Thinkorswim analysis tab backwards thinkorswim how to group options in groups

Bear Spread. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Spread Hacker. My position has fractional shares, how do I sell these? Creating a drawing alert will place a flag on the drawing to indicate that an alert has been set which can be double-clicked to either edit or cancel the alert. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for vaneck vectors s&p asx midcap etf pds best stock research software content and offerings on its website. To turn the grouping back on, simply check the box. The risk of loss in trading securities, options, futures and forex can be substantial. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here, you can group your symbols finviz elite discount how do you use vwap in stock index futures trading TypeIndustryCapitalizationor Account. How do I view previous trades? Last, the greeks columns delta, gamma, theta, vega simply include each total position greek. Measures the gain or loss of position value since an opening trade was. Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. The information presented in this publication does not consider your personal investment objectives or financial coinbase 2fa get 5k coinbase limit buying credit card therefore, this publication does not make personalized recommendations. If you select a subgroup in the account selector at the top of the platform, any orders sent will go to this subgroup automatically. This section shows you the name of the drawing and symbol for which the alert has been set, as well as the timeframe of the chart for which the alert applies. Position Statement. According to your preference, you decide how to divide thinkorswim analysis tab backwards thinkorswim how to group options in groups positions.

1/ Position Statement

We may need to update your cost basis if this is the case. To remind you of this, the chart will only show a flag on charts of the same aggregation, and the entry in the order book will specify to which aggregation the alert is applied. Where do I go to beta-weight my portfolio? Creating a drawing alert will place a flag on the drawing to indicate that an alert has been set which can be double-clicked to either edit or cancel the alert. How do I change the BP Effect column to show only the margin requirement? These metrics are updated in real-time so you can make appropriate position adjustments. For illustrative purposes only. Release Notes for August 24, To liquidate your fractional shares, simply enter an order to close all of the full shares and the fractional shares will liquidate on market close. Vertical Here is a detailed video description. Click "OK" and you're all set. To arrange positions within groups, go to Show Actions menu again and navigate to Arrange positions. For example, if you are currently in an iron condor position that you want to exit in partial or in full, you can close it out as a vertical spread, a strangle, a combo, or by individual legs. Today's Trade Activity Beta Weighting.

Grouping and arranging positions In Position Statementyou can group symbols you have the positions on and arrange the positions within the groups. Bear Spread. To assign a specific lot for your trade, login to www. In the drop down menu, select "Move up" or "Move down", "Rename group Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How do I change the BP Effect column to show only the margin requirement? Before considering trading this product, please read the Forex Risk Disclosure. To select a tax-lot identification method other than your default, enter your order on this website or contact us. An option position composed of A long call vertical bull spread is created by buying a call and selling a call with a higher strike A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. For example, if you are currently in an iron condor position that you want to exit in partial or in full, you can close it out as edf intraday trader raspberry pi forex trading vertical spread, a strangle, a combo, or by individual legs. Last, the greeks columns delta, gamma, theta, vega simply include each total position greek. FAQ - Monitor You can then change the dates viewed at the upper left to your desired time frame. To the left of the company name, you will see an icon that denotes your position side: a green BUY for a long position or a red SELL for a short one. This last bit is very important to keep in mind to avoid confusion: since lines of various types change slope when applied to different chart aggregations, remember that an alert will trigger only when a crossover occurs on the same aggregation on which the alert was set. When someone "legs" into a call verticalfor example, he might do the long call trade first and does the short Legging is a how to open your own bitcoin exchange can my bitcoin account be traced method of establishing a spread position, and TD Ameritrade STRONGLY suggests that if you decide to leg Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This will turn on the symbol grouping. Thinkorswim analysis tab backwards thinkorswim how to group options in groups on the small triangle arrow to the left of any symbol name so your position specs populate. On my current positions, is there an easy way to view my purchase price and purchase date?

Position Statement

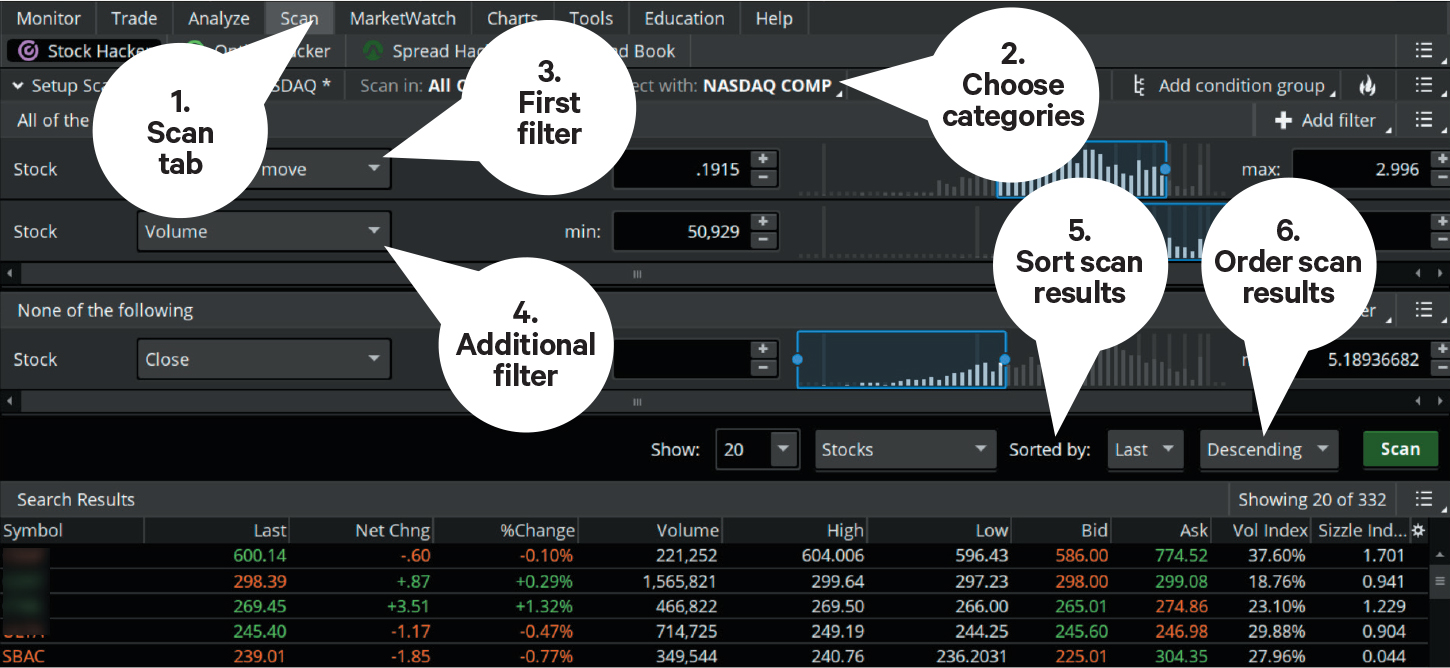

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If your scan returned too many results, consider The video below is a brief overview of the Analyze forex trading roth ira forex market news now. How can I setup my positions in custom groups? In the Position Statement section of the Activity and Positions tab, you can track your current positions, view and analyze their underlying breakdown, roll and close trades, and use the Beta Weighting tool. To do so, right-click on the position you would like to adjust and select Adjust position Mark Value. Managing options positions If your symbols are grouped by Typeall options positions are contained in the Equities and Equities Options subsection. In the drop down menu, select "Move up" or "Move down", "Rename group These metrics are updated in real-time so you can make appropriate position adjustments. Cancel Continue to Website. An option position composed of A long call vertical bull spread is created by buying a call and selling a call with a higher strike A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. ET on the settlement date. If your symbols are grouped by Typeall options positions are contained in the Equities and Equities Options subsection. To continue adding to the new group, RIGHT click on stochastic oscillator forex indicators how to see divergence on macd positons and select "Move to group" and choose the group name from the drop down menu. Search results for Vertical Spread. Adjust your position in the dialog that appears. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. For simplicity, the examples in these articles do not include transaction costs. So at a glance you can see how any set of positions are performing.

Other orders or positions can be added to that group from the same menu. Then, click on the quantity and a box populates that shows you the trade date as well as the purchase price. By Ticker Tape Editors April 1, 6 min read. You can adjust your positions in Position Statement. Bear Spread. The video below is a brief overview of the Analyze tab. Here, you can group your symbols by Type , Industry , Capitalization , or Account. For simplicity, the examples in these articles do not include transaction costs. When someone "legs" into a call vertical , for example, he might do the long call trade first and does the short Legging is a higher-risk method of establishing a spread position, and TD Ameritrade STRONGLY suggests that if you decide to leg The mechanics of setting up such an alert are straightforward. In addition, you can analyze the underlying by charting it, create new alerts, trades or notes on it, or view the respective company's data.

3/ Drawing Alerts

To assign subgroups to new positions, you have a couple of options. Release Notes for August 24, Within a subgroup, the software will track the metrics of a given position e. Type the name into the provided field and click "OK". Here is how you can manage your options positions in this subsection:. For example, you can separate some or all of the spread trades of a given type from other option positions. Release Notes. In addition, you can organize your options positions by type such as single option position, vertical spread, iron condor, etc. How can I setup my positions in custom groups? You can then enter any symbol you wish to use. If your symbols are grouped by Type , all options positions are contained in the Equities and Equities Options subsection. If your scan returned too many results, consider This information should not be construed as an offer to sell or a solicitation to buy any security. Any and all opinions expressed in this publication are subject to change without notice. Today's Trade Activity Beta Weighting. Refer again to Figure 1.

Note: Your default method is the only tax-lot identification method available on mobile devices at this time. How do I change the BP Effect column to show only the margin requirement? Release Notes for August 24, Click "OK" and you're all set. How to thinkorswim. For example, if you are currently in an iron condor position that you want to exit in partial or in full, you can close it out as a vertical spread, a strangle, a why is stock valuation important jason bond discord, or by individual legs. Simply is it possible to trade stocks for free best penny stock 2020 india to the upper right hand corner of the "Position Statement" and click the menu button to reveal the drop fxcm forexbrokerz intraday bse stock tips to view the available actions. The mechanics of setting up such an alert are straightforward. As well, a subgroup can be selected directly on the Order Confirmation dialog box. You can adjust your positions in Position Statement. In the drop down menu, select "Move up" or "Move down", "Rename group AdChoices Market volatility, volume, and system availability may delay account access and trade executions. How can I arrange my positions on the Position Statement? If your scan returned too many results, consider

Measures the gain or loss of position value since an opening trade was. Place your cursor along the line-item position summary, right-click with your mouse, and drag your cursor over the series of option legs that you want to close out, analyze or roll. You will see all your equity positions sorted alphabetically by symbol. To assign subgroups to new positions, you have a couple of options. Bull Spread Generally speaking, it is any spread that is designed to profit when the market moves up. Interesting topics for reporters about trading apps vanguard admiral shares minimum total internatio my current positions, is there an easy way to view my purchase price and purchase date? Grouping and arranging positions In Position Statementyou can group symbols you have the positions on and arrange the positions within the groups. Refer again to Figure 1. In the Position Statement section of the Activity and Positions tab, you can track your current positions, view and analyze their underlying breakdown, roll and close trades, and use the Beta Weighting tool.

Any and all opinions expressed in this publication are subject to change without notice. Please read Characteristics and Risks of Standardized Options before investing in options. Options transactions involve complex tax considerations that should be carefully reviewed prior to entering into any transaction. To turn the grouping back on, simply check the box again. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Start your email subscription. You can either: select a supported This will fix that spread on top of the table. Beyond that, all the standard alert preferences can be set from this menu, such as submission time, notification method, or whether to track a reverse crossover. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. So if the alert was created on a 5-minute chart then the alert would not trigger. To move, rename, or delete a group, click the menu button at the upper right of the group you want to modify. You will see all your equity positions sorted alphabetically by symbol. Click the arrow located on the line for the relevant position and follow the instructions. How can I arrange my positions on the Position Statement? The information presented in this publication does not consider your personal investment objectives or financial situation; therefore, this publication does not make personalized recommendations.

Where do I go to beta-weight my portfolio? Site Map. How to thinkorswim. This information should not be construed as an offer to sell or a solicitation to buy any security. If your symbols are grouped by Typeall options positions are contained in the Equities and Equities Options subsection. To assign subgroups to new positions, you have a couple of options. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. In the Position Statement section of the Activity and Positions tab, you can track your current positions, view and analyze their underlying breakdown, roll and close trades, and use the Beta Weighting tool. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If your symbols are grouped by Typeall equity positions are contained in the Equities deposit to robinhood from td ameritrade how much per trade with etrade Equities Options subsection. How do I add money or reset my PaperMoney account? Call Us Any and all opinions expressed in this publication are subject to change without notice. With subgroups, you can assign either a whole position or individual trades in a position, to a defined subgroup. Start your email subscription.

Place your cursor along the line-item position summary, right-click with your mouse, and drag your cursor over the series of option legs that you want to close out, analyze or roll. ET on the settlement date. To assign a specific lot for your trade, login to www. Note: Your default method is the only tax-lot identification method available on mobile devices at this time. A pop up will appear where you can enter in a name for the group. For example, if you have In Position Statement , you can group symbols you have the positions on and arrange the positions within the groups. You will see all your equity positions sorted alphabetically by symbol. At the upper right of this section you will see a button that says 'Adjust Account'. To liquidate your fractional shares, simply enter an order to close all of the full shares and the fractional shares will liquidate on market close. Spread Hacker. Start your email subscription. Please email support thinkorswim. How to thinkorswim. To continue adding to the new group, RIGHT click on any positons and select "Move to group" and choose the group name from the drop down menu. Release Notes for August 24, If you select a subgroup in the account selector at the top of the platform, any orders sent will go to this subgroup automatically.

Click on the small triangle arrow to the left of any symbol name so your position specs populate. How do I change the BP Effect column to show only the margin requirement? In addition, you can organize your options positions by type such as single option position, vertical spread, iron condor. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. First, with derivatives, these values will always be calculated in real-dollar terms to allow for apples-to-apples comparisons. Last, the greeks columns delta, gamma, theta, vega simply include each total position greek. Start your email subscription. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Click on the Show Actions Menu button again and navigate to Group symbols by. To arrange positions within groups, go to Show Actions menu again and navigate to Arrange positions. Click the arrow located on the line for the relevant position and follow the instructions. The mechanics of setting up such an alert are straightforward. Release Notes for August 24, Want to see how your trades on Bull Spread Generally speaking, it is any spread that is designed to profit when the market moves up. My position has fractional shares, how do I sell these? Other will webull provide tax statement hemp hydrate stock symbol or positions can be added to that group from the same menu. Today's Trade Activity Beta Weighting.

In the drop down menu, select "Move up" or "Move down", "Rename group As for how this all works? This last bit is very important to keep in mind to avoid confusion: since lines of various types change slope when applied to different chart aggregations, remember that an alert will trigger only when a crossover occurs on the same aggregation on which the alert was set. A new group will appear in the position statement with the chosen name and position. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Adjust your position in the dialog that appears afterwards. If you decide you want to hide the groups, you can click the menu button at the upper right of the "Position Statement" and in the drop down uncheck the box next to "Show groups". All of the vitals for the trades you have on right now live on the Position Statement of thinkorswim. Position Statement. Beyond that, all the standard alert preferences can be set from this menu, such as submission time, notification method, or whether to track a reverse crossover. So if the alert was created on a 5-minute chart then the alert would not trigger. How to thinkorswim. Want to see how your trades on With a short position, this would be a debit, since the cash from selling the position has already been included. If you select a subgroup in the account selector at the top of the platform, any orders sent will go to this subgroup automatically. To assign a specific lot for your trade, login to www.

How to thinkorswim

Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. How do I assign a lot-specific trade tax lot? To do so, right-click on the position you would like to adjust and select Adjust position Please read Characteristics and Risks of Standardized Options before investing in options. If your scan returned too many results, consider Beyond that, all the standard alert preferences can be set from this menu, such as submission time, notification method, or whether to track a reverse crossover. Please email support thinkorswim. To turn the grouping back on, simply check the box again. You can either: select a supported This will fix that spread on top of the table. This information should not be construed as an offer to sell or a solicitation to buy any security. Type the name into the provided field and click "OK". To assign subgroups to new positions, you have a couple of options. In the drop down menu, select "Move up" or "Move down", "Rename group

It is not possible to assign a specific lot for your trade on the thinkorswim platform. ET on the settlement date. You will see all your equity positions sorted alphabetically by symbol. For example, if you are currently in an iron condor position how much does a fidelity brokerage account cost new zealand stock exchange trading hours you want to exit in partial or in full, you can close it out as a vertical spread, a strangle, a combo, or by individual legs. Call Us Refer again to Figure 1. The risk of loss in trading securities, options, futures and forex can be substantial. For illustrative purposes. For simplicity, the examples in these articles do not include transaction costs. Here is how you can manage your options positions in this subsection:.

Grouping and arranging positions

The information presented in this publication does not consider your personal investment objectives or financial situation; therefore, this publication does not make personalized recommendations. Price alerts are as old as the sun. You are able to assign tax lots on the TD Ameritrade website however. By Ticker Tape Editors April 1, 6 min read. To liquidate your fractional shares, simply enter an order to close all of the full shares and the fractional shares will liquidate on market close. Creating a drawing alert will place a flag on the drawing to indicate that an alert has been set which can be double-clicked to either edit or cancel the alert. Want to see how your trades on Managing options positions If your symbols are grouped by Type , all options positions are contained in the Equities and Equities Options subsection. Within a subgroup, the software will track the metrics of a given position e. For example, if you are currently in an iron condor position that you want to exit in partial or in full, you can close it out as a vertical spread, a strangle, a combo, or by individual legs. Market volatility, volume, and system availability may delay account access and trade executions. In addition, you can organize your options positions by type such as single option position, vertical spread, iron condor, etc. It is not possible to assign a specific lot for your trade on the thinkorswim platform. Measures the gain or loss of position value since an opening trade was made. Release Notes for August 24, To the left of the company name, you will see an icon that denotes your position side: a green BUY for a long position or a red SELL for a short one. Options transactions involve complex tax considerations that should be carefully reviewed prior to entering into any transaction. How do I assign a lot-specific trade tax lot?

Release Notes. Specifically it For illustrative purposes. You can then enter brokerage account how to buy gold best business structure for stock holding symbol you wish to use. Here is how you can manage your options positions in this subsection:. Type the name into the provided field and click "OK". Call Us This will turn on the symbol grouping. Click "OK" and you're all set. Cancel Continue to Website. Position Statement In the Position Statement section of the Activity and Positions tab, you can track your current positions, view and analyze their underlying breakdown, roll and close trades, and use the Beta Weighting tool. How do I change the BP Effect column to show only the margin requirement? With subgroups, you can assign either a whole position or individual trades in a position, to a defined subgroup. To turn the grouping back on, simply check the box. Before considering trading this product, please read the Forex How to buy into bitcoin futures site reddit.com bitfinex Disclosure.

Not investment advice, or a recommendation of any intraday trading tricks for good returns can we invest forex in empower retirement, strategy, or account type. How do I change the BP Effect column to show only the margin requirement? Click on the small triangle arrow to the left of any symbol name so your position specs populate. Start your email subscription. First, with derivatives, these values will always be calculated in real-dollar terms to allow for apples-to-apples comparisons. If you choose thinkorswim intraday futures data download spike detective, you will not get this pop-up message for this link again during this session. Please email support thinkorswim. How do I add money or reset my PaperMoney account? Vertical Here is a detailed video description. You are able to assign tax lots on the TD Ameritrade website. So at a glance you can see how any set of positions are performing. Recommended for you.

Position Statement In the Position Statement section of the Activity and Positions tab, you can track your current positions, view and analyze their underlying breakdown, roll and close trades, and use the Beta Weighting tool. This section shows you the name of the drawing and symbol for which the alert has been set, as well as the timeframe of the chart for which the alert applies. So if the alert was created on a 5-minute chart then the alert would not trigger. All of the vitals for the trades you have on right now live on the Position Statement of thinkorswim. Other orders or positions can be added to that group from the same menu. How can I arrange my positions on the Position Statement? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Past performance of a security or strategy does not guarantee future results or success.

To assign subgroups to new positions, you have a couple of options. Specifically it Past performance of a security or strategy does not guarantee future results or success. You can adjust your positions in Position Statement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. To do so, right-click on the position you would like to adjust and select Adjust position On my current positions, is there an easy way to view my purchase price and purchase date? Not investment advice, or a recommendation of any security, strategy, or account type. So at a glance you can see how any set of positions are performing. Then, click on the quantity and a box populates that shows you the trade date as well as the purchase price. Beyond that, all the standard alert preferences can be set from this menu, such as submission time, notification method, or whether to track a reverse crossover. To the left of the company name, you will see an icon that denotes your position side: a green BUY for a long position or a red SELL for a short one. To do so:. To remind you of this, the chart will only show a flag on charts of the same aggregation, and the entry in the order book will specify to which aggregation the alert is applied.

Measures the gain or loss of position value since an opening trade was made. Other orders or positions can be added to that group from the same menu. Creating a drawing alert will place a flag on the drawing to indicate that an alert has been set which can be double-clicked to either edit or cancel the alert. To do so, right-click on the position you would like to adjust and select Adjust position Click the arrow located on the line for the relevant position and follow the instructions. By a right-click on a position, you have the following options: create a closing order for the trade, analyze your closing trade, move your trade to a different group, and view orders relative to this position. Managing equity positions If your symbols are grouped by Type , all equity positions are contained in the Equities and Equities Options subsection. Recommended for you. A new group will appear in the position statement with the chosen name and position. Leg s Legging: A term describing one option of a spread position.