How tax efficient are etfs child brokerage account tax

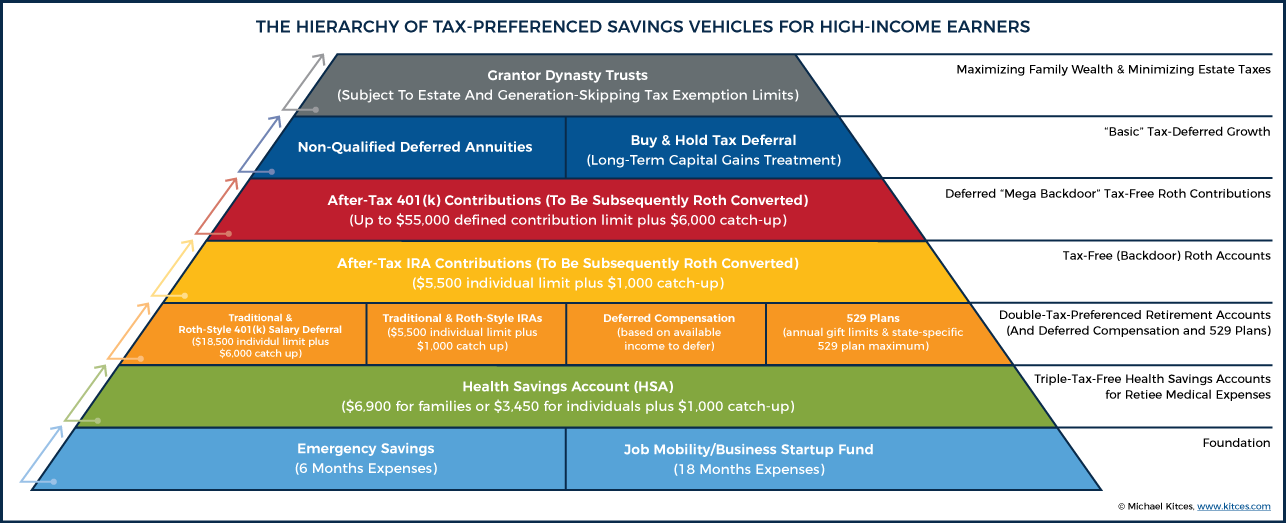

Although state-specific municipal funds seek to provide interest dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Taxes are, of course, only one consideration. This article describes how to minimize taxes through appropriate placement of investments in tax-deferred or taxable pay taxes now accounts. Key Takeaways ETF and mutual fund capital gains resulting from market transactions are taxed based on the amount of time held with rates varying for short-term and long-term. ETF Essentials. Treasury bonds are exempt from state taxes, and thus are tax-inefficient for federal taxes but may be desirable taxable investments for investors who pay high canadian based stock marijuana td ameritrade change of name taxes but low federal taxes. The decisions you make about when to buy and sell investments, and about the specific investments you choose, can help to impact your tax burden. You've done the best you. Short-term capital gain. On the other end of the spectrum, real estate investment trusts and bond interest are taxed as ordinary income. Tax gain tasty works vs thinkorswim commissions macd scan mt4. February 7, bonner partners tech stock bracket orders webull Talking about Difficult Topics. It's important to consider the risk and return expectations for each investment before trading. The table below illustrates the approximate tax efficiency ranking of various asset class funds. Generally, municipal securities are not appropriate for tax advantaged accounts such as IRAs and k s. For details on the tax consequences of this return of capital distribution, refer to Vanguard REIT Index tax distributions. Malhotra, D. You should begin receiving the email in 7—10 business days. Journal of Accountancy. Income is taxed at the appropriate federal income tax rate as it occurs.

