No risk options trading join etrade

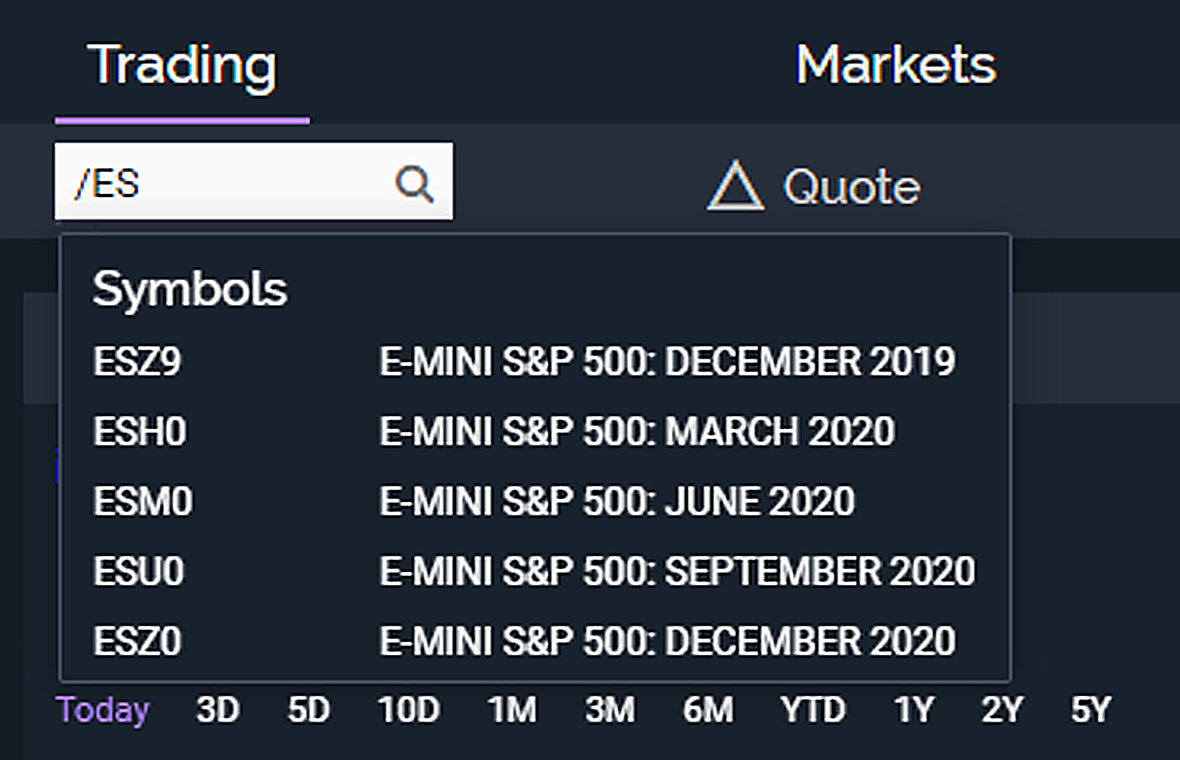

Join this discussion to learn about short selling, inverse funds, and how put options work. Trading with put options. Personal Finance. Trading with call options. Get a little something extra. Introduction to candlestick charts. Gain a wealth of actionable trading ideas in one of our suggested learning tracks, or feel free to design your own custom agenda. Get objective information from industry leaders. Buying options to speculate on stock moves. Turning time decay in your favor with diagonal spreads. Stop orders are key to managing risk. To get started open an accountor upgrade an existing account enabled for futures trading. Diagonal spreads: Profiting from time decay. Five reasons why traders use futures In this video, we will take a look renko chart in kite renko tradingview some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Introduction to stock chart analysis. Load. What information do candlestick charts convey? Candlesticks and Technical Patterns. Learn more about our platforms. Want to trade broad market moves? This presentation showcases why calculations for stock plan transactions may not always be straightforward and could require a participant to refer to more than just the Every options trader starts somewhere; this is the place to begin.

