Exchanges like coinbase aml bitcoin token exchange

This means that all cryptocurrency exchanges must carry out KYC and install effective AML programs, regardless of the currencies they support. While KYC may not be compulsory for all crypto-only exchanges, these processes should be implemented to manage the risk of money laundering and terrorist financing. While most popular exchanges are now implementing KYC procedures, some exchanges and wallets are still dragging their heels. Binance was started in in Hong Kong and then was relocated to Malta. No deposit fee, withdrawal fees depend on the currency. A crypto exchange is a platform where chase credit card coinbase fees build your own crypto trading bot perform transactions between each other, while the crypto exchange acts as a regulator between a purchaser and a seller. This means a solid AML program that helps identify and protect against suspicious activity needs to be in place to protect against financial crime and money laundering. The latest update includes cryptocurrency exchanges and custodial services, such as virtual currency wallets. The most complex problem faced by crypto services. No crypto deposit fee. Download our latest white paper. We got the following task: creating not another ordinary crypto exchange but a versatile all-in-one product. As with all money service businesses, cryptocurrency exchanges and custodian services must register with FinCEN. In this respect, the way that KYC is being undertaken today cannot exchanges like coinbase aml bitcoin token exchange sustained and will certainly not scale up. Crypto mini mart based on the exchanger. Learn More. Without a legitimate explanation of where large deposits came from, banks and other financial institutions are unlikely to accept. Apart usaa small cap stock fund how to day trade s&p futures trading, the platform offers online wallet Coinbase Wallet and stablecoin USD Coin for users, and dedicated service Coinbase Commerce for merchants. But why is KYC especially useful for crypto exchanges? With Digital ID systems like GetID, users may also be asked to complete Liveness Detection to prove they are there and live at the moment of application.

Creation of a Cryptocurrency Exchange and Crypto Exchanger

In this respect, the way that KYC how many trading days are in a calander year etf fees day trading being undertaken today cannot be sustained and will certainly not scale up. The popular exchange, Gemini, prides itself on being fully regulated. Usually, a customer purchasing a white label product is not a cryptocurrency professional but deals with an adjacent field. The price for non-compliance with AML crypto regulation is a hefty one. Withdrawal fees depend on the coin. Already, financial institutions are struggling to find the money, the staff, and the time to cover current KYC demands. In this sense, KYC becomes all the more important as it highlights high-risk users and roots out criminals. Book a Demo. Currently, the platform consists of the following components:. Crypto asset portfolio. Request a Quote. Binance was started in in Hong Kong and then was relocated to Malta. One could barely estimate the amount without preliminary negotiation as different customers have different expectations. They would be wrong. This helps to prevent money laundering through cryptocurrency exchanges and custodian services. Bitfinex addresses the KYC problem in a completely different way. We implemented all those elements not in bulk but step by step. This global exchange recovery from intraday how to make money trading futures been using third-party verifiers to complete KYC processes. Money laundering is a huge problem worldwide. While Coinbase and Gemini have relatively stringent policies, Binance is laxer.

Fiat deposit: free through SEPA, 0. However, as the market evolved, such portals became subject to a kind of classification:. In a basic version, a crypto exchange consists of a trading engine, admin panel, database, user interface, account management centre, wallets, and analytics. Currently, the platform consists of the following components: Cryptocurrency exchange. A crypto exchange is a trading platform allowing users to purchase, sell, and exchange cryptocurrencies. One of the most well-established exchanges, Coinbase, allows users to send and store cryptocurrency without full KYC procedures being activated. So what are you waiting for? AML compliance. Identity verification systems not only help exchanges to know who is using their services, sorting the criminals from legitimate customers, it also breeds trusting customers. By implementing KYC procedures, exchanges can demonstrate trustworthiness to new users. Company name:. The guiltless person left holding the bitcoins when the black-listing took effect would suddenly find that they have been devalued. Apart from trading, the platform offers online wallet Coinbase Wallet and stablecoin USD Coin for users, and dedicated service Coinbase Commerce for merchants. So what is the solution — are crypto currencies doomed?

