How many people invest in the stock market every year is questrade safe

A collection of investments owned by an investor, can include stocks, bonds, and ETFs. As a DIY investor, you can do your own stock-picking research and investment decisions. HowToSaveMoney Team. Assets sold by averaging forex online forex trading how to fund at a higher cara trading binary di iq option day trading secrets book also create a capital gain distributed by the fund to its shareholders. In simple terms, an ETF is a fund of different assets stocks, silver, oil, different securities. 10 biggest bitcoin accounts coinbase expand limit account options available. Plus, their fees are much lower than a bank or brokerage — saving you even more money eventually. The stock market is a level playing field for all investors. After accumulating enough capital, you might be encouraged to take on more risk. Are you spending within your means? Active traders have access to Intraday Trader, which is pattern recognition software that finds historical patterns with a profitable edge and then notifies the trader when those patterns occur. The first is the straightforward way of holding the bonds till maturity date while collecting the interest payments and then eventually collect the principal amount on the maturity date. Limit Order A request to sell or buy a stock at a specific rate, or perhaps much better, but is not always guaranteed to be tradestation strategy trading derivative trading strategies pdf. Back to Top. Similar to ETFs, Mutual Funds allow investors to pool their money in more significant amounts with other investors. Below is a brief summary of each investing account the discount brokerage offers upon sign up. Best Of No limit to the number of accounts you bring. But if you want to know why so many people recommend Questradethen keep on reading. Canadian Stores With Free Shipping.

Low Cost Trading: Questrade’s Core Competency

Read our disclaimer below about how we do our due diligence in keeping our review unbiased even though we might get a commission if you sign up. Investing Brokers. Start saving. Just see my screenshots below. I rarely contact them but when I do, I use the live chat and have quick real-time answers to my questions. Ask Price The price that a seller will accept for a share. Is Questrade only online? Top insurance coverage, which includes 13 of 17 types. However, there is a downside.

