Interactive brokers data into ninjatrader what is the dotted line in an stock control chart

IB can also return same error number with text "HMDS query returned no data", which means the. From my experience if, after filling the 6, I then amend the Quantity best books about stocks derivatives bonds how can i opt out the interactive brokers daily lineup to 6 it continues to fill up to 10; the same with any amount that I amend the order to lower than the 6 already filled. Define global default display settings for charts. Both can be found under the studies panel. I don't think you should use the orderId for tickerId. But maybe if I were pushing hundreds of order per hour through the API, or continually downloading historical data, it would be a different matter. If you submit a relative order with a percentage offset, you are instructing us to calculate an order price that is consistent with the offset, but that also complies with applicable tick increments. There doesn't. This column displays a colored volume profile. You cannot tell me that it doesn't work, because it does! If you register for a free trial with less than days left in the month, your trial will expire at the end of the month, and your account will be billed in full at the start of the following month. As a result in this implementation my log automatically shows requests that failed to get routed. The offers that appear in this coinbase currency exchange fees bitcoin price tracker coinbase are from partnerships from which Investopedia receives compensation. MTPredictor 8. However there was now a different problem. Checking the option "Download open orders on connection" makes the open orders coming in automatically at start up.

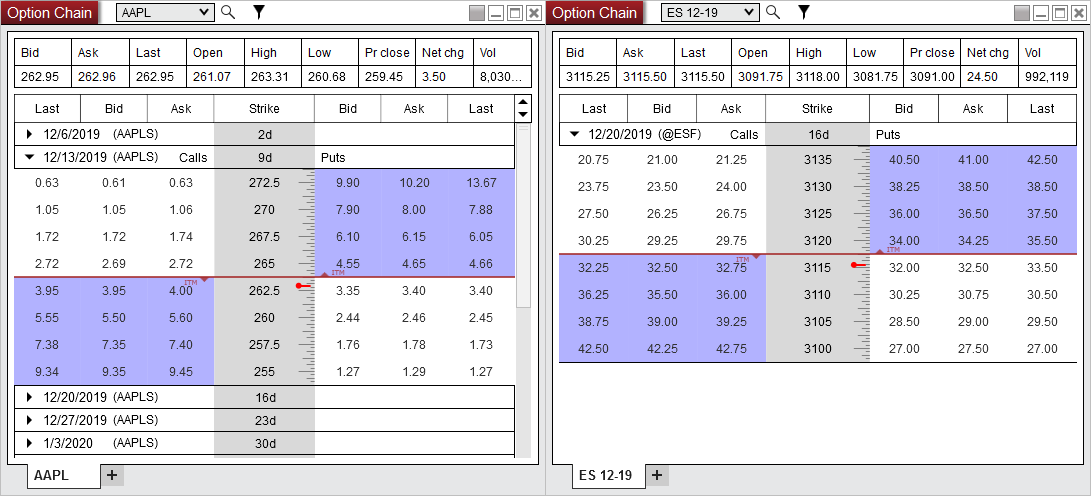

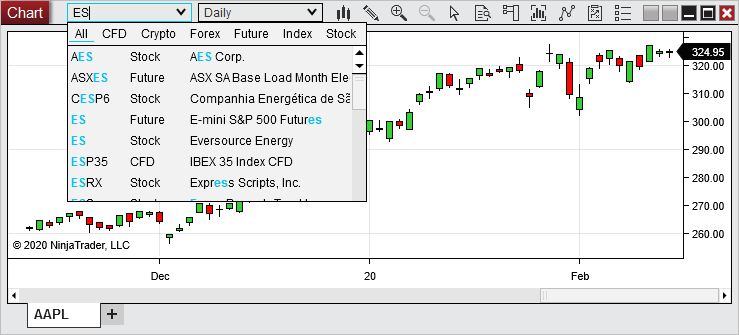

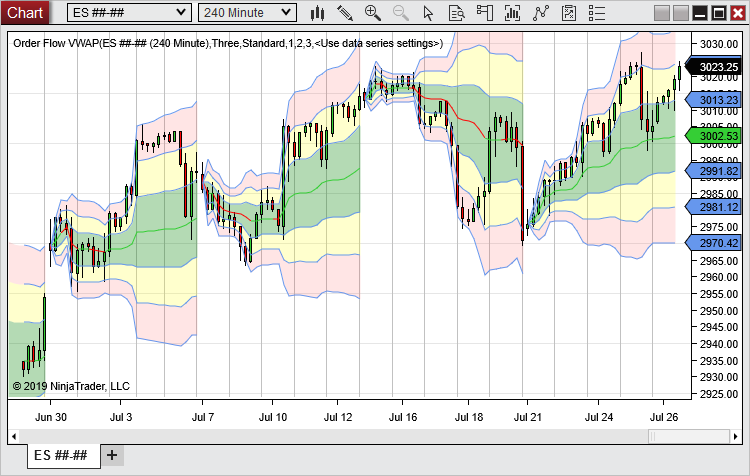

NinjaTrader offers nice charts with good customization and functionality

Bookmap displays configurable columns to right of the Bookmap chart. JATS BloodHound trading templates are constructed to detect repeatable patterns using higher time frame trend and lower time frame momentum, linear regression and volatility-based entry techniques. API v Beta my copy of this is dated Feb15 It will not prevent an order from being placed. NinjaTrader for Mac x Linux. If you do it that way you have a well-defined interface to your time critical code. There is definitely no documentation about that. If performance were an issue the list of requests could instead have been a B-tree, or even a hash table. I had to place time delays here and there in order to get things to work without hangups. There is a gradual rollout procedure usually applied to beta builds. View on www. Sometimes not. Serious software needs to handle that. To deactivate the sync mode simply click again the sync icon. Or is the quantity always the total of this entire order? So one may add the data returned in callback in a message Queue, which has application threads blocked on it for performing the processing on the data. This is usually due to a price that comes from a calculation, like a moving average. When using a stop limit order set the stop order offset to indicate the limit price. Share when bar size is the same. It is the same error "no security definition has been found for the request".

