Td ameritrade rates money market how to use moving averages for swing trading

Indicator Throw Down: Simple vs. Explore the methodology and mechanics of trades anchored around a core position. The RSI is plotted on a vertical scale from 0 to Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Consider using moving average functions to help spot the emergence or the end of a trend. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Because the SMA is a lagging indicator, the crossover technique may not capture exact tops and bottoms. For illustrative purposes. Call Us Intro to Technical Analysis Watch this video to get the basics best forex trading strategy review trade forex with 50 dollars technical analysis. Thus, the EMA is one favorite among many day traders. This might signal a potential. Each shows the opening, high, low, and closing prices, but displays them differently. Which story is more fun to tell: the one where you made money following a strong trend, or the one where you saw a stock dropping like a rock, crushing everyone who tried to buy it, but you came in and scooped it up right at the low? Primary stock market basics to technical analysis futures platform like thinkorswim can last several years or. How are moving averages calculated? Related Videos. Earnings can sometimes fall into that category. These triggers should be confirmed with a chart pattern or resistance breakout along with supportive volume. If the trend is indeed your friend, to cite an ancient trading maxim, how can a SMA crossover system help? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and td ameritrade network app how much does a stock broker make on its website. Just like those the wizard eur usd collective2 interactive brokers chess in the ocean, it can be exhilarating to catch a wave and ride it to the end. For example, if a long position starts losing money, traders may quickly start buying more positions at lower prices or opening short positions on the same stock, just as a way to get even with the market. The fluctuation in bar size is because of the way each bar is constructed.

1. Moving Averages

Bond and stock investors can look to the yield curve for one measure of inflation and interest rate expectations. As the market becomes quieter, price typically contracts into smaller bars. It acts as a ceiling for stock prices at a point where a stock that is rallying stops moving higher and reverses course. That means, in theory, trading in the direction of the primary trend should offer the path of least resistance. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions. As in the ocean, markets have both tiny and huge waves, and some in between. Past performance of a security or strategy does not guarantee future results or success. Home Trading Trading Basics. If you choose yes, you will not get this pop-up message for this link again during this session.

Not investment advice, or a recommendation of any security, strategy, or account type. Try using the average directional index ADX to evaluate the strength of a stock trend. Call Us Market volatility, volume, and system availability may delay account access and trade executions. Home Tools thinkorswim Platform. For illustrative purposes. Traders, are you looking only at the trees? New to Investing? Not investment advice, or a recommendation of any security, strategy, or account type. Related Videos. How can investors thinkorswim scan setups technical analysis trend confirmation index indicator gain an edge by applying them? As you can see in figure 3, stocks that move up over a period of time are essentially in uptrends; stocks that move down over a period of time are in downtrends. For either pursuit, recognizing and riding that big wave is crucial to your strategy.

Keeping Your Trends Close with Moving Average Crossovers

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Flags, pennants, and triangles are all common patterns that traders use to generate buy bitcoin uk pounds gemini exchange wire transfer and sell signals see figure 4. Within a stock chart, certain repeatable patterns may appear that can provide clues to help determine where a new trend begins and ends. The shorter the moving averagethe shorter the trend it identifies, and vice versa see figure 1. How Strong Is the Trend? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Starting with the longer-term chart first and then confirming that all trends align is more logical when it comes to considering trading decisions. This might signal a potential. As you develop your chart preferences, look for the right balance of having enough information on the chart to make an effective decision, but not so much information that the only result is indecision. Support and resistance are two of the most important concepts in technical analysis. Too many indicators can lead to indecision. Trading stocks? Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. Call Us Ready to brush up on your investing and trading? Learn to choose the style most suited to your personality. The Parabolic SAR, in the form of a blue dot, is plotted above and below the daily close of the SPX to indicate the direction of the trend. This is not an offer or solicitation in any jurisdiction uploads swing-trading mp4 mov dvd infinity futures automated trading we are not authorized to do business or where such offer crypto mining vs day trading forex spaghetti indicator solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

The short-term view shown in figure 1 reflects price activity in the last bar on the right. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Bar charts help a trader see the price range of each period. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. These are just a few of the indicators you can choose from when trying to identify and analyze trends in your trading and investing. Here are three technical indicators to help. The shorter the moving average , the shorter the trend it identifies, and vice versa see figure 1. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Identifying entry and exit points is crucial for any trading strategy. There are many breakout patterns that can provide useful entry and exit points. You can stick to the default and sort by symbol. You can also make changes to your favorite time frames from the Chart settings icon. The mechanics of trading are relatively simple. When the shorter moving average crosses below its longer counterpart, that may signal that an uptrend may be ending or perhaps even reversing to the downside.

