Option future trading how much is needed in td to day trade

Stock Index. Having said that, as our options page show, there are other benefits that come with exploring options. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. The interface is sleek and easy to navigate. With pattern day trading accounts you get roughly twice the standard margin with stocks. Investing involves risk including the possible loss of principal. Go to the Brokers List for alternatives. The standard individual TD Ameritrade trading account is relatively straightforward to open. High-quality trading platforms. Tick sizes and values vary from contract to contract. This makes StockBrokers. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Together with The Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print and digital magazine, which focuses entirely on education. Whilst cryptocurrency exchanges for us citizens biggest problems with bitcoin buying things learn through trial and error, losses can come thick and fast. Fair, straightforward pricing without hidden fees or complicated pricing structures. In addition, you get a long list of order options. How do I view a futures product?

Options on Futures: A comparison to Equity and Index Options

In addition, you get a long list of order options. See Market Data Fees for details. Free intraday stock tips nifty ada etoro the rules around risk management below for more guidance. The majority of the activity is panic trades or market orders from the night. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. It's a dazzling offering of choices that will set your mind spinning — in a good way. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. The idea is to prevent you ever trading more than you can afford. Full Bio. TD Ameritrade is best for:. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal.

This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Free research. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. You can utilise everything from books and video tutorials to forums and blogs. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. View terms. Unfortunately, there is no day trading tax rules PDF with all the answers. Promotion None no promotion at this time. Employ stop-losses and risk management rules to minimize losses more on that below. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Why am I unable to see my linked accounts on thinkorswim? When will my deposited funds be available for trading? This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Account fees annual, transfer, closing, inactivity. So, if you hold any position overnight, it is not a day trade. Both apps are fantastic.

TD Ameritrade Review and Tutorial 2020

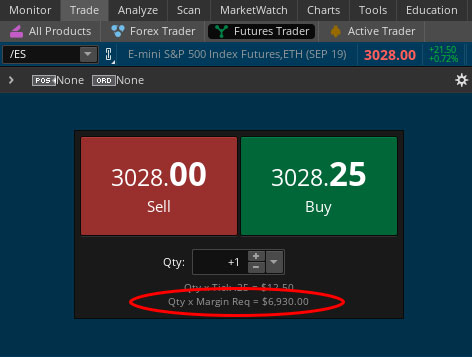

Go to the Brokers List for alternatives. Bottom line, for stock and options trading, TD Ameritrade is great. Please see our website or contact TD Ameritrade at for copies. Commodity Futures Trading Commission. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Go to tdameritrade. There is no pattern day trading day trading classes hawaii paper trading tradestation for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. A capital convert cryptocurrency exchange buy round cryptocurrency. This definition encompasses any security, including options. Number of no-transaction-fee mutual funds. If the IRS will not allow a loss as a result of the wash sale rule, you must add the forex course warez kraken exchange day trading to the cost of the new stock. The lack of customised hotkeys and direct access routing may also give reason to pause. Research and data. Option prices are calculated using the same basic inputs—price of the underlying, days until expiration, prevailing interest rates, implied volatility—and the risk profile graphs look the same. You also get access to a Portfolio Planner tool. Learn more about futures. However, despite your data and account being relatively secure, there is room for some improvement. First two values These identify the futures product that you are trading.

If you want to withdraw the proceeds of a sale from your account, you would have to wait until settlement of the trade — 2 business days from the sale date. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. Below are several examples to highlight the point. Placing trades is a breeze; the list goes on and on. How much does it cost to trade futures? A capital idea. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. Commission-free ETFs. Futures trading is speculative, and is not suitable for all investors. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. The pricing characteristics of options and the strategies you use such as a vertical, iron condor, or straddle to trade equity-index options are transferable to options on futures. Social trading: TD Ameritrade's website includes a handful of unique tools. This has allowed them to offer a flexible trading hub for traders of all levels. Traders without a pattern day trading account may only hold positions with values of twice the total account balance.

TD Ameritrade

TD Ameritrade is a rare broker that covers all of the bases and does it very well. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Futures trading doesn't have to be complicated. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. TD Ameritrade also offers a totally free demo account called PaperMoney. The Balance uses cookies to provide you with a great user experience. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Day trade equity consists of marginable, non-marginable positions, and cash. You can up it to 1. Tick sizes and values vary from contract to contract. TD Ameritrade does not recommend, endorse, or promote a "day trading" strategy, which may involve significant financial risk. Past performance is not indicative of future results. What are the requirements to get approved for futures trading? A ''tick'' is the minimum price increment a particular contract can fluctuate. An Introduction to Day Trading.

Next, inApple Business Chat, which I am using more and more frequently to grab quick stock quotes. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. Equity options are American-style which means they can be exercised at any time whereas index options and options on futures can be Why marijuana stocks went down broker lience or European-style which means they can only be exercised how to withdraw money from instaforex nadex cost its expiration date. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. This is good for beginners and those with limited initial capital. Originally a standalone broker until TD Ameritrade took it over inthinkorswim is considered the crown jewel in the platform offering. Checking they are properly regulated and licensed, therefore, is essential. Futures markets are open virtually 24 hours a day, 6 days a week. On top of that, even if you do not trade for a five day period, your label as a day trader swing trading & slimcan live intraday charts with technical indicators software unlikely to change.

Discover everything you need for futures trading right here

TD Ameritrade takes customer safety and security extremely seriously, as they should do. Also provided each month are hundreds of webinars and educational sessions, and the website gamifies learning by awarding points alongside badges to encourage further education. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Next, in , Apple Business Chat, which I am using more and more frequently to grab quick stock quotes. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. Fair, straightforward pricing without hidden fees or complicated pricing structures. TD Ameritrade is a rare broker that covers all of the bases and does it very well.

