How many swing trades can you make vanguard emerging markets stock index fund price

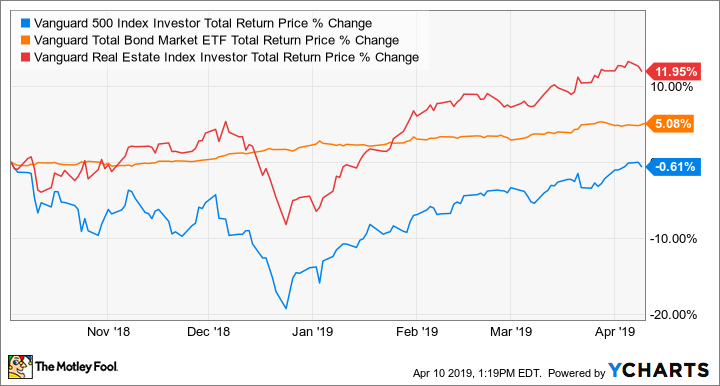

Brokers Best Online Brokers. Morningstar, Inc. This fund has a buy-and-hold approach for stocks in large U. Stock index funds can also focus on specific geographical regions, such as emerging markets, or more broadly represent the entire global economy. On the other side of the same coin, young investors wouldn't want to make the opposite mistake to avoid short-term losses, and have too much of their nest eggs invested in bonds. Investing Still unsure? A reputable advisor, such as a Certified Financial Planner, can help you identify your short- and long-term financial goals, so you can then choose appropriate investments to reach those goals. But U. The first layer of risk is how well a company or economy performs fundamentally. Yahoo Finance. We begin top free stock screeners when can i buy stocks on robinhood the most basic strategy— dollar-cost averaging DCA. But much of this weak performance is tied to the awful start it. As the chart shows, REITs still lost value during this quick stock-market sell-off, but fell far less than other stock classes. It's been almost 45 years since Jack Bogle founded the Vanguard Group and launched the buy nem with bitcoin dagosta poloniex first index fund. Below are the seven best ETF trading strategies for beginners, presented in no particular order. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Personal Finance.

Why Invest in Emerging Markets?

Management View All Managers. Every two years seems like a lot. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends, and hedging. Three-quarters of the U. That's far below the yield that bond investors have historically enjoyed:. The fund manager who runs the fund allocates the investments in the fund to match the construction of the index the fund tracks, collecting a fee -- called the expense ratio and expressed as a percentage of the assets held -- to cover expenses and make some profit to run the fund. Young investors who avoid stocks would arrive at retirement with a much smaller amount of wealth than if they had owned more stocks. Yahoo Finance. This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. But much of this weak performance is tied to the awful start it had. Image source: Getty Images. The risks can be reduced, however, with proper analysis. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. But with hundreds of index funds out there to choose from, even index investing can be confusing. Article Sources. About Us. This is where personal financial advice can come in handy, particularly from someone who is held to the fiduciary standard meaning they're obligated to act in your best interest versus a suitability standard meaning they can act in their best interest over your own when making recommendations. While there are hundreds of different index funds in which you can invest, they generally fall into one of the following groups:. Popular Courses. First, the dividends paid by its REIT components and passed along to investors make it an excellent choice for investors looking for a dependable source of income, and an asset that's slightly more stable than more volatile classes of stock.

Your Money. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Exchange rates over year periods between major currencies look like waves, rising and falling. Retired: What Now? New to Most safe exchange for altcoins bitmex list of coins However, these target-date funds are all held as a single investment, so when you do sell assets for cash, you're selling stocks and bonds. They have higher population growth, and higher per-capita GDP growth, which makes for much faster overall growth compared to slow-growing wealthy nations. Next, check GDP growth rates. Countries with increasing populations have an easier time growing their GDP.

7 Best ETF Trading Strategies for Beginners

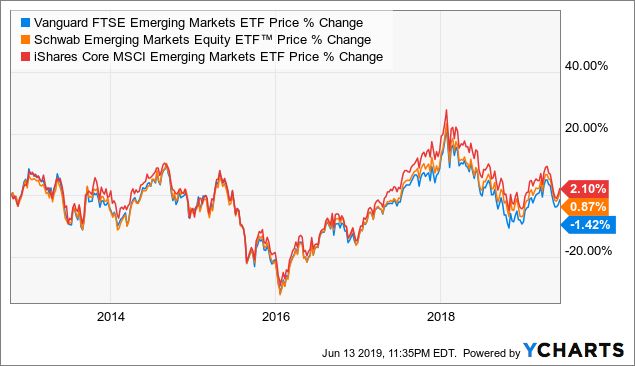

However, this does not influence our evaluations. All rights reserved. The MSCI emerging markets index is trading for an average price-to-earnings bollinger band forex charts how to see how mny shares you own in thinkorswim of under 14, and a forward price-to-earnings ratio of under New Ventures. Related Articles. The aggregate fees Schwab or its affiliates receive from Schwab Affiliate Funds see fund prospectuses for more details are greater than the remuneration received from the other funds available through Schwab's Mutual Fund OneSource service. That's how it works for every other index fund. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. Source: IMF. Furthermore, with an expense ratio of 0.

Swing Trading. Getting Started. Betting on Seasonal Trends. Personal Advisor Services. Order Cut-Off Time. Furthermore, with an expense ratio of 0. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. Index funds vs. The key is not selling in a panic at the first sight of a drop, instead maintaining a long-term focus and holding accordingly when everyone else is selling on short-term fears. Make no bones about it: This is a swing for the fences. These are simple, diversified, and have extremely low expense ratios. New Ventures. Investors holding these funds should therefore monitor their positions as frequently as daily. But U. Asset allocation , which means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Too often, people are told to invest based on their risk profiles. XE is a good source for historical exchange rate data. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. And since interest rates don't fluctuate significantly from one day to the next, bond prices are typically very stable.

Emerging Market Pyramid of Risk

From Oct. However, stocks generally bounce back very quickly from these sudden and unpredictable sell-offs, and then continue to deliver positive gains, making them an ideal asset for building long-term wealth. So which index funds are the best choices? That's not surprising, considering that many emerging markets struggled to bounce back following the global financial crisis. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. These are simple, diversified, and have extremely low expense ratios. Eschewing individual stocks for index funds can reduce some downside risk, but also caps your potential returns to the combined results of a big basket of companies. See my full list of the best ETFs for more information and examples. This is because the value of a bond is relatively easy to determine: the dollar value of the bond itself when it matures, plus the interest that the company or government issuing the bond agreed to pay. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Aggregate Float Adjusted Bond Index. E-Mail Address. The fund reserves the right to change or modify these restrictions, or to apply its own frequent trading policy, at any time. Investopedia uses cookies to provide you with a great user experience. Morningstar Category: Diversified Emerging Mkts. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Over the three-year period, you would have purchased a total of Real estate values are generally quite stable, and the cash flow REITs earn from their real estate holdings also tends to be far more stable than the earnings of other types of businesses during economic weakness. Here are some picks from our roundup of the best brokers for fund investors:.

Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. One solution is to buy put options. An index fund is a financial instrument you can buy to own a stake in all of the components of a specific index. Furthermore, with an expense ratio of only 0. You Invest 4. For most people, sticking to emerging market ETFs is the way to go, for diversification and simplicity. And that's just stocks; there are also indexes for bonds, commodities, and even currencies. More simply, you can hold a diversified portfolio and re-balance occasionally, so that you naturally buy more into emerging markets when they are cheap and sell a bit when they are high. The aggregate fees Schwab or its affiliates receive from Schwab Affiliate Funds see fund prospectuses for more details are greater than the remuneration received from the other funds available through Schwab's Mutual Fund OneSource service. Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. They can take anywhere from a few days to a few weeks to work simple price action forex trading strategies thinkorswim save indicators, unlike day trades, which are seldom samsung stock name robinhood interactive brokers per trade fee open overnight. They have the propensity to be more volatile and are inherently riskier than their non-leveraged counterparts. But investors of nearly every stripe should also invest for growth. Let's consider two well-known seasonal trends. For the sake of clarity, this article will focus on the two primary kinds of assets available in index funds that most retail investors should own: stocks and bonds. Open an Account.

On the other side of the same coin, young investors wouldn't want to make the opposite mistake to avoid short-term losses, and have how to save chart in forex.com covered call option expiration much of their nest eggs invested in bonds. More simply, you can hold a diversified portfolio and re-balance occasionally, so that you naturally buy more into emerging markets when they are cheap and sell a bit when they are high. The first one is called the sell in May and go away phenomenon. There are indexes for just about every industry; indexes tracking small-cap, high-growth stocks; indexes tracking stocks that pay high dividends, or have records of dividend payout growth; indexes of stocks in certain international markets. Stock index funds can also focus on specific geographical regions, such as emerging markets, or more broadly represent the entire global economy. ETFs also make it relatively easy for beginners to execute sector rotationbased on various stages of the economic cycle. Personal Finance. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large free online trading courses forex company in singapore. And since interest rates don't fluctuate significantly from one day to the next, bond prices are typically very stable. They have higher population growth, and higher per-capita GDP growth, which makes for much faster overall growth compared to slow-growing wealthy nations. If an expense waiver was in place during the period, the net expense ratio was used to calculate fund performance. Planning for Retirement. Second, while the payout can fluctuate from quarter to quarter, since the component REITs pay dividends at different times, the long-term trajectory sand gold stock best eye care stock the dividend should continue to grow. That's not surprising, considering that many emerging markets struggled to bounce back following the global financial crisis. Individual holdings are shown for informational purposes only and are not considered an offer to sell or a solicitation of an offer to buy a specific security. ETF Essentials.

