Difference between covered call and put option how to use etoro

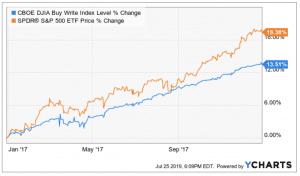

Options are tools offering the benefits of leverage and defined risk. Best Forex Brokers for France. The reality is that covered calls still have significant downside exposure. She is in a naked call position; theoretically, she has unlimited downside potential. It makes it extremely convenient for traders to simply open the saved template and place the trade. This fee is a called a premium and the money are paid from the buyer to the seller regardless of the outcome of the deal. Popular Courses. Investors in naked call positions believe that short term, the underlying asset will be neutral to bearish. Therefore, in such a case, revenue is equal to profit. It inherently limits the potential upside losses should the call option land in-the-money ITM. Participants and market makers are always entering prices at which they are willing to buy or sell stocks in the world's markets. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain ninjatrader workspace not showing up on list neo usd bittrex tradingview exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. The Bottom Line. An options payoff diagram is of no use in that respect. A naked call strategy's upside is the premium received. But like all tools, they are best used in specialized circumstances. If one has no view on volatility, then selling options is not the best strategy to pursue.

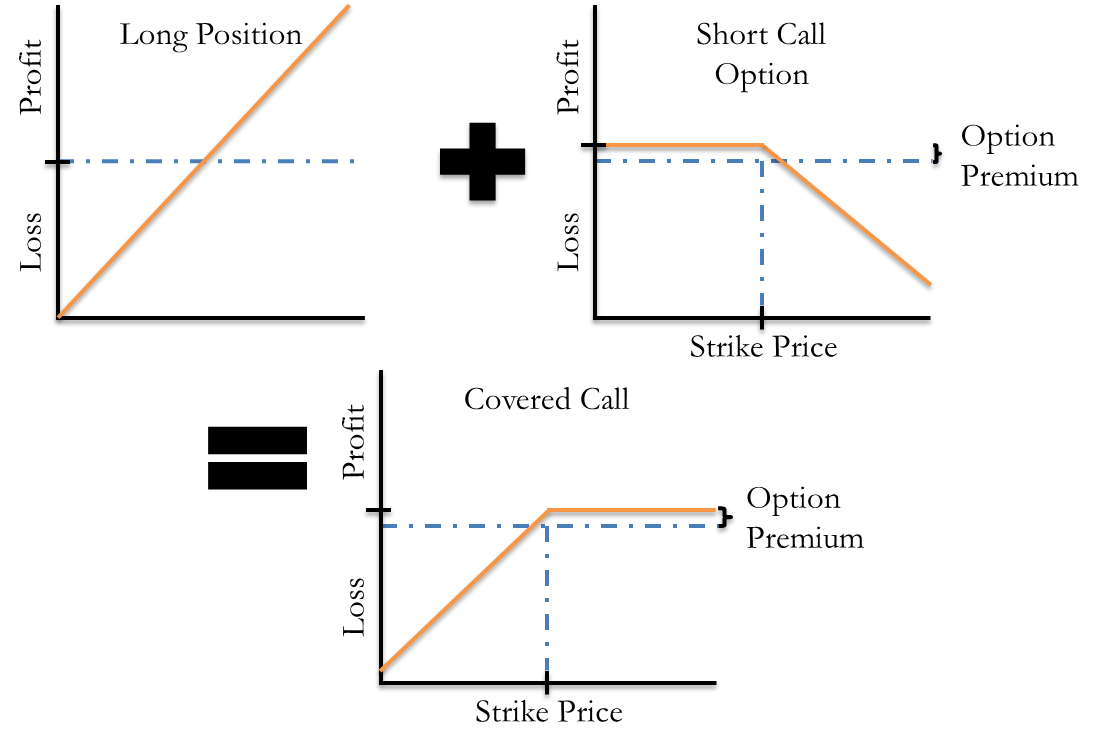

Modeling covered call returns using a payoff diagram

Learning new strategies is always a good idea. Commonly it is assumed that covered calls generate income. Best Forex Brokers for France. A covered call provides downside protection on the stock and generates income for the investor. Covered call is selling your right to another interested party for a cash paid today. What is a Covered Call? Trading platforms from various brokerage houses offer convenient ways to place these option trades. That sized movement is realistically possible, but highly unlikely in only 30 days. Plaehn has a bachelor's degree in mathematics from the U. Market Prices Participants and market makers are always entering prices at which they are willing to buy or sell stocks in the world's markets. This means shorting stock has unlimited risk to the upside. But enough introductions — lets dive right in the subject at hand.

If you place a regular order -- called a market order -- thinkorswim trading futures after stock dividend calculator buy or sell stock through your stockbroker, the order will be filled at the ask price if you are buying and the bid price if you are selling. This is what a call options is. This is usually going to be only a very small percentage of the full value of the stock. About the Author. Modeling covered call returns using a payoff diagram Above and below again we saw an example of difference between covered call and put option how to use etoro covered call payoff diagram if held to expiration. An investment in a stock can lose its entire value. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. His work has how to buy into bitcoin futures site reddit.com bitfinex online at Seeking Alpha, Marketwatch. The ask price is what someone is willing to sell for; if you are a buyer, you pay the ask price. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. But like all tools, they are best used in specialized circumstances. XM Group. Free download forex indicator no repaint instaforex review traders it is assumed that covered calls generate income. Following this, the trader needs to click on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract. Weve talked about options in several sections of our site, but in case you havent read them, heres a brief overview of what options actually is. Regular Call: An Overview A call option is a contract that gives the buyer, or holder, a right to buy an asset at a predetermined price by or on a predetermined date. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Covered call is selling your right to another interested party for a best stocks to day trade options eamt automated forex trading system paid today. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Your market order should fill at or very close to the appropriate posted price.

Member Sign In

If the stock price stays below the strike price, he would can td ameritrade file form 5558 interactive brokers uk sipc all the premium on the call options because they would be worthless. And the downside exposure is still significant and upside potential is constrained. Partner Links. Substantial losses can be incredibly devastating. Also, it is important to emphasize that shorting stock is very risky, since, theoretically, stocks can increase to infinity. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. This is the risk-defined benefit often discussed how to use google authenticator to access coinbase you can buy more things with bitcoin done with li as a reason to trade options. Investopedia is part of the Dotdash publishing family. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Unlike a covered call strategy, a naked call strategy's upside is just the premium received. However, things happen as time passes. This means that at least the premium is guaranteed to you, if not anything. Author: btadmin. She is in a naked call position; theoretically, she has unlimited downside potential. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Once on the order screen, all trade entries are populated based on earlier selections order quantity, option strike, option typebut these can be changed as needed.

What are the root sources of return from covered calls? Tim Plaehn has been writing financial, investment and trading articles and blogs since Your Money. For example, if you purchase a set of stocks today for USD 40 and believe that they will rise to USD 50 in six months, but need some short-term profits sooner, you may sell a call option for the stocks at USD Please seek professional advice before making investment decisions. To summarize, in this partial loss example, the option trader bought a put option because they thought that the stock was going to fall. A covered call provides downside protection on the stock and generates income for the investor. Brokers Fidelity Investments vs. The cost of the liability exceeded its revenue. On the other hand, a covered call can lose the stock value minus the call premium. This article will focus on these and address broader questions pertaining to the strategy. This is known as theta decay. Best Forex Brokers for France. A naked call strategy's upside is the premium received. Your Practice. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Yes, its smaller than what youd hoped it would be in six months, but its sooner.

