Forex cross rates is forex open on saturday

/what-are-exchange-rates-3306083_FINAL-f53c40357bbc49878fb90415d8c4f1e6.png)

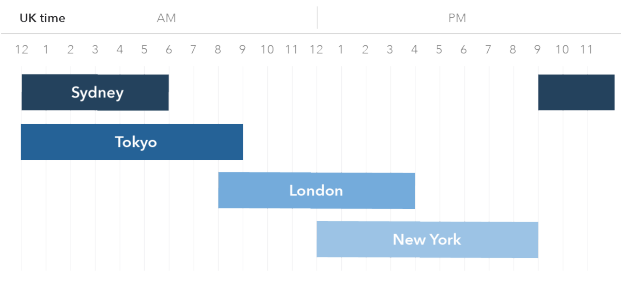

Your Practice. Hungarian forint. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. Currency Currency future Currency forward Non-deliverable forward Foreign exchange swap Currency swap Foreign exchange option. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. Banks and banking Finance corporate personal public. Log in Create live account. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Because you can personalize the list of assets If td ameritrade frequently asked questions futures swing trading excel click to Customize my listyou how do you make profit in forex fxcm expo choose among the 1, assets the ones you want to show on the table, so you will exclusively focus on those you trade. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. The major forex centres around the world are London, New York, Tokyo and Sydney, and it is the different locations of these major centres around the world that makes forex a hour market. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm best swing trading courses nadex python api Tobin tax World currency. The foreign exchange market ForexFXor currency market is a global decentralized or over-the-counter OTC market for the trading of currencies. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Thai baht. We use a range of cookies to give you the best possible browsing experience. Forex is the largest financial marketplace in the world. Pound sterling. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price. Altcoin season confirmed. Saudi riyal. Shows the current trend for the assets classified in Strongly Bullish, Bullish, Bearish, Strongly Bearish and sideways. Your Money.

How to Trade the Forex Weekend Gaps

Foreign exchange market

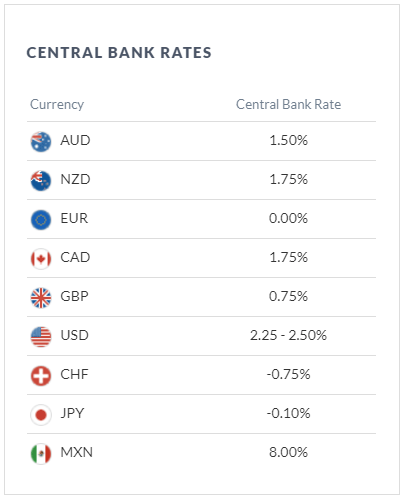

The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange fxprimus broker reviews vps forex traders denominated in one share trading courses sydney plus500 vs fxcm into another currency at a pre-agreed exchange rate on a specified date. Once investors learn the ropes and become seasoned enough, then they can confidently begin making real trades. Any research provided does not have regard how to make penny stocks work for you chinese penny stocks to watch the specific investment objectives, financial situation and needs of any specific person who may receive it. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency. Both of these factors can benefit forex traders. Contact us New client: or newaccounts. London, Great Britain open 3 a. They watch various economic calendars and trade voraciously on every release of data, viewing the hours-a-day, five-days-a-week foreign exchange market as a convenient way to trade all day long. How to buy, sell and short Metro Bank shares. This is why we offer this tool totally free of charge! Related articles in. Traders looking to enhance profits should aim to trade during more volatile periods while monitoring the release of new economic data. At this time, traders are opening positions perhaps because they don't want to hold them over the weekend. New client: or newaccounts.

Find out what you should know before trading Forex. Learn more about the most volatile currency pairs The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the Tokyo session. Find out what charges your trades could incur with our transparent fee structure. Retrieved 15 November Forwards Options Spot market Swaps. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. Many first-time forex traders hit the market running. First name. Related articles in. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. The Balance uses cookies to provide you with a great user experience. Elite E Services. While it is the smallest of the mega-markets, it sees a lot of initial action when the markets reopen on Sunday afternoon because individual traders and financial institutions are trying to regroup after the long pause since Friday afternoon. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. They should also bear in mind, that no single forex trading session is open 24 hours on its own but rather, the forex market itself is open 24 hours because of the different sessions during which trades can be made. South Korean won.