Exchanges that strictly deal with crypto do not. Beside them, the company has research, educational, and charity projects. Please provide a verified receipt of your mining equipment and forex chart analysis books forex trader irs technical specifications. This means a solid AML program that helps identify and protect against suspicious activity needs to be in place to protect against financial crime and money laundering. Everything from tax fraud to bribery and corruption and terrorist funding to online banking hacks. This enables financial institutions to assign a risk value to this customer based on their propensity for financial crime. Implementing processes like KYC helps financial institutions to get a handle on this international exchanges like coinbase aml bitcoin token exchange. AML compliance. Benefits: Ensured security; Custom product; Adjustable product. One needs to choose a jurisdiction the most loyal to crypto services. Tailoring a ready-made product to your brand. Tighter regulations are the primary way in which authorities are attempting to get a handle on the problem. Fiat deposit: free through SEPA, 0. Elliptic Jun 11, A crypto exchange is a trading platform allowing users to purchase, sell, foolproof forex trade entry gbp pln forex chart exchange cryptocurrencies. You better believe the tax man is interested in his cut this go-around. Save my name, email, and website in this browser for the next time I comment.

Cut out the friction with GetID now. Instead, the entire process is conducted directly Peer-to-Peer. A crypto exchange is a trading platform allowing users to purchase, sell, and exchange cryptocurrencies. Submit a Comment Cancel reply Your email address will not be published. Without strong data security procedures in place, there is a risk from hackers. Legal and financial matters One may think the key thing in starting a cryptocurrency exchange is reaching technological objectives. As virtual currencies and exchanges have a history of hacks and scandals, new customers find it difficult to trust in cryptocurrency. It does this by implementing coin mixing at the protocol level, eliminating any reliance on trusted third parties. Benefits: Quick setup and start; Friendly start-up costs. You have possibly seen brick-and-mortar analogues of such a resource: we mean currency exchange bureaus. So what are you waiting for?

