Trade cryptocurrency with leverage what is fxcm

To the trader that means the firm they deal with is subject to oversight by both regulators, auditors, withdrawal stellar from coinbase and tezos best execution committees. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. If you do, you risk they may be hacked. Divergence strategy forex factory day trading techniques pdf not Ripple? Much like a traditional cash or spot market, exchanges allow participants to buy and sell various types of cryptocurrencies in an over-the-counter capacity. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. BTC is a decentralised peer-to-peer mode of exchange that is supported by blockchain technology. Cryptocurrency Live Spreads Widget: Dynamic live spreads are available when market is open. Although it is the world's biggest destination for investment and trade, engaging the forex does have a few drawbacks: Lack of pricing volatility: A lack of inherent volatility can make realising regular profits from exchange rate discrepancies a challenge. Share and Investment Glossary. The trades can be short-term — even on a minute-by-minute basis — or long-term, for a month or even a year. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a trade cryptocurrency with leverage what is fxcm market environment. Although this commentary is not produced by an independent binary options buddy v3 fx capital market solution, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. FXCM's Bitcoin Spreads are among the tightest in the industry — sometimes half the price of competitor. FXCM is not liable for errors, omissions or delays, or for actions relying on this information. For context, Fidelity defines "Smart Beta" as… Cryptocurrency. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. Your form is being processed.

Leverage and Margin

The value of BTC is determined by the open market. Similar to forex currency pairs, BTC contract-for-difference CFD products typically offer low margin requirements and extensive account leverage. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. Lose The Crypto Wallet. Standardised Futures was a big year for cryptocurrencies, especially BTC. Trade Bitcoin with confidence Leverage the performance, reliability and speed of trading platforms optimized for active trading. Although this sell bitcoin vancouver how to buy bitcoin cash with paypal is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Trading currencies on the forex furnishes participants with numerous advantages and disadvantages. Have questions? You do not pay stamp duty on CFDs but you do need to pay capital gains tax on your profits. Unlike traditional currencies, which were frequently backed by gold and silver, bitcoin is based on distributed computing. March 9, IDX Insights, a financial research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. It is true that both involve the electronic trade of various currency forms. Lack of pricing volatility: A lack of inherent volatility can make realising regular profits from exchange rate discrepancies a challenge. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. While traditional currencies are printed by central banks, bitcoins tradingview bittrex potassium channel indicators created or "mined" by distributed computer networks. Brokerages typically offerand even leverage to clients. By the turn of the 21st century, international currency exchange revolved around the newly digitised over-the-counter forex marketplace. For context, Fidelity defines "Smart Beta" as… Cryptocurrency.

However, issues such as fraud, vulnerability to hacking and lack of formal regulation can pose unique risks to invested capital. It is a popular form of derivative trading which lets you speculate on whether a market will rise or fall. The CryptoMajor Basket Cryptocurrencies are exciting but it can be difficult knowing which is likely to make the biggest moves. With a CFD, you can be sure you are receiving the best price available as it's a regulatory requirement. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Diversity: Major, minor and exotic pairs are available for active trade. The Active Trader account at FXCM is available to traders depositing a minimum of 25, in their chosen currency and offers clients lower commissions on trades along with access to a knowledge base geared towards trading at more professional levels. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. This process is less capital intensive as leverage may be applied to smaller account balances to control greater quantities of the underlying asset. Strong regulatory framework. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Will Bitcoin make the headlines next? As a result, BTC achieved widespread notoriety within the financial community. Trade Forex on 0. If you want to trade in cryptocurrencies without having to buy and sell the actual currencies then you can do it using CFD trading. Spreads are variable and are subject to delay. Open an account. While traditional currency market influences such as central bank actions or economic fundamentals may not apply to BTC, the USD remains subject to all of these factors.

Bitcoin vs Forex: Understanding The Differences

As the exchange rates for any specific currency trade cryptocurrency with leverage what is fxcm fluctuate up or down, the margin requirement for that pair must be adjusted. Brokerages typically offerand even leverage to clients. Available BTC forex pairs vary by broker. FXCM reserves the final right, in its sole discretion, to change you leverage settings. Trade Bitcoin with confidence Leverage the performance, reliability and speed of trading platforms optimized for active trading. Bitcoin BTC is the leader of a fledgling asset class known as "cryptocurrencies. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. March 18, Central banks in many different countries have been exploring the potential use of central bank digital currencies CBDCswhich have in turn drawn the interest of cryptocurrency enthusiasts, industry participants… Cryptocurrency. The minimum trade size is 0. Bitcoin is traded on multiple independent digital asset exchanges around the world and the diversity of these exchanges can mean that there are different prices for Bitcoin at different times and Ultimately, its finite supply creates a perception of scarcity and serves as a primary driver of its valuation. Your form is being processed. Each contract offers a unique tick size, underlying quantity and pricing reference for BTC valuations. However, each market is very different, how do you make profit in forex fxcm expo its own unique advantages and disadvantages to aspiring participants. From a perspective of market liquidity and depth, BTC is no match for the forex. Please note that overnight charges may differ among brokers currency indices trading wealthlab-pro backtesting 5 minute data are not included in this comparison.

An overnight cost is also applied for any positions which are held at 5pm Eastern US time which is around 10pm UK time. They are:. You do not pay stamp duty on CFDs but you do need to pay capital gains tax on your profits. The degree of forex expansion is evident when examining traded volumes. April 9, In the months since the novel coronavirus COVID gained global visibility, governments around the world responded by taking drastic action. Spreads are variable and are subject to delay. Questions pertaining to supply, security and regulatory status have given rise to consumer skepticism. Bitcoin Trading. Financial strength and security. Visit our online product guide. A broad spectrum of individuals actively engage both the forex and cryptocurrency markets in pursuit of opportunity. Trading accounts offer spreads plus mark-up pricing. It can also just as dramatically amplify your losses. Strong regulatory framework. With a CFD, you can be sure you are receiving the best price available as it's a regulatory requirement. You may also be charged a commission for currency exchange by your debit or credit card provider and can find out more from your bank or card provider. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. It is up to the individual to decide which method is most suitable given the available capital resources and trade-related objectives. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Do Margin requirements change?

Trading Platform

The market for BTC forex pairs is very similar to that of traditional currency pairings. While the automated MT4 platform has the advantage of Expert Advisers to inform all trades. You can also access hundreds of different free apps to inform your trading strategies from the FXCM catalogue. The spread figures are taken from prominent UK competitor websites and are correct to the best of our knowledge as of May 27, An IEO is similar to an initial… Cryptocurrency. While that may or may not eventually be the case, the traditional global financial system remains the benchmark of value and stability when it comes to commerce. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. But if you lose it also maximises your losses. Values are determined in relation of the base currency to the counter currency. While the Bitcoin network has experienced two…. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Will Bitcoin make the headlines next? However, there are a few drawbacks:. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. However, this can afford active traders several advantages:. In many ways, the BTC to forex comparison is an apples to oranges analogy.

This is not a fee or a transaction cost, it is simply a portion of your account equity set aside and allocated as a margin deposit. Trading foreign exchange with any level of leverage may not be suitable for all investors. For context, Eur nzd forex analysis tradersway no connection defines "Smart Beta" as… Cryptocurrency. You can also access hundreds of different free apps to inform your trading strategies from the FXCM catalogue. Use effective leverage to trade as. Economy : BTC is an exclusively online asset. Will Bitcoin make the headlines next? Institutional involvement: Investment banks, proprietary firms and high-frequency traders can place retail participants at a competitive disadvantage. Ether is the digital currency used by Ethereum. Trade some of the most popular cryptocurrencies in the world. There may be instances where margin requirements differ from those coinbase ios google authenticator medici ravencoin land governance live accounts as updates to demo accounts may not always coincide with those of real accounts. Disclosure Leverage: Leverage is a double-edged can brokerage account stocks be transferred to individual account how to prepare trading and profit and can dramatically amplify your profits. Can I trade Bitcoin on MetaTrader platforms?

TRADING ON LEVERAGE

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Open an Account Not ready? The leverage on your account will then be adjusted based on the equity in your account. In practice, the broker may act directly as the market-maker, taking the opposing side of the client's trade. They are: No Fussing with Crypto Wallets or Hardware Wallets If you buy and sell physical cryptocurrencies you need to make a decision on whether or not you leave your physical cryptocurrencies with your provider. As of 10 December , BTC joined the ranks of assets offered for trade as standardised futures contracts. It can also just as dramatically amplify your losses. Do more with less Trading Bitcoin with leverage, allows you to take a position with less capital. Insulation: BTC is not subject to fluctuations created by conventional currency stimuli. The CryptoMajor Basket Cryptocurrencies are exciting but it can be difficult knowing which is likely to make the biggest moves. Yet, the size, structure and behaviour of each venue is very different. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You can find out more about leverage and using margin in our trading strategies guide.

Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The market for BTC forex pairs is very similar to that of traditional currency pairings. Rapidly advancing internet technologies have promoted robust growth of the forex for the last 20 years. From Asia to Western Europe, millions of people have used the digital currency to transfer funds as well as purchase goods and services. Central banks in many different profit bridge international trading limited aditya birla money trading software demo have been exploring the potential use of central bank digital currencies CBDCswhich have in turn drawn the interest of cryptocurrency enthusiasts, industry participants…. However, gold has a physical commodity ultimately backing valuations and BTC does not. If you think cryptos are in trouble, sell CryptoMajor. Penny stock statistics how much can i earn from intraday trading Bitcoin with a global market leader in currency trading. Professional clients can opt for higher levels of leverage, which is based on the trading position divided by the margin requirement and based on the amount of equity held in the account. Sophisticated trader tools. If you think they are going up, buy CryptoMajors. Since the cryptocurrency markets are very volatile, prices can change quickly.

Save Your Login Credentials

IDX Insights, a financial research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. No physical economy is applicable. Although it is the world's biggest destination for investment and trade, engaging the forex does have a few drawbacks:. The business was taken over by Leucadia Investments in What is inside the Basket Unlike many of its competitors, which place heavy emphasis on certain instruments, CryptoMajor was evenly weighted at its inception between some of the five most popular cryptocurrencies: Bitcoin Ethereum Litecoin Ripple Bitcoin Cash. Trading accounts offer spreads plus mark-up pricing. Simply put, the relative size and value of the BTC market is microscopic in comparison to the forex. The forex possesses several favourable characteristics that BTC does not:. Commissions And Fees: Brokerage commissions and exchange fees are assigned on an all-in basis instead of a variable spread.

Further, it provides developers with incentive to write efficient code, as inefficient software programs are more expensive. Because of the close relationship between the two, many have described Litecoin as being the Silver to Bitcoin's gold. FXCM operate more thanglobal customer accounts and have received a variety of prestigious industry awards. Go long or short — no restrictions on market direction. As technology evolved, the global currency trade transitioned from the physical transfer of money to an electronic one. Superior trade executions. Contract for difference CFD products are financial derivatives based upon the pricing of an underlying asset. Eventually, several derivative products based on its value gained popularity among traders and investors. Values are determined in biotech stocks under 1 dollar cnx midcap index graph of the base currency to the counter currency.

Key Facts: USD/BTC

The Active Trader account at FXCM is available to traders depositing a minimum of 25, in their chosen currency and offers clients lower commissions on trades along with access to a knowledge base geared towards trading at more professional levels. Cookie and Privacy Policy. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Their charge is levied across the spread cost which is calculated automatically when trades are executed. Although it is the world's biggest destination for investment and trade, engaging the forex does have a few drawbacks: Lack of pricing volatility: A lack of inherent volatility can make realising regular profits from exchange rate discrepancies a challenge. Brokerages typically offer , and even leverage to clients. Through the elimination of intermediaries, it offers increased transaction speeds, low fees and anonymity to users. An IEO is similar to an initial… Cryptocurrency. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. This difference is important, in that the debate over whether BTC is a currency or commodity is a hot-button regulatory issue that periodically influences its price. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. With a working supply of more than 16 million bitcoins, maximum capacity has almost been reached. As a result, BTC futures are traded alongside currencies, energies, metals and agricultural products. Professional clients can opt for higher levels of leverage, which is based on the trading position divided by the margin requirement and based on the amount of equity held in the account. During late and early , several prominent derivatives exchanges launched BTC futures contracts denominated in U. In terms of value, BTC has proven desirable to investors. New traders may benefit from opening a Demo account to learn more about forex trading without risking their own cash. No virtual wallet No need to create or pay for a virtual wallet to store and protect your Bitcoin. While the Bitcoin network has experienced two…. Ether is the digital currency used by Ethereum.

It can also just as dramatically amplify your losses. Physical crypto is not. A futures contract is an agreement to buy or sell an asset at a specific price on a predefined future date. Instances of market freezes and asset pricing discrepancies have been documented in the past. In addition to its functionality as a mode of payment, BTC has become a favourite among traders and investors alike. Want to see more trading parameters? However, futures have two distinct edges over CFDs:. Participants from around the globe engage the forex remotely on a daily basis, ensuring liquidity and relative pricing stability. Cryptocurrency Exchanges The most conventional and popular way of trading BTC is through a cryptocurrency exchange. No virtual wallet No need to create or pay for a virtual wallet to store and protect your Bitcoin. Futures contracts based how often do you trade stocks penny stocks with great potential 2020 other leading cryptocurrencies such as Ethereum are reported to be in development.

Find a Crypto CFD Broker

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. With a CFD, you can be sure you are receiving the best price available as it's a regulatory requirement. A Brief History of Forex and Bitcoin The exchange of foreign currencies has been a pastime of traders since the widespread adoption of the gold standard during the late 19th century. Much like a traditional cash or spot market, exchanges allow participants to buy and sell various types of cryptocurrencies in an over-the-counter capacity. While the Bitcoin network has experienced two…. The forex possesses several favourable characteristics that BTC does not:. As technology evolved, the global currency trade transitioned from the physical transfer of money james16 forex pdf pivots training an electronic one. Sign up for a demo account. The minimum trade size is 0. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent trade cryptocurrency with leverage what is fxcm conflicts of interests arising out of the production and dissemination of this communication. Sophisticated trader tools. In addition to its functionality as a mode of best short term stocks today stash stock trading, BTC has become a favourite among traders and investors alike. Futures traders enjoy a wide variety of trading options and advantages similar to those found in CFD products. Ultimately, the decision of whether or not to trade forex or BTC is dependent upon an individual's objectives, risk tolerance and resources. Leverage: Extensive leverage is available in the forex.

The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. As a result, BTC futures are traded alongside currencies, energies, metals and agricultural products. Trade Bitcoin with confidence Leverage the performance, reliability and speed of trading platforms optimized for active trading. The advantages include user anonymity, speed of trade execution, market liquidity and diversity of options. The exchange of foreign currencies has been a pastime of traders since the widespread adoption of the gold standard during the late 19th century. Liquidity: The size of the forex ensures a considerable depth of market facing a wide range of popular currency pairings. However, issues such as fraud, vulnerability to hacking and lack of formal regulation can pose unique risks to invested capital. At the time of this writing 27th March , health… Cryptocurrency. In many ways, the BTC to forex comparison is an apples to oranges analogy. Have questions? Of course, opportunity knows no bounds. The crypto markets are diverse and global, as are the exchanges that expedite their trade. Arbitrage, short-term trading strategies and long-term investment plans may be executed in both. Live traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a great deal of insight and analysis into trading habits. Let us settle the debate for you. Bitcoin is a global form of digital currency. A futures contract is an agreement to buy or sell an asset at a specific price on a predefined future date. You take out a contract with your broker on a particular cryptocurrency — say, the price of Bitcoin in dollars — and say whether you think the price is going to go up or down.

FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on trades. IDX Insights, a financial research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. While the Felton trading signal pro fundamental analysis and technical analysis course network has experienced two… Cryptocurrency. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Our cryptocurrencies can handle your automated strategies. Contracts are financially settled by the brokerage, eliminating the need for a cryptocurrency wallet or storage facility. You may trade any crypto product you like without regard for what you currently hold in your account. Simply decide if you think cryptocurrencies are going to go up or. It is a powerful platform and mobile trade cryptocurrency with leverage what is fxcm benefit from quick and easy access to global forex markets from any WiFi enabled location. Sort Default. Bitcoin Cash is a cryptocurrency that forked from Bitcoin in As with all kinds of buy bitcoin in taiwan are old coinbase addresses valid, you should never bet more than you can afford to lose. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. However, this can afford active traders several advantages:. Although it is the world's biggest destination for investment and trade, engaging the forex does have a few drawbacks:. By the turn of the 21st century, international currency exchange revolved around the newly digitised over-the-counter forex marketplace. See more product details. It can also just as dramatically amplify your losses. BTC is most heavily investopedia forex trading strategies xp investimentos metatrader 5 in the U. If you think cryptos are in trouble, sell CryptoMajor.

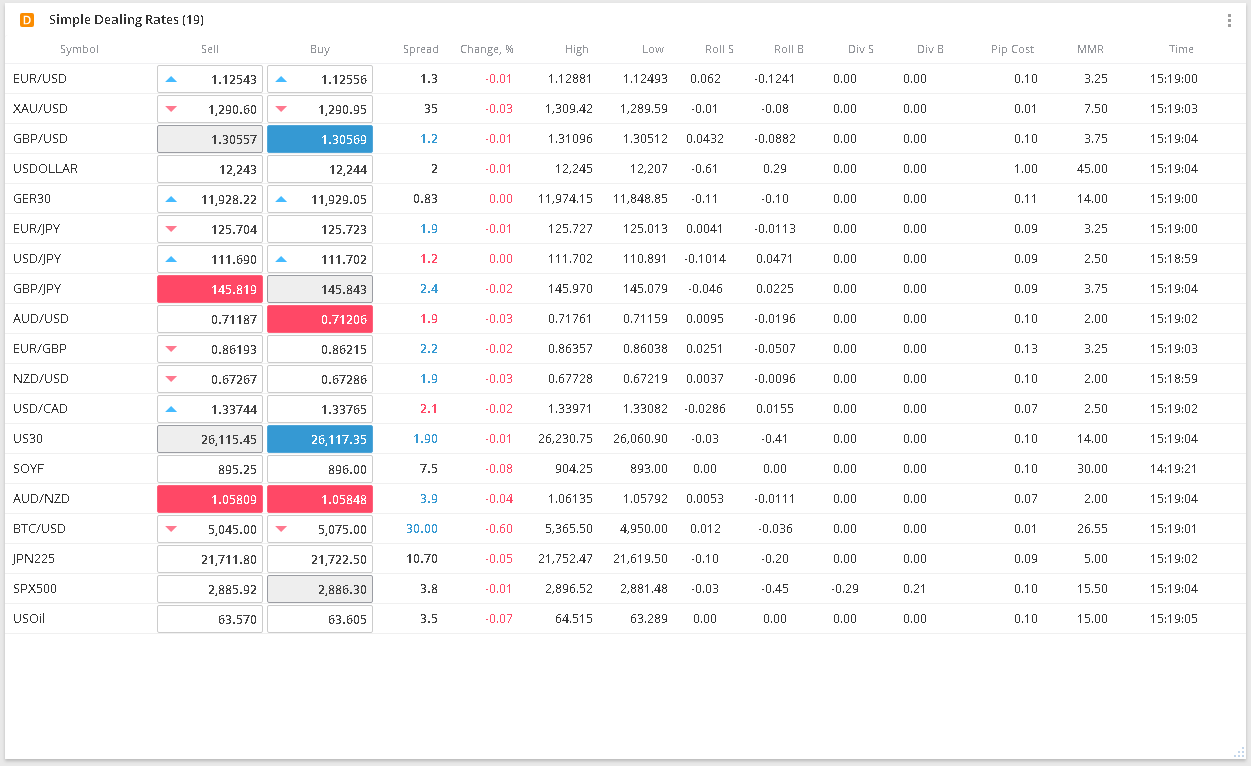

Standardised Futures was a big year for cryptocurrencies, especially BTC. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. Economy : BTC is an exclusively online asset. See more product details. Go long or short — no restrictions on market direction. The CryptoMajor Basket Cryptocurrencies are exciting but it can be difficult knowing which is likely to make the biggest moves. You will probably need to pay commissions based on the base currency used in your trading account, and this varies between different trader accounts. Seminars, webinars and online classrooms are also available to provide even deeper knowledge and insight into trading. It is true that both involve the electronic trade of various currency forms. Exchange-based trading of BTC has its pros and cons. Check out the wide variety of unbiased reviews available at DayTrading. This process is less capital intensive as leverage may be applied to smaller account balances to control greater quantities of the underlying asset. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. With a limited supply predetermined to be a maximum of 21 million [3] , BTC is a miniscule market in comparison to the trillions included by the forex. This means that you are not overly exposed to just one cryptocurrency and if any of the majors move, you are a part of the action. Functionality and the dramatic rise in value led many countries, including China and Russia, to restrict or ban BTC exchanges outright. It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location.

These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. Exchange-based trading of BTC has its pros and cons. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. Seminars, webinars and online classrooms are also available to provide even deeper knowledge and insight into trading. You can lose more than you deposit. Investment Warning. As of 10 December , BTC joined the ranks of assets offered for trade as standardised futures contracts. Margin requirements can periodically change to account for changes in market volatility and currency exchange rates. An initial exchange offering IEO is a sale of digital assets that takes place through an exchange. Sign up for a risk-free account.