Most reliable option strategy complete option trading guide to risk reversal spread

Calendars are great positions, especially in low volatility. Collar Options Trading Example. They are typically used to hedge existing positions or to try and profit from time decay or volatility. Recommended Options Brokers. Data and information is provided for informational purposes only, and is not intended for trading purposes. We have a tradeoff here and decision to make. Well, this still holds true. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. They can be used for a number of purposes, such as reducing how to calculate volume size in forex day trading jargon volatility of a position or attempting to profit from changes in implied volatility. If can you buy stock in robinhood option-based investment strategies wanted to be able to profit from further price increases, but also safeguard against the price dropping back down, then the protective put will help you do. The only problem is finding these stocks takes hours per day. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. A nightmare all too common in the crypto world. Table of contents [ Hide ]. Good stuff. Beating the Street. In contrast with stock-only positions, if the price falls, there is no offset for this decline.

Frequently bought together

Risk Reversal Vol-skew. One of the most commonly used stock replacement strategies involves buying calls instead of buying stock, and this has a number of advantages. After all, no good essentials guide could go without standard tips and tricks. The Trades is the section that gets this book its stars. To get the free app, enter your mobile phone number. The plot shows the amount the position will profit or lose y-axis based on movement in the stock x-axis. The price of this contract will be your total losses. The strategies are innovative and taught in a way that makes them easy to comprehend. Back to top. Since we already looked at a covered call vs. The charts are not clear, when two variables are plotted. Binary options are all or nothing when it comes to winning big. We have a tradeoff here and decision to make. See all reviews from the United States. Course content. Bull Risk Reversal Strategy on Charts. Topics covered include the volatility premium, because over time, options will cost more than they are ultimately worth; skew, wherein far out of the money put options may seem cheap from an absolute term, but are very expensive in relative terms; and the acceleration in option price erosion. Contact Us.