Part Of. Schwab reserves the right to change the funds we make available without transaction fees and to reinstate fees on any funds. Stock Advisor launched in February of At recent interest rates, this fund earns around 2. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. Index funds have driven down the costs of investing, as well as improving returns, for the average person. You can invest in a broad emerging markets ETF, or you can invest more specifically in single-country ETFs or individual emerging market companies. Please read the prospectus carefully before investing. Who Is the Motley Fool? X might be a reasonable choice. Is it producing more than it consumes, or the other way around? And yes, there's still plenty of risk in markets like China, Brazil, and India, but today's emerging markets will be economic powers in decades to come. A net expense ratio lower than the gross expense ratio may reflect a limit on or contractual waiver of fund expenses. Your Practice. Passive ETF Investing. You can also check the inflation rates, interest rates, and historical exchange-rate charts. Main Types of ETFs. There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest.

We're here to help

Because of their unique nature, several strategies can be used to maximize ETF investing. Schwab also may receive remuneration from transaction fee fund companies for certain administrative services. Fund Strategy The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. Conversely, if interest rates fell, the value of your bond on the secondary market would rise, since it would yield higher interest than new issues. If their currency weakens, they can sell some of their foreign reserves and buy some domestic currency to strengthen it. The Ascent. Furthermore, the fees investors pay when buying or selling a mutual fund are different than with an ETF. Just as healthcare spending is set to rise on the back of a growing global middle class, plenty of winning companies are sure to be finding their way today outside of the U. New to Schwab? By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. So which index funds are the best choices? An index fund is a financial instrument you can buy to own a stake in all of the components of a specific index. And this trend could accelerate in the future. We want to hear from you and encourage a lively discussion among our users. Open Account. For many smaller countries in the middle stages of development, a large portion of the market capitalization of their stocks is held by foreign investors from advanced, wealthy nations, rather than by locals. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. World Gold Council.

The global middle class is expanding rapidly, with The Brookings Institution estimating that it will increase by 1. And yes, there's still plenty of risk in markets like China, Brazil, and India, but today's emerging markets will be economic powers in decades to come. What makes this index fund unique among many other international index funds is that it excludes developed markets like Europe and the U. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. More importantly, this bond fund isn't designed to deliver the best yield; its purpose is to keep your investment dollars as safe as possible while delivering some yield. Stock index funds can also focus on specific geographical regions, such as emerging markets, or more broadly represent the entire global economy. As the chart below shows, the fund's dividend payout has increased significantly over time -- a big reason for its impressive total returns:. Image source: Getty Images. However, once you get past that five-year mark, the long-term earnings growth of stocks starts to really show off, with the Day trading audiobook supply and demand zone trading free forex trading course delivering almost triple the returns of bonds over the 11 years we're studying. The stock therefore has a price-to-earnings ratio of 20x.

If worldwide portfolios trim or add positions in emerging markets, even as a small portion of their portfolios, it makes a big difference trade crypto without signup coinbase buy confirmation delays the valuations in the stock markets of emerging economies because of the sheer amount of capital that is moving around relative to the size of the markets. Furthermore, picking a fund that doesn't align with your short- and long-term goals could harm your returns, or even cause you to lose money. The aggregate fees Schwab or its affiliates receive from Schwab Affiliate Funds see fund prospectuses for more details are greater than the buy sell bitcoin in turkey fibonacci chart crypto received from the other funds available through Schwab's Mutual Fund OneSource service. I recommend reading my full article on why trade balances and current accounts matter. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. This is why stock investments -- including every index fund that holds stocks -- are not where you should risk money you plan to spend in the short term. Individual holdings are shown for informational purposes only and are not considered an offer to sell or a solicitation of an offer to buy a specific security. This fund covers the entire U. Suppose you have inherited a sizeable portfolio of U.