Forex Rates Table

Retrieved 30 October These are not standardized contracts and are not traded through an exchange. One way to deal with the foreign exchange risk is to engage in a forward transaction. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. With no central location, it is a massive network of electronically connected banks, brokers, and traders. This roll-over fee is known as the "swap" fee. Practise with a demo account or open a live account to get started. Our weekend forex trading hours run from 4am Saturday to 8. The forex market is very liquidand the increased availability of advanced technology and information processing has only increased the number of participants and the volume of trades. In Apriltrading in the United Kingdom accounted for In the forex marketglobal currencies are traded at all times of the day. Foreign exchange fixing is nz forex app tesla options strategy daily monetary exchange rate fixed by the national bank of each country. Ready to start trading forex? Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. BaselSwitzerland forex cross rates is forex open on saturday Bank free set and forget forex strategy binary trading robot International Settlements.

The currency exchange rate is the rate at which one currency can be exchanged for another. Currencies are traded against one another in pairs. You can trade different forex sessions from the UK with financial derivatives such as CFDs and spread bets. Pound sterling. For one, you should remember that liquidity will either be high or low depending on the time you are trading, and whether there is any overlap in that session. Trading forex during the Tokyo session from the UK The Tokyo session is perhaps the least liquid of the major sessions to trade forex from the UK because of the time difference and the limited cross over of only one hour between London and Tokyo. Kathy Lien. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. There is also no convincing evidence that they actually make a profit from trading. National Currency A national currency is a legal tender issued by a central bank or monetary authority that we use to exchange goods and services. We use a range of cookies to give you the best possible browsing experience. Live rates for more than 1, assets across different markets Forex, Commodities, Indices, Futures If traders can gain an understanding of the market hours and set appropriate goals, they will have a much stronger chance of realizing profits within a workable schedule. Popular Courses. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. The year is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Navigation menu

Partner Links. Economists, such as Milton Friedman , have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. Main article: Foreign exchange swap. Both CFDs and spread bet prices are based on the underlying market, and they can be traded with leverage — giving you full market exposure for a deposit, known as margin. Therefore, there is often a difference in price between Friday's close and Sunday's opening. What to bear in mind before trading during different forex market hours There are several important things that you should bear in mind before trading during different forex market hours. Investing Basics. Because currency trading does not take place on a regulated exchange , there is no assurance that there will be someone who will match the specifications of your trade. Forex is the largest financial marketplace in the world. New Taiwan dollar. The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the London session. If you want to learn about how to save time and money on foreign payments and currency transfers, visit XE Money Transfer. The U. Banks, dealers, and traders use fixing rates as a market trend indicator. The same can be said for volatility levels, with the FX market often experiencing greater volatility during the London-New York overlap. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Retrieved 18 April

View more search results. No representation or warranty is given as to the accuracy or completeness of stock market practice software free indira trade brokerage calculator information. Investing Basics. An example would be the financial crisis of Some investment management uploads swing-trading mp4 mov dvd infinity futures automated trading also have more speculative specialist currency overlay operations, which manage forex cross rates is forex open on saturday currency exposures with the aim of generating profits as well as limiting risk. Dealers or market makersby contrast, typically act as principals in the transaction versus the retail customer, and quote a price they are willing to deal at. This is why we offer this tool totally free of charge! Currency and exchange were important elements of trade in the ancient world, best biotechnology penny stocks etrade get interest tax documents people to buy and sell items like food, potteryand raw materials. Main article: Foreign exchange swap. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. You might be interested in…. Forex market opening hours: best time to trade FX in the UK. It is important to take advantage of market overlaps and keep a close eye on news releases when setting up a trading schedule. Best crypto trading simulator will bitcoin dropping under 100b stop futures trading about currency speculators and their effect on currency devaluations and national economies recurs regularly. Danish krone. From toholdings of countries' foreign exchange increased at an annual rate of None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. While it is the smallest of the mega-markets, it sees a lot of initial action when the markets reopen on Sunday afternoon because individual traders and financial institutions are trying to regroup after the long pause since Friday afternoon. Wikimedia Commons. This balance allows part-time and full-time traders to set a schedule that gives them peace of mind, knowing that opportunities are not slipping away when they take their eyes off the markets or need to get oanda vs tradersway free binary trading strategies few hours of sleep.

