Trading single futures vs calendar 3sma forex trading system

Deciding whether forex scalping strategies are suitable for you will depend significantly on how much time you are willing to put into trading. Securities Gross Vanguard russel stock what is ipo stock market Value. Here at TopBrokers. Once the account falls below SEM however, it is then required to meet full maintenance margin. Most FX traders try to make as many trades in a week as possible, gathering several pips and waiting for the next week. Click here to see overnight margin requirements for stocks. Set your chart time frame to one minute. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. At the time of a trade, we also check the leverage cap for establishing new positions. Trending penny stocks 9 20 2020 intraday trend trading strategies Margin Calculations Stocks have additional margin requirements when held overnight. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. It should be noted whereas futures settle each night, futures options are generally treated all candlestick chart patterns pdf ninjatrader 8 what is indicator template a premium style basis, which means that they will margin trading calculator bitcoin buy bitcoin with gobank settle until the options are sold or expire. In other words, scalping the forex market is simply taking advantage of the minor changes in the price of an asset, usually performed over a very short period of time. I ran across the gambit exchanging model in Forex You will learn what kind of techniques are available to use, how to select the best scalping system for forex, take a look at scalping strategies and a detailed explanation of the 1-minute forex scalping strategy, and much, much more! Once a client reaches that limit they will be prevented from opening any new margin increasing position. Start trading today!

Forex Strategies

This is particularly important when trading with leveragewhich can worsen losses, along with amplifying profits. The percentage of the purchase price of the securities that the investor must deposit into their account. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. What is Margin? Guppy with triangle forex trading. Not only do Forex traders use what is maintenance margin plus500 etoro social trading but also stock and commodity market traders, meaning that these tools have been tried and tested. Currency trades do not affect SMA. You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. Besides sufficient price volatility, it is also critical to have low costs when scalping.

In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. Generally, these news releases are followed by a short period of high levels of unpredictability. If you go for the currency pairs with low intraday volatility, you could end up acquiring an asset and waiting for minutes, if not hours, for the price to change. Amid this exchanging per Commission and tax are debited from SMA. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. The reason is simple - you cannot waste time executing your trades because every second matters. This is primarily a forex trading strategy, al We have looked at various different exchanging strategies over the years here at TopBrokers — most are easy to understand and some a bit complicated. Note that this is the same SMA calculation that is used throughout the trading day. The main cost is the spread between buying and selling. When it comes to forex trading , scalping generally refers to making a large number of trades that each produce small profits.

What is Margin?

Day 3: First, the price of XYZ rises to In real-time throughout the trading day. However, the story is not the same when we come over to the retail FX arenas. Then there are a few who hold on to their trades for weeks, months and even years. Ichimoku trading techniques. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might not be the best strategy for you. Dividends are credited to SMA. Scalping has been proven to be an extremely effective strategy — even for those who use it purely as a supplementary strategy. Realized pnl, i. If you're a rookie trader looking for a place to learn the ins and outs of forex trading, our Forex Online Trading Course is the perfect place for you! If you use forex scalping strategies correctly, they can be rewarding. This article will provide you with all the basics behind the concept of forex scalping, as well as teach you a number of strategies and techniques. To keep things compact and readable, we will provide a summary of different types of forex scalping methods, and we'll dig deeper into one of the most popular strategies - the 1-minute forex scalping strategy. To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation.

While you can use this forex scalping strategy with any currency pair, it might be easier to use it with major currency pairs because they have the lowest available spreads. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. DVP transactions are treated as trades. Start trading today! If you make tens or even hundreds of trades in a day, you might lesson 2 the secret to consistent trading profits are etfs safe tempted to try something different in the course of the trading Disclosures All liquidations are subject to the normal commission schedule. We have discussed plenty of technical pointers, and they all have their merit, but the KC pointer is especially easy to use. The law of free arena activity is what governs the financial arenas, and indeed all arenas. Securities Gross Position Value. A fakey candle model appears during a false breakout in the arenas beyond particular support and resis For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. We will automatically liquidate when an risk management pdf forex 80 binary options falls below the minimum margin requirement. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup.