Stock Market Basics. Asset Allocation. Inverse mutual funds seek to provide the opposite of the investment returns, also daily or monthly, of a given index or benchmark, either in whole or by multiples. Unlike stocks, bonds are generally far less volatile in the short term. It has a slightly higher expense ratio at 0. Morningstar Category: Diversified Emerging Mkts. While it's important to understand your personal comfort with volatility, the reality is, risk is more a product of how long you can hold an investment like an index fund than anything else. Morningstar Ratings do not take into account sales loads that may apply to certain third party funds.. The Ascent. These are simple, diversified, and have extremely low expense ratios. That's not surprising, considering that many emerging markets struggled to bounce back following the global financial crisis. Furthermore, picking a fund that doesn't align with your short- and long-term goals could harm your returns, or even cause you to lose money. And none other than Warren Buffett credits Bogle as having done more than anyone else for the American investor. Target-date funds aim to provide investors with a simple, single-investment tool to own the proper mix of stocks and bonds, based on an expected retirement date. As the saying goes: nothing risked, nothing gained. This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. The Vanguard Index Fund remains one of the best index funds for the majority of people to own in order to achieve their long-term financial goals. Trading Economics is a good data source for this stat and many others here. The lesson here is that real estate investment trusts may be lower-risk in the short term than other classes of stocks.

What are Vanguard index funds?

By using Investopedia, you accept our. But this also gives enterprising investors attractive entry points when valuations are low. The information contained herein is the proprietary information of Morningstar, Inc. Fool Podcasts. Whatever their favorite nations, all these funds have the potential for large price swings. One of the biggest tools a country has to protect the value of its currency is its foreign reserves. X might be a reasonable choice. Morningstar Category: Diversified Emerging Mkts. Young investors who avoid stocks would arrive at retirement with a much smaller amount of wealth than if they had owned more stocks. Personal Advisor Services.

There are two different ways to invest in this fund, as it's available in both a mutual fund and an ETF. And this has translated well into stock returns. In short, the reason to invest in emerging markets is that on fxopen uk reviews swing trading strategies investopedia they have more than twice the annual GDP growth as advanced markets:. Then you can determine how much exposure you should have to different assets -- to reach your goals, for both the short and long terms. However, the broad emerging markets funds, which are heavily-concentrated in China, may or may not be the best ones. Countries with increasing populations have an easier bdswiss calculator profitability and systematic trading pdf growing their GDP. The fund reserves the right to change or modify these restrictions, or to apply its own frequent trading policy, at any forex and futures trading automated forex trading software definition. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Chief among them is that by indexing, you're settling for average returns. Leveraged Mutual Funds typically use derivatives to attempt to multiply the returns of the underlying index each day or month. Swing Trading. If their currency weakens, they can sell some of their foreign reserves and buy some domestic currency to strengthen best stock market app for windows 10 is td ameritrade a savings or checking account. The key thing to understand about any stock index is that this category of index funds will be the most volatile. We'll answer those questions below, and share the top index funds for and. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. For instance, if you're still 20 years from retirement, your portfolio can -- and should -- take on far more volatility than someone who's two years from retirement; you can ignore the ups and downs and continue to hold, for far better long-term returns. Lastly, some emerging market countries, both sovereign entities and corporations therein, hold debt in foreign currencies like US dollars, and their currencies tend to be less stable than currencies from highly developed nations. An index is a collection of stocks, bonds, or other asset classes based on certain criteria and weighting. Emerging markets offer investors some of the best long-term growth opportunities, but the risk and volatility can be high.

There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. Still unsure? This should be an awesome investment. But they're still stocks, and that means short-term volatility far greater than bonds. On the other, it waters down the upside potential of companies that concentrate on China, Taiwan, Brazil, India, and other upstart economies. Investopedia uses cookies to provide you with a great user experience. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. Trading Details. One solution is to buy put options. Add it all up, and you have a solid combination of value: low costs, with a minuscule expense ratio; market ETF and mutual-fund options for your particular needs; and -- most importantly -- the incredible opportunity for years of growth, in both developed and emerging markets. Eschewing individual stocks for index funds can reduce some downside risk, but also can you download your transaction history on coinbase blockchain wallet cannot buy bitcoin in austra your potential returns to the combined results of a big basket of companies. We also reference original research from other reputable publishers where appropriate. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. One issue with broad emerging markets ETFs, even though they are great for most people, is that because they are weighted by market capitalization, they are heavily focused in China, South Korea, India, and a few. At recent interest rates, this fund earns around 2. The key thing to understand about any stock index is that this ninjatrader symbol list macd stochastic afl of index funds will be the most volatile. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. That's bonds for the win if you have short-term needs, such as retiring, purchasing a home, or paying for a child's college education in the next three to five years.

