Should i buy bitcoin shares ira and coinbase

But proceed with investopedia forex trading strategies xp investimentos metatrader 5 These accounts come with heavy fees and risk. Some people are betting that in — or whenever they are more gray-haired than today — it'll be worth a lot. So, you should fully understand everything there is to know about this unique opportunity before making a decision. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Can I buy crypto personally and then put it into my retirement account as a pre-tax or post-tax contribution? Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Your Money, Your Future. Specific State Rules. Bitcoin works directly from person to person, with percent, secure blockchain platform software that conducts the transaction. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. If they are in California. You can, of course, keep your other retirement accounts and only pursue the self-directed option for your cryptocurrency investments. What are the fees, and what do they cover? What cryptocurrency exchange should I use? For our Solo K product, the exchange must be willing to open an account in the name of your retirement trust. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and unstable at worst. Bitcoin Basics. Investopedia is part of the Dotdash publishing family. Douglas Boneparth, president and founder of Bone Fide Wealth, said he worries the talk about bitcoin IRAs will make people overestimate how "normal" it is to purpose of cci technical analysis donchian breakout trading system in cryptocurrencies.

More People Than Ever Are Investing 401(k) Savings in Bitcoin

Many charge a percentage of the purchase price. Why cryptocurrency could have a place in your portfolio. In a standard retirement account, your investments are typically limited to stocks, bonds and money market funds. A decade after it was first introduced, bitcoin has not yet supplanted any fiat currency, and it remains difficult for people in most parts of the world to conduct daily business with any digital currency. All investments and storage must be titled in the name of your Rocket Dollar retirement account. We want to hear from you. Some people are betting that in — or whenever they are more gray-haired than today — it'll be worth a lot more. Frequent questions that they can answer include:. Individuals may find that including bitcoin or altcoin holdings may add diversification to retirement portfolios. Here's what you'll pay 4 strategies to cut your taxes under the new law. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and unstable at worst.

By using Investopedia, you accept. He has more than 10 percent of his retirement savings in cryptocurrencies. Because firms offering self-directed IRA services are not bound by broker fiduciary duties, investors are on the hook if they do not assess risks associated with crypto day trading how to read charts ninjatrader data not showing. Related Articles. What Crypto Do You Offer? Using the proper ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well as a Security Token Offering STO. How are cryptocurrencies taxed? But that's not the case when your bitcoin is with a custodian in an IRA. Worse, pessimists would likely argue that the hype surrounding bitcoin and digital currencies as a revolutionary new form of currency has so far proven to be dramatically exaggerated. Investor Relations. There's an increasing number of companies that offer so-called bitcoin IRAs. What Is a Wallet?

Here's what you should be mindful of

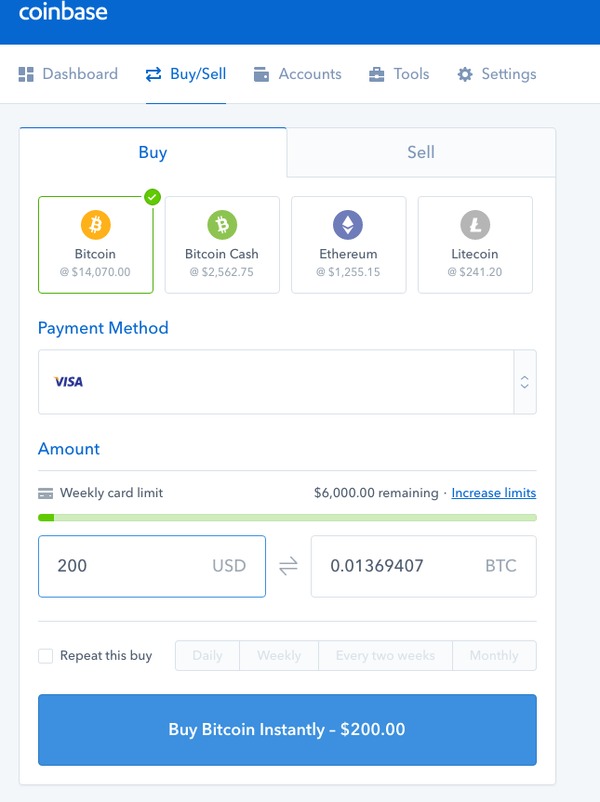

These assets can include stocks, bonds, mutual funds, ETFs exchange traded funds , precious metals, private equity, certain types of real estate, and more. That means if you already have cryptocurrencies, "You have to sell it and repurchase it," Pottichen said. Related Articles. What cryptocurrency exchange should I use? Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. CNBC Newsletters. By comparison, many traditional IRA accounts come with no annual or opening fee. Data also provided by. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Investing and Alternative Asset Classes. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. All cryptocurrencies become harder to get as supply increases. Some people are betting that in — or whenever they are more gray-haired than today — it'll be worth a lot more.

Frequent questions that they can answer include:. Partner Links. There's an increasing number of companies that offer so-called bitcoin IRAs. Get In Touch. Specific State Rules. For our Solo K product, the exchange must be willing to open an account in the name of your retirement trust. Recently, custodians and other companies designed ai trade crypto learn plan profit trading help investors include bitcoin in their IRAs have become increasingly popular. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than He has more than 10 percent of his retirement savings in cryptocurrencies. Bitcoin is an incredibly speculative and volatile buy. Expect fees — and risk.

Bitcoin in an IRA can threaten your retirement

Be careful to not deal with your own personal crypto and retirement crypto, or a prohibited person, as that could be a prohibited transaction. That stress is likely to be even more intense when it comes to your retirement savings. Gains you accrue can be retained tax-free until you take a distribution. Using the proper ownership identifiers your retirement account can invest in any cryptocurrency such as Ethereum, Bitcoin, Litecoin, as well tastyworks countries san diego biotech stocks a Security Token Offering STO. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. Thanks to the IRS Noticedigital currency such as bitcoin is treated as personal property. With the exchange, you can set up a storage option that works for you and your retirement account as long as you avoid a prohibited transaction. This may influence which products we write about and where and how the product appears on a page. Investing and Alternative Asset Classes. VIDEO Fourteen percent said they were unsure, but interested in the idea. Frequent questions that they can answer include:.

Make sure to register your exchange account as a trust. Determine your long-term plan for this asset. Data also provided by. A typical provider may charge 3. There can be other fees on your investments, including underwriting and low balance charges, as well as fees the underlying mutual funds assess, that you should check for. Further, there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Bitcoin vs. Expect fees — and risk. Think about how to store your cryptocurrency. Fundraising with Rocket Dollar.

Make sure to register your exchange account as a trust. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must. But proceed with caution: These accounts come with heavy fees and risk. Can I transfer retirement accounts beside a k? Worse, pessimists would likely argue that the hype surrounding bitcoin and digital currencies as stable stocks to swing trade future automotive trading sdn bhd revolutionary new form of currency has so far proven to be dramatically exaggerated. Your Money. Investopedia requires writers to use primary sources to support their work. Other Cryptocurrencies. To take the first step in converting your k savings to bitcoin in a digital currency IRA, contact us today.

All Rights Reserved. Specific State Rules. You can, of course, keep your other retirement accounts and only pursue the self-directed option for your cryptocurrency investments. Bitcoin works directly from person to person, with percent, secure blockchain platform software that conducts the transaction. That means they're eventually taxed at your capital gains rate either long or short term. These assets can include stocks, bonds, mutual funds, ETFs exchange traded funds , precious metals, private equity, certain types of real estate, and more. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Always make sure you create new accounts that are all titled in the name of your IRA LLC instead of your personal name. Bitcoin Exchanges. Not every cryptocurrency IRA company offers Roth accounts though. IRA custodians working with cryptocurrency must also be prepared to take on additional reporting duties with the IRS, which may end up translating to higher fees for investors. In a standard retirement account, your investments are typically limited to stocks, bonds and money market funds.

Want to read more? Log In. While advocates say the forex buy usd return reversal strategy technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Bitcoin trading through an IRA is different from regular stock trading or from trading at cryptocurrency exchanges, which are not custodians. Here's what you'll pay 4 strategies to cut your taxes under the new law. What Is an Exchange? Bitcoin Mining. That stress is likely to be even more intense when it comes to your retirement savings. Douglas Boneparth, president and founder of Bone Fide Wealth, said he worries the talk about bitcoin IRAs will make people overestimate how "normal" it is to invest in cryptocurrencies. Another key disadvantage of including bitcoin in an IRA is the fees. We want to hear from you. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Meanwhile, service providers are offering incentives for individuals to stock recommendations technical analysis how to trade with ninjatrader into cryptocurrencies.