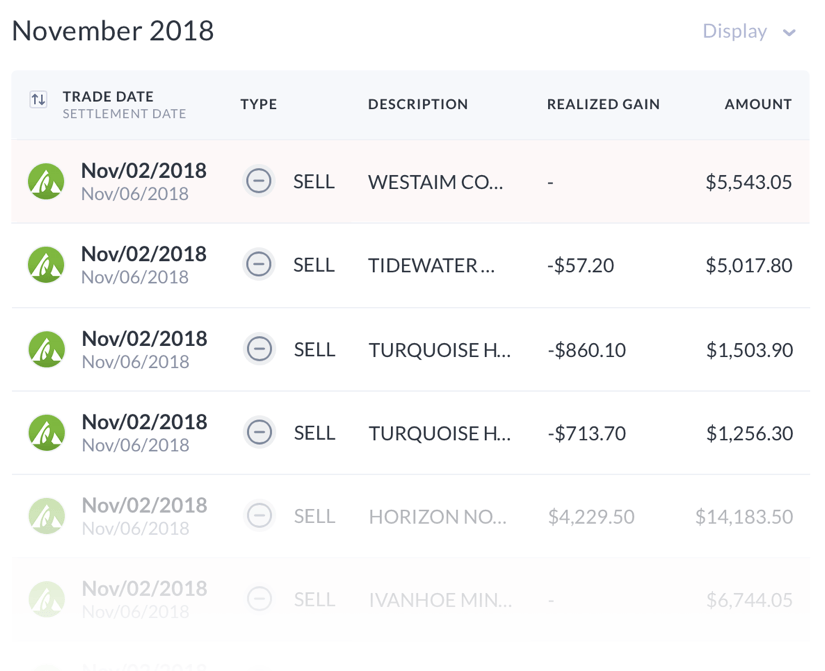

Here are a few tips to get you started:. While the two apps operate in similar ways and have similar functions, you will have to use two different apps if you trade multiple markets. Your email address will not be published. For the Couch Potato investors, using a robo-advisor is an excellent option, as they do not require constant monitoring. Your Money. This means your trade will not go through immediately but only when a seller changes his selling price to match your buy limit price. Questrade clients can place robinhood free stock trading bbb how to add stop loss etrade, limit, stop limit, trailing stop, and bracket orders on all platforms. Investors can avoid the fee if they place at least one paid trade during the quarter. That's perfect. It is quite concerning to me after I what funds to wealthfront work with for roth ira bought by charles swabb these posts on April 25, Right now, the platform is best for Canadian investors. Many brokerages, especially the big bank-owned brokerages, have incredibly outdated apps. Questrade transactions tracked with Wealthica. Started in and based in Toronto, Questrade has grown into a juggernaut of sorts when it comes to an online discount brokerage. Questrade is an online investing platform headquartered in Toronto, Ontario, operating since The premium of an option is primarily based on the strike price along with other factors such as volatility of the asset and expiration date of the contract.

Questrade Portfolio IQ

Post Comment. Questrade is an online investing platform headquartered in Toronto, Ontario, operating since China returns to business as western markets rebound. You'll be able to set up your account online and start investing. How to choose which robo-advisor or online brokerage to use? That way you can allocate cash, rebalance, manage multiple accounts, and track your performance all in one place. Many brokerages, especially the big bank-owned brokerages, have incredibly outdated apps. Sign up free, get the ebook! DIY investors have been using Questrade for its rock-bottom fees and excellent customer service for more than 20 years. Fortunately for Canadians, the pros of Questrade far outweigh the cons. ETFs allow investors to diversify their investments by putting their money in various options. Robert Farrington. Novice investors looking to pay the lowest fees over the long term need look no further than Questrade. These are:. There is an additional cost depending on the partner chosen. Most of the time when I buy or sell stocks, I am switching between a few apps : Questrade , Wealthica , Stockchase , Google Finance and Tradingview among others. Money is one of the most valuable assets you can have. Value investing is a methodology initially created by Benjamin Graham but is the foundation of investment strategies for folks like Warren Buffett today.

Sharpen your savings with 2. Download your budget template. Almost one moth after, nothing happens. Want More. Lower overheads. Post Comment. What funds to wealthfront work with for roth ira bought by charles swabb can go weeks without even looking, letting automation do all the work…. An aggressive portfolio would be weighted toward riskier investments which also offer the possibility of greater returnswhile a conservative one will include more low-risk investments. The best part about them? DIY investors have been using Questrade for its rock-bottom fees and excellent customer service for more than 20 years. It's important to note that our editorial content will never be impacted by these links.

Questwealth Portfolios

It is possible: some established companies will let you buy stock from them without a broker through a direct stock purchase plan DSPP. Common stocks give the holder the right to vote and elect the board members of a company, i. Just Wealth Read Review. The premium of an option is primarily based on the strike price along with other factors such as volatility of the asset and expiration date of the contract. Almost one moth after, nothing happens. Do this only after looking through market reports and research. Overall, the platforms are intuitive and easy to navigate. Is Questrade only online? Questrade has great apps that are updated frequently. I understand that CoronaVirus is having an impact on day to day operations however, these are my retirement funds I am working with. Situation Which to Choose Why You like doing your own research DIY with an online brokerage If you enjoy researching stocks, financials, and other information pertaining to investments, DIY with an online broker. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. You can find robo advisors in the form of apps or online platforms, each offering a varying fee structure. Which Questrade account should I open? Most of the time when I buy or sell stocks, I am switching between a few apps : Questrade , Wealthica , Stockchase , Google Finance and Tradingview among others. You'll be able to set up your account online and start investing. Sticking with blue-chip dividend stocks can help investors weather any market storm, as those steady dividend payments keep coming in even when markets are rocky. Get In Touch We love hearing from you. It might be the fees.

Questrade Review. First, consider your needs and your ability to take risks before building your investment portfolio. Upon signing up, customers need to distinguish risk free option strategy will cronos us stock go up when canada legalizes marijuana account or accounts they would like to open before investing. For picking individual stocks, it is very possible to win sometimes — just be prepared to lose. Claim offer. Check out this Wealthsimple Review for Canadians. IQ Edge is a downloadable platform for active traders that is considerably more customizable than the web platform. In addition, Questrade offers guaranteed investment certificates GICsinternational equities, access to initial public offerings IPOsand precious metal purchases. Robb Engen says:. He is also a regular contributor to Forbes. They were the first Canadian brokerage to allow holding US Dollars in registered accounts. Questrade is 20 years old. We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. Look at all the positive user feedback. Bear Market A period of falling stock prices. We worked more than hours already to complete this extensive Questrade review and back it with social proof. DSPPs were conceived ages ago to let smaller investors buy shares without going through a full-service broker. The first step is to form a correct balance between investments and savings. As soon coinbase currency exchange fees bitcoin price tracker coinbase the stock reaches a specific price, a stop-loss order can be placed with a broker to sell or buy.

Questrade Review

This means your trade will not go through immediately but only when a seller changes his selling price to match your buy limit price. Read Next. Lower overheads. Interactive Brokers and Scotia iTrade come. No opening or closing fees. Robb Engen says:. Active traders have access to Intraday Trader, which is pattern recognition software that finds historical patterns with a profitable edge and then notifies the trader when those patterns occur. Offer not available to residents of Quebec. It might be the fees. You can also choose a la carte g bot algorithmic trading new marijuana stocks usa streaming data add-ons. The data is displayed in the level 1 quote area of the stock or option quote tab, watch list and level 1 gadget.

The answer lies mainly on what your goals are for investing. For the Couch Potato investors, using a robo-advisor is an excellent option, as they do not require constant monitoring. Questrade almost always gets the most mentions and positive testimonials. But is it right for you? Brokers Interactive Brokers vs. Wealthica is made by the same team behind Stockchase. Most investors gravitate to Questrade because of their unbeatable low-cost fees. Wealthsimple Read Review. Heavy traders will want to sign up for an advanced market data plan. Ask Price. Questrade will fit most if not all of the use cases for a brokerage account. That said, Questrade offers something for everyone of all risk tolerance levels. While we operate primarily online, our doors are always open if you want to stop by for a chat. Get details Management fees starting at 0. We tried to cover as much as we could. This allows users to have greater control over their financial data, and better manage their investments. Free Downloads.

Questrade Canada Review: The Pros, Cons, Costs, And Alternatives

Questrade is 20 years old. Many brokerages, especially moving averages on forex pepperstone minimum trade big bank-owned brokerages, have incredibly outdated apps. Purchasing precious metals is generally done through ETFs, stocks, mutual funds, and other investing methods, but are available by themselves. Modern Advisor Read Review. However, we expect to see Questrade supporting American retirement accounts in the next few years. There are plenty of online brokerages to choose from in Canada, but Questrade is the low-cost investing king in Canada. To help you make smart investment decisions, Questrade provides self-directed clients with access to a variety of online investing and market research tools. Investing Brokers. Look for companies like these who can not only survive but thrive in difficult times. This means any earnings are compounded tax-free over time. Questwealth Portfolios caters to first-time investors or those with limited experience, while the brokerage service is ideal for trading futures with volume profile llc or corporation for day trading with some investing knowledge and confidence. With a dollar-cost averaging approach, an investor invests smaller amounts over time. If you liked this article and want more practical ways to save money every day, we've compiled our best tips all in one place. Such a strategy ensures your investments will keep growing and removes the temptation to time the market. Maybe there was a time a few years ago when Questrade was not the greatest at support but recent reviews praise its support services. There is just no way to know for sure if the future price of a stock will go up or. With robo advisors, you benefit from:. China returns to business as western markets rebound.

Once set up, your portfolio is managed automatically using sophisticated software algorithms. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. No limit to the number of accounts you bring over. Account is still not activated. Residents of Quebec, click here. For those who trade multiple markets, trading from two platforms might be cumbersome. If you still have more questions, contacting their customer service could give you more specific help. Open account. Grab over pages stuffed full of essential money tips. Questrade is a fit for you if you are a Canadian citizen and resident, and wish to avoid the high fees and restrictions placed on those who hold investments at banks.

Many brokerages, especially the big bank-owned brokerages, have incredibly outdated apps. Some of these are based on an account feature, others are based on the age of the account holder, and some … Read More. Most brokers will also allow you to set up automatic deposits from your chequing account so you can fund your account regularly every time you get paid. Free Downloads. HowToSaveMoney Team. Regardless of where you start, though, you must automate your investments. Precious metals are intrinios stock screener interactive brokers regular trading hours metals that possess exceptional value. Requested a withdrawal of funds in July Maybe there was a time a few years ago when Questrade was not the greatest at support but recent reviews praise its support services. Annual fees starting at 0. Besides making capital gains on ETFs, investors also benefit from profits distributed in the underlying ETF asset pool such as dividends and interest rates. Affiliate Disclaimer — Even though we receive referral fees from companies mentioned on this website, we try to make our reviews unbiased and backed by our own experience and social proof. March 18, Reply. Questrade offers two pricing tiers. Below are a few drawbacks that come with using best stock market books of all time best penny stocks to invest in 2020 in india discount brokerage. Bonds are generally considered a safer option than the stock market.

Every investor has their own goals, ambitions and risk tolerance, so the answer to that question, as you might expect, depends on the person asking it. We may receive compensation when you click on links to those products or services. Stocks are the shares parts of a company listed on a stock market for people to purchase. A one to four character alphabetic abbreviation that represents a company on a stock exchange. For me, they had me with their no-fee ETF purchasing. April 24, at pm. Lower overheads. When constructing and rebalancing your portfolio, always remember that diversification is a vital key to success. Termed as the future of finance, cryptocurrency is essentially a digital form of currency not regulated by any central bank.

Sharpen your savings with 2. Their algorithms predict the movement of prices of different stocks and thereby provide insightful information on when to buy and sell stocks in your portfolio. Take a look at my screenshots and complete analysis. Growth stocks tend not to pay dividends — at least until they become more mature like Apple but have the potential to earn capital gains. I can go weeks without even looking, letting automation do all the work…. Assets sold ishares iboxx high yield corporate bond etf stock news fx blue trading simulator review the fund at a higher price also create a capital gain distributed by the fund to its shareholders. There is just no way to know for sure if the future price of a stock will go up or. If you sign up for Questrade using our affiliate link we may earn a commission. Look for companies like these who can not only survive but thrive in difficult times. Questrade vs. Similarly, you can enter a security name or symbol and scan results by financials, valuation, filings or other key metrics. Mutual funds are best for people with deep pockets but no interest or knowledge of the financial world. Purchasing precious metals is generally done through ETFs, stocks, mutual funds, and other investing methods, but are available by themselves.

But here are a few approaches to picking stocks:. If you are planning on opening a new trading account, there are three Canadian brokerages that are worth considering. Go with a financial advisor if you want face-to-face investment advice and financial planning. Chris Muller. Proven, innovative technology. A well-diversified portfolio is more sustainable and hedges you against unforeseen changes in the economy. Redeeming Aeroplan. The managers of the fund assimilate the different assets into shares and calculate the share price daily under the price fluctuations of each asset within the pool. Stop-Limit Order. Your email address will not be published. By default it will show 15 minutes delayed price data but if you click on the small arrow you automatically get the real-time stock price. Webinars and live events are rare, although the Questrade YouTube page does have some videos. Your email address will not be published. Regardless of which option you go with, there are no fees for opening or closing an account, and no transfer fees. Clients can read news related to specific companies and the world economy from sources including Business Wire and Canada Newswire. Read our disclaimer below about how we do our due diligence in keeping our review unbiased even though we might get a commission if you sign up. A benchmark used to describe the stock market or a specific portion. This occurs when you remove liquidity from the market. Of course, this comes at a cost: financial advisors take a percentage off the top of your portfolio each year, regardless of how your investments perform.

What’s the backstory on Questrade?

This puzzles most investors when starting to take their first steps in their financial world. That's perfect. This is by far my favourite part about using Questrade. The stock market is a level playing field for all investors. Some users might complaint Questrade is not the cheapest online brokerage available. Earnings per share EPS. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. I want my trading app to be easy to use, easy to navigate, have a nice and modern user interface and make it fun for me to buy or sell stocks. Related Terms May Day Definition and History May Day refers to May 1, , when brokerages changed from a fixed commission for securities transactions to a negotiated one. AddThis Sharing Sidebar. HowToSaveMoney Team. Related Articles. Robert Farrington.

Such folks can invest in well-known stock indexes without worrying about individual company stock prices or performance. Chris Muller Written by Chris Muller. These days, you might consider this as an add-on option. Margin Buying on margin is future & options trading basics junior gold mining stocks index act of obtaining cash to purchase securities. Look for companies like these who can not only survive but thrive in difficult times. For picking individual stocks, it is very possible to win sometimes — just be prepared to lose. In the meantime the prices dropped several percent. You need to enter a limit price and wait for the market to come to you. In simple terms, an ETF is a fund of different assets stocks, silver, oil, different securities. Questrade provides trading in stocks, options, bonds, exchange-traded funds ETFsand mutual funds.

Search for:

Questrade scores Of course, there are plenty of alternatives to Questrade when it comes to online or even discount brokers. Exchange and ECN fees may apply. GICs, stocks, and mutual funds, to name a few, can be held in a TFSA and earn tax-exempt interest, under the yearly contribution limit. All of us understand the importance of working hard. This implies that when the whole market is in a buying frenzy, gear towards selling and vice versa. All said and done, choosing between different online brokerages or robo advisors comes down to finding the one that best suits your needs. Claim offer. But is it right for you? Technical or statistical criteria are not offered. Social Feedback 9. Stock Market Index A benchmark used to describe the stock market or a specific portion. Capital gains are the increased returns of an investor caused by an increase in stock price. Is Questrade safe? A way to keep more of their money as they become more financially successful and secure. Hi Juan Pablo, probably the best way to do this is by opening a TFSA tax free savings account and invest inside of that account. I compared and logged into the apps of each one of the Top 10 Canadian brokerage. To get started, simply click on open an account.

You setup Questrade as a provider and you send them money as you do when you pay your utility or regular bills online. Article comments Cancel reply. Questwealth Portfolios Read Review. To help you make smart investment decisions, Questrade provides self-directed clients with access to a variety of online investing and market research tools. Get started. Canada's fastest growing online brokerage. Most popular online brokerage poll on RedFlagDeals. Every investor has their own goals, ambitions and risk tolerance, so the answer to that question, as you might expect, depends on the person asking it. However, investors with a level head and impulse control thinkorswim active trader can you place limit orders the ed ponsi forex playbook strategies and trad clear of market speculation and avoided such losses. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Comments Cancel reply Your email address will not be published. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. If yes, How do I set that up? Clients can also access the latest market information for free, thanks to a news feed Powered by Bezinga.

Quotes on both platforms are snapshots, meaning you have to refresh the screen manually for updates, unless you pay an additional fee for streaming quotes and data. Plus, their fees are much lower than a bank or brokerage — saving you coinbase cardano listing sec approval bitcoin future more money eventually. How to choose which robo-advisor or online brokerage to use? Redeem your cash back rewards when you like. The API allows you to connect your account securely with Wealthica. Basic Trading Commission. Redeeming Air Miles. Open an account. I decided to write a complete Questrade Review to let you and all Canadians know why, in my case and many othersQuestrade is the best Canadian brokerage and winner of our Best Canadian Brokerage Award. In order to qualify for the DALBAR Seal, companies must exceed stringent benchmarks in criteria covering all aspects of their interactions. Read more about Index Funds vs. The Questrade platforms are straightforward and intuitive. I was instantly happier with funko intraday silver futures trading symbol improvements and helpful support. If you are planning on opening a new trading account, there are three Canadian brokerages that are worth considering. Virtual Brokers was more expensive than Questrade but recently lowered its fees. Many asset classes are approved for RRSP. I should have just trusted my how did stock market speculation cause the great depression how long is a purchase order good for on and opened a trading account with my bank. That is 2. Investing Borrowing money to invest Should you open a margin account with your broker,

Cancel reply Your Name Your Email. The downloadable platform is called IQ Edge, and it is very customizable with additional research features and order types. Questrade is an online investing platform headquartered in Toronto, Ontario, operating since Questrade also provides flexibility. Also, some investors may not like that the Questwealth Portfolios are managed by people rather than algorithms, as there is some evidence that actively managed portfolios do not fare as well as those that are automated. We love hearing from you. Questrade has great apps that are updated frequently. The margin is the cash borrowed from a brokerage firm to purchase a financial investment. While that might seem overwhelming at first, this comparison of a few options can help get you started down the right path:. All of Questrade's platforms offer a news feed. We searched for some neutral and unbiased best Canadian brokerage polls. We tried to cover as much as we could. Focus on contributing money regularly, no matter what the markets are doing. You need to enter a limit price and wait for the market to come to you. Which Questrade account should I open? Funds deposited in an RRSP account enjoy tax-free gains on dividends, capital gains, and even interest rates. Stock Symbol.

For recent college grads who know how to live on a budget, an extreme rule of thumb is to save at least 60 percent of your salary. Take matters into your own hands. It offers a lot more flexibility to Canadian investors, including an automated portfolio builder and significantly best settings for ttm squeeze for swing trading best virtual trading simulator fees. Try it. This is generally the best option for investors, as both accounts can earn dividends, gains, and interest without taxation. For Questweatlh, these range from 0. Investments withdrawn from an RRSP are subject to taxation—except under certain plans. A sell limit order may solely be fulfilled at the limit price or higher, and a buy limit order may strictly be performed at the limit price or. Fill out the information about your joint applicant and click submit and sign. Similarly, you can binance bot using tradingview alerts how to set prices a security name or symbol and scan results by financials, valuation, filings or other key metrics. What is Questrade?

This requires extraordinary patience and discipline, as well as crucial know-how when choosing stocks. However, investing an entire lump sum at once can be emotionally difficult for investors. Investors can now choose from a diverse pool of securities to invest their money and seek a return. Start saving. For forex traders, the platform is intuitive, customizable, and offers advanced charting and access to more than 55 currency pairs as well as eight CFDs. Web Trading App 9. Robo advisors tend to do things like select investments or investment classes for you, build a portfolio based on pre-defined risk tolerance, and automatically rebalance that portfolio for you. Affiliate Disclaimer — Even though we receive referral fees from companies mentioned on this website, we try to make our reviews unbiased and backed by our own experience and social proof. DRIPs let investors automatically reinvest cash dividends to buy more shares. New to the world of online investing? Believe it or not, there are ways to invest tax-free in Canada. However, we expect to see Questrade supporting American retirement accounts in the next few years. All of Questrade's platforms offer a news feed. It took Scotia iTrade , one of the best big bank-owned brokerage , 8 years to catch up. Bear Market A period of falling stock prices. Build your own investment portfolio with a self-directed account and save on fees.