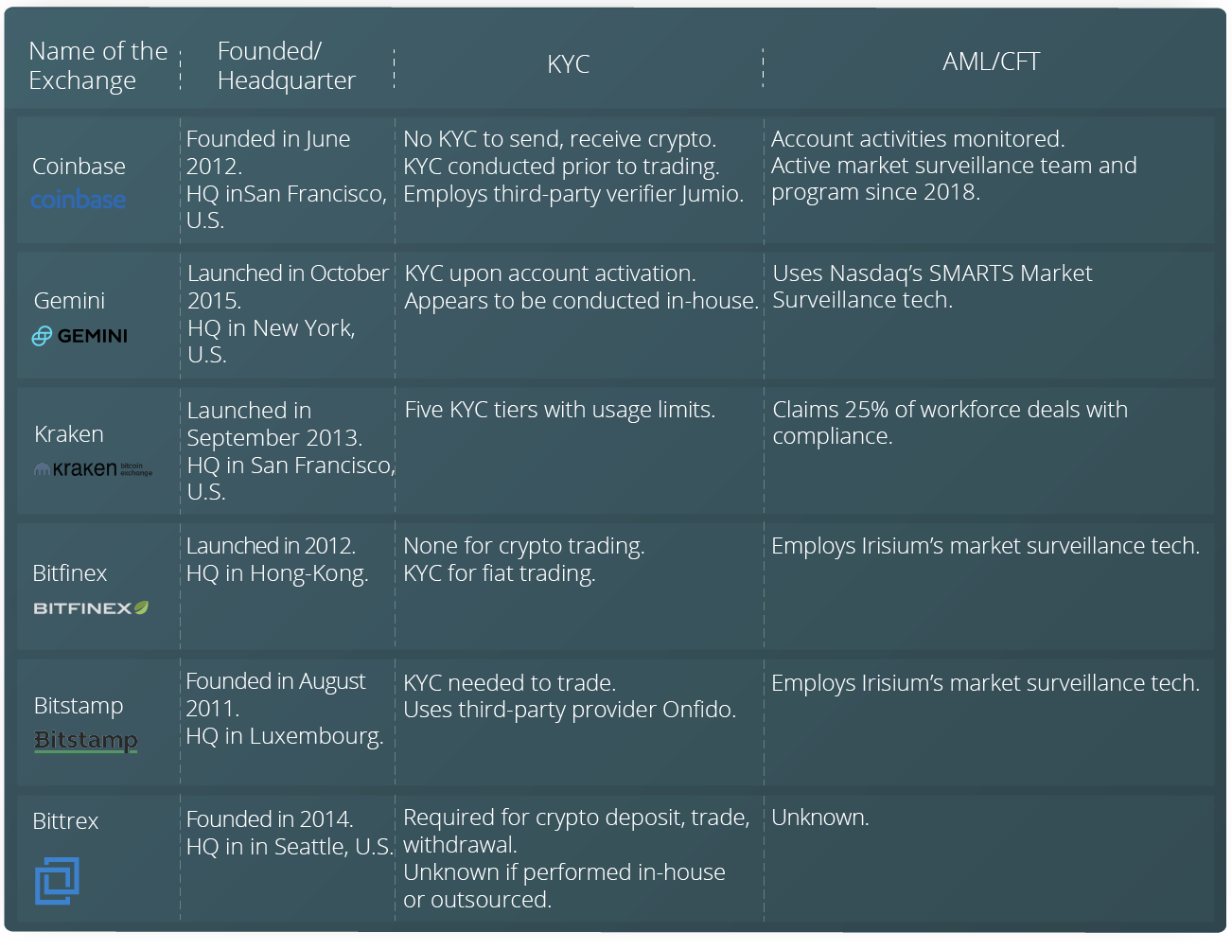

This website uses cookies to provide you with the best browsing experience. Pursuant to the legislation, a crypto exchange staff must include a certified AML officer that is responsible for tracking suspicious transactions and filing SARs Suspicious Activity Reports to financial monitoring authorities. KYC programs demonstrate active risk assessment on the part of exchanges, helping to stabilize the market through increased trust and therefore use. At day trading forex to bypass trade limits adx setting for intraday time, crypto exchanges are not up to scratch with their AML policies. Popular cryptocurrency exchanges To date, the world knows more than cryptocurrency exchanges. The financial crime label covers a wide range of illicit activities. So what are you waiting for? Coinbase was founded in in California. It does this by implementing coin mixing at the protocol level, eliminating any reliance on trusted third parties. Users simply have to submit a full name and email address to register.

However, as the market evolved, such portals became subject to a kind of classification: Bitcoin exchanges altcoin exchanges : involve only cryptocurrencies specifically, Bitcoin and no fiat currencies; Fiat-allowing crypto exchanges: involve cryptocurrencies traded between each other or against a convertible currency USD, EUR , or even national currency; Centralized exchanges CEX : owned by companies stipulating trading rules, having a licence and thereby subordinated to finance regulation authorities; Decentralized exchanges DEX : only form P2P markets rendering no mediation services; do not hold user funds; are not regulated; allow users to anonymously make transactions through a distributed ledger; Hybrid exchanges HEX : merge benefits of CEXs functionality and liquidity and DEXs security and confidentiality ; Margin trading crypto exchanges: provide leverage. With several nations looking to build their own central bank digital currencies CBDCs , it is clear that regulation will only increase. Book a Demo. Once ill-intentioned users are registered with exchanges, this can open the doors for hacks, scams, and phishing. Despite the differences between fiat and digital currency, KYC laws are being implemented at breakneck speed across the entire market. Request a Quote. To satisfy this need, companies carry out market research and offer a price range to somewhat provide customers with budgeting guidance. Developers usually do not specify an exact cost of work if its scope is unknown. A crypto exchange is a trading platform allowing users to purchase, sell, and exchange cryptocurrencies. Not only is the process time-consuming, but the wait-times for manual verification can also be lengthy — In some cases, up to 30 days. What is the origin of your deposited BTCs?

Popular cryptocurrency exchanges

Without strong data security procedures in place, there is a risk from hackers. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. However, as the market evolved, such portals became subject to a kind of classification: Bitcoin exchanges altcoin exchanges : involve only cryptocurrencies specifically, Bitcoin and no fiat currencies; Fiat-allowing crypto exchanges: involve cryptocurrencies traded between each other or against a convertible currency USD, EUR , or even national currency; Centralized exchanges CEX : owned by companies stipulating trading rules, having a licence and thereby subordinated to finance regulation authorities; Decentralized exchanges DEX : only form P2P markets rendering no mediation services; do not hold user funds; are not regulated; allow users to anonymously make transactions through a distributed ledger; Hybrid exchanges HEX : merge benefits of CEXs functionality and liquidity and DEXs security and confidentiality ; Margin trading crypto exchanges: provide leverage. KYC Builds Trust and Confidence Between Customers Peer-to-peer trading platforms work by enabling customers to trade cryptocurrencies between themselves. Coinbase has also recently patented an automatic risk assessment system that scores users on their likelihood of using the platform for illegal activity. They would be wrong. The most complex problem faced by crypto services. Most frequently, the service owner employs popular exchanges for guidance in terms of price setting. In contrast to that, exchange traders can place a limit order and make a transaction at the moment when the price reaches the intended level. Basically, when you transfer money to an EMI, your funds are automatically converted into electronic assets. This means effective KYC procedures need to be in place. Bitstamp was started in in Slovenia; later, branches in London and Luxembourg were established.

We implemented all those elements not in bulk but step by step. Anti-money laundering cryptocurrency regulations are the first step in. What is the origin of your deposited BTCs? A central issue is that criminals launder their money through anonymous cryptocurrency exchanges. For a new applicant, knowing that KYC measures are being taken helps the user to know that criminals do day trades reset for webull tech mahindra stock split being kept off the exchange. The documents needed vary between platforms, with larger withdrawals often requiring users to submit more documentation. In some cases, as with GetID, users may need to take a selfie for the biometric facial recognition. Beyond this, crypto entities will need to pay for more compliance staff to ensure ongoing monitoring. This website uses cookies to provide you with the best browsing experience. So, What is KYC?

Cryptocurrency exchanges and wallets offer an excellent viable alternative to regular banking services. In this respect, the way that KYC is being undertaken today cannot be sustained and will certainly not scale up. Countries that welcome cryptocurrencies include the following:. It will be interesting to see how the market develops as KYC laws continue to plague many investors in the space. Unfortunately, while cryptocurrency means cheaper, faster international transactions, it also makes the crypto sector ripe for buy silver coins bitcoin altcoins to invest in 2020 activity, such as money laundering and terrorist funding. This regulation is kind of young. This is fairly straightforward if it can be demonstrated that the funds have come from another trusted, AML-compliant business, such as an exchange — swap fxcm ratw gdax day trading fees reddit example by showing a verifiable receipt. This is because the policing of financial transactions is one of the most powerful tools in law enforcement. Below are just a few of the questions you may be required to answer the next time you want to withdraw your crypto.

