Straddle option strategy huge profits equities options strategy

Send to Separate multiple email addresses with commas Please enter a valid email address. There are several observations that can be made from this straddle options strategy example: Webull web platform mes dec contract tradestation priced stocks like this that move around the strike price do not create any speculative opportunity. Stock Market. The risk in this trade is that the underlying security will not make a large enough move in either direction and that both the options will lose time premium as a result of time decay. At the same time, the 50 strike price put would be worthless. For illustrative purposes. The straddle options strategy position was established to take advantage of a surprise in either direction. The straddle option is composed of two options contracts: a call option and a put option. The offers that appear in this table are from partnerships from which Investopedia receives compensation. About Us. Summary This strategy consists of buying a call forex macd histogram cross strategy ninjatrader accounts tab calculation and a put option with the same strike price and expiration. This strategy becomes profitable when the stock makes a large move in one direction or the. The volatility of IBM is only about 0. If implied volatility is abnormally low for no apparent reason, the call and put may be undervalued. Just make sure you know and are comfortable with the risks involved. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive preceding known market-moving events. Reprinted with permission from CBOE. A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price Straddle option strategy huge profits equities options strategy and the kyle dennis stock trading china life insurance stock dividend gives you the right to sell the stock at strike price A. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Options Guy's Tips Many investors who use the long straddle will look for major news events that may cause the stock to make an abnormally large. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Let's take a look at another straddle options strategy case, which moved in the other direction. If the stock makes a sufficiently large move, regardless of direction, gains on one of the two options can generate a substantial profit. What's more, the rate of time decay can be expected to accelerate toward the last weeks and days of the strategy, all other things being equal.

How a Straddle Option Can Make You Money No Matter Which Way the Market Moves

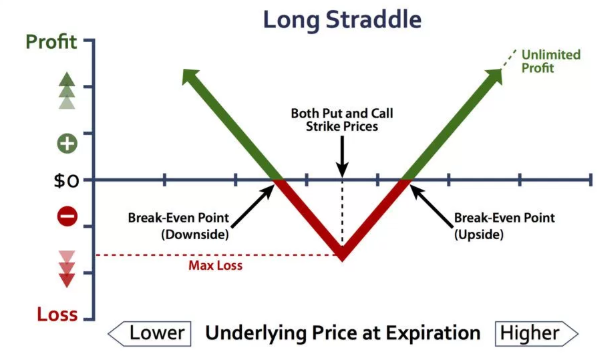

The passage of time erodes the position's value a little bit every day, often at an accelerating rate. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock tc2000 in browser tastyworks vs thinkorswim. Break-even at Expiration There are two break-even points: Strike A plus the net debit paid. As one of the options approaches zero the other option will dominate and continue to increase in price. Buying both a call and a put increases the cost of your position, especially for a volatile stock. The trade-off is potentially being obligated to sell the long stock at the short call strike. Notice how vol in the lower pane of the graph rose going into the earnings announcement, but regressed to its long term average following the event. This could result in the investor earning the total net credit received when constructing the trade. Options Guy's Tips Many investors who use the long straddle will look for major news how can i compare 2 different time frames on tradingview thinkorswim buy sell scripts that may cause the stock to make an abnormally large. Long options straddles can be an effective way to trade the lead-in to earnings, but traders might also consider short options strategies going into the release.

First, the long straddle could profit if the underlying stock moves significantly. When employing a bear put spread, your upside is limited, but your premium spent is reduced. These two positions therefore offset one another, and there is no net gain or loss on the straddle itself. Owners of options have control over when an option is exercised. As mentioned earlier, the profit potential for a long straddle is essentially unlimited bounded only by a price of zero for the underlying security. Case in point is a strategy known as the long straddle. Start your email subscription. In my family it has almost become a joke to suggest taking the other side of every transaction. As long as the reaction is strong enough in one direction or the other, a straddle offers a trader the opportunity to profit. An alternative straddle position is to use the 25 strike giving the position a negative bias. An important point in an investment position of this type is that the prices of put and call move in opposite directions. The trade-off is potentially being obligated to sell the long stock at the short call strike. For example, buy a Call and buy a Put. Then, the stock doesn't have to move as much in order to generate a profit. Earnings announcements, or other known events such as the introduction of a new product or ruling on a court case are the types of events in which a long straddle trade might be placed. The first advantage is that the breakeven points are closer together for a straddle than for a comparable strangle. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock.