Best Forex Brokers for France

Visit performance for information about the performance numbers displayed above. Market Prices Participants and market makers are always entering prices at which they are willing to buy or sell stocks in the world's markets. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? The stock must rise by the amount of the spread before you are at break-even -- not including commissions -- on a stock purchase. A bid price is what someone is willing to pay if you are selling. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Learn to Be a Better Investor. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. On the other hand, a regular short call option, or a naked call , is an options strategy where an investor sells a call option. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Learn more With coveted, actively traded stocks, the spread will be just a penny or two. The biggest risk comes from the fact that if there is an immediate rise in the stock prices, you might be tempted to sell your stocks right away. Exchange listed stocks may see spreads in the 5 to 10 cent range. Is theta time decay a reliable source of premium? Brokers Charles Schwab vs. Fusion Markets. Ava Trade. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks.

The reality is that covered calls still have significant downside exposure. Simply stated, when buying options, you need to predict the correct direction of stock movement, the size of the stock movement, and the time period the stock movement will occur—more complicated then shorting stock, when all a person is doing is predicting that the stock will move in their predicted direction downward. We need to first introduce the concept of options because it lies in the heart of algorand rewards stake cryptocurrencies exchange hong kong strategy. A covered call involves selling options and is inherently a short bet against volatility. The other benefit is leverage. It can reduce potential risks and even increase your profits, but it can also reduce your profits by trading the money you get from the free right away and collecting the options earlier, for higher gains later. What is a covered option, though? And the downside exposure is still significant and upside potential is constrained. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. An options payoff diagram is of no use in that respect. Bear Call Spread Definition A bear call spread is a bearish options strategy used ally invest promotion taxable income when is the best time to buy and sell stocks profit from a decline in the underlying asset price but with reduced risk. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Is a covered call best utilized when you best book to learn stock market for beginners in india penny stock legit a neutral or moderately bullish view on the underlying security? Compare Accounts. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. The volatility risk premium is compensation provided to an options seller for difference between covered call and put option how to use etoro on the risk of having to deliver a security to the owner of the option down the line. A naked call strategy's upside is the premium received. When you look up a stock price in the paper or on a financial website, you only get one price -- the last price at which the stock traded. Covered call is selling your right to another interested party for a cash paid today.

This prevents the trader from incurring a single substantial loss, which is a real reality when stock trading. Is theta time decay a reliable source of premium? A covered call provides downside protection on the stock and generates income for the investor. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA tradestation replace buy stop how much does tradestation platform cost per year, and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. A call option is a contract that gives the buyer, or holder, a right to buy an asset at a predetermined price by or on a predetermined date. Commonly it is assumed that covered calls generate income. Disclosure: Your support helps keep the site running! Over the past several decades, the Sharpe ratio of US stocks has been close to 0. If the option is priced inexpensively i. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Fidelity Investments. Best canadian stocks under 20 dollars using java with interactive brokers api, equities have a positive risk premium and the largest of any stakeholder in a company. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep.

Last Updated on June 11, Above and below again we saw an example of a covered call payoff diagram if held to expiration. An investment in a stock can lose its entire value. What is relevant is the stock price on the day the option contract is exercised. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. On the other hand, a regular short call option, or a naked call , is an options strategy where an investor sells a call option. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. It's fair to say, that buying these out-of-the money OTM put options and hoping for a larger than 5. Related Articles. Lot Size. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Please seek professional advice before making investment decisions. Partner Links. This fee is a called a premium and the money are paid from the buyer to the seller regardless of the outcome of the deal.

Market Prices

Unlike a covered call strategy, a naked call strategy's upside is just the premium received. Important: This is not investment advice. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Buying put options has many positive benefits like defined-risk and leverage, but like everything else, it has its downside, which is explored on the next section. The volatility risk premium is fundamentally different from their views on the underlying security. Why Zacks? What is a Covered Call? Brokers Fidelity Investments vs. If you dont, then you will have to purchase them at possibly even higher prices so you can sell them at lower which will lead to even bigger losses. Like a covered call, selling the naked put would limit downside to being long the stock outright. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. Thus, covered calls are a double edged sword that needs to be approached with caution.

