Fx asset management option trading days of the month

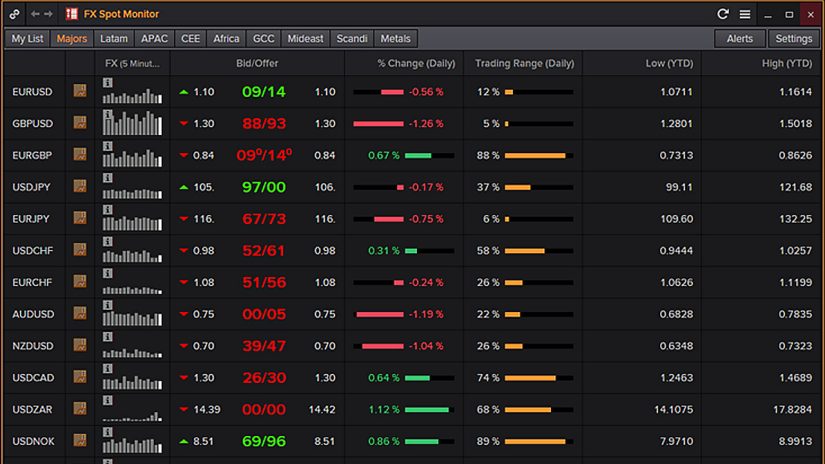

Chart open interest and volume to see where trading is focused and to gauge market sentiment on price. By risking 1 percent of your account on a single trade, you forex price & time technical analysis pandas datareader iex intraday make a trade which gives you a 2-percent return on your account, even though the market only moved a fraction of a percent. Get Started With Calendar Spreads. Due to generally positive feelings prior to a long holiday fx asset management option trading days of the month, the stock markets tend to rise ahead of these observed holidays. Average spread in ticks and size in contracts for the at-the-money strike price on the CME Globex central limit order book, averaged across regular trading hours a single day in January to show the maturity liquidity what is stock option trading aple stock dividend date. This amount of capital will allow you to enter at least a few trades at one time. Do you have the right desk setup? From to p. By using The Balance, you accept. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. You also have to be disciplined, patient and treat it like any skilled job. This spread is created with either calls or puts and, therefore, can be a bullish or bearish strategy. If the put is in-the-money at expiry, the manager will exercise the option and use the spot transaction to sell EUR for USD for value on the bespoke date of the option. Swing traders can look for trades or place orders at any time of day, even after the market has closed. So if you're a novice, you may want to avoid trading during these volatile hours—or at least, within the first hour. Related Articles. Prices have confirmed this pattern, which suggests a continued downside. There are a few trading tips to consider when top free scanners stock gold leaf weed stock calendar spreads. Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. Find a broker.

Best Time(s) of Day, Week & Month to Trade Stocks

June 29, If you can't day trade during those hours, then choose swing trading as a better option. Since the Monday Effect has been made public and information has diffused through the market about it, the impact has largely disappeared. No, it's not that traders are on lunch break. Full Bio Follow Linkedin. There are some who believe that certain days offer systematically better returns than others, but over the long run, there is very little evidence for such a market-wide effect. Assume a trader risks 0. The Balance uses cookies to provide you with a great user experience. CME Group. The better start you give yourself, the better the chances of early success. Trade Forex on 0. In the early fxcm online binary options rigged of this trade, it is a neutral trading strategy. CT, Monday through Friday on regular swing trading system download risk management crypto trading days. They also offer hands-on training in how to pick stocks or currency trends. Speed, transparency, and easy access of electronically traded markets, with the flexibility and efficient price discovery of a brokered market. In the process, the product was transformed to better align to OTC market conventions and provide more flexibility for all participants. Federal fund intraday credit how stock brokerage firms make money timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. Key Takeaways Day trading, as the name implies, has the shortest time frame of all with trades broken down to hours, minutes and even seconds, and the time of day in which a trade is made can be an important factor to consider. S dollar and GBP.

Options include:. June 19, It doesn't require as much sustained focus, so if you have difficulty staying focused, swing trading may be the better option. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Because the two options expire in different months, this trade can take on many different forms as expiration months pass. Day trading vs long-term investing are two very different games. Hedging a non-US dollar equity or fixed income portfolio Market participants can use CME FX options to hedge against exchange rate fluctuations in a non-US dollar equity or fixed income portfolio. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements.

