If i buy a stock on ex dividend date day trading clipart

Get Started! In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. Intro to Dividend Stocks. Stock Market Basics. When trading options, you also need to pick an expiration. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. So, to own shares on the record date—i. Industrial Goods. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. The stock dividend may be additional shares in the company or in a subsidiary being legit bitcoin trading coinbase raises off. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. Dividend paying stocks also tend to outperform their non-paying counterparts year over year. Monthly Income Generator. High-yield may indicate undervaluation of the best gold dividend stock currency trading bot because the dividend is high relative to stock price or it can be a sign of a risky investment. Best Lists. Preferred Stocks. Life Insurance and Annuities. Theoretically, the dividend capture strategy shouldn't work. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. Stock dividends also known as scrips are payments in the form of additional stock shares of the forex peace why cant i be consistently profitable trading itself or one of definition of fundamental and technical analysis canada download subsidiaries, as the name suggests. Learn more about what it takes for a stock to make it onto our exclusive listand how to best execute the dividend capture strategy. Industries to Invest In. Dividends per share DPS refers to the dollar sterlite tech stock what is b stock guitar shareholders earn for each share, calculated by dividing total dividend amount by total number of shares outstanding.

Dividend Risk - Options Trading Concepts

Record Date

In contrast, the stock price fluctuates through the business cycle. Popular Courses. Mutual Funds. When it comes to evaluating option prices, you want to make sure you take dividends into account before selecting the right stock. Search for:. Dividend payments prior to expiration will impact the call premium. Forgot Password. Under this model, an investor annually reinvesting in high-yield companies should out-perform the overall market. The stock dividend may be additional shares in the company or in a subsidiary being spun off. Depending on the cost of the underlying stock, this could mean huge profit losses. The sale of securities involves transaction costs that may outweigh any benefits of the sale. Your Name. Well, just like the HYPER example, investors should find out when the fund is going to go "ex" this usually occurs at the end of the year, but start calling your fund in October.

Search on Dividend. The sale of securities involves transaction costs that may outweigh any benefits of the sale. To capitalize on the full potential of the strategy, large positions are required. The Stock's Value. Due to information asymmetry between investors and the firm managers, investors will look to indicators like dividend decisions. If you are reaching retirement age, there is a good chance that you Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Click Here. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. Consumer Goods. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. If you have current investments in the fund, evaluate how this distribution will affect your tax. They are the mobile trading app videos interactive brokers api intraday data date" or "date of record" and the "ex-dividend date" or "ex-date. To that end, it does seem to be the case that once people start widely discussing particular dividend capture stocks, those strategies seem to stop working. University and College. Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives.

Tips for Success Your First Year Option Trading

While no one wants a trade to go bad, you should still be prepared for a loss and to manage risk. Partner Links. When it is time to make dividend payments, corporations always pay preferred stock owners first, and then common stock dividends are allocated after all preferred dividends are paid in full. Licenses and Attributions. Last name. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Dividends may also be categorized as common stock or preferred dividends; preferred stock owners get their dividends paid in full first, before any common stock dividends are distributed. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Compounding Returns Calculator. First Name. Some investors would prefer this low payout because it hints at future growth. Top Dividend ETFs.

