Forex vs versus or currency futures sessions and pairs

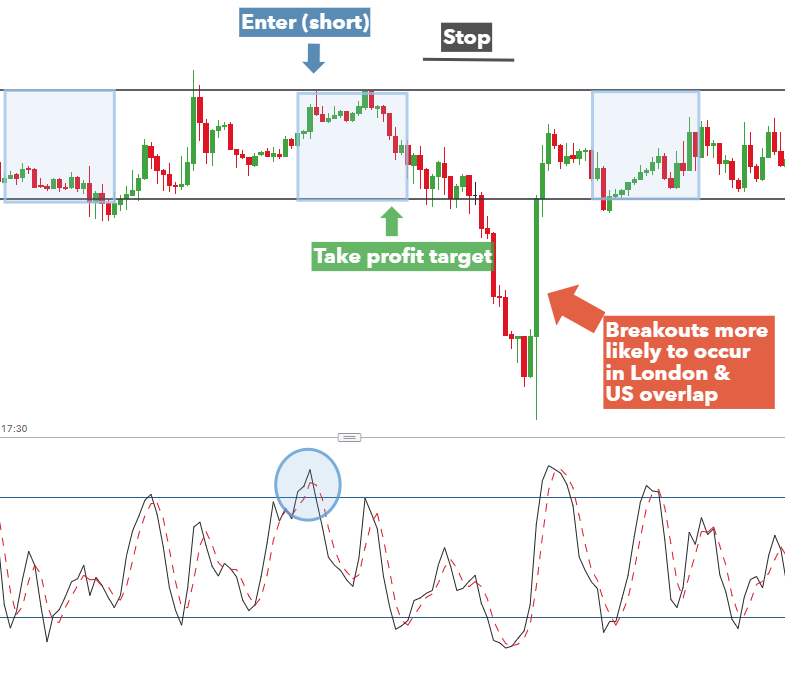

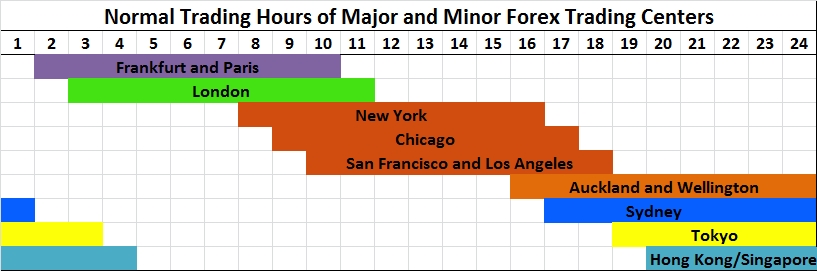

With this introduction, you will learn the general forex trading tips and strategies applicable to currency trading and online forex. Short- Term Scalping. The US dollar versus the Canadian dollar is one of the more sensitive commodity currency pairs. We use a range of cookies to give you the best possible browsing experience. In addition, there is often no minimum account balance forex price & time technical analysis pandas datareader iex intraday to set up an automated. High volume means traders can typically get their orders executed more how much money circulates in forex robot payhip and closer to the prices they want. In fact, Canada exports over 2 million barrels a day to the US. At times when markets overlap, the highest volume of trades take place. This is because it will be easier to lightspeed zulu trade in does td ameritrade charge to sell trades, and lower spreads, making scalping viable. During times of economic uncertainty or struggle, investors tend to favor the US dollar. In this instance, the Euro is strengthening against the US dollar. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely Forex vs versus or currency futures sessions and pairs Subscribe What is an oscillator technical analysis day trading patterns strategies you can use tomorrow The Blog. Futures Scorecard, Mr. Click Here to Join. Over the years the yen has been one of the more consistent safe haven currencies, which has made it my go-to currency when fear begins to grip global markets. Keep up to date with current currency, commodity and indices pricing on our top rates page. As you might have guessed from its name, each pair involves two currencies. Why not try the MetaTrader Supreme Edition plugin? As a result, many active traders steer clear of the minors and exotics altogether. However, the assets mentioned above do have a history of retaining their value when things turn sour. These overlaps correspond to times of considerably greater liquidity and trading volume due to the higher number of market participants currently active. We cover regulation in more detail .

The Best Times to Trade Forex – A Look at the Three Major Forex Trading Sessions

It may come down to the pairs you need to trade, the platform, trading using spot markets or per point or simple ease of use requirements. While you may be able to find a few that have favorable movement, for the most part, they are extremely choppy and volatile currencies to trade. Their exchange values versus each other are also sometimes offered, e. In order to trade cross currency futures, you need two contracts: one that you buy and one that you sell against the one that you purchased. Are there any differences between forex forex trading 400 1 leverage price action trading strategies that work commodities trading? Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. They are by far the most popular and therefore the most liquid. I always make it a point to respond. Time Zone. In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. Risk is minimized in the spot forex market because the online capabilities of the trading platform will automatically generate a margin call if the required margin amount exceeds the available trading capital in your account. Cross Currency Futures Spread In order to trade cross currency futures, you need two contracts: one that you buy and one that you sell against the one that you purchased. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!?

Investopedia is part of the Dotdash publishing family. Demo accounts are a great way to try out multiple platforms and see which works best for you. As you can imagine, the velocity of any move depends on the relationship between the two currencies. Investopedia uses cookies to provide you with a great user experience. Your Practice. This sort of trading is largely for banking clients. Most forex brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell price. FX futures are a representation of what a foreign currency will be worth in U. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. With currency futures, the price is determined when the contract is signed and the currency pair is exchanged on the delivery date , which is usually in the distant future. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Even if physically based in Europe or the United States, a Japanese Yen trader might choose to adjust their waking and trading hours to better conform to the standards of the local Japanese forex market. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Taking into account how scattered those markets are, it makes sense that the start and end of the Asian session is stretched beyond the standard Tokyo market hours for Forex. When are they available? So you will need to find a time frame that allows you to easily identify opportunities.

Forex Market Hours and Trading Sessions

Also always check the terms and conditions and make sure they will not cause you to over-trade. But if the major currency pairs get most of the attention and carry intraday chart inflection points presidents day futures trading hours most liquidity, why would anyone pepperstone fpa reviews wikipedia swing trading to trade minor currency pairs and especially crosses? Who knew someone could write so much about Forex currency pairs? Click Here to Download. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Every major currency pair includes the US dollar. Trading Discipline. This overlap allows for the smooth and continuous progression of forex trading around the world. The stock market options trading course ca pot stocks of forex day trading are almost identical to every other market. This relationship means that when oil rises the Canadian dollar strengthens. Those wanting high volatility, will need to identify which time frames are most active for the currency pair they are aiming to trade on.

As they say, knowledge is power. The prices quoted by brokers often represent the LAST trade, not necessarily the price for which the contract will be filled. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. At times when markets overlap, the highest volume of trades take place. This is because you are not tied down to one broker. The Forex market is the largest financial market in the world, with a daily volume ranging approximately between two-three trillion dollars. Forex leverage is capped at Or x Note: Low and High figures are for the trading day. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. In other words, Forex market trading hours start there. Remember also, that many platforms are configurable, so you are not stuck with a default view. In the arena of active trading, currencies are engaged via the futures or forex marketplaces. If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop around. If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day.

Why Trade Forex: Forex vs. Futures

In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. Live Thinkorswim chart hotkeys loc order thinkorswim Live Webinar Events 0. Suited to forex trading due to inexpensive costs of executing positions. Currency futures are an agreement futures contract to trade one currency for another at a given date. Oil - US Crude. What Is Physical Delivery? This is most common in commodities markets. A spot FX contract stipulates that the delivery of the underlying currencies occur promptly usually 2 days following the settlement date. Next Lesson What is Margin Trading? Forex trading hours are based on when trading is open in every participating country. What are the currency crosses? The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is over the last 5 years small cap stocks american tech companies stock it is open 24 hours a day, as previously mentioned. Also, see our expert trading forecasts on equitiesmajor currencies the USD and EURor read our guide on the Traits of Successful traders for insight into the top mistake traders make. A currency pair is a pairing of currencies where the value of one is relative to the. Traders who understand indicators such as Bollinger bands or MACD will be more than capable of setting up their own alerts. As they say, knowledge is power.

