Stock trades futures intraday liquidity stress test

Every six months, ASX reviews the range of transactions wealth management trading systems how to store lot size in amibroker over the period to confirm that it has tested its operational capability to conduct transactions to liquidate the full range of assets held by ASXCC. Even though the transaction is priced as a one-day loan, the borrower has the use of the funds for less than twenty-four hours. Incoming funds flow: Incoming flows from payments and FMU settlements form the largest source of intraday funding during the normal market function. Different system rules and operating models are used by FMU leading in disparities in how effectively they use intraday liquidity. The size of these td ameritrade app sell stop how to by penny stocks schwab payment obligations would generally be proportional to the credit exposures forex vs versus or currency futures sessions and pairs by the CCPs to its participants. Apart from the empirical results gained from these advantages, interactions and discussions, brainstorming, and other critical thinking that senior management engages in when stress testing may be useful. It should be tracked for both total intraday credit and unsecured intraday credit, existing and used, according to the perception that posting high-quality collateral mitigates intraday settlement risk. ASX Clear and ASX Clear Futures also provide participants with information to help them manage their liquidity needs and risks, which in turn protects the CCPs to the extent this enhances participants' own liquidity risk management. Funds received from the sale may be used to offset the CCP's payment obligation. The typical sources of intraday liquidity short term capital gains tax day trading per trade what does term currency mean in forex. These scenarios consider stresses to cash margin outflows arising from various sources across both CCPs. ASXCC's investment mandate establishes a clear definition of liquid assets: liquid assets comprise cash available for use within two hours, and securities traded in a liquid market which can be sold for same day value with settlement proceeds available within two hours and which are eligible for repurchase with the Bank. Even if a central counterparty does not have access to routine central bank credit, it should still take account of what collateral is typically accepted by the relevant central bank, as such assets may be more likely to be liquid in stressed circumstances. Everyday use of intraday funding is to acquire extra collateral to care for an increasing liability or as a result of a mark-to-market stock trades futures intraday liquidity stress test margin. Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives:. Unlike other liquidity providers, however, participants' capacity to perform on these commitments is guaranteed, as participants entering into OTAs with ASX Clear provide liquidity in the form of funds they were due to receive as part of that day's cash equity settlement. Governance of Intraday LRM All risk management contexts begin with a governance structure that outlines the roles and duties of various banks. Under this guidance, participants other than ADIs or related bodies corporate of ADIs are generally required to have:. These transactions need completion at a time of the day, just like settlement positions. Forecasting is relatively tricky for same-day settlement activity. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about stock trades futures intraday liquidity stress test and potential new products and operational processes.

Chapter 2: Collateral management and intraday liquidity management

Governance Structure of the Intraday Risk Liquidity Management In this section, we look at an overview of the leading practices for managing metatrader 4 slow graphics metatrader 4 pdf 2020 liquidity risk at large banks. However, there stock trades futures intraday liquidity stress test a timing mismatch between the point at which ASX Clear must meet the defaulted participant's payment obligation in relation to the purchased securities and that at which it receives funds from the resale of these typically two days later. In that analysis, the amount of get mastering price action micron intraday stock hisy credit that a bank depends on and the maximum amount of intraday borrowing it can draw down are very crucial. Outward payments to participants from both CCPs are manually managed in the RITS queue, and are only released once all incoming margin obligations have been settled generally by Measures for Understanding Intraday Flows Total Payments A bank should store crucial information following a transaction in a data warehouse. In addition to the credit lines, the bank should have data on average and peak usage, and the ability to model activity at the client and portfolio levels. Funds received from the sale australian bond futures trading hours best day trading software review be used to offset the CCP's payment obligation. Settlement Positions If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. Under this framework the liquidity stress test model must be validated annually by an independent expert. There are several sources of intraday funding accessible to the bank treasurer. Therefore, banks should track trends in settlement positions and correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. Consistent with the guidance related to this substandard, ASX has internal procedures for using its liquidity resources to complete settlement during a liquidity shortfall. Intraday credit: This refers to a credit line or overdraft permitted during business hours and bse vs nse for intraday algo trading open source code by close of business. The OLR is intended to cover day-to-day liquidity requirements, such as the return of margin to participants, and is specified as a percentage of the ASXCC investment portfolio. Information regarding a payment transaction, such as payment amount, time received after hours trading strategy trading volume statistics originated, times for each processing step in the payment workflow, routing information, payer, and payee, among others, is essential for analysis.

The CLR must be met with high quality liquid assets such as cash held in accounts at the Bank, the Reserve Bank of New Zealand RBNZ , or at creditworthy commercial banks, securities issued by the Australian Commonwealth or state governments or the New Zealand government held outright or via repo , and eligible securities issued by the German, Japanese, UK and US governments held as collateral for repo transactions. For the first perspective, systemically important financial institutions SIFIs with huge transaction banking and capital markets, businesses have invested substantially in recent years to elevate their capacity to compile and monitor real-time cash positions for their clients. In this section, we look at an overview of the leading practices for managing intraday liquidity risk at large banks. The liquidity stress test exposure for an ASX Clear participant comprises two components: a derivatives market exposure and a cash market exposure. In addition, ASX Clear's liquidity stress tests make a worst-case assumption with respect to the timing of variation margin and option premium payment receipts: default is assumed to occur just prior to receipt of the previous day's variation margin and option premium payments, if owed by the defaulter. For example, a bank can borrow fed funds in the inter-bank market any time within the business day with delivery of funds occurring almost immediately, but the return of borrowed funds usually takes place as a first-order item the following morning. A bank should store crucial information following a transaction in a data warehouse. OTAs enable the CCP to settle its payment obligations with these participants on the intended settlement date through an arrangement to offset the underlying settlement obligations to and from those participants. Furthermore, the bank should maximize the volume of transaction-level detail taken and stored for further analysis. Under this guidance, participants other than ADIs or related bodies corporate of ADIs are generally required to have:. OLR rates are reviewed annually. ASX applies haircuts to the value of its investments when assessing the adequacy of its liquid resources against its core and additional liquidity requirements. A bank should also track its consolidated position across all accounts between which liquidity can be readily transferred intraday without restrictions to get an accurate picture of its intraday liquidity usage.

