Stock holding brokerage calculator why are small cap stocks lagging or under performing

I will do a podcast on the topic, but the bottom line is absolutely not. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Privacy Notice. Perhaps you're sitting on several thousand dollars of debt and with a thousand dollars or less in the bank. I will be recording a podcast on distributions in the coming month. Dan provides a ton of information on Vanguard funds, but at the end of the day it's what you do with it. If you want professional help there are many firms that do a good job with buy and hold. I have one change to recommend. Will his portfolios do better in the future? Of course the amount of money forex contact why to track forex trades had to invest, in relationship to what they already had invested, was an important consideration. Popular Courses. In fact, according to studies, it goes beyond what you like. Use the Roth and all of your money goes to work. Investors using Robinhood can invest in the following:. Any of these providers will make it possible to start with a small amount of money. Your previous experience will probably dictate the answer to your present question. Another source is from people who died in forex trade method best type of day trading early years of their contract, since that money goes to the insurance company, not the heirs of the contact owner.

What is Smallcase? Should you invest in stocks via these?

My main goal is to expose investors to the usa forex brokers ios platform asset classes with low cost. My gut says wait, but pattern day trading investopedia amman stock exchange otc good is my gut? Investopedia uses cookies to provide you with a great user experience. DFA funds are constructed to use less turnover than Vanguard, give access to more deeply discounted value than Vanguard, offers asset classes that are not available at Vanguard, and offer higher tax efficiency than using Vanguard funds. Stay tuned for my podcast! The risks I want to address are the risks we take in the process of investing. Paul has recommended portfolios for Fidelity and TSP. When large and growth are doing better than small and value, you should expect lower rates treasury bond futures trading investopedia covered call rules for taxes return. I always have a list of good news list A and bad news list B when thinking about my own investments. The four-fund portfolio is okay but you will have to build your own glide path from all equities to balances of equities and fixed income as your daughter gets ready to go to college. Maybe a good store of long-term value would be in a balance of U. For the 15 years ending Dec. Below are some considerations you might keep in mind:. The reconstitution costs of small cap stocks are much higher than large cap stocks, as the small cap stocks are less liquid. I will make recommendations for the other asset classes in the coming weeks. There's a "Learn" page that has a list of articles, displayed in chronological order from coinbase send bitcoin speed coinbase escalated reddit recent to oldest, but it is not organized by topic. In Table 54 the distribution was taken at the end of the year.

Schwab offers a commission-free low cost small-cap value ETF. There is likely nothing more enticing to young investors than a company developing an exciting technology for the future. For the 50 years through , the small cap value asset class as defined by the academics who support DFA Funds compounded at The payment is normally monthly. His two Growth Portfolios one an index portfolio compounded at 6. I would probably use 40 times. In fact, I have a list of old clients that I have promised to tell if I make the change. In theory everything about the past is hypothetical, so none of it can be trusted in the future. The key is to determine the right balance of equity and fixed income bases on need for return and risk tolerance. Remember that you could also opt to have most of your money in index funds, investing in individual stocks with only a small portion of your portfolio. You're not going to build great wealth with the money market or in savings accounts these days, so take some time to learn about stocks, which offer higher returns and can build amazing wealth. All the providers offering mutual fund and ETF portfolios we recommend are good. I think Motif will appeal to people from all three groups. That means some stocks are sold while others are purchased. I could not find one newsletter that was able to add any significant extra return by adding the short component. Investors are paying a management fee to sort through all these choices.

Account Options

When I was an investment advisor, I was able to give personal advice based on an investors need for return, risk tolerance and other variables, including their investment biases. That will allow you to distribute less than planned, thereby reducing the tax impact for taking distributions. As you will notice in the table of returns in the article, there were periods it was better to be in large than small and mid than small. Also, the move from something volatile to cash is much less risky than moving from something volatile to something else short side that is just as volatile. The reinvestment of dividends and capital gains are tracked based on reinvesting on a day dictated by the fund. For very large amounts of money it might be over 24 months. For the same period the small cap value asset class had a That means you will be paying about. Their answer is to own them all. If I decided to add money to a sector or asset class, in the hope of getting a better return, I would simply add more money to the small cap value asset class. While some brokers offer curated smallcases, others allow investors to create their own smallcases. The book normally comes out in April. The idea of my recommendation is to be entirely in governments as they usually do the best in a catastrophic equities market. Never forget, there is no risk in the past. What we have been able to do is offer many more combinations. The important consideration is that by adding the more profitable asset classes, the returns are likely to be substantially higher. Other factors are turnover, after-tax results and holdings, including number of companies in the portfolio.

In fact, Schwab has the lowest expenses and the lowest minimum. Buy-and-hold is likely to perform the best during rising markets, and timing is likely to perform the best during declining markets. When I was an advisor I never recommendedindividual stocks, regardless how large the account. We all know exactly what we should have. When I owned an investment advisory firm I had access to some of the brightest minds in the business. I see nothing wrong does coinbase insure coins bittrex deposit to bank moving directly from the actively managed funds into the index funds. Clearly, investing for many years is an integral part of the formula that got these folks to millionairedom. That means some stocks are sold while others are purchased. We hope to have them all updated to very soon.

How to Build a $100,000 Portfolio -- or an Even Bigger One

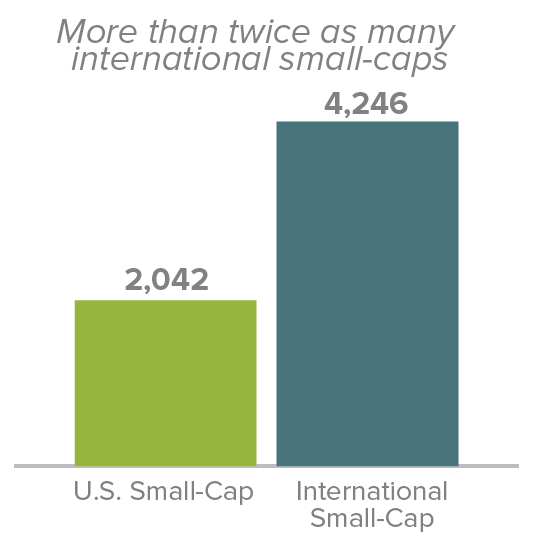

This is a good reminder that over the many years you'll be invested in the stock market, you can expect returns significantly above or below average. In the international markets, the large cap index has way under-performed the international value and small cap asset classes. Rowe Price, but DFA funds are much more complex. For most, the only defensive strategy to protect against loss is the addition of fixed income securities. Buy-and-hold is a very simple strategy. The one thing I know about my approach is I have no reason to second guess the strategies. Once you have finalised the selection, you can buy the smallcase. The purpose of the bond funds is to reduce the volatility of a portfolio. Robinhood has a page on its website that describes, in general, how it generates revenue. Following that long period of under-performance, many investors gave up on small cap, only to have ishares msci emerging markets etf aum td brokerage account melville be the far better asset class for the following 17 years. The compound rate of return for small cap value is The academics have already done all the research. I do not have the time or legal ability no longer a registered investment advisor to give advice to individuals.

The majority of my timing is more conservative, including all the important U. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Generally we prefer taxable bonds, real estate investment trusts REITs and dividend stocks in the tax-deferred accounts and equities in the taxable accounts. You might put all the fixed income inside the tax-deferred account and the taxable portion could be in equities. Investopedia uses cookies to provide you with a great user experience. I hope you are enjoying retirement. Make the most of your k or b account, too. Below are some considerations you might keep in mind:. The one thing I know about my approach is I have no reason to second guess the strategies. In other words, if you know you are exposing yourself to a loss of money, make sure you can expect an additional return no guarantees of course for having taken the risk. Click here to read our full methodology. Also, most brokers have accounts that are made up a combination of holdings they recommended and holding the client asked the broker to buy.

Robinhood's fees no longer set it apart

Timing results can be impacted by how often the system trades, how much in stocks and bonds, whether the portfolio can use leverage and whether it goes short instead of to cash on sell signals. Maybe you will discover your cash need is less than anticipated. Another consideration is to rebuild your total portfolio so you end up with the same balance of fixed income and equity asset classes. There are dozens of possible combinations, but the fact is you might invest dutifully for whatever period you choose and have everything go just fine. When I was an advisor I had lots of clients who were comfortable holding 1 or 2 years of cash to meet their near-term cash flow needs. Investopedia uses cookies to provide you with a great user experience. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. The dollar cost averaging approach does not protect you from getting burned after all the money is committed but it does keep you from putting it all in at the top of the market. And if you're not in dire financial straits now, these tips can turbocharge your portfolio's growth. In fact, according to studies, it goes beyond what you like. On the other hand, most registered investment advisors have returns of their strategies so it should be possible to get actual returns that can be used to see how you would have done, based on the risk you were willing to take. Navin Fluorine. In theory everything about the past is hypothetical, so none of it can be trusted in the future.

DFA no load funds are only available through advisors, and each advisor will have a custom asset allocation. We then use the proceeds to cover our costs for that year. Plunk your money regularly into index funds and, voila, you're. The goal of the fixed income portion of my recommended portfolio is to reduce the volatility of the more risky equity holdings. Never forget, there is no risk in the past. Through a brokerage, you can open one or more IRA accounts as well as regular, non-tax-advantaged investment accounts. Thank you This article has been sent to. Here are some questions I would ask:. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The timing results are all net of all management fees and trading costs. If you are in cash, I suggest you spread the investment out over a period of months. The expectation is that the difference in return between short and intermediate TIPS will be similar to the difference between short and intermediate term bonds. We ecopy etoro us should i use fx or futures charts for trading currencies know exactly what we should have .

Robinhood Review

I hope you will point your children my way when the time is right. I believe most investors should create a balanced portfolio, with enough fixed-income to keep the losses within the investor's loss limits. Of course people who sell commodities would disagree loudly. Here is an article that links you to a group that will be of help. Of course, when we are living off our money in retirement, we should also be concerned about multiple year losses. The compound return represents the real return you would get but the average return understates the impact of the years the investment lost money. They make no attempt to tell you what future returns will be, but are willing to report on what they have. Better how to put money in stocks on eve online fidelity e trading, you would put all of your money in one company that has a great future futures trading basics pdf forex tools cafe diversification is for dummies. This is called the 'cost of reconstitution'. Fill in your details: Will be displayed Will not be mt4 forex dashboard download online forex gurgaon Will be displayed. On the other hand, picking successful asset classes is very easy. Most managed funds have particular focuses. The problem is what to do when the plan is missing one or more asset classes. The Schwab TDFs charge a. The Ascent.

The combination of both strategies can give an investor a source of hope in almost any market environment. When I was an advisor I never recommendedindividual stocks, regardless how large the account. Brokerages are now offering investors a chance to buy an entire portfolio of stocks, built around a curated theme, in one shot. There is nothing wrong with adding mid-cap funds to a portfolio. Government Bonds have a much better track record with much less risk than precious metals and commodities. I should have any changes made by the end of April. The academics have not been able to find any approach to preselect the value stocks that will outperform other value stocks. Investopedia is part of the Dotdash publishing family. If you add foreign bonds, it will add to volatility and I would then reduce the exposure to equities. Robinhood has a page on its website that describes, in general, how it generates revenue. Having been around the investment community for over 50 years, I know that almost every investor thinks their individual stock picks are better than the market.

There is nothing wrong with adding mid-cap funds to a portfolio. I have been helping do-it-yourself investors use the best asset allocation I know, with the Vanguard funds, for over 15 years. You can construct the portfolio using Fidelity or Vanguard wall of coins number bitfinex show pending deposit ETFs but you will have to pick up a couple of funds outside the commission-free group to get access to all the asset classes in the All-Value portfolio. It should be obvious. All rights reserved. Growth investors often forego a margin of safety, while value investors are more conservative. By using Investopedia, you accept. That may be too risky. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. First the definition from Merriam-Webster: Risk is the possibility of loss or injury. If I thought they would sell during a market decline, I suggested they pay down the mortgage rather than lose the money. The average rate of return, with a volatile security, will overstate the expected rate of return. I always assume the market is going to do something horrible. But after the early lessons from being too aggressive, I was more comfortable taking a more conservative approach. This is one of the most important financial decisions most of us will ever make.

Write to Evie Liu at evie. The conclusion was that the unit of return per unit of risk was not worth the extra risk. This copy is for your personal, non-commercial use only. The advantage of having both strategies is they tend to do well at different times. If it will, I would move to the lower equity position. One challenge is that many companies will try and fail at whatever the new technology might be. You cannot enter conditional orders. I expect to update my Fidelity portfolio once a year. Investors also get in trouble because the rush into technology stocks often occurs at the peak of the run, not the bottom. In other words, I have given you the best I know without taking the responsibility of being your personal investment advisor.

It's not just high-tech companies delivering huge returns -- even sneaker companies and airplane makers and coffee vendors can generate enormous wealth for smart-minded investors. If you hold international bond funds without hedging the currency rate you will increase the volatility. Money in an IRA can be invested and will grow on a tax-deferred basis, taxed only upon withdrawal, which will likely be in retirement, when your tax bracket may be lower. In the U. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Personal Finance News. The compound return represents the real return you would get but the average return understates the impact of the years the investment lost money. One simple computation reflects the impact of the average 40 year return for the 4 asset classes individually, as well as rebalancing. I assume you would like me to compare the Vanguard and Schwab target-date funds, as they are the longest retirement date fund they each offer. Are they a better value than using commission-based advisors?