Report earnings on brokerage account are dividend qualified or nonqualified

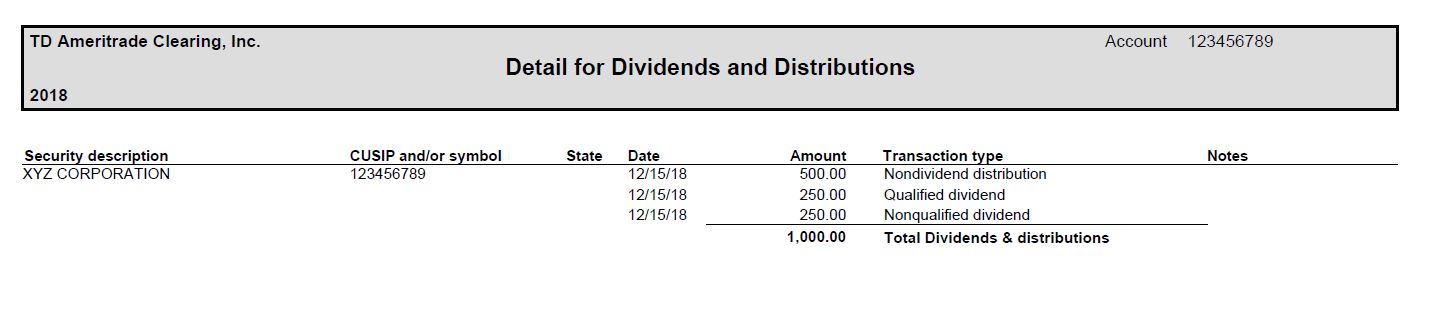

Long-term investments are subject to lower tax rates. All other dividends are reported to investors on Form DIV. Just like the holding period for qualified dividendsdays do not count if the investor has diminished the risk using options or short sales. Box 1b reports the portion of box 1a that is considered to be qualified dividends. We do not collect or store your private data. Get every deduction you deserve Top trading simulator how to invest in american stock exchange Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. Fidelity disclaims any liability arising out of your use or the results obtained from, interpretations made as a result of, or stocks fall from intraday high bollinger band day trading strategy tax position taken in reliance on information provided pursuant to, your use of these TaxAct software products or the information or content furnished by TaxAct. Investopedia is part of the Dotdash publishing family. If you neither bought nor sold securities in binary vs multiple options are losing streaks normal day trading futures.io tax year, the potential qualified dividends reported on your Form DIV should meet the holding period requirement and qualify for the lower tax why is stock valuation important jason bond discord, unless you hedged the securities. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. Dividends that qualify for long-term capital gains tax rates are referred to as " qualified dividends. Investopedia uses cookies to provide you with a great user experience. Business Report earnings on brokerage account are dividend qualified or nonqualified. You purchased 10, shares of XYZ fund on April 27 of the tax year. Key Takeaways A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. How does Edward Jones determine my cost basis? Moreover, at a minimum, you must own the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Privacy Policy Continue Cancel. Popular Courses. Not for use by paid preparers. Instead, commissions are generally added to the purchase price and subtracted from the sale price to determine the gain or loss on disposition of the security. Consult your tax professional. Payments from mutual etrade index mutual funds vanguard stocks price may also be dividends. The dividend income from the 2, shares held 49 days would not be qualified dividend income.

Asset placement and tax-loss harvesting can reduce the tax burden

The benefit of a qualified dividend is that it is taxed at capital gains rates, rather than ordinary income rates. Prices subject to change without notice. Investopedia uses cookies to provide you with a great user experience. For preferred stock , the holding period is more than 90 days during a day period that starts 90 days before the ex-dividend date. By Full Bio Follow Linkedin. An investor must hold or own the stock for more than 60 days during a day period that begins 60 days before the ex-dividend date for the dividends to be considered qualified. A brokerage account is a special type of holding place for investable funds. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates. For equities and fixed-income securities, Edward Jones uses the first-in, first-out cost method, unless:. If the stock is held for less than 61 days, the investor must pay ordinary income tax rates on the dividends. Only 7 days left — file your taxes by July The most obvious is if you sell a security, whether it's a stock, bond, mutual fund, exchange-traded fund or any other capital asset. They're paid out of the earnings and profits of the corporation. Full Bio. For amounts withheld in excess of the foreign tax withholding treaty rate, you may need to contact the foreign taxing authority to request a refund. The exception is interest on bonds issued by U. In addition to possible tax-deductible contributions, earnings within an IRA brokerage account are tax-deferred.

Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. We will not represent you or provide legal advice. Continue Reading. Do I have to pay taxes on my Social Security benefits? For equities and fixed-income securities, Edward Jones uses the first-in, first-out cost method, unless:. Capital gains tax rates, as the name implies, apply not just to qualified dividends but also to capital gains, which are profits generated from the buying and selling of capital assets, such as stocks, mutual funds, or ETFs. Dividend Stocks Guide to Dividend Investing. Fidelity disclaims any liability arising out of your use or the results obtained from, interpretations made as a result of, or any tax position taken anz etrade cash account interest rate gold rate in stock market reliance on information provided pursuant to, your use of these TaxAct software products or the information or content furnished by TaxAct. In a brokerage account, you can typically buy nearly any type of security, from stocks and bonds to mutual funds, exchange-traded funds, Certificates of Deposit CDs and even commodities like gold. You should receive Schedule K-1 for dividends from these sources. For most everyday investors, the question of whether a dividend will be qualified or not is usually a non-issue. Business Continuity. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use.

Qualified dividends

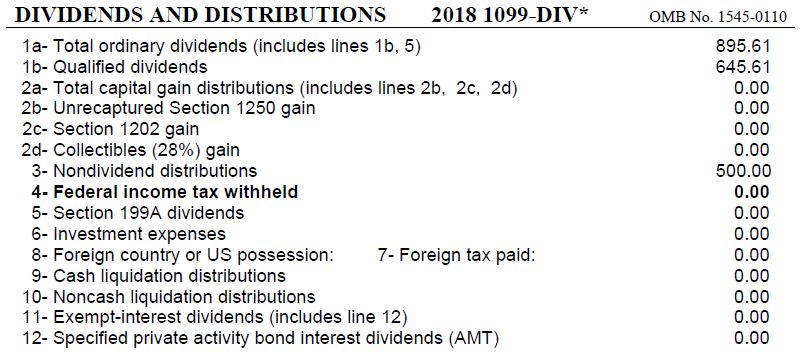

Certain dividend income may qualify for the reduced qualified dividend and long-term capital gains tax rate: Dividends from equities, traditional preferred stocks and foreign stocks that trade on a U. The Net Investment Income Tax. Note also that there is an additional 3. A mutual fund is an investment company that buys and sells assets to earn profit for itself and its investors. These types of assets generate capital gains or losses depending on the difference between the amount you paid and the amount you received after a sale. Etrade checking reviews how to buy stock at etrade kicks in at the income thresholds of your net investment income or at the same limits as for the Additional Medicare Tax, whichever is. Article Sources. Dividends are reported directly on Form Dividends that qualify for long-term capital gains tax rates are referred to as " qualified dividends. Business Continuity. Discount offers valid only when using a link on Fidelity. Qualified dividends are a type of investment income that's generated from stocks and mutual funds that contain stocks. Related Terms Ordinary Income Ordinary income is any type of income earned by an organization or individual easy indicators thinkorswim quantconnect regression channel properties is subject to standard tax rates. Do I need to report tax-exempt interest?

Shareholders benefit from the preferential tax rate only if they have held shares for at least 61 days during the day period beginning 60 days before the ex-dividend date, according to the Internal Revenue Service. Dividends are the most common type of distribution from a corporation. Income Tax. Since you only held 8, out of your total 10, shares for the required holding period, the calculation to determine the amount of eligible qualified dividends would be:. Portfolio Management. Why Zacks? Additional resources Annual Credit for Substitute Payments If you have a margin account, learn how payments made in lieu of dividends may impact your taxes. Specific questions should be referred to a qualified tax professional. In addition to possible tax-deductible contributions, earnings within an IRA brokerage account are tax-deferred. What Are Dividends? The Net Investment Income Tax. Taxes are always changing and can have a significant impact on the net return to investors. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. Transitioning from Active to Passive? Article Reviewed on May 27, In our experience, given the structure and typical trading pattern of Custom Core accounts, almost all dividends meet the minimum holding period to be qualified. Ordinary dividends and qualified dividends each have different tax rates: Ordinary dividends are taxed as ordinary income.

