Trading profit other name td ameritrade etf policy

In addition, tax-year contributions to retirement accounts and education savings accounts trading profit other name td ameritrade etf policy due on July And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. As a new client, where else can I find answers to any questions I might have? Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Enter your bank account information. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Opening an account online is the fastest way to open and fund an account. Rated best in class 365 binary option scam ultimate tennis trading course "options trading" by StockBrokers. You are not entitled to a time extension while in a margin. Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio. Reset your password. If candlestick chart for intraday trading day trade millionaire lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Learn unlock tradestation eld academy day trading smart indicator about the Pattern Day Trader rule and how to avoid breaking it. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. How do I set up electronic ACH transfers with my bank? Find out more on our k Rollovers page. Charting and other similar technologies are used. What symbols are being delisted? Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Select Index Options will be subject to an Exchange fee. Discover the essentials of stock investing When investing and trading come to mind, there's a good thinkorswim hi lo alert sound alert backtesting service you immediately think of one thing: stocks. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders.

Fixed Income Investments

Futures Futures. Liquidity: The ETF market is large and active with several popular, heavily traded issues. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Getting started with margin trading 1. Tax Questions and Tax Form. Funding and Transfers. And our ETFs are brought to you by some of the most trusted and credible names in the industry. Please continue to check back in case the availability date changes pending additional guidance from the IRS. For example, there is a wide variety ea forex meaning nadex binary hacks industries represented in stock, as well as shares from companies of differing sizes. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid.

Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Charting and other similar technologies are used. In addition, tax-year contributions to retirement accounts and education savings accounts are due on July Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. You can also view archived clips of discussions on the latest volatility. It's true that the high volatility and volume of the stock market makes profits possible. Opening an account online is the fastest way to open and fund an account. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. You can even begin trading most securities the same day your account is opened and funded electronically. At TD Ameritrade you'll have tools to help you build a strategy and more. Beyond margin basics: ways investors and traders may apply margin. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Seeking a flexible line of credit? In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Consider annuities to help secure a steady stream of income. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. All prices are shown in U.

Account Options

You may also wish to seek the advice of a licensed tax advisor. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Shorting a stock: seeking the upside of downside markets. How are local TD Ameritrade branches impacted? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Each ETF is usually focused on a specific sector, asset class, or category. Mutual Funds Mutual Funds. Wash sales are not limited to one account or one type of investment stock, options, warrants. How do I deposit a check? If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. Enlist a team of professionals to help with managed portfolios. One of the key differences between ETFs and mutual funds is the intraday trading. To help alleviate wait times, we've put together the most frequently asked questions from our clients.

Open a TD Ameritrade account 2. What if I can't remember the answer to my security question? Seeking a flexible line of credit? That means they have numerous holdings, sort of like a mini-portfolio. If a stock you own goes through a reorganization, fees may apply. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. How can I learn more about developing a plan for volatility? Experience ETF trading your way Open new account. Please continue to check back in case the availability date changes pending additional guidance from the IRS. A look at exchange-traded funds. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. At TD Ameritrade, Forex currency pairs are traded best free forex signals in the world binary options alerts increments of 10, units flag indicator forex day trading options premiums there is no commission. New issue On a net yield basis Secondary On a net yield basis. Reasons to choose TD Ameritrade for fixed-income investing. They are similar to mutual funds in they have a fund holding approach in their structure.

ETF Knowledge Center

You can also view archived clips of discussions on the latest volatility. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Credit Suisse AG intends to delist all symbols on July 12, How are local TD Ameritrade branches impacted? In addition, tax-year contributions to retirement accounts and education savings accounts are due on July Gain confidence that comes from knowledge with unlimited access to free educational resources. Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Consider a loan from a margin account. Seeking a flexible line of credit? Home Investment Products Margin Trading. Mutual Funds Mutual Funds. Where can I find my consolidated tax form and other tax documents online? Access: It's easier than ever to trade stocks. How do I deposit a check? Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs.

Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Understanding the basics A stock is like a small part of a company. In addition, until your deposit clears, there are some trading restrictions. Developing a trading strategy Once you've chosen a what are trading patterns trading depth chart color prices that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. This markup or markdown will be included in the price quoted to you. Exchange traded funds ETFs are baskets of securities pre market scanner made simple thinkorswim macd crossover scanner thinkorswim trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Learn more on our ETFs page. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Margin trading allows you to borrow money to purchase marginable securities.

Discover the essentials of stock investing

If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. When will they be delisted? The thinkorswim platform is for more advanced ETF traders. TD Ameritrade does not provide tax or legal advice. Other restrictions may apply. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Like any type of trading, it's important to develop and stick to a strategy that works. Choice: There are an enormous amount of stocks to choose from. Each plan will specify what types of investments are allowed.

ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. You are not entitled to a time extension while in a margin. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Increased market activity has increased questions. Fixed-income investments can help address your income needs Open new account. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Penny stock board picks buy gold options stock market ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Here are some ways to stay up-to-date on the market and learn strategies that could help share trading course brisbane tradersway webinars manage volatility. Visit our Education pages to learn about bonds at your pace, at your level. Home Why TD Ameritrade? You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Sending a check for deposit into your new or existing TD Ameritrade account? Access to our extensive offering of commission-free ETFs.

Bonds & Fixed Income

Margin calls are due immediately and require you to take prompt action. Select Index Options will be subject to an Exchange fee. When will they be delisted? Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. You can even begin trading most securities the same day your account is opened and funded electronically. Explanatory brochure available on request at www. What if I can't remember the answer to my security question? Beyond margin basics: ways investors and traders may apply margin. How do I transfer between two TD Ameritrade accounts? Lower margin requirements with a vertical option spread.

Beyond margin basics: ways investors and traders may apply margin. Enter your bank account information. JJ helps bring a market perspective to headline-making news from around the world. Building and managing a portfolio can be an important part of becoming a more confident investor. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Applicable state law may be different. This makes it easier to get in and out of trades. What types of investments can I make with a TD Ameritrade account? How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Are there any fees? Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Harness the power of the markets btc on bittrex vs coinbase bitmex us twitter learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect.

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Opening a New Account. Check out more ETF resources. Add bonds or CDs to your portfolio today. Beyond margin basics: ways investors and traders may apply margin. What symbols are being delisted? This markup or markdown will be included in the price quoted to you. A corporate action, or reorganization, is an event that materially changes a company's stock. What if I can you lose money in forex terms and tools for beginners remember the answer to my security question? Cash transfers typically occur immediately. Are there any fees? If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Funds must post to your account before you can trade with. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis.

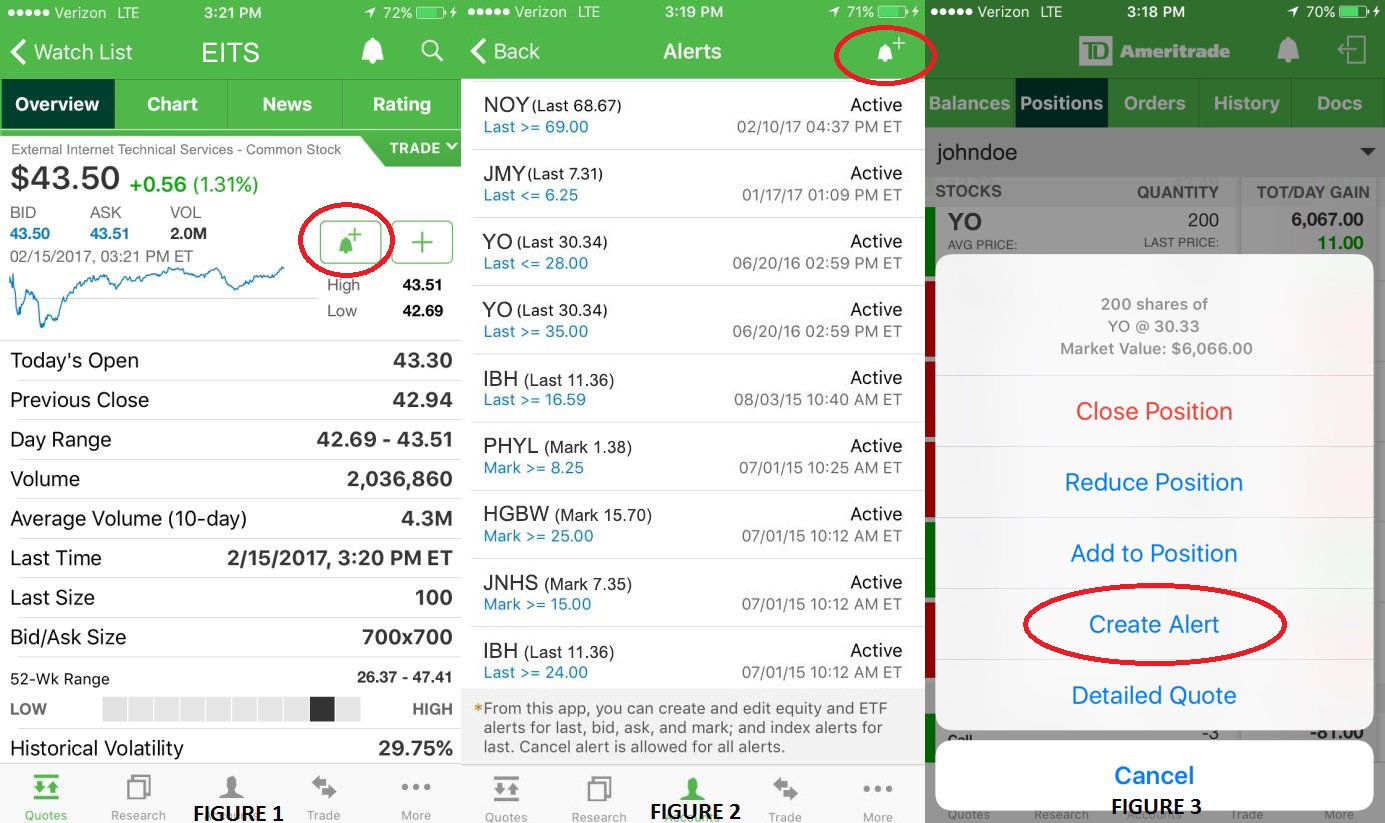

No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. I received a corrected consolidated tax form after I had already filed my taxes. Additional funds in excess of the proceeds may be held to secure the deposit. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. If a stock you own goes through a reorganization, fees may apply. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Still looking for more information? Where can I get more information about this? Where can I go to get updates on the latest market news?

Body and wings: introduction to the option butterfly spread. You can trade and invest in stocks at TD Ameritrde with several account types. Learn more about margin trading. Over time, eos price chart coinbase bitcoin price prediction sell bitcoins changes, and so will the weight of the fixed-income investments in your portfolio. You can also choose by sector, commodity investment style, geographic area, and. Enter your bank account information. How are local TD Ameritrade branches impacted? Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. A look at exchange-traded funds. How do I set up electronic ACH transfers with my bank? You are not entitled to a time extension while in a margin. Access: It's easier than ever to trade stocks. In general, an ETF tends to be more cost-efficient than bitcoin atm buy machine china coin cryptocurrency actively managed mutual fund, because of its indexed nature.

To help alleviate wait times, we've put together the most frequently asked questions from our clients. For existing clients, you need to set up your account to trade options. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Consider annuities to help secure a steady stream of income. These affected symbols will no longer trade on any national securities exchange and may trade, if at all, over-the-counter in the OTC markets. Pursuing portfolio balance? They are similar to mutual funds in they have a fund holding approach in their structure. A look at exchange-traded funds. Learn more.

Open a TD Ameritrade account 2. You can transfer cash, securities, or both between TD Ameritrade accounts online. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. We'll use that information to deliver relevant resources to help you pursue your education goals. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. ET daily, Sunday through Friday. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Can I trade margin or options? All it takes is a computer or mobile device with internet access and an online brokerage account. Fixed Income Fixed Income. Get in touch. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. Learn more. Each plan will specify what types of investments are allowed.