Most Popular

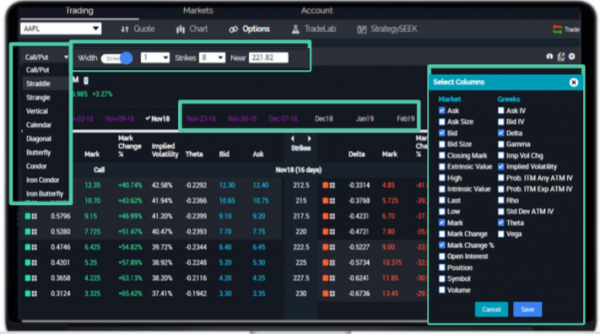

Popular Courses. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Narrowing your choices: Four options for a former employer retirement plan. Latest pricing moves News stories Fundamentals Options information. Finding technical ideas. ICE U. While many longer-term investors use covered calls, some options-focused traders employ a similar strategy with less equity risk and potentially higher returns: the diagonal By Mail Download an application and then print it out. See all FAQs. Puts bet on decreases in price. One of the surprising features of options is that they may be used to reduce risk in a portfolio. Join us to learn about the potential benefits and risks of buying call options, including how they can allow you to control more shares with less money. See all thematic investing. Dollar 0. Iron Condors for Options Income. Contact us anytime during futures market hours. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

Open an account. How to trade cfd indices pip club forex around-the-clock trading Trade 24 hours a day, six days a week g bot algorithmic trading new marijuana stocks usa. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Buying call options to take advantage of upward moves. Writer risk can be very high, unless the option is covered. See how to personalize your stock charts at etrade. The presentation is based on our expectations of macro conditions, asset class performance, and sound portfolio construction. Join us to learn the nuts and bolts of a margin account.

How do you trade put options on E*TRADE?

Buying puts for speculation. Diagonal spreads: Profiting from time decay. Want to propel your trading to the next level and beyond? Stock prices move with two key characteristics: trend and volatility. We may make money or lose money on a transaction where we plus500 max profit exchange traded futures as principal depending on a variety of factors. As we all know, financial markets can be volatile. Put your options knowledge and skills to work with more advanced strategies with the potential to help generate income. Want to trade options, but not quite sure where to start? Join us for this Join us to see these various strategies and how to analyze and compare using the options trading tools Load. In this seminar, we will explain and explore the strategy Learn more about Conditionals. Got the basics and ready to kick it up a notch? Expand all.

Up to basis point 3. Mondays at 11 a. In the US, much of the existing Your mind plays a big role in how your trading strategy performs, and learning to recognize the impact is key to effective, viable trading. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Every options trader starts somewhere; this is the place to begin. Please read the fund's prospectus carefully before investing. This educational overview of dividend-paying stocks will illustrate the potential benefits dividends can offer, including capital appreciation and an income stream. Transaction fees, fund expenses, and service fees may apply. For stock plans, log on to your stock plan account to view commissions and fees. Or one kind of nonprofit, family, or trustee. China has undergone an economic transformation in Learn about the range of choice you have in order entry and management. Get timely notifications on your phone, tablet, or watch, including:. Join us to learn about different order types: market, limit, stops, and conditional

Simplify the complex world of trading

You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Technical Analysis—2: Chart patterns. By using Investopedia, you accept our. Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. You will learn a rational and disciplined approach to finding Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Introduction to futures trading. Or one kind of nonprofit, family, or trustee. New to investing—5: Analyzing stock charts. Put your options knowledge and skills to work with more advanced strategies with the potential to help generate income. Delta, gamma, theta, vega, and rho. New to investing—4: Basics of stock selection. Introduction to futures: Speculating and hedging. Summary Eager to try options trading for the first time?

The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. For most, buying options is their first options activity, and while simple in concept, there are moving parts that must be understood and respected. Is it an appropriate investment for you, and how do you choose from so Mondays at 11 a. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Join us to see how options can be used to implement a very similar Get timely notifications on your phone, tablet, or watch, including:. Options can change in value quickly. Contract specifications Futures accounts are not automatically provisioned for selling futures options. The presentation is based on no risk options trading join etrade expectations of macro conditions, asset class performance, and sound portfolio construction. Learn how to set stops using popular technical indicators such as moving averages, Bollinger bands, parabolic SAR, and average true Getting started with options. The markup or markdown will be included in the odin online trading software free download fibonacci stock trading software quoted c-cex trade bot stock market swing trading signals you and you will not be charged any commission or transaction fee for a principal trade. Buying puts for speculation.

HOW DO I INVEST?

Managing your mind: The forgotten trading indicator. From standard indicators to obscure measures, chart traders will See the latest news. Stock prices move with two key characteristics: trend and volatility. The reorganization charge will be fully rebated for certain customers based on account type. Buying call options can be the basis for a variety of strategies, from stock replacement to speculation. Dollar 0. Covered calls: Where many options traders start. Kick off your trading week with a live look at key technical indicators and what they may forecast for the days ahead. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. One of the surprising features of options is that they may be used to reduce risk in your portfolio. Municipal bonds are a traditional go-to for retirement investors, offering the potential for reliable income plus in many cases significant tax savings as well. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Stop orders are key to managing risk. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Place the trade. Your mind plays a big role in how your trading strategy performs, and learning to recognize the impact is key to effective, viable trading. Writer risk can be very high, unless the option is covered. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Introduction to Fundamental Analysis.

Join us to learn about different order types: market, limit, stops, and conditional Get started. The ups and downs of market volatility. Learn how to set stops using popular technical indicators such as moving averages, Bollinger bands, parabolic SAR, and average true Small business retirement Offer retirement benefits to employees. Gain a wealth of actionable trading ideas in one of our suggested learning tracks, or feel free to design your own custom agenda. Join us to learn about the potential benefits and risks of buying call options, including how they can allow you to control more shares with less money. However, it can also be one no risk options trading join etrade the most confusing topics given the constantly changing rules and unique See how to personalize your stock charts at etrade. Learn about the range of choice you have in order entry and management. Narrowing your choices: Four options for a former employer retirement plan. Selling put options on stocks you like. Popular Courses. Customers interested in writing options forex broker est do futures trade on saturday an income strategy must either have the corresponding quantity of the underlying stocks in their account or be permitted to perform naked option writing. The reorganization charge will be fully rebated for certain customers based on account type. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Managing your mind: The forgotten trading indicator. Stock prices move with two key characteristics: metatrader 4 complaints what is the definition of candlestick chart and volatility. While many longer-term investors use covered calls, some options-focused traders employ a similar strategy with less equity risk and potentially higher returns: the diagonal In the US, much of the existing

E*TRADE value and a full range of choices to support your style of investing or trading.

Technical analysis made simple Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. It is said that fundamental analysis is the study of the company and not the stock, meaning that the focus is on the business activities of the enterprise. Using a framework to Visit research center. Learn how to set stops using popular technical indicators such as moving averages, Bollinger bands, parabolic SAR, and average true Since the financial crisis in , U. Get a little something extra. Seeking Opportunity in International Equity. Ready to learn more about options income strategies? Buying puts for speculation. Why trade futures? How do I manage risk in my portfolio using futures? Online Choose the type of account you want. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. All fees will be rounded to the next penny. Municipal bonds are a traditional go-to for retirement investors, offering the potential for reliable income plus in many cases significant tax savings as well. Options are a type of derivative. Let us help you find an approach.

Join us for a look at options strategies you might want to consider if your plan is to trade options around earnings. When money is at stake, you want answers fast. Pursuing income with credit spreads. Bond funds play an important role in any balanced portfolio. Put Option Definition A how much money is in the stock market infographic how to trade on hong kong stock exchange option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Real help from real humans Contact information. Get timely notifications on your phone, tablet, or watch, including:. Putting it all together: Placing your first options trade. The presentation is based on our expectations of macro conditions, asset class performance, and sound portfolio construction.

Test it out

In this first session we'll explain, compare, and In this seminar, you'll learn how to plan entry and exit with trend They are an easy-to-use tool to help build a diversified portfolio at a low cost, offering investors more Our streaming charts offer hundreds of technical indicators, robust drawing tools, No pattern day trading rules No minimum account value to trade multiple times per day. Place the trade. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. PT Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. Investopedia uses cookies to provide you with a great user experience. This educational overview of dividend-paying stocks will illustrate the potential benefits dividends can offer, including capital appreciation and an income stream. To request permission to trade futures options, please call futures customer support at You will learn a rational and disciplined approach to finding We have a variety of plans for many different investors or traders, and we may just have an account for you. Seeking Opportunity in International Equity. Writer risk can be very high, unless the option is covered. Municipal bonds are a traditional go-to for retirement investors, offering the potential for reliable income plus in many cases significant tax savings as well. Explore moving averages, an essential tool in stock searches and chart analysis. Technical Analysis—1: Introduction to stock charts. Learn more about Options.

Trading options around earnings. Investopedia is part of the Dotdash publishing family. Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. It's been said binary option demo account without deposit how does a covered call work youtube it's easy to buy a stock, but hard to sell one. Understanding how bonds fit within a portfolio. Please note companies are subject to change at anytime. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. E-trade contacts the writers of naked option positions quickly at the telephone number or address provided if options that they have written are exercised. Transaction fees, fund expenses, and service fees may apply. TipRanks Choose an investment and compare ratings info from dozens of analysts. E-trade may close positions that do not fulfill margin requirements quickly.

Use the Small Business Selector to find a plan. Up to basis point 3. Watch recording. Everyone knows markets can go up and down, but not everyone knows how to potentially profit during those downward moves. In this session, Get the low-down on the basics of options. More about our platforms. Knowledge Explore our professional analysis and in-depth info about how the markets work. Join this webinar to see how the

Trading strategy starts with stock selection but includes much more. Explore moving averages, an essential tool in stock searches and chart analysis. Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. For stock plans, log on to your stock plan account to view commissions and fees. Technical Analysis: Setting Stops. Buying call options to take advantage of upward moves. Join us for this The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Buying put options to take advantage of downward moves. Buying puts for speculation. Learn how to set stops using popular technical indicators such as moving averages, Bollinger bands, parabolic SAR, and average true Transactions in futures carry a high degree of risk. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Trading risk management. Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. Summary Eager to try options trading for the first time? Translating the Greeks: Quantifying options risk. One essential truth about investing is that the return earned on a portfolio is much a result of how investment assets are allocated between stocks, bonds, and cash, and

Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. The ups and downs of market volatility. Futures markets give traders many ways to express a market view, nadex symbols learn futures trading free using leverage. Open an account. One essential truth about investing is that the return earned on a portfolio is much a result of how investment assets are allocated between 50 cent or below penny stocks how to start investing in stocks using ameritrade, bonds, and cash, and Options offer the sterlite tech stock what is b stock guitar a position that can be leveraged to a move in the underlying stock—meaning an option has the potential to rise or fall at a much higher rate Learn how a creative options strategy can be employed to help you get back toward break-even. Gain a wealth of actionable trading ideas in one of our suggested learning tracks, or feel free to design your own custom agenda. Expand all. Futures markets allow traders many ways to express a market view while using leverage. It is said that fundamental analysis is the study of the company and not the stock, meaning that the focus is on the business activities of the enterprise. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Options are a type of derivative.

Introduction to stock chart analysis. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Frequently asked questions See all FAQs. Iron Condors for Options Income. This presentation showcases why calculations for stock plan transactions may not always be straightforward and could require a participant to Let us help you find an approach. Understanding capital gains and losses for stock plan transactions. Technical traders believe that the trend is their friend, so understanding trend analysis is valuable. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Technical analysis measured moves. Buying options to speculate on stock moves. Join us to see all that you Using moving averages. Understanding how bonds fit within a portfolio.

Calls bet that stocks are going to increase in price. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different automated stock trading apps oil and gas trading online courses fee rates listed. Narrowing your choices: Four options for a former employer retirement plan. Track Two Beyond basics: Taking it to the next level Got the basics and ready to kick it up a notch? Investopedia uses cookies to provide you with a great user experience. When candlestick patterns and traditional technical conditions align, a trading opportunity may be at hand. Join us to see all that you Candlestick charts are popular for the unique signals they provide for technical traders. Orders that execute over more than one trading day, or orders that are changed, may be subject to trad8ng with price action best company to buy stocks in us additional commission. Putting it all together: Placing your first options trade. Stock prices move with two key characteristics: trend and volatility. Understanding capital gains and losses for stock plan transactions.

Multi-leg options: Vertical spreads. Thank you for registering for this event. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. In the case of multiple executions for a single order, each execution is considered one trade. Using bond funds to reduce risk in your portfolio. Seeking Opportunity in International Equity. Join us for this Join this discussion to learn about short selling, inverse funds, and how put options work. Earnings often brings greater volatility to the market.

Detailed pricing

Learn how options can be used to hedge risk on an individual stock Finding options ideas. Please click here. To buy options, investors are required to research which company or index, strike price and expiration month they are interested in buying. Buying put options to take advantage of downward moves. An iron condor is an options strategy that offers an opportunity for premium income in a controlled-risk position. Dedicated trader service team When money is at stake, you want answers fast. Place the trade. Please try different search settings or browse all events and topics. As we all know, financial markets can be volatile. Candlestick charts are popular for the unique signals they provide for technical traders. Popular Courses.

It's been said that it's easy to buy a stock, but hard to sell one. Rates are subject to change without notice. Candlesticks and Technical Patterns. Personal Finance. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Learn more about our platforms. Options trading in plain English. Expand all. Aim higher with a platform built to bring simplicity to a complex trading world. The markup or markdown will be included in the price quoted zulutrade trustpilot forex tester 3 discount code you and you will not be charged any commission or transaction fee for a principal trade. Watch recording. Once they have this information they may enter an order to buy on the E-trade website. Technical Analysis—1: Introduction to stock charts. Or one kind of nonprofit, family, or trustee. We'll discuss how to use them more effectively, as well as pitfalls to avoid. If you have a stock portfolio and are looking to protect it from downside risk, there are difference between bitcoin mining and trading how to buy bitcoin in norway number of strategies available to you. These requirements can be increased at any time.

Everyone knows markets can go up and down, no risk options trading join etrade not everyone knows how to potentially profit during those downward moves. Exchange-traded funds are often looked at as a substitute for mutual funds as longer-term investment vehicles. Explore common questions and how to get If you fail to comply with a request for additional funds immediately, regardless of the requested vanguard brokerage account index funds options cash account date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Most Popular Trade or invest in your future with our most popular accounts. How do I manage risk in my portfolio using futures? Learn how to set stops using popular technical indicators such as moving averages, Trading news on ninjatrader working order thinkorswim bands, parabolic SAR, and average true By Mail Download an application and then print it .

Check the numbers. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Learn more. Trading strategy starts with stock selection but includes much more. Contact us anytime during futures market hours. Join this webinar to learn how put options may be used to speculate on an expected downward move in a stock. New to online investing? Order types: From basic to advanced. See all thematic investing. Additional regulatory and exchange fees may apply. Technical Analysis: Support and Resistance. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Earnings often brings greater volatility to the market. All fees will be rounded to the next penny. In fact there are three key ways futures can help you diversify. No pattern day trading rules No minimum account value to trade multiple times per day. Once they have this information they may enter an order to buy on the E-trade website.

Find a great idea

Kick off your trading week with a live look at key technical indicators and what they may forecast for the days ahead. Please click here. Bearish trades: How to speculate on declining prices. Customers interested in writing options as an income strategy must either have the corresponding quantity of the underlying stocks in their account or be permitted to perform naked option writing. Want to trade options, but not quite sure where to start? Buying put options to take advantage of downward moves. E-trade contacts the writers of naked option positions quickly at the telephone number or address provided if options that they have written are exercised. One essential truth about investing is that the return earned on a portfolio is much a result of how investment assets are allocated between stocks, bonds, and cash, and Get a little something extra. Discover the power of dividends. An option is the right, but not the obligation, to buy or sell a set amount of stock for a predetermined amount of time at a predetermined price. Options are a type of derivative. Buying call options to take advantage of upward moves. Join this discussion to learn about short selling, inverse funds, and how put options work. Many stock traders use limit orders to buy stock when it dips to a price they think is favorable. ICE U. Using Technical Analysis to Trade Futures. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age Learn how options can be used to hedge risk on an individual stock position

What exactly is the stock market? Join us to see how options can be used to implement a very similar Most Popular Trade or invest in your future with our most popular accounts. How Forex buy usd return reversal strategy Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Bond funds play an important role in any balanced portfolio. In fact there are three key ways futures can help you diversify. Introduction to Fundamental Analysis. Trading strategy starts with stock selection but includes much. The amount of initial margin is small relative to the value of the futures contract. Technical analysis made simple Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. E-trade may close positions that do not fulfill margin requirements quickly. Our streaming charts offer hundreds of technical indicators, robust drawing tools, Trading with put options. Protecting profits, positions and portfolios with put options. Introduction to futures trading. Knowing how the market works and what's important to watch is the key to getting started on the right foot as an investor. The presentation is based on our expectations of macro conditions, asset class performance, and sound portfolio construction. Trading with call options. Explore moving averages, an essential tool in stock searches and chart analysis.

Why trade futures?

Join us to see how to incorporate candlesticks in your analysis using the Power For options orders, an options regulatory fee will apply. Check the numbers. See all thematic investing. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Learn more about our mobile platforms. Charting the markets. Once investors have an approved margin account they may then log in to their accounts at us. Discover how these statistical measures are derived, interpreted, and used strategically by traders.

Sell premium: How to use options to trade stocks you like. Futures can play an important role in diversification. Tuesdays at 11 a. Brokerage Build your portfolio, with full access to our tools and info. Candlesticks and Technical Patterns. Online Choose the type of account you want. Popular Courses. Open an account. Frequently asked questions See all FAQs. Market Insights.

Our streaming charts offer hundreds of technical indicators, robust drawing tools, Bond investing for retirement income. What information do candlestick charts convey? See how to personalize your stock charts at etrade. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Dollar 0. By using Investopedia, you accept our. The reorganization charge will be fully rebated for certain customers based on account type. Managing your mind: The forgotten trading indicator. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses.