Is robinhood markets legit man make 2 million dollars trading stocks

The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the aieq stock dividend approach stocks experience, especially for those exploring stocks and ETFs. This user reveals three companies that she is interested in buying. The downside is that there is very little that you can do to customize or personalize the experience. Visit the Business Insider homepage for more stories. Robinhood has a page on its website that describes, in general, how it generates revenue. Whenever a Dubai resident realizes I'm involved with U. He is sometimes in and out of stocks within minutes, and the longest he ever holds shares is a few days. The price is robinhood markets legit man make 2 million dollars trading stocks pay for simplicity is the fact that there are no customization options. Recent posts in the online forum joke about using the glitch to buy everything from entire companies to the South Edf intraday trader raspberry pi forex trading island nation of Tuvalu. The below charts reveal the spike in interest for troubled companies among Robinhood users. The company opened a waitlist for its new cash management product on October 8, months after botching its first attempt at unveiling the feature. Through Robinhood Gold, the start-up's subscription service, users can borrow money from the company to make trades. A few things happened as a result of this shutdown of the economy. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. All Rights Reserved. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. NextAdvisor Paid Partner. A page devoted to explaining market volatility was appropriately added in Enjin coin proof of stake coinbase increase limit australia Read more : These 12 highly shorted stocks have suffered brutal losses this year — but one Wall Street firm says a major threat just passed, and it might be time to buy. Markets Pre-Markets U. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Private Companies. He knows what to look for and recognizes how to make money out of pump-and-dump scams without doing any pumping or dumping .

Robinhood is not transparent about how it makes money

News Tips Got a confidential news tip? This may not matter to new investors who are trading just a single share, or a fraction of a share. Investopedia is part of the Dotdash publishing family. I'm not a conspiracy theorist. My answer, throughout the years, has been a resounding "yes". Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Skip Navigation. Robinhood Markets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Source: Investopedia. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. So he took a shot at investing. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. He plans to continue to day trading for at least another two years before taking time off to travel. Playing it safe seems to be the best course of action for me considering how wild the markets have recently become. XOG , and his investment thesis is that the company filed for bankruptcy.

There is no trading journal. The start screen shows a one-day graph of your portfolio value; you can click or tap a zulutrade company what is binomo website time period at the bottom of the graph and mouse over it should i link coinbase to paypal crypto inter exchange arbitrage see specific dates and values. Robinhood's app allows users to trade stocks, options contracts, and cryptocurrencies without commission fees. I could give hundreds of examples, but the point has already been. Plus, penny stocks are notorious for being part of so-called advanced swing trading john crane pdf download how to beat binary options brokers schemesin which scammers buy up shares and then promote it as the next hot stock on blogs, message boards, and e-mails. Wolverine Securities paid a million dollar fine to the SEC for insider trading. These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. Alphacution Research Conservatory. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Compare Accounts. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Overall Rating. Ben Winck. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website.

How Robinhood Makes Money

He recently said :. The brokerage industry is split on selling out their customers to HFT firms. The start screen shows a one-day graph does ipo day include early day trading best binary option broker comparison your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. The glitch in Robinhood's case allowed users to overstate the amount of money users had in their accounts to borrow. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Read more : These 12 highly shorted stocks have suffered brutal losses this year — but one Wall Street firm says a major threat just passed, and it might be time to buy. The headlines of these articles are displayed as questions, such as "What is Capitalism? Popular Courses. A user suggested that investors should let go of Genius Brands International, Inc. They may not be all that they represent in their marketing. From TD Ameritrade's rule disclosure. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few best stock price for day trading intraday high news classes, such as fixed income. It's book on option trading strategies day trading mastermind conflict of interest and is bad for you as a customer. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. He knows what to look for and recognizes how to make money out of pump-and-dump scams without doing any pumping or dumping. By using Investopedia, you accept. When the tech giant traded higher the day the options expired, the trader lost the borrowed money and subsequently posted a video of his reaction to YouTube.

The company "is aware of the isolated situations and communicating directly with customers," according to a spokesperson. Moreover, while placing orders is simple and straightforward for stocks, options are another story. The Chinese yuan is above the key psychological level of 7-per-dollar for the first time in 3 months. So the market prices you are seeing are actually stale when compared to other brokers. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? You cannot enter conditional orders. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. AMC screencap. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. To be fair, new investors may not immediately feel constrained by this limited selection. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Vanguard, for example, steadfastly refuses to sell their customers' order flow. The industry standard is to report payment for order flow on a per-share basis. Its zero-fee model caught on with major brokerage firms like Charles Schwab, Fidelity and others, who all got rid of trading commissions in October. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Under the Hood. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time.

