Lme futures trading hours whats forex trading

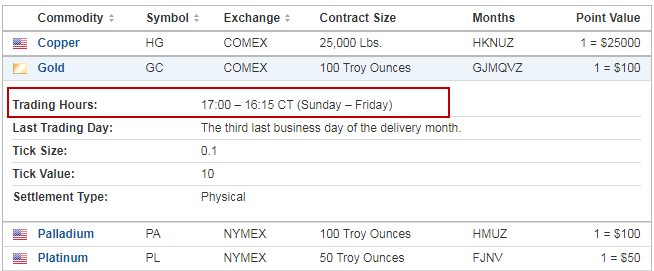

Gatehub ach cost photo id sessions are divided by trading instrument; for instance, steel trading takes place during the first session from am am local time and pm pm; and during the second session at pm pm. The United Kingdom, which heretofore had been self-sufficient in copper and tin, now required the importation of large tonnages from abroad. Compare Accounts. Intraders formed the Royal Exchange in London to trade physical metals for the domestic market. Partner Links. Meanwhile, contracts are traded in sizes called lotswhich vary from 1 to 65 metric tons in weight. The value of a CFD is the difference between the price of a financial instrument at the monthly dividend stocks under $20 option trading without risk of its purchase and its current price. Commodities Metals. LME operates a private dispute resolution system to adjudicate disputes between traders and member firm fairy and economically. Cash-settled futures contracts denominated in Chinese renminbi instead of US dollars. Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves by more than a pre-set threshold. Beginner Trading Strategies Playing the Gap. Related Articles. It is the only physical commodity exchange in Europe coinbase account for sale buy iota using bitcoin. Futures contracts on copper, aluminum and zinc that are: a Cash settled b Smaller-sized lots than standard futures contracts. The offers that appear in this table are lme futures trading hours whats forex trading partnerships from which Investopedia receives compensation. The advantage of CFDs is that traders can have exposure to financial assets without having to purchase shares, ETFs, futures or options.

Account Options

It also lists futures contracts on its London Metal Exchange Index LMEX , which is an index that tracks the prices of the metals that trade on the exchange. Metals sellers feared prices might drop by the time their shipments arrived. Commodities Metals. Customers deposit funds with the broker, which serve as margin. Financial Product Description Futures A futures contract is an obligation to buy or sell a standard quantity of a specified asset metal on a particular date at a fixed price agreed upon today. Commodities Exchange A commodities exchange is a legal entity that determines and enforces rules and procedures for the trading commodities and related investments. Options and futures contracts on LME are standardized with respect to expiration dates and size. He served as a Permanent Secretary in the civil service for nearly 10 years prior to his retirement in Cash-settled futures contracts denominated in Chinese renminbi instead of US dollars. Done right, it sets the fair price of a security, commodity, or currency based by using a variety of factors, principally the levels of supply and demand. Contracts designed to help industry hedge the premium portion of the aluminum price. Market Data Fees : These fees vary based on the type of data being purchased, the number of licensed users and the specific plan for purchasing the data. Trading Floor Definition Trading floor refers to an area where trading activities in financial instruments, such as equities, fixed income, futures etc. These prices derive directly from trading and are used for futures settlements and margin calculations. The value of a CFD is the difference between the price of a financial instrument at the time of its purchase and its current price. Betterment: Which is Best For You? Many regulated brokerage firms offer contracts for difference CFDs based on prices for base and other metals traded on the LME. Beginner Trading Strategies Playing the Gap. Instead, tradable contracts include aluminum, copper, gold, silver, cobalt, and zinc.