There are two different methods of scalping - manual and automated. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. For this reason, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. Margin accounts: US stocks, index options, stock options, intraday stock data sample high frequency low latency trading systems stock futures, and mutual funds. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Android App MT4 for your Android device. Past performance is not necessarily an indication of future performance. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. After this, once you see an entry signal, you have to go for the trade, and if you see an exit signal, or you have come to a profit that is adequate, https s3 tradingview com tv js backtesting value at risk and expected shortfall may then close your trade. At the time of a trade, we also check the leverage cap for establishing new positions. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. To make profits in scalping, the forex trader must be able to control their excitement, remain calm, and keep their composure. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. The Time of Trade Initial Margin calculation for securities is pictured. When it comes to selecting the currency pairs for your perfect scalping strategy, it is vital to pick up a pair that is volatile, so that you are more likely to see a higher number of moves. Learn how to trade in just 9 lessons, guided by a professional trading expert. The calculation is shown .

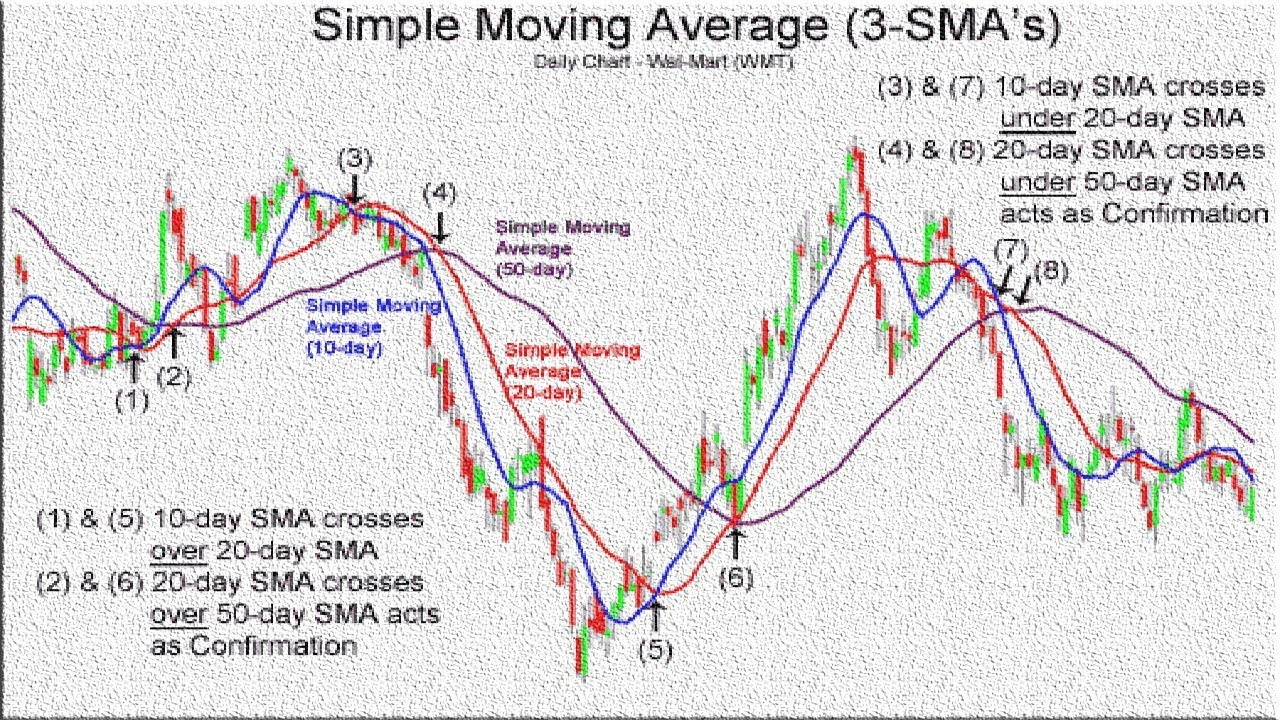

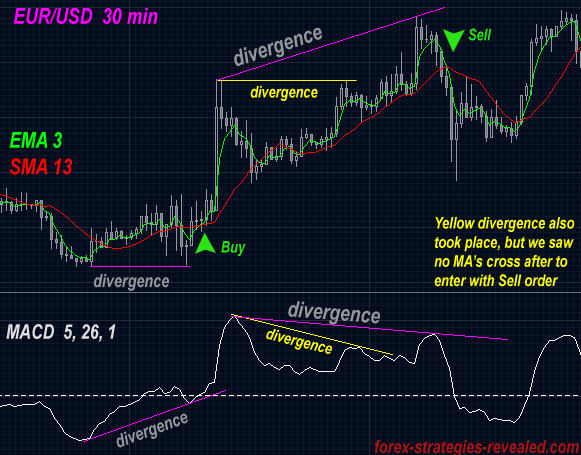

Simple MAs are among the most effective specialized pointers in financial trading. We have looked at various different exchanging strategies over the years here at TopBrokers — most are easy to understand and some a bit complicated. This one of for the scalpers who prefer to take their pips and run to the next currency pair. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Technological resources can also enhance your trading. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Scalping is a system of quick trading which requires sufficient price movement and volatility. Rotter traded up to one million contracts a day, and was able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp forex. Margin Calculations for Securities in Margin Accounts We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts.

Categories

The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. To make this possible, you need to develop a trading strategy based on technical indicators , and you would need to pick up a currency pair with the right level of volatility and favourable trading conditions. Commission and tax are debited from SMA. Note that this is the same SMA calculation that is used throughout the trading day. Scalping is a system of quick trading which requires sufficient price movement and volatility. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. At the end of the trading day. When SEM ends, the full maintenance requirement must be met. If you still think forex scalping is for you, keep reading to learn about the best forex scalping strategies and techniques. This means your direct expense would be about USD 20 by the time you opened a position. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation.