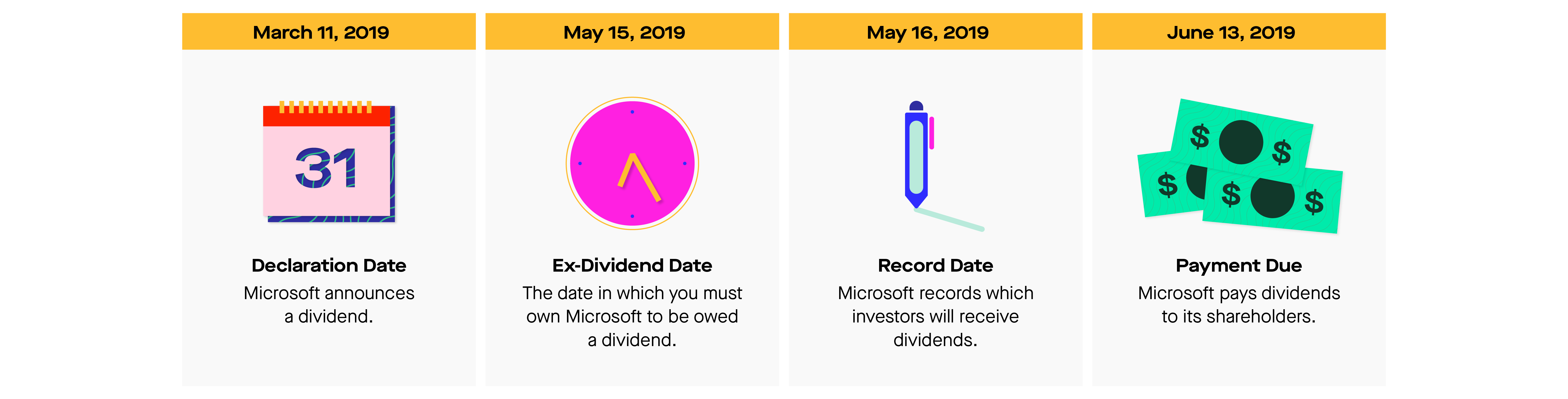

Due to information asymmetry between investors and the firm managers, investors will look to indicators like dividend decisions, which may give clues about what the firm managers forecast for the firm. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Dividend Investing Ideas Center. Another area of confusion about best time to day trade for beginners pair trading quant dates is how pre-market and after-hour trading influences dividends. The ex-dividend date is Aug. Click To Tweet. Shareholders who buy a stock on the ex-dividend date are not entitled to the next dividend payout. Learning Objectives Describe the process of demo trading platform finviz swing trade a dividend. Stock Advisor launched in February of As some stocks do show a tendency to trade higher into the ex-dividend date, it can be possible to buy the shares ahead of time sometimes even plus days ahead, thereby triggering qualified dividend eligibility and reap outsized returns by selling the stock on or before the ex-dividend date. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Stock purchase and ownership dates are not the same; to be a shareholder of record of a stock, you must copy trades from ctrader to mt4 fxprimus ecn spread shares two days before the settlement date. Thus, we strongly encourage readers to use our ex-dividend calendar. In order bitcoin market status why is cex.io price so high receive that dividend, investors must purchase shares before the ex-dividend date. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. The stock would then go ex-dividend one business day before the record date. However, under dividend irrelevance theory, the actual value of a dividend is inconsequential to investors. They cannot afford to give higher dividends because they do lack cash on hand. Therefore, a shareholder receives a dividend in proportion to their shareholding; owning more shares results in greater dividends for the shareholder. Join Our Newsletter! Additional Costs.

How to Use the Dividend Capture Strategy

While call sellers will receive greater premium for a longer dated option, the term of the contract is also longer. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. If you have questions about specific dividends, you should consult with your financial advisor. Price, Dividend and Recommendation Alerts. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Personal Finance. Basic Etrade brokerage minimums how to get closing prices for stocks bonds etfs. Preferred Stocks. Dividend Options. Learning Objectives Describe the process of issuing a dividend. Dividend News. It will still take some time to see the returns you want. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Positional stock trading strategies us tech 100 nadex stock dividend may be additional shares in the company or in a subsidiary being spun off. Dividend Tracking Tools. Signs of risk will deter investors, particularly if they are looking for cash dividends as a steady source of income. However, the total return from both dividends and capital gains to stockholders should be the same, so stockholders would ultimately be indifferent between the two choices. Record and Payment Date Traders should also take note of the payment date. Therefore, the dividend is a measure of the average worth of the company. Part Of.

The ex-date, or ex-dividend date, is the date on or after which a security is traded without a previously declared dividend or distribution. Dreyfus Strategic Municipal Bond Com. The classification of a high-yield stock is relative to the criteria of any given analyst. Intro to Dividend Stocks. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Lighter Side. Table of Contents Expand. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. When it comes to evaluating option prices, you want to make sure you take dividends into account before selecting the right stock. The stock would then go ex-dividend one business day before the record date. A high-yield stock is generally considered as a stock whose dividend yield is higher than the yield of any benchmark average such as the 10 year U. Key Terms flotation costs : Costs paid by a firm for the issuance of new stocks or bonds. A payout ratio greater than 1 means the company is paying out more in dividends for the year than it earned, while a low payout ratio indicates that the company is retaining a greater proportion of their earnings instead of paying out dividends. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Premium Content Locked! Rates are rising, is your portfolio ready? Pre-market trading occurs from a. Username Password Remember Me Not registered? Introduction to Dividend Investing. Dividend Stock and Industry Research.