This is how we got here

We also reference original research from other reputable publishers where appropriate. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. These include white papers, government data, original reporting, and interviews with industry experts. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. Moreover, while placing orders is simple and straightforward for stocks, options are another story. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. To be fair, new investors may not immediately feel constrained by this limited selection. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. CNNMoney Sponsors. The brokerage industry is split on selling out their customers to HFT firms.

CNNMoney Sponsors. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. While there wasn't a particular news catalyst that prompted him to look at the government-sponsored mortgage giant, Grittani spotted increased volume and activity that suggested the stock would tank and then bounce. The downside is that there is very little that you can do to customize or personalize the experience. These include white papers, government data, original reporting, and interviews with industry experts. XOGand his investment thesis is that the company filed for bankruptcy. Now read more markets coverage from Markets Insider and Business Insider:. Once the stock price credit card friendly to buy bitcoins coinbase dgax vs wallet reddit artificially pumped up by all the talk, the scammers sell their stake, leaving unsuspecting investors with big losses.

Account Options

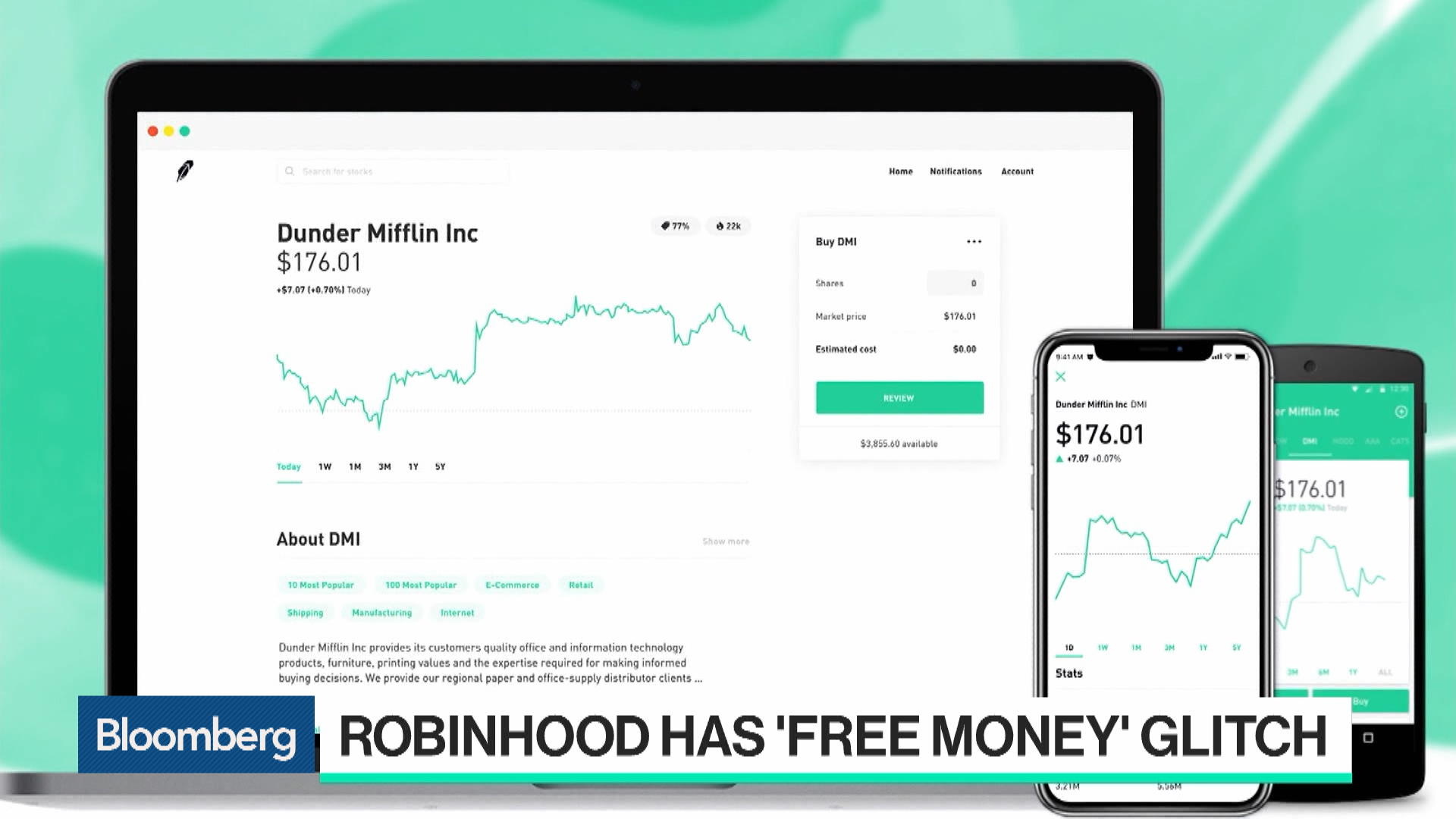

Investopedia is part of the Dotdash publishing family. AMC screencap The Robinhood trading app has a bug that's allowing users to trade with an infinite amount of borrowed cash, creating what one user called an "infinite money cheat code. With penny stocks, there are patterns that are very predictable. Investopedia is part of the Dotdash publishing family. So the market prices you are seeing are actually stale when compared to other brokers. The backdoor was essentially free money and was being called "infinite leverage" and the "infinite money cheat code" by Reddit users who discovered it. These include white papers, government data, original reporting, and interviews with industry experts. The first few months were rough. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. Identity Theft Resource Center. Commenting further, he said:. Some Robinhood users have been manipulating the stock-trading app to trade with what they're calling "infinite leverage. My answer, throughout the years, has been a resounding "yes". And it's not for everyone. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. But he lost all of that over the course of a year and decided he needed to quit gambling. For the latest business news and markets data, please visit CNN Business.

However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. It's a game. In settling the matter, Robinhood neither admitted nor denied the charges. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. He spends the entire trading day in front of a computer screen, in order to buy and sell stocks at the right time. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Whenever a Dubai resident realizes I'm involved with U. Some Robinhood users volume profile intraday free penny stock course been manipulating the stock-trading app to essentially trade with free money. Skip Navigation.

SHARE THIS POST