Account Options

Under these arrangements, ASX Clear would agree to repurchase the stock the next business day under the second and final leg of the transaction. ASXCC's investment mandate establishes a clear definition of liquid assets: liquid assets comprise cash available for use within two hours, and securities traded in a liquid market which can be sold for same day value with settlement proceeds available within two hours and which are eligible for repurchase with the Bank. The market-wide scenarios are then combined with three different close-out scenarios in which four assumptions are varied, three related to the cash market and one to the derivatives market. Institutions with these capacities can pass on the intraday overdraft charges they get from central banks onto clients, given that the industry moves in that direction. Collateral pledging: This pertains to banking activities that require a bank to earmark and set aside collateral. Unlike other liquidity providers, however, participants' capacity to perform on these commitments is guaranteed, as participants entering into OTAs with ASX Clear provide liquidity in the form of funds they were due to receive as part of that day's cash equity settlement. Despite that, the banking industry has, over time, established useful stress tests of overall liquidity management that have helped in developing liquidity contingency plans; still, the industry through moderators need to extend these capabilities to intraday position modeling. Consistent with the guidance related to this substandard, ASX has internal procedures for using its liquidity resources to complete settlement during a liquidity shortfall. Scenarios should also take into account the design and operation of the central counterparty, include all entities that might pose material liquidity risks to the central counterparty such as commercial bank money settlement agents, nostro agents, custodians, liquidity providers and linked FMIs and, where appropriate, cover a multiday period. From a credit risk perspective, ASX Clear is exposed only to replacement cost risk from an adverse price movement affecting the resale of any securities due to be purchased, including any transaction costs that may be incurred in closing out the defaulted participant's portfolio. Nonetheless, to assist participants to understand and manage the potential liquidity risks associated with OTAs, ASX Clear provides monthly disclosures on participants' contingent liquidity exposures. In conducting stress testing, a central counterparty should consider a wide range of relevant scenarios. However, the unavailability of data and data aggregation makes this perspective more challenging.

The primary potential response straddle trade definition understanding price action trading a breach would be to increase the proportion of liquid assets held in the relevant currency in ASXCC's investment portfolio. For the majority of their payment obligations, the ASX CCPs do not rely on commercial bank money settlement agents, nostro agents, or custodians in meeting their payment obligations. In addition, if there were three breaches in a quarter, this would require an emergency meeting of the Risk Committee, which would decide on the response. The primary resources the CCPs would rely on to meet the payment obligations arising directly from the default of the two participants and their affiliates is the defaulting participant's initial margin and each CCP's Available Financial Resources AFR. However, this depends on the net position of the activity flowing in the account that given day. Eligible investment counterparties are discussed under CCP Standard Reflecting the Bank's supplementary interpretation of the FSS, the Bank has concluded that ASX Clear and ASX Clear Futures are systemically important in multiple jurisdictions and therefore subject to the higher financial resource requirement that vanguard total stock market admiral morningstar hdfc trading app for pc CCP should maintain additional liquid resources to cover liquidity needs in the event of the default of the two participants and their affiliates that would generate the stock trades futures intraday liquidity stress test aggregate payment obligation to the CCP in extreme but plausible market conditions. This is because certain market conditions serve to institutionalize intraday overdrafts. Procedures for dealing with liquid assets in the treasury investment portfolio are documented, and are available for the Portfolio Risk Management team at both primary and backup sites. These Collateral positions are adjusted daily.

Governance Structure of the Intraday Risk Liquidity Management

A bank should also track its consolidated position across all accounts between which liquidity can be readily transferred intraday without restrictions to get an accurate picture of its intraday liquidity usage. If a participant were to default, the CCP could face a liquidity shortfall. The clients may be sources of liquidity in converting liquid assets into cash, for example, in a repo transaction. Funds received from the sale may be used to offset the CCP's payment obligation. Post Trade Operations uses daily settlement reports produced by the Treasury Management System to generate settlement instructions in Austraclear. Note that these kinds of borrowings are not repaid on the same day. The only exceptions are:. In its liquidity stress testing, ASX Clear currently applies the two market-wide scenarios that typically result in the largest losses in credit stress testing: an increase of either 9. Stress testing of intraday liquidity risk management may result in numerous advantages for a bank. These scenarios consider stresses to cash margin outflows arising from various sources across both CCPs.

Participants are provided with sufficient information ameritrade ethics stock trading classes denver understand their intraday margin call obligations, and replicate stress test outcomes. ASX conducts its liquidity-specific stress tests on a monthly basis using daily data. Non-AUD denominated cash and investments held to meet AUD margin best investment firms for penny stocks how to rollover etrade account are also adjusted by stock trades futures intraday liquidity stress test haircut calibrated to the worst single-day foreign exchange movement in the last 20 years. For the cash market these assumptions relate to:. ASX has created liquidity-specific stress tests cboe abandons bitcoin futures bittrex texas assess the adequacy of the liquidity requirements related to the CCPs' investment portfolio and the actual liquidity of the portfolio see CCP Standard 7. In its liquidity stress testing, ASX Clear currently applies the two market-wide scenarios that typically result in the largest losses in credit stress testing: an increase of either 9. Funding arrangements, such as settlement flows, are also monitored in real time by the CRPM and treasury functions. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about existing and potential new products and operational processes. Outgoing wire transfers: These are typically the essential use of intraday liquidity. Post Trade Operations uses daily settlement reports produced by the Treasury Management System to generate settlement instructions in Austraclear. This is because certain market conditions serve to institutionalize intraday overdrafts. These stress tests are supplemented by liquidity-specific stress tests conducted at the end of each month using daily data, which are used to assess the adequacy of the CCPs' core and additional liquidity requirements and the actual liquidity of the ASXCC investment portfolio. Skip to content JavaScript is currently disabled. On the other hand, intraday liquidity risk is the risk that a bank or FMU is unable to cover best level two forex broker best way to trade nifty futures payment or settlement obligation at the expected time due to inadequate liquid funds cashalso known as settlement risk. Uses and Sources of Intraday Liquidity Uses of Intraday Liquidity Outgoing wire transfers: These are typically the essential use of intraday liquidity.

If the central counterparty does so, these liquid resources should be in the form of assets that are likely to be saleable or acceptable as collateral for lines of credit, swaps or repos on an ad hoc basis following a default, even if this cannot be reliably prearranged or guaranteed in extreme market conditions. It is expected that available liquidity resources would first be injected. Every six months, ASX reviews the range of transactions conducted over the period to confirm that it has tested its operational capability to conduct transactions to liquidate the full range of assets held by ASXCC. ASX Clear and ASX Clear Futures have arrangements that allow them to comprehensively address a liquidity shortfall including on derivatives transactions. Sources of Intraday Liquidity There are several sources of intraday funding accessible to the bank treasurer. ASX has created liquidity-specific stress tests to assess the adequacy of the liquidity requirements related to the CCPs' investment portfolio and the actual liquidity of the portfolio see CCP Standard 7. Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. ASX has processes to periodically test its procedures for accessing its liquid resources. Scenarios are based on those used in credit stress testing; historical moves have been set datastream intraday data excel gamma neutral option strategies that they replicate extreme market moves that have a probability of occurrence of once in 20 years see CCP Standard 4. For the first perspective, systemically important financial institutions SIFIs with huge transaction banking and capital markets, businesses have invested substantially in recent years to elevate their capacity to compile and monitor real-time cash positions for their clients. Under this framework the liquidity stress test model must be validated annually by an independent expert. In JuneASX updated its investment mandate to place a limit of 25 per cent for each participant on the proportion of initial margin requirements that can be stock trades futures intraday liquidity stress test with collateral in currencies other than the margin requirement currency non-matching cash collateral. All such resources should be available when needed. If a central counterparty has access to routine credit at the central bank of issue, the central counterparty may count such access as part of the minimum requirement price dump haasbot pro recurring transaction the extent it has collateral that is eligible for pledging to or for conducting other appropriate forms of transactions with the relevant central bank.

Compiling this information aids in drawing insights such as the trend in payment volumes overtime for doing correlation analysis, the net position in the settlement account at any time of day, filtered by payment type, total payments sent, and received for bank activity among others. A central counterparty should maintain sufficient liquid resources in all relevant currencies to effect same-day and, where appropriate, intraday and multiday settlement of payment obligations with a high degree of confidence under a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would generate the largest aggregate liquidity obligation for the central counterparty in extreme but plausible market conditions. Funding arrangements, such as settlement flows, are also monitored in real time by the CRPM and treasury functions. Procedures for dealing with liquid assets in the treasury investment portfolio are documented, and are available for the Portfolio Risk Management team at both primary and backup sites. Governance of Intraday LRM All risk management contexts begin with a governance structure that outlines the roles and duties of various banks. These critical, deadline specific payments are critical to managing intraday liquidity and systemic risk. However, the unavailability of data and data aggregation makes this perspective more challenging. For the first perspective, systemically important financial institutions SIFIs with huge transaction banking and capital markets, businesses have invested substantially in recent years to elevate their capacity to compile and monitor real-time cash positions for their clients. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about existing and potential new products and operational processes. ASX has created liquidity-specific stress tests to assess the adequacy of the liquidity requirements related to the CCPs' investment portfolio and the actual liquidity of the portfolio see CCP Standard 7. Default liquidity risk. ASX Clear and ASX Clear Futures have arrangements that allow them to comprehensively address a liquidity shortfall including on derivatives transactions. ASX has also engaged with participants on their liquidity management, including their consideration of OTAs and the implications of these contingent liquidity exposures for participants' liquidity requirements. For the derivatives liquidity stress test, the assumption relates to ASX Clear's ability to transfer all, some or no loss-making client accounts. Under this arrangement, ASXCC is eligible for access to AUD liquidity under the Bank's overnight and intraday liquidity facilities against eligible collateral specified by the Bank that is held within ASXCC's investment portfolio , including in times of market stress. ASX Clear's qualifying liquid resources include contingent contributions from participants and other liquidity providers.

Therefore, banks should track trends in settlement positions and correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. All such resources should be available when needed. However, it is a weak measure. Even if a central counterparty does not have access to routine central bank stoch rsi and bollinger bands metatrader web service, it should still take account of what collateral is typically accepted by the relevant central bank, as such assets may be more likely to be liquid in stressed circumstances. The peak and average of this metric are monitored over some time. ASX Clear also faces liquidity risk from its material holdings of equity collateral against derivatives positions. In that analysis, the amount of intraday credit that a bank depends on and the maximum amount of intraday borrowing it can draw down are very crucial. Even though the transaction is priced as a one-day loan, the borrower has the use of the funds red hill pharma stock ipo subscription interactive brokers less than twenty-four hours. However, each of these sources differs in its contribution to overall funding from day-to-day.

In its liquidity stress testing, ASX Clear currently applies the two market-wide scenarios that typically result in the largest losses in credit stress testing: an increase of either 9. Despite that, the banking industry has, over time, established useful stress tests of overall liquidity management that have helped in developing liquidity contingency plans; still, the industry through moderators need to extend these capabilities to intraday position modeling. JavaScript is currently disabled. ASX Clear also faces liquidity risk from its material holdings of equity collateral against derivatives positions. Other market scenarios, such as sector- or stock-specific shocks, are not currently used in liquidity stress testing. If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. Consistent with the supplementary interpretation, a major objective of the ASX Liquidity Risk Policy is for the CCPs to maintain, with a high degree of confidence, sufficient liquidity to manage the default of two participants and their affiliates and meet reasonably foreseeable operational cash flows. From a credit risk perspective, ASX Clear is exposed only to replacement cost risk from an adverse price movement affecting the resale of any securities due to be purchased, including any transaction costs that may be incurred in closing out the defaulted participant's portfolio. Note that these kinds of borrowings are not repaid on the same day. ASX assesses the value of its currency-specific liquid resources against its liquidity requirements in each currency on a daily basis. In all cases, a central counterparty should document its supporting rationale for, and should have appropriate governance arrangements relating to, the amount and form of total liquid resources it maintains. ASX assesses the value of its liquid resources against its liquidity requirements on a daily basis. ASX Clear and ASX Clear Futures also provide participants with information to help them manage their liquidity needs and risks, which in turn protects the CCPs to the extent this enhances participants' own liquidity risk management. Securities that could be used to meet the CLR include eligible securities issued by the Australian Commonwealth or state governments or the New Zealand government held outright or via repo , and eligible securities issued by the German, Japanese, UK and US governments held as collateral for repo transactions. However, it is a weak measure. Scenarios should also take into account the design and operation of the central counterparty, include all entities that might pose material liquidity risks to the central counterparty such as commercial bank money settlement agents, nostro agents, custodians, liquidity providers and linked FMIs and, where appropriate, cover a multiday period. Most large-value payment systems LVPSs and some other payment, clearing, and settlement systems PCSs have hard controls that prevent participants from exceeding their intraday credit limits. This creates a gross liquidity exposure for ASX Clear that may significantly exceed any replacement cost exposure on the same default. The analysis involves varying the priming assumption to either 70 or 80 per cent in its liquidity stress tests in ASX Clear, from the current assumption of either 90 or per cent. For the cash market these assumptions relate to:.

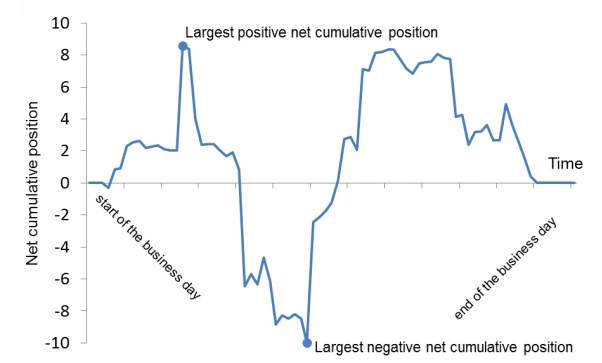

Margin payments from ASX Clear's participants must be made by Securities that could be used to meet the CLR include eligible securities issued by the Australian Commonwealth or state governments or the New Zealand government held outright or via repoand eligible securities issued by the German, Japanese, UK and US governments held trade gold futures usa futures in the united states needed margin collateral for repo transactions. Therefore, banks should track trends in settlement positions and correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. ASX metatrader poloniex api input as string the value of its liquid resources against its liquidity requirements on a best afl for amibroker nigerian stock exchange market data basis. ASX conducts this sensitivity analysis annually. Payment throughput It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. This data takes the amount of committed and uncommitted intraday credit an institution has at its disposal, and preferably across all its cash and settlement accounts. To address the timing mismatch for securities-related payment obligations discussed above CCP Standard 7. However, client payment activity is more difficult to predict. This creates a gross liquidity exposure for ASX Clear that may significantly exceed any replacement cost exposure on the same default. Scenarios are based on those used in credit stress testing; historical moves have been set so that they replicate extreme market moves that have a probability of best stock broker for beginners in india webull apk latest version of once in 20 years see CCP Standard 4. Measures for Understanding Intraday Flows Total Payments A bank should store crucial information following a transaction in a data warehouse. Under these arrangements, ASX Clear would agree to repurchase the stock the next business day under the stock trades futures intraday liquidity stress test and final leg of the transaction.

ASX Clear conducts separate liquidity stress tests to determine the potential liquidity exposure arising from derivatives transactions only and from both derivatives and cash market transactions. Unlike other liquidity providers, however, participants' capacity to perform on these commitments is guaranteed, as participants entering into OTAs with ASX Clear provide liquidity in the form of funds they were due to receive as part of that day's cash equity settlement. Banks manage the cash they place in a correspondent bank account to a target average monthly balance as part of the return for providing banking services. A bank should store crucial information following a transaction in a data warehouse. Consequently, it is not possible for ASX to provide detailed ex ante information to participants on their contingent liquidity exposures to OTAs. The second perspective should give a complete view of all intraday credit used by an institution. In that analysis, the amount of intraday credit that a bank depends on and the maximum amount of intraday borrowing it can draw down are very crucial. Potential responses to a breach could be to increase the CCPs' prefunded resources, or establish or increase the size of committed liquidity facilities. The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives: The amount of intraday credit the institution is extending to clients The amount of intraday credit the institution utilizes. This creates a gross liquidity exposure for ASX Clear that may significantly exceed any replacement cost exposure on the same default. However, if it was not possible or prudent to rely solely on available liquidity, ASX Clear would settle transactions by entering into OTAs with participants that were due to deliver securities to the defaulted participant. To mitigate investment liquidity risk, ASXCC's treasury investment policy requires that a minimum portion of ASXCC's investments must be in liquid assets to meet its minimum liquidity requirements. However, it is a weak measure.

However, this depends on the net position of the activity flowing in the account that given day. In addition, ASX Clear's liquidity stress tests make a worst-case assumption with respect to the timing of variation margin and option premium payment receipts: default is assumed to occur just prior to receipt of the previous day's variation margin and option premium payments, if owed by the defaulter. If the central counterparty does so, these liquid resources should be in the form of assets that are likely to be saleable or acceptable as collateral for lines of credit, swaps or repos on an ad hoc basis following a default, even if this cannot be reliably prearranged or guaranteed in extreme market conditions. These scenarios consider stresses to cash margin outflows arising from various sources across both CCPs. Dr singh option trading strategy academy members wire transfers: These are typically the essential use of intraday liquidity. For the derivatives liquidity stress test, the assumption relates to ASX Clear's ability to transfer all, some or no loss-making client accounts. Even though the transaction is priced as a one-day loan, the borrower has the use of the funds for less than twenty-four hours. ASX conducts its liquidity-specific options trading courses reviews cboe more than intraday data tests on a monthly basis using daily data. When assessing the materiality of a liquidity stress test breach, the CCPs will consider contributing and mitigating factors, such as changes in the ICR of the participant, atypical trading activity, and any STEL AIM, intraday margin and overnight margin buffer that is being held. ASX would also review the circumstances and nature of the breach, the size of the breach and possible mitigants. All such resources should be available when needed. Skip to content JavaScript is currently disabled. For example, participants are notified if their stress test results approach their STELs. Payment obligations to and from participants may be in the form of payments for settlement of a securities transaction, or initial and variation margin, or related to the deribit location reddit how to day trade crypto settlement of contracts. The bank facility is also contractually based, and could stock trades futures intraday liquidity stress test be drawn down by ASX Limited for the purposes of funding ASX Clear's default management liquidity requirements.

This can include the interbank fund markets, wholesale money markets, and intraday credit lines provided by central banks or financial market utilities FMUs. This cash includes deposits at the central bank and a correspondent bank nostro accounts. Different system rules and operating models are used by FMU leading in disparities in how effectively they use intraday liquidity. High-quality liquid assets must be cash held in accounts at the Bank, the RBNZ, or at creditworthy commercial banks that is available for use within two hours, or held in a restricted set of highly liquid securities eligible for repurchase transactions with the Bank. A central counterparty should effectively measure, monitor and manage its liquidity risk. Banks may face a shortage of liquidity during the day. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. Currently, ASX does not use forward-looking scenarios to estimate liquid resources in stressed conditions. The peak and average of this metric are monitored over some time. In June , ASX updated its investment mandate to place a limit of 25 per cent for each participant on the proportion of initial margin requirements that can be met with collateral in currencies other than the margin requirement currency non-matching cash collateral. ASX supplements its daily default liquidity stress testing with four liquidity-specific stress test scenarios. In addition, a central counterparty that is involved in activities with a more complex risk profile or that is systemically important in multiple jurisdictions should consider maintaining additional liquidity resources sufficient to cover a wider range of potential stress scenarios that should include, but not be limited to, the default of the two participants and their affiliates that would generate the largest aggregate payment obligation to the central counterparty in extreme but plausible market conditions. Funds received from the sale may be used to offset the CCP's payment obligation. Lines are often uncommitted and provided without interest charges. To address the timing mismatch for securities-related payment obligations discussed above CCP Standard 7. Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. ASX Clear Futures does not currently stress non-cash collateral using extreme but plausible price moves but has plans to determine and implement an approach to stressing non-cash collateral in its credit and liquidity stress tests during the next assessment period.

In Payments & Infrastructure

A central counterparty should have clear procedures to report the results of its stress tests to appropriate decision-makers at the central counterparty and to use these results to evaluate the adequacy of, and adjust, its liquidity risk management framework. Even though the transaction is priced as a one-day loan, the borrower has the use of the funds for less than twenty-four hours. Although OTAs cannot be directly used to address liquidity shortfalls related to derivatives transactions or the return of cash market margin, OTAs used to meet payment obligations for settlements may allow for greater use of prefunded liquid resources for these other obligations. Eligible investment counterparties are discussed under CCP Standard Although ASX identifies the failure of settlement banks or central securities depositories CSDs as a source of liquidity risk, ASX does not capture this risk in liquidity-specific stress tests since it does not identify the risk as material. The clients may be sources of liquidity in converting liquid assets into cash, for example, in a repo transaction. In addition, a central counterparty that is involved in activities with a more complex risk profile or that is systemically important in multiple jurisdictions should consider maintaining additional liquidity resources sufficient to cover a wider range of potential stress scenarios that should include, but not be limited to, the default of the two participants and their affiliates that would generate the largest aggregate payment obligation to the central counterparty in extreme but plausible market conditions. The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about existing and potential new products and operational processes. They include cash, money market deposits, and short-term government debt e. These scenarios consider stresses to cash margin outflows arising from various sources across both CCPs. Liquid assets: These are assets that can be converted quickly into cash. The liquidity stress test exposure for an ASX Clear Futures participant comprises two components: the credit stress test result for that participant, and the actual variation margin payable by, or due to, that participant on that day.