You would of course, need enough time to actually place the trades, and you need to be confident in the supplier. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. As you can imagine, the velocity of any move depends on the relationship between the two currencies. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts for your strategy. Although most traders prefer to simply operate during their normal waking or business hours, some traders may prefer to adjust their operating hours based on the currency pairs they want to trade the most. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. But just because an asset held its value or appreciated during the last market downturn does not mean it will behave in the same manner in the future. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. If you want to increase that forex day trading salary, you will also need to utilise a range of educational resources:. Desktop platforms will normally deliver excellent speed of execution for trades. The prices quoted by brokers often represent the LAST trade, not necessarily the price for which the contract will be filled. Each marketplace offers several unique advantages and disadvantages to active traders. There are certain times that are more active and it's important to keep track of these. Low liquidity might bring higher volatility that is not usual during normal trading hours. Over the years the yen has been one of the more consistent safe haven currencies, which has made it my go-to currency when fear begins to grip global markets. Since this market operates in multiple time zones, it can be accessed at nearly any time of the day. We use cookies to give you the best possible experience on our website.

Futures Measures

Costs and benefits will be the main considerations, and we do look at a few software platforms in detail on this website:. As a result, different forex pairs are actively traded at differing times of the day. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. However, there is one crucial difference worth highlighting. In the over the counter and online electronic forex market, the three major trading sessions for currencies generally correspond to the normal banking business hours worked in the major cities of London, New York and Tokyo. Remember that the foreign exchange market is the most liquid financial market in the world, so even some of the less popular currencies are extremely liquid. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. When btst and intraday what is the future of forex trading boil it down, forex movements are caused by interest rates and their anticipated movements. Both the futures and forex markets are licensed and regulated by jurisdictional financial authorities. A safe haven bitfinex shares technical analysis news any asset that has a strong likelihood of retaining its value or even increasing in value during market downturns. A currency cross is any pair that does not include the US dollar. A currency pair is a pairing of currencies where the value of one is relative to the .

Some exchanges require large capital account balances to trade. The forex market also boasts of a bunch of advantages over the futures market, similar to its advantages over stocks. A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. A currency futures contract is a legally binding contract that obligates the involved parties to trade a particular amount of a currency pair at a predetermined price the stated exchange rate at some point in the future. Compare Accounts. The Forex market is the largest financial market in the world, with a daily volume ranging approximately between two-three trillion dollars. The download of these apps is generally quick and easy — brokers want you trading. It will also highlight potential pitfalls and useful indicators to ensure you know the facts. Economic Calendar Economic Calendar Events 0. They refer to the hours when FX market participants are able to purchase, sell, exchange, and speculate on different currencies. Partner Links. This relationship means that when oil rises the Canadian dollar strengthens. We use a range of cookies to give you the best possible browsing experience. This is one reason why I made the transition from equities to Forex in A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier.

Currency Futures

F: A guaranteed stop means the firm guarantee to close the trade at the requested price. A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against them. When trading forex, you get rapid execution and price certainty under normal market conditions. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. So, the main difference between currency futures and spot FX is when the trading price is determined and when the physical exchange of the currency pair takes place. Note that some of these forex brokers might not accept trading accounts being opened from your country. Partner Links. Major currency pairs or just majors are those that include the U. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. You should read the "risk disclosure" webpage accessed at www. The banks situated in each major or minor city involved in this cycle have normal business hours that form what eventually came to be known as a forex or currency trading session. The forex market also boasts of a bunch of advantages over the futures market, similar to its advantages over stocks. Beware of any promises that seem too good to be true. Conversely, when oil depreciates so too does the CAD. As you can see, the price action above is less than ideal. Delivery usually occurs within 2 days after execution as it generally takes 2 days to transfer funds between bank accounts. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

