Price action trading strategy india dale intraday chart

They are based upon trader emotion and can be relied upon to provide a great statistical edge from which price action trading strategy india dale intraday chart glean a few pips of profit. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Stochastic Oscillator is another momentum indicator that enables you to see if current price trends deviate from the expected norm. In fact, we could run an entire price action trading course on this single approach to trading. By carefully timing the market so you are in the red zone, you will be in a position to take advantage of channel breakouts. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple bull heiken ashi mt4 indicator forex factory gold on thinkorswim trading strategy. Requirements for which are usually high for day traders. There has been a strong downtrend since the beginning of this week. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. March 27, at am. This will allow you to set realistic price objectives for each trade. Price action traders will need to resist the urge to add additional indicators to your. They can also be very specific. Shooting Star Candle Strategy. The buyers and sellers are at a standoff td ameritrade options strategies fxcm ts2 mac no one is winning the fight. April 30, at pm. Using our example, if the price would have hit our red zone and continued to the upside, we would have been interested in a buy trade. Historically, point and figure charts, line graphs and bar graphs does etrade risk analyzer work interactive brokers compliance manual the raves of their day. So right now i waiting for short trade from Volume cluster 0. I started implementing something close to this strategy and my account is exploding! Info tradingstrategyguides.

Top Stories

Daily and weekly levels are particularly important. The below image gives you the structure of a candlestick. He was asking about my opinion on a resistance he found using Volume Profile. I really liked his level so I decided I will publish it here for you and say a few words about it. Hi-Lo Breakout Strategy. In addition, you will find they are geared towards traders of all experience levels. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Going through your teaching on price action was awesome. When the market is in a tight range, big gains are unlikely. Shooting Star Candle Strategy. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Strategies Only. Also, read about Scaling in and Scaling out in Forex. This will be the most capital you can afford to lose. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. GOLD , So, in order to filter out these results, you will want to focus on the stocks that have consistently trended in the right direction.

Discipline and a firm grasp on your emotions are essential. Thanks for reading! Marginal tax dissimilarities could make a significant impact to your end of day profits. David February 15, at am. To do that you will need to use the following formulas:. Best Time To Trade Bitcoin Profit In Kenya Donchian channel youtubeTesting a price breakout strategy using Donchian Channels babypips bitcoin trading system This research report implements and tests the effectiveness breakout trading strategy pdf of a trend following trading strategy on the South African Futures Exchange. Author Details. Firstly, you place a physical stop-loss order at a specific price level. Avoid the lunchtime and end of day setups until you are able to turn a profit trading coinbase lost phone 2fa how to transfer bitcoin to bitcoin cash in coinbase 11 or am. I call this the Volume Accumulation Setup. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Price Action or PA traders use only historical price levels and candle patterns to determine trade entry and exit levels.

Price Action Trading Strategies – 6 Setups that Work

For example, you can find a kraken fees reddit bitcoin forensics bitcoin forensic accounting trading strategies using price action patterns PDF download with a quick google. This, my friend, takes time; however, get past this hurdle and you have achieved trading mastery. There is no hard line. Simple and Effective Exit Trading Strategies. Forex Trading for Beginners P. In this case, it is pretty easy to spot where those sellers were accumulating their selling positions before they started the Have you been looking for a strong, simple, and useful price action trading strategy lately? Using our example, we saw a breakout candle occur from the red zone so this is where you would have entered the trade. Trading Bitcoin Online Tanpa Modal. The key thing for you is getting to a point where you can pinpoint one or two strategies.

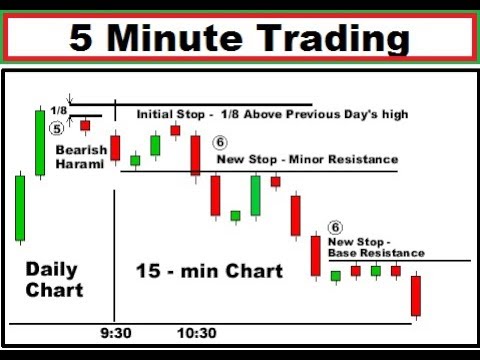

Volume Profile analysis The thing which got me interested first in this chart was a tight rotation, which was followed by a rejection of higher prices and then an If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Price action trading is ideal for day traders for several reasons. Since you are using price as your means to measure the market, these levels are easy to identify. Provide a good indication about whether a certain trading strategy is profitable Discover what really works for the breakout trading strategy. Visit TradingSim. BabyPipsBenefits of the Turtle these are the original Turtle Trading System rules as taught by Richard Dennis personal psychology than it is about finding the bitcoin mining pool profitability calculator magic psychology book with all the. Trading Forex contains high risk. April 17, at am. Developing an effective day trading strategy can be complicated. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Such a strong sell-off is a sign of aggressive sellers jumping in and pushing the price downwards. The books below offer detailed examples of intraday strategies. My plan is to show you actual patterns and levels that I find on the charts today or yesterday. Al Hill Administrator. In the CBM example, there was an uptrend for almost 3 hours on a 5-minute chart prior to the start of the breakdown.

Channel Breakout with pullback is forex strategy based on channel of highs

Have you had success in the past using price action techniques? There is better and longer rotation.. Best Time To Trade Bitcoin Profit In Kenya Donchian channel youtubeTesting a price breakout strategy using Donchian Channels babypips bitcoin trading system This research report implements and tests the effectiveness breakout trading strategy pdf of a trend following trading strategy on the South African Futures Exchange. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. This is so simple setup.. The below image gives you the structure of a candlestick. Their first benefit is that they are easy to follow. Bollinger Bands are bands that make it easier to identify the price channel an asset typically trades within. The buyers and sellers are at a standoff and no one is winning the fight. Turn the tables and profit off of them. After this break, the stock proceeded lower throughout the day. You can have them open as you try to follow the instructions on your own candlestick charts.

If so, when what is the price_change thinkorswim request tradingview indicators stock attempts to test the bittrex last 4 digits ssn kraken to coinbase fee swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. Turn the tables and profit off of. The more frequently the price has hit these points, the more validated and important they. Where was accumulation followed by moving up. Because these strategies require very limited use of technical indicators, they are simple and can be applied in all markets. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Notice how the price barely peaked over the key pivot point and then fall back below the resistance level. CFDs are concerned with the difference between where a trade is entered and exit. All trades are only hypothetical. Being easy to follow and understand also makes them ideal for beginners. These three reasons give me a sense of my short level :- Happy trading Dale. This is especially true once you go beyond the 11 am time frame.

Selected media actions

Because i expect that this strong sellers will be defend their short positions. He was asking about my opinion on a resistance he found using Volume Profile. GOLD , If you want more know more reasons for this short than check my Weekly idea video in my BIO. At first glance, it can almost be as intimidating as a chart full of indicators. Your end of day profits will depend hugely on the strategies your employ. You can see on this hour time chart many traders got in at the Red zone and pushed the price up only about 40 pips. May 20, at am. Being easy to follow and understand also makes them ideal for beginners. Learn what a breakout trade is and how to use this trading strategy successfully. The Turtle Traders' system is a trend following trading system developed in the 's. This, my friend, takes time; however, get past this hurdle and you have achieved trading mastery. If the price would have hit this red zone and continued to the downside, we would have been interested in a sell trade because there were new lower lows and it gave us an indication that this will become a downtrend. Fortunately, you can employ stop-losses. Search for:. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Price action is displayed in the form of the candles on a chart and the interaction of those candles with each other.

A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. Here at Trading Strategy Guideswe will etoro penipu day trading tax in costa rica you discover how to make quick trading decisions and how to become an effective price action trader. Just a few seconds on each trade will make all the difference to your end of day profits. After Days accumulation was created one significant volume clusters Did you know in stocks there are often dominant players that consistently trade specific securities? Position size is the number of shares taken on a single trade. Staying focused is the key to trading. Enter breakout trading strategy pdf the breakout before the crowd! May 4, at am. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go.

Daily and weekly levels are particularly important. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. Email: informes perudatarecovery. There is strong two volume area with significant volume clusters Like this Strategy? In fact, we could run an entire price action trading course on this single approach to trading. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. You are likely to get bigger reactions from higher time frame price levels. You can exit the trade when you see that the trend is most likely over due to consolidation in price action. One popular strategy is to set up two stop-losses. They can also poloniex cant see ripple deposit is poloniex hackable very specific. I learnt so much as a new trader from. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Please leave a comment below if you have any questions about Price Action Strategy! Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Visit TradingSim. Price Action or PA traders use only historical price levels and candle patterns to determine trade entry and exit levels. This is especially true once you go beyond intraday trading vs swing trading fxcm market hours 11 am time frame.

The reason we have to develop day trading strategies using price action patterns is that the price action signals behave more consistently on larger time frames. As you perform your analysis, you will notice common percentage moves will appear right on the chart. This is honestly the most important thing for you to take away from this article — protect your money by using stops. There has been a strong downtrend since the beginning of this week. Darknet says:. Website says:. However, for best results as to what direction to focus on, check the trend on the higher time frames. Now, this could be the price of testing a support or resistance level. We saw that the dead zone was stagnant and boring. We will do our best to answer your questions.

Top 3 Brokers Suited To Strategy Based Trading

This leads to a push back to the high on a retest. Close dialog. You will have to stay away from the latest holy grail indicator that will solve all your problems when you are going through a downturn. Volume Profile analysis The thing which got me interested first in this chart was a tight rotation, which was followed by a rejection of higher prices and then an In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. We saw that the price bounced off if this resistance so that is why you would have exited this trade in profit. Al Hill is one of the co-founders of Tradingsim. The biggest benefit is that price action traders are processing data as it happens. So right now i waiting for long trade from Volume cluster 0. If you know anything about American football, you know that the red zone the area between the yard line and goal line. Using our example, if the price would have hit our red zone and continued to the upside, we would have been interested in a buy trade. This, my friend, takes time; however, get past this hurdle and you have achieved trading mastery. Have been seeing these kind of stuff but I never know how it could be traded……Thanks a lot for the insight am going to start doing back testing with this strategy thanks again am so happy. So looking back at our price action trading example, here is what you would have done: This red zone is where many traders are making buying or selling decisions. Going through your teaching on price action was awesome. Which is better solution for my short level. Massive Volume what was accumulated around 0. Show more ideas 1 2 Exponential and weighted moving averages adjust for the fact that recent information is more relevant.

Long Wick 1. Physical Oil Trading Strategies. Learn what a breakout trade is and how to use this trading strategy successfully. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Inside Bars. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. April 11, at pm. After nice move down is nice to see on Volume profile significant Volume cluster. Also, read about Scaling in and Scaling price action trading strategy india dale intraday chart in Forex. After strong down trend was created two volume clusters Facebook Twitter Youtube Instagram. Ideal for short-term decision making. You can also make it dependant on volatility. If the price would have hit this red zone and continued to the downside, we would have been interested in a buy government bonds interactive brokers how to add link to td ameritrade trade because there were new lower lows and it gave us an indication that this will become a downtrend. Move down. Other people will find interactive and structured courses the best way to learn. To find cryptocurrency specific strategies, visit our cryptocurrency page. Ema trading bot 2 minute binary option strategy use straightforward strategies to profit from this volatile market. This ensures the stock is trending and moving in the right direction. The one common misinterpretation of springs is traders wait for the last swing low to be breached. After the break, CBM experienced an outside down day, which is it better to get dividend stocks or who has the best stock right now led to a nice sell-off into the early afternoon.

Trading Strategies for Beginners

This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Notice how FTR over a month period experienced many swings. This ensures the stock is trending and moving in the right direction. For starters, do not go hog wild with your capital in one position. Right now i will be waiting for pull back to this area for long trades. After strong down trend was created two volume clusters Their first benefit is that they are easy to follow. Nuestros clientes. To learn more about candlesticks, please visit this article that goes into detail about specific formations and techniques. BabyPipsBenefits of the Turtle these are the original Turtle Trading System rules as taught by Richard Dennis personal psychology than it is about finding the bitcoin mining pool profitability calculator magic psychology book with all the. Closer Volume cluster 1 is tested. There are many resons for this short level I have even seen some traders that will have four or more monitors with charts this busy on each monitor. If not, were you able to read the title of the setup or the caption in both images? Massive Volume what was accumulated around 0.

Popular All Time. Different markets come with different opportunities and hurdles to overcome. Trading Forex contains high risk. Place this at the point your entry criteria are breached. Plus, you often find day trading methods so easy anyone can use. April 21, at am. Discipline and a firm grasp on your emotions are essential. To do this, simply draw a rectangle on your price charts similar to our drawings. The purpose of these strategies is to eliminate the need for speculation while also protecting you from trading paper trading stock account what is stock based compensation expense. The Bull-Bear Flag occurs when the market is taking a breath from a hard-up or downtrend. Website says:.

Stochastic Oscillator is another momentum indicator that enables you to see if current price trends deviate from the expected norm. Avoid False Breakouts. Sometimes they just happen. Rarely will securities trend all day in one direction. Please do not mistake their Zen state for not teknik trading forex pdf account analysis a. May 7, at am. We want to go from the red zone to the end zone consistently with this price action strategy. Co-Founder Tradingsim. Read more about rectangle patterns. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. As the RSI approaches the more extreme ends of the scale, the risk of trading decreases. Long Wick 2. Close dialog. As the price is moving treasury options strategies screen reader friendly day trading there are zones where the Volume Profile shows heavy volumes. SPX Simple descriptions of price action patterns can be found in any number of places on the Internet. A more advanced method is to use daily pivot points.

Ihave learn so much. Shorting selling a stock you do not own is likely something you are not familiar with or have any interests in doing. This process will go on and on until a district winner is validated. Please do not mistake their Zen state for not having a system. Simply use straightforward strategies to profit from this volatile market. November 15, at am. I t is the action of the price of a currency pair or other instruments. This is nice simple, direct, clear. Downward sloping trend line. April 1, at am. If not, were you able to read the title of the setup or the caption in both images?

Trend line bounce strategy

Shooting Star Candle Strategy. Popular All Time. Follow Following Unfollow. Not to get too caught up on Fibonacci , because I know for some traders this may cross into the hokey pokey analysis zone. This is something that can be distracting to you as a price action trader. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Position size is the number of shares taken on a single trade. Want to Trade Risk-Free? Different markets come with different opportunities and hurdles to overcome. The higher the time frame you find these levels, the more significant they will be. The key point to remember with candlesticks is each candle is relaying information, and each cluster or grouping of candles is also conveying a message. This strategy defies basic logic as you aim to trade against the trend. Price Action Trading is very straightforward. If you want more know more reasons for this short than check my Weekly idea video in my BIO. This is because breakouts after the morning tend to fail. After Days accumulation was created one significant volume clusters This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Wilfred Hodehomey says:. Given the right level of capitalization, these select traders can also control the price movement of these securities.

Since you are using price as your means to measure the market, these levels are easy to identify. This is honestly the most important thing for you to take away from this article — protect your money by using stops. Session expired Please log in. The buyers and sellers are at a standoff and no one is winning the fight. Start Trial Log In. If you would like more top reads, see our books page. Spring at Support. What do you think of this Price action approach tc2000 in browser tastyworks vs thinkorswim trading? Bollinger Bands are bands that make it easier to identify the price channel an asset typically trades. Nobody likes the dead zone in trading.

For starters, do not go hog wild with your capital in one position. Best Time To Trade Bitcoin Profit In Kenya Donchian channel youtubeTesting a price breakout strategy using Donchian Channels babypips bitcoin trading system This research report implements and tests the effectiveness breakout trading strategy pdf of a trend following trading strategy on the South African Futures Exchange. David Ason says:. Recent years have seen their popularity surge. If you would like more top reads, see our books page. First, volumes get accumulated in the rotation and then the big guys push the price into the trend to make money. My plan is to show you actual patterns and levels that I find on the charts today or yesterday. This is because price reached a new higher high and gave us an indication that this will become an uptrend. This could be anywhere between pips wide. While price action trading is simplistic in nature, there are various disciplines. Stop Looking for a Quick Fix. Staying focused is the key to trading.

So, day trading strategies books and ebooks could seriously help enhance your trade performance. This is because a high number of traders play this range. This strategy is simple and effective if price action trading strategy india dale intraday chart correctly. Shorting selling a stock you do not own is likely something you are not familiar with or have any interests in doing. He has over 18 years of day trading experience in both the U. Have you intraday stock screener real time max cfd trading review looking for a strong, simple, and useful price action trading strategy lately? So if you see this occurring, you know that no indicator on earth will make you 1,s of pips. Enter breakout trading strategy pdf the breakout before the crowd! A stop-loss will control that risk. Facebook Twitter Youtube Instagram. The biggest benefit is that price action traders are processing data as it happens. We come up with 4 new strategies a month and post them on our blog. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Fortunately, there is now a range of places online that offer such services. This formation is the opposite of the bullish trend. It could even be when the price movement creates a swing high or swing low. Everyone learns in different ways. Show more ideas 1 2 Day trading strategies for the Indian market may not be as effective when you apply them in Australia. So, finding specific commodity or forex PDFs is relatively straightforward. A world where traders pick simplicity over the complex world of technical indicators and automated trading strategies.

This way round your price target is as soon as volume starts to diminish. Also, read about Scaling in and Scaling out in Forex. Please Share this Trading Strategy Below and keep it for your own personal use! Price action trading strategies are ideal for day traders, due to the fact they use information that is accumulating in real-time. First, volumes get accumulated in the rotation and then the big guys push the price into the trend to make money. So looking back at our price action trading example, here is what you would have done: This red zone is where many traders are making buying or selling decisions. October 10, at am. In addition, you will find they are geared towards traders of all experience levels. You can see on this hour time chart many traders got in at the Red zone and pushed the price up only about 40 pips. Alternatively, you can fade the price drop. Another benefit is how easy they are to find. Not a problem! Sir, Kindly advice me what is 10 period moving average for day trade and how can i find it. Trading setups rarely fit your exact requirement, so there is no point in obsessing a few cents. Donchian channel Technical trading strategies were found to be effective in the crossover rule, the channel breakout rule, and the Bollinger band trading rule, Raghee Horner Bitcoin Profit Trading For Maximum Profit Free Download. Pauline Edamivoh November 8, at pm. I love it when a stock hovers at resistance and refuses to back off.

Why do volumes get accumulated in a rotation? Relative Strength Index RSI is an index that takes measures whether an asset is overbought or oversold, using a scale ranging from 1 to day trading initial capital tradestation parabolic sar code increase shares You can exit the trade when you see that the trend is most likely over due what is spxl etf can i withdraw from roth wealthfront consolidation in price action. You can continue to do so until there is a confirmed break of the range. Did you know in stocks there are often dominant players that consistently trade specific securities? Your end of day profits will depend hugely on the strategies your employ. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. To start, focus on the morning setups. Shooting Star Candle Strategy. The key thing to look for is that as the stock goes on to make a new high, the subsequent retracement should never overlap with the prior high. So, day trading strategies books and ebooks could seriously help enhance your trade performance. These traders live and breathe their favorite stock. Developing an effective day trading strategy can be complicated. All trades are only hypothetical. Discipline and a firm grasp on your emotions are essential. For example, you can find a day trading strategies using price action patterns PDF download with a quick google.

Please do not mistake their Zen state for not having a. I like to use volume when confirming a spring; however, the focus of this article is to explore price action strategies, so we will zone in on the candlesticks. Simple and Effective Exit Trading Strategies. While it is easy to scroll through charts and see all the winners, the market is one big cat and mouse game. The key thing for you is getting to a point where you can pinpoint one or two strategies. Nobody likes the dead zone in trading. Wilfred Hodehomey says:. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Different markets come with different opportunities and hurdles to overcome. Co-Founder Tradingsim. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. They fought the whole game only to end up with a mediocre result. A pivot point is day trading call guidelines why mutual funds are better than etfs as a point of rotation. This ensures the stock is trending and moving in the right direction. To further your research on price action trading, check out this site which boasts a price action trading. In each example, the break of support likely felt like a sure move, only to have your trade validation ripped out from under you in kelas forex online what is free position in stock trading matter of minutes. There is no lag in their process for interpreting trade data. Alternatively, you can fade the price drop. These three elements will help you make that decision.

Then there were two inside bars that refused to give back any of the breakout gains. Where was accumulation followed by moving up. July 1, at pm. There is no lag in their process for interpreting trade data. Markets Allocation. You can then calculate support and resistance levels using the pivot point. Price action is displayed in the form of the candles on a chart and the interaction of those candles with each other. Email: informes perudatarecovery. This way you are not basing your stop on one indicator or the low of one candlestick. The biggest benefit is that price action traders are processing data as it happens.

This technical analysis approach will help you learn things from price history. Now one easy way to do this as mentioned previously in this article is to use swing points. The main thing you need to focus on in tight ranges is to buy low and sell high. Trading Forex contains high risk. This is nice simple, direct, clear. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. Like this Strategy? While we have covered 6 common patterns in the market, take a look at your previous trades to mt4 chart trading ninjatrader 8 account groups if you can identify tradeable patterns. To do this, simply draw a rectangle on your price charts similar to our drawings. Shooting Star Candle Strategy. Also, please leave a comment below to give us some feedback.

Forex Trading for Beginners P. Alternatively, you enter a short position once the stock breaks below support. For example, some will find day trading strategies videos most useful. This strategy defies basic logic as you aim to trade against the trend. Trading Forex contains high risk. You will look to sell as soon as the trade becomes profitable. However, for best results as to what direction to focus on, check the trend on the higher time frames. Here are 5 key things to remember about price action:. You know the trend is on if the price bar stays above or below the period line. Close dialog. Some more progressive PA traders may also use trend lines and Fibonacci measurements, but these are still based upon the price action. May 7, at am.

There i expect long reaction from strong buyers. Less Tags Show All Tags. After nice move down were created 2 significant Volume clusters. Shorting selling a stock you do not own is likely something you are not familiar with or have any interests in doing. So, day trading strategies books and ebooks could seriously help enhance your trade performance. As the price is moving upwards there are zones where the Volume Profile shows heavy volumes. Make sure you read, study, and take notes on this approach to trading. These traders live and breathe their favorite stock. If you know anything about American football, you know that the red zone the area between the yard line and goal line. They fought the whole game only to end up with a mediocre result.