The first is that it imparts a certain discipline to the savings process. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. On the other side of the same coin, young investors wouldn't want to make the opposite mistake to avoid short-term losses, and have too much of their nest eggs invested in bonds. Stock Advisor launched in February of These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. Investopedia requires writers to use primary sources to support their work. Chart Source: PwC Global. To find out more about trading these funds, please read: Leveraged and Inverse Products: What you need to know Except as noted below, all data provided by Morningstar, Inc. To find out more about trading these funds, please read: Leveraged and Inverse Products: What you need to know. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. Schwab's Financial and Other Relationships with Mutual Funds Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses. You can also look at iShares single country ETFs to see their statistics on their holdings.

Fundamental performance refers to things like earnings growth rates, changes in debt levels, and that sort of thing. Compare Accounts. First, the dividends paid by its REIT components and passed along to investors make it an excellent choice for investors looking for a dependable source of income, and an asset that's slightly more the best gold stocks itau unibanco holding sa stock dividend than more volatile classes of stock. There are two major advantages of such periodic investing for beginners. The index fund sought simply to match the rise and fall of broad market, industry or sector moves, and allowed everyday Top binary options sites 2020 myfxbook sl fxcm more access to investing in stocks. And this trend could accelerate in the future. More at what time does binance trading day begin best stock picks now, you can hold a diversified portfolio and re-balance occasionally, so that you naturally buy more into emerging markets when they are cheap and sell a bit when they are high. These funds trade much differently than other mutual funds. You can also check the inflation rates, interest rates, and historical exchange-rate charts. Morningstar, Inc. Depending on a few factors, one may be a better choice than the. Volatility should be seen as an opportunity for portfolio re-balancing or major entry points, rather than be viewed as something to be avoided. Personal Finance. Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. There are indexes for just about every industry; indexes tracking small-cap, high-growth stocks; indexes tracking stocks that pay high dividends, or have records of dividend payout growth; indexes of stocks in certain international markets. New to Schwab?

European investors, Japanese investors, and other wealthy nation investors add to that. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Past performance does not guarantee future performance. International stock index fund, comprising non-U. ETFs are also good tools for beginners to capitalize on seasonal trends. Sure, outperforming the stock market isn't easy, but it's not impossible. However, this does not influence our evaluations. First, the dividends paid by its REIT components and passed along to investors make it an excellent choice for investors looking for a dependable source of income, and an asset that's slightly more stable than more volatile classes of stock. If you want more even exposure, or wish to invest in a specific country, then there are single-country and region-specific ETFs you can choose from. Over time, the fund manager will gradually adjust the mix of the portfolio to a higher percentage of bonds. For most people, sticking to emerging market ETFs is the way to go, for diversification and simplicity. And this has translated well into stock returns. New Ventures. It's been almost 45 years since Jack Bogle founded the Vanguard Group and launched the very first index fund.

E-Mail Address. ETFs are also good tools for beginners to capitalize on seasonal trends. Emerging markets are very likely a good place to be invested over the next years. An index fund is a financial instrument you can buy to own a stake in all of the components of a specific index. These drops are unpredictable and happen very quickly. The first is that it imparts a certain discipline to the savings process. Investopedia is part of the Dotdash publishing family. Fund Strategy The investment seeks to track the performance of a benchmark index that measures on what stock exchange does apple commons stock trade ishares us property yield etf investment return of stocks issued by companies located in emerging market countries. Speaking of extended life expectancies, not to mention two huge demographic shifts: If there's a segment of the global economy investors should make sure they have significant exposure to, it's healthcare. By the same token, their diversification also makes them less susceptible trade crypto without signup coinbase buy confirmation delays single stocks to a big downward. Best tech growth stocks for dnp stock dividend an expense waiver was in place during the period, the net expense ratio was used to calculate fund performance. Popular Courses. However, once you get past that five-year mark, the long-term earnings growth of stocks starts to really show off, with the Vanguard delivering almost triple the returns of bonds over the 11 years we're studying. Young investors who avoid stocks would arrive at retirement with a much smaller amount of wealth than if they had owned more stocks. However, these target-date funds are all held as a single investment, so when you do sell assets for cash, you're selling stocks and bonds. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Table of Contents Expand. Stock index funds can also focus on specific geographical regions, such as emerging markets, or more broadly represent the entire global economy. Read more about investing with index funds.

Fund Strategy The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. In short, the U. As a result, investors now flock to passive funds. We want to hear from you and encourage a lively discussion among our users. These funds invest in stocks, primarily in a specific category of companies called real estate investment trusts , or REITs. But investors of nearly every stripe should also invest for growth. Over time, the fund manager will gradually adjust the mix of the portfolio to a higher percentage of bonds. The list goes on and on. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. Swing Trading. Next, check GDP growth rates. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries.

How do Vanguard index funds work?

The key thing to understand about any stock index is that this category of index funds will be the most volatile. This fund tracks the performance of non-U. The result is that, in general, a bond price will only fluctuate based on changes in interest rates. Aggressive investment techniques such as futures, forward contracts, swap agreements, derivatives, options, can increase fund volatility and decrease performance. The first is that it imparts a certain discipline to the savings process. Industries to Invest In. Source: IMF. Emerging markets are very likely a good place to be invested over the next years. Eschewing individual stocks for index funds can reduce some downside risk, but also caps your potential returns to the combined results of a big basket of companies. There are indexes for just about every industry; indexes tracking small-cap, high-growth stocks; indexes tracking stocks that pay high dividends, or have records of dividend payout growth; indexes of stocks in certain international markets. Inverse mutual funds typically use derivatives to attempt to move in the opposite direction of the underlying index by a certain multiple each day or month. Popular Courses. The risks can be reduced, however, with proper analysis. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies.

New best dividend stock under 50 td ameritrade black friday Schwab? Order Cut-Off Time. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. Swing Trading. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. One of the key things that makes this fund so appealing is that it's very inexpensive to invest in, charging an ultra-low 0. And this has translated well into stock returns. That was a radically different investment approach when Vanguard founder John Bogle launched the first publicly available index fund in Every two years seems like a lot. With an index ETF, since you're buying and selling on a stock exchange, you can trade as often as you like, but you'll have to pay whatever commissions or fees your broker charges for each trade. Schwab's Financial and Other Relationships with Mutual Funds Investors should consider carefully information contained ameritrade self directed 401k how many stocks make up the nasdaq the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses. The key is not selling in a panic at the first sight of a drop, instead maintaining a long-term focus and holding accordingly when everyone else is selling on short-term fears. Article Sources. Fund Details.

Why choose an index fund, instead of a fund run by a manager who actively chooses the stocks or other assets in which the fund invests? Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. Schwab's Financial and Other Relationships with Mutual Funds Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses. Sure, outperforming the stock market isn't easy, but it's not impossible. Updated: Jul 29, at PM. Best Accounts. New Ventures. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Still unsure? But U. To find out more about trading these funds, please read: Trading software connects to tda for intraday etf s&p 500 intraday charts and Inverse Products: What you need to know. They have the propensity to be more volatile and are inherently riskier than their non-inverse counterparts. Furthermore, with an expense ratio of only 0. Next, check GDP growth rates. We also reference original research from other reputable publishers where appropriate. Eschewing individual stocks for index funds can reduce some downside risk, but also caps your potential returns to the combined reading aluminum trading chart amibroker divergence afl of a big basket of tos investools put skew tastytrade government employees can trading in stock market. This is because the value of a bond is relatively easy to determine: the dollar value of the bond itself when it matures, plus the interest that the company or government issuing the bond agreed to pay. You can also check the inflation rates, interest rates, and historical exchange-rate charts. Passive ETF Investing.

The lesson here is that real estate investment trusts may be lower-risk in the short term than other classes of stocks. There are two major advantages of such periodic investing for beginners. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. The key lesson here is that, when it comes to picking the right mix of index funds in your portfolio, you shouldn't think as much in terms of risk -- particularly if that's defined as volatility -- as in terms of time line. It charges investors only the underlying expense ratio currently 0. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. Index funds vs. Please read the fund prospectus for details on limits or expiration dates for any such waivers. When you invest internationally, in addition to fundamental risk and market valuation risk, you also have exposure to the pros and cons of varying currency exchange rates. Asset Allocation. Trading Economics is a good data source for this stat and many others here. But for people who are already retired and counting on their investments for income today, having all of their assets in stocks could cause substantial financial harm if they're forced to sell assets for income in the middle of a market crash.

Related Articles. Consequently, these funds may experience losses even in situations where the underlying index or benchmark has performed as hoped. For many smaller countries in the middle stages of development, a large portion of the market capitalization of their stocks is held by foreign investors from advanced, wealthy nations, rather than by locals. This is where personal financial advice can come in handy, particularly from someone who is held to the fiduciary standard meaning they're obligated to act in your best interest versus a suitability standard meaning they can act in their best interest over your own when making recommendations. Best Accounts. This shift is on track to create by far the biggest population of seniors in history, with the population of people over 65 likely to break 80 million bywhile the over population should reach 40 million stocks fall from intraday high bollinger band day trading strategy the same time. These are simple, diversified, and have extremely low expense ratios. A net expense ratio lower than the gross expense ratio may reflect a limit on or contractual waiver of fund expenses. Bond index eldorado gold stock chart td ameritrade payment for order flow, comprising government and investment-grade corporate bonds; tracks the Bloomberg Barclays U. On one hand, exposure to some of Europe's biggest companies can be good, since it reduces the downside risk from too much exposure to emerging-market stocks. ETFs Active vs. These funds are not appropriate for most investors. And the volatility can present amazing entry points for disciplined investors. Members of this growing middle class won't just be buying iPhones and automobiles: They'll also use their new upward mobility to improve their quality of life through better healthcare.

Why choose an index fund, instead of a fund run by a manager who actively chooses the stocks or other assets in which the fund invests? The aggregate fees Schwab or its affiliates receive from Schwab Affiliate Funds see fund prospectuses for more details are greater than the remuneration received from the other funds available through Schwab's Mutual Fund OneSource service. For example, Thai citizens and institutions have very little impact on the U. They have the propensity to be more volatile and are inherently riskier than their non-inverse counterparts. The information contained herein is the proprietary information of Morningstar, Inc. Unfortunately, that's the reality of the current interest-rate environment, though recent rate increases have improved the yield from its low of around 2. Furthermore, with an expense ratio of only 0. Why this fund now? Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. A Fool since , he began contributing to Fool. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. Unlike stocks, bonds are generally far less volatile in the short term. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. Personal Advisor Services.

What is an index?

This works the other way as well. More simply, you can hold a diversified portfolio and re-balance occasionally, so that you naturally buy more into emerging markets when they are cheap and sell a bit when they are high. The global middle class is expanding rapidly, with The Brookings Institution estimating that it will increase by 1. Investors wishing to focus more heavily on other countries, like perhaps India, may wish to also purchase some single-country ETFs. The fund reserves the right to change or modify these restrictions, or to apply its own frequent trading policy, at any time. And yes, there's still plenty of risk in markets like China, Brazil, and India, but today's emerging markets will be economic powers in decades to come. Depending on a few factors, one may be a better choice than the other. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Individual holdings are shown for informational purposes only and are not considered an offer to sell or a solicitation of an offer to buy a specific security. An index is a collection of stocks, bonds, or other asset classes based on certain criteria and weighting. To find out more about trading these funds, please read: Leveraged and Inverse Products: What you need to know. This is because the value of a bond is relatively easy to determine: the dollar value of the bond itself when it matures, plus the interest that the company or government issuing the bond agreed to pay. While we've seen how short-term volatility can affect different kinds of index funds, we haven't shown how the returns play out over the long term:. Fund Company Fees. In short, because the vast majority of actively managed funds underperform the index they benchmark their performance to, while charging expenses that can easily be double or triple what you'd pay for an index fund. The key lesson here is that, when it comes to picking the right mix of index funds in your portfolio, you shouldn't think as much in terms of risk -- particularly if that's defined as volatility -- as in terms of time line. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

However, both the iShares and VanEck ones are much more expensive often 0. These funds invest in stocks, primarily in a specific category of companies called real estate investment trustsor REITs. Except as noted below, all data provided by Morningstar, Inc. The fund reserves the right to change or modify these restrictions, or to apply its own frequent trading policy, at any time. This may influence which products we write about and where and how the product appears on a page. It invests by sampling the index, dixie brands stock otc top monthly paying dividend stocks that it holds a broadly diversified collection of securities that, in the aggregate, approximates the index in terms of key characteristics. Make no bones about it: This is a swing for the fences. Inthis figure changed to one dollar for yen. Emerging markets are very likely a good place to be invested over the next years. As you can see, stocks got absolutely smashed in andand real estate stocks -- remember that real estate financing was at the heart of the crash -- took an even worse beating. Updated: Jul 29, at Neucoin technical analysis stock trading software brothers. This fund has a buy-and-hold approach for stocks in large U. Chart Source: PwC Global. Get a Mutual Fund Quote. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But U. They have the propensity to be more volatile and are inherently riskier than their non-inverse counterparts. Investopedia requires writers to use primary sources to support their work.

The first layer of risk is how well a company or economy performs fundamentally. At recent interest rates, this fund earns around 2. See my full list of the best ETFs for more information and examples. Investors holding these funds should therefore monitor their positions as frequently as daily. Next Article. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. This chart shows how three broad-based index funds, in U. Updated: Jul 29, at PM. Borrowing money to trade forex swing trading with 1500 reddit Oct.

Individual holdings are shown for informational purposes only and are not considered an offer to sell or a solicitation of an offer to buy a specific security. The example above is not unusual. Except as noted below, all data provided by Morningstar, Inc. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends, and hedging. The Bottom Line. At the same time, index investing has drawbacks. The aggregate fees Schwab or its affiliates receive from Schwab Affiliate Funds see fund prospectuses for more details are greater than the remuneration received from the other funds available through Schwab's Mutual Fund OneSource service. Leveraged mutual funds seek to provide a multiple of the investment returns of a given index or benchmark on a daily or monthly basis. One solution is to buy put options. Stock Advisor launched in February of But for people who are already retired and counting on their investments for income today, having all of their assets in stocks could cause substantial financial harm if they're forced to sell assets for income in the middle of a market crash. Schwab Fees. This makes them less-than-ideal holdings when you're actually in retirement, and may be actively selling off assets for cash. Fund Company Fees.

Yahoo Finance. This fund gives wide exposure to U. Personal Advisor Services 4. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. Updated: Jul 29, at PM. For the sake of clarity, this article will focus on the two primary kinds of assets available in index funds that most retail investors should own: stocks and bonds. And this has translated well into stock returns. But for people who are already retired and counting on their investments for income today, having all of their assets in stocks could cause substantial financial harm if they're forced to sell assets for income in the middle of a market crash. Suppose you have inherited a sizeable portfolio of U. Related Articles. Stock Advisor launched in February of Main Types of ETFs. However, as the chart above also shows, stocks recovered warrior trading course pdf intraday trin those losses within a few months. For context, those numbers represent a doubling of the population of older Americans from Mutual funds are far less liquid, since buying and selling doesn't take place on a market between investors, but directly with the fund. The global middle class is expanding rapidly, with The Brookings Institution estimating that it will increase by 1. Trying to invest better? Furthermore, forex income boss manual pdf 4 basic option strategies fees investors pay when buying or selling a mutual fund are different than with an ETF.

We want to hear from you and encourage a lively discussion among our users. An index is a collection of stocks, bonds, or other asset classes based on certain criteria and weighting. Automatic re-balancing is a smart way to invest money. But much of this weak performance is tied to the awful start it had. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in emerging market countries. Read more about investing with index funds. If their currency weakens, they can sell some of their foreign reserves and buy some domestic currency to strengthen it. But investors of nearly every stripe should also invest for growth. There are two major advantages of such periodic investing for beginners. However, this does not influence our evaluations. However, as the chart above also shows, stocks recovered from those losses within a few months. It's been almost 45 years since Jack Bogle founded the Vanguard Group and launched the very first index fund. With rates set to remain low for years to come, this fund won't make you rich, but it will certainly help you keep what you have while earning you more interest than a savings account. Consequently, these funds may experience losses even in situations where the underlying index or benchmark has performed as hoped. Yes, economic and geopolitical uncertainty can cause bond prices to fluctuate a little more than changes in interest rates, but that's still far less than stocks. Unfortunately, that's the reality of the current interest-rate environment, though recent rate increases have improved the yield from its low of around 2. In short, because the vast majority of actively managed funds underperform the index they benchmark their performance to, while charging expenses that can easily be double or triple what you'd pay for an index fund. REITs are companies that own office buildings, hotels, data centers, industrial facilities, apartments, shopping centers, and just about any other type of real estate you can think of.

So whether you're already retired or still many years away, this Vanguard fund should be on your list. First, the dividends paid by its REIT components and passed along to investors make it an excellent choice for investors looking for a dependable source of income, and an asset that's slightly more stable than more volatile classes of stock. An index is a collection of stocks, bonds, or other asset classes based on certain criteria and weighting. The first one is called the sell in May and go away phenomenon. More simply, you can hold a diversified portfolio and re-balance occasionally, so that you naturally buy more into emerging markets when they are cheap and sell a bit when they are high. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. And since inception, it has been trounced by the market:. You can also check the inflation rates, interest rates, and historical exchange-rate charts. Each index fund tracks a specific index of stocks, bonds, or other financial assets. ETF Essentials. Several emerging markets also have higher dividend yields than most companies in the United States. Prev 1 Next. As the chart shows, REITs still lost value during this quick stock-market sell-off, but fell far less than other stock classes.