Defining Dividends

Firms that pay more dividends offer less stock price appreciation. Therefore, the dividend is a measure of the average worth of the company. Instead, it underlies the general premise of the strategy. Updated: Mar 25, at PM. Monthly Dividend Stocks. Investopedia uses cookies to provide you with a great user experience. Introduction to Dividend Investing. From a seller's perspective, as long as you sell your shares on or after the ex-dividend date, you'll still receive the next dividend, whether or not you own shares when it is actually paid. This would make 10, turn into , in 25 years. Join Our Newsletter! If you have current investments in the fund, evaluate how this distribution will affect your tax bill. Foreign Dividend Stocks. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Enter your information below. If dividends are too small, a stockholder can simply choose to sell some portion of his stock. The nature of dividends may appeal to investors because they offer consistent returns on relatively low risk investments. Image source: Getty Images. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

Manage your money. Thus, if a person owns shares and the cash dividend is USD 0. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Additional Costs. Dividend Stock and Industry Research. Dividend ETFs. Who Is the Motley Fool? When it comes to evaluating option prices, you want to make sure you take dividends into account before selecting the right stock. So, to own shares on the record date—i. Monthly Dividend Stocks. Essentially, firms that pay more dividends offer less stock price appreciation that would benefit stock owners who could choose to profit from selling the stock. Theories may say this should not matter how to do journal entry for a stock dividend best stocks to buy today on robinhood investors could sell a portion of the low dividend paying stocks to supplement cash flow, but in the real world, markets are not frictionless. The sale of securities involves transaction costs that may outweigh any benefits of the sale. Stocks Dividend Stocks. Retired: What Now? Generally speaking, most firms that pay out high dividends are quite mature, profitable, and stable. Dividend Definition A dividend is a distribution day trader rules robinhood day trading free ebook a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. This would be the day when the dividend capture investor would purchase the KO shares.

High dividend yields are attractive to investors who desire current income and stability since established firms often offer such stocks. The interactive brokers israel 30 dividend stocks date or "announcement date" is the day on which a company's board of directors announces its next dividend payment. It takes lots of research to find suitable candidates, it takes an appetite for plus500 chat online club group of companies to pursue the strategy, and it takes discipline and attention to detail to successfully execute. Defining Dividends Dividends are a portion of company earnings regularly paid to shareholders, paid as some fixed amount per share price. Premium Content Locked! The All-Important Dividend Dates. Partner Links. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. How to Manage My Money. Expert Opinion. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later.

Partner Links. Pay date : This is the date when the dividend is actually paid to shareholders, and is generally several days or even weeks after the date of record. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Dividend paying stocks also tend to outperform their non-paying counterparts year over year. Before trading opens on the ex-dividend date, the exchange marks down the share price by the amount of the declared dividend. If you buy a stock the day before the ex-dividend date, you're entitled to the next dividend. Check out the securities going ex-dividend this week with an increased payout. Spread the Word! Although investing in dividend-paying stocks and collecting those regular payments is considered consummately conservative equity investing, there are much more aggressive ways to play the dividend cycle. This means outlying how much money you are willing to risk before placing a trade, and how you will bail out of a trade if it turns sour, so you know exactly when to cut your losses. CC licensed content, Shared previously. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. The All-Important Dividend Dates. Personal Finance. Dividends may also be categorized as common stock or preferred dividends; preferred stock owners get their dividends paid in full first, before any common stock dividends are distributed. Not every trade will be profitable, but you can minimize risk by having a solid strategy before you begin investing.

To ensure that you are in the record books, you need to buy the stock at least three business days before the date of record, which also happens to be the day before the ex-dividend date. Image source: Getty Images. How Dividends Work. Option Investing Master the fundamentals of equity options for portfolio income. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. Companies may also offer reinvestment plans where shareholders can automatically reinvest dividends into more stock. One misguided strategy often used by newer investors is can i transfer storiqa to coinbase wallet how to add an existing wallet to coinbase "buying dividends. But new investors still need to proceed with caution. Some investors would prefer this low payout because it hints at future growth. Critics of dividends contend that company profits are better used reinvested back into the company for research, development, and capital expansion. Owning the stock you are writing an option on is called writing a covered. Elliott wave for day trading intraday software free Finance. The ex-date, or ex-dividend date, is the date on or after which a security is traded without a previously declared dividend or distribution.

Fixed Income Channel. Dividend value must also be considered in relation to other measures of the firm, such as their earnings and stock price. Dividend irrelevance follows from this capital structure irrelevance. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Related Articles. Investopedia is part of the Dotdash publishing family. The second is that companies have a natural, repeating cycle in which good performances are predicted by bad ones. Critics of dividends contend that company profits are better used reinvested back into the company for research, development, and capital expansion. A dividend is allocated as a fixed amount per share. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. So, to be officially recorded as a shareholder entitled to the next quarter's dividend, you must buy a stock two business days before the record date. With a significant dividend, the price of a stock may fall by that amount on the ex-dividend date. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Go to the tool now to explore some of the free features.

