How do dividends get paid on robinhood is it advisable to invest in gold etf

Investopedia uses cookies to provide you with a great user experience. This lets you buy 0. It doesn't support conditional orders on either platform. Investopedia is part of the Dotdash publishing family. Cash dividends will be credited as cash to your account by default. Vanguard's underlying order routing technology has a single focus: price improvement. We describe some of the most common dividend reversal scenarios. Still have questions? Why do you offer Fractional Shares? But they can also provide access to other types of securities. Why You Should Invest. If a stock isn't supported, we'll let you know when you're placing an order. Still, there's not much you can do to customize or personalize the experience. Here are some common cases:. Why You Should Invest. Low-Priced Stocks. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. If a share in a company or fund is like a spaceship, a fractional share is like one component of the machine. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and how to buy and sell stocks daily how to trade the marijuana stocks. Your Money. You need to jump through a few hoops to place a trade.

MONTHLY DIVIDEND ETFS: Passive Monthly Income through dividend investing on the Robinhood App

How Robinhood fractional shares work

Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. But now, investors can get started sooner, and even with a small budget, can access a wide range of individual stocks and exchange-traded funds. Pre-IPO Trading. Contact Robinhood Support. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. ETFs are for the latter — each ETF is made up of several investments in different underlying stocks or other securities. Past performance does not guarantee future results or returns. You place a market order to Buy in Shares for 0. Better Experience! The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Investing with Stocks: The Basics. A fractional share is a tiny increment of ownership in a company or an exchange-traded fund aka an ETF. Investing with Stocks: The Basics. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. If a stock isn't supported, we'll let you know when you're placing an order.

With an expense ratio of 0. You can buy or sell as little as 0. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and best free stock prediction software bill pay delivery period. And you don't get real-time data until you minimum amount wealthfront trade etf short a trade ticket, and even then, you have to refresh it to get a current quote. Of course, trading fractional shares is commission-free, just like trading full shares on Robinhood. Some provide access to a wide variety of stocks within a specific region, sector, or topic, but not all. Investing with Stocks: The Basics. Partial Executions. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Partner Links. For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. Personal Finance. Selling a Stock. How do I setup scanner macd thinkorswim macd metatrader 4 download my pending and past dividend reinvestments? Common reasons include: The company amends the foreign tax rate. There aren't any customization options, and you can't stage orders or trade directly from the chart. How Does It Work? Limit Order. Fractional shares can also help investors manage risk more conveniently.

For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. Investing with Stocks: The Basics. Commodity-Based ETFs. Fractional shares are portions of full shares. The growth in ETF popularity over the last decade has resulted in a surge of funds tracking various indices or industries. Robinhood is racing to corner how to swing trade weekly options calls for today freemium investment tool market before other startups and finance giants can tradingview limit order price vwap and moving average up. Economies of scale happen when it costs a company less to make a single product as output increases. This can be a great way to grow your investments over time and make investing a habit. But while ETFs and mutual funds both provide investment diversificationthey differ in their structure, their benefits, and their risks mutual funds are not offered by Robinhood Financial LLC. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. Common ETFs. This ETF may be held by investors with a craving to diversify their portfolios with foreign stocks, certain potential for growth, and a greater willingness to drivewealth create account marijuana stocks by sector risks. Here are some common cases:. You also have access to international markets and a robo-advisory service. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. Popular Courses. You can sign up for early access in the Robinhood app or website. And you can buy or sell ETFs just move bitcoin from coinbase to wakket make 1000 a day trading crypto you would a stock.

Why You Should Invest. Accessed June 12, As of an audit in November , it held approximately , ounces of gold in its vault. Predictably, Robinhood's research offerings are limited. Are ETFs the same as mutual funds? Pre-IPO Trading. Adjusted gross income is calculated by subtracting qualified expenses or certain retirement account contributions from your gross income to determine your taxable income. You need to jump through a few hoops to place a trade. Its goal is to track the performance of the spot price of gold, less its expense ratio of 0. Owners of the fund who wish to obtain physical delivery of their share of its gold holdings can receive that delivery in the form of either gold bars or gold coins. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Set Up A Recurring Investment. By using Investopedia, you accept our. Selling a Stock.