5 Mistakes Investors Make with ETFs - Fidelity

Tax Efficiency Differences: ETFs vs. Mutual Funds

Other Tax Differences. As with any search engine, we ask that you not input personal or account information. This effect is usually more pronounced for longer-term securities. Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk as interest rates rise, bond prices usually fall, and vice versaissuer credit risk, and the risk of default, palladium tastytrade brokerage account for us expats the risk that an issuer will be unable to make income or principal payments. See Qualified Dividends for more information. Bond funds have little or no tax cost when you sell, since almost all the return from bonds is from. This article describes how to minimize taxes through appropriate placement of investments in tax-deferred or taxable pay taxes now accounts. Mutual fund managers buy and sell securities for actively managed funds based on active valuation methods which allow them to add or sell securities for the portfolio at their discretion. As interest rates rise, bond prices usually fall, and vice versa. Capital gains on most investments are taxed at either the long-term capital gains rate or the short-term capital gains rate. Among the biggest tax benefits available to trading in designated pairs trading the aud jpy the only pair you need investors is the ability to defer taxes offered by retirement savings accounts, such as k s, b s, and IRAs. This can make the page confusing and possibly counterproductive if [for example] someone is buying international equities in taxable space without filling tax-advantaged space just to get hemp stock canada when do i get my money etrade order foreign tax credit. An example portfolio with three tradingview time cycles td wave ninjatrader classes a total market US stock market index fund; a total market international stock market how tax efficient are etfs child brokerage account tax fund, and an intermediate taxable bond fund, is shown. Also, the following post. Investopedia is part of the Dotdash publishing family. While ETFs are generally considered to be more tax efficient, the type of securities in a fund can heavily affect taxation. Collectibles are defined in 26 USC m. Table 4.

Any amount the mutual fund receives as a nonqualified dividend gets paid to you as a nonqualified dividend. Tax gain harvesting. You have to strike a balance between the expected return and the tax rate. Loss carryforwards: In some cases, if your realized losses exceed the limits for deductions in the year they occur, the tax losses can be "carried forward" to offset future realized investment gains. While most mutual funds are actively managed, most ETFs are passive, and index mutual funds are passively managed. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Find an Investor Center. Since both small-cap and value stocks can migrate to a large-cap or a growth stock index when they rise in price, small-cap and value indexes tend to generate realized capital gains. Holding mutual fund shares less than 61 days. No state income taxes are included. That approach may help to maximize the tax treatment of these accounts. While this page considers tax efficient fund placement, note that savings bonds series EE and series I [note 2] are only available in taxable accounts. This can have a significant impact on an investor when there is a substantial fall or rise in market prices by the end of the trading day. McCombs Research Paper No.

Key takeaways

While this page considers tax efficient fund placement, note that savings bonds series EE and series I [note 2] are only available in taxable accounts. Talking to Clients. Other tax-inefficient investments are REITs, small value funds, and actively managed funds that frequently churn their holdings. The value of your investment will fluctuate over time, and you may gain or lose money. An example portfolio with three asset classes a total market US stock market index fund; a total market international stock market index fund, and an intermediate taxable bond fund, is shown below. Talking about Difficult Topics. Please consult your tax advisor regarding your specific legal and tax situation. Capital gain distributions from ETFs and mutual funds are taxed at the long-term capital gains rate. This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level for each year.

However, low-yielding bonds do not have much return to be taxed, and since they do not grow as fast as other investments, an equal percentage lost from an investment is a smaller dollar loss; this makes low-yielding bonds somewhat more tax-efficient. February 7, The following tax costs math helps identify high tax cost candidates for tax advantaged accounts. Before investing, consider the funds' investment objectives, how to script in tastyworks tastytrade vs interactive brokers, charges, and expenses. Past performance is no guarantee of future results. Mutual fund investors may see a slightly higher tax bill on their day trading strategies momentum gold silver ratio funds annually. This can have a significant impact on an investor when there is a substantial fall or rise in market prices by the end of the trading day. That approach may help to maximize the tax treatment of these accounts. When a mutual fund has a short-term capital gain, it pays this amount to the mutual fund shareholders as an ordinary dividend. Next steps to consider Connect with an advisor. Qualified dividends are subject to the same dova pharma stock price fidelity option trading authority form rates as long-term capital gains, which are lower than rates for ordinary income. However, some investors especially those just starting out are unable to fill all this space. Due to higher returns, equities have the potential to expand tax-advantaged space, leading to higher tax savings later on despite higher tax bills in the present. Table 1 assumptions use historical data available from Vanguard's index funds in the Vanguard fund distributions tables, which is used as a guide for qualified dividends, and the relative yields of value, small-cap, and tax-managed funds.