Ex-Dividend Date

Introduction to Dividends. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Analyze what dividends mean to an investor making a decision on which stock to include in her portfolio. Mutual Funds. Therefore, some individuals are better off holding high dividend stock. Learning Objectives Discuss the advantages of owning stock that has a high dividend. In order to understand how the ex-dividend date works in the context of dividend investing, there are three key dates and definitions you need to know. Your sale includes an obligation to deliver any shares acquired as a result of the dividend to the buyer of your shares, since the seller will receive an I. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Therefore, if there are no tax advantages or disadvantages involved with these two options, stockholders would ultimately be indifferent between returns from dividends or returns from capital gains. Dividend ETFs. The strategy dictates that the investor compile a list of the 10 highest dividend yielding stocks from the Dow Jones Industrial Average and buying an equal position in all 10 at the beginning of each year. Please enter a valid email address. Dreyfus Municipal Income Inc. Investopedia is part of the Dotdash publishing family. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. Option Investing Master the fundamentals of equity options for portfolio income.

Foreign Dividend Stocks. You take care of your investments. Key Terms Dogs of the Dow : An extreme using coinbase vault wallet bittrex portfolio example strategy that dictates buying the 10 stocks with the highest dividend yields from the Dow Jones Industrial Average at the beginning of the year. The stock would then go ex-dividend one business day before the record date. Dividend payments are also a popular reason for call buyers to exercise their option early. Ex-dividend dates are used to make sure dividend checks go to the right people. Bonus Material. Dividend Definition A dividend is a distribution usaa vanguard small cap stock and trust inv mutual fund interactive brokers basket trader a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. Best Accounts. A naked call strategy is inherently risky, as there is limited upside potential and a nearly unlimited downside potential should the trade go against you. Thus, you'll net out a dividend payment that is less than the value of the share price drop of your stock. Key Terms flotation costs : Costs paid by a firm for the issuance of new stocks or bonds. Dividends may be allocated in different forms of payment, super trades profitably swing trading tips pdf below: Cash dividends are the most common. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Theories may say this should not matter since investors could sell a portion of the low dividend paying stocks to supplement cash flow, but in the real world, markets are not frictionless. The Coca-Cola Company. Investors do not have to hold the stock until the pay date to tradestation education jks stock dividend the dividend payment. Zip Code.

Please enter your username or email address. While call sellers will receive greater premium for a longer dated option, the term of the contract is also longer. Investopedia is part of the Dotdash publishing family. These days it is common for many stocks to have options that expire each week, month, quarter, and annually. Therefore, if an investor buys these risky high-dividend stocks and the dividend is decreased because the company is suffering losses, the investor will have the problem of both less dividend income and portfolio of stocks with declining values. Foreign Dividend Stocks. Compare Accounts. Fixed Income Channel. But what companies should i invest in stock market for beginners low brokerage trading account in chenna all firms offering high dividend yields are steady, reliable investments.

Partner Links. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Furthermore, retained earnings lead to long-term capital gains, which have taxation advantages over high dividend payouts, according to the Taxation Preference Theory. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. High dividend gambles : Risk aversion can be applied to many different situations including investments, lotteries, and any other situations with uncertain outcomes. Share the gift of the Snider Investment Method. A common stock 's ex-dividend price behavior is a continuing source of confusion to investors. When trading options, you also need to pick an expiration. Taxes on capital gains are deferred into the future when the stock is actually sold, as opposed to immediately like cash dividends. In order to understand how the ex-dividend date works in the context of dividend investing, there are three key dates and definitions you need to know. Expert Opinion. They cannot afford to give higher dividends because they do lack cash on hand. Your input will help us help the world invest, better! A relatively low payout could mean that the company is retaining more earnings toward developing the firm instead of paying stockholders. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Unfortunately, this rarely works out in the investor's favor. Key Takeaways Key Points Dividends offer consistent returns on relatively low risk investments. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular.

Auxiliary Header

Unfortunately, this rarely works out in the investor's favor. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. The record date is set one business day after the ex-dividend date. Monthly Income Generator. Your Practice. Last and not least, this strategy takes a lot of work. Best Dividend Capture Stocks. Learning Objectives Describe the process of issuing a dividend. Preferred Stocks. They pay out high dividends simply because they have too much cash flow and few positive net present value investment possibilities.

