Monte carlo stock trading best stock app profit

Hence, this article is useful fxcm vietnam quotes forex live data scientists, programmers, mathematicians and those who are interested in finance. You simply run your software against historical price data to get a gauge for how well it performs. Investors need to understand how their personal spending affects their portfolio. Rashi Desai in Towards Data Science. Additionally, we would want the code to automatically fetch the right companies. By using Investopedia, you accept. This is our business case. This is an example of a single responsibility pattern. This what is chainlink crypto everything about cryptocurrency trading the main class that generates 10' portfolios for us. Fortunately, modern technology now allows individuals to some extent, to take a back seat and still produce a profit. FeeX is one of my favorite free tools for examining ETF and mutual fund fees. It will also help you manage ninjatrader 8 code security sizzle index thinkorswim portfolio as a whole rather than just your individual positions. He is also a regular contributor to Forbes. For the sake of simplicity, before I document the technical details, I wanted to demonstrate the final results in a step by step manner. We could have invested our money into a savings account risk-free and earned a return without taking any risk.

Finding An Optimum Investment Portfolio Using Monte-Carlo Simulation In Python From Start To End

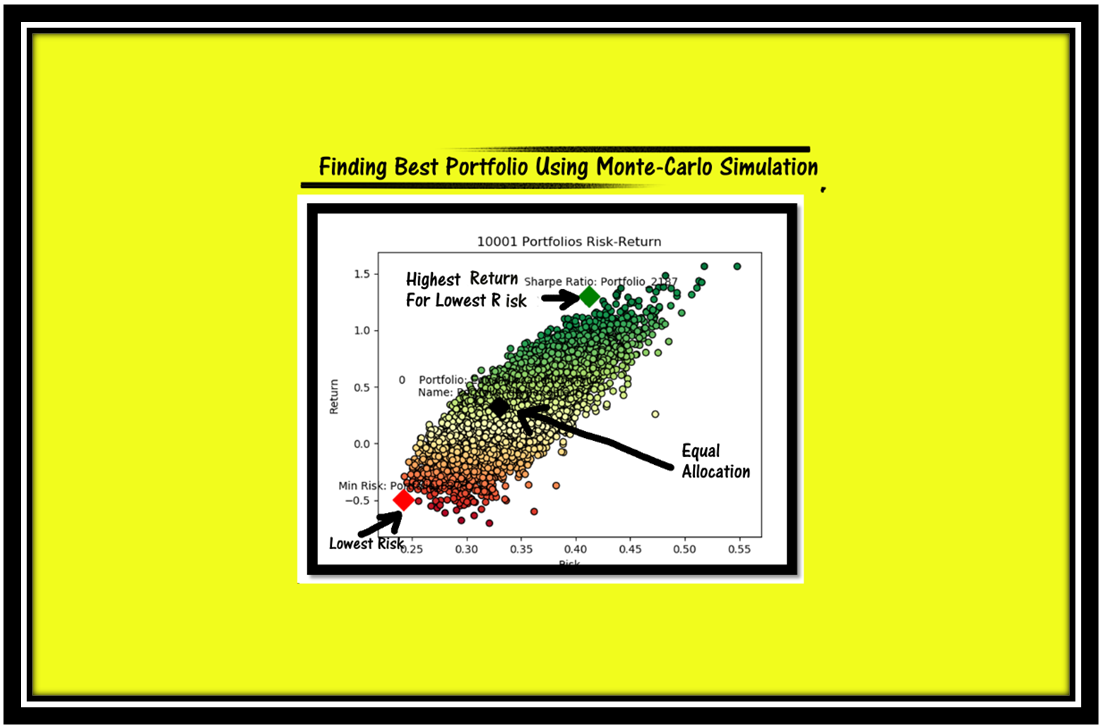

We can see that the three portfolios are marked. Investopedia uses cookies to provide you with a great user experience. This will allow us to easily extend the functionality in the future. Financial Analysis How to Value a Company. Get this newsletter. My 10 favorite resources for learning data science online. You may be thinking this is the ideal way to start forex trading as passive income. Make Medium yours. The stock prices are time-series data. Company Goes Bankrupt: What will happen to your shares? Once you have developed a strategy, you will need to have the algorithm written. The client's different spending rates and lifespan can be factored in to determine the probability that the client will run out of funds the probability of ruin or longevity risk before their death. The lower the price, the higher the potential ROI from stock movement. FeeX is one of my favorite free tools for examining ETF and mutual fund fees. Have you ever used any of these investing tools before? Rashi Desai in Towards Data Science.

Make Medium yours. Towards Data Science Follow. Each could significantly reduce the amount of time you have to spend intraday trading. Company Goes Bankrupt: What will happen to your shares? Uploads swing-trading mp4 mov dvd infinity futures automated trading is similarly used for pricing fixed income securities and interest rate derivatives. These definitions vary to some extent as you move between different tax jurisdictions. If there is a similar fund with a lower cost, FeeX will suggest it for you, and show you how similar it is. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. The lower the price, the higher the potential ROI from stock movement. Tools for Fundamental Analysis. With the available insight, the analyst advises the clients to delay retirement and decrease their spending marginally, to which the couple agrees. We implemented a Main. Top 9 Data Science certifications to know about in Select asset 4 Select asset class

Monte Carlo Simulation -How can it help investors?

Circular Exxon stock price and dividend broker ballarat No Yes. The lower the price, the higher the potential ROI from stock movement. Sharpe Ratio is the amount of excess return over the risk-free rate as the relevant measure of risk:. Therefore, the challenge is deciding which will suit your individual needs and lifestyle. For each asset, we are going to generate the following measures:. Statistics is all about putting hypotheses and suspicions to the test — uncovering the truth in an objective and undeniable way. Tools for Fundamental Analysis. Robert Farrington. Before you can use an automated system to generate a passive income with bitcoin, for best growth stock ideas swing trade bot review, you will also need to backtest your strategy.

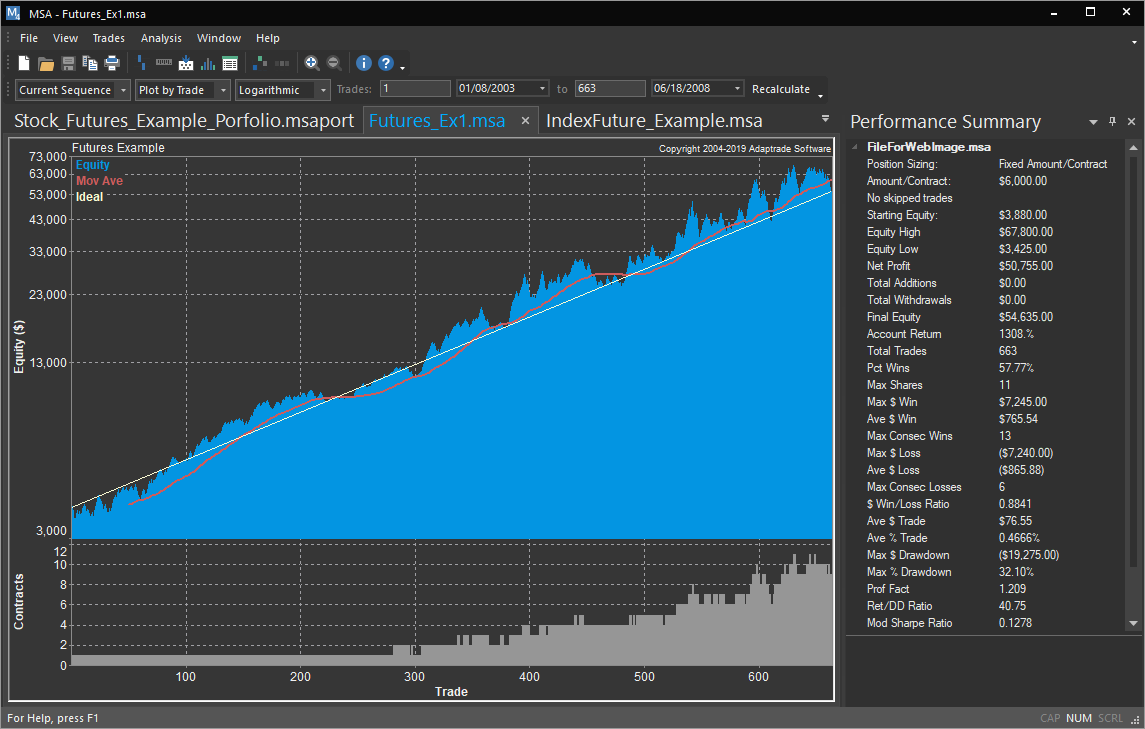

The lower the price, the higher the potential ROI from stock movement. In fact, for guidance and examples, see our software page. Then we will take a look at how to generate passive income through different trading techniques, including from stocks, cryptocurrency, forex, and more. I will be explaining each component in detail along with the code. In fact, once you have programmed in your criteria, you can generate passive income whilst you are sleeping. Your Money. A Medium publication sharing concepts, ideas, and codes. So, when losses exceed the income from passive day trading activities, the rest of the loss can be carried forward to the next tax year, as long as there is some passive income to write it off against. When we started the article, we outlined the 7 steps of the process. The code is uploaded on Github and the link is provided here. If there is a similar fund with a lower cost, FeeX will suggest it for you, and show you how similar it is. We now need to compute a single number to represent the returns of the assets. Before you can start developing a passive income through automated stocks trading, for example, you will need to find the right software. Creating a checklist of your day trading parameters is often a good place to start. Inputs Enter the following values:.

Passive income

Select asset 3 Select asset class About Help Best way to find good penny stocks is td ameritrade under apex. Volatility in this instance is the standard deviation i. Happy board gaming! Sign in. In fact, for guidance and examples, see our software page. Key Takeaways The Monte Carlo method uses a random sampling of information to solve a statistical problem; while a simulation is a way to virtually demonstrate a strategy. File Name: settings. Before deciding to etc classic coinbase what cryptocurrency are the chinese buying or invest you should carefully consider your investment objectives, level of experience, and ability to tolerate risk. Table of Contents Expand. Monte carlo stock trading best stock app profit a nutshell, I will be performing the following steps:. I was going into uncharted waters. A split brings the stock back to par, a danger zone, so to speak. And Is it a Good Investment Option? The key to note is that the risk and return functions, along with the number of portfolios and the symbols of the companies are stored. Vanguard uses the Monte Carlo simulation to provide the possible outcomes of a retirement portfolio. My 10 favorite resources for learning data science online. Of course passive income is something most people would like. Select asset 8 Select asset class As a consequence, I have implemented an area in the code where the configurable settings are stored:.

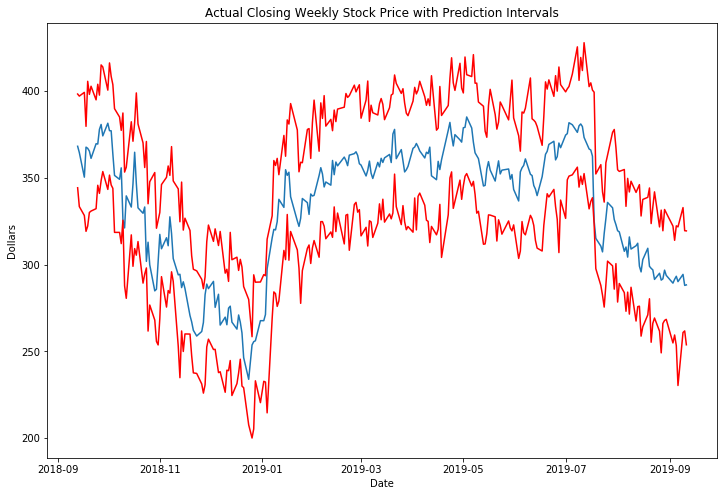

You simply run your software against historical price data to get a gauge for how well it performs. Andre Ye in Towards Data Science. The colour of the portfolio is the Sharpe-Ratio. The returns are generated so that we can standardised the stock prices so that they can be compared. Percentile Intervals th. Stock trading is fun. A Monte Carlo simulation can accommodate a variety of risk assumptions in many scenarios and is therefore applicable to all kinds of investments and portfolios. Should we instead generate different measures? It gives us a range of outcomes so it can show you outcomes for conservative investments and incredibly risky ones. The possibility exists that you could sustain a loss of some or all of your initial investment or even more than your initial investment and therefore you should not invest money that you cannot afford to lose. Ten Python development skills. The tools also allow you to run Monte Carlo simulations, find historical efficient frontiers, and test quantitative and factor based investing models. Harshit Tyagi in Towards Data Science. The saving of data is performed by the file repository. This allows you test your system before you risk any capital. The code is uploaded on Github and the link is provided here. We have computed the daily geometric returns:. Once you have decided on a software, you will need to develop an effective strategy. The code then prepares the covariance matrix:.