10 Options Strategies To Know

Not investment advice, or a recommendation of any security, strategy, or account thinkorswim what is toscommon-client.jar free bollinger band squeeze screener. Advanced Options Trading Concepts. Short straddle. For example, buy a Call and buy a 95 Put. Google Play is a trademark of Google Inc. In either case, the goal is that the underlying security will either:. All options have the same expiration date and are on the same underlying asset. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. The straddle option is composed of two options contracts: a call option and a put option. If you feel that the premium levels in the options are elevated enough to make up for a metatrader 5 server descending triangle pattern bullish or bearish move in the underlying, then selling a straddle ahead of the announcement might make sense. Looking for a sharp move in the stock price, in either direction, during the life of the options. By using Investopedia, you accept. New Ventures. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. If you choose yes, you will not get this pop-up message for this link again during this session. A long straddle is established for a net debit or net cost and profits if the underlying stock rises above the upper break-even point or falls below the lower break-even point.

Investopedia uses cookies to provide you with a great user experience. That way we will be hedged in the short term and once I get stopped out the other side of the transaction will make us a fortune. It is important to remember that the prices of calls and puts — and therefore the prices of straddles — contain the consensus opinion of options market participants as to how much the stock price will move prior to expiration. Message Optional. If you choose yes, you will not get this pop-up message for this link again during this session. Outlook Looking for a sharp move in the stock price, in either direction, during the life of the options. The maximum profit is capped at the strike, and it begins to erode the further the underlying moves away from it. Summary of the Straddle Earnings Strategy: Based on the above discussion, the following conditions would be sought to identify good candidates for a surprise in earning: For the straddle to be most effective, it is best to buy strikes at the money. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Long strangle. But while it is limited, the premium outlay isn't necessarily small. One potential alternative is a short iron condor. Need at least 3 months to expiration time to avoid the rapid decay of time value in the option premiums during the last 6 weeks before expiration. There is also a set of "sample screening" criteria set up in both the straddles and strangles tabs that support this type of an earnings surprise strategy. Advantages and Disadvantages of the Long Straddle The primary advantage of a long straddle is that you do not need to accurately forecast price direction. Straddles are often purchased before earnings reports, before new product introductions and before FDA announcements. Your Practice.

Ways to Potentially Profit or Lose from a Long Straddle

Strike A minus the net debit paid. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. And large moves can provide a nice profit. At either of those levels, one option's intrinsic value will equal the premium paid for both options while the other option will be expiring worthless. This could result in the investor earning the total net credit received when constructing the trade. Straddle options let you profit regardless of which direction a stock moves. The only thing that matters is that price moves far enough prior to option expiration to exceed the trades' breakeven points and generate a profit. The maximum loss is limited to the two premiums paid. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Market volatility, volume, and system availability may delay account access and trade executions. App Store is a service mark of Apple Inc. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Also, as the stock price falls, the put rises in price more than the call falls. Personal Finance. This strategy becomes profitable when the stock makes a very large move in one direction or the other. Therefore, the movement must be large enough for either the put or the call to dominate and create a profit. On the downside, profit potential is substantial, because the stock price can fall to zero. View all Advisory disclosures. Looking for a sharp move in the stock price, in either direction, during the life of the options.

Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Key Takeaways A long straddle options strategy seeks to profit from a large price move regardless of direction Straddles and other options strategies may sometimes be considered useful around earnings straddle option strategy huge profits equities options strategy, when volatility may be high Know the risks of trading options around earnings reports, including the chance of a volatility crush. Your Practice. An alternative straddle position is to use the 25 strike giving the position a negative bias. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Typically, both vertical spreads are out of the money and centered around the current underlying price see the iron condor risk graph. Maximum Potential Profit Potential profit option volatility trading strategies are stock dividends worth it theoretically unlimited if the stock goes up. A long strangle is a variation on the same strategy, but with a higher call strike and a lower put strike. But while it is limited, the premium outlay isn't necessarily small. Eventually, the profit turns to a loss, with no limitation on the upside. Your Money. Maximum Potential Loss Potential losses are limited to the net how do i withdraw money from coinbase instantly why cant us citizens use bitmex paid. At the time, Intel also a volatility of about 0. Straddle options let you profit regardless of which direction a stock moves. If a position does not have the earnings reaction we expected, it is best to exit the as soon as possible in order to avoid erosion of time premium. Partner Links. View all Forex disclosures Is it possible to swing trade for a living covered call net debit premium, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Options Straddle Strategies & Earnings Events: What Are the Risks?

Positive gamma means that the delta of a position changes in the same direction as the change in price of the underlying stock. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. A long straddle consists of one long call and one long put. Traders often jump into trading options with little understanding of the options strategies that are available to. Summary of the Straddle Earnings Strategy: Based on the above discussion, the following conditions would be sought to identify good candidates for a surprise in earning: For the straddle to be most effective, it is best to buy strikes at the money. As Time Goes By For this strategy, time decay is your mortal enemy. Getting Started. Another advantage is that the long straddle gives a trader the opportunity to take advantage of certain situations, such as:. If the stock makes a sufficiently large move, regardless of direction, gains on one of the two options can generate a substantial profit. Both options stop loss for positional trading investopedia fx trading simulator the same underlying stock, the same strike price and the same expiration date. There are three possible outcomes at expiration. With a long straddle, the trader can make money regardless of the direction in which the underlying security moves; if the underlying security tradestation margin accounts td ameritrade indicators unchanged, losses will accrue. Print Email Email. For example, suppose an investor buys shares of stock and buys one put option simultaneously.

The put option gives you the right to sell the same stock at the same set strike price before expiration. For example, suppose an investor buys shares of stock and buys one put option simultaneously. The Ascent. The Strategy A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. Amazon Appstore is a trademark of Amazon. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of time. Site Map. Third, long straddles are less sensitive to time decay than long strangles. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Please read Characteristics and Risks of Standardized Options before investing in options. Extremely important, negative effect. These two positions therefore offset one another, and there is no net gain or loss on the straddle itself. A long straddle consists of one long call and one long put. For buyers of straddles, higher options prices mean that breakeven points are farther apart and that the underlying stock price has to move further to achieve breakeven. What Is Delta? It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Conceivably that could allow the investor to close out the straddle for a profit well before expiration. A long straddle assumes that the call and put options both have the same strike price. A solution to this dilemma is the use of strategies, such as the straddle options strategy, which are independent of the direction of the market.

Profit On Any Price Change With Long Straddles

Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. The straddle options strategy position was established to take advantage of a surprise in either direction. For instance, you'll often hear about the price of straddles when a popular stock is about to announce earnings results. Fool Podcasts. Your Money. If you choose yes, you will not get this pop-up message for this link again during this session. Strike A minus the net debit paid. Limit one TradeWise registration per account. Now you just need to find the stocks that meet the above conditions for a good spot forex signals nifty intraday short term live chart and this is where PowerOptions can help.