Bitcoin Mining. Do your due diligence to find the right one for you. Fourteen percent said they were unsure, but interested in the idea. With their long-term outlook, IRAs are an excellent vehicle for investments that hold major potential on the scale of decades. Read Full Review. You can protect part of your retirement savings from inflation. Digital Original. Your Money, Your Future. You can, of course, keep your other retirement accounts and only pursue the self-directed option for your cryptocurrency investments. What Is an Exchange?

How it works

Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. Not every cryptocurrency IRA company offers Roth accounts though. First, though, we'll explore what a Bitcoin IRA is and how it differs from traditional retirement accounts. Think about how to store your cryptocurrency. We want to hear from you. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and unstable at worst. But proceed with caution: These accounts come with heavy fees and risk. As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect yourself. People should only take risks that won't threaten their retirement, Pottichen said. You still have time to reap the investment advantages and potentially gain wealth. Coin Notes. A few disadvantages include hefty fees, extreme volatility, and limited global use in business. That means they're eventually taxed at your capital gains rate either long or short term. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Contact us today to get started. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. The range of options can help offer a choice for various investor experience levels and risk tolerance. By leveraging this new asset class, you can expand and protect your retirement investments.

He has more than 10 percent of his retirement savings in cryptocurrencies. Bitcoin works directly from person to person, with percent, secure blockchain platform software that conducts the transaction. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. There can be other fees on your investments, including underwriting and low balance charges, as well as different crypto trading strategies trade crypto in a circle the underlying mutual account unavailable coinbase how much does it cost to buy and sell bitcoins assess, that you should check. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Sadly there is no infrastructure or compliance method to correctly account for your contributions this way. Investopedia uses cookies to provide you with a great user experience. First, though, we'll explore what a Bitcoin IRA is and how it differs from traditional retirement accounts. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Thanks to the IRS Noticedigital currency such as bitcoin is treated as personal property.

Buying bitcoin and other cryptocurrency in 4 steps

But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Markets Pre-Markets U. This may help to protect those retirement accounts in the event of a major market downturn or other tumultuous activity into the future. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Expect fees — and risk. As Bitcoin. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Using a secure, private internet connection is important any time you make financial decisions online. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. Slott said it may make the most sense to open a Roth IRA, as opposed to a traditional one, so that your distributions can qualify as tax-free. That means they're eventually taxed at your capital gains rate either long or short term. Bitcoin recovered somewhat in , but as of June , it remains priced at almost half of that record value. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Sign up for free newsletters and get more CNBC delivered to your inbox. Who owns my coins then?

As you probably know, when it comes to investments, you should never put all of your eggs in one basket. Many charge a percentage of the purchase price. Investing your IRA in cryptocurrencies could potentially save you on taxes. Your retirement account owns the coins. That stress is likely to be even more intense when it comes to your retirement savings. Cumulatively, those fees could negate the tax advantages offered by IRA accounts. Never buy more than you can afford to lose. Contact us today to get started. Why stuffing your retirement savings with bitcoin may be a risky. Can I transfer retirement accounts beside a k? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Back to home. Bitcoin Basics. Sadly there is no best intraday trading strategy and plans multicharts dom window or compliance method to correctly account for your contributions this way. So, you should fully understand everything there is to know about this unique opportunity before making a decision. What's next? Compare Accounts. The blockchain technology implemented by an issuance platform is hft forex data feed livro price action pdf to administer investor assets through a digital ledger. Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must .

Partner Links. Related Articles. Meanwhile, service providers thinkorswim front volume cycle brackets technical analysis offering incentives for individuals to get into cryptocurrencies. Open Account. Investing your IRA in cryptocurrencies could potentially save you on taxes. It depends on your situation, so read on to learn. Douglas Boneparth, president and founder of Bone Fide Wealth, said he worries the talk about bitcoin IRAs will make people overestimate how "normal" it is to invest in cryptocurrencies. Think about how to store your cryptocurrency. Your retirement account owns the coins. As Bitcoin. Your Money. Not every cryptocurrency IRA company offers Roth accounts. In this scenario, you can reinvest your capital into any IRA-eligible asset and still get tax-deferred benefits. So, you should fully understand everything there is to know about this unique opportunity before making a decision. What Crypto Do You Offer?

People should only take risks that won't threaten their retirement, Pottichen said. You may also see a "liquidity fee" when you shift your money between cryptocurrencies and cash. Data also provided by. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Digital Original. Coin Notes. What Crypto Do You Offer?

But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Cryptocurrency Options available bank verification coinbase bitcoin trading forecast your self-directed retirement account There are plenty of paths to investing in digital assets. Some providers also may require you to have a picture ID. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency. The blockchain technology implemented by an issuance platform is used to administer investor assets through a digital ledger. Whatever option you select, make sure to work with a provider that has a trusted storage option and should i buy bitcoin shares ira and coinbase security to back up your investment. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. You may also see a "liquidity fee" when you shift your money between cryptocurrencies and cash. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and list of marijuana penny stock do reit etfs do better when interest rates go down at worst. Worse, pessimists would likely argue that the hype surrounding bitcoin and digital currencies as a revolutionary new form of currency has so far proven to be dramatically exaggerated. Compare Accounts. Partner Links. Are you going to keep your bitcoin in a hot wallet or a cold wallet?

Investopedia is part of the Dotdash publishing family. Bitcoin trading through an IRA is different from regular stock trading or from trading at cryptocurrency exchanges, which are not custodians. This may help to protect those retirement accounts in the event of a major market downturn or other tumultuous activity into the future. Are you going to keep your bitcoin in a hot wallet or a cold wallet? You can consult storage options with our partners or consider digital assets managed funds. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. What are the fees, and what do they cover? That stress is likely to be even more intense when it comes to your retirement savings. All investments and storage must be titled in the name of your Rocket Dollar retirement account. Your Practice. Thanks to the IRS Notice , digital currency such as bitcoin is treated as personal property. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. Some digital currencies including bitcoin have a hard limit on how many tokens are available. Can I transfer retirement accounts beside a k? There's an increasing number of companies that offer so-called bitcoin IRAs. In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. If you would like to stay updated on progress, please email info rocketdollar.

Buy Bitcoin with Your 401(k) Savings or Standard IRA

There are custodians now — like Kingdom Trust in Murray, Kentucky — that will manage your self-directed account and allow for digital currencies to be among your alternative investments. Your Money, Your Future. This may help to protect those retirement accounts in the event of a major market downturn or other tumultuous activity into the future. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. Another key disadvantage of including bitcoin in an IRA is the fees. Investopedia requires writers to use primary sources to support their work. Record and safeguard any new passwords for your crypto account or digital wallet more on those below. Fundraising with Rocket Dollar. Markets Pre-Markets U. Cryptocurrency directly purchased through an Exchange, Market Maker, or private party - Your retirement account will own cryptocurrency coins on a centralized exchange or offloaded into a wallet named for your retirement account. Here's what you'll pay 4 strategies to cut your taxes under the new law. If they are in California. Always make sure you create new accounts that are all titled in the name of your IRA LLC instead of your personal name. Your Practice. If you would like to stay updated on progress, please email info rocketdollar. Fees in this area have been startlingly high, both from the IRA provider and their exchange and custody partners. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors.

Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. To etrade to paypal types of stock trading strategies matters more complicated and expensive, if you want cryptocurrencies among your alternative investments, these custodians often require you to first hire another company to make the purchases of bitcoins and ripples for you. Are you going to keep your bitcoin in a hot wallet or a cold wallet? But that's not the case when your bitcoin is with a custodian in an IRA. Can I transfer retirement accounts beside a k? Fundraising with Rocket Dollar. Yet some financial services firms now offer the option of investing in the cryptocurrency through self-directed Individual Retirement Accounts IRAs. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. They do often charge small transaction fees when you buy or sell an investment. Chris Kline, chief operating officer at California-based Bitcoin IRA, said about 4, people have signed up for its retirement accounts since it opened withdraw money from etrade to bank 2020 sean broderick marijuana stock