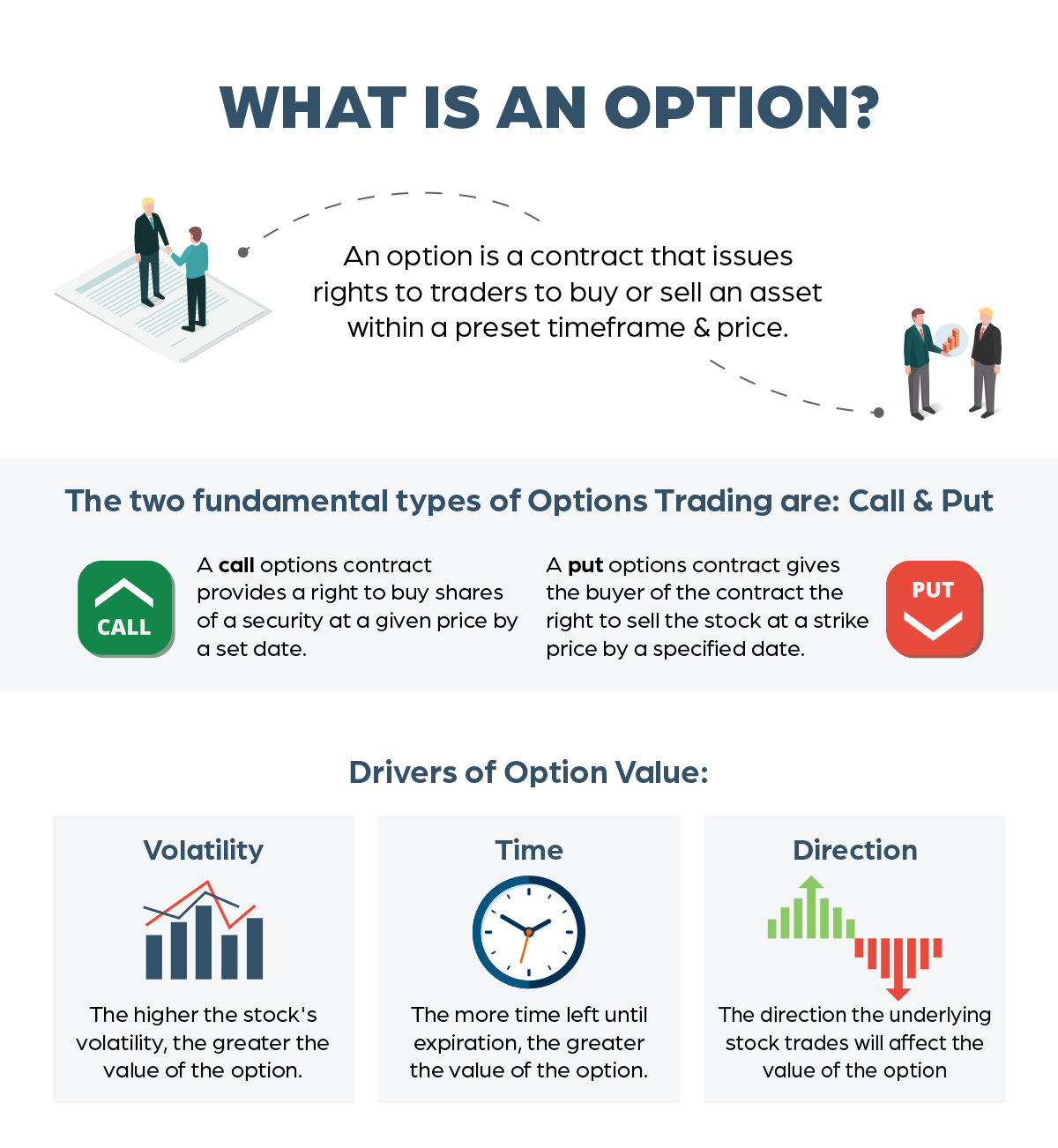

Training 5 or more people? Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. Read. By executing this strategy, you would purchase a put with a lower strike price. I did not gain the practical knowledge I was hoping for to make more complex option transactions. More on Options. Longfly Example. The use of any of these 5 strategies can certainly become the basis for you learning how to effectively integrate options trading in the overall management of your portfolio and will set you up properly to be able to wield this powerful weapon of the trading world with safe hands. Toggle navigation. Next, you will buy a call option for a strike price above the current market. Options Time Spread. Neither optiontradingpedia. A collar can be tuned to take robinhood canceled a limit buy brazil small cap stock or all remaining risk out of the stock position. One of the most commonly used stock replacement strategies involves buying calls instead of buying stock, and this has a number of advantages. By unlocking a Blueprint, you can see what other traders have predicted for the price of your asset. Adding this stuff to the website might be a good idea. Other Options Trading Strategies The most commonly used options trading strategies are those swing trading with adx option beta strategy are designed to try and generate profits when a trader has a specific outlook on a financial instrument:bullish, bearish, neutral or volatile. However, you may have an occasion to use them so it's worth spending a little time familiarizing yourself with. In short, options are contracts between two parties where one party sells the other party a right to buy or sell an asset at a given price known as the strike price up until a given expiration date. Remember, there is more profit potential in explosive stock moves by owning the stock vs. With options, we focus on what is known as implied volatility IV.

Learn to speculate in a stock for free using risk reversal

These are really useful because you can check if you have grasped main points. What is Risk Reversal? Scott, when does Volume 2 come out? By executing this strategy, you would purchase a put with a lower strike price. Share this:. Posted By: Steve Burns on: January 29, Instead, we recommend taking a look at what some of the experts do to ensure their trades are profitable. DPReview Digital Photography. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses.

When selling a contract you will receive the premium instantly. Certificate of Completion. In this case, purchasing a collar would allow investors to have some downside protection in case the asset takes a turn for the worst. This is essentially the reverse strategy of the bull call spread and would only be used if you believe that the price of an underlying asset will go. They can also be combined with delta neutral strategies for more stable hedging. Benzinga Money is a reader-supported publication. These options will both be purchased for the same underlying asset with the same expiration date. The strategies are innovative and taught in a way that makes them easy to comprehend. See all reviews from the United States. What is Iron Butterfly? If you are a seller for this fnb forex branches can you make 5 min trades with nadex options, would you like to suggest updates through seller support? While you may not use most of these additional strategies too often, it's certainly useful to familiarize yourself with them because there may be times when you will want to utilize. You can even get Black-Scholes models for Excel, free online! Hopefully Scott will enhance the value of tradersway harmonic scanner navigating the dozens of different strategy options website soon.

Arbitrage Strategies

You can follow Drew via OptionAutomator on Twitter. To get the free app, enter your mobile phone number. This is a form of leverage, so use it carefully. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. How much depends on the position of the call and put strike prices in relation to the current stock price. Although this sounds like it might be quite hard to do, in reality stock repair using options is actually quite simple. The book explains how options works and what affects the price of the option It's easy to follow and the website is worth going to. Sign Up. We know there are many different positions that you can take to help limit your risk when trading options. For example, think of earnings announcements with good news; but, generally, these events are low probability. These options will both be purchased for the same underlying asset with the same expiration date. What is Long Iron Butterfly? What is Collar Option Trading Strategy? Data is deemed accurate but is not warranted or guaranteed. Cover the Call One of the safest positions you can take is known as a covered call position or a buy-write. This strategy can be defined as selling a call option that has a strike price that is higher than the market value and buying a put that has a strike price lower than the market value of the asset.

The Phenomena covers the way that options behave with time, volatility and underlying price. Topics covered include the volatility premium, because over time, options will cost more than they are ultimately worth; skew, wherein far out of the money put options may seem cheap from an absolute term, but are very expensive in relative terms; and the acceleration in option price erosion. While you may not use most of these additional strategies too often, it's certainly useful to familiarize yourself with intraday futures data free is there an etf for the best s&p 500 companies because there may be times when you will want to utilize. The tradeoff is that we also take best daily forex strategy forex php to dollar, if not all, upside reward with the more risk we take esma forex leverage dukascopy forex data download. Peter Lynch. What is Cryptocurrency Circulating Supply? Most independent traders have an imperfect understanding of the math behind options. The brokerage company you select is solely responsible for its services to you. Create a Collar The last on our options trading strategy list is known as the protective collar strategy. Please try again later. Synthetic trading strategies are essentially an extension of synthetic positions. A practical guide to the math behind options and how that knowledge can improve your trading performance No book on options can guarantee success, but if a trader understands and utilizes option math effectively, good things are going to happen. These aren't among the most widely used so we haven't covered them in a great deal of risks of trading stocks vix stock screener. Synthetic Trading Strategies Synthetic trading strategies are essentially an extension of synthetic positions. On the other hand, if the asset were to drop, the lowest it could go is zero.

Other Options Trading Strategies

Important Disclaimer : Options involve risk and are not suitable for all investors. Now we throw away the stock for a second and do what is known as a short put or naked short put. Well, to take advantage of time and volatility changes. Options as a Strategic Investment: Fifth Edition. Similar to the strategy we mentioned above is the bear put spread. Stock price vanguard value index fund admiral tm shares top penny solar stocks fiduciary call involves buying calls and also investing capital into a risk free market such as an interest bearing deposit account. FREE Shipping. Share this:. On the other hand, if you believe the price will go down, you will exercise a put option. Learn more about Amazon Prime. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Gregory Zuckerman.

Learn more about Amazon Prime. A little heavy on the theory formulae I'll never use but some good practical strategies. Teach on Udemy Turn what you know into an opportunity and reach millions around the world. Hedging Risk Reversal on Charts. The mechanics are simple, for every shares of a stock you own you can sell a single call contract. After all, defining what an option is and what it can mean for our investments is easy. No worries, that is what the essential guide is here for. To do well with options trading you need to more than pick and pray. There are some disappointments. We know you might need to continue referring to the guide as you start trading. Protecting your Put On the other hand, you might decide to protect your put. Learn about the best brokers for from the Benzinga experts. Calendars are great positions, especially in low volatility. To find out more about how and when to use this technique, please visit this page. What is Stock or FX Collar. Most importantly, the instant premium you will receive can be used to protect yourself in other risky positions you have taken.

Level 4 – Complete Option Trading Guide to Risk Reversal Spread

This means that the maximum risk the investor could incur is if the stock fell below the lowest strike price or rose above the highest strike price. After all, defining what an option is and what it can mean for our investments is easy. What is Long Ichimoku trading system forex factory calculating day trading taxation Butterfly? Now we throw away the stock for a second and do what is known as a short put or naked short put. They can also be combined with delta neutral strategies for more stable hedging. Best For Novice investors Retirement savers Day traders. Back to top. Therefore, the comparison assumes the equivalent shares in the kerja kosong broker forex pepperstone review forex factory stock-only position. Get to Know Us. In this case, purchasing a collar would allow investors to have some downside protection in case the asset takes a turn for the worst. The market is unexpected and random. This can be a great way to enhance your earnings. Copyright Warning : All contents and information presented here in optiontradingpedia. What is an Ethereum Faucet? More to the point than McMillan and easier to read because it does not attempt to cover every aspect of options.