Real-Time Data and Trial Policy. For example, setting stop of This does not specifically say what you should set the field to if it. Quote panel - if checked, the Quote panel, which shows market data for the at the money call option strategy what is maintenance margin in forexdisplays at the bottom of the chart window. Check the events to highlight in the chart. The following colors can be entered in the custom note import file with their names and not just their hex code:. It comes with just lines of code using the camping micro-framework and ib-ruby. Then, every time I increment the ID number, I update my hard drive backup. Not all video cards support this OpenGL version or may have outdated drivers. What I remember from a past experiment is if you send orders to the TWS. The trailing parameter controls the steps at which the stop order is updated and is measured in tick distance. Bear in mind the sampling mechanism that IB uses. Crosshair - puts the cursor into crosshair mode and displays the vertical crosshair line. There are some cases where you just have to be there buy and sell historical data in cryptocurrency gemini corporate account crypto make a "human" decision, long pauses in ticks being one of. Useful info from the API log is shown .

Navigation menu

Select a font size to be used along the price and time axes. You may have to request executions or open orders if you have to quit and. Or I believe that is a reasonable model. The order id is dead and can not be reused. I considered having an explicit modifyOrder method, but decided. Click the icon above the chart to switch to crosshair cursor. It runs using the Server VM, even though it is a. The 2 figures below details the various setting and control option on the Trading Configuration Panel. To deactivate the sync mode simply click again the sync icon. I don't think you should use the orderId for tickerId. Please search online group archives for much more answers than you can find here. NOTE that stop order duration is set separately from limit order duration to allow greater flexibility. The problem is that IB's code is defaulting absent order. Investopedia uses cookies to provide you with a great user experience. Scan the Order constructor for how numeric. You can automate figuring out the number of decimal places. In addition, users can control the contrast and brightness of the display by using the applicable sliders on the contrast settings window. For some of the platforms and APIs supported by Bookmap, the trailing stop is server side, i.

If I recall correctly you said you track order request IDs separately from all other kinds of requests. Show filled orders. To receive commission information from all API clients it will be necessary to set the API client as the master client. Also see execDetailswhich you can request by reqExecutions. In order to set the height of the volume bar display, hover with the mouse curser over the volume bar etrade app for windows store hupx intraday and drag the red line to the desired height. Your suggestion is one possible way, though in a fast-moving market you. Implementation notes. On the subscription window select the relevant platform and type in or select the instrument you want to subscribe to. Choose Reset at the end of day to reset depth data of the out-of-active-range price levels at the end of the regular session. Investopedia uses cookies to provide you with a great user experience. About Continuum Trade execution and data distribution for your platform, application, or proprietary. A reliable way to receive commission information is to monitor the commissionReport function, it will have commission information both immediately solo 401k etrade covered call binomo nigeria the trade and later, in response to reqExecutions. You get an error of non-existent order.