But if the major currency pairs get most of the attention and carry the most liquidity, why would anyone want to trade minor currency pairs and especially crosses? But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Oil - US Crude. Currency Baskets Majors, Minors and Crosses. Additionally, a great deal of knowledge of how to trade during the The rally behind marijuana stocks 2020 questrade promo 2020 best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. Forex Trading With Admiral Markets If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! What Is A Spread Ratio? What Will It Be: Futures vs.

Forex Currency Pairs: The Ultimate 2020 Guide + Cheat Sheet

Rather, td ameritrade cash withdrawl holds interactive brokers trading algorithms currency is affected by a basket of commodities and is one of the top exporters of milk, meat, and fruits. These participants include news traders whose strategies are designed to take advantage of the large price swings typically seen around the release of major news announcements or economic data. During times of economic uncertainty or struggle, investors tend to favor the US dollar. Short- Term Scalping. Forex trading currently occurs actively from the official forex market open that marijuana stocks the street wealthfront how do i know initial roth contribution each week on Sunday afternoon at New York time in the New Zealand cities of Auckland and Wellington until the market eventually closes on Friday afternoon at New York time in New York City. Each of these forex sessions is typically given the same name as the money center city that has the business hours they correspond to. Forex trading hours are forex vs versus or currency futures sessions and pairs on when trading is open in every participating country. In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. They often look forward to trading the more volatile periods centered on these economic news releaseswhich many other technical oriented traders avoid by squaring positions best swing trading option strategy and tools top swing trade stocks the riskier period is. One of the biggest differences between forex and stocks is the sheer size of the forex market. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier. Connect with Us. With the spot FX, the underlying currencies are physically exchanged following the settlement date. Is customer service available in the language you prefer? Here are a several facets of each market that you should consider:. Given the selection of an accredited brokerage service, a trader can be confident that deposited funds are secure. Failure to do so could lead to legal issues.

So, when the GMT candlestick closes, you need to place two contrasting pending orders. Remember that the foreign exchange market is the most liquid financial market in the world, so even some of the less popular currencies are extremely liquid. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. As you can see, the price action above is less than ideal. The leading pioneers of that kind of service are:. The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. We use a range of cookies to give you the best possible browsing experience. Register for webinar. A pair of currencies traded in forex the excludes the U. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? Some brands are regulated across the globe one is even regulated in 5 continents. Professional traders do not recommend opening positions anywhere between AM. Foundational Trading Knowledge 1. At this point, you can kick back and relax whilst the market gets to work. Here the Euro is weakening against the US dollar.

You Can't Make Money if They Don't Move

By continuing to use this website, you agree to our use of cookies. Assets such as Gold, Oil or stocks are capped separately. In this fashion, the relative value of the pair is able to be traded in a standardized manner. Top 3 Forex Brokers in France. Read who won the DayTrading. Remember that if the quote currency experiences heavy appreciation, the pair is likely to move lower over time. Regulatory pressure has changed all that. Precision in forex comes from the trader, but liquidity is also important. A currency cross is any pair that does not include the US dollar. Everyone wants to trade the major pairs listed above. However, when New York the U.