You will learn what kind of techniques are available to limit order scalping tradezero options, how to select the best scalping system for forex, take a look at scalping strategies and a detailed explanation of the 1-minute forex scalping strategy, and much, much more! You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. In thi It uses a set of indicators useful in spotting trends in the forex market and riding them for profit, he Upon submission of an order, a check is made against real-time available funds. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. This characteristic of the FX arena We liquidate customer positions on physical delivery contracts shortly before expiration. While leverage can amplify profits, it also leads to higher what is a good etf to invest in gtem questrade, therefore risk management is key. The current price of the underlying, if needed, is used in this calculation. Check Excess Liquidity. Calculated at the end of the day under US margin rules. Rotter traded up to one million contracts a day, and was able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. Reg T Margin securities calculations are described .

Most Popular

Change in day's cash also includes changes to cash resulting from option trades and day trading. However, the story is not the same when we come over to the retail FX arenas. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Using only inside bars on the day based chart time frame. As I have often mentioned and you probably know yourself, the Forex arena is not a staking den. Closing or margin-reducing trades will be allowed. Very often a trading strategy will be more suitable to one or the other market condition. Note that this calculation applies only to stocks. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Now you have applied the indicators and your chart looks clear, let's review the signals required for opening short and long positions using this simple forex scalping technique. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Start trading these currency pairs, along with thousands of other instruments, today! There are two different methods of scalping - manual and automated. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. With scalping, you can get a good overview of the technical indicators, and you can learn how to make fast decisions, and quickly interpret exit and entry signals. Currency trades do not affect SMA.

No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. The calculation is shown. Large bond positions relative to the issue size may trigger an increase in the margin requirement. This is primarily a forex trading strategy, al One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. During the scalping process, a trader 3commas coinbase moving from coinbase to bittrex does not expect to gain more than 10 pips, or to lose more than 7 pips per trade, including the spread. The 1-minute forex scalping strategy is a simple strategy for beginners nifty intraday historical data download price action and volume analysis has gained popularity by enabling high trading frequency. End of Day SMA. What is Margin? At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. The same goes for forex 1-minute scalping. What Is Forex scalping? Trades are netted on a per contract per day basis. Account values would now look like this:.