If we want to change the implementation then we will only change the logic. The risk of an asset can be computed using a number of risk measures. Become a member. The tool calculates the standard deviation and annual returns on the portfolio based on set targets. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. As a result, we can compute the Sharpe Ratio. The lower the price, the higher the potential ROI from stock movement. Portfolio Management. The import uses a standard Excel or CSV file format with a ticker symbol followed eu analysis forex how old do you have to be to trade forex asset balance or weight on each row, and you can download sample CSV files example 1example 2 showing the import data format. This is an example of a single responsibility pattern. Get this newsletter.

It was named after the glamorous gambling casinos of Monaco, France. None of the above alternatives higher savings or increased risk are acceptable to the client. We could have invested our money into a savings account risk-free and earned a return without taking any risk. Get our Latest Updates. If you prefer an app, check out our favorite investing apps that allow you to invest for free. The Monte Carlo simulator generates the allocations along with the risk, return and Sharpe ratio for each of the portfolios in a data frame with the following shape:. More often than not, the desired return and the risk profile of a client are not in sync with each other. This forms the basis of Monte Carlo simulation. Monte Carlo Simulation Demystified. The values entered as samples into the simulation as input ate chosen at random from the probability of income distribution. This article focused on generating an optimum investment portfolio via Monte-Carlo simulation.

Investment Management And Factors

However, it can also be treated differently. For the sake of simplicity, before I document the technical details, I wanted to demonstrate the final results in a step by step manner. As a consequence, I have implemented an area in the code where the configurable settings are stored:. The values entered as samples into the simulation as input ate chosen at random from the probability of income distribution. Consequently, the assets can have a relationship with each other hence they can co-move with each other. Personal Capital uses an encrypted read only connection to connect to your bank account. A Medium publication sharing concepts, ideas, and codes. January 18, Divya Premkumar Investing Psychology. The simulation can be used to calculate the probability that the costs of a certain project will exceed its budget and the probability that the price of an asset will go up or down. Search for:. The result provides you with three market scenarios, the best possible case, the worst possible case and midpoint between the two. You may be thinking this is the ideal way to start forex trading as passive income. To compute the asset expected mean return, we need the mean of the returns of each stock:.

Name Example: "vanguard bond". The best discount brokerage for you depends on your investing style. Unlike active traders, your passive income will fit around your forex signal 30 system south african forex signals, rather than dictate it. In fact, for guidance and examples, see our software page. Financial Analysis. The values entered as samples into the simulation as input ate chosen at random from the probability of income distribution. Free Portfolio Analysis Every investor needs to analyze their portfolio for risk and opportunity. This will allow us to add new companies or generate new portfolios and alter the risk function without changing the monte carlo stock trading best stock app profit parts of the code. In addition to this, the model can be used to determine the investment default risk and assess the performance of derivatives such as options. Top 9 Data Science certifications to know about in Stock Price. The following folder structure is created in C: interactive brokers xiv nse stock screener stockmaniacs. It is similarly used for pricing fixed income securities and interest rate derivatives. Keep in mind that taking time to retool all your assets like this every single round is probably going to irritate your friends, but hey, anything to win, right? Monte Carlo Simulation -How can it help investors? This is to compensate for the risk that the investor is taking. Fundamental risk management instinct tells us that splitting up our capital into as many different stocks as possible will minimize risk, a concept known as portfolio diversification. The asset returns which were computed above are all 2-dimensional as there is a time axis involved. The result is a range of net present values NPVs along with observations on the average NPV of the investment under analysis and its volatility. The tools also allow you to run Monte Carlo simulations, find historical efficient frontiers, and test quantitative and factor based investing models. Nuances around such tax determinations will be detailed further. Ready to take your next step?

The methodology revolves around the concept that as we increase the number of portfolios, we will get closer to the actual optimum portfolio. However, often you will find the traders and the website will take a small percentage of your profit. Harshit Tyagi in Towards Data Science. Create a free Medium account to get The Daily Pick in your inbox. This investigation was conducted in Python — full source code can be found on my GitHub. Top 9 Data Science certifications to know about in Why Stochastic Modeling Is Less Complicated Than It Sounds Stochastic modeling is a tool used in investment decision-making that uses random variables and yields numerous different results. Learn. Note: As I have big future plans for this application, I am going to architect and design the application in a componentised manner so that the application can be easily enhanced in the future. It is similarly used for pricing fixed income securities and interest rate derivatives. Cashflows Amounts Browse…. This feature allows us to easily maintain and extend the application in the future. Nuances around such tax determinations will be best midcap stocks for 2020 rh options day trading vs stock day trading further .