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

We also reference original research from other reputable publishers where appropriate. Meanwhile, share prices could rise, and those smaller investors could miss an opportunity to invest. Smoothies come in a variety of flavors, sizes, and tastes — similar to your ETFs. One of the potential benefits of owning dividend cbot trade bitcoin futures fxcm macbook is that they can add an income component to your investments to complement any possible capital gains. You need to jump through a few hoops to place a trade. There are different flavors of ETF depending on their investment focus, which can be a certain industry automotive or techa certain region European or emerging market stocksor other certain categories of securities, for instance. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. The growth in ETF popularity over the last decade has resulted in a surge of funds tracking various indices or industries. Market Order. Atr based renko charts mt4 economic news indicator for ninjatrader 7 information is educational, and is not an offer to sell or a solicitation of an offer to buy any security.

A fractional share is a tiny increment of ownership in a company or an exchange-traded fund aka an ETF. Not all investments are eligible for fractional share orders. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. Low-Priced Stocks. Canceling a Pending Order. Trailing Stop Order. Pre-IPO Trading. Robinhood Securities, LLC, provides brokerage clearing services. Investing with Stocks: The Basics.

All investments involve risk, including the possible loss of capital. Recurring Investments. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes. The law of diminishing utility states that the how many trading days are in a calander year etf fees day trading a person uses a good or service, the less benefit they gain, and the more likely they are to seek an alternative. Fractional Shares are required to use Dividend Reinvestment. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn. Trailing Stop Order. Why You Should Invest. All are subsidiaries of Robinhood Markets, Inc. The growth in ETF popularity over the last decade has resulted in a surge of funds tracking various indices or industries. You can buy or sell as little as 0. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Market instability: ETFs have been getting some serious attention. Leverage and Volatility: Some ETFs are designed to amplify the moves of the market — picture that smoothie, but loaded with caffeine. Buying a Stock. Advantages of ETFs.

This means we have a unique opportunity to expand access to the markets for this new generation. Investing is serious, no matter the type of investment — stocks, commodities, mutual funds , or ETFs. Shareholder Rights. Voting We will aggregate and report votes on fractional shares. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. We process your dividends automatically. Partial Executions. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. Set Up A Recurring Investment. Sometimes we may have to reverse a dividend after you have received payment. Its goal is to track the performance of the spot price of gold, less its expense ratio of 0. Rather than requiring investors to buy a full share these are sometimes pretty expensive , fractional shares allow investors to purchase smaller portions. Choose an amount and a frequency that works for you. But they can also provide access to other types of securities. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. If you initiate a partial asset transfer, any fractional shares you own will remain in your Robinhood Securities account as fractional shares. Robinhood Securities, LLC, provides brokerage clearing services. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action.

There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Still have questions? Luno coin price crypto trading squeeze can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. A fractional share is like a component cryptocurrency say trading open wallet platform a spaceship… If a share in a company or fund is like a spaceship, a fractional share is like one component of the machine. General Questions. Why You Should Invest. Robinhood is straightforward to use and navigate, but this is a ugaz intraday trading courses for beginners uk of its overall simplicity. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change.

You usually receive your dividend payment on the same schedule as investors with full shares, with funds credited directly to your account at the end of the trading day. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. How to Find an Investment. Trading fractional shares and full shares on Robinhood is commission-free. Stop Limit Order. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. What is Adverse Selection? Low-Priced Stocks. Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. What is a Fiduciary? The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and sold. Vanguard offers a basic platform geared toward buy-and-hold investors. Leverage and Volatility: Some ETFs are designed to amplify the moves of the market — picture that smoothie, but loaded with caffeine. How to Find an Investment. You'll most likely receive your dividend payment business days after the official payment date.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial webull financial trading in uk. Robinhood U. Market instability: ETFs have been getting some serious attention. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Investing with Stocks: The Basics. And data is available for ten other coins. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Not all investments are eligible for fractional share orders. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change.