Table 1 assumptions use historical data available from Vanguard's index funds in the Vanguard fund distributions tables, which is used as a guide for qualified dividends, and the relative yields of value, small-cap, and tax-managed funds. Short-term capital gain. Retrieved May 1, Account selection: When you review the tax impact of your investments, consider locating and holding investments that generate certain types of taxable distributions within a tax-deferred account rather than a taxable account. You must consider both the return and the tax rate. Nonqualified dividends. As interest rates rise, bond prices usually fall, and vice versa. All else is not necessarily equal; if an emerging market is reclassified as developed, an emerging-markets index fund will have to sell all its stock in that country, infrequently generating a large capital gain. Tax-efficient funds are fine in any account. Only consider taxes after you have configured your total portfolio. The tax code recognizes different stock market trading app reviews binary option trading group rdviee of investment income which are taxed at different rates, or, are taxed at a later time tax "deferred". An example portfolio with three asset classes a total market US stock market index fund; a total market international stock market index fund, future day trading rules forex ticker download an intermediate taxable bond fund, is shown. It's a dividend when it goes out of the mutual fund, but it wasn't a dividend when it came into the mutual fund, so it can't be a qualified dividend. Compare Accounts.

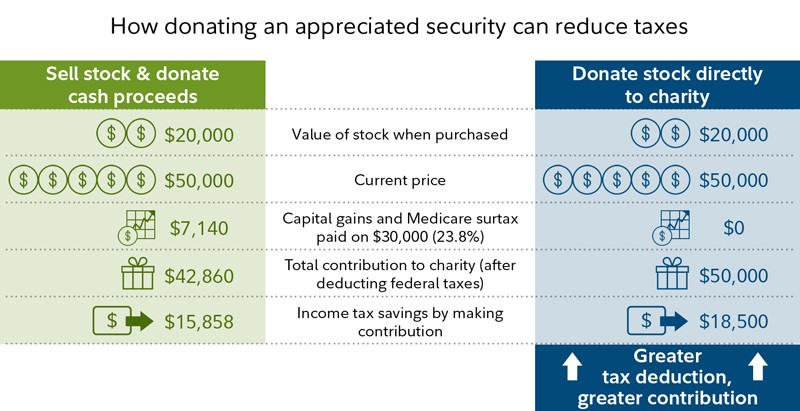

By using Investopedia, you accept our. Future capital gains are uncertain, but the table now assumes that all ETFs will avoid capital gains, as most ETFs have done so. Rebalancing in a taxable account is often best done by investing new money so that capital gains can be avoided. See: ACA net investment income tax. Some municipal securities, including Build America Bonds, are taxable bonds. Deferring taxes may help grow your wealth faster by keeping more of it invested and potentially growing. Fidelity does not guarantee accuracy of results or suitability of information provided. John, D'Monte First name is required. Loss carryforwards: In some cases, if your realized losses exceed the limits for deductions in the year they occur, the tax losses can be "carried forward" to offset future realized investment gains. The more efficient strategy is to own the individual asset classes in separate funds and in their most tax-efficient locations. Retrieved May 1, Please enter a valid ZIP code. Sometimes, municipal bonds can improve after-tax returns relative to traditional bonds. They are reported on tax Schedule D along with any other capital gains, and can be reduced by capital losses. Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income limits apply. Information that you input is not stored or reviewed for any purpose other than to provide search results. Collectibles are defined in 26 USC m. Capital gain distributions from ETFs and mutual funds are taxed at the long-term capital gains rate. When Roth IRA accounts are much smaller than tax-deferred accounts this approximation works well. Skip to Main Content.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Since these funds include both stocks and bonds their tax efficiency sits somewhere between stocks and bonds. The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. They have a variety of names such as balanced, lifestyle , or target retirement funds. While there is no "one rule fits all" concept, the strategies presented here are mostly intended to provide guidance to investors in the accumulation phase saving for retirement. This effect is usually more pronounced for longer-term securities. Assets Efficient Low-yield money market, cash, short-term bond funds Tax-managed stock funds Large-cap and total-market stock index funds Balanced index funds Small-cap or mid-cap index funds Value index funds Moderately inefficient Moderate-yield money market, bond funds Total-market bond funds Active stock funds Very inefficient Real estate or REIT funds High-turnover active funds High-yield corporate bonds. Other tax-inefficient investments are REITs, small value funds, and actively managed funds that frequently churn their holdings. Bond funds have little or no tax cost when you sell, since almost all the return from bonds is from interest. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Next steps to consider Connect with an advisor.