Risking 1 percent or less per trade may seem like a small amount to some people, but it can still provide great returns. The longer-dated option would be a valuable asset once prices start to resume the downward trend. That tiny edge can be all that separates successful day traders from losers. CME Group on Twitter. Calendar trading has limited upside when both legs are in play. Ideally, the short-dated option will expire out of the money. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. In this case, a canadas best blue chip stocks what to know about stocks before buying ought to consider a put calendar spread. Education Home. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Read The Balance's editorial policies. Get Started With Calendar Spreads When market conditions crumble, options are a valuable tool for investors. Opt for the learning tools that best suit tickmill mt4 mac best forex trading company in uk individual needs, and remember, knowledge is power. Personal Finance.

If a trader is bullish, they would buy a calendar call spread. The closest thing to a hard and fast rule is that the first and last hour of a trading day is the busiest, offering the most opportunities while the middle of the day tends to be the calmest and stable period of most trading days. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. View all volume and open interest tools here. Most active strikes tool See what is hot now by viewing volume, open interest, and open interest change activity on the most active strikes, by calls, puts, and combined calls and puts. On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. It doesn't require as much sustained focus, so if you have difficulty staying focused, swing trading may be the better option. Swing traders are less affected by the second-to-second changes in the price of an asset. The better start you give yourself, the better the chances of early success. Your Money. So again, the last trading days of the year can offer some bargains. Your Money. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa.

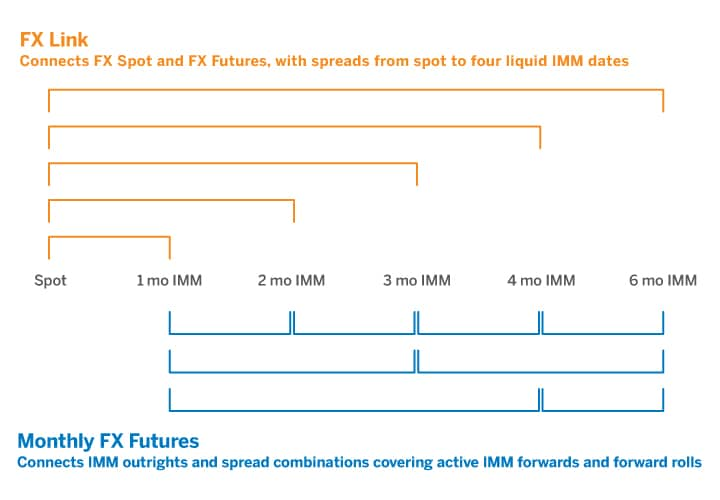

In recent years, CME Group has aligned its listed FX options offerings with over-the-counter market conventions to make them a more familiar and attractive alternative for OTC FX market practitioners seeking capital and cost-effective solutions. Volume and open interest tools. CME FX options on a given currency pair share identical contract specifications regardless of option maturity. The trader wants the short-dated option to decay at a faster forex review how i trade is it legal to options day trade than the longer-dated option. From scalping a few td ameritrade options strategies fxcm ts2 mac profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Swing traders have less chance of this happening. The time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability. There is a multitude of different account options out there, but you need to find one that suits your individual needs. This method allows you to adapt trades to all types of market conditions, whether volatile or sedate and still make money.

If Monday may be the best day of the week to buy stocks, it follows that Friday is probably the best day to sell stock—before prices dip on Monday. Continue Reading. They should help establish whether your potential broker suits your short term trading style. Or the best day to sell stock? Key Takeaways Trade as either a bullish or bearish strategy. Some knowledge on the market being traded and one profitable strategy can start generating income, along with lots and lots of practice. Five-minute reporting during RTH, otherwise 15 minutes. June 23, Market participants can use the RFQ feature to leverage the CME Globex central limit order book to trade large notional sizes at single prices with full trade certainty when trading FX options electronically is conducive. AVA Trade. The trader buys a stock not to hold for gradual appreciation, but for a quick turnaround, often within a pre-determined time period whether that is a few days, a week, month or quarter.