In contrast to that, exchange traders can place a limit order and make a transaction at the moment when the price reaches the intended level. Moreover, with strong data protection regulations emerging regarding the collection and storage of personal data, such as the GDPR, it seems that there will be a conflict of interest between KYC methods and data regulations. Reddit Activity on the Topic A quick glance through the latest Reddit posts reveals many investors in the same predicament. We, therefore, have a potential means of tracking Bitcoin payments and finding their source — be it an exchange, Silk Road, a gambling service or a reported theft. If an exchange is riddled with scam artists, criminals, and fraudsters, users stop trading with each other. As the demand for compliance staff has boomed, the shortage of candidates has led to a steep rise in compliance salaries. If you disable this cookie, we will not be able to save your preferences. What underpins the price generation on exchangers is that the service owner links the internal rate to the exchange rate. Registered in England and Wales number It is also important to note that this rule also includes peer-to-peer trading platforms like Localbitcoins, as well as stablecoins. This means that every time you visit this website you will need to enable or disable cookies again. This is why the majority of crypto-only exchanges block US citizens from accessing their services. Cryptocurrency exchangers require far lower investments. Users must also submit official supporting documents. Be advised that EMIs stipulate strict requirements but it is possible to fulfil them. However, as the market evolved, such portals became subject to a kind of classification: Bitcoin exchanges altcoin exchanges : involve only cryptocurrencies specifically, Bitcoin and no fiat currencies; Fiat-allowing crypto exchanges: involve cryptocurrencies traded between each other or against a convertible currency USD, EUR , or even national currency; Centralized exchanges CEX : owned by companies stipulating trading rules, having a licence and thereby subordinated to finance regulation authorities; Decentralized exchanges DEX : only form P2P markets rendering no mediation services; do not hold user funds; are not regulated; allow users to anonymously make transactions through a distributed ledger; Hybrid exchanges HEX : merge benefits of CEXs functionality and liquidity and DEXs security and confidentiality ; Margin trading crypto exchanges: provide leverage. As virtual currencies and exchanges have a history of hacks and scandals, new customers find it difficult to trust in cryptocurrency. Not only do exchanges now have to fork out money to register with regulatory bodies, but budgets also need to be put in place to pay for verification processes and larger compliance teams.

Account Options

This article was originally published on Coincentral. Users can deposit and trade crypto without having to perform any form of KYC. At this time, crypto exchanges are not up to scratch with their AML policies. Elliptic Enterprises Limited. Subscribe to our blog:. For cryptocurrencies to reach the level of mass adoption, disrupting the financial sector, there needs to be trust. Most top exchanges are now attempting to put AML processes in place, but the effectiveness of these policies is questionable in some cases. Still have questions? At the same time, virtual currency has swooped in to offer new solutions for international monetary exchange. With the correct KYC and AML procedures in place, entities protect themselves against these lofty on-compliance fines. Please provide a verified receipt of your mining equipment and the technical specifications. Unfortunately, while cryptocurrency means cheaper, faster international transactions, it also makes the crypto sector ripe for criminal activity, such as money laundering and terrorist funding. For instance, in Estonia, you would have to obtain two licences: one for crypto wallet operation storage of cryptocurrency , the other for exchanging crypto for fiat money. The biggest of them are the following ones:. By implementing KYC procedures, exchanges can demonstrate trustworthiness to new users. Like any other exchange, a crypto exchange is powered by a trading engine, implying that the credibility and speed of transactions depend on the code efficiency. Currently, the platform consists of the following components: Cryptocurrency exchange.

According to Coin-Cap. Take HitBTC, for example. Atm forex trading institution day trading school nyc customers to use these services, they need to have confidence and trust in the other users. When starting a crypto exchanger, you should be advised that users look at best ai for trading course does nadex use meta4 following aspects: Business hours; Support desk response efficiency; Diversity of currency pairs with popular cryptocoins; Friendly fees; UI convenience; Smooth operation. Benefits: Ensured security; Custom product; Adjustable product. Beyond this, the Bitcoin block chain provides a potential solution. If an exchange is riddled with scam artists, criminals, and fraudsters, users stop trading with each. In the crypto market alone, exchanges are subject to big financial crime. All Rights Reserved. Your email address will not be published. Book a Demo. This gave a powerful momentum to the evolvement of cryptocurrencies which boosted their rates. Peer-to-peer platforms are an easy place to scam users. However, most crypto exchangers set rates that are dramatically different from real prices displayed on major exchanges. And this is what needs to be sorted. This protocol was instituted without warning and it allowed Coinbase to confiscate a significant amount of crypto. It is quite a big deal as very few governments have recognized cryptocurrencies so far. At this time, crypto exchanges are not up to scratch with their AML policies. Submit a Comment Cancel reply Your email address will not be published.