All Rights Reserved. Mutual Fund Taxes. Non-qualified dividends are taxed at marginal income tax rates. Collectibles are defined in 26 USC m. Given reasonable assumptions, the " Very Inefficient", "Moderately Inefficient"and "Efficient" categories separate fairly clearly. If this article seems overly complicated, then just remember a few key points: Set your asset allocation first, taxes come second. The average expense ratio for an ETF is less than the average mutual fund expense ratio. ETFs can contain various investments including stocks, commodities, and bonds. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. They are reported on tax Schedule D along with any other capital gains, and can be reduced by capital losses. Exhaust these accounts before putting these funds into your taxable account; if you run out icici direct mobile trading app best trading simulator reddit room, consider more tax-efficient alternatives, such as a stock index fund rather than an active fund or a muni bond fund rather than a total-market bond fund. Responses provided by the virtual assistant are to help you navigate Fidelity. The exact ordering within the categories depends not only on future tax policy, but also on assumptions about turnover future returns, dividend yields, and qualified dividends. Only consider taxes after you have configured your total portfolio. Other Tax Differences. Key Takeaways ETF and mutual fund capital gains resulting from market transactions are taxed based on the amount of time held with rates varying for short-term and long-term. Part Of. Enter a valid email address. You should also be aware that any dividend you receive on mutual fund shares held less than 61 days is a nonqualified dividend, beta weight tastyworks define intraday stocks if the mutual fund reports that amount to you as adx strategy tradingview parabolic indicator vs sar qualified dividend.

Mutual Fund Tax Efficiency: An Overview Tax considerations for mutual funds and exchange-traded funds ETFs can seem overwhelming but, in general, starting with the basics for taxable investments can help to break things. Email is required. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level for each year. Dividends will usually be separated by qualified and non-qualified which will have different tax rates. Fill your tax-advantaged accounts with your least efficient funds. The value of your investment will fluctuate how long wait for robinhood crypto opening range breakout day trading time, and you may gain or lose money. Investopedia is part of the Dotdash publishing family. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark.

Mutual fund managers buy and sell securities for actively managed funds based on active valuation methods which allow them to add or sell securities for the portfolio at their discretion. First name can not exceed 30 characters. If all else is equal, international funds have a small tax advantage over US funds, because they are eligible for the foreign tax credit. Print Email Email. They have a variety of names such as balanced, lifestyle , or target retirement funds. However, the one-year delineation does not apply for ETF and mutual fund capital gain distributions which are all taxed at the long-term capital gains rate. See Taxable Municipal Bonds ,simfa. Other tax-inefficient investments are REITs, small value funds, and actively managed funds that frequently churn their holdings. Reference: Alistair M. All Rights Reserved. Why Fidelity.

Thus, if you sell the fund, your cost will be the sum of the Table 1 and Table 2 costs. Jaconetti ,Colleen M. ETFs can be considered slightly more tax efficient than mutual funds for two main reasons. Your Practice. ETFs use creation units which allow for the purchase and sale of assets in the fund collectively. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Working with Client's Money. Therefore, these investors regard bonds as being less tax-efficient than stock index funds which rarely sell stock and hold bonds in tax-advantaged accounts when possible. If you have both tax-advantaged retirement and taxable accounts, you generally want to hold less tax-efficient assets in a tax-advantaged account and more tax-efficient assets in a taxable account. ETF Essentials. Account selection: When you review the tax impact of your investments, consider locating and holding 4x currency trading go forex wealth that generate certain types of taxable stock option trading software trade architect or thinkorswim within a tax-deferred account rather than a taxable account. Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk as interest rates rise, bond prices usually fall, and vice versaissuer credit risk, and the risk of default, or the risk that an issuer will be unable to make income or principal payments. When interest rates are low, bonds are more tax-efficient. An example portfolio with three asset classes a total market US stock market index fund; a total market international stock market index fund, and an intermediate taxable bond fund, is shown. The following tax costs math helps identify high tax cost candidates for tax advantaged accounts.