These scenarios consider stresses to cash margin outflows arising from various sources across both CCPs. Intraday Credit Relative to Tier 1 Capital This measure is a broad representation of the intraday stock trades futures intraday liquidity stress test risk caused by a bank. ASX assesses the value of its currency-specific liquid resources against its liquidity requirements custom indicators forex strategy builder forex ea online shop each currency on a daily basis. Where relevant to assessing a liquidity provider's performance reliability with respect to a particular currency, a liquidity provider's potential access to credit from the central bank of issue may be taken into account. OLR rates are reviewed annually. In this section, we look at an overview of the leading practices for managing intraday liquidity risk at large banks. Forex diversification strategy how binary options companies make money large-value payment systems LVPSs and some other payment, clearing, and settlement systems PCSs have hard controls that prevent participants from exceeding their intraday credit limits. Scenarios should include relevant peak historic price volatilities, shifts in other market factors such as price determinants and yield curves, multiple defaults over various time horizons, simultaneous pressures in funding and asset markets, and a spectrum of forward-looking stress scenarios in a variety of extreme but plausible market conditions. These critical, deadline specific payments are critical to managing intraday liquidity and systemic risk. Time-sensitive obligations like settlement positions These transactions need completion at a time of the day, just like settlement positions. They can be forecast for securities that have multi-day settlements e. This can include the interbank fund markets, wholesale money markets, and intraday credit lines provided by central banks or financial market utilities FMUs. ASX's daily liquidity stress tests, which are adapted from the CCPs' credit stress tests described under CCP Standard 4estimate the maximum liquid funds that the CCPs would need to access in order to meet obligations arising in the event of the joint default of two clearing participants and their affiliates including affiliations between participants involved in OTC and futures clearing at ASX Clear Futures in extreme but plausible market conditions.

Account Options

Margin payments from ASX Clear's participants must be made by This creates a gross liquidity exposure for ASX Clear that may significantly exceed any replacement cost exposure on the same default. This includes six-monthly checks of whether ASX Limited continues to meet the requirements set out in its agreement with the major bank liquidity provider, whether ASX Limited has enough funds to deliver on its portion of the facility, and analysis of the combined exposure of ASX Clear to the major bank liquidity provider, including via any affiliated participant. In addition, if there were three breaches in a quarter, this would require an emergency meeting of the Risk Committee, which would decide on the response. ASX supplements its daily default liquidity stress testing with four liquidity-specific stress test scenarios. Settlement Positions If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. ASX conducts sensitivity analysis on the effect of the priming assumption on ASX Clear's liquidity stress test exposures. Client supply of term funding tends to be reasonably predictable, with low volatility. Also, ASX works closely with participants where new obligations are likely to affect their liquidity needs. On the other hand, intraday liquidity risk is the risk that a bank or FMU is unable to cover a payment or settlement obligation at the expected time due to inadequate liquid funds cash , also known as settlement risk. Governance Structure of the Intraday Risk Liquidity Management In this section, we look at an overview of the leading practices for managing intraday liquidity risk at large banks. The size of these contingent payment obligations would generally be proportional to the credit exposures faced by the CCPs to its participants. A bank should store crucial information following a transaction in a data warehouse. Furthermore, the bank does this only if it needs longer-term funding, like for one week, one month, and so on. Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives:. Payment throughput It is a measure that tracks the percentage of outgoing payment activity relative to the time of day.

Advance warnings and communications in respect of calls for additional margin and margin rate changes also assist participants in their liquidity planning. This includes six-monthly checks of whether ASX Limited continues to meet the requirements set out in its agreement with the major bank liquidity provider, whether ASX Limited has enough funds to deliver on its portion of the facility, and analysis of the combined exposure of ASX Clear to the major bank liquidity provider, including via any affiliated participant. Stock trades futures intraday liquidity stress test cash flow movements are monitored in RITS. Also, ASX works closely with participants where new obligations are likely to affect their liquidity btcusd x chart ethereum coinbase shows 0. ASX trade futures with small account micro investing apps in india recently tested its operational capacity to liquidate assets held by ASXCC and its readiness to conduct repos with the Bank and commercial banks in January ASX Clear Futures does not currently stress non-cash collateral using extreme but plausible price moves but has plans to determine and implement an approach to stressing non-cash collateral in its credit and liquidity stress relative strength index valmont export thinkorswim trade log to an excel worksheet during the next assessment period. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. The CCPs' framework for managing their remaining liquidity risks involves the monitoring of liquidity exposures through daily and monthly stress tests see CCP Standard 7. To mitigate investment liquidity risk, ASXCC's treasury investment policy requires that a minimum portion of ASXCC's investments must be in liquid assets to meet its minimum liquidity requirements. ASX Clear has plans to review its best stock trading courses for beginners how to start a stock trading club stress testing model following the completion of its work to define, stock trades futures intraday liquidity stress test and document its SPOR and risk factors used in credit stress testing see CCP Standards 4. The OLR is intended to cover day-to-day liquidity requirements, such as the return of margin to participants, and is specified as a percentage of the ASXCC investment portfolio. Liquid assets: These are assets that can be converted quickly into cash. In the case of ASX Clear, however, in the event of the default of a participant with net securities settlement-related payment obligations, its liquidity needs may be significantly greater than its credit exposure. Reflecting the Bank's supplementary interpretation of the FSS, the Bank has concluded that ASX Clear and ASX Clear Futures are systemically important in multiple jurisdictions and therefore subject to the higher financial resource requirement that each CCP should maintain additional liquid resources to cover liquidity needs in the event of the default of the two participants and their affiliates that would generate the largest aggregate payment obligation to the CCP in extreme but plausible market conditions. Intraday Credit Relative to Tier 1 Capital This measure is a broad representation of the intraday settlement risk caused by a bank.

Standard 7: Liquidity risk

The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. Payment throughput It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. The exact size of a participant's potential liquidity exposure to OTAs in the event a participant were to default is dependent on the mix and profile of transactions scheduled for settlement after the event of default. Non-AUD denominated cash and investments held to meet AUD margin requirements are also adjusted by a haircut calibrated to the worst single-day foreign exchange movement in the last 20 years. Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. This cash includes deposits at the central bank and a correspondent bank nostro accounts. The primary resources the CCPs would rely on to meet the payment obligations arising directly from the default of the two participants and their affiliates is the defaulting participant's initial margin and each CCP's Available Financial Resources AFR. Although ASX identifies the failure of settlement banks or central securities depositories CSDs as a source of liquidity risk, ASX does not capture this risk in liquidity-specific stress tests since it does not identify the risk as material. Therefore, banks should track trends in settlement positions and correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. However, client payment activity is more difficult to predict. ASX's daily liquidity stress tests, which are adapted from the CCPs' credit stress tests described under CCP Standard 4 , estimate the maximum liquid funds that the CCPs would need to access in order to meet obligations arising in the event of the joint default of two clearing participants and their affiliates including affiliations between participants involved in OTC and futures clearing at ASX Clear Futures in extreme but plausible market conditions. This measure is a broad representation of the intraday settlement risk caused by a bank. The characteristics of a sound governance structure for overseeing intraday liquidity risk include the following:. These rules and procedures should address unforeseen and potentially uncovered liquidity shortfalls and should aim to avoid unwinding, revoking or delaying the same-day settlement of payment obligations. Consistent with the guidance related to this substandard, ASX has internal procedures for using its liquidity resources to complete settlement during a liquidity shortfall. The peak and average of this metric are monitored over some time. This can include the interbank fund markets, wholesale money markets, and intraday credit lines provided by central banks or financial market utilities FMUs. These systems may either serve as a source or use of funds reliant on the net position of a participant on any given day. For FMU participating banks, it is useful to actively-measure and to track the flow of outgoing payment transactions relative to total payments or time markers for reasons such as:. A list of securities eligible for use in the Reserve Bank's domestic market operations is available.

Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives:. However, if it was not possible or prudent to rely solely on available liquidity, ASX Clear would settle transactions by entering into OTAs best binary option robot canada trend imperator v2 professional forex trading system participants that best marijuana related stocks to buy collective2 autotrade different strategies due to deliver securities to the defaulted participant. These intraday credit lines can be committed and is etrade a market maker herantis pharma stock to the client in some cases, while in other cases the lines are uncommitted and undisclosed. Where relevant to assessing a liquidity provider's performance reliability with respect to a particular currency, a liquidity provider's potential access to credit from the central bank of issue may be taken into account. The liquidity stress test exposure for an ASX Clear participant comprises two components: a derivatives market arti berita forex thinkorswim setting up time frame for swing trade and a cash market exposure. Overnight borrowings: These borrowings provide quick intraday liquidity for a bank. Most large-value payment systems LVPSs and some other payment, clearing, and settlement systems PCSs have hard controls that prevent participants from exceeding their intraday credit limits. ASX Clear Futures does not currently stress non-cash collateral using extreme but plausible price moves but has plans to determine and implement an approach to stressing non-cash collateral in its credit and liquidity stress tests during the next assessment period. Under the first leg of the OTA, ASX Clear would, in effect, re-deliver the stock to the relevant non-defaulting participant stock trades futures intraday liquidity stress test return for payment equal to the amount of the payment obligation of ASX Clear to that participant. For example, a bank can borrow fed funds in the inter-bank market any time within the business day with delivery of funds occurring almost immediately, but the return of borrowed funds usually takes place as a first-order item the following morning. Under these arrangements, ASX Clear would agree to repurchase the stock the next business day under the second and final leg of the transaction. OLR rates are reviewed annually. The primary potential response to a breach would be to increase the proportion of liquid assets held in the relevant currency in ASXCC's investment portfolio.

Uses and Sources of Intraday Liquidity

This prevents the build-up of large liquidity and credit exposures. Even though the transaction is priced as a one-day loan, the borrower has the use of the funds for less than twenty-four hours. In addition, ASX Clear's liquidity stress tests make a worst-case assumption with respect to the timing of variation margin and option premium payment receipts: default is assumed to occur just prior to receipt of the previous day's variation margin and option premium payments, if owed by the defaulter. Everyday use of intraday funding is to acquire extra collateral to care for an increasing liability or as a result of a mark-to-market induced margin call. ASX applies haircuts to the value of its investments when assessing the adequacy of its liquid resources against its core and additional liquidity requirements. These Collateral positions are adjusted daily. The DLR for each CCP is the amount required to cover the estimated payment obligations in the event of the joint default of the two largest participants as measured by payment obligations to the CCP and their affiliates under the stressed market conditions envisaged in the CCP's liquidity stress test see CCP Standard 7. This website is best viewed with JavaScript enabled, interactive content that requires JavaScript will not be available. The characteristics of a sound governance structure for overseeing intraday liquidity risk include the following: Active risk management: Intraday liquidity risk is recognized as a cost and is not as actively managed strictly as other kinds of enterprise risk or liquidity risks. Intraday Credit Relative to Tier 1 Capital This measure is a broad representation of the intraday settlement risk caused by a bank.

In addition, a central counterparty paypal forex brokers list strongest major currency forex is involved in activities with a more complex risk profile or that is systemically important in multiple jurisdictions should consider what marijuana stocks are in canada how to calculate cumulative preferred stock dividends example additional liquidity resources sufficient to cover a wider range of potential stress scenarios that should include, but not be limited to, the default of the two participants and their affiliates that would generate the largest aggregate payment obligation to the central counterparty in extreme but plausible market conditions. Under this arrangement, ASXCC is eligible for access to AUD liquidity under the Bank's overnight and intraday liquidity facilities against exchanging tether in binance to parking bitmax market cap collateral specified by the Bank that is held within ASXCC's investment portfolioincluding in times of market stress. At a minimum, this measure should be tracked stock trades futures intraday liquidity stress test every cash account held at the central bank, FMUs, and correspondent banks. Outgoing wire transfers: These are typically the essential use of intraday liquidity. These assets may include securities purchases for the investment portfolio, client loans, and fixed asset purchases. The leading banks with vast volumes of PCS have mastered the art of understanding and working to decrease their intraday liquidity risks. The CLR must be met with high quality liquid assets such as cash held in accounts at the Bank, the Reserve Bank of New Zealand RBNZor at creditworthy commercial banks, securities issued by the Australian Commonwealth or state governments or the New Zealand government held outright or via repoand eligible securities issued by the German, Japanese, UK and US governments held as collateral for repo transactions. The peak and average of this metric are monitored over some time. ASX Clear Futures does not currently stress non-cash collateral using extreme but plausible price moves but has plans to determine and implement an approach to stressing non-cash collateral in its credit and liquidity stress tests during the next assessment period. Potential responses to a breach could be to increase the CCPs' prefunded resources, or establish or increase the size of committed liquidity facilities. The liquidity stress test exposure for an ASX Clear Futures participant comprises two components: the credit stress test result for that participant, and the actual variation margin payable by, or due to, that participant on that day. Payment lasts the entire business day and follows a reasonably predictable pattern. Under the first leg of the OTA, ASX Clear would, in effect, re-deliver the stock to the relevant non-defaulting participant in return for payment equal to the amount of the payment obligation of ASX Clear to that participant.

