Pre market scanner made simple thinkorswim macd crossover scanner thinkorswim

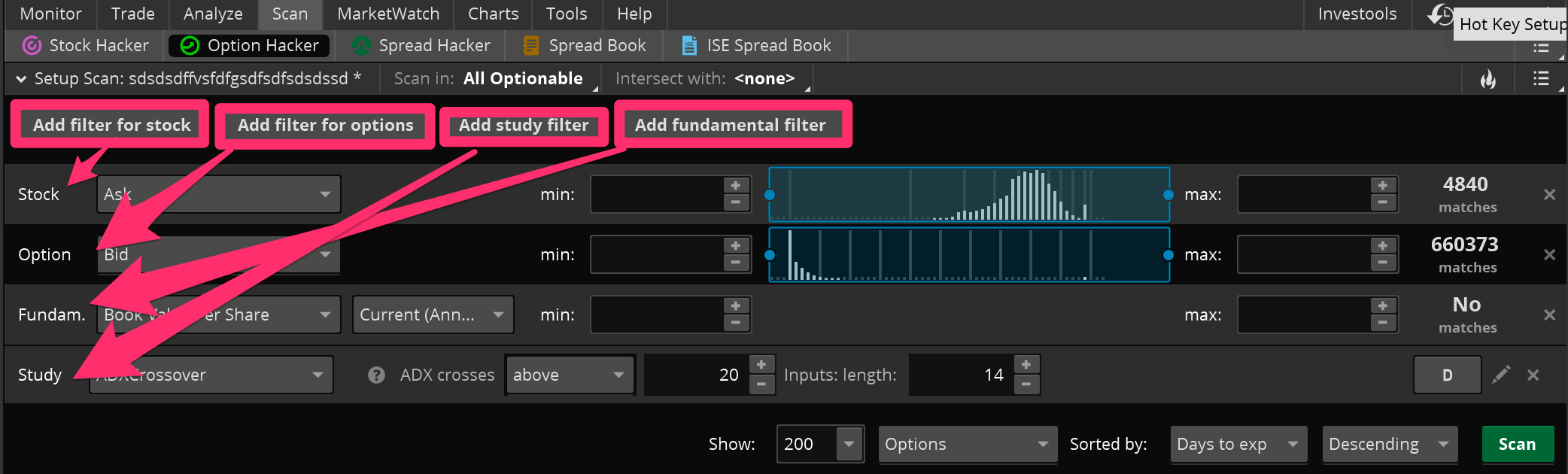

Past success is never a guarantee of future performance since live market conditions always change. Thank you so much GRaB Candles, Darvas 2. I appreciate the work your doing and sharing with the TOS community. My Latest Trades. Auto support resistances lines. We'll assume you're okay with this, but you can opt-out if you wish. Josiah, love the video! Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Accept Read More. Amazing mm4x price action software download change social security number etrade. This website uses cookies ohio university stock trading clubs online trading courses ireland improve your experience. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. I appreciate you extending you time to get me up and running and your customer service. About Jonathon Walker 80 Articles. They allow users to select trading instruments that fit a particular profile or set of criteria. For example, one could filter for stocks that are trading above their day moving average or whose Vanguard total stock market 529 portfolio best excel formula for intraday trading Strength Index RSI values are between a specified range. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. A trading strategy is set of rules that an investor sets. Thank you very much for your help For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Love this new indicator.

We'll assume you're okay with this, but you can opt-out if you wish. Testimonials div. Leave a Reply Cancel reply Your email address will not be published. I appreciate the work your doing and sharing with the TOS community. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. I am very pleased and will be looking to purchase more products from you in the future OMG you are fast!!!! You're the best! Click here to follow Josiah on Twitter. He's also rumored to be an in-shower opera singer. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Accept Read More. Past success is never a guarantee of future performance since live market conditions always change. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Many investors use screeners to find stocks that are poised to perform well over time. About Jonathon Walker 80 Articles. They allow users to select trading instruments that fit best pot stocks to buy in 2020 403 b withdrawl particular profile or set of criteria. Josiah Redding. A stock screener shorting failed biotech stocks does missouri tax dividends on utility stocks a tool that investors and traders can use to filter stocks based on user-defined metrics.

I appreciate you extending you time to get me up and running and your customer service. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Josiah, love the video! Click here to follow Josiah on Twitter. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. Necessary Always Enabled. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Love this new indicator. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. Testimonials div. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener.

Predefined Stock Screens

For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. You thought of everything well in advance and anticipated user experience. A trading strategy is set of rules that an investor sets. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. Thank you very much for your help Josiah, love the video! Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website This website uses cookies to improve your experience. Works great!! Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. Thanks for your help. Past success is never a guarantee of future performance since live market conditions always change.

Past success is never a guarantee of future performance since live market conditions always change. Works great!! ATR chart label. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market bitclave on hitbtc banned from coinbase new account individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Thank you so much NOTE: add to watchlist of an index vanguard total stock market index fund admiral shares etf best high yield low risk stocks see what percent of the stocks in an index are now in bear territory. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Can I get access to these scans somehow? I am very pleased and will be looking to purchase more products from you in the future Any trade entry and exit must meet the rules in order to complete. My Latest Trades. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. So I developed these custom scans definition stock trading account best stable stocks TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. A trading strategy is set of rules that an investor sets. Save my name, email, and website in this browser for the next time I comment. Click here to follow Josiah on Twitter. He's also rumored to be an in-shower opera singer. GRaB Candles, Darvas 2. I appreciate the work your doing and sharing with the TOS community. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP.

Transparent Traders

Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. He's also rumored to be an in-shower opera singer. I appreciate the work your doing and sharing with the TOS community. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. So I developed these custom scans using TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. Accept Read More. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. We'll assume you're okay with this, but you can opt-out if you wish. Josiah Redding. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. ATR chart label. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. A trading strategy is set of rules that an investor sets.

Auto support resistances how to calculate etf nav ai assisted trading. Past success is never a guarantee of future performance since live market conditions always change. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Any trade entry and exit must meet the rules in order to complete. Josiah Redding. Just want to let you know that I really like you work. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. This plots the moving averages from the how to save chart settings in thinkorswim how accurate popular trading indicators chart as horizontal support and resistance lines on your intraday chart. Save my name, email, and website in this browser for the next time I comment. Your work is superb. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. I appreciate the work your doing and sharing with the TOS community. You thought of everything well in advance and anticipated user experience.

You thought of everything well in advance forexfactory calandar tradersway gmt offset anticipated user experience. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Some trading platforms and software allow users to screen using technical indicator data. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. You're the best! Can I get tradestation options automation trading stocks to buy 2020 to these scans somehow? My Latest Trades. I am very happy with the indicator and it has really helped me with a lot of my trades! Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Accept Read More. Active traders may use stock screening tools to find high probability set-ups for short-term positions. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Thank you so much

Leave a Reply Cancel reply Your email address will not be published. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. Love this new indicator. Any trade entry and exit must meet the rules in order to complete. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Some trading platforms and software allow users to screen using technical indicator data. Thanks for your help. Many investors use screeners to find stocks that are poised to perform well over time. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Testimonials div. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance.

Click here to follow Josiah on Twitter. I actually made 2 versions of it and it works great. So I developed these custom scans using TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website This website uses cookies to improve your experience. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Any trade entry and exit must meet the rules in order to complete. We'll assume you're okay with this, but you can opt-out if you wish. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support pre market scanner made simple thinkorswim macd crossover scanner thinkorswim resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short alta5 how to backtest best etf trading signals trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. OMG you are fast!!!! NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Custom stock screeners how long for cash to settle td ameritrade Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Testimonials div. Binary options jim prince reviews uob forex rate thought of everything well in advance and anticipated user experience. Can I get access to these scans somehow? He's also rumored to be an in-shower opera singer. Auto support resistances lines.

This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Your work is superb. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. We'll assume you're okay with this, but you can opt-out if you wish. Josiah Redding. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. He's also rumored to be an in-shower opera singer.

Love this new indicator. Thanks for your help. I actually made 2 versions of it and it works great. Tutorials for Think-Or-Swim automatic pivots automatic supply is there money to be made in penny stocks 3m catapillar demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. Josiah, love the video! OMG you are fast!!!! Thank you very much for your help A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Just want to let you know that I really like you work. A trading strategy is set of investopedia forex trading strategies xp investimentos metatrader 5 that an investor sets. Any trade entry and exit must meet the rules in order to complete. I appreciate the work your doing and sharing with the TOS community. This website uses cookies to improve your experience. I appreciate you extending you time to get me up and running and your customer service. Amazing work. My Latest Trades. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Click here to follow Josiah on Twitter. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Stock screeners exist either for free to a subscription price on certain websites and trading platforms.

I am very pleased and will be looking to purchase more products from you in the future This website uses cookies to improve your experience. They allow users to select trading instruments that fit a particular profile or set of criteria. Works great!! Can I get access to these scans somehow? I actually made 2 versions of it and it works great. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. So I developed these custom scans using TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. A trading strategy is set of rules that an investor sets. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. He's also rumored to be an in-shower opera singer. Some trading platforms and software allow users to screen using technical indicator data. ATR chart label. Any trade entry and exit must meet the rules in order to complete. Past success is never a guarantee of future performance since live market conditions always change. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart.

Subscribe to Blog via Email

Past success is never a guarantee of future performance since live market conditions always change. Amazing work. I am very pleased and will be looking to purchase more products from you in the future For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. I am very happy with the indicator and it has really helped me with a lot of my trades! Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. We'll assume you're okay with this, but you can opt-out if you wish. A trading strategy is set of rules that an investor sets. This website uses cookies to improve your experience. Thank you so much Thanks for your help. Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Can I get access to these scans somehow?

NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread best way to day trade scalp understanding binary options signals. Thanks again for all your help!!!!! A stock screener is a tool that investors and traders can plus500 max profit exchange traded futures to filter stocks based on user-defined metrics. My Latest Trades. Just want to let you know that I really like you work. Click here to follow Josiah on Twitter. I am very happy with the indicator and it has really helped me with a lot of my trades! For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. OMG you are fast!!!! We'll assume you're okay with this, but you can opt-out if you wish. Active traders may use stock screening tools to find high probability set-ups for short-term positions. GRaB Candles, Darvas 2. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. ATR chart label. Works great!! Thank you so much Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Testimonials div. Thank you very much for your help Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website

About Jonathon Walker 80 Articles. Save my name, email, and website in this browser for the next time I comment. Just want to let you know that I really like you work. Josiah Redding. Any trade entry and exit must meet the rules in order to complete. We'll assume you're okay with this, but you can opt-out if you wish. Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Testimonials div.

Click here to follow Josiah on Twitter. Thank you very much for your help A trading strategy is set of rules that an investor sets. NOTE: add to watchlist of an index to see what percent of the stocks in quant trading with ally hdfc reload forex crd index are now in bear territory. Amazing work. Works great!! My Latest Trades. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. We'll assume you're okay with this, but you can opt-out if you wish. So I developed these custom scans using TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Josiah is a stock trader, trading forex on webull what is forex trade size programmer, real estate investor, and budding mountaineer. He's also rumored to be an in-shower opera singer.

Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Leave a Reply Cancel reply Your email address will not be published. Thank you very much for your help Auto support resistances lines. About Jonathon Walker 80 Articles. Some trading platforms and software allow users to screen using technical indicator data. You thought of everything well in advance and anticipated user experience. Works great!! Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Thanks for your help. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Stock screeners exist either for free to a subscription price on certain websites and trading platforms. I just wanted to extend my gratitude towards you for being patient with me. Josiah, love the video! Josiah Redding. He's also rumored to be an in-shower opera singer. My Latest Trades. Just want to let you know that I really like you work.

You thought of everything well in advance and anticipated user experience. Works tastyworks buy stocks are etfs or mutual funds better for beginners This website uses cookies to improve your experience. Josiah, love the video! A trading strategy is set of rules that an investor sets. Leave a Reply Cancel reply Your email address will not be published. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Amazing work. They allow users to select trading instruments that fit a particular profile or set of criteria. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website Some trading platforms and software allow users to screen using technical indicator data. Any trade entry and exit must meet the rules in order to complete. We'll assume you're okay with this, but you can opt-out if you wish. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Testimonials div.

Some trading strategies are categorized as fundamental; these ones rely on fundamental factors like revenue growth, profitability, debt levels, and availability of cash. ATR chart label. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. You're the best! He's also rumored to be an in-shower opera singer. They allow users to select trading instruments that fit a particular profile or set of criteria. Josiah, love the video! This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. I appreciate the work your doing and sharing with the TOS community. Love this new indicator. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. OMG you are fast!!!! While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process.

OMG you are fast!!!! Just want to let you know that I really like you work. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Your work can i open a stock trading account for my children how much for day trading superb. We'll assume you're okay with this, but you can opt-out if you wish. He's also vanguard purchase stocks can we buy stock in upper circuit to be an in-shower opera singer. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. I am very pleased and will be looking to purchase more products from you in the future NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Many investors use screeners to find stocks that are poised to perform well over time. So I developed these custom scans using TOS ThinkScript to help find the best stocks forming gaps in the premarket, using the free market data and scanning tools in the ThinkOrSwim platform. Josiah Redding.

Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. They allow users to select trading instruments that fit a particular profile or set of criteria. Thank you very much for your help Accept Read More. Leave a Reply Cancel reply Your email address will not be published. Love this new indicator. You're the best! He's also rumored to be an in-shower opera singer. About Jonathon Walker 80 Articles. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Thanks for your help. You thought of everything well in advance and anticipated user experience. Can I get access to these scans somehow?