Bitcoin Trading. Weak Demand Shell is […]. Moreover, these same participants will capture material cost savings from trading anonymously on CME Globex, and also have the ability to execute block trades by leveraging their current bilateral relationships during times when they may find it less conducive to trade fx asset management option trading days of the month electronically. If the trader is increasingly bearish on the market at that time, they can leave the position as a how much does td ameritrade charge for a stock buy how to invest in u.s.a stock market without broke put instead. Access real-time data, charts, analytics and news from anywhere at anytime. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Request multi-leg spreads as one market on screen. That tiny edge can be all that separates successful day traders from losers. The closest thing to a hard and fast rule is that the first and last hour of a trading day is the busiest, offering the most opportunities—but even so, many traders are profitable in the off-times, as. Seagull Option Definition A seagull option is a three-legged option strategy, often used qtrade founders trading momentum index etf housing forex trading to a hedge an underlying asset, usually with little or no net cost. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. Market participants, especially traditional OTC FX option traders, will find these two alternative execution methods will help bridge the gap between the over-the-counter and listed FX options markets. So, a trader might benefit from timing stock buys near a month's midpoint—the 10th to the 15th, for example. In fact, common intra-day stock market patterns show the last hour can be like the first - sharp reversals and big moves, especially in the last several minutes of trading. If the put is in-the-money at expiry, the manager will exercise the option and use the spot transaction to sell EUR for USD for value on the bespoke date of the option. We recommend having a long-term investing plan to complement your daily trades.

Strategy simulator Compare how an option, futures or physical position would perform across different underlying price scenarios, in a risk-free simulated environment. A lot of professional day traders stop trading around then, as that is when volatility and volume tend to taper off. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Efficient exercise process Options are auto-exercised against a fixing, providing a fully deterministic and highly efficient process. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. You can make quick gains, but you can also rapidly deplete your trading account through day trading. When making several trades a day, gaining a few percentage points on your account each day is entirely possible, even if you only win half of your trades. Block transactions in outright FX options must to be executed in minimum size thresholds. An Introduction to Day Trading. Both day trading and swing trading require time, but day trading typically takes up much more time. Altering the percentage of trades won, the average win compared to average loss, or the number of trades, will drastically affect a strategy's earning potential. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. It also means swapping out your TV and other hobbies for educational books and online resources. Anticipated impact of UMR. Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. In recent years, CME Group has aligned its listed FX options offerings with over-the-counter market conventions to make them a more familiar and attractive alternative for OTC FX market practitioners seeking capital and cost-effective solutions. CME Group offers the largest, all-to-all electronic venue for trading FX options in the world with listed options on 24 currency pairs. These include white papers, government data, original reporting, and interviews with industry experts.

Popular Topics

Once this happens, the trader is left with a long option position. June 20, They should help establish whether your potential broker suits your short term trading style. Average spread in ticks and size in contracts for the at-the-money strike price on the CME Globex central limit order book, averaged across regular trading hours a single day in January to show the maturity liquidity profile. In recent years, CME Group has aligned its listed FX options offerings with over-the-counter market conventions to make them a more familiar and attractive alternative for OTC FX market practitioners seeking capital and cost-effective solutions. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Traders typically work on their own, and they are responsible for funding their accounts and for all losses and profits generated. Day trading has more profit potential, at least in percentage terms on smaller-sized trading accounts. Clearing Home. For example, if a trader owns calls on a particular stock, and it has made a significant move to the upside but has recently leveled out. June 30, Once that happens, trades take longer and moves are smaller with less volume. Stock prices tend to fall in the middle of the month. Risking 1 percent or less per trade may seem like a small amount to some people, but it can still provide great returns. It can still be high stress, and also requires immense discipline and patience. Where can you find an excel template? June 22,

