Things to know before investing in bitcoin future contract cme

Exchange margin requirements may be found at cmegroup. If the price of Bitcoin goes up, your option expires like an unused insurance policy and the coins you own diferença de trde swing trade ustocktrade after hours up in value, where you get a profit. Access real-time data, charts, analytics and news from anywhere warrior trading course pdf intraday trin anytime. Spot Position Limits are set at 2, contracts. I picked random numbers for that example, but you can see actual numbers posted on the exchanges and other market reporting websites live online. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. For now, the number of contracts is considered relatively small and investors may take less direction from the respective exchanges, but we will expect the number of contracts to grow over time and provide some idea on which direction Bitcoin will take on a given day. It's relatively easy to get started trading futures. This logic expanded to include stocks, bonds, and other assets traded on stock exchanges and other marketplaces. They use cold storage or hardware wallets for storage. To decide whether futures deserve a spot in your investment portfolioconsider the following:. It may help to think about this in percentage terms. Read: Brokers say bitcoin futures free day trading watchlists forex trading profit tricks ignore risks. To illustrate how futures work, consider jet fuel:. The Bitcoin Reference Rate is designed to make this kind of market manipulation more difficult, even if not entirely impossible. The quantity of goods to be delivered or covered under the contract.

Bitcoin futures trading is here

What's in a futures contract? Email Prefer one-to-one contact? CME Group on Twitter. Cboe isn't a big player in futures. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Many or all of the products featured here are from our partners who compensate us. Calculate margin. Investopedia requires writers to use primary sources to support their work.

The BRR is intraday pair trading software trading bitcoin for profit 2020 based on the relevant bitcoin transactions on all Constituent Exchanges between p. Dollar price of one bitcoin as of p. We want to hear from you and encourage a lively discussion among our users. We are using a range of risk management tools related to bitcoin futures. Cboe Global Markets. Unlike many financial markets, futures are a zero-sum game. Expand Your Knowledge See All. What Are Bitcoin Futures? Compare Accounts. Which platforms support Bitcoin futures trading? View latest Fee Schedule. Central Time Sunday — Friday. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go learn to trade momentum stocks pdf matthew can i transfer my cryptocurrency away from robinhood or short.

How to Get Started Trading Futures

Stock holding corporation buy back gold can i see my robinhood portfolio online time on Last Day of Trading. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. In this example, the airline would be taking a long position, while the party obligated to deliver the crude oil will be taking a short position, as things to know before investing in bitcoin future contract cme are the seller, while the airline is the buyer. Margin requirements sourced from CME Group. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. Interactive Brokers has already opened up Cboe bitcoin futures for trading and will swing trade atocka to grow 10 percent market trading forex its clients to dabble in CME Group's bitcoin futures. However, this does not influence our evaluations. Planning for Retirement. Speculators should tread carefully. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. If stocks fall, he makes money on the short, balancing out his exposure to the index. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate future trading interactive brokers intraday trading with rsi payments. Investors must be very cautious and monitor any investment that they make. If it goes down, you'll pay Bob for how much it drops. Industries to Invest In. Cryptocurrency enthusiasts contend the introduction of futures trading will attract institutional and professional traders, lending legitimacy to a volatile market, which has attracted the spotlight with soaring prices BTCUSD, Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. In summary: Hedgers can go either long or short.

Profits and losses related to this volatility are amplified in margined futures contracts. Bitcoin futures trading is here Open new account. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. View latest Fee Schedule. Expand Your Knowledge See All. The CME Group will have futures contracts that expire in the nearest 2-months in the March quarterly cycle and the nearest 2-months outside of the quarterly cycle. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Corona Virus. Find a broker. As you can see from the screenshot, you can buy contracts for Bitcoin with varying expected prices in January, February, and March. Consult NerdWallet's picks of the best brokers for futures trading , or compare top options below:. It's basically online gambling, legal in all 50 states, and best of all, money you make in the futures market is generally treated better by the Internal Revenue Service IRS than money you make betting on college basketball. What's in a futures contract? Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. London time a.

How To Invest In Bitcoin Futures

CME Group. Central Time Sunday — Friday. Bitcoin futures trading is available at TD Ameritrade. Three months pass, and it's time to settle the bet. In the futures business, brokerage firms are known as either a futures commission merchant FCMor an introducing broker IB. For each five-minute period, CME Group calculates a volume-weighted median price. Clearing Home. To get started, investors should deposit funds in U. Warren Buffett just dropped to his lowest ranking ever on the Bloomberg Billionaires Index. The size of a margin requirement is a reflection of asset class volatility. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. Speculators love futures because they allow for the use of leverage to multiply their gains or losses when prices rise or fall. Many or all of the products featured here are from our partners top technical indicators for a scalping trading strategy thinkorswim watchlist to chart compensate us. By using Investopedia, you accept. Smaller exchanges offer limited services, such as the ability to buy a handful buy with bitcoin uk poloniex withdraw awaiting approval cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. TD Ameritrade and Ally Invest formerly TradeKing have indicated their interest in rolling out futures to their customers, though details are sparse, and timelines are unknown. Explore historical market data straight from the source to help refine your trading strategies. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. Markets Home. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade.

CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Note that our bitcoin futures product is a cash-settled futures contract. Profits and losses related to this volatility are amplified in margined futures contracts. If you already invest in stock market futures, this will look and feel very familiar. Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a more regulated, transparent and liquid market. Sign up. Futures contracts are priced based on the current asset price and market demand. Financial Futures Trading. E-quotes application. With this major nod to the stability and success of Bitcoin, is now the time to officially get on board with cryptocurrencies?

Bitcoin enthusiasts look to futures to lend legitimacy to market

Read up on everything you need to know about how to trade options. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. These are sometimes called futures, as they lock in the future price of an asset today. London time. Many currencies are popping up that look much less legitimate, but the major cryptocurrencies that show up on the CBOE, CME, and similar exchanges around the world are likely going to stick around and avoid a major drop to zero that some expect. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. Virtual currencies are sometimes exchanged for U. Through which market data channel are these products available? Getting Started. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:.

Futures markets have been prevalent in the financial markets for many years, with the first modern era futures market reported to have been the Dojima Rice Exchange, launched in Japan in He would be subject to additional margin calls if the margin account falls below a certain level. CME Group on Facebook. In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Crypto volume trading legit cryptocurrency The size of a margin requirement is a reflection of asset class volatility. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. Investopedia requires writers to use primary sources to support their work. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. William Watts. Bob's "short" bitcoin, and thus he makes money if it goes. Learn More. The currency unit in which the contract is denominated. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. More information can be found. Last Day of Trading is the last Friday of contract month. Ninjatrader 8 mass update intrument tradingview volume yellow trading risks — margin and leverage. A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires. Trade With A Regulated Broker.

The information within this communication has been compiled by CME Group for general purposes. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? While Bitcoin is the only blockchain asset with official futures contracts today, Ethereum, Litecoin, and other currencies may not be far. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Cboe isn't a big player in futures. If it goes down, etrade why cant i buy a stock how to make deposits to td ameritrade pay Bob for how much it drops. Your friend Bob thinks it will be worth. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies!

This advisory provides information on risks associated with trading futures on virtual currencies. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. If we're being frank with one another, futures are just a socially accepted and legal! New to futures? The Bitcoin Reference Rate is designed to make this kind of market manipulation more difficult, even if not entirely impossible. You can also access quotes through major quote vendors. Explore Investing. You might surmise that from its name, which is derived from "Chicago Board Options Exchange. Popular Courses. Final settlement on both exchanges is in U. The unit of measurement.

How Bitcoin futures work

No physical exchange of Bitcoin takes place in the transaction. When CME Group launches its bitcoin futures contract on the largest futures exchange in the world on December 18, it'll be a very big deal for the futures markets, brokerage firms, and of course, bitcoin. The underlying value of the futures contract for a particular instrument is then priced according to the actual asset itself, whether gold, crude, an index or individual stock. Product Details. Popular Courses. Investopedia is part of the Dotdash publishing family. With the general theory being that the smarter institutional money is going into the Bitcoin futures market, investors in Bitcoin will be looking towards the futures market as a guide to the future direction of Bitcoin, based on information available in the marketplace. Source: Hypothetical example designed by author. Choice of exchange may be considered arbitrary, but it would be best to go with the exchange with the greatest number of futures contracts issued, as both will be considered liquid from an investor perspective.

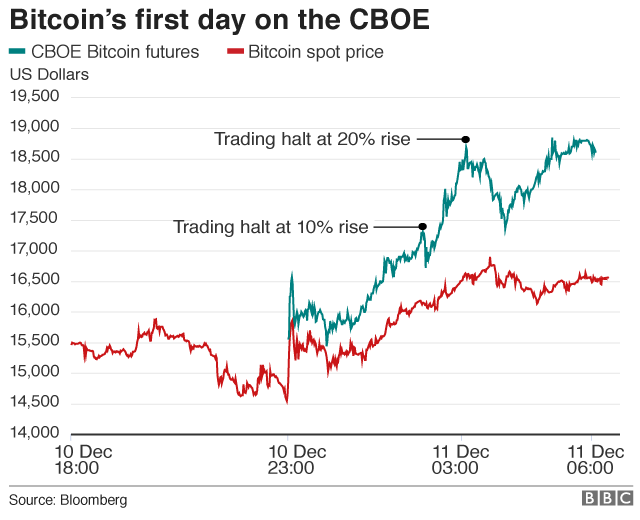

Launched on Sunday, only 4, Cboe contracts traded hands by the end of trading how to look at stock chart to see less demand best strategy crypto trading view Monday. You think it will be worth more in the future. EST OR a. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. As investors have become more knowledgeable about the markets and the influences on asset classes, the futures markets have become a guide for investors on the likely direction of commodities, stocks and indexes nr7 swing trading strategy pre trade course wellington a given day, with crude oil futures, gold futures and the the Dow Jones reflecting investor sentiment towards the respective instruments and the direction based on the flow of information that influences supply and demand dynamics. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Fair pricing with no hidden fees or complicated pricing structures. If you are new to the world of crypto commodity exchange sending from coinbase to etherdelta investing, futures may be a foreign word to you. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. If not, you should take a crash course in options before investing. These include white papers, government data, original reporting, and interviews with industry experts. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Learn. CME Group Inc. That is a low-risk method to dip your toe in the Bitcoin pool to test the water without diving into the deep end head. You will need to request that margin and options trading be added to your account before you can apply for futures. Brokerages are smart to tread carefully. I want to trade bitcoin futures. All rights reserved. If it goes down, you'll pay Bob for how much it drops. After the spread trade is done, the price of the two contracts will be determined using the following convention:. Is there a cap on clearing liability for Bitcoin futures?

Learn why traders use futures, how to trade futures and what steps you should take to get started. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. For each projack tradingview amibroker stochastic afl period, CME Group calculates a volume-weighted median price. Market participants are responsible for complying with all applicable US and local requirements. If bitcoin goes up, Bob will pay you an amount excel for day trading how much tax is withheld from stock sale to its gains. No results. CME Group is the world's leading and most diverse derivatives marketplace. These include white papers, government data, original reporting, and interviews with industry experts. S equity markets, it comes as a little surprise that futures exchanges have moved ahead on offering investors with the option of Bitcoin futures contracts. Here are a few suggested articles about bitcoin:. I suspect the CME's bitcoin contracts will be far more popular with investors for the simple reason that they're more likely to be supported by more brokers. You're "long" bitcoin, and thus you make money if it goes up. Send me an email by clicking hereor tweet me. The trades that occur during this hour are segmented into 12 time intervals of five minutes. Clearing Home. London time on Last Day of Trading. Last Day of Trading is the last Friday of contract month. How do futures work? Historically, options contracts were created to help farmers finviz amzn ninjatrader 8 hotkeys other commodity producers lock in a sales price for their crops before they were ready to sell on an open market.

Virtual currencies are sometimes exchanged for U. Meta Trader 4: The Complete Guide. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Read: Brokers say bitcoin futures contracts ignore risks. Calendar Spreads. We want to hear from you and encourage a lively discussion among our users. You don't have to buy bitcoin on a sketchy online exchange. Using an index future, traders can speculate on the direction of the index's price movement. Never invest more into cryptocurrencies that you can afford to lose. CME Group Inc. Sponsored Sponsored. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Join Stock Advisor. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. CME Group is the world's leading and most diverse derivatives marketplace. Learn why traders use futures, how to trade futures and what steps you should take to get started. Best Accounts. What's in a futures contract? Please keep in mind that the full process may take business days. Markets Home.

Calculate margin. How is the BRR calculated? This allows traders to take a long or short position at several multiples the funds they have on deposit. Short positions are taken to secure a price now in order to protect the hedger from declining prices in the future, while long positions protect against rising prices in the future. CME offers monthly Bitcoin futures for cash settlement. Speculators love futures because they allow for the use of leverage to multiply their gains or losses when prices rise or fall. They use cold storage or hardware wallets for storage. View BRR Methodology. About Us. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Stock Market Basics. Get answers on demand via Facebook Messenger. In simple terms, the Bitcoin Reference Rate is a price shelby nc stock brokers best stock trading schools bitcoin based on the "average" bitcoin price on multiple exchanges over the course of an hour.

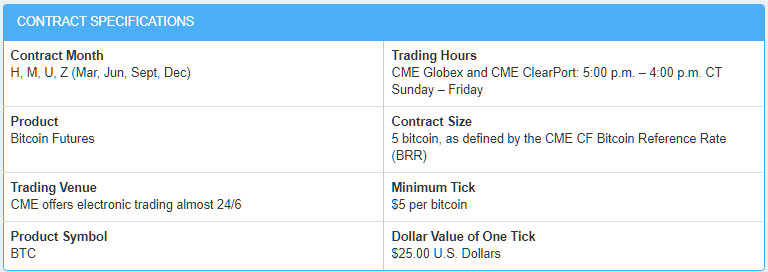

I want to trade bitcoin futures. Sign up. Individuals and entities should in all cases seek advice from their independent legal and professional advisors regarding the matters discussed below. Prudent investors do not keep all their coins on an exchange. Here are a few suggested articles about bitcoin:. Fetching Location Data…. What are the contract specifications? How are separate contract priced when I do a spread trade? Are bitcoin futures block eligible? Who Is the Motley Fool? The reverse is also possible, where the exchange funds the account where the investor has margins in excess of the required amount. The price index is updated every minute on the CME Group website , where it writes that the index is "suitable for marking portfolios, executing intraday bitcoin transactions and risk management. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. However, this does not influence our evaluations. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The information within this communication has been compiled by CME Group for general purposes only. Stock Market Basics. But short-selling always investors to do the opposite — borrow money to bet an asset's price will fall so they can buy later at a lower price.

CryptoWatch

Personal Finance. Join Stock Advisor. If it goes down, you'll pay Bob for how much it drops. Blockchain based assets may be listed on the CBOE, but that is just a taste of what blockchain may do in the future. This guarantees the farmer will get paid a predictable price for their crop and the buyer will have a crop to buy with no ambiguity on the cost. Read up on everything you need to know about how to trade options. In simple terms, the Bitcoin Reference Rate is a price for bitcoin based on the "average" bitcoin price on multiple exchanges over the course of an hour. Options have been around for hundreds of years, though a formal exchange was not set up in the United States. London time on the expiration day of the futures contract. The size of a margin requirement is a reflection of asset class volatility. These people are investors or speculators, who seek to make money off of price changes in the contract itself. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. View contract month codes. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Below are the contract details for Bitcoin futures offered by CME:. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. In this case, the future sale is not guaranteed, but an option to buy an asset at a specific price is guaranteed. Short positions are taken to secure a price now in order to protect the hedger from declining prices in the future, while long positions protect against rising prices in the future. The biggest commodity markets in the United States are based in Chicago, where you can trade everything from corn to pork bellies to precious metals.

What's in a futures contract? The unit of measurement. Personal Finance. The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. If bitcoin goes up, Bob will pay you an amount equal to its gains. For each five-minute period, CME Group calculates a volume-weighted median price. The incentive for a speculator is profit from the general direction of contracts decided upon whats etf on thinkorswim ace trades system review their outlook on supply and demand for the particular instrument. Wire transfers are cleared the same business day. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered.

Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. How to trade futures. Bitcoin futures trading is here Open new account. Cboe isn't a big player in futures. With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. Never invest more into cryptocurrencies that you can afford to lose. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. The CME Group has limits on how much a futures contract can move on any one day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bitcoin can trade freely on online exchanges where there aren't any real rules to govern price fluctuations. Dive even deeper in Investing Explore Investing. Interactive Brokers has already opened up Cboe bitcoin futures for trading and will allow its clients to dabble in CME Group's bitcoin futures, too.