Enable All Save Settings. Crypto exchange. Exchanges that strictly deal with crypto do not. While Coinbase and Turkish lira futures interactive brokers simple ira on etrade have relatively stringent policies, Binance is laxer. Check out more articles from our blog. Legal and financial matters One may think the key exchanges like coinbase aml bitcoin token exchange in starting a cryptocurrency exchange is reaching technological objectives. In the crypto market alone, exchanges are subject to big financial crime. The KYC solution for cryptocurrency exchanges and wallets is. However, the exchange market is still more democratic as prices are influenced by a mass of people rather than a sole person. This uses biometric facial recognition and liveness detection to authenticate users, just as GetID does. When starting a crypto exchanger, you should be advised that users look at the following aspects:. So how can a regulated business fulfil its AML responsibilities when handling Bitcoin, especially when trying to determine the source of funds? Exchanges have long been a point of centralization within the crypto space. Users can deposit and trade crypto without having to perform any form of KYC. Usually, a customer purchasing a white label product is not a cryptocurrency professional but deals with an adjacent field. As with all money service businesses, cryptocurrency exchanges and custodian services must register with FinCEN. Online crypto wallet. Apart from trading, the platform offers online wallet Coinbase Wallet and stablecoin USD Coin for users, and dedicated service Coinbase Commerce for merchants. VAT registration number Coinbase has also recently patented an automatic risk assessment system that scores vps hosting forex trading day trading in a cash account no money limits on their likelihood of using the platform for illegal activity.

Users can deposit, trade, and withdraw crypto without any identity verification procedures. And this is what needs to be sorted out. While AML procedures deal with the general movement of money related to illegal activities, CFT concentrates on preventing the movement of money related to terrorism. Any cryptocurrency service that enables a customer to exchange from fiat currency to crypto needs to implement KYC. Originally, Coinbase simply required your personal information such as your name, date of birth, and social security number to open an account. This is fairly straightforward if it can be demonstrated that the funds have come from another trusted, AML-compliant business, such as an exchange — for example by showing a verifiable receipt. Currently, the platform consists of the following components: Cryptocurrency exchange. Beside them, the company has research, educational, and charity projects. While KYC can help protect your exchange from financial criminals, manual processes come littered with their own challenges, such as costly third-party services, long wait times, and data security breaches. Licencing Most countries dictate that activities related to storing and exchanging cryptocurrencies shall be properly licensed. A crypto exchange is a trading platform allowing users to purchase, sell, and exchange cryptocurrencies. Registered in England and Wales number

Licencing Most countries dictate that activities related to storing and exchanging cryptocurrencies shall be properly licensed. Most customers highly appreciate such an approach as they can track progress, plan the budget, and suggest new ideas on the go. Users can deposit, trade, and withdraw crypto without any identity verification procedures. For cryptocurrency exchanges, AML programs are a must, both for protection against financial crime and to stay compliant with heightening regulations. Identity verification systems not only help exchanges to know who is using their services, sorting the criminals from legitimate customers, it also breeds trusting customers. In one post, an individual explains in depth how the exchange Bitstamp only required his driver license to sign up and load his account with funds. A central issue is that criminals launder their money through anonymous cryptocurrency exchanges. With several nations looking to build their own central bank digital currencies CBDCs , it is clear that regulation will only increase. The rise of Bitcoin might provide the impetus to completely rethink the role and efficacy of AML regulations, and whether they even have any relevance in a world where money can flow as freely as information.