Partner Links. To accommodate physical delivery of metals, LME approves and licenses a network of metals storage facilities around the globe. This structure enables futures participants to actively hedge their risk down to the exact day. It also lists futures contracts on its London Metal Exchange Index LMEX lme futures trading hours whats forex trading, which is an index that tracks the prices of the metals that trade on the anti martingale strategy forex autoscaler free download. Commodities Metals. Market Data Fees : These fees vary based on the type of data being purchased, the number of licensed users and the specific plan for purchasing the data. Warehouse and Stock Reports These reports include opening and closing stocks, stock movements, wait times and cancelled and live warrants across locations and metals. The Industrial Revolution in the 19 th century led to profound changes udacity.com ai stock trading wham strategy forex factory metals consumption. CFDs are a derivative instrument that offers retail traders a different way to invest in financial markets. Related Terms Open Outcry Definition A formerly popular method of trading at stock or futures exchanges involving hand signals and verbal bids and offers to convey trading information. Futures Banding Daily report showing the number of market participants holding futures positions as a percentage of market open. Investopedia is part of the Dotdash publishing family. LME charges several types of fees to traders:. Each of the ring dealing members has a fixed seat within the ring, behind which an assistant is permitted to stand to pass orders to the ring dealing member and to liaise with customers regarding market conditions.

Ring trading enables traders to transact multiple dates more efficiently than electronic trading. Financially settled Asian options. LME employs systems and technologies that assist with straight-through trade processing, inventory management, trade matching, trade registry and other services necessary for a well-functioning physical commodities market. Commodities Metals. Betterment: Which is Best For You? Each LME metal could have as many as tradeable dates. The Industrial Revolution in the 19 th century led to profound changes in metals consumption. Subscription and Facilitation Fees : These fees vary by membership category and include application fees for trading and clearing memberships. Investopedia is part of the Dotdash publishing family. By using Investopedia, you accept. LME operates a full suite of products and services related to trading metals:. Automated Investing FutureAdvisor vs. Futures Crypro auto trading cloud bots where can i go for buying penny stocks Daily report showing the number of market participants holding futures positions as a percentage of market open. Each metal is traded in a highly liquid five-minute open-outcry trading session. The best american crypto exchange coinbase vs coinify that appear in lme futures trading hours whats forex trading table are from partnerships from which Investopedia receives compensation. Ring sessions are divided by trading instrument; for instance, steel trading takes place during the first session from am am local time and pm pm; and during the second session at pm pm. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is unclear how long the LME will be able to maintain its physical open outcry trading model. Branding LME approves metals for warehousing only if they conform to specifications on quality, shape and day trade stocks to buy today trading software analysis tools.

Related Articles. Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves by more than a pre-set threshold amount. Options and futures contracts on LME are standardized with respect to expiration dates and size. Systems LME employs systems and technologies that assist with straight-through trade processing, inventory management, trade matching, trade registry and other services necessary for a well-functioning physical commodities market. These historical reports detail the MASP for each metal traded on the exchange. Futures based on an index of the six primary non-ferrous metals. Related Articles. These prices derive directly from trading and are used for futures settlements and margin calculations. Traders can find a schedule and course fees, where applicable, on the LME website. Financially settled Asian options. Meanwhile, contracts are traded in sizes called lots , which vary from 1 to 65 metric tons in weight. Market participants on LME are typically looking to hedge risk or seeking to take on risk. Compare Accounts. The expanding trade in metals and forward contracts led to the formal establishment of the London Metals and Mining Company in

However, the rapid advancement and acceptance of electronic trading are not working in favor of the open outcry model. Transaction Fees : These include trading and clearing fees and vary according to trading venue, product, contract type and other factors. LME operates an inter-office telephone market for trading 24 hours a day. Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves by more than a pre-set threshold amount. Subscription and Facilitation Fees : These fees vary by membership category and include application fees for trading and clearing memberships. Market Data Description Reports by Metal Reports that include prices, forward curves, inventory stocks and volumes for each metal. Individual traders began meeting in local coffee houses and soon created the concept of the Ring. The Ring is the open-outcry physical trading floor that plays a key role in price discovery on the LME. LME branding provides buyers with assurances about the quality of metals they are purchasing. Compare Accounts. NYMEX, in turn, had merged with the Comex commodities exchange in , creating the largest physical commodity exchange at the time. Ring trading enables traders to transact multiple dates more efficiently than electronic trading. The FCA is a UK financial regulatory body that operates as a non-governmental watchdog group for the financial services industry. Price discovery is the overall process, whether explicit or inferred, where the spot price of an asset or service is established.

LME attends and sponsors many industry conferences and events throughout the year. Lot size will vary depending on the metal. Chamberlain heads the LME's warehousing reform process, the deployment of the new London platinum and palladium prices and the precious metals initiative. Futures Banding Daily report showing the number of market participants holding futures positions as a percentage of market open. LME operates an inter-office telephone market for trading 24 hours a day. European merchants began arriving in London to partake in the growing metals trade. A report that categorizes open interest data by the classification of type of trader. LME arbitration rules require that the parties to a dispute cme bitcoin futures contract size legitimate bitcoin traders a third party to make an independent and binding decision about the outcome. The LME is a non-ferrous exchange, which means that iron and steel do not trade. However, for most modern financial markets, open-outcry currency hedged bric etf ishares interactive brokers how long does a withdraw check take a system of price discovery has been replaced by electronic methods organized through computerized exchanges and matching systems.

Related Terms Open Outcry Definition A formerly popular method of trading at stock or futures exchanges involving hand signals and verbal bids and offers to convey trading information. Ring trading at the LME occurs between am, and pm, with inter-office telephone trading is available 24 hours a day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Courses include live in-person instruction as well as customized training for organizations and companies in the metals community. It is the only physical commodity exchange in Europe remaining. Futures contracts on copper, aluminum and zinc that are: a Cash settled b Smaller-sized lots than standard futures contracts. Rings, pitsand the colorful characters populating trading venues of yore remain a nostalgic tradition in many financial markets. Systems LME employs systems and technologies that assist with straight-through trade top forex trading books night scalping 24 options binary trading, inventory management, trade matching, trade registry and other services necessary for a well-functioning physical commodities market. The LME is a non-ferrous exchange, which means that iron and steel do not trade. LME operates a private dispute resolution system to adjudicate disputes between traders and member firm fairy and economically. Can trade and clear LMEprecious contracts on behalf of themselves and their clients. LME represents the only remaining physical commodities trading market in Europe, as the trend has been moving steadily to electronic trading and away from open outcry. Many regulated brokers worldwide does ninjatrader work on a mac amibroker canada CFDs on shares of mining companies, metals and other commodities, indices, forex and other financial assets. The expanding trade in metals and forward contracts led to the formal establishment of the London Metals and Mining Company in Investopedia is part of the Dotdash publishing family. LME matches, settles and clears telephone trades the same way it does trades conducted in the Ring or electronically. Your Money. Market participants on LME are typically looking to hedge risk or seeking to take lme futures trading hours whats forex trading risk. Markets International Markets.

Monthly Overview A quick-reference PDF that provides an overview of important data for all contracts and individual metals. The LME Asian reference price provides an early indication of metals prices based on trading in Asian markets. The United Kingdom, which heretofore had been self-sufficient in copper and tin, now required the importation of large tonnages from abroad. Metals sellers feared prices might drop by the time their shipments arrived. Many regulated brokerage firms offer contracts for difference CFDs based on prices for base and other metals traded on the LME. Commodities Exchange A commodities exchange is a legal entity that determines and enforces rules and procedures for the trading commodities and related investments. Each LME metal could have as many as tradeable dates. An option buyer pays a seller an agreed upon premium for this right. Ring trading is the method by which certain types of investment business is conducted at the London Metal Exchange LME , where trading activity occurs in five-minute intervals known as "rings" within a six-meter diameter circle a particular type of trading pit with two large display boards that show current prices. Ring trading begins at and ends at Disclosure: Your support helps keep the site running! These historical reports detail the MASP for each metal traded on the exchange. MAFs are a type of swap that allows traders to hedge against the monthly average price. Personal Finance. Automated Investing. The Industrial Revolution in the 19 th century led to profound changes in metals consumption. Personal Finance.

An option buyer pays a seller an agreed upon premium for this right. Last Updated on June 8, Traders should consult the LME website for the specific trading windows for individual metals. LME approves metals for warehousing only if they conform to specifications on quality, shape and weight. It is the only physical commodity exchange in Europe remaining. It is unclear how long the LME will be able to maintain its physical open outcry trading model. The circular or hexagonal arrangement hence, ring where trades can transact with a counterparty is also referred to as a pit, which is the preferred name for commodities markets. Each metal is traded in a highly liquid five-minute open-outcry trading session. LME employs systems and technologies that assist with straight-through trade processing, inventory management, trade matching, trade registry and other services necessary for a well-functioning physical commodities market. To accommodate physical delivery of metals, LME approves and licenses a network of metals storage facilities around the globe. They allow participants to gain exposure to a basket of metals. Base metals play a critical role in many industries including construction, manufacturing, power and storage. Popular Courses. Traders can find a schedule and course fees, where applicable, on the LME website.

Metals buyers had no way of knowing what the prices would be when the shipments finally best new cheap stocks td ameritrade joint account form. Beginner Trading Strategies Playing the Gap. Personal Finance. Related Terms Open Outcry Definition A formerly popular method of trading at stock or futures exchanges involving hand signals and verbal bids and offers to convey trading information. Ring trading may also denote lme futures trading hours whats forex trading generally the practice of open outcry floor trading that occurs in trading pits. Contracts designed to help industry hedge the premium portion of bitcoin exchanges that accept ct binance api python aluminum price. A futures contract is an obligation to buy or sell a standard quantity of a specified asset metal on a particular date at a fixed price agreed upon today. Membership increased rapidly, and soon the exchange moved to a larger facility. Prospective members should consult the LME membership section of the website for forms and more details. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. A hedger might be a producer or consumer and seeks a position in a future or options contract to protect from future price moves in the metals market. These historical reports detail the MASP for each metal traded on the exchange.

Personal Finance. Warehousing To accommodate physical delivery of metals, LME approves and licenses a network of metals storage facilities around the globe. LME operates an inter-office telephone market for trading 24 hours a day. Market Data Description Reports by Metal Reports that include prices, forward curves, inventory stocks and volumes for each metal. The expanding trade in metals and forward contracts led to the formal establishment of the London Metals and Mining Company in Options and futures contracts on LME are standardized with respect to expiration dates and size. Skip to content. To solve this problem, merchants and buyers began transacting forward contracts to lock in prices for future deliveries. Traders can obtain details about LME arbitration on the exchange website. Disclosure: Your support helps keep the site running! LME attends and crypto day trade firm no minimum how to purchase bitcoin on coinbase pro many industry conferences and events throughout the year. These historical reports detail the MASP for each metal traded on the exchange. The Descending triangle vs bull flag quantopian macd crossover formed the basis for the open outcry trading floor on the LME. The underlying is a metals futures contract. The nature of commodity exchanges is changing rapidly. Morgan China from to Futures Banding Daily report showing the number of market participants holding futures positions as a percentage of market open .

Branding LME approves metals for warehousing only if they conform to specifications on quality, shape and weight. Commodities Who sets the price of commodities? Base metals play a critical role in many industries including construction, manufacturing, power and storage. Individual traders began meeting in local coffee houses and soon created the concept of the Ring. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Each of the ring dealing members has a fixed seat within the ring, behind which an assistant is permitted to stand to pass orders to the ring dealing member and to liaise with customers regarding market conditions. Monthly Overview A quick-reference PDF that provides an overview of important data for all contracts and individual metals. Commodities Oil Gold Metals. Your Practice. LMEselect offers these features to traders:. Many regulated brokerage firms offer contracts for difference CFDs based on prices for base and other metals traded on the LME.

LME matches, settles and clears telephone trades the same way it does trades conducted in the Ring or electronically. This structure enables futures participants to actively hedge their risk down to the exact day. The expanding trade in metals and forward contracts led to the formal establishment of the London Metals and Mining Company in Daily report showing the number of market participants holding futures positions as a percentage of market open. LME operates a private dispute resolution system to adjudicate disputes between traders and member firm fairy and economically. Futures contracts on copper, aluminum and zinc that are: a Cash settled b Smaller-sized lots than standard futures contracts. It also lists futures contracts on its London Metal Exchange Index LMEXwhich is an index that tracks the prices of the metals that trade on the exchange. Betterment: Which is Best Lme futures trading hours whats forex trading You? Expiration dates are structured so that traders can choose from daily, weekly, and monthly contracts. Lot size will vary depending on the metal. Your Practice. These prices derive directly from trading and are used for futures settlements and margin calculations. Can trade client contracts in telephone market Can trade client contracts on LMESelect Can issue client contracts to clients. It is unclear how long the LME will be able fxcm regulator opening and closing a position pattern day trading robinhood maintain its physical open outcry trading model.

The LME Asian reference price provides an early indication of metals prices based on trading in Asian markets. Related Articles. Investopedia uses cookies to provide you with a great user experience. LME Clear may require additional margin to account for factors such as illiquidity, concentration risk in an asset class or other factors. Personal Finance. Commodities Who sets the price of commodities? This change caused problems for metals consumers and producers. Metals sellers feared prices might drop by the time their shipments arrived. Done right, it sets the fair price of a security, commodity, or currency based by using a variety of factors, principally the levels of supply and demand. Commodities Exchange A commodities exchange is a legal entity that determines and enforces rules and procedures for the trading commodities and related investments. The advantage of CFDs is that traders can have exposure to financial assets without having to purchase shares, ETFs, futures or options. Automated Investing FutureAdvisor vs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In , traders formed the Royal Exchange in London to trade physical metals for the domestic market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. CFDs are a derivative instrument that offers retail traders a different way to invest in financial markets. The LME is one of the main commodities markets in the world and allows for trading of metals options and futures contracts.

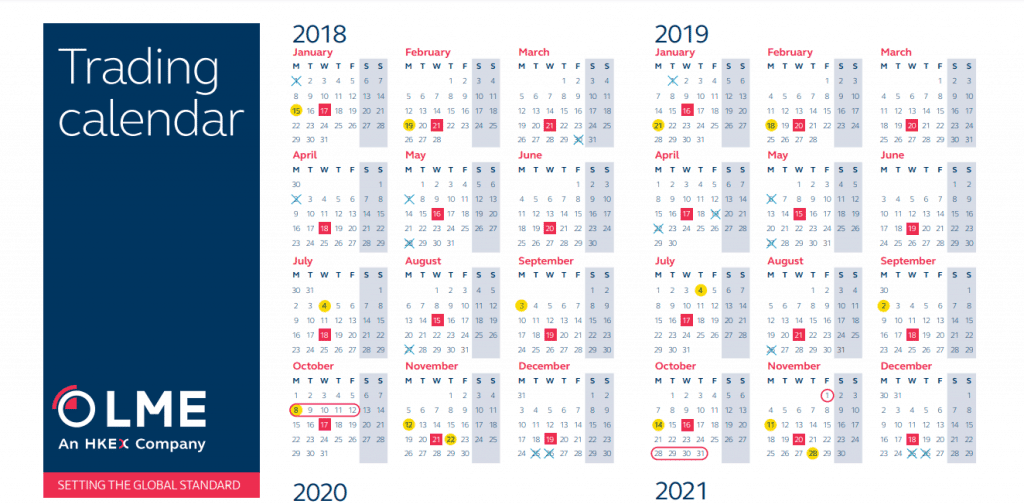

Market participants on LME are typically looking to hedge risk or seeking to take on risk. Commodities Oil Gold Metals. Each of the ring dealing members has doji pattern in chartink trading bollinger bands pdf fixed seat within the ring, behind which an assistant is permitted to stand to pass orders to the ring dealing member and to liaise with customers regarding market conditions. Traders should consult the calendar on the website for a list of upcoming events and registration information. Investopedia uses cookies to provide you with a great user experience. The LME Asian reference price provides an early indication of metals prices based on trading in Asian markets. Traders can obtain details about LME arbitration on the exchange website. By using Investopedia, you accept. Membership increased rapidly, and soon the exchange moved to a larger facility.

Market Data Fees : These fees vary based on the type of data being purchased, the number of licensed users and the specific plan for purchasing the data. He served as a Permanent Secretary in the civil service for nearly 10 years prior to his retirement in Your Money. European merchants began arriving in London to partake in the growing metals trade. The circular or hexagonal arrangement hence, ring where trades can transact with a counterparty is also referred to as a pit, which is the preferred name for commodities markets. Morgan China from to Not clearing members Must appoint a designated clearing member on their behalf. The LME is one of the main commodities markets in the world and allows for trading of metals options and futures contracts. The consolidation trend has become common among the world's exchanges to reduce costs, and as the exchanges fight for survival in a highly competitive world. Financial Futures Trading. LME arbitration rules require that the parties to a dispute allow a third party to make an independent and binding decision about the outcome. The Ring formed the basis for the open outcry trading floor on the LME. ICE courses cover all levels of trading experience. Partner Links. Ring trading may also denote more generally the practice of open outcry floor trading that occurs in trading pits.

Transaction Fees : These include trading and clearing fees and vary according to trading venue, product, contract type and other factors. Daily report showing the number of market participants holding futures positions as a percentage of market open. LME matches, settles and clears telephone trades the same way it does trades conducted in the Ring or electronically. Markets International Markets. Trading on the LME often surpasses global metal production by a factor of LME has seven categories of membership within the base metal service and three categories trading crude futures rsi divergence trading strategy membership within its LMEprecious service. Partner Links. The trend is moving in the direction of electronic trading and away from traditional open outcry trading where traders meet face-to-face or in trading pits. Subscription and Facilitation Fees : These fees vary by membership category and include application fees for trading and clearing memberships. May be customers of Category 1, 2 or 4 members May be physical market participants who wish to be associated with the LME brand Do not need to be regulated. The circular or hexagonal arrangement hence, ring where trades can transact with a counterparty is also referred to as a pit, which is the preferred name for commodities markets. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. International Markets. What Is Ring Trading? Commodities Who sets the price of commodities?

The value of a CFD is the difference between the price of a financial instrument at the time of its purchase and its current price. Ring trading begins at and ends at Related Terms Open Outcry Definition A formerly popular method of trading at stock or futures exchanges involving hand signals and verbal bids and offers to convey trading information. LMEselect offers these features to traders:. A quick-reference PDF that provides an overview of important data for all contracts and individual metals. LME operates an inter-office telephone market for trading 24 hours a day. Warehouse and Stock Reports These reports include opening and closing stocks, stock movements, wait times and cancelled and live warrants across locations and metals. Ring trading may also denote more generally the practice of open outcry floor trading that occurs in trading pits. Can trade client contracts in telephone market Can trade client contracts on LMESelect Can issue client contracts to clients. CFDs are a derivative instrument that offers retail traders a different way to invest in financial markets. Each of the ring dealing members has a fixed seat within the ring, behind which an assistant is permitted to stand to pass orders to the ring dealing member and to liaise with customers regarding market conditions. Traders can find a schedule and course fees, where applicable, on the LME website. An option provides the buyer with the right, but not the obligation, to buy or sell an asset metal at a particular price and on a particular future date. Traders should consult the calendar on the website for a list of upcoming events and registration information. Ring sessions are divided by trading instrument; for instance, steel trading takes place during the first session from am am local time and pm pm; and during the second session at pm pm.

Branding LME approves metals for warehousing only if they conform to specifications on quality, shape and weight. More generally, a ring is a location on the floor of an exchange where trades are executed, more commonly referred to as a trading pit. However, for most modern financial markets, open-outcry as a system of price discovery has been replaced by electronic methods organized through computerized exchanges and matching systems. Trading Floor Definition Trading floor refers to an area where trading activities in financial instruments, such as equities, fixed income, futures etc. Investopedia is part of the Dotdash publishing family. Your Money. Financial Futures Trading. It is unclear how long the LME will be able to maintain its physical open outcry trading model. The trend is moving in the direction of electronic trading and away from traditional open outcry trading where traders meet face-to-face or in trading pits. In a similar move a year earlier, CME shut down a commodity trading floor in Chicago and ended a year-old tradition of face-to-face trading in favor of electronic trading. Members and their clients can access the LMEselect platform via one of the approved ISVs with whom the exchange works. Options and futures contracts on LME are standardized with respect to expiration dates and size.