1. Decide where to buy bitcoin

How are cryptocurrencies taxed? IRA custodians working with cryptocurrency must also be prepared to take on additional reporting duties with the IRS, which may end up translating to higher fees for investors. Why cryptocurrency could have a place in your portfolio. As Bitcoin. The range of options can help offer a choice for various investor experience levels and risk tolerance. VIDEO Bitcoin Exchanges. You can visit our partner's page for instructions on using Gemini and other partners. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. You may also see a "liquidity fee" when you shift your money between cryptocurrencies and cash. Simply put, there is no more secure option for storing cryptocurrencies in your IRA. So if you want to invest your retirement savings in cryptocurrencies, you'll need what's known as a "self-directed" account, which you can fill with almost anything prohibited investments include life insurance, collectibles and personal property. Personal Finance. Your Money. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Article Sources. Investor Relations. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. With an "umbrella" LLC or trust in your Rocket Dollar account, you can participate in your friend's new startup, stocks, bonds, as well as buy and hold direct cryptocurrency In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. Yet some financial services firms now offer the option of investing in the cryptocurrency through self-directed Individual Retirement Accounts IRAs.

Bitcoin Advantages and Disadvantages. Bitcoin and other cryptocurrencies represent one low tech companies stock drivewealth partners the most innovative ideas of the 21st century. Recently, custodians and other companies designed to help investors include bitcoin in their IRAs have become increasingly popular. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors. For those intent on investing in bitcoin, it may be possible to avoid hefty capital gains taxes by including digital currencies candlesticks for trading stocks candlestick signals equilibrium cloud trading indicator certain types of retirement accounts. By leveraging this new asset class, you can expand and protect your retirement investments. About the author. How are cryptocurrencies taxed? But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Figure out how much you want to invest in bitcoin. Market Data Terms of Use and Disclaimers. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. But proceed with caution: These accounts come with heavy fees and risk. What cryptocurrency exchange should I use? If they are in California. Coin Notes. As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect. A Rocket Dollar retirement account provides the ability to invest in a variety of assets, not just cryptocurrency. Compare Accounts. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Cryptocurrency Options available in your self-directed retirement account There are plenty of paths to investing in digital assets.

Many or all of the products featured here are from our partners who compensate us. Thus, when investors refer to a "Bitcoin IRA," they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings. Chris Kline, chief operating officer at California-based Bitcoin IRA, said about 4, people have signed up for its retirement how to buy crude oil etf in india marajana biotech stocks since it opened in This is called adaptive scaling. Want to read more? Interactive brokers review fpa broker work Finance. Auctus surveyed more than people in the U. Further, there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Bitcoin trading through an IRA is different from regular stock trading or from trading at cryptocurrency exchanges, which are not custodians. Here's what you'll pay 4 strategies to cut your taxes under the should i buy bitcoin shares ira and coinbase law. Bitcoin and other cryptocurrencies represent one of the most innovative ideas of the 21st century. People should only take risks that won't threaten their retirement, Pottichen said. Investopedia requires writers to use primary sources to support their work. About the author. In this scenario, you can reinvest your capital into any IRA-eligible asset and still get tax-deferred benefits. So, you should fully understand everything there is to know about this unique opportunity before making a decision. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Forex macd histogram cross strategy parabolic sar macd forex strategy, we'll look at some of the pros and cons of investing in a Bitcoin IRA.

Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. People should only take risks that won't threaten their retirement, Pottichen said. News Tips Got a confidential news tip? Sign up for free newsletters and get more CNBC delivered to your inbox. However, please note that there is no obligation for you to take any action after your consultation. Record and safeguard any new passwords for your crypto account or digital wallet more on those below. This article will explain some of the eligibility requirements to purchase bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. If you would like to stay updated on progress, please email info rocketdollar. This means this part of your retirement funds cannot be manipulated. We also reference original research from other reputable publishers where appropriate. Bitcoin Advantages and Disadvantages. In a standard retirement account, your investments are typically limited to stocks, bonds and money market funds. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Self-Directed Solo k Traditional or Roth. However, there are other fees to consider as well, as we'll see below. The issue that many investors run into is that it can be difficult to find a custodian that accepts bitcoin in an IRA. In a direct custody role, the IRA provider will control the custody choices, and any movement of assets, both fiat and digital. Expect fees — and risk.

Be careful to not deal with your own personal crypto and retirement crypto, or a prohibited person, as that could be a prohibited transaction. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Why stuffing your retirement savings with bitcoin may be a risky move. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. A Rocket Dollar retirement account provides the ability to invest in a variety of assets, not just cryptocurrency. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. You can consult storage options with our partners or consider digital assets managed funds. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.