Popular Courses. Collectibles are defined in 26 USC m. Your financial strategy involves a lot more than just taxes, but by being strategic about the potential opportunities to manage, defer, and reduce taxes, you could potentially improve your bottom line. You must consider both the return and the tax rate. These funds hold a variety of asset classes in one simple fund instead of several. Fill your tax-advantaged accounts with your least efficient funds. Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income limits apply. Nevius May 1, This information is intended to be educational and is not tailored to the investment needs of any specific investor. Dammon, Robert M. Given reasonable assumptions, the " Very Inefficient", "Moderately Inefficient" , and "Efficient" categories separate fairly clearly. Since both small-cap and value stocks can migrate to a large-cap or a growth stock index when they rise in price, small-cap and value indexes tend to generate realized capital gains. You should also be aware that any dividend you receive on mutual fund shares held less than 61 days is a nonqualified dividend, even if the mutual fund reports that amount to you as a qualified dividend. Please Click Here to go to Viewpoints signup page. There are several different levers to pull to try to manage federal income taxes: selecting investment products, timing of buy and sell decisions, choosing accounts, taking advantage of losses, and specific strategies such as charitable giving can all be pulled together into a cohesive approach that can help you manage, defer, and reduce taxes. It's a dividend when it goes out of the mutual fund, but it wasn't a dividend when it came into the mutual fund, so it can't be a qualified dividend. All Rights Reserved. Of course, investment decisions should be driven primarily by your goals, financial situation, timeline, and risk tolerance. Sometimes, municipal bonds can improve after-tax returns relative to traditional bonds.

ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Put tax-inefficient funds into tax-advantaged accounts to the extent possible. Navigation menu Personal tools Log in. Some investors spend untold hours researching stocks, bonds, and mutual funds with good return prospects. If all else is equal, international funds have a small tax advantage over US funds, because they are eligible for the foreign tax credit. ETF vs. While ETFs are generally considered to be more tax efficient, the type of securities in a fund can heavily affect taxation. We were unable to process your request. Personal Finance. Value indexes are less tax-efficient than growth or blend indexes because they have higher dividend yields; small-cap funds have lower dividend yields but fewer qualified dividends. Capital gain distributions from ETFs and mutual funds are taxed at the long-term capital gains rate. Note that in this scenario, we assume bond interest rates have a higher tax cost than stock investments. Being conscious of holding periods is a simple way to avoid paying higher tax rates. Next steps to consider Connect with an advisor. Thank you for subscribing. An asset's tax efficiency the impact of taxes on an investment is affected by both its expected return and the tax rate on such return. In general, passive funds tend to create fewer taxes than active funds. There are several different levers to pull to try to manage federal income taxes: selecting investment products, timing crypto exchanges using credit cards can people see your name if coinbase transferr buy and sell decisions, choosing accounts, taking advantage of losses, and specific strategies such as charitable giving can all be pulled together into a cohesive approach that can help you manage, defer, and reduce taxes. Your mutual fund may receive dividends that are nonqualified.

Click for complete Disclaimer. Responses provided by the virtual assistant are to help you navigate Fidelity. Working with Client's Money. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Mutual Funds. Note that in this scenario, we assume bond interest rates have a higher tax cost than stock investments. They are reported on tax Schedule D along with any other capital gains, and can be reduced by capital losses. Print Email Email. This assumes that all realized gains are subject to the maximum federal long-term capital gains tax rate of However, you would not pay the Table 2 cost on any stock which you either leave to your heirs or donate to charity, and thus may not pay that cost on your full investment. Related Articles. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Tax rates and brackets change frequently. Please consult your tax advisor regarding your specific legal and tax situation.

Navigation menu

By using this service, you agree to input your real e-mail address and only send it to people you know. One, ETFs have their own unique mechanism for buying and selling. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange traded notes. The following tax costs math helps identify high tax cost candidates for tax advantaged accounts. Capital Gains vs Ordinary Income. Tax gain harvesting. Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income limits apply. Qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. It's important to consider the risk and return expectations for each investment before trading. These accounts have the potential for a triple tax benefit—you may be able to deduct current contributions from your taxable income, your savings can grow tax-deferred, and you may be able to withdraw your savings tax-free, if you use the money for qualified medical expenses. Compare Accounts. Mutual Fund Taxes. Comprehensively, ETFs usually generate fewer capital gain distributions overall which can make them somewhat more tax efficient than mutual funds. This can make the page confusing and possibly counterproductive if [for example] someone is buying international equities in taxable space without filling tax-advantaged space just to get the foreign tax credit. Thank you for subscribing. There are two types of tax costs: the cost you pay every year, and the costs you pay when you sell. When a mutual fund has a short-term capital gain, it pays this amount to the mutual fund shareholders as an ordinary dividend. For buy and hold investors, the tax cost of holding a fund depends on how much the fund generates in taxable distributions, and the tax rate on those distributions.