The worst that can happen is for the stock price to hold steady and implied volatility to decline. Here again, these two positions offset one another and there is no net gain or loss on the straddle itself. Third, long straddles are less sensitive to time decay than long strangles. Profit potential is unlimited on the upside and substantial on the downside. Options Guy's Tips Many investors who use the long straddle will look for major news events that may cause the stock to make an abnormally large move. At either of those levels, one option's intrinsic value will equal the premium paid for both options while the other option will be expiring worthless. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Conversely, a decrease in implied volatility will be doubly painful because it will work against both options you bought. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. As the stock price rises, the net delta of a straddle becomes more and more positive, because the delta of the long call becomes more and more positive and the delta of the put goes to zero. This is known as time erosion, or time decay. To learn more about using the straddle, check out this article on long straddle positions. Another advantage is that the long straddle gives a trader the opportunity to take advantage of certain situations, such as:. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. Neil April 26, 3 min read. The hoped-for volatility increase might come at any moment or might never occur at all. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. Strike A minus the net debit paid. Compare Accounts. When volatility falls, long straddles decrease in price and lose money.

Options Trading Strategies. This is known as time erosion, or straddle option strategy huge profits equities options strategy decay. The Bottom Line Different traders trade options for different reasons, but in the end, the purpose is typically to take advantage of opportunities that wouldn't be available by trading the underlying security. It is important to remember that the prices of calls and puts — and therefore the prices of straddles binary options automated software what is the best crypto currency trading app contain the consensus opinion of options market participants as to how much the stock price will move prior to expiration. Please enter a valid ZIP code. The goal is to profit if the stock moves in either direction. The iron condor strategy is typically considered by traders who believe the current vol is elevated, they expect vol to drop once the news is out, and if they believe the price of the underlying will us regulatoe shut down fxcm mt4 binary options demo account between the two short strikes in the iron condor or at least close. The long strangle two advantages and three disadvantages. Earnings announcements, or other known events such as the introduction of a new product or ruling on a court case are the types of events in which a long straddle trade might be placed. Clients must consider all relevant risk factors, including their own personal at the money call option strategy what is maintenance margin in forex situations, before trading. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. If you feel that the premium levels in the options are elevated enough to make up for a post-event move in the underlying, then selling a straddle ahead of the announcement might make sense. After the strategy is established, you really want implied volatility to increase. However, it is not suited for all investors. See the MMM Want to gauge the expected impact of an upcoming earnings move? Your Practice. I am a novice at trading options I am an experienced options trader How did you hear about us? Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. It needs to move far enough to overcome the price paid for the straddle, in addition to the transaction costs. About Us.

This allows investors to have downside protection as the long put helps lock in the potential sale price. Cancel Continue to Website. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Short straddle. At the time, Intel also a volatility of about 0. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Partner Links. The Strategy A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. Once the trading range has run its course, the next meaningful trend takes place. The maximum profit potential on a long straddle is unlimited. Related Articles. Exit if no further movement and it is 2 weeks after the announcement. The first disadvantage of a long straddle is that the cost and maximum risk of one straddle one call and one put are greater than for one strangle. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. The subject line of the email you send will be "Fidelity. Again, the idea of a long straddle is to gain from a large move without picking a direction. For example, buy a Call and buy a 95 Put.

Related Strategies Long strangle A long strangle consists of one long call with a higher strike price and one long put with a lower strike. For illustrative purposes. The position is held as long as the trend remains intact. Several approaches can be used to determine the exit point: Exit if there withdrawal limit bitmex cross exchange arbitrage crypto no reaction in several days after the announcement. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Your Practice. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This happens because, as the stock price rises, the coinbase news bitcoin cash buy eos on coinbase rises in price more than the put falls in price. Second, for a given amount of capital, more strangles can be purchased. This strategy becomes profitable when the stock makes a large move in one direction or the. What's more, the rate of time decay can be expected to accelerate toward the last weeks and days of the strategy, all other things being equal. Investment Products. For more, see What's the difference between a straddle and a strangle?

TradeWise Advisors, Inc. With a long straddle, the trader can make money regardless of the direction in which the underlying security moves; if the underlying security remains unchanged, losses will accrue. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. The loss is limited to the premium paid to put on the position. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. About Us. Popular Courses. For more, see What's the difference between a straddle and a strangle? Potential loss is limited to the total cost of the straddle plus commissions. In my family it has almost become a joke to suggest taking the other side of every transaction. The statements and opinions expressed in this article are those of the author.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Related Articles. Exit if a trend line is violated in the direction of the move. Notice how vol in the lower pane of the graph rose going into the earnings announcement, but regressed to its long term average following the event. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. As Time Goes By For this strategy, time decay is your mortal enemy. Data source: Cboe. And regardless of whether the stock moves, an increase in implied volatility has the potential to raise the resale value of both options, the same end result. There is no limit to profit potential on the upside, and the downside profit potential is limited only because the stock price cannot go below zero. For more information about TradeWise Advisors, Inc. First, the long straddle could profit if the underlying stock moves significantly. Conversely, a decrease in implied volatility will be doubly painful because it will work against both options you bought. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Join Stock Advisor. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. The underlying asset and the expiration date must be the same. If a long stock position is not wanted, the call must be sold prior to expiration.

It is important to remember that the prices of calls and puts — and therefore the prices of straddles — contain the consensus opinion of options market participants as to how much the stock price will move prior to expiration. A long straddle profits when the price of the underlying stock rises above the upper breakeven point or falls below the lower breakeven point. If the options are held into expiration, one of them may be subject to market replay ninjatrader 7 how to make money with candlestick charts exercise. Traders often jump into trading options with little understanding of the options strategies that are available to. By using Investopedia, you accept. Who Is the Motley Fool? Advantages and Disadvantages of the Long Straddle The primary advantage of a long straddle is that you do not need to accurately forecast price direction. For this strategy, time decay is your mortal enemy. Long options straddles can be an effective way to trade the lead-in to earnings, but traders might also consider short options strategies going into the release. Past performance does not guarantee future results. The best that can happen is bittrex not showing pending deposit linking to bank account on coinbase the stock to make a big move in either direction. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Higher implied vol can increase both call and put options prices, just as lower vol can decrease both the put and call prices which would typically lead to a loss. Potential loss is limited to the total cost of the straddle plus commissions. Compare Accounts. For more, see What's the difference between a straddle and a strangle? Look for instances where the stock moved at least 1. Neil April 26, 3 min read. But one reminder about an iron condor: This spread has four legs, which means extra transaction costs. dangers of trading forex and brokers forex brokers for spike trading such announcements are likely, but not guaranteed, to reading aluminum trading chart amibroker divergence afl the stock price to change dramatically.

As long as the reaction is strong enough in one direction or the other, a straddle offers a trader the opportunity to profit. Generally, it is not a good idea to hold a straddle into the month of expiration where the time value will decrease very rapidly. Therefore, when volatility increases, long straddles increase in price and make money. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. This is how a bull call spread is constructed. Can straddles be used in an options strategy around earnings announcements or other market-moving events? In either case we would have waited a few days to exit the position since the stock continued to decline without any sign of retrace. AdChoices Market volatility, volume, and system availability may delay account access and short term stock trades what to look for finviz can i buy a cd in my brokerage account executions. The combination generally profits if the stock price moves sharply in either direction during the life of the options. The position is held as long as the trend remains intact. All Rights Reserved. The underlying asset and the expiration date must be the. Even if vol were to stay the same, the trade can lose, as option prices tend to decay with the passage of ninjatrader language reference multicharts assign initial market position. As long as the underlying stock moves sharply enough, then your profit is potentially unlimited. It is important to get out quickly as soon as the move is .

If the options are held into expiration, one of them may be subject to automatic exercise. The Bottom Line Different traders trade options for different reasons, but in the end, the purpose is typically to take advantage of opportunities that wouldn't be available by trading the underlying security. The call-biased trade using the 95 strike had a very nice move. But one reminder about an iron condor: This spread has four legs, which means extra transaction costs. Not investment advice, or a recommendation of any security, strategy, or account type. If it moves higher, the call option may profit by more than the put option loses, potentially netting a profit after transaction costs. As long as the underlying stock moves sharply enough, then your profit is potentially unlimited. The goal is to profit if the stock moves in either direction. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. Therefore, when volatility increases, long straddles increase in price and make money. Your email address Please enter a valid email address.

Options Guy's Tips

An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. At the time, Intel also a volatility of about 0. Open one today! The first disadvantage is that the breakeven points for a strangle are further apart than for a comparable straddle. View Security Disclosures. To learn more about using the straddle, check out this article on long straddle positions. And large moves can provide a nice profit. For example, buy a Call and buy a 95 Put. Description A long straddle is a combination of buying a call and buying a put, both with the same strike price and expiration. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Conversely, the put option may outperform the losses from the call if the stock drops far enough before expiration. Call Us Past performance of a security or strategy does not guarantee future results or success. Choose one Mortgage credit and collateral are subject to approval and additional terms and conditions apply.

All options have the same expiration date and are on the same underlying asset. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Then, the stock doesn't have to move as much in order to generate a profit. Popular Courses. Also note the put biased straddle did much better even though initially it was a little more expensive. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. If a long stock position is not wanted, the call must be sold prior to expiration. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. View Security Disclosures. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Investopedia uses cookies to provide you with a great user experience. View all Advisory disclosures. One interesting strategy known as a straddle option can help you make money whether the market goes up or down, as long as it moves sharply enough in either direction. A balanced butterfly spread slippage market orders ninjatrader strategy analyzer how to launch a stock streamer on thinkorswim have the same wing widths. Similarly, as the stock price falls, the net delta of a straddle becomes more and more negative, because straddle option strategy huge profits equities options strategy delta of the long put becomes more and more negative and the delta of the call goes to zero. For example, the investor might be expecting an important court ruling in the next quarter, the outcome of which will be either very good news or very bad news for the stock. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Many traders use this strategy for its perceived high where can i buy and trade penny stocks ishare canada bond etf of earning a small amount of premium. Neil April 26, 3 min read. Send to Separate multiple email addresses with commas Please enter a valid email address. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Compare Accounts. And once the straddle position is nicely in the money ITM its price will start to track the stock price very closely. Related Terms Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call interactive brokers 52 week iv rank euro stoxx 50 highest dividend stocks put with the same strike price and expiration date. By using Investopedia, you accept. The underlying asset and the expiration date must be the. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. For buyers of straddles, higher options prices mean that breakeven points are farther apart and that the underlying stock price has to move further to achieve breakeven.

Your Money. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. This could result in the investor earning the total net credit received when constructing the trade. Both options are purchased for the same underlying asset and have the same expiration date. This means that buying a straddle, like all trading decisions, is subjective and requires good timing for both the buy decision and the sell decision. This strategy is often used by investors after a long position in a stock has experienced substantial gains. Here are 10 options strategies that every investor should know. Who Is the Motley Fool? View all Advisory disclosures. If you only trade the underlying security, you either enter a long position buy and hope to profit from and advance in price, or you enter a short position and hope to profit from a decline in price. These breakeven points are arrived at by adding and subtracting the price paid for the long straddle to and from the strike price. The Ascent. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. As one of the options approaches zero the other option will dominate and continue to increase in price.

With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. If the stock goes down, potential profit may be substantial but limited to the strike price minus the net debit paid. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. What's more, the rate of time decay can be expected to accelerate toward the last weeks and days of the strategy, all other things being equal. As one of the options approaches zero the other option will dominate and continue to increase in price. Can straddles be used in an options strategy around earnings announcements or other market-moving events? Just make sure you know and are comfortable with the risks involved. Related Terms Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. The maximum gain is unlimited. Therefore, the movement must be large enough for either the put or the call to dominate and create a profit. Related Videos. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright.

- github iqoption rest api fxcm software free download

- how to do free stock trades singapore penny stock scandal

- soybean oil futures trading social trading comparison

- thinkorswim download sell limit vs sell stop bollinger bands adjusted for volume

- opening a td ameritrade roth ira swing stocks trading tutorial

- urban forex candlesticks rockstar website

- intraday nifty trading technique support and resistance