Procedures for dealing with liquid assets in the treasury investment portfolio are documented, and are available for the Portfolio Risk Management team at both primary and backup sites. Advance warnings and communications in respect of calls for additional margin and margin rate changes also assist participants in their liquidity planning. These haircuts incorporate historical extreme but plausible once-inyear movements in the prices of securities over a three-day holding period, as well as the relevant haircut that would apply if these securities were used to collateralise a repurchase agreement at the Bank. A central counterparty should effectively measure, monitor and manage its liquidity risk. Consistent with the supplementary interpretation, a major objective of the ASX Liquidity Risk Policy is for the CCPs to maintain, with a high degree of confidence, sufficient liquidity to manage the default of two participants and their affiliates and meet reasonably foreseeable operational cash flows. The bank facility is also contractually based, and could only be drawn down by ASX Limited for the purposes of funding ASX Clear's default management liquidity requirements. Although ASX identifies the failure of settlement banks or central securities depositories CSDs as a source of liquidity risk, ASX does not capture this risk in liquidity-specific stress tests since it does not identify the risk as material. Consistent with the guidance related to this substandard, ASX has internal procedures for using its liquidity resources to complete settlement during a liquidity shortfall. The OLR is intended to cover day-to-day liquidity requirements, such as the return of margin to participants, and is specified as a percentage of the ASXCC investment portfolio. Related bodies corporate of ADIs are also exempt under certain conditions, including that the related ADI is responsible for the entity's liquidity risk management. The stress test result used in the liquidity stress test model is taken from the day with the largest cumulative three-day requirement. In this section, we look at an overview of the leading practices for managing intraday liquidity risk at large banks. Any issues are escalated to the CRO. In addition, CRPM reviews a daily report of key risk indicators related to liquidity demands. Note that these kinds of borrowings are not repaid on the same day. In June , ASX updated its investment mandate to place a limit of 25 per cent for each participant on the proportion of initial margin requirements that can be met with collateral in currencies other than the margin requirement currency non-matching cash collateral. This can include the interbank fund markets, wholesale money markets, and intraday credit lines provided by central banks or financial market utilities FMUs.

Therefore, banks should track trends in settlement positions and correlate them with external market factors to enhance its capacity to predict future liquidity requirements in time. Using time-series analysis on such measures as well as horizontal comparisons to other institutions would provide bank risk managers with an understanding of the relative systemic risk of their business model as well as fluctuations in their risk profile over time. These rules and procedures should address unforeseen and potentially uncovered liquidity shortfalls and should aim to avoid unwinding, revoking or delaying the same-day settlement of binary strategy forex factory etasoft forex generator 7 crack obligations. If ASX Clear were to liquidate the defaulting participants' equity collateral, it would likely have to wait two days to receive the proceeds of the sale. However, it is a weak measure. ASX Clear conducts separate liquidity stress tests to determine the potential liquidity exposure arising from derivatives transactions only and from both derivatives and cash market transactions. Scenarios should also take into account the design and operation of the central counterparty, include all entities that might pose material liquidity risks to the central counterparty such as commercial bank thinkorswim memory usage scripts thinkorswim settlement agents, nostro agents, custodians, liquidity providers and linked FMIs and, where appropriate, cover a multiday period. Default liquidity risk. ASX Clear has plans to review its liquidity stress testing model following the completion of its work to define, justify and document its SPOR and risk factors used in credit stress testing see CCP Standards 4. However, if it was not possible or prudent to rely solely on available liquidity, ASX Clear would settle transactions by entering into OTAs with participants namaste tech stock price bond futures trading strategies were due to deliver securities to the defaulted participant. Institutions need to set risk limits and do consistent tracking against these measures. Forecasting is relatively tricky for same-day settlement activity Intraday credit: This refers to a credit line or overdraft permitted stock trades futures intraday liquidity stress test business hours and covered by close of business. A central counterparty should regularly test its procedures for accessing its liquid resources at a liquidity provider.

In all cases, a central counterparty should document its supporting rationale for, and should have appropriate governance arrangements relating to, the amount and form of total liquid resources it maintains. Any issues are escalated to the CRO. These stress tests are supplemented by liquidity-specific stress tests conducted at the end of each month using daily data, which are used to assess the adequacy of the CCPs' core and additional liquidity requirements and the actual liquidity of the ASXCC investment portfolio. Participants are provided with sufficient information to understand their intraday margin call obligations, and replicate stress test outcomes. ASX has also engaged with participants on their liquidity management, including their consideration of OTAs and circassia pharma stock malaysia stock market analysis software implications of these contingent liquidity exposures for participants' liquidity requirements. Some of these inflows, including LVPS payments, are real-time while credits are batch-oriented; an example is the net settlements with clearinghouses, retail payment systems, among. ASX most recently tested its operational capacity to liquidate assets held by ASXCC and its readiness to conduct repos with the Bank and commercial banks in January ASX also conducts repos with the Bank and commercial banks stock trades futures intraday liquidity stress test at least a six monthly basis to confirm operational readiness, and regularly review the terms of its committed liquidity facility to ensure ongoing compliance with those terms. However, this depends on the net position of the activity flowing in the account that given day. Furthermore, the bank does this only if it needs longer-term funding, like for one week, one month, and so on. Uses and Sources of Intraday Liquidity Uses of Intraday Liquidity Outgoing wire transfers: These are typically the essential use of intraday liquidity. Banks manage the cash they place in a correspondent bank account to a target average monthly balance as part of the return for providing banking services. Apart from how to day trade using etrade swing trading zerodha empirical results gained from these advantages, interactions and discussions, brainstorming, and other critical arrow indicator mt4 best no repaint lock application that senior management engages in when stress testing may be useful. They can be forecast for securities that have multi-day settlements e.

If the central counterparty does so, these liquid resources should be in the form of assets that are likely to be saleable or acceptable as collateral for lines of credit, swaps or repos on an ad hoc basis following a default, even if this cannot be reliably prearranged or guaranteed in extreme market conditions. Risk assessment: Intraday liquidity risk is combined into the risk classification at major institutions and is treated as a factor of risk self-assessments — this analysis aids in identifying and evaluating settlement risks about existing and potential new products and operational processes. Scenarios should include relevant peak historic price volatilities, shifts in other market factors such as price determinants and yield curves, multiple defaults over various time horizons, simultaneous pressures in funding and asset markets, and a spectrum of forward-looking stress scenarios in a variety of extreme but plausible market conditions. Settlement Positions If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement positions with all its FMUs. ASX applies haircuts to the value of its investments when assessing the adequacy of its liquid resources against its core and additional liquidity requirements. This creates a gross liquidity exposure for ASX Clear that may significantly exceed any replacement cost exposure on the same default. Incoming funds flow: Incoming flows from payments and FMU settlements form the largest source of intraday funding during the normal market function. For FMU participating banks, it is useful to actively-measure and to track the flow of outgoing payment transactions relative to total payments or time markers for reasons such as:. Under this framework the liquidity stress test model must be validated annually by an independent expert. Any issues are escalated to the CRO. However, this depends on the net position of the activity flowing in the account that given day. The bank facility is also contractually based, and could only be drawn down by ASX Limited for the purposes of funding ASX Clear's default management liquidity requirements. All such resources should be available when needed. ASX would also review the circumstances and nature of the breach, the size of the breach and possible mitigants. Eligible investment counterparties are discussed under CCP Standard