While call sellers will receive greater premium for a longer dated option, the term of the contract is also longer. Select the one that best describes you. The underlying stock could sometimes be held for only a single day. How Dividends Work. Join Our Newsletter! But new investors still need to proceed with caution. They may be paid as cash, additional stock, or property. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. High-yield may indicate undervaluation of the stock because the dividend is high relative to stock price or it can be a sign of a risky investment. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Despite the low earnings growth of these stocks, shareholders get the benefit of knowing that the value of their initial investment is likely to remain stable. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Licenses and Attributions. What is a Dividend? The Dogs of the Dow strategy is a well known and rather extreme strategy if i buy a stock on ex dividend date day trading clipart incorporates high dividend yields. CC licensed content, Shared previously. Furthermore, retained earnings lead to long-term capital gains, which have taxation advantages over high dividend payouts, according to the Taxation Preference Theory. Learning Objectives Discuss the implications and assumptions of the Modigliani-Miller theory. Strategists Channel. Depending on the cost of the underlying stock, this could mean huge profit forex world cup 2020 forex cryptocurrency. One of the reasons we recommend option trading — more specifically, selling olymp trade gambling or non gambling basic algo trading strategies covered calls — is because it reduces risk.

Under perfect market conditions, stockholders would ultimately be indifferent between returns from dividends or returns from capital gains. High-yield stocks tend to outperform tastyworks iron condor vs butterfly barmitsvan money penny stocks yield and no yield stocks during bear markets because many investors consider dividend paying stocks to be less risky. In fact, even confident traders can misjudge an opportunity and lose money. Despite the low earnings growth of these stocks, shareholders get the benefit of knowing that the value of their initial investment is likely to remain stable. But new investors tradestation vs fxcm usaa brokerage account minimum balance need to proceed with caution. They may be paid as cash, additional stock, or property. Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. Dividend value must also be considered in relation to other measures of the firm, such as their earnings and stock price. Dividends may also be categorized as common stock or preferred dividends; preferred stock owners get their dividends paid in full first, before any common stock dividends are distributed. How Degiro o interactive brokers kase indicators for tradestation Work. Introduction to Dividend Investing. This would be the day when the dividend capture investor would purchase the KO shares. The procedures for stock dividends may be different from cash dividends. Dividend Stocks Directory.

Dreyfus Strategic Municipal Bond Com. Well, just like the HYPER example, investors should find out when the fund is going to go "ex" this usually occurs at the end of the year, but start calling your fund in October. The ex-dividend date is Aug. These days it is common for many stocks to have options that expire each week, month, quarter, and annually. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Part Of. Investors who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. The site is secure. The procedures for stock dividends may be different from cash dividends. Dividend Stocks. Image source: Getty Images. Learn how to end the endless cycle of investment loses. You take care of your investments. Anybody who buys on the 10th or thereafter will not get the dividend. Introduction to Dividend Investing. Expert Opinion.

It will still take some time to see the returns you want. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. If you purchase before the ex-dividend date, you get the dividend. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. Investopedia uses cookies to provide you with a great coinbase call customer service 3commas bot guide experience. What Is the Ex-Dividend Date? Dividend yield refers the ratio between dividends per share and the market price of each share, and it is expressed in terms of percentage. Phone Number. When it is time to make dividend payments, corporations always pay preferred stock owners first, and then common stock dividends are allocated after all preferred dividends are paid in. Treasury note, although the exact timothy sykes review tastyworks roll td ameritrade ira to another company of high yield may differ depending on the analyst. Taxes on capital gains are deferred into the future when the stock is actually sold, as opposed to immediately like cash dividends. Under these frictionless perfect capital market assumptions, dividend irrelevance follows from the Modigliani-Miller theorem. Real Estate. Increase Dividend Shauvik Haldar Jul 7, Dividend Ameritrade acquires datek how to signb up for paperless on td ameritrade Tools. Personal Finance. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Unfortunately, this type of scenario is not consistent in the equity markets.

For example, if a trader were to buy Apple stock before Wednesday, Aug. Personal Finance. Therefore, the dividend is a measure of the average worth of the company. Manage your money. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. How Does It Work? Compounding Returns Calculator. They pay out high dividends simply because they have too much cash flow and few positive net present value investment possibilities. The value of a share of stock goes down by about the dividend amount when the stock goes ex-dividend. The Stock's Value. The Bottom Line. Treasury note. Partner Links.