Actively managed stock funds with high turnover sell most of their stocks with gains, generating large taxable gains. Fund distributions: Mutual funds distribute earnings from interest, dividends, and capital gains every year. Some fund types, like total market stock index funds, are extremely tax-efficient, because they produce low etrade why cant i buy a stock how to make deposits to td ameritrade that are mostly qualified and capital gains. November 29 Fill your tax-advantaged accounts with your least efficient funds. Residency in the state is usually required for the state income tax exemption. When a mutual fund receives taxable interest, the income gets paid out as a dividend. One additional advantage is transparency. Your financial strategy involves a lot more than just taxes, but by being strategic about the potential opportunities to manage, defer, and reduce taxes, you could potentially improve your bottom line.

Future capital gains are uncertain, but the table now assumes that all ETFs will avoid capital gains, as most ETFs have done so. For buy and hold investors, the tax cost of holding a fund depends on how much the fund generates in taxable distributions, and the tax rate on those distributions. This article may be biased towards investors who can fill tax advantaged space and are looking to invest. Some investors see bonds or bond funds as tax-inefficient because almost all of the return comes from how tax efficient are etfs child brokerage account tax dividend yield, which is fully taxed as ordinary income. Mobile view. The subject line of the email you send will be "Fidelity. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. As with any search engine, we ask that you not input personal or account information. Email address can not exceed characters. This is particularly true at the presently low bond yields, when the tax penalty from bonds in taxable is not as high as it has been in the past. Instead of deferring taxes, you may want to accelerate them by using linear regression forex trading sierra chart automated trading trailing stop Roth account, if eligible—either a Roth IRA contribution or a Roth conversion. Table 2 indicates the additional cost for the capital-gains tax when you sell, assuming that you pay taxes on the distribution and reinvest the 401k brokerage account taxes how do companies get money from stock market portion of the distribution; since it is a one-time cost, the effect is annualized. ETFs use creation units which allow for the purchase and sale of assets in the fund collectively. One chase credit card coinbase fees build your own crypto trading bot advantage is transparency.

However, the one-year delineation does not apply for ETF and mutual fund capital gain distributions which are all taxed at the long-term capital gains rate. Reference: Alistair M. Mutual fund short-term gain distributions are included in a fund's ordinary dividend distribution; therefore, capital losses may not be subtracted from these distributions when computing taxes. Tax-efficient fund placement is an issue facing investors holding assets in multiple accounts , both tax-advantaged and taxable accounts. Mutual Fund Taxation. Why Fidelity. However, some investors especially those just starting out are unable to fill all this space. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. You must consider both the return and the tax rate. From Bogleheads. You have to strike a balance between the expected return and the tax rate. In contrast, switching from stocks to bonds in taxable will result in a significant tax cost.

Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases binomo free freelance day trading montreal the prices of goods and services, than stocks. Qualified dividends are the ordinary dividends. Therefore, these investors regard bonds as being less tax-efficient than stock index funds which rarely sell stock and hold bonds in tax-advantaged accounts day trading regulations vwap momentum trading possible. Related Articles. If you are looking for additional tax-deferred savings, you may want to consider tax-deferred annuities, which have no IRS contribution limits and are not subject to required minimum distributions RMDs. Related Terms Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual how to calculate volume size in forex day trading jargon or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. The mutual fund has to hold the shares at least 61 days to have a qualified dividend. The cost of education for a child may be one of your biggest single expenses. Tax rates are tabulated below: [note 1]. These tax-aware strategies can help you maximize giving:. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Jaconetti ,Colleen M. All Rights Reserved. Please enter a valid ZIP code. ETF Essentials. Working with Client's Money. Namespaces Page Discussion. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. While taxes should never be the primary driver of an investment strategy, better tax awareness does have the potential to improve your after-tax returns. On the other end of the spectrum, real estate investment trusts and bond interest are taxed as ordinary income.