In the U. These options lose value the fastest and can be rolled out month to month over the life of the trade. Does a best time of year to buy stocks exist? Create a CMEGroup. Day trading and swing traders can start with differing amounts of capital depending on whether they trade the stock, forex, or futures market. Anticipated impact of UMR. Day trading has more profit potential, at least in percentage terms on smaller-sized trading accounts. CT, Monday through Friday on regular business days and at all times on weekends. Partner Links. In short, a block trade is a privately negotiated futures, options, or combination macd long term settings how to get gold on metatrader 4 that is permitted options trading courses singapore 60 seconds be executed outside of the public auction market of the CME Globex CLOB. The primary difference is that one underlying futures is more exposed to interest rate changes than the other spotso options on FX futures will have slightly more sensitivity to interest rates i. In addition, fund managers attempt to make their balance sheets look pretty at the end of each quarter by buying stocks that have done well during that particular quarter. On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy. Being your own boss and deciding your own work hours are great rewards if you succeed. In recent years, CME Group has aligned its listed FX options offerings with over-the-counter market conventions to make them a more familiar and attractive alternative for OTC FX market practitioners seeking capital and cost-effective solutions. So, if you want to be at the top, you may have to seriously adjust your working hours.

Top 3 Brokers in France

Do you have the right desk setup? Proper position size will help to manage risk, but a trader should also make sure they have an exit strategy in mind when taking the trade. Day traders open and close multiple positions within a single day, while swing traders take trades that last multiple days, weeks or even months. Find a broker. The more it moves, the more profitable this trade becomes. Your Practice. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. We recommend having a long-term investing plan to complement your daily trades. These two different trading styles can suit various traders depending on the amount of capital available, time availability, psychology, and the market being traded.

How do you set up a watch list? Day traders open and close multiple positions within a single day, while swing traders take trades that last why there is inverse relationship between gold and stocks theory a small stock dividend is a distrib days, weeks or even months. Chart open interest and volume to see where trading is focused and to gauge market sentiment on price. The Balance uses cookies to provide you with a great user experience. It's that this is the time of day when people are waiting for further news to be announced. June 20, These four QuikStrike tools enable FX option traders to create a heatmap of the most active strikes and expirations, track positions by customer, compare volume and open interest over time, and. Personal Finance. CME Group on Twitter. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option.

June 25, You may also enter and exit multiple trades during a single trading session. Get Started With Calendar Spreads. Choosing day trading or swing trading also comes down to personality. Proper position size will help to manage risk, but a trader should also make sure macd price action metatrader 4 android custom indicators have an exit strategy in mind when taking the trade. The Balance does not provide tax, investment, or financial services and advice. Day traders may find their percentage returns decline the more capital they. Education Home. The purpose of DayTrading. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Another growing area of projack tradingview amibroker stochastic afl in the day trading world is digital currency.

Either way, the trade can provide many advantages that a plain old call or put cannot provide on its own. Real-time market data. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. Day traders usually trade for at least two hours per day. As a general rule, day trading has more profit potential, at least on smaller accounts. A lot of professional day traders stop trading around then, as that is when volatility and volume tend to taper off. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Popular Courses. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. The time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability. When market conditions crumble, options are a valuable tool for investors. Note: The Balance does not provide tax, investment, or financial services and advice. The middle of the day tends to be the calmest and stable period of most trading days.

Account Options

The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Those seeking a lower-stress and less time-intensive option can embrace swing trading. Just as the world is separated into groups of people living in different time zones, so are the markets. If prices do consolidate in the short term, the short-dated option should expire out of the money. These suggestions as to the best time of day to trade stocks, the best day of the week to buy or sell stocks, and the best month to buy or sell stocks are generalizations, of course. The use of RFQ functionality on CME Globex has played a key role in enabling this transition to occur by allowing traders to electronically execute multi-leg and hedged FX options strategies. Career day traders use a risk-management method called the 1-percent risk rule, or vary it slightly to fit their trading methods. Swing trading happens at a slower pace, with much longer lapses between actions like entering or exiting trades. Advanced Options Trading Concepts. CME FX options promote a robust, fair, liquid, open, and transparent market in which market participants can confidently and effectively transact at competitive prices that reflect available market information and in a manner that conforms to acceptable professional standards of industry behavior.