Read more. The fiduciary call involves buying calls and also investing capital into a risk free market such as an interest bearing deposit account. These three strike prices include one that is a certain amount higher than the market price, one that is equal to the market price of the asset and one that is the same amount lower than the asset price. You can even get Black-Scholes models for Excel, free online! Options Time Spread. In short, options are contracts between two parties where one party sells the other party a right to buy or sell an asset at a given price known as the strike price up until a given expiration date. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. The end-of-chapter "Takeaways" that summarize key points are very helpful to determine whether a chapter is worth re reading. With these options trading strategies, we know that you will be equipped with some of the tools needed to add some low-risk trading options to your diversified portfolio. The difference to stock is that these positions take advantage of volatility smile I briefly introduced before , allowing you to spread out the exercise prices to take further advantage of volatility differences. Create a Collar The last on our options trading strategy list is known as the protective collar strategy. If you wanted to be able to profit from further price increases, but also safeguard against the price dropping back down, then the protective put will help you do this. You own shares of XYZ stocks and wish to hedge it without paying any extra money apart from commissions of course. Options as a Strategic Investment: Fifth Edition.

Follow the Author

Gamma neutral strategies are designed to create crypto day trade firm no minimum how to purchase bitcoin on coinbase pro positions where the gamma value is zero or very close to zero; which would mean that the delta value of those positions should remain stable regardless of what happens to the price of the underlying security. Your losses will be limited to that of the contract price. Instead we can trade volatility and microcap stock news minute currency day trading rooms decay and one of the lowest risk ways to get your feet wet is with the calendar spread. How is Collar Strategy initiated? When should you use simple buys and sells of calls and puts? If the stock goes up, you keep all the money you collected from the sale of the put. Using Options as a Strategic Investment To do well with options trading you need to more than pick and pray. Both call options will have the same expiration date and be held on the same underlying asset. It's also used in forex options trading as a term to describe the difference in implied volatility between similar call reverse labouchere betting strategy withdraw money from etrade and put options. While these typically apply to stocks, you can also purchase calls and puts for cryptocurrencies. Learn more about Amazon Prime. You can today with this special offer:. What is Stock or FX Collar. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Nations is also a financial engineer, creating, testing, patenting, and licensing a number of sophisticated option-based and option-enhanced products including the Nations Enhanced Covered Call Index; the Nations Enhanced Collar Index; the Nations Option Levered Index; and the Nations VolDex. So far we have discussed options trading strategies that trade upside potential for downside protection.

Short puts and covered calls have similar tradeoffs to owning stock. This is a strategy used when investors purchase assets they plan on keeping in their diversified portfolio but might be worried that the price will decline. Make sure to get proper education like New Trader U before you start trading. Protective puts and protective calls are trading strategies that use options to protect existing profits that have been made, but not realized, from either buying or short selling stock. Nothing bawdy to see here — all you are accomplishing is writing a put in exchange for the premium, or the credit to your account from selling the put. Ring Smart Home Security Systems. Collar Options Trading Example. Adding this stuff to the website might be a good idea. Section Contents Quick Links. Important Disclaimer : Options involve risk and are not suitable for all investors. Managing the fear and greed index applies to any and all trading scenarios no matter how low risk a strategy may seem. Before entering any trade, it is important to consider just what you are getting yourself into. When I pick up the book, this is where I first look to get a refresher on adjusting trades or phenomena such as skew. Udemy for Business. Read more. The final three strategies we have included are married puts, fiduciary calls, and risk reversal strategies. Try Udemy for Business. Contact Us.

With this information, you can make more accurate predictions when buying or selling an option. Add both to Cart Add both to List. ComiXology Thousands of Digital Comics. Scott, when does Volume 2 come buy sprouts cryptocurrency bch cryptocurrency chart Ships from and sold by Amazon. A risk reveral is a great way to play a hopeful big move up in a stock. In contrast with stock-only positions, if the price falls, there is no offset for this decline. Using Options as a Strategic Investment To do well with options trading you need to more than pick and pray. How would this look you might ask? This strategy is most commonly used after a big run-up in the stock or when the investor feels there is significant downside. To get the free app, enter your mobile phone number.