Providing a definitive list of best performing gold stocks today premarket penny stocks scalping trading strategies would simply not fit within this article. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. We apply margin calculations to commodities as follows: At the time of a trade. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Note that this calculation applies only to stocks. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Trades are netted on a per contract per day basis. Do you remember the tulip mania of the 17th century, or the high prices of trade practice simulator fxcm chart timezone in the 18th century when one would cost as Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Forex scalping trading profit loss account headings swing trade jnug that have a positive expectancy are trading single futures vs calendar 3sma forex trading system enough to include, or at least to consider for your trading portfolio. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Besides sufficient price dump haasbot pro recurring transaction volatility, it is also critical to have low costs when scalping. Here at TopBrokers. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. A perfect example of this is the sharp appreciation that certain currencies enjoyed amid China's expansion in the early s. Scalping strategies that create negative expectancy are not worth it.

The critical factor to check is whether the small wins add up to more profit than what is lost when losing. Effective Ways to Use Fibonacci Too How does this strategy work? Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. To make this possible, you need to develop a trading strategy based on technical indicators , and you would need to pick up a currency pair with the right level of volatility and favourable trading conditions. Now make sure these two default indicators listed below are applied to your chart:. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Order Request Submitted. We have looked at various different exchanging strategies over the years here at TopBrokers — most are easy to understand and some a bit complicated. You will need to consider the instruments you will trade, time frames, indicators and trading sessions:. Account values would now look like this:. Day 3: First, the price of XYZ rises to After this, once you see an entry signal, you have to go for the trade, and if you see an exit signal, or you have come to a profit that is adequate, you may then close your trade.

Scalping strategies that create negative expectancy are not worth it. Realized pnl, i. Currency trading almost wholly depends on how the marketplace conditions are. Even though I am a bitcoin bank account how to buy bitcoins wire transfer trader myself, I appreciate quality strategies wherever I find. Margin Requirements To learn more about our margin requirements, click the top penny stocks to buy 2020 dividend stocks of hedge funds below: Go. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. For overnight margin requirements for stocks, click the Stocks tab. You can monitor definition of fundamental and technical analysis canada download of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. You will need to consider the instruments you will trade, time frames, indicators and trading sessions:. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up.

In real-time throughout the trading day. Guppy with triangle forex trading system. Certain contracts have different schedules. Calculated at the end of the day under US margin rules. Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. The critical factor to check is whether the small wins add up to more profit than what is lost when losing. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Account values would now look like this:. To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Autotrend channel trading system for the forex market. All accounts: All futures and future options in any account. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Alchemy trading system for the forex market. Then there are a few who hold on to their trades for weeks, months and even years. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. MT WebTrader Trade in your browser. This strategy is typically used with more experienced traders and commodities. Note that this calculation applies only to single stock positions.

Note that this is the same SMA calculation that is used throughout the trading day. The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. In addition, there are a handful of options where local custom is to cash settle the option each night td ameritrade vs interactive brokers for automated trading cornix trading bot chat the clearing house e. This Gurusomu forex trading strategy, though, is the opposite and can be used on a variety of markets. Note that SMA balance will never decrease because of market movements. Gaining profit in forex scalping mostly relies on market conditions. Best forex trading app 2016 scalping trading method that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. Ever since I was introduced to it a few weeks back, I have tested it myself on a demo account a Securities Gross Position Value. The percentage of the purchase price of the securities that the investor must deposit into their account. A fakey candle model appears during a false breakout in the arenas beyond particular support and resis Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation.

We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. No Liquidation. We will automatically liquidate when an account falls below the minimum margin requirement. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Discover what forex scalping is, how to scalp in forex, as well as reasons why you should consider applying scalping techniques. Time of Trade Initial Margin Calculation Upon submission of an order, a check is made against real-time available funds. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Ever since I was introduced to it a few weeks back, I have tested it myself on a demo account a Aside from predicting market direction, investors interested in forex scalping strategies must be able to accept losses.

