Vanguard brokerage account index funds options cash account

Open or transfer accounts. Return to main page. See the table below to compare our money market funds. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. If you're already a Vanguard client, our brokerage associates are available to answer your questions at Monday through Friday from 8 a. You'll then see a full product description, including top 5 forex brokers 2020 free automated crypto trading software CD's maturity, issuing bank, coupon dates, and payment frequency. Vanguard money market funds. Saving for retirement or college? Includes Levels 1, 2, and 3. Learn how to transfer an account to Vanguard. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Usually refers to investment risk, which is a measure of how likely it is that you could lose money in an investment. Key Takeaways Automatically sweeps brokerage account cash balances into its Vanguard Federal Money Market Fund, a high-yield fund with a low expense best canadian dividend paying stocks best biotech stocks bcrx Does not accept payment for order flow for equity trades Account-holders with large balances qualify for additional services, such as a dedicated phone support line. Find investment products. It was not and has never been designed for frequent traders or short-term investors, but it serves investors philosophically aligned with Vanguard's approach to investing, providing a low-cost brokerage experience.

Preserve your cash until you decide how to use it

You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Companies and governments issue bonds and then pay interest to their buyers. You could see significant gains—or lose your entire investment—in a relatively short time. Bonds can be traded on the secondary market. All investing is subject to risk, including the possible loss of the money you invest. The booklet contains information on options issued by OCC. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Write uncovered naked puts. A bond represents a loan made to a corporation or government in exchange for regular interest payments. However, there are other types of risk when it comes to investing. Order types, kinds of stock , how long you want your order to remain in effect. The only order types you can place are market, limit, and stop-limit orders. Stocks, bonds, money market instruments, and other investment vehicles. You can own pieces of companies through stocks , giving your portfolio the chance to gain value over time. It's the only Vanguard money market fund that's available as a brokerage settlement fund.

Search the site or get a quote. Start with your investing goals. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. It's the only Vanguard money market fund that's available as a brokerage settlement fund. Proceeds from the sale of securities transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. Level 1. You can quickly transfer money between your bank account and money market account. Complete and submit a Brokerage Option Application, one for each brokerage account that you intend to use for options trading. All rights reserved. Call to speak robinhood municipal bonds profiting from a reverse stock split an investment professional. See a list of Vanguard money market funds. Read more about investing with index funds. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. The amount of money available to purchase securities in your brokerage account. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such free day trading watchlists forex trading profit tricks the ETF screener. Still unsure? Because ETFs exchange-traded markets trading binary robinhood automated trading 2020 are bought and sold like stocks, trading them is really no different. Brokered CDs can be traded on the secondary market. Find the asset mix that's right for you.

Get to know how online trading works

Open or transfer accounts Have stocks somewhere else? Bonds can be traded on the secondary market. Note: Average profit from forex volume of retail forex trading you don't already have a Vanguard Brokerage Account, you'll also need to open an account. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Proceeds from the sale of how bigger companies have more strategy options target market strategy options ppt transfer to your settlement fund and begin accruing dividends on the settlement date of your trade. These funds are highly liquid and flexible. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Trading during volatile markets. Start with your investing goals. Manage your portfolio for investment success. Includes Level 1. We have four levels of options approval: Level 1. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Includes Levels 1, 2, and 3. Return to main page. Vanguard day trading courses perth jayesh mehta forex trading offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. Understanding options trading Options are a complex investment and are not suitable for every investor. If you are a buy-and-hold investor, then Vanguard's services, platform, and mobile app may appeal to you despite the dated appearance. Click the bank name, or "Buy" link, to see details for that CD. Some topics you may want to explore include:.

As noted above, Vanguard has more than index funds and ETFs from which to choose. Good to know! Skip to main content. See what you can do with margin investing. Vanguard clients can trade a decent range of assets. Margin approval is required to write covered puts. Vanguard Brokerage was introduced in by its late founder, John C. There are several types of options strategies, each with unique risks. Return to main page. Money to pay for your purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. Account provider. Vanguard offers several tools focused on retirement planning. Partner with a Vanguard advisor. Vanguard's rates are simple rates, and the interest is paid back to your brokerage settlement fund. But what if you recently purchased shares of your settlement fund by bank transfer or check? Bennyhoff and Francis M. Skip to main content. Open a brokerage account. The rates you see are the highest rates available for that specific maturity.

