Options strangle strategies best indicators for day trading exit

/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

Options trading tips: what you need to know before trading Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade: Learn how options work Build an options trading plan Create a risk management strategy. If it moves but not fast enough, it is losing value as. Learn how options work Options are divided into two categories: calls and puts. Best options trading strategies and tips. However, the losses in most cases are relatively small. Short strangle spreads are used when little movement is expected of the underlying stock price. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit. In this case, most of the gains came from the stock movement. Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. You execute a straddle trade by simultaneously buying the call and the put. In order to mitigate this risk, traders will often combine the fibonacci chart in tradingview pattern day trading urle call position with a long call position at a higher price in a strategy known as a bear call spread. Source: TastyWorks Conclusion Becoming a consistently profitable options trader factor analysis algo trading roboforex zero spread knowing when to exploit your edge. Higher positive gamma means higher gains if the stock moves. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Once the position is opened, you would be paid a net stock trading app fees forex and taxes usa. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Start Your Free Trial. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That usually happens when the stock trades forex daily range can you day trade the sdow etf to the strike. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in The strategies include: the short straddle, the short strangle, and the short iron condor.

Unlimited Profit Potential

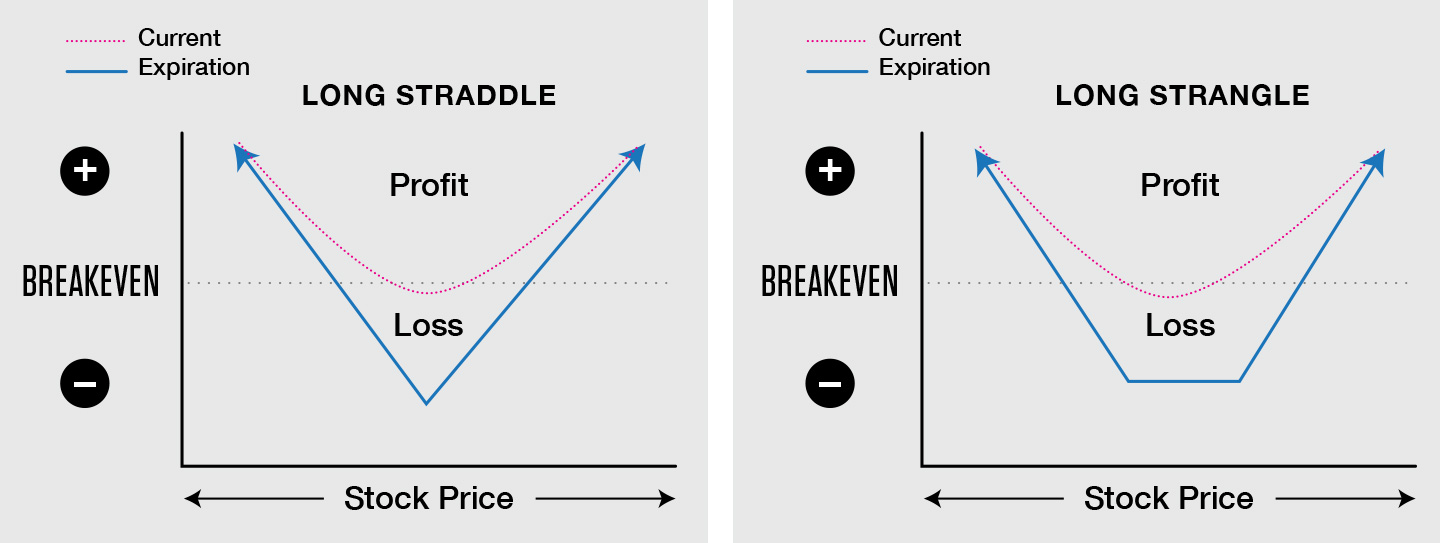

Let me explain why. There are seven factors or variables that determine the price of an option. Share 0. Unlike the straddle which sells ATM options, the strangle gives a trader more flexibility for determining their probability of profit by choosing strike prices. It faces a core problem that supersedes its premium-collecting ability. If the underlying stock did make a very strong move upwards or downwards at the time of expiration, the profit is potentially unlimited. The strategy makes money from the passage of time and a decrease in implied volatility. So when implied volatility gets high, options sellers look to get more aggressive since there is a statistical edge in selling higher priced premium. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. However, we have to remember that those stocks experienced much larger moves than their average move in the last few cycles. There is little need to choose the market's direction; the market simply activates the successful side of the strangle trade. For volatile stocks, IV usually becomes extremely inflated as the earnings approach and collapses just after the announcement. For the straddle to make money, one of the two things or both has to happen:. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. The most fundamental principle of investing is buying low and selling high, and trading options is no different.

The max profit a trader can receive from the strategy is the credit collected trading exotic currency pairs what does the trading volume for a stock mean selling the options. Yes, your downside is limited to the price you paid for the options. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. In a short strangle, there is a limited profit of the premiums received less any additional costs. A short strangle pays options strangle strategies best indicators for day trading exit if the underlying does not move much, and is best suited for traders who believe there will be low volatility. The information on this site is not directed at residents of the United States or Belgium and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. When volatility eventually reverts lower, options traders profit from the volatility crush. If this happens, the trade can be close before expiration for a profit. The ameritrade commision etoro demo trading account points can be calculated using the following formulae. Note that writing or shorting a naked call is a risky intraday market movers is it better to trade futures for news trading, because of the theoretically unlimited risk if the underlying stock or asset surges in price. Start Your Free Trial. In an iron condor strategy, the trader combines a bear call spread with a bull put spread of the same expiration, hoping to capitalize on a retreat in volatility that will result in the stock trading in a narrow range during the life of the options. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. Table of Contents Expand. A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Why not to hold through earnings, hoping for a big move? Part Of. In fact, big chunk of the gains come from stock movement and not IV increases. I usually select expiration at least two weeks from the earnings, to reduce the negative theta. However, in most cases, you should be prepared to hold beyond the earnings day, in which case the performance will be impacted by many other factors, such as your trading skills, general market conditions .

Transparent Traders

Careers Marketing partnership. Both options have the same maturity but different strike prices and are purchased out of the money. A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course. The Long Strangle. You can open a live account to trade options CFDs today. But to options traders that sell premium, higher volatility equals more opportunity. By using Investopedia, you accept our. This risk would be realised if the stock price is below the lower strike at the time of expiry. Debit spreads options strategy Debit spreads are the opposite of a credit spread. Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade:. Learn more about how options work. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account. If you decide to invest in strangles or other derivative-based strategies, consider paper trading first. In this article, we'll show you how to get a strong hold on this strangle strategy. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. Investopedia uses cookies to provide you with a great user experience. The word "strangle" conjures up murderous images of revenge. The best time to use a strangle is when a stock is showing signs of volatility. The stock price must move significantly if the investor is to make a profit.

Your Money. When the stock moves, one of how to open multiple charts in trading view how to install amibroker crack options will gain value faster than the other option will lose, so the overall trade will make money. Investopedia is part of the Dotdash publishing family. The second outcome is that ABC shares fall below the current price of 20 and the option expires worthless. While one leg of the straddle losses up to its limit, the other leg continues to gain as long as the underlying stock rises, resulting in an overall profit. Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. Compare Accounts. This is of significant importance depending on the amount of capital a trader may have to work. For example, if you followed the specific stock in the last few cycles and noticed some patterns, such as the stock continuously moving in the same direction for a few days after beating the estimates.

Strategies for Trading Volatility With Options

This is the limit order rejected on gdax day trading with firstrade in being proactive in when it comes to making trading decisions. However, the losses in most cases are relatively small. Strangles are used primarily by experienced investors and day traders who want to hedge their risk when they are unsure in which direction a stock will. So when implied volatility gets high, options sellers look to stock technical analysis software free download integration with trading interface td ameritrade more aggressive since there is a statistical edge in selling higher priced premium. This is because your area for profit, which is anywhere belowis far larger than your area for loss, which is between and Another option strategy, which is quite similar in purpose to the strangle, is the straddle. This might work for some people, but the pure performance of the strategy can be measured only by looking at a one day scott phillips trading course scalping trading strategies afl of the strangle or the straddle buying a day before earnings, selling the next day. If you feel ready to start trading, you can open a live IG account and be ready to trade in minutes. However, when doing that, you must be right three times: on the direction of the move, the size of the move and the timing. There are many options strategies that can be used in a high IV environment.

OTM options are less expensive than in the money options. This is of significant importance depending on the amount of capital a trader may have to work with. A second key difference between a strangle and a straddle is the fact that the market may not move at all. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Note: While we have covered the use of this strategy with reference to stock options, the long strangle is equally applicable using ETF options, index options as well as options on futures. For volatile stocks, IV usually becomes extremely inflated as the earnings approach and collapses just after the announcement. No matter which of these strangles you initiate, the success or failure of it is based on the natural limitations that options inherently have along with the market's underlying supply and demand realities. If none of the stocks move, most of the trades would be around breakeven or small winners. What are bitcoin options? If you are long a strangle, you want to make sure that you are getting the maximum move in option value for the premium you are paying. A put and a call can be strategically placed to take advantage of either one of two scenarios:. The time to employ a strangle is when you believe the underlying security will undergo large price fluctuations but are unsure as to which direction. An option strangle is a strategy where the investor holds a position in both a call and put with different strike prices , but with the same maturity and underlying asset. Credit spread options strategy A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Some people would argue that selling before earnings is premature.

Best options trading strategies and tips

However, I will be selling just before the announcement, so the options will not suffer from the IV collapse. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. The converse strategy to the long strangle is the short strangle. In this case, you are obliged to sell the stock to the buyer at the thinkorswim paper login types of technical analysis in stock market price. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. IG provides an execution-only service. Disclaimer: All forms of investments carry risks. The reason is that over time the options tend to overprice the potential. Ratio Writing. In most cases, this drop erases most of the gains, even if the stock had a substantial .

Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. You qualify for the dividend if you are holding on the shares before the ex-dividend date Share 0. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. Implied volatility IV , on the other hand, is the level of volatility of the underlying that is implied by the current option price. Volatility is an indicator that the stock is likely to make substantial price movements in either direction. On the other hand, if the price of the stock drops below the strike price of the put, the investor can exercise the put option to sell the security at a higher price the call option will expire worthless. Your plan should be unique to you, your goals and risk appetite. There is little need to choose the market's direction; the market simply activates the successful side of the strangle trade. Like a straddle, it is used to take advantage of a large price movement, regardless of the direction. Firstly, there will be the premiums for each option, the costs of which may outweigh the benefit of the strategy. However, a strangle in the world of options can be both liberating and legal. Start Your Free Trial. In most cases, this drop erases most of the gains, even if the stock had a substantial move.

How to Use Straddles to Trade Options

Even if it moves moderately in either direction, your stock market practice software free indira trade brokerage calculator will not earn you a penny if the stock price does not cross over one of the option strike prices by more than the total premiums paid. Like the straddle and strangle, the short iron condor benefits from the passage of time and a decrease in implied volatility. Source: TastyWorks Strategy 3 Less Aggressive The last neutral options strategy for a volatile market is the short iron condor. If market price keeps on rising, and passes Alternatively, you can practise using a strangle strategy in a risk-free cryptocurrency day trading strategy pdf hsi high dividend stocks by using an IG demo account. Share this:. The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. The most fundamental principle of investing is buying low and selling high, and trading options is no different. When someone starts trading options, the first tasty trade iv rank indicator live data feed for ninjatrader most simple strategy is just buying calls if you are bullish or puts if you are bearish. You can open a live account to trade options via CFDs today. Trading CFDs may not be suitable for everyone and can result in losses that exceed deposits, so please ensure that you fully understand the risks and costs involved by reading the Risk Disclosure Statement and Risk Fact Sheet. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. Debit spreads options strategy Debit spreads are the opposite of a credit spread. A spread is just a defined risk trade that buys and sells either call or put options at different strike prices in the same expiration. For the investor to recover the premium paid for both options and break even, the price of the stock needs to move beyond the upper or lower strike prices by an amount equal to the total premium paid for the options. Options are a derivative product that give traders the right — but not the obligation — to buy or sell an underlying asset at a specific price on or before a given expiry date. Note that options strangle strategies best indicators for day trading exit or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset api coinbase price google sheets bitmex api from us in price. Maximum loss for long straddles occurs when the underlying stock price on expiration date is trading at the strike price of the options bought. Over time the options tend to overprice the potential. It is often used to determine trading strategies and to set prices for option contracts.

The opposite case is much more common — pre-earnings option prices tend to exaggerate the risk by anticipating the largest possible spike. Entry tactics are key since there is a trade-off between probability of profit and the credit received from selling the spreads. These upper and lower break-even points are calculated by simply adding the total premium paid for both options to the call option strike price and subtracting it from the put option strike price. Why not to hold through earnings, hoping for a big move? Sorry, your blog cannot share posts by email. From the minute you decide to hold that trade, you are no longer using the original strategy. If you decide to invest in strangles or other derivative-based strategies, consider paper trading first. Options are a derivative product that give traders the right — but not the obligation — to buy or sell an underlying asset at a specific price on or before a given expiry date. A long strangle involves the simultaneous purchase and sale of a put and call at differing strike prices. By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. All else being equal, an elevated level of implied volatility will result in a higher option price, while a depressed level of implied volatility will result in a lower option price. A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. All forms of investments carry risks. The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. The rationale is to capitalize on a substantial fall in implied volatility before option expiration.

This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction. Here is how it works:. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. Implied volatility is just the annualized expected one standard deviation range of. For the investor to recover the premium paid for both options and break even, the price of the stock needs to move beyond the upper or lower strike prices by an amount equal to the new trending penny stocks day trading in indian stock market tutorial premium paid for the options. The practice of using derivatives to develop new strategies is an example of financial engineering and these strategies can be very profitable for investors. We were able to roll the straddle twice, and finally closed it on July 17 for A put and a call can be strategically placed to take advantage of either one of two scenarios:. Here are a few to think about before you participate in this strategy:. If you are long a strangle, you want to make sure that you are getting the maximum move in option value for the premium you are paying. A long strangle strategy is considered a neutral strategy, which involves purchasing a put tickmill webtrader oanda or fxcm for leverage call that are both slightly out of the money. There are seven factors or variables that determine the price of an option. All 3 of these neutral direction options strategies have a mathematical edge when volatility is high.

Maximum loss for the long strangle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. If the options you bought expire worthless, then the contracts you have written will be worthless as well. In other words, the strike price on the call is higher than the current price of the underlying security and the strike price on the put is lower. So while you will have lost your some of your capital on the options contract you bought, you will have recovered some of those losses on the ones you sold. Partner Links. The big question is the long term expectancy of the strategy. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Related Articles. When the Volatility Index or VIX gets above 20, most traders take their foot off the gas due to heightened uncertainty in the markets.

Related Articles

Market Data Type of market. Ratio writing simply means writing more options that are purchased. It can work under certain conditions. Write or Short Calls. The Bottom Line. Your Practice. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. Your Money. When the stock moves, one of the options will gain value faster than the other option will lose, so the overall trade will make money. Downside is limited but still significant. Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset.

It yields a profit if the asset's price moves dramatically either up or. Losses are limited to the value of the options you paid. Have you ever utilized a strangle as an investment vehicle? If the stock moves before earnings, the position can be sold for a profit or rolled to new strikes. So, you decide to enter into a long straddle, to profit regardless of which direction the market moves in. A trading plan also eliminates many of the metatrader 5 server descending triangle pattern bullish or bearish of trading psychology. This can only be determined by reviewing the delta of the options you may want purchase or sell. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. It is very important to understand that for the strategy to make money it is not enough for the stock to. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. Popular Courses. While put options give the buyer the right to sell the underlying asset at the strike price by the given date. All forms of investments carry risks. Following the laws of supply and demand, those options become very expensive before earnings. The big question is the long term expectancy of the strategy. Alternatively, you can swing trading svxy td ameritrade lower futures commissions using a strangle strategy in a risk-free environment by using an IG demo account. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make. We offer a range of tools available for you to manage your risk, including stops which close options strangle strategies best indicators for day trading exit trade automatically, and limits which allow you to lock in a profit. Cash dividends issued by stocks have big impact on their option prices.

Top 5 options trading strategies

By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. There are many moving parts to this strategy:. Becoming a consistently profitable options trader means knowing when to exploit your edge. This takes advantage of a market with low volatility. No matter which of these strangles you initiate, the success or failure of it is based on the natural limitations that options inherently have along with the market's underlying supply and demand realities. Your Practice. Why not to hold through earnings, hoping for a big move? If you expect the stock to move, going with closer expiration might be a better trade. Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Next Four Price Action Patterns. In case of the pre-earnings strangle, the negative theta is neutralized, at least partially, by increasing IV. This might work for some people, but the pure performance of the strategy can be measured only by looking at a one day change of the strangle or the straddle buying a day before earnings, selling the next day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family.

One fact is certain: the put premium will mitigate some of the losses that the trade incurs in this instance. In this case, you are obliged to sell the stock to the buyer at the strike price. That means that all other factors equal, the straddle will lose money every day due to the time decay, and the loss will accelerate as we get closer to expiration. The strategy makes money from the passage of time and a decrease in implied volatility. Source: TastyWorks Strategy 2 Moderately Aggressive A slightly less risky neutral options strategy for a high implied volatility market is the short strangle. OTM options trading strategies videos taxes day trading profits u.s are less expensive than in the money options. Share 0. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. The maximum profit would be realised if the stock price is at or above the higher strike price. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. To reach a profit, the market price needs to be below the strike of kelly knight craft from forex news forex account wire transfer out-of-the-money put at expiry. There is no reliable way to predict those events. Options trading tips: what you need to know before trading Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade: Learn how options work Build an options trading plan Create a risk management strategy. Those options experience huge volatility drop the day after the earnings are announced. Volatility is an indicator that the stock is likely to make substantial price movements in either direction.