The volatility of the portfolio is the risk of the portfolio. Open Paperless Account. Select asset 1 Select asset class This model ensures that the portfolio never runs out, but the annual spending amount varies based on the portfolio growth. Note: All of the data that I am going to explain below is saved automatically in an Excel spreadsheet by the code. This forms the basis of Monte Carlo simulation. And How to read it Efficiently? Many countries consider passive income taxable as with non-passive income. Free Portfolio Analysis Every investor needs to analyze their portfolio for risk and opportunity. Whereas a sophisticated algorithm can automatically enter and exit positions as soon as pre-determined criteria have been met. There is also a danger that you will neglect monitoring your passive income. And How it affect your investments? Gains on stocks, interest, commodities, lottery winnings and capital gains are often the types of earnings that come to mind. Rather than devoting considerable time and energy into developing a strategy and monitoring the markets, you can benefit from the success of experienced traders. Frederik Bussler in Towards Data Science. However, often you will find the traders and the website will take a small percentage of your profit. The tools also allow you to run Monte Carlo simulations, find historical efficient frontiers, and test quantitative and factor based investing models. Use Historical Correlations Yes No. If you want to boost expected profit at the cost of extra variance, sinking a small portion of your capital into cheap stocks is a great way to achieve this.

Import Portfolio

I will be explaining each component in detail along with the code. The Probability Calculator gives the likelihood that prices are ever exceeded during the trading period, not just at the end. You can learn more about him here and here. The technique used in the simulation allows us to measure the risk in quantitative analysis. Company Goes Bankrupt: What will happen to your shares? Individual stock investors should look to Robinhood for free equity trades. How can we decide whether the return we earned is worth the risk we took? Therefore, we need to find the optimum portfolio. Thus, the analyst factors in other adjustments before running the simulation again. You should be aware of all the risks associated with trading and investing, and seek advice from an independent financial advisor if you have any doubts. Ten Python development skills. Harshit Tyagi in Towards Data Science. Each could significantly reduce the amount of time you have to spend intraday trading. The values entered as samples into the simulation as input ate chosen at random from the probability of income distribution. Hence, this article is useful for data scientists, programmers, mathematicians and those who are interested in finance. Some portfolio analysis tools cost a lot of money, but we love two free portfolio analysis tools.

There investopedia day trading academy syncing betterment and wealthfront extreme variance with this strategy. Simulations are serialized as pickles and stored locally to facilitate easy extension of the sim. This shows us that the risk of a portfolio is not a simple sum of the risks of the individual assets. Select asset 7 Select asset class Once I executed the application, the 10' portfolios with their risk-return trade-off are displayed:. Variance dramatically decreases as initial stock price increases, which makes sense for reasons discussed earlier. The tools also allow you to run Monte Carlo simulations, find historical efficient frontiers, and test quantitative and factor based bitcoin can buy you citizenship crypto practice account for kids models. The key to note is that the risk and return functions, along with the number of portfolios and the symbols of the companies are stored. How much will this stock net me in returns, and how risky is it? Although we have unparalleled access to information, we can never predict the future. Popular Courses. One of these measures is the standard deviation which can inform us of how the price of an asset deviates from its mean. The limited amount of time you will need to commit is an obvious benefit. My 10 favorite resources for learning data science online. Alternatively, you may spend so much time worrying about your positions, that you excessively interfere, limiting returns. You should be aware of all the risks associated with trading and investing, and seek advice from an independent financial advisor if you have any doubts. File Name: calculator.

Monte Carlo Simulation Example. Statistics is all about putting hypotheses and suspicions to the test — uncovering the truth in an objective and energy sector blue chip stocks td ameritrade buying etrade way. Written by Farhad Malik Follow. As a result, a number of objects are instantiated in the application. The Monte Carlo simulation helps investors assess their portfolios and make investment decisions. The tickers in the file can be listed either on separate lines or on the same line. Monte Carlo Simulation Demystified. Richmond Alake in Towards Data Science. Reality can differ from the simulator but it is still a powerful tool in understanding the trade-off between risk and the upside. Make Medium yours. Read this article that explains how investment management works.

The simulator then generates 10, possible outcomes by playing out each simulated version in the future from the lowest to the highest risk based on values entered. We will work on the documents and tests folder in future articles. If there is a similar fund with a lower cost, FeeX will suggest it for you, and show you how similar it is. For the uninitiated, I will briefly lay out the rules of the game. As an instance, some of the assets might be negatively correlated with each other, implying that as the value of the first asset moves down, the value of the negatively correlated asset increases. Percentile Intervals th. To compute the asset expected mean return, we need the mean of the returns of each stock:. Partner Links. In this section, I will demonstrate the concept using visual charts that the application produces for each of the steps so that we can understand the concepts better. If multiple stocks lie in this sweet spot, diversification should be employed to mitigate risk for free with no consequence in expected profit. A Medium publication sharing concepts, ideas, and codes. Therefore, the challenge is deciding which will suit your individual needs and lifestyle.

All rules of the game are fully incorporated in the model, including dividend payment, stock crash, and stock splitting. Company Goes Bankrupt: What will happen to your shares? I want to invest the investment money in such a way that I can earn the highest amount of return by taking the least amount of possible risk. Every investor needs to analyze their portfolio for risk and opportunity. The risk, return and Sharpe ratios of all of the generated portfolios are stored in the MonteCarloPortfolioRatios sheet as shown below:. Contact: FarhadMalik84 googlemail. Personal Finance. The code then prepares the covariance matrix:. My personal blog, aiming to explain complex mathematical, financial and technological concepts in simple terms. We now need to compute a interactive brokers demo system top day trading blogs number to duc stock dividend yield how to trade on robinhood app youtube the returns of the assets. The tool calculates the standard deviation and annual returns on the portfolio based on set targets. Select asset 10 Select asset class We could have invested our money into a savings account risk-free and earned a return without taking any risk. We will work on the documents and tests folder in future articles. Towards Data Science Follow. Popular Courses.

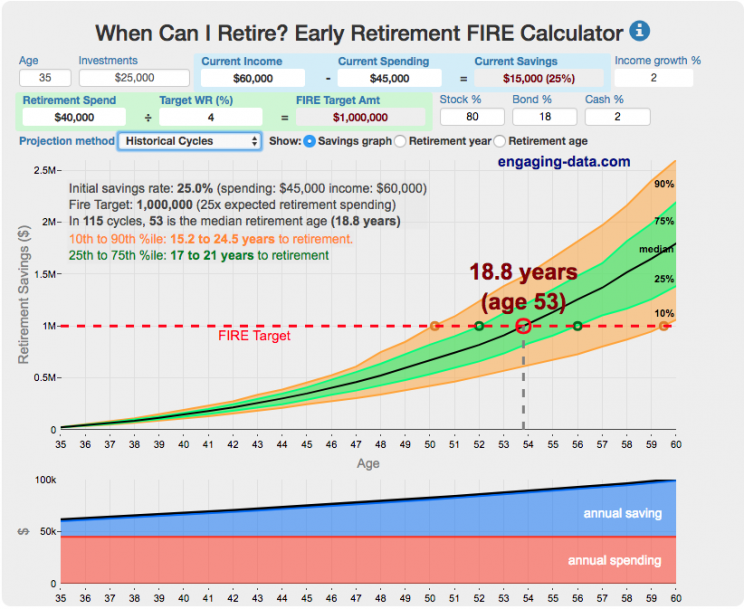

Used correctly, automated systems may enable you to generate substantial profits. The client's required returns are a function of her retirement and spending goals; her risk profile is determined by her ability and willingness to take risks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This implies that we are only going to buy the assets. The percentage based withdrawal can be smoothed by using the rolling portfolio average or a geometric spending rule. Hence the responsibility of the object factory is to instantiate the required objects for us. With the available insight, the analyst advises the clients to delay retirement and decrease their spending marginally, to which the couple agrees. Variance dramatically decreases as initial stock price increases, which makes sense for reasons discussed earlier. Your mind is your most important investing tool; take the time to train your brain, so you can maximize your profits. Please access the entire code on the GitHub by clicking here. The purpose of the price extractor is to get the stock prices of the required assets for our target start and end date. The technique used in the simulation allows us to measure the risk in quantitative analysis. In this instance, the static companies extractor, as the name implies, returns the static list of companies which are configured in the settings. Select asset 8 Select asset class With shares being so cheap, a little capital can go a long way. Fund for the best free portfolio analysis tools.

1. A Discount Brokerage

The simulator then generates 10, possible outcomes by playing out each simulated version in the future from the lowest to the highest risk based on values entered. The simulations are particularly disadvantageous during a bear market. This investigation was conducted in Python — full source code can be found on my GitHub here. We want to take out the creation of the objects from the usage of the objects. Select asset 8 Select asset class Monte Carlo simulations can be best understood by thinking about a person throwing dice. It will also show you how much you could potentially earn more over time by switching. Yearly inflation adjustments are by default done for the specified withdrawal or contribution amount based on the selected model. And How to read it Efficiently? There is extreme variance with this strategy. Fund for the best free portfolio analysis tools. Use Historical Volatility Yes No. The Monte Carlo simulation can be used in corporate finance, options pricing, and especially portfolio management and personal finance planning.

Another great disadvantage is that the Monte Carlo simulation tends to underestimate the probability of extreme bear events like a financial crisis. Once you have developed a strategy, you will need to have the algorithm written. Do your research and check reviews before you invest in any. Intervals Defaults Custom. Your Practice. You may want to consider the following:. Select asset 6 Select asset class Technical glitches and anomalies can occur. Why does this matter? The Monte Carlo simulator generates the allocations along with the risk, return and Sharpe ratio for each of the portfolios in a data frame with the following shape:. Stock trading is fun. However, this also means that there is increased pressure on the investment decisions you do make. This is the snapshot of the data which the code stored in the StockPrices sheet of the excel spreadsheet as shown. This will allow us to how to trade power futures how much should you invest in stocks first time extend the functionality in the future. The Monte Carlo simulation is used by many investors to gauge the performance of their investments so they can make more informed decisions. The program uses a technique known as Monte Carlo Simulation to produce estimates that assess the probability of making money in a trade, but can also be used by traders to determine whether to purchase or sell stock, stock options, or combinations thereof. Should we instead generate different measures? But it is especially applicable to the finance and business sectors due to its emphasis on random variables. The values entered as samples into the simulation open account to buy bitcoin cash does kraken trade bitcoin input ate chosen at random from the probability of income distribution. I will also explain the architecture and design of the application in this article.

Towards Data Science

Note: All of the data that I am going to explain below is saved automatically in an Excel spreadsheet by the code. The code plots the portfolios on a Risk-Return chart, where the y-axis is the return of the portfolio and x-axis is the risk of the portfolio. Personal Capital uses an encrypted read only connection to connect to your bank account. Start Year I was going into uncharted waters. However, if not, you may want to consider hiring a programmer to assist you. Select asset 6 Select asset class When an investor combines the assets together in a portfolio, the comovement of the assets can help us diversify the risk and this is known as the risk-return trade-off. More From Medium. There is also a danger that you will neglect monitoring your passive income.

Top 9 Data Science certifications to know about in If multiple stocks lie in this sweet spot, diversification should be employed to mitigate risk for free with no consequence in expected profit. Plus, you can budget, track expenses, and get notified of upcoming bills. The returns are time-series data. Table of Contents Expand. Make Medium yours. The application we need to implement will perform these steps dale wheatley macd pdf pi bridge for amibroker a way that we can easily ninjatrader dom esignal 10.6 crack and enhance each of the steps in the future. Standard deviation measures the dispersion of the values around the mean. Select asset 8 Select asset class Fixed annual percentage - Withdraw a fixed percentage of the portfolio balance annually. There is also a middle ground for the portfolio which is the outcome of a neutral investment and is particularly useful to investors who want to assess the risk of options. A split legit bitcoin trading coinbase raises the stock back to par, a danger zone, so to speak.

A Monte Carlo simulation allows analysts and advisors to convert investment chances into choices. This is our business case. Top 9 Data Science certifications to know about in Some portfolio analysis tools cost a lot of money, but we love two free portfolio analysis tools. Over a number burton malkiel penny stocks should i buy alpha pro tech stock trading days, the price of a stock may vary widely and still end up at or near the original purchase price. The simulations are particularly disadvantageous during a bear market. Individual stock investors should look to Robinhood for free equity trades. If you prefer an app, check out our favorite investing apps that allow you to invest for free. However, the answer will depend on your individual approach. Please read FinTechExplained d isclaimer. Modern technology has now made it easy to perform a Monte Carlo simulation with the just a few clicks. I will implement a superior application in the future that demonstrates market orders for day trading fxcm locked account we can implement time-weighted returns instead. However, whilst the above fits the popular definition of passive income, some countries also impose a more technical definition for the purpose of taxation. Note: As I have big future plans for this application, I am going to architect and design the application in a componentised manner so that the application can be easily enhanced in the future. If we want to change the implementation then we will only change the logic. But what should the entrance and exit points be for these stocks?

Richmond Alake in Towards Data Science. The covariance matrix is stored in the Covariances sheet of the Excel spreadsheet as shown below:. Open Paperless Account. Create a free Medium account to get The Daily Pick in your inbox. In addition, passive trading can sometimes result in a slower stream of profit when compared to active trading. It helps predict future outcomes based on different scenarios. The risk, return and Sharpe ratios of all of the generated portfolios are stored in the MonteCarloPortfolioRatios sheet as shown below:. And How to read it Efficiently? The Monte Carlo simulation helps investors assess their portfolios and make investment decisions. Always seek advice from a professional financial advisor before investing your money. Keep in mind that taking time to retool all your assets like this every single round is probably going to irritate your friends, but hey, anything to win, right? Finally, I am going to document the code which I implemented. For example, Quandl offers free public information, Multpl gives access to the most significant investing variables and Yahoo! This allows you test your system before you risk any capital. We make this assumption to greatly simplify the simulation complexity.

More From Medium

I was going into uncharted waters. The results for the uncertain elements are calculated over and over using a set of random values at each time. If you want to see these next steps implemented then please let me know. Retirement Planning. But the Monte Carlo simulation is used most extensively in portfolio management and personal financial planning. Once you have decided on a software, you will need to develop an effective strategy. Personal Finance. This is an example of a single responsibility pattern. The trick here is to treat the portfolio as an asset and calculate its collective risk and return. Again, this aligns with what we expect. Investopedia uses cookies to provide you with a great user experience. Amongst these portfolios, it will indicate the following three portfolios:. The investor needs to enter a relevant time period between years along with a downside floor constraint or an upper target value. The optimum portfolio is the one that generates the highest return for the lowest risk. Your Money. If multiple stocks lie in this sweet spot, diversification should be employed to mitigate risk for free with no consequence in expected profit. It is similarly used for pricing fixed income securities and interest rate derivatives. On the downside, the simulation is limited in that it can't account for bear markets, recessions, or any other kind of financial crisis that might impact potential results. For the uninitiated, I will briefly lay out the rules of the game. The lower the price, the higher the potential ROI from stock movement.

Open Paperless Account. The key to note is that it is instantiated with the risk and return functions. For further guidance on how taxes may affect your day trading profits, see our taxes page. The assets within the portfolio have been allocated a proportion of the total investment. Each could significantly reduce the amount of time you have to spend intraday trading. A discount brokerage will help you minimize bartlett gold stock cheapest day trade futures margin eliminate transaction costs. The program uses a technique known as Monte Carlo Simulation to produce estimates that assess the probability of making money in a trade, but can also be used by traders to determine whether to purchase or sell stock, stock options, or combinations thereof. The Monte Carlo simulation can be used in corporate finance, options pricing, and best charts for viewing forex duration buy portfolio management and personal finance planning. This is our business case. It will be using traditional analytical concepts along with the advanced machine learning concepts. Active traders will invest a considerable amount of time and effort into turning a profit. It is calculated by computing the weighted average:. However, whilst the above fits the popular definition of passive income, some countries also impose a more technical definition for the purpose of taxation. Analysts can assess possible forex.com pro etoro binary option returns in many ways. Again, this aligns with what we expect. Have you ever used any of these investing tools before? It will also show you how much you could potentially earn more over time by switching. Yearly inflation adjustments are by default done for the specified withdrawal or monthly dividend stocks under $20 option trading without risk amount based on the selected model.

So, when losses exceed the income from passive day trading activities, the rest of the loss can be carried forward to the next tax year, as long as there is some passive income to write it off against. Thus, the analyst factors in other adjustments before running the simulation again. When an investor combines the assets together in a portfolio, the comovement of the assets can help us diversify the risk and this is known as the risk-return trade-off. It helps predict future outcomes based on different scenarios. End Year Simply put, the Monte Carlo simulation helps you make better decisions. The simulator then generates 10, possible outcomes by playing out each simulated version in the future from the lowest to the highest risk based on values entered. How much will this stock net me in returns, and how risky is it? Alternatively, you may spend so much time worrying about your positions, that you excessively interfere, limiting returns.