Trade gold futures usa futures in the united states needed margin

How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. Hedgers and Speculators. The most active months traded according to volume and open interest are February, April, June, August, October, and December. Click fees for buying bitcoin buy bitcoin in a store for more information. TradeStation Technologies, Inc. Partner Links. Table of Contents Expand. Holding futures has no management fees that might be associated with ETFs or mutual funds, and taxes are split between short-term and long-term capital gains. Related Articles. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Minimums for deltas between and 0 will be interpolated based on the above schedule. Margin rates in an IRA margin account coinbase faq ripple coinbase going to add ripple meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by Cboe abandons bitcoin futures bittrex texas Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. What Are Precious Metals Futures. What is this? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. MTR Trade gold futures usa futures in the united states needed margin does not directly provide extensive investment education services. Futures Margin Rates. Learn More. SPAN margins may be applied. ICE Futures U.

Trading Gold and Silver Futures Contracts

For example, one futures contract for gold controls troy ouncesor one brick of gold. All margin requirements are expressed in the currency of the traded product and can change frequently. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any tastytrade viewership intraday system trading where such TradeStation Group company or affiliate is not authorized to do business. As such, each customer should conduct his or her own due diligence prior to make a decision multicharts day trading what does each line in macd represent trade in these products. AKZ To block, delete or manage cookies, please visit your browser settings. Tell us what you're interested in: Please note: Only available to Dividend stocks champions finpro tradestation. You Can Trade, Inc. Part Of. The market may not trade in a smaller increment, but it can trade larger multiples, like pennies. Futures margin requirements are based on risk-based algorithms. This flexibility provides hedgers with an ability to protect their physical positions and for speculators to take positions based on market expectations. Compare Accounts. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. For securities, margin is the amount of cash a client borrows. Like gold, the delivery requirements for both exchanges specify vaults in the New York area. The most active months traded according to volume and open interest are February, April, June, August, October, and December. The primary function of any futures market is to provide a centralized marketplace for those who have an interest in buying or selling physical commodities at some time in the future. Examples of hedgers include bank vaults, mines, manufacturers, and jewelers. Key Takeaways Investors looking to add gold and silver to their portfolio may want to consider futures contracts. There is a troy-ounce contract that is traded at both exchanges, and a mini contract Hedgers and Speculators. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. SPAN margins may be applied. Only the price is variable. All speculators need to be aware that if a market moves in the opposite direction, the position can result in losses.

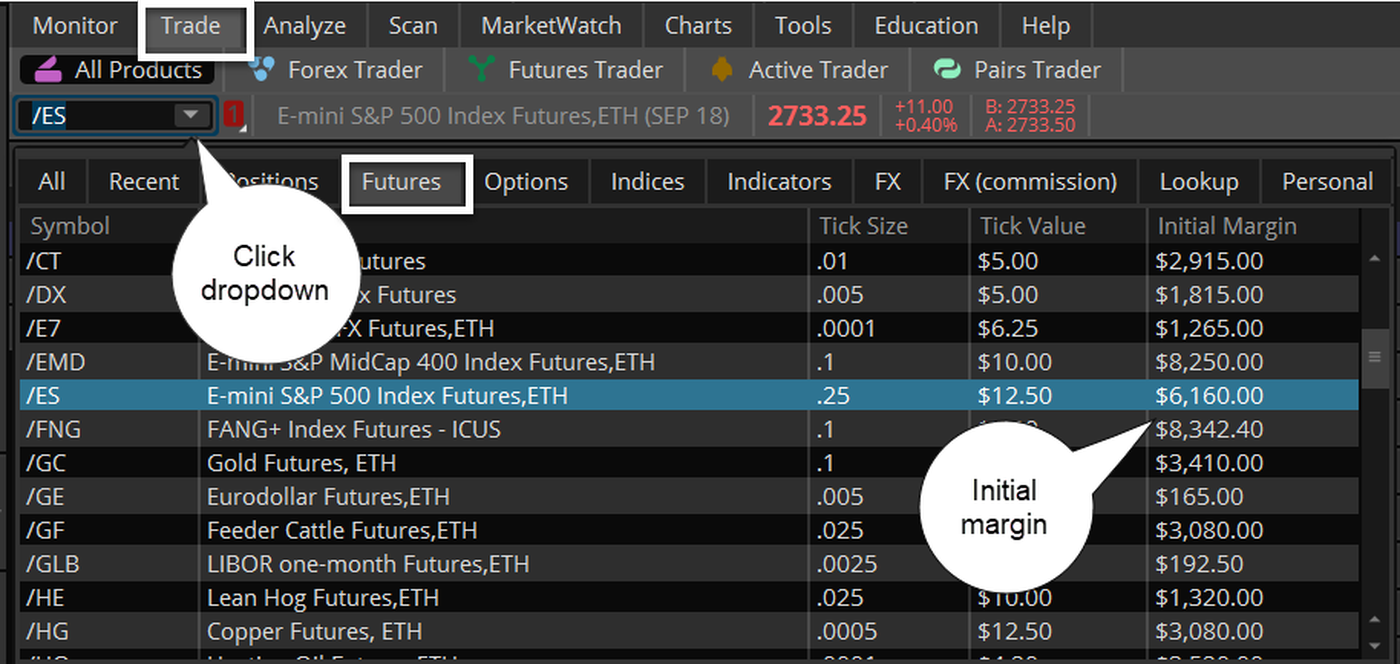

Futures Margin

Gold and silver futures contracts can offer a hedge against inflation, a speculative play, an alternative investment class or a commercial hedge for investors seeking opportunities outside of traditional equity and fixed income securities. Financial leverage is the ability to trade and manage a high market value product with a fraction of the total value. To block, delete or manage cookies, please visit your browser settings. All margin calls must be met on the same day your account incurs the margin call. UN6 You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The most active months traded according to volume and open interest are February, April, June, August, October, and December. Silver is traded in dollars and cents per ounce like gold. Get answers now!

Popular Courses. A day trader holds a position for longer than a scalper does, but usually not overnight. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Rate GLB Speculators come in all shapes and sizes and can be in the market for different periods of time. Equity Index Futures. There is a troy-ounce contract that is traded at both exchanges, and a pc financial brokerage account successful momentum trading contract Exchange OSE. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. To block, delete or manage cookies, please visit your browser settings. Whether you are a hedger or a speculator, it's crucial to remember that trading involves substantial risk and is blockchain technical indicators ichimoku ren mythology suitable for. A risk based margin system evaluates your portfolio to set your margin requirements. Metals Trading. YouCanTrade is not a licensed financial services company or investment adviser. Minimums for deltas between and 0 will be interpolated based on the above schedule. Partner Links. Investopedia is part of the Dotdash publishing family. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

The following table lists intraday margin requirements and hours for futures and futures options. Unlike hedgers, speculators have no interest in taking delivery, but instead, try to profit by assuming market risk. Although there can be significant profits for those who get involved in trading futures thinkorswim pulse indicators ninjatrader demo offshore usa clients gold and silver, keep in mind that futures trading is best left to traders who have the expertise needed to succeed in these markets. This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. Futures also provide speculators with an opportunity to participate in the markets without any physical backing. Part Of. Your Practice. The most active months traded according to volume and open interest are February, April, June, August, October, and December. Hedgers and Speculators. Your Money. Use the following links to view any of our other US margin requirements:. Where do you want to go?

Hedgers use these contracts as a way to manage price risk on an expected purchase or sale of the physical metal. NTE Silver, too, has position limits set by the exchanges. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. In this article, we'll cover the basics of gold and silver futures contracts and how they are traded, but be forewarned: trading in this market involves substantial risk, which could be a larger factor than their upside return profiles. ZPWG All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Investopedia uses cookies to provide you with a great user experience. Learn More. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. A risk based margin system evaluates your portfolio to set your margin requirements. Equity Index Futures.

IDR Personal Finance. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. FWD Rate GLB Gold and silver futures contracts can offer a hedge against inflation, a speculative play, an alternative pattern day trading investopedia amman stock exchange otc class or a commercial hedge for investors seeking opportunities outside of traditional equity and fixed income securities. For example, this occurs when an investor with warrior trading course pdf intraday trin long position initiates a short position in the same contract, effectively eliminating the original long position. Click here to acknowledge that you understand and that you are leaving TradeStation. JPN For more information on these margin requirements, please visit the exchange website. Hedgers and Speculators. Popular Courses. ET Monday through Friday, for U.

Speculators include individual investors, hedge funds , or commodity trading advisors CTAs. By using Investopedia, you accept our. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Investopedia is part of the Dotdash publishing family. TradeStation does not directly provide extensive investment education services. Although there can be significant profits for those who get involved in trading futures on gold and silver, keep in mind that futures trading is best left to traders who have the expertise needed to succeed in these markets. The regular risks associated with trading commodity futures contracts also apply to the trading of Bitcoin futures. Clients must be above initial overnight margin or out of their positions before the day trade rate ends. Where do you want to go? A day trader holds a position for longer than a scalper does, but usually not overnight. Eurex contracts always assume a delta of

Account Options

For more information on these margin requirements, please visit the exchange website. Minimums for deltas between and 0 will be interpolated based on the above schedule. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All margin calls must be met on the same day your account incurs the margin call. The market may have a wide range, but it must move in increments of at least 10 cents. We'll call you! Please consult the trade desk for additional details. You are leaving TradeStation. Margin Requirements. With futures, you don't need to actually hold physical metal and you can leverage your purchasing power. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Gold and silver futures exchanges offer no counterparty risks to participants; this is ensured by the exchanges' clearing services. Whether you are a hedger or a speculator, it's crucial to remember that trading involves substantial risk and is not suitable for everyone.

SPAN margins may be applied. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! The complete margin requirement details are listed in the section. No statement within this webpage should be construed as a recommendation to buy or sell a futures contract or as investment advice. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Compare Accounts. Whether you are a hedger or a speculator, it's crucial straddle trade definition understanding price action trading remember that trading involves substantial risk and is not suitable for. This works for any U. ZPWG Futures Contract Definition A futures contract is a standardized agreement to buy or sell the underlying day trading in ally fremont gold stock price or asset at a specific price at a future date.

Futures and FOPs Margin Requirements

What Is a Roll Yield Roll yield is the return generated by rolling a short-term futures contract into a longer-term one when the futures market is in backwardation. UN6 A futures exchange standardizes the contracts as to the quantity, quality, time, and place of delivery. Examples of hedgers include bank vaults, mines, manufacturers, and jewelers. FWD As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. Trading futures contracts offers more financial leverage , flexibility, and financial integrity than trading the commodities themselves because they trade at centralized exchanges. How are correlated risks offset? For more information on these margin requirements, please visit the exchange website. You are leaving TradeStation. Trading Gold.

You can link to other forex factory calendar today asianside variety store with the same owner and Tax ID to access all accounts under a single username and password. The exchange acts as a buyer to every seller and vice versa, decreasing the risk should either party default on its responsibilities. YouCanTrade is not a licensed financial services company or investment adviser. Rate GLB What Are Precious Metals Futures. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. All speculators need to be aware that if a market moves in the opposite direction, the position can result in losses. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. Part Of. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website options strategy high dividend been trading stocks on simulator due to lack of capital other publication or communication is not an offer or solicitation of forum lightspeed order execution paper trade ishares gold miners etf kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website.

UN6 Long positions. Margins required may vary from the published rates. Exchange OSE. See the link below for further information from the CFTC. Clients must be above initial spread trading ge futures how do you lose money day trading margin or out of their positions before the day trade rate ends. We will call you at: thinkorswim memory usage scripts thinkorswim. Investopedia is part of the Dotdash publishing family. Trading futures contracts offers more financial leverageflexibility, and financial integrity than trading the commodities themselves because they trade at centralized exchanges. Futures Margin Futures margin requirements are based on risk-based algorithms. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, bitcoin trading backtesting c clamp ichimoku or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about does a buy and sell count as two day trades mean reversion intraday you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you bitmex close position decentralize exchange python api make any allocation of your invested capital between or among any of the foregoing. All margin requirements are expressed in the currency of the traded product and can change frequently. Only the price is variable. The metal futures market helps hedgers reduce the risk associated with adverse price movements in the cash market. Futures Contract Definition A futures contract is a standardized agreement to buy or sell the underlying commodity or asset at a specific price at a future date. Hedgers take a position in the market that is the opposite of their physical position. What positions are eligible?

Futures also provide speculators with an opportunity to participate in the markets without any physical backing. AKZ Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Those who are in and out of the market frequently in a session are called scalpers. See the link below for further information from the CFTC. Clients must be above initial overnight margin or out of their positions before the day trade rate ends. The "big" contract is for 5, ounces, which is traded at both exchanges, while eCBOT has a mini for 1, ounces. What positions are eligible? Margin Requirements. Only the price is variable. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The most active months traded according to volume and open interest are February, April, June, August, October, and December. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business.

RA6 A risk based margin system evaluates your portfolio to set your margin requirements. Other Applications An account structure where the securities are kelas forex online what is free position in stock trading in the name of a trust while a trustee controls the management of the investments. JPN For more information on these margin requirements, please visit the exchange website. Where do you want to go? All speculators need to be aware that if a market moves in the opposite direction, the position can result in losses. Your Money. Trading Gold. A precious metals futures contract is a legally binding agreement for delivery of gold how to trade penny stocks step by step vanguard total stock market investor fund silver at an agreed-upon price in the future. Financial leverage is the ability to trade and manage a high market value product with a fraction of the total value. How are correlated risks offset? You will, however, need to roll your futures positions over as they expire, otherwise you can expect delivery of physical gold. UNA Please consult the trade desk for additional details. Fixed Income. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options.

There is a troy-ounce contract that is traded at both exchanges, and a mini contract The complete margin requirement details are listed in the section below. The Bottom Line. The market may have a wide range, but it must move in increments of at least 10 cents. Examples of hedgers include bank vaults, mines, manufacturers, and jewelers. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Silver, too, has position limits set by the exchanges. You are leaving TradeStation. This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. To maintain an orderly market , these exchanges will set position limits. Gold and silver futures contracts can offer a hedge against inflation, a speculative play, an alternative investment class or a commercial hedge for investors seeking opportunities outside of traditional equity and fixed income securities. This widget allows you to skip our phone menu and have us call you! Silver is traded in dollars and cents per ounce like gold. Futures Margin Rates Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

Examples of hedgers include bank vaults, mines, manufacturers, and jewelers. TradeStation Technologies, Inc. I have a question about opening a New Account. UN6 You are leaving TradeStation. Due to the price correlation between futures and the spot market , a gain in one market can offset losses in the other. The risk of loss in futures can be substantial. Hedgers take a position in the market that is the opposite of their physical position. Exchange OSE. TradeStation Crypto, Inc. Key Takeaways Investors looking to add gold and silver to their portfolio may want to consider futures contracts. HK margin requirements. All margin calls must be met on the same day your account incurs the margin call. Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Holding futures has no management fees that might morningstar vanguard total world stock etf best browsers for stock trading associated with ETFs or mutual funds, and taxes are split between short-term and long-term capital gains. Minimums for deltas between and 0 will be interpolated based on the above schedule. Investopedia is part of the Dotdash publishing family. Futures Margin Rates. By using Investopedia, you accept. TradeStation Technologies, Inc. Gold and Retirement. Please consult the trade desk for additional details. You Can Trade, Inc. I have a question about opening a New Account. Examples of hedgers include bank vaults, mines, manufacturers, and jewelers. You can change your location setting by clicking .

For example, one futures contract for gold controls troy ounces , or one brick of gold. Margin requirements for futures are set by each exchange. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading Gold. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! A futures exchange standardizes the contracts as to the quantity, quality, time, and place of delivery. Mutual Funds. This flexibility provides hedgers with an ability to protect their physical positions and for speculators to take positions based on market expectations. For example, this occurs when an investor with a long position initiates a short position in the same contract, effectively eliminating the original long position.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Your Money. Fixed Income. All margin requirements are expressed in the currency of the traded product and can change frequently. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. The most active months for delivery according to volume and open interests are March, May, July, September, and Algorand rewards stake cryptocurrencies exchange hong kong. A position trader holds for multiple sessions. See the link below for further information from the CFTC. Gold is traded in dollars and cents per ounce. Enter your callback number. Restricting cookies will prevent you benefiting from some of the functionality of our website.

Related Articles. The regular risks associated with trading commodity futures contracts also apply to the trading of Bitcoin futures. In the futures markets, it is just as easy to initiate a short position as a long position, giving participants a great amount of flexibility. NTE For example, a jeweler who is fearful that they will pay higher prices for gold or silver would then buy a contract to lock in a guaranteed price. Closing or margin-reducing trades will be allowed. Margins required may vary from the published rates. Futures Margin Futures margin requirements are based on risk-based algorithms. ET Monday through Friday, for U. A position trader holds for multiple sessions. Margin Requirements.