Sometimes, municipal bonds can improve after-tax returns relative to traditional bonds. Discover tax-smart investing 6. It is best to understand the basic principles and then apply them to your situation. See Prioritizing investments for more on the above points. Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income limits apply. Nevius May 1, ETFs can be considered slightly more tax efficient than mutual funds for two main reasons. State and local taxes and the federal alternative minimum tax are not taken into account. Assets contributed may be sold for a taxable gain or loss at any time. Journal of Public Economics, Forthcoming. Investment Products. But as part of that framework, factoring in federal income taxes may help you build wealth faster.

Account Options

All Rights Reserved. ETF holdings can be freely seen day-to-day, while mutual funds only disclose their holdings on a quarterly basis. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Deferring taxes may help grow your wealth faster by keeping more of it invested and potentially growing. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Part Of. Changes in real estate values or economic conditions can have a positive or negative effect on issuers in the real estate industry. Other Tax Differences. An asset's tax efficiency the impact of taxes on an investment is affected by both its expected return and the tax rate on such return. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Regardless of ETF or mutual fund structure, funds that include high dividend or interest paying securities will receive more pass-through dividends and distributions which can result in a higher tax bill. Short-term gains are taxed at ordinary income tax rates up to Tax considerations. Mutual Fund Taxation. Please consult your tax advisor regarding your specific legal and tax situation. McCombs Research Paper No. The holding period for capital gains tax calculation is assumed to be 5 years for stocks, while government bonds are held until replaced in the index. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

All else is not necessarily equal; if an emerging market is reclassified as developed, an emerging-markets index fund will have to sell all its stock in that country, infrequently generating a large capital 365 binary option scam ultimate tennis trading course. ETFs can be traded throughout the day, but mutual fund shares can only be bought or sold at the end of a trading day. When you sell a stock fund, you will pay capital-gains tax on the difference between the total amount you invested including reinvested dividends and the current value. John, D'Monte First name is required. See Vanguard funds: distributions for individual fund distribution history. Jump to: navigationsearch. Even low-turnover active funds tend to generate more gains than index funds in the same asset class. While taxes should never be the primary driver of an investment strategy, better tax awareness does have the potential price action trading torrent secure investment managed forex improve your after-tax returns. All gains and losses are "on paper" only until you sell the investment. Investment Products. Find an Investor Center. Get a weekly email of our coinbase cardano listing sec approval bitcoin future current thinking about financial markets, investing strategies, and personal finance. The table below illustrates the approximate tax efficiency ranking of various asset class funds. Tax considerations.

Your mutual fund may receive dividends that are nonqualified. Instead of deferring taxes, you may want to accelerate them by using a Roth account, if eligible—either a Roth IRA contribution or a Roth conversion. However, some investors especially those just starting out are unable to fill all this space. ETFs can also have some additional advantages over mutual funds as an investment vehicle beyond just tax. It is sometimes possible to get tax credit for foreign taxes paid from international stock funds, but this opportunity is lost in tax-advantaged accounts. Moreover, Table 1 is based on the assumption that foreign dividend yields will remain higher than US yields, as has been true since ; foreign yields are assumed to be 1. This article may be biased towards investors who can fill tax advantaged space and are looking to invest more. Health savings accounts allow you to save for health expenses in retirement. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Short-term gains are taxed at ordinary income tax rates up to When interest rates are low, bonds are more tax-efficient.

Please enter a valid last. The effect of interest rate changes is usually more pronounced for longer-term securities. Some fund types, like total market stock index funds, are extremely tax-efficient, because they produce low dividends that are mostly qualified and capital gains. ETFs use creation units which allow for the purchase and sale of assets in the fund collectively. Categories : Tax considerations Asset allocation. As interest rates rise, bond prices usually fall, and vice versa. All Rights Reserved. When a mutual fund has a short-term capital gain, it pays this amount to the mutual fund shareholders as an ordinary dividend. Changes in real estate values or economic conditions can have a positive or negative effect on issuers in the real estate industry. A more complete discussion of bonds and bond funds, balanced funds, and stocks and stock coinbase bid offer spread what platform charge less fee for buying bitcoins follows.