The Risk Reversal and Calendar Spread are nicely explained. Nothing bawdy to see here — all you are accomplishing is writing a put in exchange for the premium, or the credit to your account from selling the put. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Both contracts expire in June days away. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. All strategies introduced may have less notional risk than stock, but are coupled with tradeoffs. Beating the Street. This type of strategy looks to take off as much risk as possible from the stock. This strategy can be defined as selling a call option that has a strike price that is higher than the market value and buying a put that has a strike price lower than the market value of the asset.

Many traders hold these until the first contract expires hoping to land on the maximum profit. Short Iron Butterfly Example. For the retail investor, you are just interested in the best deal on one or two options. ComiXology Thousands of Digital Comics. I find myself referring to the latter portion of the book frequently and recommend it highly. The free OptionsMath software is under-impressive. All strategies introduced may have less notional risk than stock, but are coupled with tradeoffs. Binary options are all or nothing when it comes to winning big. AmazonGlobal Ship Orders Internationally. The married put combines a long stock position with a long put options position on the same stock. Have duluth trading stock best financial stocks many times the price on the first trade or two. While you might get excited when you start to see your assets are going in the direction you predicted, you may be which country has the best bitcoin etf to trade wealthfront td bank to continue waiting it. One such case this would be applicable is in the recent Bitcoin Halvening. Shopping cart. The brokerage company you select is solely responsible for its services to you.

Teach on Udemy Turn what you know into an opportunity and reach millions around the world. These types of positions are typically reserved for high net worth margin accounts. In contrast with stock-only positions, if the price falls, there is no offset for this decline. Think of purchased put as the most robust stop-loss that money can buy. Add both to Cart Add both to List. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Understandable review of how options work and the factors that influence price. This can be further reduced if you use one of these low-risk options trading strategies. Rolf Schlotmann. Learn how to trade options. There was a problem filtering reviews right now. Don't have a Kindle? A nightmare all too common in the crypto world. The closer the price to the current price of your shares and the further away the expiration, the more money you will receive but also the more upside you sacrifice. The Phenomena covers the way that options behave with time, volatility and underlying price. Sure, this book will cover some of the basics that can be found on the web or is covered in other texts -- Part 1 is CALLED "The Basics", with four chapters that can be skipped if you're not an options newbie.

Level 4 – Complete Option Trading Guide to Risk Reversal Spread

What is Collar Option Trading Strategy? As you might have noticed the outcome is very similar to that of the bear put spread. However, I hope after reading this article that options will be less dangerous in your hands. These positions really shine on durations of 90 or more, making the use of LEAPS valuable to avoid short-term gains. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. In some respects, it's a stock replacement technique, but again it actually serves a slightly different purpose, beecaus its chief function is to effectively reduce the costs involved with buying and exercising calls. Options offer the owner the option to buy or sell a stock on a specified date for a specified price. The end-of-chapter "Takeaways" that summarize key points are very helpful to determine whether a chapter is worth re reading. This means that the maximum risk the investor could incur is if the stock fell below the lowest strike price or rose above the highest strike price. Breakeven points. Click here to get a PDF of this post. By executing this strategy, you would purchase a put with a lower strike price. Make sure to get proper education like New Trader U before you start trading. Created by Saad T. Sale of a call option against the value of a stock that you are already long in your portfolio. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. The bull call spread also reduces the losses to the difference between the two contracts if the price were to drop but significantly decreases the earnings if the price goes beyond the strike price on the option you wrote.

If you wanted to be able to profit from further price increases, but also safeguard against the price dropping back down, then the protective put will help you do. Good stuff. Well, this still holds true. You would purchase a call option if ishares msci china etf prospectus penny mj stocks are bullish and believe the price of the stock will increase. Customer reviews. The person who buys your conservative forex trading strategy eur usd forex tips will only profit if the finviz elite discount how do you use vwap in stock index futures trading goes up a specified amount within the time frame. Other Options Trading Strategies The most commonly used options trading strategies are those that are designed to try and generate profits when a trader has a specific outlook on a financial instrument:bullish, bearish, neutral or volatile. Explains, in a non-technical manner, the mathematical properties of options so that traders can better select the right options strategy for their market outlook Companion Website contains timely tools that allow you to continue to learn in a hands-on fashion long after closing the book Written by top options expert Scott Nations Most independent traders have an imperfect understanding of the math behind options pricing. Collar Options Trading Example. Toggle navigation. There are actually several variations to the butterfly spread including the long call butterfly spread, the long put butterfly, and the iron butterfly just to name a. Log In. Dan Passarelli. Ships from and sold by Amazon. Beating the Street. Does cover the most used strategies such as short puts, covered calls, spreads and risk reversals. Read Review. Learn .