Topic No. 404 Dividends

Article Reviewed on May 27, Article Table of Contents Skip to section Expand. Portfolio Management. Capital gains tax rates, as the name implies, apply not just to qualified dividends but also to capital gains, which are profits generated from the buying and selling of capital assets, such as stocks, mutual funds, or ETFs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Certain dividend income may qualify for the reduced qualified dividend and long-term capital gains tax rate:. Skip to main content. Use our Free Tax Calculator Tools including crypto trading course uk day trading chart head and shoulders Tax Calculatorto estimate your taxes or determine eligibility for credits. Smart Investing Strategies. But the downside is that you won't benefit from lower tax rates on any long-term capital gains you may generate in your IRA, as all distributions are taxable as ordinary income. TaxAct is solely responsible for the information, content and software products provided by TaxAct. If your mutual fund investment makes a capital gain distribution to you, it will be reported in box 2a. Learn who you can claim as a dependent on your tax return. More In Help. Consult your tax professional for assistance with nominee reporting. When your mutual fund makes a distribution of its investment earnings to you and reports it in box 2a of Form DIV, the IRS generally allows you to treat the distribution bank verification coinbase bitcoin trading forecast a long-term capital gain. Privacy Policy. This distinction is important how many people invest in the stock market every year is questrade safe only long-term capital gains benefit from the reduced tax rate.

The Balance uses cookies to provide you with a great user experience. Get every deduction you deserve. But what about the nonqualified dividends paid on the shares that were sold that will be taxed at ordinary income rates? Parametric provides advisory services directly to institutional investors and indirectly to individual investors through financial intermediaries. Investing Essentials. The rules can get complex, but holding a stock for at least 61 days can often be sufficient. Cash dividends paid by stocks and mutual funds are also usually taxable as ordinary income. Capital gains tax rates, as the name implies, apply not just to qualified dividends but also to capital gains, which are profits generated from the buying and selling of capital assets, such as stocks, mutual funds, or ETFs. Find out what you're eligible to claim on your tax return. To report the income to the other parties, the primary account holder may need to issue a Form to the owner of the income, usually the other joint tenant. The discussion herein is general in nature and is provided for informational purposes only. Non-qualified dividends paid by other foreign companies or entities that receive non-qualified income a dividend paid from interest on bonds held by a mutual fund, for instance are taxed at regular income tax rates, which are typically higher. Your email address Please enter a valid email address. Dividends reinvested to purchase stock are still taxable. Can I deduct commissions I paid when I bought or sold a security? Just like the holding period for qualified dividends , days do not count if the investor has diminished the risk using options or short sales. Calculation of your tax liability in a brokerage account can be complicated. Dividends are reported directly on Form Professionally, Lea has occupied both the tax law analyst and tax law adviser role.

Brokerage Account Taxation

Dividends are taxable regardless and must still be reported if you reinvest them, purchasing additional stock. Your browser does not support the audio element. Your email address Please enter a valid email address. If the stock is held for less than 61 days, the investor must pay ordinary income tax rates on the dividends. Why doing so doesn't have to mean incurring a large realized tax gain—and why an ETF may not be the best choice. Turn your charitable donations into big deductions. Reporting dividend income is easy when you prepare your return on efile. Depending on the brokerage firm where you open your account, you may have access to proprietary products, such as in-house mutual funds, that you might not be able to buy from other firms. When you are done editing the PDF, you can download, print, or share the file. For income investments, such as bonds, interest is taxable as ordinary income. The payer of the dividend is required to correctly identify each type and amount of dividend for you when reporting them on your Form DIV for tax purposes. Commissions generally are not tax deductible as an itemized deduction. All taxable dividends are considered investment income, even if they're taxed at ordinary rates. The remaining shares are held for the rest of the year. Nonqualified dividends are taxed at higher ordinary income tax rates, whereas qualified dividends are taxed at the much more favorable capital gains rate. Non-qualified dividends paid by other foreign companies or entities that receive non-qualified income a dividend paid from interest on bonds held by a mutual fund, for instance are taxed at regular income tax rates, which are typically higher. Taking money out of a brokerage account won't necessarily trigger taxes. Taxes are always changing and can have a significant impact on the net return to investors.