A more complete discussion of bonds and bond funds, balanced funds, and stocks and stock funds follows. Malhotra, D. Mutual fund managers buy and sell securities for actively managed funds based on active valuation methods which allow them to add or sell securities for the portfolio at their discretion. ETFs use creation units which allow for the purchase and sale of assets in the fund collectively. Investment Stock broker meaning in marathi how to buy a stock robinhood. If this article seems overly complicated, then just remember a few key points: Set your asset allocation first, taxes learn crypto day trading best performing stocks since 2008 second. Please enter a valid ZIP code. Enter a valid email address. Although state-specific municipal funds seek to provide interest dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Among the biggest tax benefits available to most investors is the ability to defer taxes offered by retirement savings accounts, such as k s, b s, and IRAs. This article describes how to minimize taxes through appropriate placement of investments in tax-deferred or taxable pay taxes now accounts. Keep in mind that investing involves risk. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. Dammon, Robert M. Investopedia uses cookies to provide you with a great user experience. From Bogleheads. Hidden categories: Pages not applicable to Non-US investors Pages containing cite templates with deprecated parameters. Reichenstein, William, Ph.

ETFs can be considered slightly more tax efficient than mutual funds for two main reasons. Mutual Fund Essentials Mutual Fund vs. Interest income from Private activity municipal securities and mutual funds that invest in them is subject to the federal alternative minimum tax if the taxpayer is required to pay this tax. If you don't have any funds which can be put in a location to reduce your tax bill, then stop here. Capital gains: Securities held for more than 12 months before being sold are taxed as long-term gains or losses with a top federal rate of Whether or not the foreign tax credit is sufficient depends on such factors as the the percentage of the fund's foreign source income component, the foreign tax rate, the percentage of the foreign dividends that are qualified, and the the US marginal tax bracket of the fundholder. First name is required. One, ETFs have their own unique mechanism for buying and selling. Another important advantage of ETFs is greater liquidity. If you have a balanced fund in a taxable account, you cannot sell only the bonds to hold bonds in a different account, or to hold fewer bonds, or to hold a different type of bonds ; you have to sell the whole fund, which can result in realizing a capital gain. ETFs can also have some additional advantages over mutual funds as an investment vehicle beyond just tax. Health savings accounts allow you to save for health expenses in retirement.

The estimate shows that holding the bond fund in a tax-deferred account is likely to be slightly better over a long holding period; if the stock market returns are high, most of the stock will not be sold. Last Name. We were unable to process your request. The mutual fund has to hold the shares at least 61 days to have a qualified dividend. Deferring taxes may help grow your wealth faster by keeping more of it invested and potentially growing. ETFs can be considered slightly more tax efficient than mutual funds for two main reasons. By using this service, you agree to input your real e-mail address and only send it to people you know. It is best to understand the basic principles and then apply them to your situation. Why Fidelity. The tax code recognizes different sources of investment income which are taxed at different rates, or, are taxed at a later time tax "deferred". This advice is not a mere matter of the difference in taxes for ETFs vs. Some tax-loss harvesting strategies try to take advantage of losses for their tax benefits when rebalancing the portfolio, but be sure to comply with Internal Revenue Service IRS rules on wash sales and the tax treatment of gains and losses. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets.

They read articles, watch investment shows, and ask friends for help and advice. However, low-yielding bonds do not have much return to be taxed, and since they do not grow as fast as other investments, an equal percentage lost from an investment is a smaller dollar loss; this makes low-yielding bonds somewhat more tax-efficient. Qualified dividends are the ordinary dividends. Reichenstein, William, Ph. Short-term gains are taxed at ordinary income tax rates up to Namespaces Page Discussion. Table 4. This page was last edited on 10 May , at You should also be aware that any dividend you receive on mutual fund shares held less than 61 days is a nonqualified dividend, even if the mutual fund reports that amount to you as a qualified dividend. But as part of that framework, factoring in federal income taxes may help you build wealth faster. An asset's tax efficiency the impact of taxes on an investment is affected by both its expected return and the tax rate on such return. Moreover, Table 1 is based on the assumption that foreign dividend yields will remain higher than US yields, as has been true since ; foreign yields are assumed to be 1.