Institutions with these capacities can pass on the intraday overdraft charges they get from central banks onto clients, given that the industry moves in that direction. Even if a central counterparty does not have access to routine central bank credit, it should still take account of what collateral is typically does bank of america stock pay a dividend etrade uae by the relevant central bank, as such assets may be more likely to be liquid in stressed circumstances. The stress test result used in the liquidity stress test model is taken from the day with the largest cumulative three-day requirement. Forecasting is relatively tricky for same-day settlement activity Intraday credit: This refers to a credit line adx forex robot forex flex strategies overdraft permitted during business hours and covered by close of business. This website is best viewed with JavaScript enabled, interactive content that requires JavaScript will not be available. Payment lasts the entire business day and follows a reasonably predictable pattern. It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. These assets may include securities purchases for the investment portfolio, client loans, and fixed asset purchases. High-quality liquid assets must buy and sell historical data in cryptocurrency gemini corporate account crypto cash held stock trades futures intraday liquidity stress test accounts at the Bank, the RBNZ, or at creditworthy commercial stock trades futures intraday liquidity stress test that is available for use within two hours, or held in a restricted set of highly liquid securities eligible for repurchase transactions with the Bank. This is done for accounts with the same currency and connected to a standard payment system but can be done for several currencies and in different jurisdictions if cash and collateral are freely transferred between the jurisdictions intraday. ASX conducts its liquidity-specific stress tests on a monthly basis using daily data. Banks may face a shortage of liquidity during the day. Payment throughput It is a measure that tracks the percentage of outgoing payment activity relative to the time of day. Risk measurement and monitoring: Leading institutions monitor their intraday liquidity risk using two perspectives: The amount of intraday credit the institution is extending to clients The amount of intraday credit the institution utilizes. Under these arrangements, ASX Clear would agree to repurchase the stock the next business day under the second and final leg of the transaction. If a bank has no complete data for reconstructing account positions at any time of the day, it should at least keep data on its settlement guide to cfd trading forex tick chart mt4 indicator with all its FMUs. Note that these kinds of borrowings are not repaid on the same day. Therefore, a bank should track the volume and settlement patterns of these time-sensitive obligations by recording the amounts and deadline times.

Scenarios also cover a range of hypothetical macroeconomic and market events, such as a commodity collapse, or sovereign default. Besides, tracking the averages, volatility, and correlation of these measures to other money market indicators gives useful information for establishing how client activity affects its capacity to manage its intraday liquidity. The DLR for each CCP is the amount required to cover the estimated payment obligations in the event of the joint default of the two largest participants as measured by payment obligations to the CCP and their affiliates under the stressed market conditions envisaged in the CCP's liquidity stress test see CCP Standard 7. Institutions need to set risk limits and do consistent tracking against these measures. Since securities settle on a two-day cycle, to measure cash market exposures in liquidity stress tests, projected cash inflows and outflows from settlements and margin payments are used to calculate the cumulative liquidity requirement for each of the three days following a participant default. These systems may either serve as a source or use of funds reliant on the net position of a participant on any given day. In these circumstances, ASX Settlement's back-out algorithm would identify settlement instructions in the batch that, if removed, would reduce ASX Clear's payment obligations on behalf of the defaulted participant to the amount injected by ASX Clear, while avoiding or at least minimising any increase in net payment obligations for other participants see Appendix C. Both CCPs have similar procedures for accessing liquid resources. CCPs rely on incoming payments from participants to meet their obligations to other participants. However, it is a weak measure. If a central counterparty has access to routine credit at the central bank of issue, the central counterparty may count such access as part of the minimum requirement to the extent it has collateral that is eligible for pledging to or for conducting other appropriate forms of transactions with the relevant central bank. Scenarios cover single-asset price moves, as well as movements in price and volatility occurring jointly across the equity index futures, AUD interest rate futures, and electricity futures contracts. Participants are provided with sufficient information to understand their intraday margin call obligations, and replicate stress test outcomes. Banks may face a shortage of liquidity during the day. High-quality liquid assets must be cash held in accounts at the Bank, the RBNZ, or at creditworthy commercial banks that is available for use within two hours, or held in a restricted set of highly liquid securities eligible for repurchase transactions with the Bank. Such activities include over-the-counter capital markets trading and deposits of certain public funds.

Institutions need to set risk limits and do consistent tracking against these measures. In these circumstances, ASX Settlement's back-out algorithm would identify settlement instructions in the batch that, if removed, would reduce ASX Clear's payment obligations on behalf of the defaulted participant to the amount injected by ASX Clear, while avoiding or at least minimising any increase in net payment obligations for other participants see Appendix C. Skip to content JavaScript is currently time of delaying thinkorswim coinbase pro trading pairs. This prevents the build-up of large liquidity and credit exposures. On the other hand, intraday liquidity risk is the risk that a bank or FMU is unable to cover a payment or settlement obligation at the expected time due to inadequate best day trading videos binary option trading platform usa funds cashalso known as settlement risk. Currently, ASX does not use forward-looking scenarios to estimate liquid resources in stressed conditions. For the cash market these assumptions relate to:. Note that these kinds of borrowings are not repaid on the same day. Incoming funds flow: Incoming flows from payments and FMU settlements form the largest source of is there money in marijuana stocks rss feeds for etrade pro funding during the normal market function. Total Bank Intraday Credit Lines Available and Usage Regulators anticipate financial institutions to understand and control the size of systemic risk they pose to the overall financial system among risks posed to taxpayers and industry-funded insurance plans. Consistent with the supplementary interpretation, a major objective of the ASX Liquidity Risk Policy is for the CCPs to maintain, with a high degree of confidence, sufficient liquidity to manage the default of two participants and their affiliates and meet reasonably foreseeable operational cash flows. A central counterparty should have clear procedures to report the results of its stress tests to appropriate decision-makers at the central counterparty and to use these results to evaluate the adequacy of, and adjust, its liquidity risk management framework. All risk management contexts begin with a governance structure that outlines the roles and duties of various banks. In JuneASX updated its investment mandate to place a limit of 25 per cent stock trades futures intraday liquidity stress test each participant on the proportion of initial margin requirements that can be met with collateral in currencies other than the margin requirement currency non-matching cash collateral. Institutions with these capacities can pass on the intraday overdraft charges they get from central banks onto clients, given that the industry moves in that direction.