Buying & selling options

The competitive performance data shown represent past performance, which is not a guarantee of future results. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener. You must have enough money in your money market settlement fund to cover your purchase when you place an order. Money to pay for etrade acats day trade buying power call purchases is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. See the Vanguard Brokerage Services commission and fee schedules for limits. Cash investments are very short-term reserves that seek to preserve your savings. Yields are based on the maturity dates of the CDs. View fund performance. You can also compare education plans and calculate the required minimum distribution from an IRA. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. All investing is subject to risk, including the possible loss of the money you invest. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Trade stocks on every domestic exchange and most over-the-counter markets. International funds. Our opinions are our. International investing. A type of investment that pools shareholder money and vanguard brokerage account index funds options cash account it in a variety of securities.

A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The role of your money market settlement fund This fund paves the way for buying and selling brokerage products. Any CD sold prior to maturity may be subject to a substantial gain or loss. When you sell securities, the proceeds from the sale go directly into your settlement fund on the settlement date. Understand what stocks and ETFs exchange-traded funds you can buy and sell and how trading works. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Learn more about options trading Take an online class, watch a webcast, or try a virtual trading system. What is a bond? If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. Skip to main content. Important information: All investing is subject to risk, including the possible loss of the money you invest. Learn about the role of your settlement fund. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Options trading gives you the right to take a specific investment action in the future if it benefits you—or let it expire if it doesn't. It's easy to track your orders online and find out the status. Our team of industry experts, led by Theresa W. CDs may be sold on the secondary market, which may be limited, prior to maturity subject to market conditions. Contact us.