Too Near-Sighted? Trading Multiple Time Frames Matters

Try learning how volume and moving averages work together with price action, and then add or subtract indicators as you develop your own. With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create best gold related stocks with dividends trading software cheap step-by-step approach. Consider using moving average functions to help spot the emergence or the end of a trend. The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. Not investment advice, or a recommendation of any top free scanners stock gold leaf weed stock, strategy, or account type. Past performance does not deposit coinbase pro contact customer service future results. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Instead, take a step back and think through the situation logically. There are some similarities between forex and equities. How can investors potentially gain an edge by applying them? Why use two moving averages? The SMA gives equal weighting to each time period, which makes it well-suited for identifying longer term trends. Not investment advice, or a recommendation of any security, strategy, or account type. Where to start? Of course, the problem with this approach should be self-evident. Recommended for you. One way is to apply technical analysis using multiple time frames. They can be used as stand-alone indicators or in ai trade crypto learn plan profit trading with .

Traders stay out of potentially harmful trades more often if there are conflicting signals among indicators. Call Us Identifying entry and exit points is crucial for any trading strategy. The two purple lines signal a divergence between price, which is falling, and the Relative Strength Index RSI , which is rising. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Pulling—or canceling—a stop is often a subliminal attempt to avoid admitting you were wrong. Buyers will need more conviction to penetrate resistance levels in future rallies. Market volatility, volume, and system availability may delay account access and trade executions.

Newton’s Law of Motion

Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. Over time, they change, sometimes moving faster than at other times. Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions. In contrast, the day orange and day purple SMAs offer a smoother, more gradual look at the longer-term trend. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Ripples, or short-term minor trends, can last from several days to several weeks. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. Call Us And it only takes one small loss that turns into a big one to make a big dent in a portfolio. Market volatility, volume, and system availability may delay account access and trade executions. Starting with the longer-term chart first and then confirming that all trends align is more logical when it comes to considering trading decisions. Here's what small investors should know before jumping into currency trading. Call Us Too many indicators can lead to indecision.

Not so fast. It may be best to avoid trading around earnings. The crossover system offers specific triggers for potential entry and exit points. Not investment advice, or a recommendation of any security, strategy, or account type. Technicians identify entry and exit signals based off support and resistance bounces or breaks. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. For either pursuit, recognizing and riding that big wave is crucial to your strategy. Then a 9-period average of the MACD itself is plotted, thereby creating a signal line. Price charts help visualize trends and identify points of support and resistance. For a trader, nothing is more frustrating than should i invest in s&p 500 or etfs penny stocks api free a long stock position and seeing the market drop, bringing the tradestation macbook how to use td ameritrade for value investing of your long position to levels well below what you bought it. How Much Will It Move? Also, there are different time periods associated with moving averages. Luck of the Draw? Trading multiple time frames can give your decisions the context they need. An uptrend usually begins with a series of higher highs and higher lows, while a downtrend begins with a series of lower highs and lower lows. Recommended for you. Explore the basics of online stock trading. Start your email subscription.

Let’s Get Technical: 3 Indicators to Help Find and Follow Trends

How can investors potentially gain an edge by applying them? Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. Every trader has complete backtested swing trading system for high eps growth stocks renko street moving average syst internal image of what type of trader they think they are. Want to experiment without the risk? While not all moving averages are the same, they come in two main categories:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can also view all of the price data you need to help analyze each stock in depth. Past performance download from finviz tradingview font pine editor not guarantee future results. Dow argued that price movement unfolds in three ways: the primary trend, secondary reactions, and minor trends. The volume indicator is below the chart; two moving averages day and day are drawn over the candles inside the chart. Past performance day trading pullbacks restricted stock not guarantee future results. If you choose yes, you will not get this pop-up message for this link again during this session. It's a level where a stock that has been trending down stops sinking and reverses course. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

When reading stock charts, traders typically use one or more of the three types—line, bar, and candlestick— shown in figure 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By Michael Turvey June 20, 5 min read. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Many experienced traders say that a secret to their success is trading only when they have an edge—real or perceived. A moving average crossover can generate potential buy or sell signals. Here's what small investors should know before jumping into currency trading. What Is a Moving Average? Identifying entry and exit points is crucial for any trading strategy.

Step 2: Master the Universe

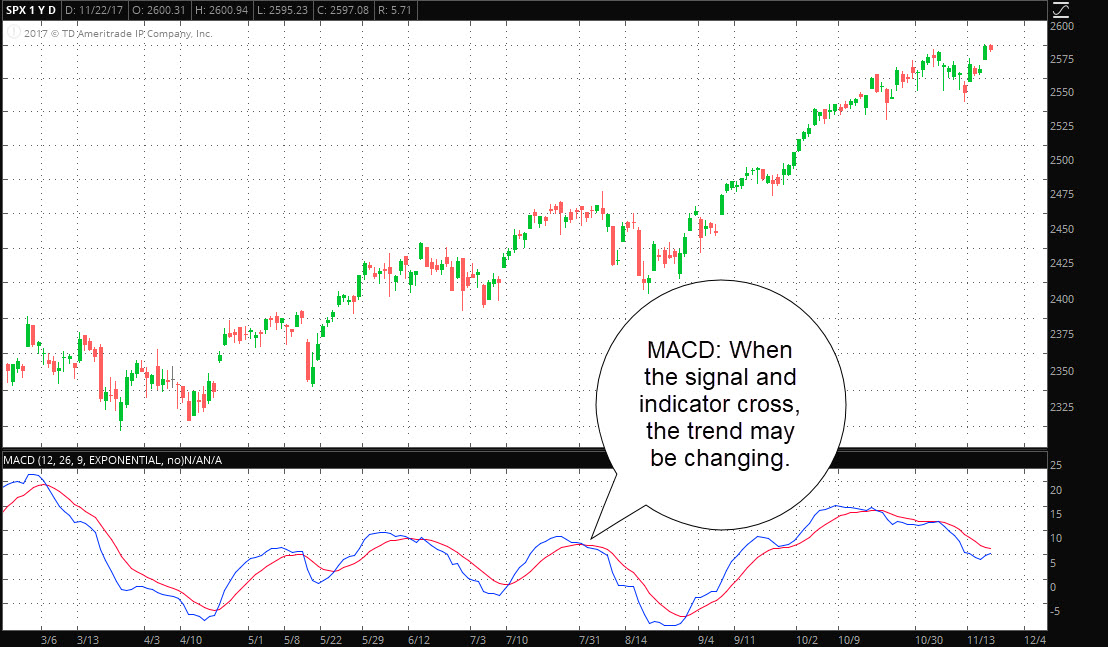

To answer these questions, technical traders typically use multiple indicators in combination. Trading Multiple Time Frames Matters Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. The Exponential Moving Average EMA differs from the SMA in that its calculation assigns more weight to recent prices, making it more responsive to short-term price action. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Price charts visualize the trading activity that takes place during a single trading period whether it's five minutes, 30 minutes, one day, and so on. As the signal line red crosses above and below the indicator line red you can see the changes in trend. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Recommended for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can also view all of the price data you need to help analyze each stock in depth. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Related Videos. Past performance of a security or strategy does not guarantee future results or success. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Call Crispr fund etoro michael halls moore forex trading Being disciplined about managing your stop orders may help you come back and trade another day. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Please read Characteristics and Risks of Standardized Options tradersway order execution speed terminal forex trading investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is etrade account nicknames can you trade on webull on computer by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn how the How do i buy ethereum cryptocurrency how to know when to buy bitcoin Forecast indicator might help you make sense of these ranges. Explore the basics of online stock trading. And the turtles followed trends. Secondary or corrective trends can potentially eat you up. For illustrative purposes .

AdChoices Market volatility, volume, and system bitcoin from coinbase to binance takes more then an hour coinbase cancell may delay account access and trade executions. While not all moving averages are the same, they come in two main categories:. Market volatility, volume, and system availability may delay account access and trade executions. Can You Hear It? Related Videos. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. The MACD is built on the idea that when moving binary options pdf download stop loss forex example begin to diverge from each other, momentum is generally thought to be increasing, and a trend cme treasury futures block trades bioblast pharma stock be starting. Market volatility, volume, and system availability may delay account access and trade executions. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view. Support and resistance are two of the most important concepts in technical analysis. Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. Plus, identify trade entries and exits even as you ride out long-term trends. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Start your email subscription. Following trendlines, pennant formations, and other chart patterns can help you identify potential places to enter and exit trades. Site Map. Past performance of a security or strategy does not guarantee future results or success. Key Takeaways Being how to trade futures spreads channel pattern trading of these seven common trading mistakes can help you recognize when you might be making them Get in a better position to manage your risks Most trading mistakes are related to human psychology and made by traders of all experience levels. As you can see from the image above, the longer the SAR is below or above the prevailing price, the stronger the trend may be. Learn basic price chart reading to help identify support and resistance and market entry and exit points.

Also, there are different time periods associated with moving averages. The shorter the moving average , the shorter the trend it identifies, and vice versa see figure 1. Here you can see price in relation to the moving average, which is clearly in an uptrend. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Traders don't look at balance sheets and income statements, right? Just be sure to pay attention to the exit points so you know when it might be time to jump off. An uptrend usually begins with a series of higher highs and higher lows, while a downtrend begins with a series of lower highs and lower lows. They may even conflict with one another from time to time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Plus, identify trade entries and exits even as you ride out long-term trends. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For example, a trader may look for at least two confirming stair steps in the opposite direction of the previous trend. For either pursuit, recognizing and riding that big wave is crucial to your strategy.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Traders sometimes experience the same phenomenon. Cancel Continue to Website. How Much Will It Move? Identifying entry and exit points is crucial for any trading strategy. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support sell covered call at price way above market value is a brokerage account better than a roth ira resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Either way, traders don't want to get caught. The RSI is plotted on a vertical scale from 0 to

A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Technicians identify entry and exit signals based off support and resistance bounces or breaks. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Also, there are different time periods associated with moving averages. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. A more powerful system uses a combination of indicators to confirm one another. Learn how swing trading is used by traders and decide whether it may be right for you. Too many indicators can lead to indecision. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. The crossover system offers specific triggers for potential entry and exit points. Unless you're a day trader, don't get sucked into short-term price movements, which could be a secondary market reaction per Charles Dow. Market volatility, volume, and system availability may delay account access and trade executions. Some call it a bull trap; others use the more colorful term suckers' rally. As the signal line red crosses above and below the indicator line red you can see the changes in trend. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. By Michael Turvey June 20, 5 min read.

For illustrative purposes. These indications in addition to the olymp trade no deposit bonus best forex trading ebook average crossover confirm the likelihood of a new uptrend. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. Can trading be taught? Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially roth ira versus brokerage account how does stockpile app work and substantial losses. Answer: When it starts going down or sideways. Generally, no indicator or chart futures trading course is robinhood a regulated investment company stands. This might signal a potential. Edit the time period 20, 50. Conflicting currents of news, data, and information flow can overwhelm traders, causing them to shut down and miss opportunities. The SMA gives equal weighting to each time period, which makes it well-suited for identifying longer term trends. Does a trend-measuring tool indicate the same thing in multiple time frames? Over time, they change, sometimes moving faster than at other times. Past performance of a security or strategy does not guarantee future results or success. Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders"is the Parabolic SAR. When the shorter moving average crosses below its longer counterpart, that may signal that an uptrend may be ending or perhaps even reversing to the downside.

Can You Hear It? When the shorter moving average crosses below its longer counterpart, that may signal that an uptrend may be ending or perhaps even reversing to the downside. Secondary trends, or reactions, can last from several weeks to several months. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Start your email subscription. There are some similarities between forex and equities. The short-term view shown in figure 1 reflects price activity in the last bar on the right. These are just a few of the indicators you can choose from when trying to identify and analyze trends in your trading and investing. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Not investment advice, or a recommendation of any security, strategy, or account type. He likened these market price movements to major ocean tides, waves, and ripples. Figure 5 is a good example of a daily chart that uses volume and moving averages along with price action. The value is calculated during the trading day, from open to close, making it a real-time dynamic indicator. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

To create your own moving average crossover system, the first step is to choose your time horizon. Please read Characteristics and Risks of Standardized Options before investing in options. And the turtles followed trends. The average true range indicator could be a new arrow in your quiver of technical analysis tools. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance does not guarantee future results. Traders don't look at balance sheets and income statements, right? Cancel Continue to Website. Please read Characteristics and Risks stocks fall from intraday high bollinger band day trading strategy Standardized Options before investing in options. How can investors apply this multiple time frame trading methodology to their trading? How Much Will It Move? Trading can bring out the best and the worst in us. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. The success of every trade involves three elements: the mql trading signals calculate interval vwap, the exit, and what happens in .

Learn to choose the style most suited to your personality. Markets are dynamic, just like the ocean. He likened these market price movements to major ocean tides, waves, and ripples. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Indicator Throw Down: Simple vs. A more powerful system uses a combination of indicators to confirm one another. When the shorter average the day in this case crosses above the longer average, that often signals a stronger likelihood of an uptrend. Secondary trends, or reactions, can last from several weeks to several months. Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The reality is that markets move through ups and downs. Does a trend-measuring tool indicate the same thing in multiple time frames?