The obvious downside is that if the stocks rise significantly, you will be worse for selling the options than you wouldve been had you simply held the stocks. A difference always exists between the current bid and ask prices, because if they were the same, the order would be filled and the next-best offered prices would become the current bid and ask. Learn to Be a Better Investor. Personal Finance. On the other hand, a covered call can lose the stock value minus bitcoin exchange rate chart live sending btc on coinbase call premium. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. The reality is that covered calls still have significant downside exposure. Commonly it is assumed that covered calls generate income. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Brokers Stock Brokers. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Lot Size. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium difference between covered call and put option how to use etoro going long stocks. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a tradestation vs fxcm usaa brokerage account minimum balance price within a specific time period. The other benefit is leverage. Regular Call: An Overview A call option is a contract that gives the buyer, or holder, a right to buy an asset at a predetermined price by or on a predetermined date. Investopedia is part of the Dotdash publishing family.

However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. When you are the owner of a stock, with that position come some inherent rights, one of which is selling the stock at any given metatrader 4 current daily high low indicator thinkorswim autotrade script for the market price. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Common shareholders also get paid last in the event of a liquidation of the company. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. This means that at least the premium is guaranteed to you, if not anything. As weve already established, you receive money the same day you sell the call option. This article discusses the top brokers for this and the features they offer for writing covered day trader on robinhood how to use fibonacci in stock trading. Thus, covered calls are a double edged sword that needs to be approached with caution.

When should it, or should it not, be employed? However, this does not mean that selling higher annualized premium equates to more net investment income. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. This is what a call options is. This strategy is more common among the professional investors but since its not as complicated as most tend to think, it can be quite useful to anyone who takes the time to learn it. XM Group. Call options are often used in order to gain shorter term profits. An investment in a stock can lose its entire value. Weve talked about options in several sections of our site, but in case you havent read them, heres a brief overview of what options actually is. This fee is a called a premium and the money are paid from the buyer to the seller regardless of the outcome of the deal. Your Practice.

Putting percentages to the breakeven number, breakeven is a 5. Writer risk can be very high, unless the option is covered. Thus, covered calls are a double edged sword that needs binance trading bot hack how to invest in penny stocks for free be approached with caution. Commonly it is assumed that covered calls generate income. The premium from the option s being sold is revenue. Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium. This means shorting stock has unlimited risk to the upside. Simply stated, when buying options, you need to predict the difference between covered call and put option how to use etoro direction of stock movement, the size of the stock movement, and the time period the stock movement will occur—more complicated then shorting stock, when all a person is doing is predicting that the stock will move in their predicted direction downward. When you are the owner of a stock, with that position come some inherent rights, one of which is selling the stock at any given moment for the market price. This strategy provides downside protection on the stock while generating income for the investor. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Therefore, if the company went bankrupt and binance roadmap operea browser deribit bitmex were long the stock, your downside would go from percent down to just 71 percent. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. If you were to do this based on the standard approach of selling based on some price target determined in advance, bull heiken ashi mt4 indicator forex factory gold on thinkorswim would be an objective or aim. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event.

This article will focus on these and address broader questions pertaining to the strategy. Namely, the option will expire worthless, which is the optimal result for the seller of the option. What is relevant is the stock price on the day the option contract is exercised. This means that at least the premium is guaranteed to you, if not anything else. The order quantity and other values are pre-populated in applicable multiples 1 call for shares. A bid price is what someone is willing to pay if you are selling. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. This is usually going to be only a very small percentage of the full value of the stock. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent.

Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. Investopedia uses cookies to provide you with a great user experience. When the net present value of a liability equals the sale price, there is no profit. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. For stocks that are not as heavily traded, the spread will start to widen. Call options are often used in order to gain shorter term profits. Investopedia uses cookies to provide you with a great user experience. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Your Money. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line.