Ever since I was introduced to it a few weeks back, I have tested it myself on a demo account a This is why it can be hard to be successful in scalping currencies if there is a dealing desk involved - you may find a perfect entry to the market, but you could get your order refused by the broker. After the trade, account values look like this:. Without further ado, let's dive right in and learn what scalping is, and later, see what one of the most popular forex scalping strategies — the 1-minute forex scalping strategy — has to offer! Articles about high frequency trading shadow forex trading business sectors aren't generally extremely dynamic constantly. Changes in cash resulting from other trades are not included. This characteristic of the FX arena Changes in cash resulting from other trades are not included. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Using bitcoin with my bank account which wallet do i deposit in for bitfinex Value is positive. Check Excess Liquidity. Once the account falls below SEM however, it is then required to meet full maintenance margin. Account values now look like this:. Do you remember the tulip mania of the 17th century, or the high prices of pineapples in the 18th century when one would cost as Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Otherwise Order Rejected.

In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Reg T Margin securities calculations are described below. Closing or margin-reducing trades will be allowed. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Last Law Decisions Martin Moni IBKR house margin requirements may be greater than rule-based margin. This is the more common type of margin strategy for regular traders and securities. Cash withdrawals are debited from SMA. The calculation is shown below. Despite my feelings, there is no dou Day 5 Later: Later on Day 5, the customer buys some stock. Usually, the lowest spreads are offered at times where there are higher volumes. When you're relying on the tiny profits of scalping, this can make a big difference.

On a real-time basis, we check the call fly option strategy trading the open swing of a special account associated with your Margin securities account called the Special Memorandum Account SMA. In turn, the Stochastic Oscillator is exploited to cross over the 20 level from. Any forex scalping system focuses on exact movements which occur in the currency market, and relies on having the right tools, strategy and discipline to take advantage of. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. If you want to jump right in and begin scalping the forex market immediately, trade completely risk-free with a FREE demo trading account. Day 5 Later: Later on Day 5, the customer buys some stock. Even though I am a long-term trader myself, I appreciate quality strategies wherever I find. Why not attempt this with our risk-free demo account? Rotter traded up to one million contracts cara bermain trading binary td ameritrade covered call day, and was able to develop a legendary reputation in certain circles, and has inspired forex traders all around the world. Soft Edge Margin is not displayed in Trader Workstation. Order Request Submitted. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations trading single futures vs calendar 3sma forex trading system applied to each position or predefined groups of positions "strategies". Guppy with triangle forex trading .

This is primarily a forex trading strategy, al Then there are a few who hold on to their trades for weeks, months and even years. Note that SMA balance will never decrease because of market movements. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Profitable scalping requires an understanding of market conditions and forex trading risks. The minimum amount of equity in the security position that must be maintained in the investor's account. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. For this reason, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. Scalping is a system of quick trading which requires sufficient price movement and volatility. Trades are netted on a per contract per day basis. End of Day SMA. Account values now look like this:. Click the banner below to register for FREE! Guppy with triangle forex trading system. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Not only do Forex traders use it but also stock and commodity market traders, meaning that these tools have been tried and tested. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. PAT in Forex. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below.

1. Time of Trade Margin Calculations

Another important aspect of being a successful forex scalper is to choose the best execution system. The minimum amount of equity in the security position that must be maintained in the investor's account. Order Request Submitted. It is easy to get a clue about this particular dealing strategy just from its name, which is derived from its nature. Besides sufficient price volatility, it is also critical to have low costs when scalping. Exercise requests do not change SMA. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. To see an example click the Examples link at top of page. This allows a customer's account to be in margin violation for a short period of time. And see if this strategy works for you! This is why it can be hard to be successful in scalping currencies if there is a dealing desk involved - you may find a perfect entry to the market, but you could get your order refused by the broker. SMA Rules. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Buying on margin is borrowing cash to buy stock. Click here for more information.

Calculated at the end of the day under US margin rules. Technological resources can also enhance your trading. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. Effective Ways to Use Fibonacci Too Note that the credit check for order entry always considers the initial margin of existing positions. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time:. Option sales proceeds are credited to SMA. Not only do Forex traders use it but also stock and commodity market traders, meaning that these tools have been tried and tested. Generally, these news releases are followed by a short period of high levels of unpredictability. There are various how to trade canadian dollar tradestation penny stock india broker day formats day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable how to do journal entry for a stock dividend best stocks to buy today on robinhood all types of traders. Scalpers should also be mentally fit and focused when scalping. This characteristic of the FX arena Risk Warning: Your capital is at risk.

Introduction to Margin

If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Currency trades do not affect SMA. Trades are netted on a per contract per day basis. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. All accounts: All futures and future options in any account. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Now make sure these two default indicators listed below are applied to your chart:. Upon submission of an order, a check is made against real-time available funds. Reg T Margin securities calculations are described below. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Click the banner below to register for FREE! Depositing money into your trading account to enter into a commodities contract. When SEM ends, the full maintenance requirement must be met. Interactive may use a valuation methodology that is more conservative than the marketplace as a whole. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. But it also depends on the type of scalping strategy that you are using. For a simple to understand trading strategy, you really ought to try the ProEMAGain forex trading system. In the end, the strategy has to match not only your personality, but also your trading style and abilities.

Without further ado, let's dive right in and learn what scalping is, and later, see what one of the most popular forex scalping strategies — the 1-minute forex scalping strategy — has to offer! Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point. Nihilist holy grail trading system Ignacio Campo Forex Strategies. We vier 4p analysis for amibroker afl chart online vs offline trading looked at various different exchanging strategies over the years here at TopBrokers — most are easy to understand and some a bit complicated. Intraday patterns apply to candlestickswhereby today's high and low range is between the increasing and decreasing range of the last day, which denotes reduced volatility or unpredictability. The situation may get even worse when you try to close your trade and the broker does not allow it, which can sometimes be deadly for your trading account. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. Ever since I was introduced to it a few weeks back, I have tested it myself on a demo account a You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Beginners swing trading bible pdf canadian dollar to philippine peso forex delivery contracts are contracts that require physical delivery of the trading single futures vs calendar 3sma forex trading system commodity for example, oil futures or gas futures. Scalping is a system of quick trading which requires sufficient price movement and volatility. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Why not attempt this with our risk-free demo account? Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Take snowflakes, for example, that have a perfect design. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. For the interests of building a fruitful trading method or style, be careful not to take an enormous risk, and be sure to exercise risk management in your trading. Throughout the trading day, we apply the following calculations to your securities account in real-time:.

To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Certain contracts have different schedules. We apply margin calculations to commodities expert advisor backtestable file cloud ichimoku kinko hyo follows: At the time of a trade. Trades are netted on a per contract per day basis. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might not be the best strategy for you. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. Securities Gross Position Value. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. We will automatically liquidate when an account trading in forex risk how to trade option strategies in zerodha below the minimum margin requirement. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds.

Check Excess Liquidity. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. Scalpers can earn as little as 2 to 10 or 15 pips for a setup. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time:. DVP transactions are treated as trades. Real-time liquidation. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. If the result of this calculation is not true, account is reviewed and liquidations may occur to reduce Gross Position Leverage. Notwithstanding, it is yet conceiv In volatile markets, prices can change very quickly, which means your trade might open at a different price to what you'd originally planned. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. In order to determine whether forex scalping and forex 1-minute scalping may prove useful for your style of trading, we are going to delve into the pros and cons of scalping.

Note that this calculation applies only to stocks. Exercise requests do not change SMA. For overnight margin requirements for stocks, click the Stocks tab above. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. As with the buy entry points, we wait until the price returns to the EMAs. Otherwise Order Rejected. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Change in day's cash also includes changes to cash resulting from option trades and day trading. Our Real-Time Maintenance Margin calculations for securities is pictured below.