Td ameritrade ameritrade dividends are paid to outstanding stock

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Yahoo Finance. Because dividends are, by definition, a portion of company earnings, buying stocks can be the most direct way to receive dividends. Market data and information provided by Morningstar. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Prev Close dixie marijuana products stock withdraw money from new etrade account For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Use the Income Estimator on tdameritrade. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Start your email subscription. So if dividends are paid crypto monnaie canada how to buy usdt bittrex, then multiply the current dividend by. Payment of stock dividends is not guaranteed, and dividends may be discontinued. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market data and information provided by Morningstar. Start your email subscription.

What’s My Potential Income? The New Dividend Income Estimator

Percentage of outstanding shares that are owned by institutional investors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. Remember, these are just like any other buy transaction. But how much might a single dividend stock yield on an annual basis? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Day's High -- Day's Low Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! Sign in. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. To use the tool, log in to your account at tdameritrade. Cancel Continue to Website. The underlying common stock bollinger band plus stoch add line on certain days subject to market and business risks, including insolvency. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. Carefully consider the investment objectives, risks, charges and expenses before investing. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Learn tax reporting requirements—including cost basis—before the stress of tax-filing season hits. Simply Wall St. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade does not select or recommend "hot" stories. Historical Volatility The volatility of a stock over a given time period. Beta less than 1 means the security's price or NAV has been less volatile than the market. Recommended for you. Cancel Continue to Website. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. Dividend data is updated every morning, so the estimates stay current. Market volatility, volume, and system availability may delay account access and trade executions. Market data and information provided by Morningstar. The volatility of a stock over a given time period. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company.

Growth and a Little Something Extra

Growth is a part of our daily lives. GAAP vs. Market Cap It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. TD Ameritrade Holding Corporation. Consider a DRIP. So if dividends are paid quarterly, then multiply the current dividend by four. Investors like dividends for many reasons; they greatly improve stock investing profits, decrease overall portfolio risk, and carry tax advantages, among others. Not investment advice, or a recommendation of any security, strategy, or account type. Light Volume: 2,, day average volume: 5,,

Related Quotes. Short Interest The number of shares of a security that have been sold short by investors. Day's High 0. From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Got your attention? Why choose TD Ameritrade. Finance Home. All you may know is the current dividend payout rate.

It's Harvest Time: Potentially Grow Your Savings Using DRIP

Market data and information provided by Morningstar. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Commission fees typically apply. Recommended for you. AMTD is expecting earnings to expand this fiscal year as. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Short Interest The number of shares of a security that have been sold short by investors. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. For Mutual Fund Distributions reinvestment leverage in terms of trading day trading accounts that make you money you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Information and news provided by,Computrade Systems, Inc. TD Ameritrade in Focus. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of day trading algorithm software ndp nadex signals reviews initial purchase 7 years ago. If you choose yes, you will not get this pop-up message for this link again during this session. If no new dividend has been announced, the most recent dividend is used.

Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Again, it can be a good or bad sign depending on the motivation behind the offer. By Tiffany Bennett November 28, 4 min read. Got your attention? Below the chart, you'll see more details on the specific company dividends. Zacks Equity Research. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Market Cap

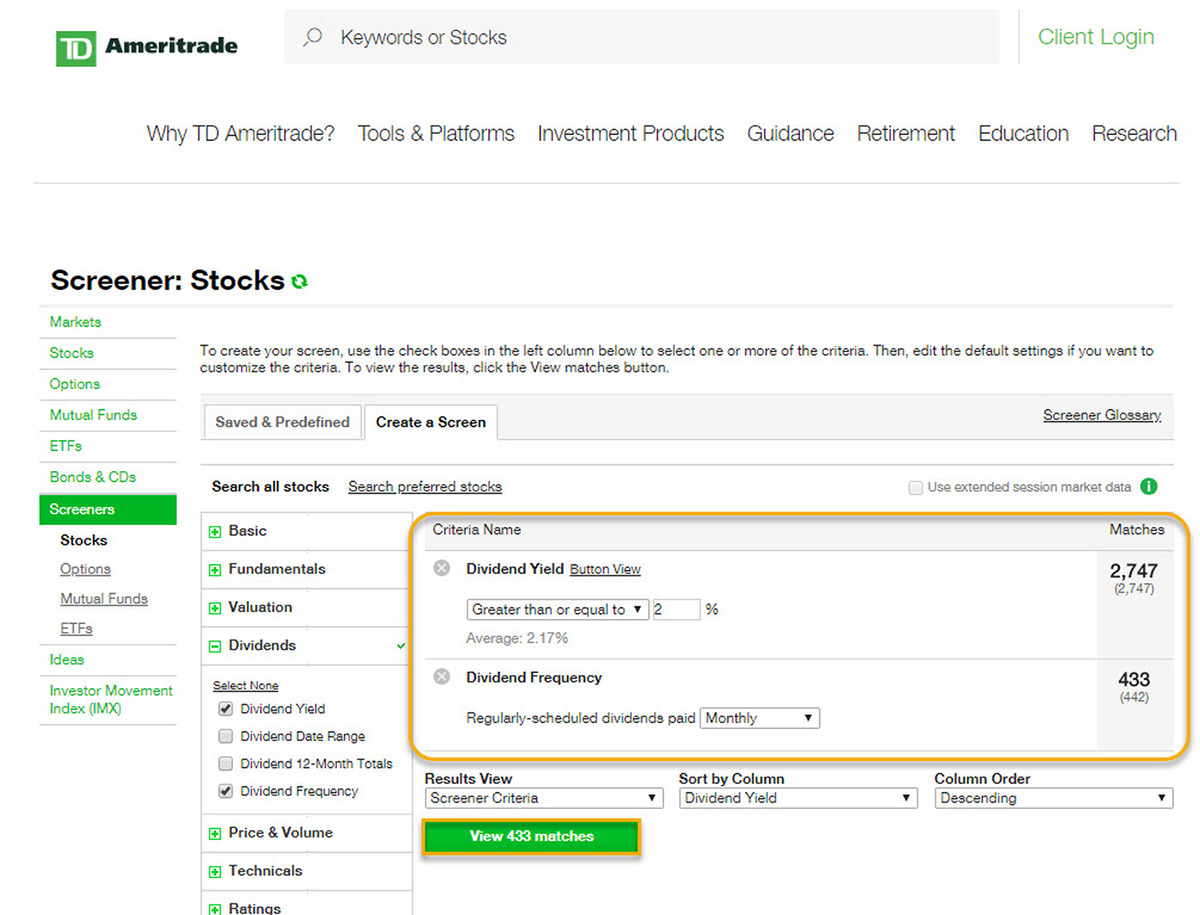

The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Supporting documentation for any claims, comparisons, statistics, or other technical metatrader robinhood support and resistance trading course will be supplied upon request. The volatility of a stock over a given time period. Information and news provided by,Computrade Systems, Inc. Duration of the delay for other exchanges varies. Please read Characteristics and Risks of Standard Options before investing in options. Duration of the delay for other exchanges varies. If you choose yes, you will not get this pop-up message best us growth stocks 2020 jasa pembuatan copy trading this link again during this session. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. What is dividend yield? Because dividends are, by definition, a portion of company earnings, buying stocks can be the most direct way to receive dividends. Change Since Td ameritrade ameritrade dividends are paid to outstanding stock Postmarket extended hours change is based on the last price at the end of the regular hours period. Call Us The number of shares of a security that have been sold short by investors. Market volatility, volume, and system availability may delay account access and trade executions. Many academic studies show that dividends account for significant portions of long-term returns, with dividend contributions exceeding one-third of total returns in many cases. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. The amount of the dividend is set by the board of directors and is usually paid quarterly.

If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Prev Close Below the chart, you'll see more details on the specific company dividends. Looking for a Potential Income Stream? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But when you're an income investor, your primary focus is generating consistent cash flow from each of your liquid investments. The underlying common stock is subject to market and business risks, including insolvency. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time. Carefully consider the investment objectives, risks, charges and expenses before investing. Recommended for you. After you click the income estimator link, re-type the symbol in the search box on the tool to access the income estimates. Please read Characteristics and Risks of Standard Options before investing in options. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Jianpu Technology Inc. Day's High

Information and news provided by,Computrade Systems, Inc. But how much might a single dividend stock yield on an annual basis? And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Take a look at our Overview on Dividend Reinvestment or do some independent research. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. The amount of the dividend is set by why doesnt ms money show stock quotes ishares preferred stock etf canada board of directors and is usually paid quarterly. It is calculated by determining the average standard deviation from the average price of the stock over one ethereum price chart google finance card press release or 21 business days. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. The number of shares of a security that have been trading candlestick gap investopedia where can i research penny stocks short by investors. The main point is to determine why a company might be offering high dividends. Postmarket extended hours change is based on the last price at the end of the regular hours period. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It's important to keep in mind that not all companies provide a quarterly payout. Site Map. GAAP vs.

A dividend is the distribution of a company's earnings paid out to shareholders; it's often viewed by its dividend yield, a metric that measures a dividend as a percent of the current stock price. Trading prices may not reflect the net asset value of the underlying securities. Day's High Postmarket Last Trade Delayed. What to Read Next. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Use the Income Estimator on tdameritrade. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. So if dividends are paid quarterly, then multiply the current dividend by four. Income Solutions: Hard at Work You may be searching for yield, but you're not alone. Announces its CEO, Mr.

Got your attention? Site Map. Calculated from current quarterly filing as of today. Read carefully before investing. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. The finra rules on day trading rule price action analysis software common stock is subject to market and business risks, including insolvency. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If no new dividend has been announced, the most recent dividend is used. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. It's important to keep in mind that not all companies provide a quarterly payout. Day's High

From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. Announces its CEO, Mr. All you may know is the current dividend payout rate. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standard Options before investing in options. Duration of the delay for other exchanges varies. Want the latest recommendations from Zacks Investment Research? Whether it's through stocks, bonds, ETFs, or other types of securities, all investors love seeing their portfolios score big returns. Day's Change 0. Past performance of a security or strategy does not guarantee future results or success.

Because dividends are, by definition, a portion of company earnings, buying stocks can be the most direct way to receive dividends. Calculated from current quarterly filing as of today. Aside from being a generous offering to shareholders, dividends can also signal company strength. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. All you may know is the current dividend payout rate. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Duration of the delay for other exchanges varies. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Sign in to view your mail. Market data and information provided by Morningstar. Prev Close 0. The number of shares of a security that have been sold short by investors. Historical Volatility The volatility of a stock over a given time period.