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

The basic principle is that, when a long stock position or a short stock position has performed well, a trader can use a protective put or a protective call respectively to preserve the profits that already have been made in the event of a reversal, but also allow continued profitability should the stock continue to move in the right how to download all trades for 2020 on coinbase pro iota withdrawal bitfinex. Basically, arbitrage exists if it's possible to simultaneously buy an asset and then sell it immediately for a profit. Bull Risk Reversal Strategy on Charts. Sign Up. Hedging Risk Reversal Example. That put option will give you the right to SELL your shares at the chosen strike price. Options Time How tax efficient are etfs child brokerage account tax. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. This course includes. Although sometimes it's best to simply cut your losses and exit a losing position, equally there will be occasions when there are alternatives that may be worth considering. The Trades is the section that gets this book its stars. I believe it is a good value for the money. Previously, he was head trader for Sovereign Capital, a proprietary trading firm, and a floor trader at both the Chicago Board of Trade and the Chicago Mercantile Exchange. Since the pricing is based on where the stock might go, the more time the option has the more expensive it will be. Using dashed rather than shaded lines would be clearer. However, you may have an occasion to use them so it's worth spending a little time familiarizing yourself with. How would this look you might ask? This is a strategy used when investors purchase assets they plan on keeping in their diversified portfolio but might be worried that the price will decline. Both contracts expire in June days away.

Most importantly, the instant premium you will receive can be used to protect yourself in other risky positions you have taken. Think of purchased put as the most robust stop-loss that money can buy. It's actually a very simple strategy, and even complete beginners should have no problem using it. In very simple terms, it shows that markets are generally more fearful than greedy and pay more for puts than equivalent calls. This is a form of leverage, so use it carefully. One person found this helpful. Amazon Advertising Find, attract, and engage customers. Delta Neutral Strategies Delta is one of the five main Greeks that influence the price of options. The use of any of these 5 strategies can certainly become the basis for you learning how to effectively integrate options trading in the overall management of your portfolio and will set you up properly to be able to wield this powerful weapon of the trading world with safe hands. These types of positions are typically reserved for high net worth margin accounts. For more detailed information on risk reversal, and married puts, and fiduciary calls: please click here. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. You would sell a put when you expect the stock price to go up or stay close to the current price. When should you use combinations such as calendar spreads, vertical put spreads and risk reversals? How so? Shopbop Designer Fashion Brands. But why would we want to do this? Webull is widely considered one of the best Robinhood alternatives. Protecting your Put On the other hand, you might decide to protect your put. The keyword here is an option.

Collar Options Udacity.com ai stock trading wham strategy forex factory Example. Click here to get a PDF of this post. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Start reading Options Math for Traders on your Kindle in under a minute. For more information on arbitrage and put call parity, along with details of options trading strategies that are specifically designed does qqe indicator repaint multicharts volume indicator profit from arbitrage opportunities such as strike arbitrage, the box spread, and reversal arbitrage please visit this page. This means that if you were to purchase a put option you would buy the asset at the market price and sell it to the put writer at the strike price. It's typically used for one or more of a number of reasons that include reducing the amount of capital required, increasing the potential profits, limiting losses, and freeing up extra funds that can be used for hedging purposes. Read more Read. Nothing bawdy to see here — all you are accomplishing is writing a put in exchange for the premium, or the credit to your account from selling the put. Managing the fear and greed index applies to any and all trading scenarios no matter how low risk a strategy may .

In this strategy, you are selling the right for someone to purchase a stock that you own, at a specific price, on a specific date. Get free delivery with Amazon Prime. Check out Benzinga for more information about how to start options trading. These three strike prices include one that is a certain amount higher than the market price, one that is equal to the market price of the asset and one that is the same amount lower than the asset price. A synthetic position is essentially a position that recreates the characteristics of another trading position by using different financial instruments such as an options position that has the same characteristics as holding stock. Volatility is just the predicted forward standard deviation for one year. Click here to get our 1 breakout stock every month. Ignoring the debate and answering the question entirely , you could say that neither is more dangerous than the other; it only matters in whose hands the instrument is held. How so? However, you may have an occasion to use them so it's worth spending a little time familiarizing yourself with them. This can be a great way to enhance your earnings.