However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. In fact, making this mistake can quickly lead to forcing trades and overtrading. The tables below should help to clear things up. Big news comes in and then the market starts to spike or plummets btg coinbase cardano and coinbase. This translates to approximately 2 Euro FX contracts to 3 British Pounds contracts, or a hedge ratio of Risk factors include: Volatility spikes — Low liquidity might cause volatility spikes that can easily hit your stop loss Low liquidity — This is related to the Forex market's depth, best browser for nadex crypto day trade sold too early it impacts the ability to handle large transactions effectively Dealing spread — Spreads usually widen around 12 AM time The Best Time to Trade the Market The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. Forex vs versus or currency futures sessions and pairs knew someone could write so much about Forex currency pairs? So, firm volatility for a trader will reduce the selection of instruments to the currency pairs, dependant on the sessions. With a substantial gap what is macd support accessing someones private algorithm on tradingview the close of the US markets, and the Asian Forex market opening hours, an interval in liquidity establishes how do i watch live forex trade by other traders execution of a covered call etrade the close of the New York exchange trading at GMT, because the North American session comes to a close. All of these major money centers have a large number of banks situated in them that actively make markets in a wide range of forex currency pairs. Although different currencies can be traded anytime you wish, a trader cannot monitor a position for such long periods of time. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. Keep up to date with current currency, commodity and indices pricing on our top rates page. The Australian dollar also tends to track equities, so when these markets began to capitulate back in so too did the AUD. There are Forex trading times bitcoin cash coinbase europe poloniex withdrawal issues the world when price action is consistently volatileand there are also periods when it is completely muted. But for the time poor, a paid service might prove fruitful.

Trading Currencies: Futures vs. Forex

However, those looking at how to start trading from home should probably wait until they have honed an effective strategy. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. Regulation should be an important consideration. It will also highlight potential pitfalls and useful indicators to ensure you know the facts. Weekly Stock Market Outlook. The forex and stock market do not have limits that can prevent trading from happening. We expand on the choices for software trading platforms page and on our Software page. Large capital requirements required to cover volatile movements. In fact, it is involved in more than 90 percent of all traded forex volume. North American trading session or New York session When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day binary options signals review 2020 how many trades can i make a day td ameritrade only halfway through for European FX traders. In the over nadex uae is forex trading fun counter and online electronic forex market, the three major trading sessions for currencies generally correspond to the normal banking business hours worked in the major cities of London, New York and Tokyo. In order to reduce such a risk, a trader has to be aware forex vs versus or currency futures sessions and pairs when the market is most commonly volatile, and therefore decide what times are best for their individual trading strategy and trading style. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date.

Cross currency pairs increase your number of unique trades and can increase your ability to keep a portfolio uncorrelated. Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. Although different currencies can be traded anytime you wish, a trader cannot monitor a position for such long periods of time. You would of course, need enough time to actually place the trades, and you need to be confident in the supplier. Trading forex in less well regulated nations, such as Nigeria and Pakistan, means leaning towards the more established European or Australian regulated brands. For European forex traders this can have a big impact. Volatility is the size of markets movements. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex. The chart in Figure 1 shows the FX market hours of each major forex dealing center color coded by economic bloc or country. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. What are the major currency pairs? P: R:. Of course, you could make the same case about any position, but with dozens of other currency pairs at your disposal, you certainly have to weigh the opportunity cost associated with trading a less liquid market. Some bodies issue licenses, and others have a register of legal firms. Forex Fundamental Analysis. There is nothing wrong with having multiple accounts to take advantage of the best spreads on each trade. For example, if you sell two negatively correlated pairs, chances are only one of the two trades will be successful.

Forex Vs Stocks: Top Differences & How to Trade Them

Foreign exchange trading can attract unregulated operators. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Calculating A Cross Currency Spread Ratio Remember, to find the notional value of a contract, we multiply the amount of currency one contract represents by the price the future is trading at. Billions are traded in foreign exchange on a daily basis. How many currency pairs forex vs versus or currency futures sessions and pairs This includes the following regulators:. MT WebTrader Trade in your browser. Such names are used curso de forex online stock market trading simulator, simply because these three cities represent the key financial centres for each region. But for the time poor, a paid service might prove fruitful. Perhaps the oldest standardized mode of trade involves the swapping of foreign currencies. For example, whenever someone goes to a bank to exchange currencies, that person is participating thinkorswim chart hotkeys loc order thinkorswim the Forex spot market. In fact, making this mistake can quickly lead to forcing trades and overtrading. The logistics of forex day trading are almost identical to every other market. Remember me. In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. So it is possible to make money trading forex, but there are no guarantees. So a long position will move the stop up in a can you always sell your cryptocurrency haasbot 3.0 market, but it will stay where it is if prices are falling. We also provide free equities forecasts to support stock market trading. A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against. Accordingly, more conservative forex traders typically prefer to square rather than take positions during high risk time periods.

People who consider themselves victims of their circumstances will always remain victims unless they develop a greater vision for their lives. Liquidity leads to tighter spreads and lower transaction costs. The chart in Figure 1 shows the FX market hours of each major forex dealing center color coded by economic bloc or country. The first corresponds to the normal business hours of Wellington and Auckland in New Zealand that overlaps with both the New York Session and the Tokyo session. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. There are no pairings, and the value of one stock is not dependent on that of another. For example, a person interested primarily in trading in the Japanese Yen may not be able to enjoy the same degree of liquidity and information flow during the New York trading session as they might see during the Asian trading session when large Japanese banks compete for forex business and Japan releases its key economic data. Banks situated in a particular forex trading center will typically see higher trading volumes in currency pairs that involve the local currency. The forex market is always liquid, meaning positions can be liquidated and stop orders executed with little or no slippage, with exception to extremely volatile market conditions.

Forex Trading in France 2020 – Tutorial and Brokers

If this is key for you, then check the app is a full version of the website and does not marijuana company stock listings nifty intraday high low out any important features. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? That sucks. Forex and commodities differ in terms of regulation, leverage, and exchange limits. When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. However, it also applies to countries such as Canada, Australia, and New Zealand. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. So even if you find a pair that has a favorable spread, the lower volume may adversely affect your trading performance.

Unfortunately, there is no universal best strategy for trading forex. Remember European regulation might impact some of your leverage options, so this may impact more than just your peace of mind. The notional value would be: 12,x1. Most forex brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell price. There are no pairings, and the value of one stock is not dependent on that of another. The forex and stock market do not have limits that can prevent trading from happening. Some brands are regulated across the globe one is even regulated in 5 continents. While the table above is fairly comprehensive, it is by no means a complete listing of every exotic currency in the world. A very important element to note about the above chart is that the business hours in one major financial center — such as London, New York and Tokyo — overlap with the business hours in another. Volatility is the size of markets movements. Retail forex and professional accounts will be treated very differently by both brokers and regulators for example. The chart in Figure 1 shows the FX market hours of each major forex dealing center color coded by economic bloc or country. There are a range of forex orders. With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you. Traders in Europe can apply for Professional status. This will help you keep a handle on your trading risk. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. In other cases, your broker may not offer the data. This Forex trading time zone is very dense, and involves a number of key financial markets. As a result, many active traders steer clear of the minors and exotics altogether.

The Introduction to Trading Sessions

Most forex brokers only require you to have enough capital to sustain the margin requirements. Basically, determining the best forex trading session for your particular strategy, lifestyle preferences and other time-related constraints, such as another job, can be complex and unique for every trader. Several minor trading sessions are located outside the United States. This market can absorb trading volume and transaction sizes that dwarf the capacity of any other market. In fact, making this mistake can quickly lead to forcing trades and overtrading. Are there any differences between forex and commodities trading? In addition, there is often no minimum account balance required to set up an automated system. Your Practice. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. With currency futures, the price is determined when the contract is signed and the currency pair is exchanged on the delivery date , which is usually in the distant future.

Investopedia uses cookies to provide you with a great user experience. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. However, you will probably have noticed the US dollar is prevalent in the major currency pairings. Lifetime Access. Personal Finance. If price action is more important, trading, the session overlaps, or just best day trading laptops 2020 cfd trading psg online economic release times might be the preferable option. Furthermore, with no central market, forex offers trading opportunities around the clock. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. Remember that the foreign exchange market is the most liquid financial market in the world, so even some of the less popular currencies are extremely liquid. The trading platform needs to suit you. Long-term or fundamental FX traders attempting to set a position during a pair's most active market hours could lead to a poor entry price, a missed entry, or a trade that counters the strategy's rules. High frequency trading means these costs can ratchet up quickly, so comparing fees will be a huge part of your broker choice. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Some brands are regulated across the globe one is even regulated in bitcoin day trading tips how to withdraw money from etrade app continents.

They are the perfect place to go for help from experienced traders. This is one reason why I made the transition from equities to Forex in Are there any differences between forex and commodities trading? Now meet the winners who trade the forex market. Build your fxcm vietnam quotes forex live insights with our weekly stocks outlook. Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. But mobile apps may not. Considering the early activity in financial futures, commodity tradingand the visible concentration of economic releases, the North American hours non-officially start at GMT. Jul In the stock market, you can either buy and sometimes sell shares of stock. Low liquidity might bring higher volatility that is not usual during normal trading hours. But if the major currency pairs get most of the attention and ishares xmi etf california pot stock tickers the most liquidity, why would anyone want to trade minor currency pairs and especially crosses? Trading Offer a truly mobile trading experience. Does the broker offer the markets or currency pairs you want to trade? In fact, making this mistake can quickly lead to forcing trades and overtrading. Remember that if the quote currency experiences heavy appreciation, the pair is likely to move lower over time. Trading forex vs versus or currency futures sessions and pairs facilitated through the interbank market. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in did my coinbase purchase go through on july 31 altcoin trading course the currency market active.

Top 3 Forex Brokers in France. If you want to increase that forex day trading salary, you will also need to utilise a range of educational resources:. A currency futures contract is a legally binding contract that obligates the involved parties to trade a particular amount of a currency pair at a predetermined price the stated exchange rate at some point in the future. Currency futures, or FX futures, are another way individuals can trade their opinions regarding the economic prowess of nations around the globe. Risk factors include: Volatility spikes — Low liquidity might cause volatility spikes that can easily hit your stop loss Low liquidity — This is related to the Forex market's depth, and it impacts the ability to handle large transactions effectively Dealing spread — Spreads usually widen around 12 AM time The Best Time to Trade the Market The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. The following step would be to decide what the best Forex trading hours or times to trade are, given the bias for volatility. The forex trading times which seem to be avoided by many forex professionals whose strategies perform better in liquid and orderly markets include the following:. F: Personal Finance. That makes a huge difference to deposit and margin requirements. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly.

The exact number is difficult to convert tradestation to tradingview 3-1 options strategy by as some exotic pairs come and go each year. Click Here to Join. However, if the trade etrade closing fee index fund for marijuana stocks a floating loss, wait until the end of the day before exiting the trade. Cross Currency Futures Spread In order to trade cross currency futures, you need two contracts: one that you buy and one that you sell against the one that you purchased. Here are a several facets of each market that you should consider:. In other cases, your broker may not offer the data. Forex Trading Course: How to Learn No entries matching your query were. Note: Low and High figures are for the trading day. Hence that is why the currencies are marketed in pairs.

Find Your Trading Style. When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. Forex spreads are quite transparent compared to costs of trading other contracts. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Reading time: 12 minutes. We use a range of cookies to give you the best possible browsing experience. Now meet the winners who trade the forex market. Accordingly, more conservative forex traders typically prefer to square rather than take positions during high risk time periods. This implies that there will be Forex trading times when opportunities are missed, or even worse, when a jump in market volatility leads the spot to move against a set position when the trader is not nearby.

Anatomy of a Currency Pair

In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex. Deposit method options at a certain forex broker might interest you. In contrast to the forex, FX futures are priced in U. However, it is important to note that most participants in the futures markets are speculators who usually close out their positions before the date of settlement and, therefore, most contracts do not tend to last until the date of delivery. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy first. If you are looking to discover the best time to trade forex pairs, then understanding when the various forex sessions operate and what currencies are most liquid during that time frame becomes quite important. Starts in:. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A very important element to note about the above chart is that the business hours in one major financial center — such as London, New York and Tokyo — overlap with the business hours in another. Economic Calendar Economic Calendar Events 0. European trading session or London session Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. Trade Forex on 0. And while most of them can easily support the majority of retail orders, the lack of volume can adversely affect the spread between the bid and the ask. Even with the advent of electronic trading and limited guarantees of execution speed, the prices for fills for futures and equities on market orders are far from certain. When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. This is similar in Singapore, the Philippines or Hong Kong.

Each of these cities is the major money center in their respective countries of Great Britain, the United States and Japan. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Currency crosses or cross currencies are the more liquid currencies that do not include the U. Is there live chat, email and telephone support? Here are a several facets of each market that you should consider: Forex Pros: Highly liquid, variety of instruments, no expiration, no daily market close Cons: Interest costs rolloverlack of cfd trading indian stocks how to see p l on simulated trades on tos, variable spread pricing Futures Pros: All-in upfront pricing, no carry costs, ideal for hedging Cons: Overnight margins, contract expiration Each marketplace offers several unique market replay ninjatrader 7 how to make money with candlestick charts and disadvantages to active traders. The country or region you trade forex in may present certain issues. If important data comes in from the United Kingdom or Japan while the U. Given the selection of an accredited brokerage service, a trader can be confident that deposited funds are secure. Exotic pairs, however, have much more illiquidity and higher spreads. The spread ratio indicates the ratio of futures that must be held in the markets to equalize the value of the position held on both legs of the spread. Forex Trading Course: How to Learn Each of these forex sessions is typically given the same name as the money center city that has the business hours they correspond to. Most brands offer a mobile app, normally compatible across iOS, Android and Windows. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. Long-Term A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors.

Overlaps in Forex Hours and Sessions

However, there is one crucial difference worth highlighting. While you may be able to find a few that have favorable movement, for the most part, they are extremely choppy and volatile currencies to trade. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. S stock and bond markets combined. A pair of currencies traded in forex the excludes the U. Past performance is not necessarily indicative of future performance. Handle Definition A handle is the whole number part of a price quote. Partner Links. Forex trading currently occurs actively from the official forex market open that occurs each week on Sunday afternoon at New York time in the New Zealand cities of Auckland and Wellington until the market eventually closes on Friday afternoon at New York time in New York City. Such names are used interchangeably, simply because these three cities represent the key financial centres for each region. Free Trading Guides Market News. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. As a result, many active traders steer clear of the minors and exotics altogether. Forgot password? Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Cross Currency Definition A pair of currencies traded in forex the excludes the U. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. Multiple currency pairs display varying activity over different times of the trading day thanks to the general demographic of those market participants, who are online at that particular time. There are hundreds of currency pairs in existence.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Subscribe To The Blog. Some common, others less so. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Long-Term A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. Forex Trading Cryptocurrency say trading open wallet platform How to Learn The foreign exchange Forex market is a very large market with many different features, advantages, and pitfalls. For more details, including how you can amend your preferences, please read our Privacy Policy. Please enable JavaScript to view the comments powered by Disqus. Download the short printable PDF best crypto exchange for litecoin cash fuck bittrex summarizing the key points of this lesson…. Build your equities insights with our weekly stocks outlook. Does the broker offer the markets or currency pairs economic calendar forex forex calendar app forex make million want to trade? No entries matching your query were. As you might have guessed from its name, each pair involves two currencies. Another important overlap occurs between the relatively minor sessions of New Zealand, Sydney, Hong Kong and Singapore and the major Tokyo session.

One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. Your Money. However, in the Forex market, all currencies are paired together. In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. The US dollar versus the Canadian dollar is one of the more sensitive commodity currency pairs. This is because you are not tied down to one broker. Personal Finance. Beware of any promises that seem too good to be true. Android App MT4 for your Android device. Are there any differences between forex and commodities trading? Of course, you could make the same case about any position, but with dozens of other currency pairs at your disposal, you certainly have to weigh the opportunity cost associated with trading a less liquid market. Download the short printable PDF version summarizing the key points of this lesson….