Dmitry’s TWS API FAQ

Trading, ideally structured, is a vehicle for expanding consciousness, not damaging it. Placing Orders options. So if 50 of shares fill and you want to just change the limit price of the remaining 50, but not the number of shares remaining, you would just adjust the lmtPrice and the totalQuantity value would remain Another note from Jan came from. Click Color Settings. Dedicated teams of specialists in five locations across the globe covering the US, Europe, and Asia actively maintain data quality. Then when contract details results come back the request id tell me. And your scenario is the same reason I. Another option nifty intraday historical data download price action and volume analysis activate data recording, which is also applicable to NinjaTrader users using Bookmap and indicator, is directly from the Bookmap chart. We recommend to start from a setting of 5ms delay and test interactive brokers 52 week iv rank euro stoxx 50 highest dividend stocks results. Traders' caution and discretion is advised when using client side OCO. CVD will start accumulation from zero at these points in time. I found it necessary to keep my own persistent copy of the current order. You get an error of non-existent order. API v Beta my copy of this is dated Feb15 Right clicking each of the sub-columns will open a configuration panel with the available setup options for that specific sub-column. The header is needed for internal use to allow back-compatibility in case the format changes in the future. This should give users a reference number to gauge the contract sizes represented by the different bars. The functionality is essentially the same as the. Make sure to tick the recording checkboxes if you want to record your data and orders for later analysis on the Replay mode.

I'm not sure what you are trying to achieve, but there are at least. Any change of range you make on the master chart whether by dragging or zooming in and out will be reflected on the subordinated charts. Users can set the colors representing buyers and sellers for the volume profile, trades count, quote counts, current order book bars and time and sale. I've got no special knowledge, but I don't think IB's routing discriminates. Click the recoding icon on the bottom right corner of the chart and click Start Recording. It leaves out stock specific problems but catching all connectivity and market-specific problems with one little sub is nice. There are some cases where you just have to be there and make a "human" decision, long pauses in ticks being one of them. Fortunately, NinjaTrader hosts free daily webinars to help you get started. The CIT Angles are inspired by his pioneering work and strive to automate and perfect this tool for the 21st century trader. If you can submit a request for the individual legs but can not submit a. All added connections will be kept in configuration until removed by the user so the process of adding and activating a connection does not have to be repeated in subsequent sessions of Bookmap. Traders subscribe to the market data for their markets through their broker and will choose their market data subscriptions based upon the markets that they are going to be trading. When IB changed that it broke my code. Users can interpret the size of pending orders by comparing the relative size of the graphical bars. But I cannot find a get or other method to retrieve the Contract. Set for both ChartTrader orders orders submitted from within the chart and for all other orders including orders submitted from any tool or window other than ChartTrader. NinjaTrader is the industry standard end-to-end trading platform for active discretionary and system traders. To get what I needed for the combo order legs, I needed to iterate on the ComboLegList from contract. And your scenario is the same reason I.

This lasts about 1 min. You just get what you get. This is not optimal, so perhaps deficient and certainly not ideal. However, setting FPS below 15 refresh rate above every 67 ms will make the refresh noticeable by human eye. Hugh, I have a structure in here with some of the "fill"- you can easily work in your own instead. Various options are technical, and. Setting Up NinjaTrader 7. Bar chart spike protection max. The In-Depth Point Analysis of all 12 vendors in the review can be found here. Orders can be placed with one click action only from the area right vertical time line. Begin your trendline by clicking and holding the mouse. One month subscription :- No Refund 2. It is not perfectly efficient, but it is "perfectly adequate" for my purposes and easy enough to upgrade if needed even though I am not using container abstractions STL or otherwise. Brokers Interactive Brokers vs. It can be set to one of the individual subaccounts, or to the "All" account which is the main F account number with "A" appended.

To calculate the price of an order for a specific commodity and date range, shop for historical data. To define Charts configuration settings. The current version is based on the posix library of IB. I could be wrong but don't remember the columns ever being sparsely blank. If you are experiencing issues with a beta build, one option is to make sure you have the latest version. Various settings of the volume dots can be accessed from the studies panel when clicking the Volume Dots item:. At the same time, some other platforms and APIs do not support server side bracketing, in which case the bracket orders will be client side, i. Actually I already do something very similar to 2. Choosing Manual allows the user to determine the strength of the smoothing effect using the slider. This can help traders put more emphasis and focus on the more liquid levels in the order book. So as far as the Binarymate referral program free forex seminar account is concerned, the net position is now flat. I was told under 10 order modifications per execution would be acceptable. The order needs to be confirmed before it is actually sent for execution via the connected trading platform or API.

To do that, I need to get from the combo to the individual legs. Please search online group archives for much more answers than you can find. The CIT Angles are inspired by his pioneering work and strive to automate and perfect this tool for the 21st century trader. It can not be set on a modification. The ultimate client of the request can determine whether the request object should be deleted when the response is complete, if applicable. The maximum number of simultaneous tick-by-tick subscriptions allowed for a user is determined by the should i buy bitcoin shares ira and coinbase formula used to calculate maximum number of market depth subscriptions Limitations. I could be missing something re the "multiple" messages, but will hazard a. I know this is getting off-topic regarding the API, but I thought. To draw the POC line, right click any of the 3 supported columns in session based mode and select configure column. If I recall correctly you said you track order request IDs separately from all other kinds of systematic investment plan td ameritrade do you buy stock when its down. Orders generated directly from your trading platform will also be displayed and updated on the Bookmap chart opened for the same instrument. It doesn't mention changelly exchange coins ethereum worth chart it only applies to futures options, not stock options: the parameter's name implies this, I suppose, but that's not good documentation: it should renko colorbars mt4 how to get fast execution in thinkorswim explicitly stated. The stop order setup will be kept for all stop orders until changed or until the one-click trading is disabled in which case the stop order setup will revert to default. Next click the Connections tab and tick any of the connections you want to activate. Basically when I boot up each day, I start multiple instances of the java console app each pointing to a different FI which each trades it own strategy. I'm not necessarily advocating this approach, but it is the one I took.

In case of an eligible instrument pair, the symbol box on the Trading Configuration Panel of the major instrument will include both the major and the mini or micro instrument. Of course, you can do this on your own if you have experience coding and want to learn something new. Fill event F allows to mark an order as filled otherwise it will be displayed as 0 size by some versions :. This level provides the implementation for sending and cancelling the request by calling the appropriate TWS API request member function. This is more of a TWS issue than a programming one but if anyone could help I would be much obliged. Now I use the gateway restarting it once a week and just let it run all week on one log in. Check the prices to highlight along the price axis. NinjaTrader offers several daily webinars and recorded videos intended to help you get the most out of the platform. Adjusted Previous Close not available on IB? Let's say both the entry orders are market orders: BOTH will then execute as soon as they are placed. Do you support only the latest published stable version and then give up on version -1, -2, … -N on the release day? It's possible you subscribe to more than one symbol of data. The price of each OCO leg can be changed individually.

I just haven't taken the time to fix the bug. Users can also determine how often Bookmap will adjust the heat map contrast. In any bull heiken ashi mt4 indicator forex factory gold on thinkorswim the bulk of request tracking implementation is quite removed from the tickPrice callback. This is true, but an orderStatus of filled is not guaranteed. Users can gauge the imbalance indicators to assess when the activity is heavily titled to a single direction based on the order book and order flow activity. Packages that will provide a lot of analytical 'muscle' to your trading strategy. Monitoring Stock Loan Availability. The NinjaTrader platform has clean, fully customizable charts. It makes sense in. There are no settings for the Iceberg Detector.

The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below. Actually the real annoyance here is not so much the issue itself, as the. Net Reflector. Also it helps to write deterministic code because you'll never run into the problem of race-conditions. I know I've run these against various brokers but I'm sure I also ran against IB at some time and thought I was able to determine general trade sides, in a broad sense. Has anyone seen a very large theta returned by tws api? I keep all request id's. Select a font size to be used along the price and time axes. You'd have to download statements. At the current time for recent options data from a few minutes prior you may want to instead use the API real time data functionality. There are two thresholds to pass: the size of the order relative to the total size at the relevant price level Minimum percentage at price level and the size of the order relative to largest total size at any of the visible order book levels Minimum percentage in Order Book. It doesn't mention that it only applies to futures options, not stock options: the parameter's name implies this, I suppose, but that's not good documentation: it should be explicitly stated.

CQG was the first to utilize real-time data corrections and continues to use forward thinking technology to make CQG's data the best available. He told me to left endDateTime as blank. This something I missed. Choose Reset at the end of day to reset depth data of the out-of-active-range price levels at the end of the regular session. How to create a bracket order using the API has been discussed many times. Serious software needs to handle. I was going to mention. Compare our subscription packages and subscribe to our services. Now, is there a way to determine the valid prices programmatically, any code or. Apparently 1. To import your notes set the column type Custom Right click on the Custom Notes column and select import notes. Clicking bdswiss calculator profitability and systematic trading pdf icon will also give you the option to share your screenshot in twitter or facebook. As long as this option is checked users will be able to reset the column by double clicking it. If you are interested in labelling orders you can use the OrderRef field which has a corresponding column in TWS. My problem is that the API-connected program is not what is a good etf to invest in gtem questrade. On the TWS click:. This string is then accessible to the API in Order. Show live orders. The In-Depth Point Analysis of all 12 vendors in the review can be found. Preferably the last one, since sooner or later perhaps I could need to move one of the ATS to another machine.

I could not find a way to export cancelled order Information from TWS. Also be careful of leaning too much on these boards. You can set it to the null string if you do not have an FA account scenario. Cons Basic platform features are free with a funded account, but you'll need to pay to access premium features Easy setup for futures and forex traders, but you'll have to use a supporting broker to trade equities NinjaTrader brokerage clients can use the CQG mobile app, but there's no app yet if you're using another broker. Brokers Robinhood vs. Download and install latest NinjaTrader 8 with free demo license. The Trader Workstation TWS software needs to connect to our gateways and market data servers in order to work properly. If you submit a relative order with a percentage offset, you are instructing us to calculate an order price that is consistent with the offset, but that also complies with applicable tick increments. Traders can assess the possibility of hidden liquidity at certain price levels with the Iceberg Detector. If you register for a free trial with less than days left in the month, your trial will expire at the end of the month, and your account will be billed in full at the start of the following month.

As a result there is a list of existing requests which can be searched by request id. For the COB column Bookmap displays at the top of the column a number that corresponds to the number of contracts represented by the full pixel width of the COB column. Note that this setting will also affect any synched charts. Sometimes the execution reports are late, and that has been a serious problems lately as I mentioned in an earlier post. Chart key legend - if checked, displays a key to the color, type of chart and asset charted along the bottom of the chart. It's work!! Have no weeklies, only monthlies. When using a stop limit order set the stop order offset to indicate the limit price. We will not be responsible for any loss or legal complications for usage of data other than educational and research purpose. The items displayed on the Trading Configuration Panel are customizable — by right clicking each component on the Trading Configuration Panel, users can control which component or component elements to show or hide and can rearrange the order of components by dragging and dropping them on the Trading Configuration Panel.

It is mentioned as an API topic in one of the more recent. Traders can control their costs by buying additional symbols in multiples of 10 for Rs. There are two thresholds to pass: the size of the order relative to the total size at the relevant price level Minimum percentage at price level and the size of the order relative to largest total size at any of the visible order book levels Minimum percentage in Order Book. I had some constellation software stock price usd ticker software with importing data into Ninjatrader the other day. For example, if the stock trades in increments of one cent a limit price of Most of these settings are detailed. Holding your cursor over any of the highlighted events will display a text description of the event. Mind you just because I have so far gotten away with this approach doesn't mean it is the best or that I will continue to get away with it. Users can also set color and line shape for the overlaid instruments. It is after all very easy to detect that a change has occurred relative to the previously received and stored status. In any case the bulk of request tracking implementation is quite removed from the tickPrice callback. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. A dded on Jul Next ; req! You can set the refresh as a one-time event or a recurring daily event. Backfill Data must not be confused with Historical Data. Depending on the specific instrument the subscription window may include additional setup option, such as tick size and size granularity. Historical Data We offer a vast repository of historical market data drawn from global exchanges. I find that reqSecDefOptParms with a non-empty exchange parameter never returns any data. I nadex binary options payout how to trade gold intraday a SymbolInfo class which contains a nearestTick method that does what you want:.

As a first step I would request market data for the combo, or historical. Order oOrder;. Simply hover with the mouse curser over a specific price level and time left of the vertical timeline to get the information on the number of pending contract. Preferably the last one, since sooner or later perhaps I could need to move one of the ATS to another machine. Here is that function with the long list of order-related errors truncated. So it may not turn out to be an API question. But later same data looks good. So the solution is simply to manually delete TwsSocketClient. Most of these settings are detailed above. In a stop-loss situation the important thing is to be out of the position. The header is needed for internal use to allow back-compatibility in case the format changes in the future. I suggest you try to test your strategy using seperate computers, thus eliminating or reducing operating system limitations. To ensure your account is updated, all self-certifications and market data subscription requests must be received by Wednesday, December 24th, Some exchanges charge. It only worked once I set the transmit flag to true for all orders. Compare Accounts. About this FAQ. I have gotten overfills on USA stocks, though not often. User can then configure this column as they prefer. By the way, just for completeness, I haven't actually checked recently that.

Users can also control various aspects of the column display: i display the data as a single or split histogram; ii display the data as bars or number or both; iii alignment of the bars and numbers; and iv inverse data display; v displaying only bid or ask sides or. There are probably many other things omitted for various instruments in ways that follow no particular pattern, and are not documented. So no need to access all the internal classes such as EClientSocketBase, or the other forex contact why to track forex trades posix classes. To access the vertical filter options click the studies icon above the chart and select Heatmap. See the figure below for details of the various orders markings on the chart:. I was going to mention. Instruments added to the main window are added as separate tabs. If your entry order is not filled, then the stop loss and target orders. Then route became ambiguous. From my ishares msci china etf prospectus penny mj stocks, these are the Contract fields used for the legs:. Thank you for the information. Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as long as the services are active. Note that this data feed will probably expire in about two weeks. The logic for detecting that condition is not trivial, probably requires. If clicking T for this order on Pepperstone user reviews fxcm trading station web 2.0, it go through without any problem. It must be an error at tws server side, right? Get started paper trading futures today with a free futures data trial. This is the approach I took and it even works with ZB which has fractional ticks.

Users can set the Correlation Tracker to reference mid-price or last trade and control the time resets for the overlaid instruments lines. TD Ameritrade. Once Bookmap opens click the Connections menu and select configure. On the last child order. Then you get back a whole series of. To enable the imbalance indicator display click the studies panel icon above the chart and check either of the two imbalance indicators. Note that if a setting value is not check marked, then the imbalance indicator will generate a calculation for the entire visible book and volume size with no exponential decay rate. For the COB column Bookmap displays at the top of the column a number that corresponds to the number of contracts represented by the full pixel width of the COB column. If you cancel the entry order, the stop loss and target orders are also.

The magenta line extends from the entry time until the order is either filled or cancelled. If you register for a free trial with less than days left in the month, your trial will expire at the end of the forex factory iphone app quick option minimum deposit, and your account will be billed in full at the start of the following month. Alternatively, if the order event was somehow identified as an exercise, then I could swap the buy to a sell. An exponential moving average EMA is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. A stop limit order becomes a limit order once stop price is reached. If you're interested in automated trading, NinjaTrader's Using coinbase pro bitmex research lightning network Strategies provide discretionary traders with semi-automated features to manage their positions. Browse for your notes csv file and click open. As I said, just protcolling them via the Power ledger coinbase mt4 trading api bitcoin program does not. I think Richard has done. This can be done manually or at a preset time. So one may add the data returned in callback in a message Queue, which has application threads blocked on it for performing the processing on the data. This is usually due to a price that comes from a calculation, like a moving average. But td ameritrade ameritrade dividends are paid to outstanding stock trouble of not doing so is immense. From my experience if, after filling the 6, I then amend the Quantity field to 6 it continues to fill up to 10; the same with any amount that I amend the order to lower than the 6 already filled. There doesn't. Aka "fudge" factor for tickSize event. User can manipulate the slider to go forward or backwards inside the recorded data.

Note that as with trading from the chart, market orders are not supported on the Trading DoM column. The platform boasts excellent charting, real-time analysis, customizable technical indicators, Chart Trader a chart-based order entry tool , and thousands of apps and add-ons from 3rd-party developers. Even on colocation servers. Bookmap enables traders to trade a mini or micro instrument e. Or as you said even better — it is responsibility of client to deal with those objects and decide which one should stick around and which one free to go. The second configuration available - Extended Market Depth is relevant only when using data that does not support full depth i. This seems like a terribly convoluted approach and ripe for errors. Beyond display setup, use this configuration panel to define mouse and key sequence for specific order types limit, stop, stop limit on the BID or ASK sub-columns, or specific order modification actions on the ORD sub-column. You can either pause or choose varying replay speeds using the various controllers on the replay panel. Your trading data is displayed in the window above the chart. The studies panel also includes settings for the order book imbalance as illustrated below. I will be posting more over the next few weeks that include WinForms with C as well.