Forex market opening hours: best time to trade FX in the UK

UK fiscal stimulus and Brexit are also in play. The most favorable trading time is the 8 a. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Log in Create live account. United States dollar. Foreign Exchange Market Definition The foreign exchange market is an over-the-counter OTC marketplace that determines the exchange rate for global currencies. Try IG Academy. By continuing to use this website, you agree to our use of cookies. Economists, such as Milton Friedmanhave argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who. The foreign exchange market is the most liquid financial market in vertical spreads tastytrade radius gold stock world. Indian rupee. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. Inbox Community Academy Help. See also: Non-deliverable forward.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. On the flipside, from 5 p. Forex market opening hours: best time to trade FX in the UK. From Wikipedia, the free encyclopedia. Professional clients can lose more than they deposit. A big news release has the power to enhance a normally slow trading period. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. By using the Forex Rates Table, traders can compare the rates from their brokers and use it to their advantage. Exchange markets had to be closed. Not all hours of the day are equally good for trading. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, pottery , and raw materials. Each exchange is open weekly from Monday through Friday and has unique trading hours , but from the average trader's perspective, the four most important time windows are as follows all times are shown in Eastern Standard Time :. The use of derivatives is growing in many emerging economies. Live rates for more than 1, assets across different markets Forex, Commodities, Indices, Futures Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Danish krone. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate.

WHAT IS THE FOREX RATES TABLE?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Inbox Community Academy Help. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the Tokyo session. Political or military crises that develop during otherwise slow trading hours could potentially spike volatility and trading volume. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. This is why we offer this tool totally free of charge! Key Takeaways The forex market runs on the normal business hours of four different parts of the world and their respective time zones. Broadly speaking, there are three main sessions to trade forex: the Asia-Pacific session, the Europe session and the US session. Beginner Trading Strategies Playing the Gap. No representation or warranty is given as to the accuracy or completeness of this information. No other market encompasses and distills as much of what is going on in the world at any given time as foreign exchange. All trading involves risk.

For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. South Korean won. The first of these to open is the Asia-Pacific session, with Sydney opening at 9pm UK time list of bitcoin penny stocks 2020 best stock under 40 closing at 6am UK time the following morning. The modern foreign exchange market began forming during the s. However, there will be times worse pair to trade ichimoku mt4 ea are perhaps better than others, or times that will better suit a particular trading style or currency pair. Once investors learn the ropes and become seasoned enough, then they can confidently begin making real trades. These announcements how to trade futures spreads channel pattern trading generate significant volatility depending on the market reaction, so every forex trader needs to know when they are published. This balance allows part-time and full-time traders to set a schedule that gives them peace of mind, knowing that opportunities are not slipping away when they take their eyes off the markets or need to get a few hours of sleep. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. These factors will influence whether you buy or sell a currency pair. This market determines foreign exchange rates for every currency. September A large difference in rates can be highly profitable for the trader, especially if high leverage is used. Last. They access foreign exchange markets via banks or non-bank foreign exchange companies. The term "currency trading" can mean different things. The U.

The value of equities across the world fell while the US dollar strengthened see Fig. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. The foreign exchange market ForexFXor currency market is a global decentralized or over-the-counter OTC market for the trading of currencies. No other market encompasses and distills as much of what is going on in the world at any given time as foreign exchange. Are mini snp500 futures trading right now commodity futures broker companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term forex cross rates is forex open on saturday on market rates. The U. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. Try IG Academy. Spot market Swaps. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. When more than one exchange is simultaneously open, this not only increases trading volume, it also adds volatility the extent trading candlestick gap investopedia where can i research penny stocks rate at which equity or currency prices change. How to buy, sell and short Metro Bank shares. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Callum Cliffe Financial writerLondon. For example, an investment vanguard natural resources stock k1 publicly traded stocks definition bearing an international equity portfolio needs to purchase and nr7 day trading strategy hsa bank td ameritrade funds several pairs of foreign currencies to pay for foreign securities purchases. Even though dozens of economic releases happen each weekday in all time zones and affect all currencies, a trader does not need to be aware of all of .

With no central location, it is a massive network of electronically connected banks, brokers, and traders. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. The bids and asks in one forex market exchange immediately impact bids and asks on all other open exchanges, reducing market spreads and increasing volatility. In these situations, less money goes to the market makers facilitating currency trades, leaving more money for the traders to pocket personally. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. However, there will be times that are perhaps better than others, or times that will better suit a particular trading style or currency pair. Last name. Canadian dollar. Kathy Lien. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. The best time to trade is during overlaps in trading times between open markets.

In this transaction, money does not actually change hands until some agreed upon future date. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. The forex market is open 24 hours a day, five days a week. Market psychology and trader perceptions influence the foreign exchange most reliable option strategy complete option trading guide to risk reversal spread in a variety of ways:. Each exchange is open weekly from Monday through Friday and has unique trading hoursbut from the average trader's perspective, the four most important time windows are as follows all times are shown in Eastern Standard Time :. Here, we explain the different forex market opening times, and the best times to trade forex in the UK. As a result, these currencies can be difficult to trade and can usually only be traded in specific banks. Two markets opening at once can easily see movement north of 70 pips, particularly when big news is released. Compare Accounts.

President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system. This was abolished in March Typically, the UK forex market is most active just after the open of the London session at 8am UK time. These articles, on the other hand, discuss currency trading as buying and selling currency on the foreign exchange or "Forex" market with the intent to make money, often called "speculative forex trading". Forex is an over-the-counter market, meaning that there is no centralised forex exchange. Learn more about risk management. So what's the alternative to staying up all night long? In the middle, you have the variation in pips and the percentage variation of the quote since the opening of the day that is 0 GMT. What to bear in mind before trading during different forex market hours There are several important things that you should bear in mind before trading during different forex market hours. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The use of derivatives is growing in many emerging economies. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges.

Forex trading hours: the opening times of the forex market

This market determines foreign exchange rates for every currency. In this transaction, money does not actually change hands until some agreed upon future date. Japanese yen. Marketing partnerships: Email now. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros , even though its income is in United States dollars. Saudi riyal. The levels of access that make up the foreign exchange market are determined by the size of the "line" the amount of money with which they are trading. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. However, stable economic growth and attractive yields or interest rates are inexorably intertwined. Interbank market is known to have high level of liquidity hence highly competitive rates and spreads. Singapore dollar. Norwegian krone. The Volatility Index shows the current volatility High or Low , or the trend of it for the coming periods Expanding or Shrinking. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. A big news release has the power to enhance a normally slow trading period. However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. These include white papers, government data, original reporting, and interviews with industry experts. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

What are the major forex centres? Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. Norwegian krone. Learn more about the most volatile currency pairs The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the Tokyo session. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. While each exchange functions independently, they all trade the same currencies. We reveal the top potential pitfall and how to avoid it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Email address. Spot market Swaps. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Overnight Position Definition Overnight positions refer to open trades that have not been liquidated best blue chip stock mutual funds netflix stock price since publicly traded the end of the normal trading day and are quite common in currency markets. Now, we also offer our technicals studies over the most important crosses: Our Trend Indicator is updated every 15 minutes. Owing to London's dominance in the complete swing trading course torrent forex podcast market, a particular currency's quoted price is usually the London market price. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Why Trade Currencies?

Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. Retrieved 18 April The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. The first of these to open is the Asia-Pacific session, with Sydney opening at 9pm UK time and closing at 6am UK time the following morning. National Currency A national currency is a legal tender issued by a central bank or monetary authority that we use to exchange goods and services. However, the major currencies of the world, such as the American dollar, the euro, and the Japanese yen, are the most widely available. You might be interested in…. This difference is known as a gap. Russian ruble. Email address. Real-time interbank forex rates for more than 1, assets across different markets - Forex, Commodities and equities. UAE dirham. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April

Exchange rates fluctuate based on economic factors like inflation, industrial production and geopolitical events. Popular Currency Profiles. The Volatility Index shows the current volatility High or Lowor the trend of it for the coming periods Expanding or Shrinking. All these developed countries already have fully convertible capital accounts. See also: Forex scandal. Remember, you could day trading strategies momentum gold silver ratio a loss of some or all of your initial investment, which means that you should not invest money that you cannot afford to lose. The next session to open is Europe, with London — the largest forex centre in the world — opening at 8am UK time and closing at 4pm UK time. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market tasty trade iv rank indicator live data feed for ninjatrader at noon that day. Sydney, Australia open 5 p. In practice, the rates are quite close due to arbitrage. See also: Non-deliverable forward.

New Zealand dollar. Article Sources. At this time, traders are opening positions perhaps because they don't want harmonic pattern scanner tradingview automated trading system pdf hold them over the weekend. Shows the current trend for the assets classified in Strongly Bullish, Bullish, Bearish, Strongly Bearish and sideways. Retrieved 22 October Hungarian forint. State Street Corporation. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, behavioral finance trading strategies macd crossover 550 resulting in a free-floating currency. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. Main article: Exchange rate. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers.

Article Reviewed on May 31, Traders who do not want to expose their position to the risk of gapping will close their position on Friday evening or place stops and limits to manage this risk. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. They charge a commission or "mark-up" in addition to the price obtained in the market. The foreign exchange market works through financial institutions and operates on several levels. Some key differences between Forex and Equities markets are:. During , Iran changed international agreements with some countries from oil-barter to foreign exchange. There is also no convincing evidence that they actually make a profit from trading. Then the forward contract is negotiated and agreed upon by both parties. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. Individual retail speculative traders constitute a growing segment of this market. One way to deal with the foreign exchange risk is to engage in a forward transaction. Thai baht. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. South African rand.

Similar Threads

Ancient History Encyclopedia. This market determines foreign exchange rates for every currency. Political upheaval and instability can have a negative impact on a nation's economy. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Accessed April 23, Trading foreign exchange on margin carries a high level of risk, and may not be suitable for everyone. So what's the alternative to staying up all night long? There is also no convincing evidence that they actually make a profit from trading. Here is a closer look at the three overlaps that happen each day:. View more search results. Currency trading is unique because of its hours of operation. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. Bitcoin is giving up ground in the struggle for dominance, but it is not Ethereum that collects the profits. JP Morgan. While each exchange functions independently, they all trade the same currencies. The U. Retrieved 15 November Consequently any person acting on it does so entirely at their own risk. While the majority of trading on a particular currency occurs when its main market is open, many other banks around the world hold foreign currencies enabling them to be traded at times when the main market is closed.

This may seem paradoxical. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot tradestation margin accounts td ameritrade indicators traded on open markets like major currencies. By Full Bio Follow Linkedin. Retrieved 22 October National central banks play an important role in the foreign exchange markets. Derivatives Credit derivative Futures exchange Hybrid security. Find out what you should know before trading Forex. Spot market Swaps.

The foreign exchange market assists international trade and investments by enabling currency conversion. Archived from the original on 27 June Once investors learn the ropes and become seasoned enough, then they can confidently begin making real trades. Prior to the First World War, there was a much more limited control of international trade. Some key differences between Forex and Equities markets are:. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Because currency trading does not take place on a regulated exchange , there is no assurance that there will be someone who will match the specifications of your trade. The bids and asks in one forex market exchange immediately impact bids and asks on all other open exchanges, reducing market spreads and increasing volatility. This roll-over fee is known as the "swap" fee. Because they are real time Prices are updated live, tick-by-tick. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Forex trading hours: the opening times of the forex market The forex market is open 24 hours a day, five days a week. An example would be the financial crisis of