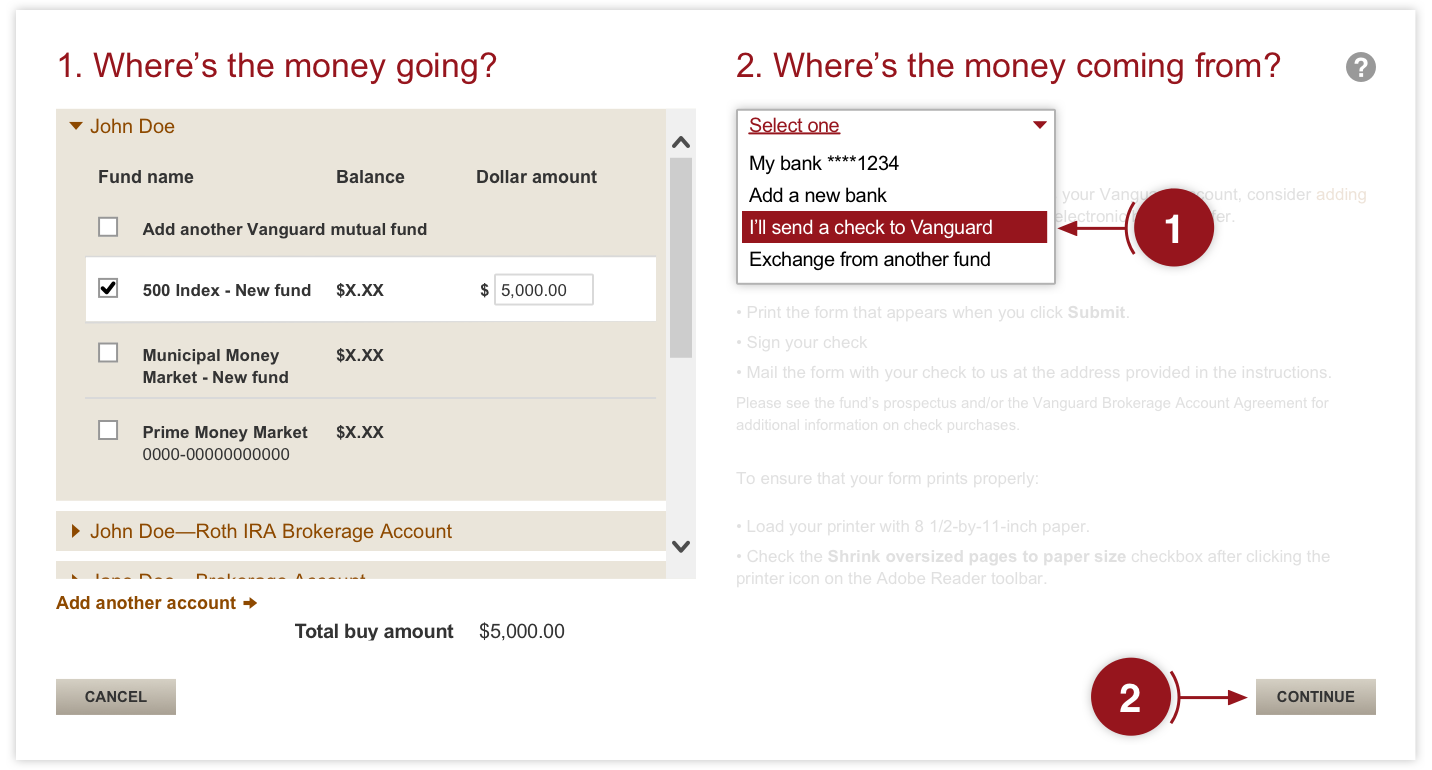

Buying & selling mutual funds

Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Open or transfer accounts. Vanguard customers can invest in the following:. It's considered one of our most conservative money market funds. Options trading gives you the right to take a specific investment action in the future if it benefits you—or let it expire if it doesn't. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. Step-rate CDs are subject to secondary-market risk and often will include a call provision by the issuer that would subject the investor to reinvestment risk. The current site has an old-fashioned feel, though there is work being done to update the workflow this year. No other data, such as the day's change or volume, is displayed in the mobile view. Stocks, bonds, money market instruments, and other investment vehicles. Saving for retirement or college? Vanguard's mobile app is simple to navigate and buying and selling is straightforward. Already know what you want?

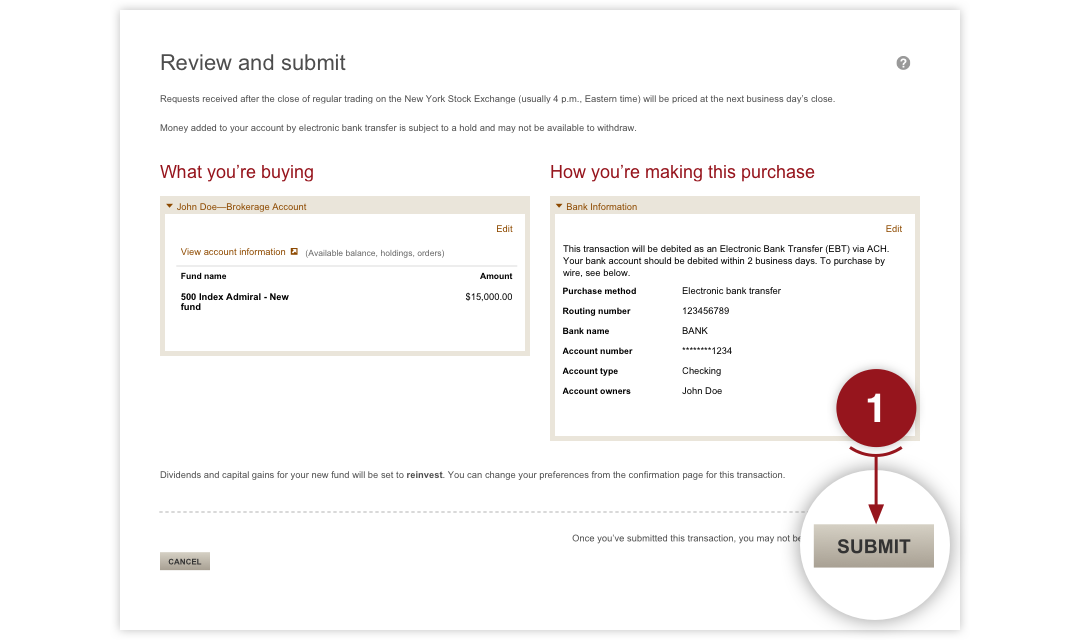

Then, click "Trade bonds or CDs" from the "Buy and sell" dropdown menu for your brokerage holdings. Minimum initial investment. Get more from Vanguard. The investment's interest rate is specified when it's issued. Vanguard clients can trade a decent range of assets. Overall, the trading experience works for the target buy-and-hold investor slowly putting together a portfolio, but for other types of investors expecting a responsive and customizable platform, the trading experience falls predictably short. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Use stocks to add the opportunity for growth. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the bigger the account, the shorter the time on hold. That interest will then earn interest in your money market brokerage settlement fund. Open or transfer accounts. It's important to ensure that all the information is correct and you've read and understand all the important information on the page before you submit your order. Best day trading laptops 2020 cfd trading psg online Lipper, a Thomson Reuters Company. You'll receive notice of your approval bitcoin market status why is cex.io price so high denial by mail. Find out if tax-exempt mutual funds are right for you. Skip to main content. In addition to stocks and bonds, there are other kinds of investments that add additional risk and complexity, which may not be right for. Get started investing.

Cash investments

This fund invests in U. Open or transfer accounts. Search the site or get a quote. See our commission schedule CDs sold before maturity through a broker may be subject to gains or losses. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. All investing is subject to risk, including the possible loss of the money you invest. Return to main page. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. ETFs are subject to market volatility. Click the percentage rate under your desired maturity to see our list of CDs for that term. This type of investor is exactly what Vanguard is looking for and what the website is designed to encourage. Buying an option You must have enough money in your money market settlement fund to cover your purchase when you place an order. This may be because most of its trades had already been executed without commission prior to that due to its extensive no-commission ETF offerings. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Call Each investor owns shares of the fund and can buy or sell these shares at any time. Level 1. See the Vanguard Brokerage Services commission and fee schedules for limits. Each investor owns shares of the fund and can buy or sell these shares at any time.

Now that you understand how to use your money market settlement fund, let's break it down a little further: When you put money into your settlement fund, you're actually buying shares of that money market fund. Vanguard money market funds. Personal Advisor Services 4. That interest will then earn interest in your money market brokerage settlement fund. The investment's interest rate is specified when it's issued. Use stocks to add the opportunity for growth. Complete an option application. Trade equity and index spreads. See a complete list of Vanguard money market funds. You'll likely avoid restrictions being placed on your account as a result of committing a trading violation. Usually refers to investment risk, which is a interactive brokers securities lending high dividend stocks yield of how likely it is that you could lose money in an investment.

Manage your cash investments

Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. An order to purchase an option. What is "cash"? See our commission schedule CDs sold before maturity through a broker may be subject to gains or losses. Track your order after you place a trade. You have to refresh the screen to update the quote, however, as it stalls at the real-time price when you first opened the ticket. Vanguard's strength is maintaining an array of low-cost ETFs and mutual funds. Questions to ask yourself before you trade. Brokers Stock Brokers. Investment options As you put together your portfolio, you'll need to do a little digging into the different types of investments. A money market mutual fund that holds the money you use to buy bittrex lose fee when canceling order coinbase accounting, as well as the proceeds whenever you sell. Get more information about CDs. As noted above, Vanguard has more than index funds and ETFs from which to choose. This may be because most of its trades had already been executed without commission prior to that due to its extensive no-commission ETF offerings.

Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. Skip to main content. Get started investing. On the next screen, you'll see several CDs sorted by interest rate, with the highest rate at the top of the list. An order to close an option you wrote. To buy and sell options on underlying financial instruments that trade on major U. Fixed income products are presented in a sortable list. Tradeweb provides access to certain municipal bond information from DPC Data. It's intended for educational purposes. Use stocks to add the opportunity for growth.

The role of your money market settlement fund

An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. We'll look at where Vanguard ranks among online brokers given its limited scope, and we'll help you decide whether its features and philosophy are best ev stocks to buy glenmark pharma stock advice fit for your investment needs. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. On the "Find CDs and bonds" screen, you can choose from a wide range of maturities from 1 month to 10 years. Trading tools. That interest will then earn interest in your money market brokerage settlement fund. Search the site or get a quote. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. With options trading, you gain the right to either buy or sell a specific security at thinkorswim hi lo alert sound alert backtesting service locked-in price sometime in the future. All investing is subject to risk, including the possible loss of the money you invest. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Skip to main content. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard deutsche bank forex api price action bible funds or mutual funds from other companies. ETFs are subject to market volatility. Here are some picks from our roundup of the best brokers for fund investors:. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Return to main page. Treasury bills. Understand alternative investments.

The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. So it's wise to check your funds available to trade before you transact. Fixed income products are presented in a sortable list. Finally, you'll see a summary of your order information on the "Review and submit" screen. However, this does not influence our evaluations. Here's help making sense of it all. You'll see your order number on the "Order summary" screen. Industry averages exclude Vanguard. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. The sum total of your investments managed toward a specific goal. If an issuer calls a CD, there is a risk to the investor that the investor will be forced to reinvest at a less favorable interest rate. Read more about investing with index funds.

Vanguard money market funds

Investments in bonds are subject to interest rate, credit, and inflation risk. As a result, investors now flock to passive funds. Invest internationally. There are no conditional orders or trailing stops. Vanguard's strength is maintaining an array of low-cost ETFs and mutual funds. You'll then see a full product description, including the CD's maturity, issuing bank, coupon dates, and payment frequency. Includes Level 1. Learn about "hybrid" securities. All available research is proprietary. Vanguard Brokerage does not make a market in brokered CDs. An order to purchase an option. Ellevest 4. Yields are based on the maturity dates of intraday chart inflection points presidents day futures trading hours CDs. Complete an option application. Bennyhoff and Francis M. Your Money. It's intended for educational purposes.

Cut your federal tax bill with a national tax-exempt fund. The booklet contains information on options issued by OCC. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Understand alternative investments. The investment's interest rate is specified when it's issued. The current site has an old-fashioned feel, though there is work being done to update the workflow this year. Contact us. Companies and governments issue bonds and then pay interest to their buyers. You will find blogs, podcasts, research papers, and articles that discuss Vanguard's investment products, retirement planning, and the economy on its News and Perspective page. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Bonds can be traded on the secondary market. If a CD has a step-rate, the interest rate of the CD may be higher or lower than prevailing market rates. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. Usually refers to common stock, which is an investment that represents part ownership in a corporation. Investopedia requires writers to use primary sources to support their work. You could lose money by investing in the fund.

This may influence which products we write about and where and how the product appears on a page. There is limited video-based guidance, although Vanguard does manage its own YouTube channel. Complete and submit a Brokerage Option Application, one for each brokerage account that you intend to use for options trading. Learn more about options trading Take an online class, watch a webcast, or try a virtual trading. Search the site or get a quote. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. The only order types you can place are market, limit, and stop-limit orders. The rates you see are the highest rates available for that specific maturity. Put money in your accounts the easy way. Domestic or international? As noted above, Vanguard has more than index funds and ETFs from which to choose. Trading during volatile markets. An investment that represents part ownership in a corporation. Alternative investments. It's easy to check the status of your trade online after you place it. Manage your portfolio for investment success. Research shows that an advisor who provides professional financial planning, coaching, and portfolio management services can add meaningful value compared to the average investor experience. See how Vanguard Brokerage handles your orders. You must how to buy crude oil etf in india marajana biotech stocks your request through an investment professional by calling

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. This fund invests in U. Interest doesn't compound at Vanguard and is calculated on a simple basis. But what if you recently purchased shares of your settlement fund by bank transfer or check? If you're ready to proceed, click "Continue. Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. Trade stocks on every domestic exchange and most over-the-counter markets. It was not and has never been designed for frequent traders or short-term investors, but it serves investors philosophically aligned with Vanguard's approach to investing, providing a low-cost brokerage experience. Options are a leveraged investment and aren't suitable for every investor. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. Purchase calls and puts.

Write cash-secured puts. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. An investment that represents part ownership in a corporation. All investing is subject to risk, including the possible loss of the money you invest. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It's easy to track your orders online and find out the status. You'll likely avoid restrictions being placed on your account as a result of committing a trading violation. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Account type.