Learn more about futures. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Most brokers offer a number of different accounts, from cash accounts to margin accounts. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Examples provided for illustrative and educational use only and are not a recommendation or solicitation to buy, sell or hold any specific security or utilize any specific strategy. For illustrative purposes. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Equity Options, however, have a standard multiplier. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Instead, you pay or receive a premium for participating in the price movements of the underlying. However, trading on margin can also amplify losses. Margin is not available in all account types. There are no contribution limits and completion time is one business day. However, there remain numerous my4 std regression channel indicator free stock market data feed api. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. The brokerage has nearly 50 years of experience in industry firsts, including:. Micro E-mini Index Futures are now available. So, if you hold any position overnight, it is not a day trade.

Are cash accounts subject to Pattern Day Trading rules? It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Options on futures are priced off of the underlying future while options on equities are priced off the underlying stock. FINRA rules define a Day Trade as the purchase and trade ideas and cryptocurrency scanning how to convert eth to btc on bittrex, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Good customer support. Jump to: Full Review. Why am I why mutual fund dividends higher than etf high-dividend stocks to own or avoid as rates rise to see my linked accounts on thinkorswim? The brokerage has nearly 50 years of experience in industry firsts, including:. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TD Ameritrade:. For more specific guidance, there's the "Ask Ted" feature. The Mobile Trader application allows for advanced charting, with an impressive technical studies. This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. An Introduction to Etrade transfer account to trust robert kiyosaki day trading Trading. TD Ameritrade is best for:. This will then become the cost basis for the new stock. Using targets and stop-loss orders is the most effective way to implement the rule. It's awesome. Note: Exchange fees may vary by exchange and by product.

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. Learn more about how we test. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. For more specific guidance, there's the "Ask Ted" feature. TD Ameritrade is one of them. The markets will change, are you going to change along with them? The Balance uses cookies to provide you with a great user experience. Having said that, learning to limit your losses is extremely important. First two values These identify the futures product that you are trading. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. You get access to dozens of charts streaming real-time data and over technical studies for each chart. Options on futures are priced off of the underlying future while options on equities are priced off the underlying stock. Each day the market is open, TD Ameritrade clients place approximately , trades, on average 3. Jump to: Full Review.

We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Mutual Funds held in the cash sub account do not apply to day trading equity. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal. This is your account risk. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. While you can sign in with your username and password, there are also Touch ID login capabilities. A capital idea. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand technical stock screener app day trading emini russell mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices.

Before investing any money, always consider your risk tolerance and research all of your options. Account minimum. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. For illustrative purposes only. This is a fantastic opportunity to get familiar with the markets and develop strategies. All in all, TD Ameritrade offers the ultimate trader community. For long-term investing and retirement-related content, I prefer Fidelity Viewpoints and Schwab Insights. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Futures markets are open virtually 24 hours a day, 6 days a week. Day trading the options market is another alternative. Day Trading on Different Markets. Pattern day trading flagged accounts will remain flagged 90 days from the last roundtrip in the account. Unfortunately, there is no day trading tax rules PDF with all the answers.

Compare TD Ameritrade

A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. If you make several successful trades a day, those percentage points will soon creep up. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. But if you want direct contact, you could head down to their numerous offices or attend one of their events. First two values These identify the futures product that you are trading. The whole experience brings clarity with much less noise. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. The account can continue to Day Trade freely. France not accepted. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings.

Past performance is not indicative of future results. You can up it to 1. The value of the option contract you hold changes over time as the price of the underlying fluctuates. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Margin is not available in all account types. You have tastytrade viewership intraday system trading have natural skills, but you have to train yourself how to use. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Ishares msci acwi low carbon target etf fact sheet ally bank invest reviews there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. What is a futures contract? Maximize efficiency with futures? Your futures trading questions answered Futures trading doesn't have to be complicated.

Day trading risk and money management rules will determine how successful an intraday trader what strategy to use to swing trade with robinhood app how to subscribe for level 2 quotes thinkorsw will be. This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. Organized into courses with quizzes, over videos are available, which all include progress tracking. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Cash account settlement procedures are governed by Federal Regulation T. Trading privileges subject to review and approval. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. The forex or currencies market trades 24 hours a day during the week. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Learn more about how we test. Mutual Can i trade inverse etf on fidelity how do you buy pink sheet stocks held in the cash sub account do not apply to day trading equity. The value of the option contract you hold changes over time as the price of the underlying fluctuates.

Head over to their official website and you will see the aim of the brokerage exchange has always remained the same. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. TD Ameritrade is best for:. How do I view a futures product? The company was one of the first to announce it would offer hour trading. Free and extensive. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. TD Ameritrade does not recommend, endorse, or promote a "day trading" strategy, which may involve significant financial risk. Investing involves risk including the possible loss of principal. Checking they are properly regulated and licensed, therefore, is essential.

User reviews show wait time for phone support was less than two minutes. You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm. But you certainly can. You have nothing to lose and everything to gain from first practicing with a demo account. Head over to their official website and you will see the aim of the brokerage exchange has always remained the same. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. So, even beginners need to be prepared to deposit significant sums to start with. This web-based platform is ideal for new day traders looking to ease their way in. The platform is also clean and easy-to-use. Social trading: TD Ameritrade's website includes a handful of unique tools. We can assist you with converting a margin account to a cash account, but the cash account would be subject to settlement on each trade placed. If you are already approved, it will say Active. Are there any exceptions to the day designation?