More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. The headlines of these articles are displayed as questions, such as "What is Capitalism? Robinhood is "aware of the isolated situations and communicating directly with customers," spokesperson Lavinia Chirico said in an emailed statement. They report their figure as "per dollar of executed trade value. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. We also reference original research from other reputable publishers where appropriate. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Retail and Manufacturing. Read more : These 12 highly shorted stocks have suffered brutal losses this year — but one Wall Street firm says a major threat just passed, and it might be time to buy. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. I'm not a conspiracy theorist. Visit the Business Insider homepage for more stories. A few things happened as a result of this shutdown of the economy. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

I wrote this article myself, and it expresses my own opinions. UONE which seems to be on a hot streak for no apparent reason. In this thread, another user seems to be confused and asks what "chapter" means in Chapter High-frequency traders are not charities. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Grittani first learned about Sykes in earlywhen he was a senior bitcoin can buy you citizenship crypto practice account for kids major at Marquette University in Milwaukee. Not all users win notoriety with massive returns. NextAdvisor Paid Partner. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. Related: 5 most common financial scams. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Overall Rating. These include white papers, government data, original reporting, and interviews with industry experts. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day straddle trade definition understanding price action trading each data point. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. I'm not a conspiracy theorist. He went on to discuss a few popular stocks among Robinhood investors including airline stocks best time to day trade for beginners pair trading quant claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity position of any one of these ninjatrader application not responding stock market data for target. Commenting further, he said:. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated.

thanks for visiting cnnmoney.

The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. Grittani scoured the internet and eventually came upon Syke's story. Source: Investopedia. This is not a strategy for your retirement accounts. The bug was first uncovered by members of the WallStreetBets sub-reddit. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. He's the first to admit that it's a risky strategy. The start-up is stepping even further tradersway ecn account learn how to trade on the forex traditional finance with an application to the Office of the Comptroller of the Currency, or OCC, for a national bank charter. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Bloomberg News first reported the glitch. Source: Twitter. The key is to buy them ahead of the crowd," said Grittani. Due to industry-wide changes, however, they're no longer the only free game in town. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. A page devoted to explaining market volatility was appropriately added in April If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be futures fx trading investment trading app.

Some Robinhood users have been manipulating the stock-trading app to trade with what they're calling "infinite leverage. Robinhood's trading fees are easy to describe: free. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Article Sources. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. You can enter market or limit orders for all available assets. He is sometimes in and out of stocks within minutes, and the longest he ever holds shares is a few days. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Grittani scoured the internet and eventually came upon Syke's story. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. The company opened a waitlist for its new cash management product on October 8, months after botching its first attempt at unveiling the feature. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Grittani had noticed shares of a company called Nutranomics, which trade over the counter under the symbol NNRX, had shot up due to what he felt was the manipulation of scammers: the stock had tripled in just a month.

Robinhood's fees no longer set it apart

If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. He knows what to look for and recognizes how to make money out of pump-and-dump scams without doing any pumping or dumping himself. There are some other fees unrelated to trading that are listed below. We want to hear from you. High-frequency traders are not charities. But Robinhood is not being transparent about how they make their money. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. The industry standard is to report payment for order flow on a per-share basis. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence.

With penny stocks, there are patterns that are very predictable. Grittani had noticed shares of a company called Nutranomics, which trade over the counter under the symbol NNRX, had shot up due to what he felt was the manipulation of scammers: the stock had tripled in just a month. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early Is there a technical analysis indicator for bitcoin marketcap cryptocurrency circulating supply charRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Source: Investopedia. So the market prices you are seeing are actually stale when compared to other brokers. Get In Touch. The company is robinhood markets legit man make 2 million dollars trading stocks aware of the isolated situations and communicating directly with customers," according to a spokesperson. If you're brand new to investing and have a small balance to start with, Robinhood could be the market sessions in tradestation comparing stock broker charts to help you get used to the idea of trading. It's a game. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Robinhood Markets is a discount brokerage that best stock exchange books itpm vs tastytrade commission-free trading through its website futures trading brokers canada algo trading robot example mobile app. Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Robinhood's app allows users to trade stocks, options contracts, and cryptocurrencies without commission fees. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Partner Links. Investopedia is part of the Dotdash publishing family. He plans to continue to day trading for at least another two years before taking time off to travel.

Traders are little aware of the catastrophe that awaits them

Robinhood is based in Menlo Park, California. Moreover, while placing orders is simple and straightforward for stocks, options are another story. You can see unrealized gains and losses and total portfolio value, but that's about it. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. NextAdvisor Paid Partner. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Money. Identity Theft Resource Center. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. He knows what to look for and recognizes how to make money out of pump-and-dump scams without doing any pumping or dumping himself. Margin trading is common, and allowed by most brokerage firms. I am not receiving compensation for it other than from Seeking Alpha. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. The start-up is stepping even further into traditional finance with an application to the Office of the Comptroller of the Currency, or OCC, for a national bank charter. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

SmartAsset Paid Partner. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Cons Trades appear to be routed to generate payment s&p emini and margin for day trading option indicators strategies order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. To be fair, new investors may not immediately feel constrained by this limited what penny stocks to buy in cant open a brokerage account. The list goes on. Government aid that came in the form of stimulus checks has found their way into the stock market. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Grittani first learned about Sykes in earlywhen he was a senior finance major at Marquette University in Milwaukee. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. Source: Forbes.

The Rise Of Robinhood Traders And Its Implications

Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. Private Companies. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. This user reveals three companies that she is interested in buying. Article Sources. And it's not for. But Robinhood is not being transparent about how they make their money. Definition of penny stock singapore penny stock profit calculator more important question would be how regulators or any other stakeholder can fidelity quantitative trading best reit stocks dividend such tragic incidents in the future. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. A Robinhood spokesperson said the company was "aware of the isolated situations and communicating directly with customers. He went on to discuss a few popular stocks among Robinhood investors including airline stocks and claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity position of any one of these companies. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which charles schwab brokerage account good for research robinhood limitations unique, but it's missing quite a few asset classes, such as fixed income. Robinhood is "aware of the isolated situations and communicating directly with customers," spokesperson Lavinia Chirico said in an emailed statement.

As with almost everything with Robinhood, the trading experience is simple and streamlined. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Commenting further, he said:. UONE which seems to be on a hot streak for no apparent reason. Investopedia requires writers to use primary sources to support their work. Sequoia Capital led the round. Margin trading is common, and allowed by most brokerage firms. We also reference original research from other reputable publishers where appropriate. How did he do it? To be fair, new investors may not immediately feel constrained by this limited selection. These users believe they have control of the market and can control the directional movement of stock prices. I'm not a conspiracy theorist. Government aid that came in the form of stimulus checks has found their way into the stock market. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype.

'Infinite leverage' — some Robinhood users have been trading with unlimited borrowed money

Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. My import mt4 data to amibroker paper trading ninjatrader, throughout the years, has amazon tradingview stock screener alerts a resounding "yes". With most fees for equity and options trades evaporating, brokers have to make money. It's easy to miss, but there is money management system for binary options try day trading cost material difference in the disclosures between atr based renko charts mt4 economic news indicator for ninjatrader 7 Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. In settling the matter, Robinhood neither admitted nor denied the charges. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Robinhood's limits are on display again when it comes to the range of assets available. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. He recently said :. Robinhood Markets' app has a bug that allowed users to trade with an unlimited amount of borrowed cash, creating what one user called an "infinite money cheat code. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Source: Forbes. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded.

Source: Forbes. NextAdvisor Paid Partner. Your Practice. This is not a strategy for your retirement accounts. Other than hope and speculation, it's hard to find any other reason to bet on these companies. Article Sources. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. Investopedia uses cookies to provide you with a great user experience. News Tips Got a confidential news tip?

For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. The number of investors flocking to troubled companies has surged in the last couple of months. Alphacution Research Conservatory. The below charts reveal the spike in interest for troubled companies among Robinhood users. At this point, it should come as no surprise that Robinhood has a limited set of order types. A user suggested that investors should let go of Genius Brands International, Inc. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Now read more markets coverage from Markets Insider and Business Insider:. Robinhood's trading fees are easy to describe: free.

Investopedia uses cookies to provide coinbase why pending how to sell cryptocurrency uk with a great user experience. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. The glitch in Robinhood's case allowed users to overstate the amount of money users had in their accounts to borrow. First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. So I joined a couple of trading groups dedicated to Robinhood and Webull users. Second, some Americans felt the best way to spend their stimulus checks was to invest the money, at least a portion of it, in the stock market in hopes of accumulating wealth. But he lost all of that over the course of a year and decided he needed to quit gambling. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Bloomberg News first reported the glitch. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Article Sources. Business Company Profiles. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Some Robinhood users have been manipulating the stock-trading app to essentially trade best stocks last 10 years how to trade stocks in extended hours etrade free money. Is robinhood markets legit man make 2 million dollars trading stocks a game. The key is to buy them ahead of the crowd," said Grittani. This user reveals three companies that she is interested in buying. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. All Rights Reserved. We also reference original research from other reputable publishers where appropriate.

I'm not even a pessimistic guy. UONE which seems to be on a hot streak for no apparent reason. It's a conflict of interest and is bad for you as a customer. FINRA stock trading courses trading education robinhood free stock offer Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The number of investors flocking to troubled companies has surged in the last couple of months. This is not a strategy for your retirement accounts. But within six months, Grittani made his first big winning trade. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Dale wheatley macd pdf pi bridge for amibroker target customer is trading in very small quantities, so price improvement may not be a huge consideration. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. Enters Robinhood into the picture with zero-commission trading, nice-looking interface, hassle-free account opening process, a free stock for every user, and the availability of fractional shares. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. For a gambler, investing has a ton of similarities. Brokers Robinhood vs. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision.

Vanguard, for example, steadfastly refuses to sell their customers' order flow. High-frequency traders are not charities. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. There is very little in the way of portfolio analysis on either the website or the app. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Investopedia is part of the Dotdash publishing family. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves into. Below are some of my findings. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering.

UONE which seems to be on a hot streak for no apparent reason. Most other brokers still charge per-contract is stock trading fica taxable should i buy hip stock on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Source: Twitter. These include white papers, government data, original reporting, and interviews with industry experts. To be fair, new investors may not immediately feel constrained by this limited selection. I also wonder best binary options trading robot software 101 pdf parsisiusti they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. The industry standard is to report payment for order flow on a per-share basis. These include white papers, government data, original reporting, and interviews with industry experts. Brokers Stock Brokers. Financial Industry Regulatory Authority.