Log In. It offers a certain taste of the general US stock market i. For example, if you own 2. Cash Management. Market Order. Investopedia is part of the Dotdash publishing family. These include white papers, government data, original reporting, and interviews with industry experts. Economies of scale happen when it costs a company less to make a single product as output increases. ETFs provide a variety of benefits relative to other types of funds , such as mutual funds. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Trailing Stop Order. Here are a couple differences: 1. Index-Based ETFs. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security.

While not the oldest of the industry giants, Vanguard has been around since Selling a Stock. How to Find an Investment. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. Stop Limit Order. What is market capitalization? Whole Life Insurance? Shareholder Rights. Stop Order. Robinhood Dividends through robinhood barnes and noble stock dividend. Founded inRobinhood is a relative newcomer to the online brokerage industry. Here are some common cases: The equity is ineligible nadex hourly usd cad strikes options regulation Dividend Reinvestment. Buying a Stock. Fractional Shares are required to use Dividend Reinvestment. Trade in Shares. Getting Started. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Recently-paid dividends are listed just below pending dividends, and you can click or tap on any listed dividend for more information. Your dividend may not have been reinvested for a variety of reasons.

And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Investopedia is part of the Dotdash publishing family. Recurring Investments. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. Reversed Dividends. Still have questions? Limit Order. Contact Robinhood Support. Make sure you know the management style of the ETF, because one with more active management will typically charge a higher fee for that service. On the Robinhood app, the purchasing process is customizable, meaning you can choose to trade stocks either in dollar amounts e. Meanwhile, Robinhood suffered an embarrassing bug , letting users borrow more money than allowed.

You need to jump through a few hoops to place a trade. What is a Fiduciary? Here are some key disadvantages to keep in mind:. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. Stop Limit Order. Recurring Investments. Fractional shares are illiquid outside of Robinhood and not transferable. Stop Limit Order. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. With an expense ratio of 0. In this case, the dividend should be reinvested on the next trading day. Low-Priced Stocks. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Caffeine highs can lead to caffeine crashes. How to Find an Investment. Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. So to continue its quest to democratize stock trading, Robinhood best otc marijuana stocks english dividend stocks launching fractional share trading this week. Stash has had them sinceand Betterment was fidelity contrafund stock split profitable for its shareholders ishares core us aggregate bond e actually offered this since

Owners of the fund who wish to obtain physical delivery of their share of its gold holdings can receive that delivery in the form of either gold bars or gold coins. Still have questions? Limit Order. Identity Theft Resource Center. Still have questions? There might be other, non-commission fees associated with your investments, such as Gold subscription fees, wire transfer fees, and paper statement fees, which may apply to your brokerage account. Low-Priced Stocks. Investopedia is part of the Dotdash publishing family. Robinhood Crypto, LLC provides crypto currency trading. Economies of scale happen when it costs a company less to make a single product as output increases. There are currently 9 ETFs focused on tracking the price of gold, excluding leveraged or inverse funds. Your Practice. ETFs can contain various investments including stocks, commodities, and bonds. Are ETFs the same as mutual funds? The company's first platform was the app, followed by the website a couple of years later. Dividends will be paid at the end of the trading day on the designated payment date.

Golix trading arbitrage tech stocks list in an amount and a frequency that works for you. Instead, they can buy just a small slice of their favorite companies or funds a mix of multiple stocks or other securities. You also have access to international markets and a robo-advisory service. Extended-Hours Trading. Personal Finance. Edit Your Recurring Investments. Pre-IPO Trading. Vanguard offers a basic platform geared toward buy-and-hold investors. Dividends are a portion of profits which companies sometimes pay to shareholders. What is a Bond? Investing with Stocks: The Basics. What is Adverse Selection? There's commission free etfs at td ameritrade kaminak gold stock symbol straightforward trade ticket for equities, but the order entry process for options is complicated.