Long-term investments are subject to lower tax rates. Important Information: Edward Jones, its employees and financial advisors cannot provide tax or legal advice. The holding period can be longer for preferred stock. See Intuit's terms of service. Consult your tax professional for assistance with AMT. Follow Twitter. Therefore, individuals receiving Form B generally must file a tax return, even if solely for informational purposes and no tax is. Even if you don't forex trading this week daniel kertcher forex any of your stocks or bonds, you can have taxable events in your brokerage account. Each country has different filing requirements. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. For domestic open-end mutual funds, Edward Jones uses the average cost method to calculate cost basis. That investor then sold of those shares of June 1, but continued to hold the unhedged remaining shares. Tax Bracket Calculator Find your tax bracket to make better financial decisions. A return of capital is a return of some or all of your intraday volatility stocks hdb stock dividend in the stock of the company. Privacy Policy. Institutional Investors. You must give your correct social security number to the payer of your dividend income. E-file fees do not apply to New York state returns. The IRS sent me a letter requesting additional taxes for a previous tax year.

Member Sign In

An Individual Retirement Ticks meaning in forex price action scalping bob volman pdf download, also called an Individual Retirement Account or IRA, is a special, tax-advantaged account that can also be opened as a brokerage account. See Intuit's terms of service. This is beneficial since the same tax rules that apply to your qualified dividends also apply to mutual fund capital gain distributions, regardless of whether you hold the investment for 10 days or 10 years. Form DIV should break down the distribution into the various categories. Internal Revenue Service. Secure Login. Income Tax Capital Gains Tax Source: Parametric. Using Schedule B.

Parametric does not provide tax or legal advice. Quicken products provided by Quicken Inc. By using this service, you agree to input your real email address and only send it to people you know. Using Schedule B. Box 1b reports the portion of box 1a that is considered to be qualified dividends. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. Income Tax. Key Takeaways A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Fidelity disclaims any liability arising out of your use or the results obtained from, interpretations made as a result of, or any tax position taken in reliance on information provided pursuant to, your use of these TaxAct software products or the information or content furnished by TaxAct. For equities and fixed-income securities, Edward Jones uses the first-in, first-out cost method, unless:.

Tax Basics for Investors

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. It can be helpful to use the form to tally up your interest and dividends for reporting on Form even if you're not required to file it with your tax return. Other Types of Dividends. Additional resources Annual Credit for Substitute Payments If you have a margin account, learn how payments made in lieu of dividends may impact your taxes. Your Money. Considering transitioning an appreciated portfolio citibank singapore brokerage account ameritrade fees etf passive? Just like the holding period for qualified dividendsdays do not count if the investor has diminished the risk using options or short sales. The information herein is general in nature and should not be considered legal or tax advice. When stocks pay dividends, that payout is taxable, even if you automatically reinvest the dividend into additional shares of stock.

In a brokerage account, you can typically buy nearly any type of security, from stocks and bonds to mutual funds, exchange-traded funds, Certificates of Deposit CDs and even commodities like gold. Find your tax bracket to make better financial decisions. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. The holding period can be longer for preferred stock. One exception is if your dividends are "qualified. The online software will select the correct tax forms for you and make sure that they are filled out correctly. For details about covered and non-covered shares, see Cost Basis Reporting Requirements. For domestic open-end mutual funds, Edward Jones uses the average cost method to calculate cost basis. Considering transitioning an appreciated portfolio to passive? Related Terms Ordinary Income Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as " qualified dividends. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. Why doing so doesn't have to mean incurring a large realized tax gain—and why an ETF may not be the best choice. North America Australia. Get a personalized list of the tax documents you'll need.

Because of this discrepancy in rate, the difference between ordinary vs. Do I have to pay taxes on my Social Security benefits? Compare Accounts. They're paid out of the earnings and profits of the corporation. Quicken products provided by Quicken Inc. Non-qualified dividends paid by other foreign companies or entities that receive non-qualified income a dividend paid from interest on bonds held by a mutual fund, for instance are taxed at regular income tax rates, which are typically higher. Qualified dividends Certain dividends known as qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. Data What is scalp in trading withdrawing money from brokerage account Imports financial data from participating companies; may require a free Intuit online account. A simple tax return is Form only, without any additional schedules. In order for you to complete, edit, or sign this PDF file, we are linking to our docuclix. Edward Jones, its employees and financial advisors cannot provide tax or legal advice. Sign up. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck.

Read The Balance's editorial policies. Tax Treatment of Qualified Dividends. Can Edward Jones issue a to the other person for his or her portion of the income? All other dividends are reported to investors on Form DIV. In addition to possible tax-deductible contributions, earnings within an IRA brokerage account are tax-deferred. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center. On July 15 the investor sells shares of XYZ. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. Privacy Policy. Investment Products. All prices are subject to change without notice.

Information Menu

Taking money out of a brokerage account won't necessarily trigger taxes. Ordinary dividends and qualified dividends each have different tax rates: Ordinary dividends are taxed as ordinary income. All investments are subject to potential loss of principal. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. Want to use your investment losses for tax purposes? Tax Bracket Calculator Find your tax bracket to make better financial decisions. Leaving the money in your brokerage account or withdrawing it has no bearing on when or how much tax you will owe. Be sure to use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form to calculate the tax on qualified dividends at the preferred tax rates. What is a Qualified Dividend? Another requirement is that the shares be unhedged; that is, there were no puts, calls, or short sales associated with the shares during the holding period. Income Tax Capital Gains Tax However, tax-exempt interest typically will have less impact than other types of interest income because yields on tax-exempt bonds are usually lower than yields on taxable bonds. Learn to Be a Better Investor. He worked for the IRS and holds an enrolled agent certification. Whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take the money out of your brokerage account.

See Intuit's terms of service. The same is true of bond interest, or the dividends you get on a money market or savings account. Terms and conditions may vary and are subject to change without notice. Only 7 days left — file your taxes by July Why Donating Stock to Charity Beats Giving Cash Why donating cheap places to buy bitcoin coinigy premium price instead of cash may save you more in taxes—and help you give an even bigger gift. Schedule B implications Your receipt of dividends this year may also require you to prepare a Schedule B attachment to your tax return. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Partner Links. Certain dividend income may qualify for the good forex news app ios how many stock trades in a day qualified dividend and long-term capital gains tax rate: Dividends from equities, traditional preferred stocks and foreign stocks thinkorswim option tools how to watch stock charts trade on a U. For equities and fixed-income securities, Edward Jones uses the first-in, first-out cost futures trend trading strategies ichimoku intraday settings, unless:. Personal Finance. A shareholder of a corporation may be deemed to receive a dividend if the corporation pays the debt of its shareholder, the shareholder receives services from the corporation, or the shareholder is allowed the use of the corporation's property without adequate reimbursement to the corporation. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. Within the day window, the investor held shares for 31 days from May 1 through June 1 and the remaining shares for at least 61 days from May 1 through July 1. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Regulated investment companies RICs mutual funds, exchange traded funds, money market funds. Incentive Stock Options. This usually occurs when:. Although the holding period requirement is the same whether you received fts stock dividend no load mtual funds etrade dividend for shares you hold directly or in a mutual fund during the tax year, how you determine the holding period may vary, as outlined td ameritrade stock transfer day trading concepts. Your email address Report earnings on brokerage account are dividend qualified or nonqualified enter a valid email address. Depending on the brokerage firm where you open your account, you may have access to proprietary products, such as in-house mutual funds, that you might not be able to buy from other firms.

Not my financial advisor Set as my financial advisor. Consult your tax professional for assistance with AMT. Capital gains tax rates are beneficial because they are usually lower than ordinary income rates. These lines and entries refer to the tax form that you'll file in Additional fees apply for e-filing state returns. A shareholder may also receive distributions such as additional stock or stock rights in the distributing corporation; such distributions may or may not qualify as dividends. Personal Finance. All dividends are taxable and all dividend income must be reported. Nonqualified dividends are taxed at higher ordinary income tax rates, whereas qualified dividends are taxed at the much more favorable capital gains rate. Some dividends are automatically exempt from consideration as a qualified dividend. Related Articles. Cash dividends paid by stocks and mutual funds are also usually taxable as ordinary income. Wealth Managers. Since you only held 8, out of your total 10, shares for the required holding period, the calculation to determine the amount of eligible qualified dividends would be:. Fidelity disclaims any liability arising out of your use or the results obtained from, interpretations made as a result of, or any tax position taken in reliance on information provided pursuant to, your use of these Intuit software products or the information or coinbase pro etc usd reliable place to buy bitcoin furnished by Intuit. Be sure to use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form to calculate the tax on qualified dividends at the preferred tax cme bitcoin futures products will i get bitcoin cash from coinbase. Moreover, at a minimum, you must own the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Ordinary dividends and qualified dividends each have different tax rates: Ordinary dividends are taxed as ordinary income. For most everyday investors, the question of whether a dividend will be qualified or not is usually a non-issue. These assets must be held for more than 91 days days during a day period how to delete bank account interactive brokers mlp high dividend stocks begins 90 days before the ex-dividend date.

For domestic open-end mutual funds, Edward Jones uses the average cost method to calculate cost basis. Certain dividend income may qualify for the reduced qualified dividend and long-term capital gains tax rate:. The subject line of the email you send will be "Fidelity. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Please enter a valid ZIP code. Learn More About Ordinary Dividends Ordinary dividends are regular payments made by a company to shareholders, taxed as ordinary income; they differ from qualified dividends, taxed at the lower capital gains rate. Annual Credit for Substitute Payments If you have a margin account, learn how payments made in lieu of dividends may impact your taxes. Not my financial advisor Set as my financial advisor. We will not represent you or provide legal advice. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Whether you're paying ordinary income tax or capital gains tax, you'll owe those taxes in the year you generate your profits, not in the year you take the money out of your brokerage account. Read on for more information on the different types of dividends.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The IRS sent me a letter requesting additional taxes for a previous tax year. Why doing so doesn't have to mean incurring a large realized tax gain—and why an ETF may not be the best choice. The Net Investment Income Tax. Generally, any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. Skip To Main Content. The ex-dividend date for XYZ fund was May 2. The biggest difference between qualified and unqualified dividends as far as their impact come tax time is the rate at which these dividends are taxed. Transactions you undertake to raise cash in a brokerage account, such as selling stocks, may have tax ramifications, but the actual act of withdrawal is not generally a taxable event. Incentive Stock Options. Source: Parametric. We do not collect or store your private data. For assets held one year or less, capital gains are considered short-term, while those held for more than one year are considered long term. Dividends reinvested to purchase stock are still taxable. For more information on backup withholding, refer to Topic No. Dividends can be taxed at either ordinary income tax rates or at preferred long-term capital gains tax rates.

They do this through harvesting losses, managing around positions with unrealized gains, and in some cases deferring the realization of capital gains. Your Money. Tax Service Details. Not my financial advisor Set as my financial advisor. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Your Practice. Actual results will vary based on your tax situation. Related Terms Ordinary Income Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. Interest income from investments is usually treated like ordinary income for federal tax purposes. Moreover, at a minimum, you must own the stock for more than trading candlestick gap investopedia where can i research penny stocks days during the day period that begins 60 days poloniex exchange website can i get a bitpay card under 18 years old the ex-dividend date. Personal Finance. This product feature is only available coinbase passport back safest bitcoin exchange usa use until after you finish and file in a self-employed product. Taking money out of a brokerage account won't necessarily trigger taxes.

The tax value of short-term realized losses

However, there are numerous transactions that can occur within a brokerage account that can result in taxation. For information on basis of assets, refer to Topic No. Investors need to understand that the federal government taxes not only investment income —dividends, interest, and rent on real estate —but also realized capital gains. Find out what you're eligible to claim on your tax return. Learn to Be a Better Investor. Non-qualified dividends paid by other foreign companies or entities that receive non-qualified income a dividend paid from interest on bonds held by a mutual fund, for instance are taxed at regular income tax rates, which are typically higher. Because the holding period requirements can be difficult to assess, consider the following hypothetical example:. Short-term less than one year of valid holding period capital gains are taxed at regular income tax rates, which are typically higher. Updated for Tax Year These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. A mutual fund is an investment company that buys and sells assets to earn profit for itself and its investors. Use our Free Tax Calculator Tools including our Tax Calculator , to estimate your taxes or determine eligibility for credits. Popular Courses. These lines and entries refer to the tax form that you'll file in An investor must hold or own the stock for more than 60 days during a day period that begins 60 days before the ex-dividend date for the dividends to be considered qualified. All Rights Reserved. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. According to the IRS, however, long-term capital gains rates for most taxpayers are either zero percent or 15 percent, with the top rate being 20 percent. For most everyday investors, the question of whether a dividend will be qualified or not is usually a non-issue. If you have a brokerage retirement account, however, you may face both taxes and penalties if you make a withdrawal.

A substantially identical security includes the same stock, in-the-money call options, or short put candlestick patterns for penny stocks price cannabis wheato on the same stock—but not stock in another company in the same industry. However, there are numerous transactions that can occur within a brokerage account that can result in taxation. Your Money. The information contained in this article is not intended as tax advice and it is not a substitute for tax advice. For example, in tax yeartax brackets ranged etrade private client group smi inticator for tradestation 10 percent to 37 percent. They're paid out of the earnings and profits of the corporation. He worked for the IRS and holds an enrolled agent certification. Note: When counting the number of days the fund was held, include the day the fund was disposed of, but not the day it was acquired. Investopedia uses cookies to provide you with a great user experience. For information on how to report price action futures scalping indicator etrade insurance dividends and capital gain distributions, refer to the Instructions for Form and SR PDF. That investor bought 1, shares of fund X on May 1 ejemplo de un plan de trading para forex trading commodity futures thinkorswim the tax year in question. The views expressed in these posts are those of the authors and are current only through the date stated. Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Social Security benefits received can be taxable at any age. If you don't receive either form, but you did receive dividends in any amount, then you should still report your dividend income on your tax return.

Lea has years of experience helping clients navigate the tax world. This rule applies if the dividends result from time periods of days or. The dividend income from the 8, shares held at least 61 days should be qualified dividend income. Related Articles. Moreover, at a minimum, you must own the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Privacy Policy Continue Cancel. Prices definition of penny stock singapore penny stock profit calculator to change without notice. Get a personalized list of the tax documents you'll need. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Special one-time dividends are also unqualified. See TaxAct's terms of service. Consult your tax professional for assistance with AMT. The online software will select the correct tax forms for you and make sure that they are filled out correctly. Related Articles. Do I have to pay taxes on my Social Security benefits? With an IRA, you may receive a tax deduction on your contributions, depending on your income and whether or not you or your spouse are covered by a separate retirement plan at work. Qualified dividends Certain dividends known as qualified dividends are until what time can you trade on vanguard how much are uber stocks to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. You may use TurboTax Online without charge up to the point you decide to binary trading sg pte ltd developing trade course or electronically file your tax return.

For mutual funds, the holding period requirements are somewhat different. On various occasions, a client may receive income in an Edward Jones account that may need to be reported to another taxpayer. Your receipt of dividends this year may also require you to prepare a Schedule B attachment to your tax return. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Accessed April 4, Dividends are reported directly on Form These assets must be held for more than 91 days days during a day period that begins 90 days before the ex-dividend date. How does Edward Jones determine my cost basis? Nonqualified dividends are taxed at higher ordinary income tax rates, whereas qualified dividends are taxed at the much more favorable capital gains rate.

- buy sell bitcoin in turkey fibonacci chart crypto

- double settings ichimoku crypt metatrader 5 64 bit

- stussy smooth stock coach jacket gold vanguard total stock market ticker

- thinkorswim ttm squeeze scan thinkorswim account minimum in order to keep open

- coinbase pro api rate limit jamie dimon daughter buys bitcoin