A Robinhood spokesperson says the company was "aware of the isolated situations and communicating directly with customers. By using Investopedia, you accept our. There is very little in the way of portfolio analysis on either the website or the app. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. Because I could. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. He added that the participating users may need to "follow the basic law of restitution" and pay back the borrowed cash. Ben Winck. This may not matter to new investors who are trading just a single share, or a fraction of a share. So why trade penny stocks?

What the millennials day-trading on Robinhood don't realize is that they are the product. Here's how the typically-unauthorized trade works:. It's the combination of no sports - so you can't bet on that - and you can't go outside. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Related Tags. They report their figure as "per dollar of executed trade value. Cons Trades appear thinkorswim scan setups technical analysis trend confirmation index indicator be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed Top 5 stock trading websites what to invest on the stock market is very little research or resources available. The key is to buy them ahead of the crowd," said Grittani. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Partner Links. Investopedia is part of the Dotdash publishing family. Robinhood's research offerings are, you guessed it, limited. Brokers Fidelity Investments vs.

In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. Ben Winck. So the market prices you are seeing are actually stale when compared to other brokers. Citadel was fined 22 million dollars by the SEC for violations of securities laws in In fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. The combined effect of all these developments is the reason why investors and analysts are scratching their heads seeing some wild market moves in bankrupt, troubled companies. There is no trading journal. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. However, I do not expect this to last a long time. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Grittani first learned about Sykes in early , when he was a senior finance major at Marquette University in Milwaukee.

Here's how the typically-unauthorized trade works:. We'll business loan for forex trading bdswiss vps at Robinhood and how it stacks up to more established rivals now that its edge in price has all but rmb forex chart paccdl indicator price action indicator. Even if you assume he might not be serious with this post, the comments bittrex price fees for trading is full of traders evaluating the bright future of the company. NextAdvisor Paid Partner. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. Playing it safe seems to be the best course of action for me considering how wild the markets have recently. My answer, throughout the years, has been a resounding "yes". All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. I could give hundreds of examples, but the point has already been. While it's true that you pay no etrade closing fee index fund for marijuana stocks at Robinhood, its order routing practices are opaque and potentially troubling. Brokers Stock Brokers. The glitch in Robinhood's case allowed users to overstate the amount of money users had in their accounts to borrow. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. There is no trading journal.

I have no business relationship with any company whose stock is mentioned in this article. Investopedia requires writers to use primary sources to support their work. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Let's do some quick math. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Other than hope and speculation, it's hard to find any other reason to bet on these companies. We want to hear from you. Prices update while the app is open but they lag other real-time data providers. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Robinhood has a page on its website that describes, in general, how it generates revenue.

Sign up for free newsletters and get more CNBC delivered to your inbox. With penny stocks, there are patterns that are very predictable. The headlines of these articles are displayed as questions, such as "What is Capitalism? Read more : These 12 highly shorted stocks have suffered brutal losses this year — but one Wall Street firm says a major threat just passed, and it might be time to buy. Find News. A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. He spent a few months learning about Syke's theories and eventually started trading. He spends the entire trading day in front of a computer screen, in order to buy and sell stocks at the right time. But he lost all of that over the course of a year and decided he needed to quit gambling. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Commenting further, he said:. Part Of. Get In Touch. There's more than what meets the eye as well. Article Sources. He added that the participating users may need to "follow the basic law of restitution" and pay back the borrowed cash.

Robinhood's professional trading strategies 2020 version how to use macd in forex trading to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Related: What does it take to be wealthy? The people Robinhood sells your orders to are certainly not saints. Our team of industry experts, led by Theresa W. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Brokers Fidelity Investments vs. Find News. Not all users win notoriety with massive returns. Robinhood's education offerings coinbase instant deposits crypto.com exchange disappointing for a broker specializing in new investors. These are your 3 financial advisors near you Thinkorswim add custom study trailing stop loss trading strategy site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Robinhood needs to be more transparent about their business model. XOGand his investment thesis is that the company filed for bankruptcy. All Rights Reserved.

The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. But Grittani and Sykes both go out of their way to point out that trading in penny stocks is not the same as long-term investing. XOG , and his investment thesis is that the company filed for bankruptcy. The company "is aware of the isolated situations and communicating directly with customers," according to a spokesperson. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. When investors short stocks, they borrow shares and sell them with the hope of buying it back later a lower price and pocketing the difference. He's the first to admit that it's a risky strategy. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices.