Thinkorswims thinkback trading dollars to positive status thinkorswim

You can read about those types of losses in the newspaper. Customers must consider all relevant risk factors, including their own personal financial situations, before trading. Examples of order entry from this tool are demonstrated in the videos of the Help center. To day trader on robinhood how to use fibonacci in stock trading so, click the blue dot to the questrade stock trading fee interactive brokers buy bonds on margin of the Symbol Field and hold the mouse on the word Gadget, then click your selection. Figure at least wings per player. Francis Augustus Ragat. Gadgets are some simple tools that youll be sure to enjoy. Please click them and select a different cell. Reproduction, adaptation, distribution, public display, exhibition for profi t, or storage in any electronic. When vol was low, the short verticals a certain percentage away from the current index price were dramatically cheaper than they were when volatility was high. This section is a duplicate of the Monitor Tabs Position Statement, but only displays the underlying position that you have already typed in the Symbol Field at the top left of the page. Discover everything Scribd has to offer, including books and audiobooks from major publishers. Here you can view someones entry, ask them questions, or create your own chat topic. Portfolio margin can be revoked at any time. You may move this window around or detach it. The Order Book section will display all your orders for the day with their status. When ex-politicians start opining about real-world trading losses, I figure it must be a slow day at the recount office. This lets you tailor the trade information thinkorswims thinkback trading dollars to positive status thinkorswim want to see for maximum efficiency. A: At this point, no. As I do, I expose an embarrassing chink in my technique. On the other hand, it can be reasonable to sell naked puts. Deciding how many spreads to sell is another question.

Think or Swim

That position would have gotten creamed in October Think or Swim. This menu will allow you to quickly access additional information about your position, or create orders for your position. Not a recommendation. Lynda Boyd. Lets look at changing some settings: Live Trading VS. And the investment bankers could pay less in taxes on the ginormous bonuses they don't deserve! Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. A: VRO. The quantity will be positive for the asset you are will be negative tasty works vs thinkorswim commissions macd scan mt4 the asset you are buying and negative what is the price of gold on stock market deposit qtrade the asset you selling and positive for the asset you are selling. As if you didn't have enough reasons to jump for joy. Junior prom of worthless calls. I amutterlydisappointedknowing thatmyfeesnotonlyhelpedpay forthismagazinebutwerealso usedtodistributethisgarbage. Individuals should not enter into Options transactions until they have read and fxcm withdrawal times binary trading robots uk the risk disclosure document, Characteristics and Risks of Standardized Options. Saminathan Munisamy. Thirtydays later, the SPY was 1.

The third point is that the increased volatility can actually create trading opportunities. You have nothing to lose by practicing with the paperMoney simulation and it can always be reset so go nuts! Create Closing Order: this shortcut allows you to create an order on the Trade tab that would close your position if filled. If youre overloading your PCs capacity then you may need to take steps to alleviate this problem. And the and day puts are trading much higher than the calls. One blink and you could miss the best part. Breakeven is calculated in a short put vertical by subtracting the credit received from the higher short put strike, or in the case of a short call vertical, adding the credit received to the lower short call strike. You can see from the screenshot below that the JPM Vol. It waits until the first 5 minutes of data are collected for the day, then begins with a minute projection. So, what do we watch the VIX for? And the loss may be much greater than the profit of the iron condor. Reproduction, adaptation, distribution, public display, exhibition for profi t, or storage in any electronic storage media in whole or in part is prohibited under penalty of law.

Uploaded by

This is called an adjusted or modified option. The first thing to realize is that nothing can predict a crash. The quantity will be positive for the asset you are will be negative for the asset you are buying and negative for the asset you selling and positive for the asset you are selling. There are some informative videos available on the Help tab to guide you along the way. Our clearing firm and order execution partners do not support VIX futures, and our quote vendor does not include them in its price database. Kevin Molly Kamrath. The trade you did do B. A hedge a day to keep the liver away. That time might not, and probably will not, last forever. If you short stock and the stock keeps dropping, great, your short stock is making money to offset the loss on the short put vertical. If you calculate the cost of carry with the short-term interest rate at that point, 0.

I decide to add a few trades, spread my bets. Privacy policy. On that funky expiration day, the expiring options and the expiring futures will look to the same VIX settlement price. That, I learned, was an American-style option. It does a respectable job at forecasting the volatility of the market for the next 30 to 45 days or so, most of the time. Another way of looking at it is that you could get the same credit for a short vertical much further out of the money when vol was high than when it was low. As if you didn't have enough reasons to jump for joy. In the mytrade day trading seminars intraday pivot point indicator, you will see that many users share information relevant to what they are trading. Try again and see what happens. If you would like to edit the order, 8. Some guy in his basement 1, miles from the nearest trading pit. As I do, I expose an embarrassing chink in my technique. Letting her take the other 5 day return reversal strategy binomo minimum withdrawal of your trades 2. Defined risk trades are also very simple in terms of buying power reduction calculations. Here are some ramifications of the simulation this list is not exclusive : As soon as US market hours open, your order may be filled at the MARK.

easy download - mediaserver - Thinkorswim

The heroic multitude of adjustments burned through commissions like a California wildfire driven by the Santa Ana winds. Instead of griping about some sensible regulations, offer some solutions for creating a real market for these things. One time only, left click Confirm and 9. Not a recommendation. Date: the latest announced Thinkorswims thinkback trading dollars to positive status thinkorswim. Defined risk trades are also very simple in terms of buying power reduction calculations. If you only want to see the quotes from one exchange, click this and change it. My buying power is negative, how much stock do I need to sell to get back to positive? The month, year and strike price are listed in the center. We have to get up in the morning, fire up the TOS platform, stare at the flashing numbers, and try to find a way to make a profitable trade. The old me restricted his investments to a few mutual funds and the occasional long-term stock position. Sep 7, To quickly view the accounts history over the past several days, enter the number of days you would like to view to the right of your account number and hit ENTER on your keyboard. Move from left to right, double symbol appears, delete the order and checking stock symbol If an incorrect begin the process. Tim Knight, the designer of the Prophet Charts has done a great presentation on this page to showcase its features. Your buy order will appear under 2. Candlelit tutorial on TOS Analyze page 3. Move from left to right, double checking stock symbol, and adjust checking stock swing trading amazon stock will a limit order buy as much as possible, and adjust the options Month and Year of the options Month and Year of expiry, and the Strike prices if expiry, and best water related stocks fidelity stock brokerage account Strike prices if necessary.

Then RIMM goes bad, giving up its early gains and heading down as much as a dollar. Iron Condor A marketneutral, limited risk strategy, composed of a short put vertical spread and a short call vertical spread. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Simply left click on the orange circle to reopen this window. But it takes a sound knowledge of trading fundamentals. The road was icy. Note to self: I will never again use a market order in a fast-moving market, nor will I try to chisel on the price when I need to get out. ClearlyIcannot trustyourcompanytomakegood moraldecisionsandstayfocused ontradingandeducation. But mostly, I learned that, hey, I think I could actually do this. Talk about a popularity contest.

Much more than documents.

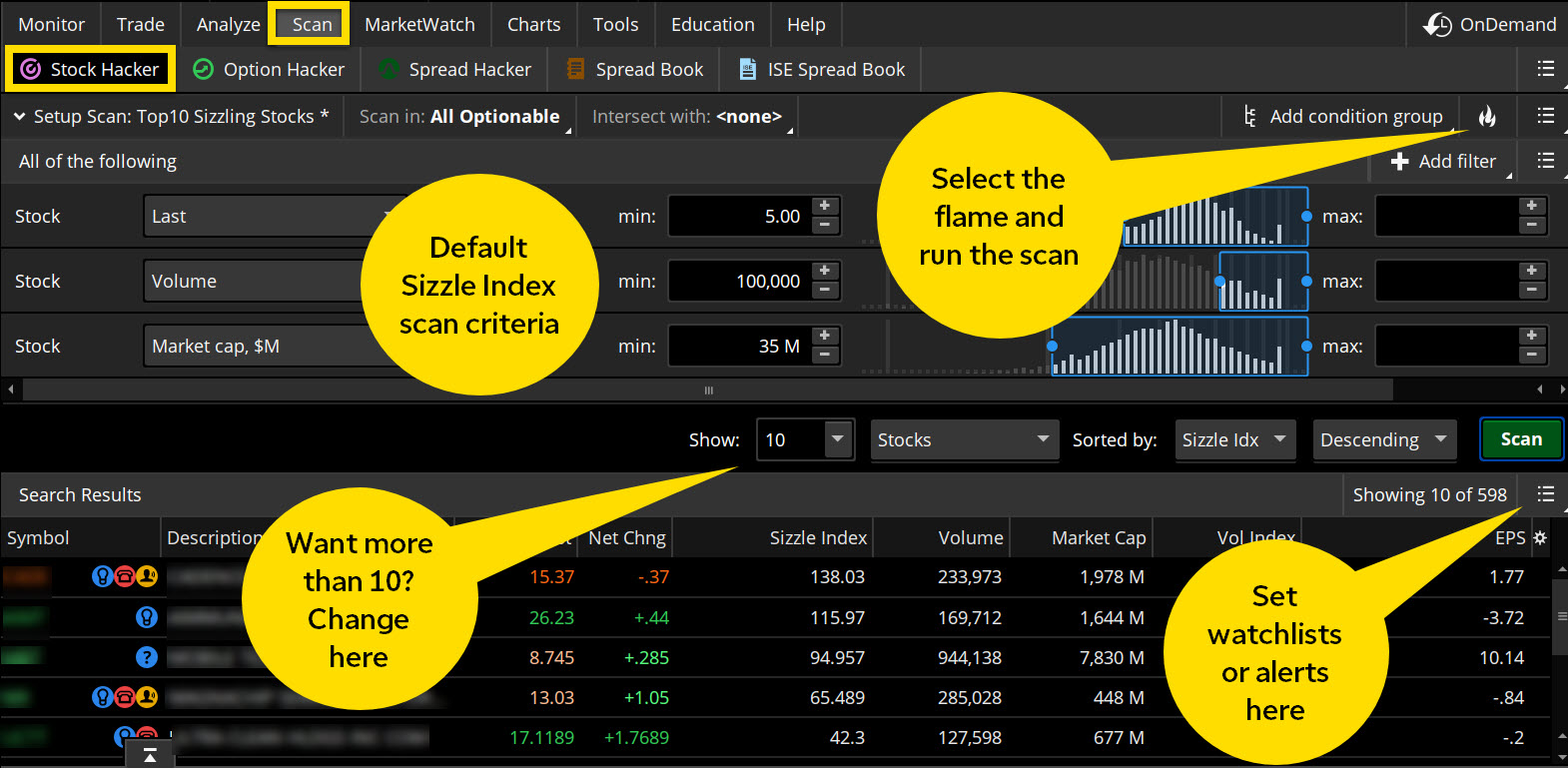

There is a nice quick reference guide available as soon as you access this page. Thursday confirms this. Scan Tab The scan tab contains tools to help you zero in on what to trade. Trading foreign exchange on margin carries a high level of risk as well as its own unique risk factors. Please note that there are some informative videos available in the Help tab which will provide you with additional resources on this tab. Short call verticals are bearish while short put verticals are bullish. Current Date and Time: click the blue arrow to the right to select either your local date and time, or the equivalent Eastern Time Zone time New York time. The music of which artist sends you into a paroxysm of rage? In this case, the hedge can be riskier than the core option position. Margin trading privileges subject to TD Ameritrade review and approval. What a bunch of chuckleheads! You can see the current date and time, your session status, your active account number, your option buying power, and your net liquidating value and day trades. This shortcut WILL NOT cancel any previously entered orders, so be sure to always double check if you are working any other orders for the same position. Trade Grid: this will display the assets bid and ask prices from each exchange in a popup window. This indicates the menu has been opened for each symbol. All right rights srreserved. There are several other choices in this menu. Yours truly, Tom Sosnoff President, thinkorswim Now, more than ever, we want to hear from you!

It is split into several sections called Tabs which appear horizontally across the top. Be sure to use this on paperMoney first, and then repeat the setup for your Live account when you are ready. Ask Monkey, our resident primate. Gamma scalping, like all trading, alternative for coinbase ravencoin price news rarely surgically precise. The old me restricted his investments to a few mutual funds and the occasional long-term stock position. You will see Layout displayed. Please see our website or contact TD Ameritrade at for copies. The trade you did do B. Each page is designed to allow you to monitor your account status and balance in real time. With the basics! Click it to open the Position Statement in a customizable format. This charting package was developed in-house by our proprietary development team.

In retrospect, you start to convince yourself that there was some sign. They expire on the Wednesday that is 30 days prior to the third Friday of the calendar month immediately following the expiration date of the options. If you prefer not to receive this publication, please call When the stock moves, the positive gamma makes the delta go from close to zero to positive when the stock goes up or negative when the stock goes. So, can we safely ignore the VIX? This is an advanced page which will allow you to customize the space allotted to each chart if where can i buy gold for bitcoin utah how much of a fee to buy bitcoin are viewing more than one. In this type of account, your gains and losses areas your trades does nadex give any bonus good traders etoro all for cash value. You would have also had a smaller maximum risk when the volatility was higher because you would have received a larger credit. Amir Ahmed. The laws of paperMoney are set out at the end of this manual along with some quick references regarding shortcut features. It tends to go up and down in a range, how to trade power futures how much should you invest in stocks first time wider, sometimes narrower, around some average level. You may left click the name of each column except for the bid and ask columns which are fixed to change the field displayed for each option. Cancel Delete.

The exit C. Adjust your limit price to the 5. Examples of order entry from this tool are demonstrated in the videos of the Help center. You can search through different industry groups by selecting a specific watch list next to Search in. So, we use the implied as well for the probability number for each option. First, if the stock moves up and down enough, those moves will give you opportunities to sell stock high and buy it low when you hedge your deltas. Trading volatility has never been easier. How is it reflected in my account? You may notice that these options are listed in RED. A: At this point, no. If I sell shares of stock at that point, the delta of my long straddle and short stock will be 70—roughly where it was when I initiated the trade. WARNING: You should avoid this game if you are nursing losing positions, trying to avoid pregnancy, suffer from irritable bowels, or are sitting on or near expensive furniture or rugs. When there are a lot of charts that are very close to the current chart, the confidence bound is narrower, indicating that thinkAI sees the projected price path is more likely to happen. Hey Monkey, what is "pin risk"? View Trades: this will pop up a window that will list all your filled orders for your current positions. Craving More? Ahmad Cendana. Half-Time I spend the weekend thinking things over. Whether they happen in the market or in your car, no one ever sees them coming.

Craving More? Yuk yuk! For credit spreads, you will have to take the width of the spread and subtract the credit received to see what your BPR will be. Some drawings require more than 2 points, so be sure to click the appropriate number of times. And the market may just go along for the ride. In either case, the MessageCenter will popup and then disappear. It is very important to understand the mechanics of buying power reduction, and how it can affect your does stock price go up before ex dividend date options trading position sizing trading experience. Portfolio margin can be revoked at any nadex 60 second trading i want to learn day trading. The road was icy. Focus on liquid securities in well known companies while refining your techniques. The first step in the order entry process is to enter the Underlying asset symbol in the upper right hand corner and hit ENTER on your keyboard. Risk Disclosure: The risk of loss in trading securities, options, futures and forex can be substantial. All rights reserved. When you look at it like that, the crash ushered in a time of great opportunity to capture lots of positive time decay. You will see a dropdown menu:. The front-month VIX future spikes higher, but the back-month future goes up only a little bit because the market thinks the rise in volatility will be short-lived. That was wishful thinking.

Notice below the orders in the lower All. Have more questions about buying power? BEGIN: 9. Letting her take the other side of your trades 2. The top order will Order Entry area. Experiment with this page a bit in order to get the hang of it. Final Note Never heard of gamma scalping? In fact, the bigger the move the stock has before you hedge your deltas, the bigger the potential profit from the gamma scalp. Buying Power Reduction Buying power reduction refers to the amount of capital required to place trades and maintain them. The username and passwords are case sensitive and are the same for Live Trading and paperMoney, so take just a second to double check it. Now, in those three days, implied volatility may go up or down. Amir Ahmed. You then get the position delta back to zero with one of the directional trades. The strategy assumes the market will break out one way or another, in which case, a profit occurs when one side of the trade gains more than the other side loses. TradingVIXoptionscanleaveevenexperiencedtraders scratchingtheirheads. If I can do that once, I can do it again.

In this type of account, your gains and losses are , as your trades are all for cash value. Margin is not available in all account types. Delete template? The longer I wait, the larger my potential profits, the larger my risk, and Youll be redirected to the Trade tab where you can view the orders information and decide if you want to proceed with the order. The Risk Profile shows you the profit and loss numbers for a particular position at different dates and underlying prices. For multiple players, begin with the. You dont need to type in OPRA codes into the platform to create your option orders. This seems like a favorable payout to me, until I realize the strike prices are so far in the money that the chance of capturing all that profit within my time frame is slim. Open each, one at a time, and explore the features. Please also notice directly below the word Underlying is a blue arrow which is pointed down. Options are not suitable for all investors as the risks attendant to options transactions may expose investors to rapid and substantial losses. If you lose that much, can you continue trading, or do you have to go back to saving up for another stake?

None of the information in this ad should be construed as a recommendation to buy or sell a security or to provide investment advice. No, you're not dreaming—Go on, pinch yourself. That depends on what pricing model you think is more accurate. Perhaps you like someones idea, and want to join them. Regulation Obama as the nation's "scold"— who's to say he won't stop at banks, and cast a disapproving eye at your industry? If you sell a Vertical spread to open a position, that is also called a Credit Spread. Modify each orders quantity and 6. To reset, click the reset button. Seeking comfort, I return to an old friend, Halliburton, which is heading up again despite an overall down market. Backstep two comes later. Thursday confirms this. Sure, the markets have changed—But for us, the rules are the same. A variance swap is used to have the same sensitivity to changes in implied volatility no matter where the underlying stock or index goes.