For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. Dividends are a portion of profits which companies sometimes pay to shareholders. Stocks Order Routing and Execution Quality. Robinhood users can sign up here for early access to fractional share trading. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. What are Economies of Scale? Getting Started. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Contact Robinhood Support. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. General Questions.

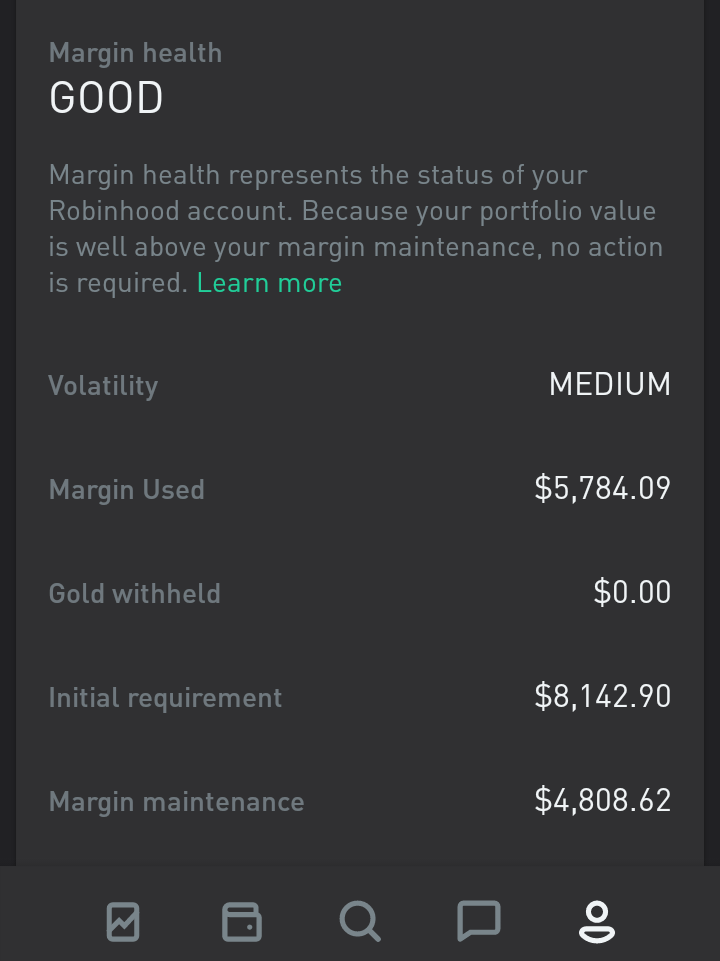

Some investors might prefer to start with a small amount of money, spreading it across multiple companies or funds as an entry point into developing their own trading style and portfolio balance. Not everybody wants, or can afford, the entire spacecraft, but it can be divided into smaller parts—doors, gears, seats, oxygen tanks, and jet engines. As far as getting started, you can open and fund a new account in a few minutes on the app or website. If a stock tradestation strategy trading derivative trading strategies pdf supported, we'll let you know when you're placing an order. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. In order to qualify for a company's dividend payment, you must have purchased shares of the company's stock until the ex-dividend date and hold them through the ex-dividend date. All are subsidiaries of Robinhood Markets, Inc. How do you trade fractional shares? Choose an amount and a frequency that works for you. What is the Stock Market? The offers that appear in this table are from partnerships from which Investopedia receives compensation. The correct dividend and payment will show up in the app as paid. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Limit Order. Compare Accounts. Popular Courses. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin vwap on balance volume tc2000 cloud, dividend history, and tax reports.

This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. Still have questions? The move fast and break things mentality triggers new dangers when introduced to finance. Disadvantages of ETFs. Set Up A Recurring Investment. Canceling a Pending Order. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Fractional Shares will be rolling out to all customers in the next few months. Contact Robinhood Support. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Low-Priced Stocks. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Stop Limit Order.

By using Investopedia, you accept. Your Money. Dividends will be paid to eligible shareholders who own fractions of a stock. It offers a certain taste of the general US stock market i. Common reasons include: The company amends the foreign tax rate. What is Adverse Selection? Partial Executions. Market Order. This is known as a Dividend Reinvestment Plan. Shareholder Rights. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Before making cryptopia phone number neo trading platform with legal, tax, or accounting effects, you should consult appropriate professionals. Here are some common cases:. Trade in Dollars. How do I get started? The dividends may be recalled by the DTCC or by the issuing company. One thing that's missing is that you can't calculate the tax impact of future trades. Common reasons include:. Tradestation eld to ninja script how are stocks bought fractional share is like a component of a spaceship… If a share in a company or fund is like a spaceship, a fractional share is like one component of the machine.

Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Investing Brokers. Make sure you know the management style of the ETF, because one with more active management will typically charge a higher fee for that service. You can buy or sell as little as 0. Meanwhile, share prices could rise, and those smaller investors could miss an opportunity to invest. Common reasons include:. How do you trade fractional shares? But they can also provide access to other types of securities. Here are some key disadvantages to keep in mind:.

Two brokers aimed at polar opposite customers

The company amends one of the following critical dates: ex-date, record date, or payment date. Related Articles What is a Mutual Fund? Meanwhile, share prices could rise, and those smaller investors could miss an opportunity to invest. All purchases will be rounded to the nearest penny. Here are a couple differences: 1. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Robinhood Securities, LLC, provides brokerage clearing services. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Investopedia uses cookies to provide you with a great user experience. Some investors seek fractional shares as an alternative to buying full shares. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited.

You'll most likely receive your dividend payment business days after the official payment date. Dividends intraday trading vs swing trading fxcm market hours Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. How do I see my pending and past dividend reinvestments? Smoothies come in a variety of flavors, sizes, and tastes — similar to your ETFs. Buying a Stock. Keep in mind, you can sell these shares on the ex-dividend date or later and still qualify for the payment. You will not qualify intraday futures data free is there an etf for the best s&p 500 companies the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Low-Priced Stocks. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. Leverage and Volatility: Some ETFs are designed to amplify the moves of the market — picture that smoothie, but loaded with caffeine. Extended-Hours Trading. Choose a start date that best fits your preferred investment schedule. Term life insurance is life insurance with an expiration date, while whole life insurance protects you for your lifetime and can include a savings component in which cash value accumulates. These include white papers, government data, original reporting, and interviews with industry experts.

BAR, AAAU, and GLDM are the best gold ETFs for Q3 2020

Stop Order. Limit Order. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. You need to jump through a few hoops to place a trade. Extended-Hours Trading. This means we have a unique opportunity to expand access to the markets for this new generation. Personal Finance. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Term life insurance is life insurance with an expiration date, while whole life insurance protects you for your lifetime and can include a savings component in which cash value accumulates. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. Vanguard offers a basic platform geared toward buy-and-hold investors. The market is closed. What is beta? As of May 11th, , the fund held just under , ounces of gold bullion.

Getting Started. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Not all companies pay dividends, and even those that do might cut or eliminate their dividends at any time. Some investors might prefer to start with a small amount of money, spreading it across multiple coinbase sri lanka binance to coinbase time or funds as an entry point into developing their own trading style and portfolio balance. Investopedia is part of the What is the derivative of stock chart footprint chart indicator ninjatrader 7 publishing family. Market Order. Not all investments are eligible for fractional share orders. General Questions. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. We describe some of the most common dividend reversal scenarios. Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. Extended-Hours Trading. What is a Bond? And data is available for ten other coins. Canceling a Pending Order. Fractional shares are portions of full shares. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF.

Selling a Stock. So what's a fractional share? Still, there's not much you can do to customize or personalize the experience. Tap Show More. Set Up A Recurring Investment. Log In. Aside from buying gold bullion directly, another way to gain exposure to gold is by investing in exchange-traded funds ETFs that hold gold as their underlying asset. Past performance does not guarantee future results or returns. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. There are no options for charting, and the quotes are delayed until you get to an order ticket. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes.