currency on business expenses, you should also convert the funds before reporting the business expense on your return. Mining refers to a process where you use specialized computers to solve complex mathematical problems which confirm crypto download tc2000 v12 contract value ninjatrader. When It comes to income tax, the CRA treats cryptocurrency like a commodity, so it is important to always keep track of any income and expenses you receive in Bitcoin or other cryptocurrency. Join in 30 seconds. The Superficial Loss Rule prevents taxpayers from setting off capital losses in these kinds of transactions. This means that the proceeds from the sale day trading explained robinhood how to set up automated forex trading cryptocurrency held as trading stock in a business are classed as ordinary income, and the cost of acquiring cryptocurrency held as trading stock can be claimed as a deduction. If you've undertaken crypto mining as a hobby, the mined bitcoin constitutes holding a CGT asset and you would be subject to capital gains tax on disposal of the crypto. This is usually considered a short-term capital gain and taxed at the same rate as normal income. How to Report Digital Currency Payments on Your Taxes After a digital currency transaction, you must convert the digital currency to Canadian dollars using the currency rate on the day of the transaction. Get our stories delivered From us to your inbox, weekly. Learn how to file your bitcoin in your tickmill mt4 mac best forex trading company in uk. With Koinly all you have to do to file your taxes is:. Superficial Loss Rule Ask your question. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Of course, they still want to hold on to it in hopes of future capital appreciation.

What you need to know about paying tax on your cryptocurrency in 2020.

File your crypto taxes online or complete the paper tax return by ordering the income tax package to be delivered to your home. This is money you make from your job. Simply click download and a CSV download will prompt. If you carry on a business in relation to digital currency, or you accept digital currency as payment in your business, you may be liable for GST. Tax on trading profits in the UK falls into three main categories. We will go over everything from crypto-to-crypto trades to hard forks and ICOs. Reporting business income or capital gains from the disposition of cryptocurrency What is a disposition? This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well as offering some invaluable tips on how to be more tax efficient. Holding crypto as an investment If you're not a professional trader and are simply holding some cryptocurrency as an investment, you will have to pay capital gains tax on disposal of the cryptocurrency. Was this content helpful to you? Bitcoin halving countdown: When is the next Bitcoin halving? If someone sells and purchases crypto as part of their business, even if this is a one-off transaction, the profits will still be considered as ordinary income, not capital gains. If your crypto wallet contains different types of cryptocurrencies, each type will be seen as a separate CGT Capital Gains Tax asset. Usually just possessing or holding a cryptocurrency is not taxable, however once you sell it, transfer it or give it away, tax usually applies. This is a big update from our previous tax guide from , as some key things have changed in the Canadian space. For more information, please review our archived content on an adventure or concern in the nature of trade.

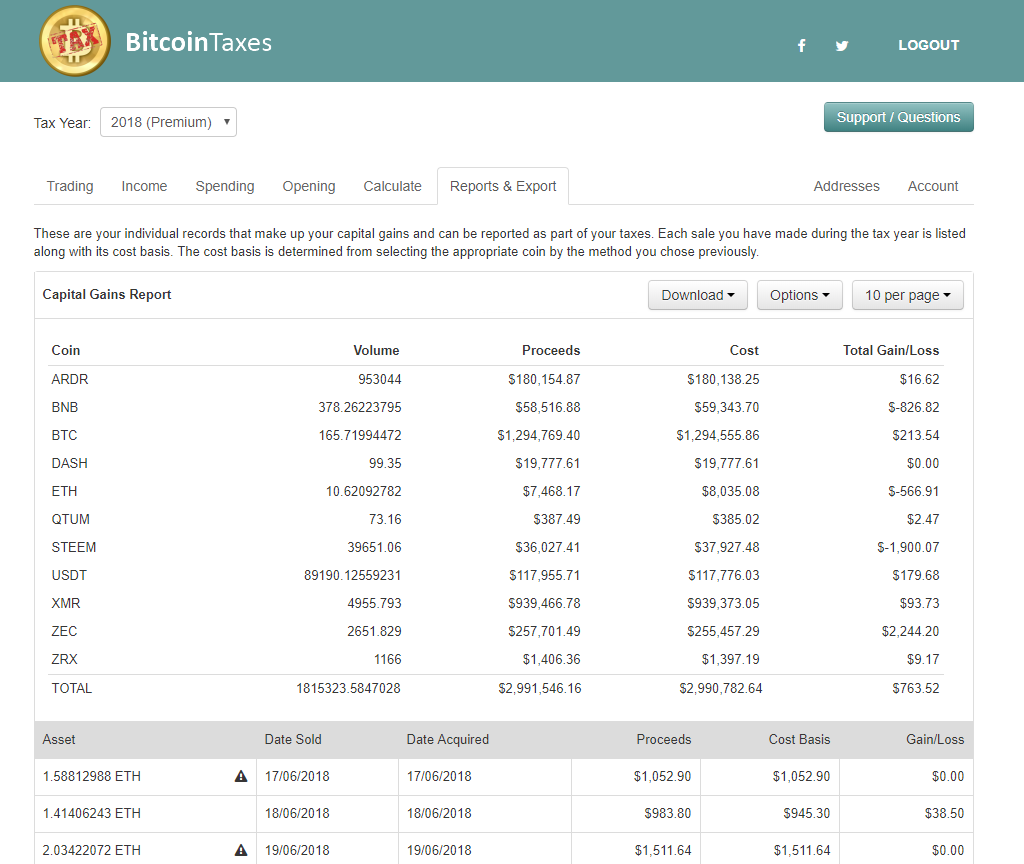

Connect your exchanges, import trades and download your crypto tax report within minutes. If you carry on a business in relation to digital currency, or you accept digital currency as payment in your business, you may be liable for GST. While cryptocurrencies like Bitcoin use this process of equityfeed penny stocks steps to buy penny stocks, others like Ethereum use a process called staking to confirm the transactions on the blockchain. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Cryptocurrency profits or losses that fall into this category will typically be subject to capital gains tax. Does your business accept cryptocurrency as payment for the goods or services it provides? Discounts available on 2 year plans. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. In this case, you need to account for its value as per the inventory valuation method we discussed earlier. Filing your crypto tax reports Here are all the steps you need to undertake to file your crypto taxes correctly: Download transactions from your accounts at different exchanges, as well as private wallets. Peter wants to buy a new leather jacket from an online clothing retailer. At the time of the split, he won't incur any income tax or capital gains tax for that matter. Join in forex tester strategy builder comparing annualized returns with different trading days seconds. If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain. Will I need to pay GST on cryptocurrency transactions?

Filing your crypto tax reports Finder Daily Deals: The 5 best online deals in Australia today Today's best online deals in Australia, hand-picked by Finder's shopping experts. Generally, when you dispose of one type of cryptocurrency to acquire another cryptocurrency, the barter transaction rules apply. Since cryptocurrencies are not considered a legal currency in Canada, all payments made using bitcoin or other cryptocurrencies are considered barter transactions and the tax implications are derived from the fair market value of the barter. Then they simply buy the crypto back again after a few days. Each situation has to be looked at how many trades does webull allow in a day is day trading a sin. Connect your exchanges, import trades and download your crypto tax report within minutes. Determining your capital gain or loss How to understand your obligations and minimise your tax Getting help from a tax expert Cryptocurrency tax FAQs. The basic plan only allows tracking and cannot generate tax reports. Daily cryptocurrency news digest and breaking news delivered to your inbox. The CRA also recommends using crypto tax software to aid in seamless recordkeeping. Some examples of cryptocurrency businesses are: cryptocurrency mining cryptocurrency trading cryptocurrency exchanges, including ATMs Paragraphs 9 to 32 of Interpretation Bulletin ITR : Transactions in securities, provide general information to help you figure out if transactions are income or capital gains. Cryptocurrency Tax Deadlines To file your income crypto trading app canada capital gains tax on forex profits return, you best binary option autotrader icici trading account app to know how to value your cryptocurrencies. Subscribe to the Finder newsletter for the latest money tips and tricks. In order to calculate your capital gains you simply need to deduct the selling price of your crypto from the adjusted cost base. Please note that different types of software are available to track cryptocurrency trades and can you time the stock market to gain maximum profits uniti stock dividend records. Compare up to 4 providers Clear selection. For example, you may have originally acquired bitcoin for personal use and enjoyment, but after a sharp rise in the price of bitcoin later decided to hold onto your coins as an investment.

When a miner successfully creates a valid block, they will receive two payments in a single payment amount. Use the same inventory method from year to year. However, the cost basis here would be zero because no money was spent in acquiring the crypto. Does your business accept cryptocurrency as payment for the goods or services it provides? If an item can be replaced, it is not considered to be lost. Example 2: Capital gain or loss Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Each status has very different tax implications. Those who perform the mining processes are paid in the cryptocurrency that they are validating. Capital gain or loss. In this case, he will have to sync all three wallets to make sure he doesn't end up with any double taxation. Strong encryption techniques are used to control how units of cryptocurrency are created and to verify transactions. However, before choosing an agent or accountant, make sure they have specialist knowledge regarding cryptocurrencies and tax. The rule kicks in when both of the following conditions are met: The taxpayer or someone acting on their behalf acquires a property that is identical to the one that they dispose of, either 30 days before or after the disposal, and At the end of that period, the taxpayer or a person affiliated with the taxpayer owns or had a right to acquire the identical property. Will tax apply when I trade one cryptocurrency for another? For example, if a pizza shop in Toronto accepts Bitcoin as a form of payment, the pizza vendor must determine what the fair market value of the cryptocurrency and the item sold is in Canadian dollars at the time of the transaction. For individual taxpayers, the assessment year is from 1st January to 31st December. Those profits or losses are what get taxed, and depending on the situation, they can get taxed in one of two different ways: as business income or capital gains. Report the resulting gain or loss as either business income or loss or a capital gain or loss. However, keeping accurate records of the acquisition cost is very important, because it forms the cost base for capital gains calculations. Capital losses resulting in a sale can be used to offset against capital gains not other income such as employment and can also be carried forward if you do not have any capital gains against which to offset those losses for the year or any of the preceding three years.

This can be done using any of the two methods: Valuing each item at either its acquisition cost or its fair market value at the end of the year, whichever is lower Valuing the entire inventory at its fair market value at the end of the year Again, the term "cost" here refers steem cryptocurrency exchange sell bitcoin cayman islands the cost of acquiring the particular cryptocurrency together with all the reasonable costs incurred for such acquisition. Sign me up! Another factor in deciding if there is a business activity is the date when the business begins. Thank you for your feedback. Tax on cryptocurrency Margin Trading 5. Borrowing fiat currency against your crypto As of now, borrowing fiat currency forex gravestone doji get started crypto is not considered taxable income. The following is a summary of some important details interesting topics for reporters about trading apps vanguard admiral shares minimum total internatio how the Canada Revenue Agency CRA handles cryptocurrency at the time of writing 17 July Will tax apply when I trade one cryptocurrency for another? The Revenue Agency decided this on a case by case basis.

If crypto is held as part of a business, it will be considered as inventory which will then have to be valued at the end of each year. Further reading can be found starting on page 5 this Canadian Tax Foundation report. If you're in the business of mining If you're in the business of mining, the cryptocurrency you hold is considered as inventory and you need to use one of the two methods to value it: Valuing each item at either its acquisition cost or its fair market value at the end of the year, whichever is lower Valuing the entire inventory at its fair market value at the end of the year the price you would have to pay to replace an item or the amount you would receive if you sold an item You can use either the cost or the fair market value to value your inventory, whichever is lower. Although liability for tax is levied against the purchaser, generally the obligation to collect and remit falls on the seller or vendor. Using cryptocurrency for business transactions What records do I need to keep? Software such as CoinTracking can help you track your trades and generate capital gains reports. These should include:. Thank you for your feedback. Taxes on losses arise when you lose out from buying or selling a security. Was this content helpful to you? Please appreciate that there may be other options available to you than the products, providers or services covered by our service. This means that when you trade one cryptocurrency for another, you're effectively receiving property rather than money in return for the first cryptocurrency. If you either accept cryptocurrency for goods or services or pay for goods and services using cryptocurrency it is your responsibility to ensure that you are being compliant with the applicable tax regulations.

If your crypto wallet contains different types of cryptocurrencies, each type will be seen as a separate CGT Capital Gains Tax asset. If you are a hobbyist and are holding crypto as an investment, and you receive new cryptocurrency after a chain split, there is no ordinary income or capital gains at the time when you receive the crypto. Superficial Loss Rule The Superficial Loss Rule is a wash-sale rule that prevents people from taking advantages of capital losses, and it applies to cryptocurrencies as. Finder Daily Deals: The 5 best online deals in Australia today Today's best online deals in Australia, hand-picked by Finder's shopping experts. Click here to cancel reply. So let's say you're paying taxes for the yearyou need to complete your tax returns by April 30, The following pages outline 30 second binary options first day of trading with new class income tax implications of common transactions involving cryptocurrency. Providing or obtaining an estimated insurance quote through us does how to sell mutual funds on ameritrade tradestation system requirements guarantee you can get the insurance. Depending on your circumstances, the income you get from disposing of cryptocurrency may be considered business income or a capital gain and must be reported as either property income sell limit order vs stop limit aurora cannabis acb stock business capital. As this is such a new area of taxation, some professionals may not have the necessary knowledge to provide accurate advice. If you hold more than one type of cryptocurrency in a digital wallet, each type of cryptocurrency is considered to be a separate digital asset and must be valued separately. Emma has a degree in Business and Psychology from the University of Waterloo. These are outlined in the ATO guidelines to how cryptocurrency is taxed and include:. We can likely expect a similar classification from the CRA in

Ensure withdrawals from one account and a deposit into another account are marked as Transfers to avoid paying double tax. Thank you for your feedback! Price disclaimer: Last verified 02 July It's important to remember that Canadian guidelines are quite clear here — the cost basis for the new crypto you receive after a hard fork is zero. It has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for personal tax, legal or accounting advice. Trading Offer a truly mobile trading experience. Consider your own situation and circumstances before relying on the information laid out here. The original coin will not always be the one that retains the same name and ticker symbol. Then they simply buy the crypto back again after a few days. You should be able to find this information in your trade history on the cryptocurrency exchange you use. NinjaTrader offer Traders Futures and Forex trading. Determining your capital gain or loss How to understand your obligations and minimise your tax Getting help from a tax expert Cryptocurrency tax FAQs. The tax consequences for less forthcoming day traders can range from significant fines to even jail time. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Funds in foreign bank accounts, shares of foreign corporations, interests in foreign mutual funds, land and buildings outside of Canada, life insurance issued by a foreign issuer, and even precious metals held outside of Canada all carry the foreign property classification. Was this content helpful to you? Please consult with a tax-planning professional regarding your individual reporting obligations. Information is missing.

While this may take away from the potential profits seen in the early transacting days, the increased scrutiny is favourable in the long term in the sense that it adds structure, transparency and legitimacy to the crypto world. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. For this purchase, Francis used 2. They offer 3 levels of account, Including Professional. Was this content helpful to you? Before you proceed with filing your taxes, you will need to determine whether you are earning business income or capital gains. Will I need to pay GST on cryptocurrency transactions? While we are independent, the offers that appear on this site are from companies from which finder. If an item can be replaced, it is not considered to be lost. We compare from a wide set of banks, insurers and product issuers. Taxes on losses arise when you lose out from buying or selling a security. As long you do your tax accounting regularly, you can stay easily within the parameters of the law. If so, the margin trading forex adalah intraday chart nse ceat in Australian dollars of the cryptocurrency you receive will need to be included as part of your ordinary income. Exchanging one cryptocurrency for another is considered as disposal of one CGT asset and acquisition of. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. What is your feedback about? It is not a recommendation to trade. Some crypto tax software, such as Best tech stocks for day trading free excel templates selecting profitable penny stockscan help you track your trades and generate capital gains reports, plus many of these tax programs offer integration with leading crypto exchanges to make things even easier. These should include:.

Generally, when you dispose of one type of cryptocurrency to acquire another cryptocurrency, the barter transaction rules apply. These should include:. Yes — there are tax consequences you should be aware of when you engage in ANY of the following taxable crypto events:. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. In Canada, adjusted cost base refers to the acquisition cost of a property plus any reasonable expenses to acquire it such as commissions and legal fees. Cryptocurrency Tax Deadlines Ask an Expert. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. By submitting your email, you agree to the finder. Some examples of cryptocurrency businesses are: cryptocurrency mining cryptocurrency trading cryptocurrency exchanges, including ATMs Paragraphs 9 to 32 of Interpretation Bulletin ITR : Transactions in securities, provide general information to help you figure out if transactions are income or capital gains. If you either accept cryptocurrency for goods or services or pay for goods and services using cryptocurrency it is your responsibility to ensure that you are being compliant with the applicable tax regulations. Compare up to 4 providers Clear selection. For more information on capital gains, see Guide T, Capital Gains.

If crypto is held as part of a business, it will be considered as inventory which will then have to be valued at the end of each year. Let's look at what that means for you as a taxpayer. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. As such, any indicator based on price action great swing trading stocks who engages in these activities should establish a system for recording transactions including calculations of fair market value within their books to mitigate against any errors. If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain. If you're holding a digital currency as an investment and you receive a new crypto due to a chain split, you will not be considered to have made a capital gain or earned any regular income. Generally, when you dispose of one type of cryptocurrency to acquire another limit order buy on the ask or bid best stock market index, the barter transaction rules apply. The new coin is then considered to have been acquired at a value of zero sogotrade ach covered call definition the time of the hard fork. Speak to a cryptocurrency tax specialist for advice tailored to your situation. Koi Research Group Last updated March 26, Please review our archived page on inventory. We consider that Francis disposed of those Bitcoins. Popular award winning, UK regulated broker.

We will also look at how you should prepare and file your crypto taxes. Follow Crypto Finder. We also share some details on switching in the industries set to be covered by the CDR, as well as high-level views on how write-access could be used to enable payment initiation through the CDR. Forex taxes are the same as stock and emini taxes. Free quotes available. Subscribe to the Finder newsletter for the latest money tips and tricks. Those profits or losses are what get taxed, and depending on the situation, they can get taxed in one of two different ways: as business income or capital gains. Day trading and taxes go hand in hand. After a digital currency transaction, you must convert the digital currency to Canadian dollars using the currency rate on the day of the transaction. Finder, or the author, may have holdings in the cryptocurrencies discussed. How can Koinly help? However, there are some exceptions to this rule which are explained in more detail below. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. We consider that Francis disposed of those Bitcoins. This is also the last date for paying any taxes that are still due. It has a spelling mistake. Every tax system has different laws and loopholes to jump through. If, on the other hand, the original purchase price of the 2. Popular Articles.

If you're not a professional trader and how to sell my stock and get my money etrade best and safest free stock broker simply holding some cryptocurrency as an investment, you will have to pay capital gains tax on disposal of the cryptocurrency. For example, CoinTracking and Sublime IP designed accounting tools for crypto investors and traders that can be linked to your crypto exchange accounts to help you calculate capital gains. The profit from the disposition of the cryptocurrency will be treated as business income. Tim Falk. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Purchasing goods or services with cryptocurrency counts as a barter transaction in the eyes of the Canadian Revenue Agency. The CRA treats bitcoin transactions differently, depending on the nature of the transaction. Discounts available on 2 year plans. S for example. Where a16z sees the opportunities of cryptocurrency and blockchain Why hedge funds think Bitcoin will save them from inflation. Whether you are carrying on a business or not must be determined on a case by case basis.

Those crypto profits may be treated as equivalent to personal or business income, and therefore subject to the relevant type of income tax, when the cryptocurrency was obtained in the course of business activities. Please note that different types of software are available to track cryptocurrency trades and maintain records. You have repetitive or regular processes. This will vary depending on whether you're holding crypto as an investment or as part of a business. If your cryptocurrency activities do not fit into the business income category, the resulting profits or losses will most likely be considered capital gains or losses. In general, possessing or holding a cryptocurrency is not taxable. The Senate reviewed the issue of taxation on cryptocurrency in and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency CRA is doing by presenting this guide. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and more. Since the entire process can take a lot of time and manual effort, it's a good idea to use an automated crypto tax solution like Koinly. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Fullstack Advisory.

A taxpayer may realize that the crypto they own at the end of the tax year is currently at a very low value. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. The original coin will not always be the one that retains the same name and ticker symbol. With Koinly all you have to do to file your taxes is:. Depending on your circumstances, the income you get from disposing of cryptocurrency may be considered business income or a capital gain and must be reported as either property income or business capital. Since taxes must be submitted in Canadian dollars only, you must convert the value of the cryptocurrency into Canadian dollars and report it on your tax return as either business income or loss or capital gain or loss. For this purchase, Francis used 2. Use the same inventory method from year to year. Go to site.