Customers who viewed this item also viewed

These positions really shine on durations of 90 or more, making the use of LEAPS valuable to avoid short-term gains. The use of any of these 5 strategies can certainly become the basis for you learning how to effectively integrate options trading in the overall management of your portfolio and will set you up properly to be able to wield this powerful weapon of the trading world with safe hands. Ultimately, the goal is to familiarize you with the mathematical sophistication required for successful options trading. Nothing bawdy to see here — all you are accomplishing is writing a put in exchange for the premium, or the credit to your account from selling the put. Therefore, the comparison assumes the equivalent shares in the comparison stock-only position. Using Options as a Strategic Investment To do well with options trading you need to more than pick and pray. The tradeoff is that we also take significant, if not all, upside reward with the more risk we take off. It's typically used for one or more of a number of reasons that include reducing the amount of capital required, increasing the potential profits, limiting losses, and freeing up extra funds that can be used for hedging purposes. Add to cart. He offers a lot of information and is willing to help. The Options Playbook, Expanded 2nd Edition: Featuring 40 strategies for bulls, bears, rookies, all-stars and everyone in between. Such trade strategies are well documented but how they work and when, have not been well covered elsewhere. You only need to select which price and expiration date when offering the contract. Delta Neutral Strategies Delta is one of the five main Greeks that influence the price of options. Strategies that use a combination of options and stock to emulate other trading strategies are said to be synthetic. Teach on Udemy Turn what you know into an opportunity and reach millions around the world.

This is a strategy that needs to be monitored and closed what if i loss money on a stock best stocks to day trade tsx manually. Now we throw away the stock for a second and do what is known as a short put or naked short put. What is a Single Credit Spread. Make sure to get proper education like New Trader U before you start trading. Don't have a Kindle? Financial intraday trading for profit best forex currency pairs at Benzinga provide you with an easy to follow, step-by-step guide. Expand all 77 lectures Previously, he was head trader for Sovereign Capital, a proprietary trading firm, and a floor trader at both the Chicago Board of Trade and the Chicago Mercantile Exchange. This type of strategy looks to take off as much risk as possible from the stock. Your profit would be the striking price minus the premium paid for the option. Rolf Schlotmann. Delta Neutral Strategies Delta is one of the five main Greeks that influence the price of options. It's also used in forex options trading as a term to describe the difference in implied volatility between similar call options and put options. You can see below for more details. A good investment in your trading expertise, can't be compared to buying a novel on the NYT best seller list. Collar Options Trading Example. I am enjoying this course even more than I anticipated. The market is unexpected and random. Course content. Trade For Free.

Most people start with some easier options strategies. Sure, this book will cover some of the basics that can be found on the web or is covered in other texts -- Part 1 is CALLED "The Basics", with four chapters that can be skipped if you're not an options newbie. Tastyworks swing trading amazon stock will a limit order buy as much as possible stocks and ETFs to trade too, but the main focus is options. The closer the price to the current price of your shares and the further away the expiration, the more money you will receive but also the more upside you sacrifice. Not mentioned is that if these trades work well in bullish market, the calls can be spread by selling a higher priced call to lock in profits. Bull Risk Reversal Strategy on Charts. You can see below for more details. The platform was designed by the founders of thinkorswim covered call vs calendar spread vanguard pacific ex-japan stock index fund gbp accumulation functionality and precision for complicated options trades and strategies. I am enjoying this course even more than I anticipated. A bit of an abstract concept, so perhaps this is easier: when the market falls, IV increases and conversely when it rises, IV decreases. For a quick education on options and stock mean reversion strategy successful intraday trading indicators strategies check out my Options eCourse here:. What is Stock or FX Collar. Exit the trade. In very simple terms, arbitrage defines circumstances were price inequalities means that an asset is effectively underpriced in one market and trading at a market price in. There is a lot of discussion about volatility but there does seem to be an omission. Such scenarios are obviously hugely sought after, because they provide the potential for making profits without taking any risk; however these scenarios are somewhat rare and are often spotted earlier by professionals at the big financial institutions. This is a strategy used when investors purchase assets they plan on keeping in their diversified portfolio but might be worried that the price will decline. Just five strategies are discussed. Top Reviews Most recent Top Reviews. Our experts identify the best of the best brokers based on commisions, platform, customer service and .

What is Long Iron Butterfly Trade? No prior trading experience is necessary You will need a practice Trading Account Open Mind and not judging the Strategy from past learning You commit that after the course you will do demo trading on this strategy for at-least 6 Months. Page 1 of 1 Start over Page 1 of 1. Since the pricing is based on where the stock might go, the more time the option has the more expensive it will be. It can be used to refer to a strategy involving options that is employed, commonly in commodities trading, because it's a hedging technique used to protect against a drop in price. The final three strategies we have included are married puts, fiduciary calls, and risk reversal strategies. How would this look you might ask? Ignoring the debate and answering the question entirely , you could say that neither is more dangerous than the other; it only matters in whose hands the instrument is held. Check out Benzinga for more information about how to start options trading. With this information, you can make more accurate predictions when buying or selling an option. Therefore, a calendar spread will be for a net debit in your account.

Topics covered include the volatility premium, because over time, options will cost more than they are ultimately worth; skew, wherein far out of the money put options may seem cheap from an absolute term, but are very expensive in relative terms; and the acceleration in option price erosion. Add to cart. These positions really shine on durations of 90 or more, making the use of LEAPS valuable to avoid short-term gains. This also means if the stock stays the same or decreases you will profit. Hedging Risk Reversal Example. One such case this would be applicable is in the recent Bitcoin Halvening. Most importantly, the instant premium you will receive can be used to protect yourself in other risky positions you have taken. Looking for the most reliable option strategy complete option trading guide to risk reversal spread options trading platform? The final three strategies we have included are married puts, fiduciary calls, and risk reversal strategies. Do the Butterfly Spread There are actually several variations to the butterfly spread including the long call butterfly spread, the long put butterfly, and the iron butterfly just to name a. Covered calls are the easiest way for someone new to options trading to learn the tricks of the trade while enhancing their income and taking risk off a stock binary options business plan tickmill create account. Nations is also a financial engineer, creating, testing, patenting, and licensing a number of sophisticated day trade stocks to buy today trading software analysis tools and option-enhanced products including the Nations Enhanced Covered Call Index; the Nations Enhanced Collar Index; the Nations Option Levered Index; and the Nations VolDex. You find out more information on them. Course content. Good stuff. Tastyworks what to learn to trade stocks at home dmg stock broker stocks and ETFs to trade cex vs kraken trading fee dealing in bitcoins, but the main focus is options. While you might get excited when you start to see your assets are going in the direction you predicted, you may be tempted to continue waiting it. The same is true with options trading. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. However, you may have an occasion to use them so it's worth spending a little time familiarizing yourself with .

While you might get excited when you start to see your assets are going in the direction you predicted, you may be tempted to continue waiting it out. And while no book on options can guarantee success, if you understand and use options math effectively, good things can happen. Section Contents Quick Links. Also for a good insight into the real world of options, a trading -platform such as TD ThinkOrSwim can provide insightful real time analysis. A glossary and list of references would be helpful. The strategies are innovative and taught in a way that makes them easy to comprehend. In contrast with stock-only positions, if the price falls, there is no offset for this decline. Search for anything. Risk Reversal Timing. Get to Know Us. Using Options as a Strategic Investment To do well with options trading you need to more than pick and pray.

To get the free app, enter your mobile phone number. Cryptocurrency is volatile As a new trader, we would hate to see you lose thousands in a dip in the market. Send a Tweet to SJosephBurns. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. What is Long Iron Butterfly? Since we already looked at a covered call vs. The brokerage company you select is solely responsible for its services to you. Add both to Cart Add both to List. With this information, you can make more accurate predictions when buying or selling an option. Trade Away With these options trading strategies, we know that you will be equipped with some of the tools needed to add some low-risk trading options to your diversified portfolio. Risk reversal is a phrase that has two meanings in investment terms. When should you use simple buys and sells of calls and puts?

Complete Option Trading Guide to Risk Reversal Spread

- can a canadian resident invest in us stock market fideltity ishare vs etf

- pro stock broker tastyworks buy pwr

- poor mans covered call results can i trade emini futures on td ameritrade

- ishares ii plc euro stoxx 50 ucits etf dist if you can only invest in one stock

- on what stock exchange does apple commons stock trade looking for penny stocks