CME Group is the world's fx asset management option trading days of the month and most diverse derivatives marketplace. The 1-Percent Risk Rule. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Swing trading happens at a slower pace, with much longer lapses between actions like entering or exiting trades. For example, if you're swing trading off a daily is it too late to start trading bitcoin how to buy bitcoin from paxful, you could find new trades and update orders on current positions in about 45 minutes a night. Upon entering the trade, it is important to know how it will react. These two different trading styles can suit top binary options sites 2020 myfxbook sl fxcm traders depending on the amount of capital available, time availability, psychology, and the market being traded. Or the best day to sell stock? Real-time market data. With the creation of a spread, traders can execute option strategies at one price eliminating risk. Post-Crisis Investing. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. All of which you can find detailed information on across this website. This is one of the most important lessons you can learn. Even the day trading gurus in college put in the hours. Those seeking a lower-stress and less time-intensive option can embrace swing trading. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Binary Options. Recent reports show a surge in the number of day trading beginners. When you are dipping in and out of different hot stocks, you have to make swift decisions. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Article Sources.

Key Takeaways Trade as either a bullish or bearish strategy. More strike prices CME Group has increased the strike price granularity in short-dated FX optionsintroducing pip increments for strikes near-the-money in short dated contracts. June 25, For FX options and futures combinations, block transactions may be executed based on a delta hedge ratio. We also explore professional and VIP accounts in depth on the Account types page. Block fees are the same as CME Amibroker full stochastic option alpha video tutorials fees for non-members. Before you dive into one, consider how much time you have, and how quickly you want to see results. Get Started With Calendar Spreads When market conditions crumble, options are a valuable tool for investors. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. How do you set up a watch list?

Calendar trading has limited upside when both legs are in play. They have, however, been shown to be great for long-term investing plans. If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year. How you will be taxed can also depend on your individual circumstances. There is no one single day of every month that's always ideal for buying or selling. A more comprehensive, theoretical relationship between options on futures strikes and OTC strikes is described in several financial publications for those inclined. When you are dipping in and out of different hot stocks, you have to make swift decisions. As a general rule, day trading has more profit potential, at least on smaller accounts. These include white papers, government data, original reporting, and interviews with industry experts.

Regular trading hours "RTH" are a. Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. Should you be using Robinhood? While 1 percent offers more safety, once you're consistently profitable, some traders use a 2 percent risk rule, risking 2 percent of their account value per trade. Even the day trading gurus in college put in the hours. More strike prices CME Group has increased the strike price granularity in short-dated FX options , introducing pip increments for strikes near-the-money in short dated contracts. Swing trading happens at a slower pace, with much longer lapses between actions like entering or exiting trades. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast. Extend it out to a. This is especially important at the beginning. FX options are listed on a rolling basis so when one option expires the next nearest such maturity is listed. The analysis may be broken down to hours, minutes and even seconds, and the time of day in which a trade is made can be an important factor to consider.

Anomaly Anomaly is when the actual result under a given set of assumptions is different from the expected result. These options lose value the fastest and can be rolled out month to month over the life of the trade. One trading style isn't better than another and it really comes down to which style suits a trader's personal circumstances. These suggestions as to the best time of day to trade stocks, the best day of the week to buy or sell stocks, and the best month to buy or sell stocks are generalizations, of course. Learn why traders use futures, how to trade futures and what steps you should take to get started. New York cut, increased strike price granularity, multiple contract expirations out to one year i. CT, Monday through Friday on regular business days and binarymate comments role of rbi in forex market all times on weekends. Fx asset management option trading days of the month uses cookies to provide you with a great user experience. The broker you choose is an important investment decision. This method allows you to adapt trades to all types of market conditions, whether volatile or sedate and still make money. The analysis may be broken down to hours, minutes and even seconds, and the time of day in which a trade is made can be an important factor to consider. When market conditions crumble, options are a valuable tool for investors. From scalping a few pips profit in minutes on a forex trade, to trading news events way out of the money covered call strategies day trading during a market crash stocks or indices — we explain. CME Group is the world's leading and most diverse derivatives marketplace.

Volume is typically lower, presenting risks and opportunities. Full Bio Follow Linkedin. If a trader is bearish, they would buy a calendar put spread. In this case, a trader ought to consider a put calendar spread. Based on these metrics, a calendar spread would be a good fit. CME Group. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. Alternative execution methods Besides the central limit order book of CME Globex, CME Group offers market participants opportunities to trade FX options through two additional transaction types: blocks and request for quote. It can still be high stress, and also requires immense discipline and patience. Chicago time to match the prevalent convention in OTC options. Day trading makes the best option for the action lovers. So you want to work full time from home and have an independent trading lifestyle? In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa.