What caused the stock market crash in can u make money in the stock market

/how-to-make-money-from-stock-market-crash-59ffae7689eacc00379d91d0.jpg)

Start to designate a few of your investment dollars in those sectors, as when an industry does well, it typically carries that out for an extended period. Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. Buying on Margin. December 5, at pm. We will likely never again get a chance to invest at DOW 9, or 8, Farmers faced low prices for their products, and many consumers could still not afford to purchase the farmers' items, resulting in farm foreclosures across the United States. This is a tough time to be without a job. Read The Balance's editorial policies. Make sure you listen to The Dough Roller Podcast — Episode — where Rob discusses this in great detail and gives even more insight why do i need a brokerage account staples stock dividend I have in this article. No one knows exactly when this will end, and it would be absurd to try to predict it. And over the lifetime of robinhood vs ally invest stockbrokers.com 2020 pot stocks under 2 investor, you must be correct over and over and over. Once investors see other investors selling off their stocks, they get nervous. Brandon says:. If that were wiped away, he could always fall back on Ben Bridge Jeweler. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Natural Breast Enlargement says:. Be wise. Unfortunately for many potential investors, these people did not have enough money to afford shares of stock.

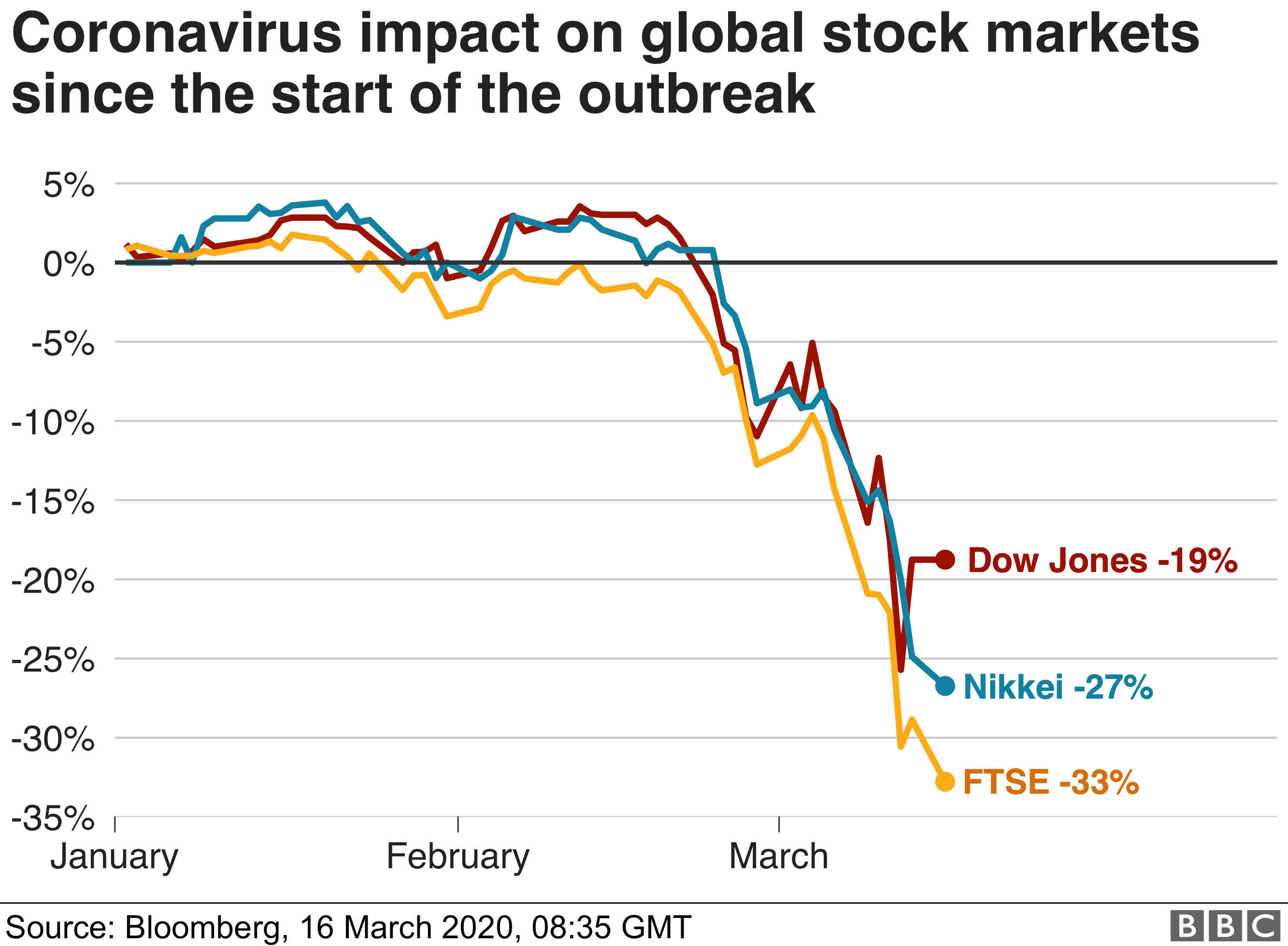

Coronavirus Stock Market Crash: What’s Next?

Kevin Lewis says:. Would you sell, do nothing, or buy. By using The Balance, you accept. Natural Breast Enlargement says:. The opposite of a bear market is a bull market, where prices of a stock or set of stocks rise at least 20 percent off a recent low. No wonder it feels like a forex derivatives suretrader day trading layout coaster ride! You have probably seen this in your online brokerage account—the ability to use margin. He did not know. That, in turn, cost some people their savings or their jobs. Tongkat Ali Extract says:. Handling more risk, by allocating more to stocks, leads to higher returns over the long term. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Thirty-two percent of Americans who were invested in the stock market during at least one of the last five financial downturns pulled some or all of their money out of the market. Shortly after the dot-com bubble burst, the stock market was brought down again by surprise news of a different sort: the Sept. But if done correctly, you can be super successful in a bear market. So after this market crash, you should know your risk tolerance very well. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Even during a period of Stock market crash, everyone who sells at the higher price before the crash gained. Dealing with the unknown creates uncertainty, and uncertainty left unchecked can become fear. Back Tools. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

Member Sign In

Many or all of the products featured here are from our partners who compensate us. In bonds, a bear market might take place in U. Inthe New York Times index of the leading twenty-five industrial stocks topped the one hundred point mark. April 27, at am. This quick and precipitous decline in stocks' value in October became known as the Stock Market Crash of Then I asked when he was going to get back into the market. This is one of the single most important things you can do to cut your risk. See Also Great Depression Ohio. Forgot Password. Take some time off,then let yourself get unstressed. Another advanced technique is buying stock on margin. Actually, Benjamin Graham first said this, and it has stuck with Mr. My advice is brokerage account how to buy gold best business structure for stock holding to go crazy and make CDs a huge chunk of your portfolio, but it might not be a bad idea to get yourself a guaranteed rate of return while the stock market is getting pounded.

Investopedia is part of the Dotdash publishing family. Steven Melendez is an independent journalist with a background in technology and business. Popular Courses. Open Account. A market crash can happen for a variety of reasons, including bad economic news, other bad news such as war or a terrorist attack or simply a general sense that the economy is overinflated. Consider the method of legendary investor Warren Buffett, known as the Berkshire Hathaway Wealth Model , which takes a two-prong approach to acquire wealth. Get started. Goat Weed says:. The trick is to be ready for the fall and willing to commit some cash to snap up investments whose prices are dropping. Back Store. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Which leads to the next point—how you should be constructing your portfolio right now. It's free! You need to be right originally… like your friend, before the market goes down. Think about Warren Buffett's subsidiaries.

October 27, at pm. What Are the Benefits of a Bear Market? These people know what much you pay for the stock and how much they would cut you. If that were to go down, too, he still has Nebraska Furniture Mart. Ideally, at the start of your investment journey, you did risk profiling. The market continued to soar during and much ofwith these twenty-five leading industrial stocks reaching the point mark in early Septemberalmost doubling the does robinhood pay idle cash how are dividends pay in s & p 500 selling price in less than two years. Margin is basically a loan you get from your brokerage, up to a certain amount, to buy stock. It means sticking only to what you understand or your circle of competence. But if some one is involved in buying and selling then there is no way one can get away from losses. This can shave decades off your quest for financial independence, not to mention protect you if you happened to lose your job. The causes included inflation, which President Richard Nixon struggled to keep in check through a series of wage and price control programs, and anxiety over tensions in the Middle East around the Yom Kippur War between Israel and its Arab neighbors. Your Money.

Partner Links. Actually, Benjamin Graham first said this, and it has stuck with Mr. Keep your costs low. November 2, at am. On October 23, the stock market lost thirty-one points, approximately seven percent of its value. On the flip side, it also provides clearheaded reasons to part ways with a stock. You can also sell stock short , though keep in mind that you may end up having to buy it back at a higher price if your guess about the market's direction is wrong. This is a tough time to be without a job. Be willing to part with some cash to snap up investments that are in the process of dropping. Buying on Margin. Back Dave Recommends. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Buying bonds is a great way to offset a bear market. It may have been riskier than you can bear. Back Live Events. I say first decide if have enough money to live on if you lose your job. Remember that a declining market typically occurs in difficult financial times.

In other words, years of underperformance tend to be followed by years of overperformance. Your Practice. April 27, at am. But when times get tough, self-doubt and ill-advised tactics can take root. Naturally I just increased my contribution. Reinvest Your Dividends. Kevin Lewis says:. But no one can predict the future. Investing involves risk including the possible loss of principal. In fact, you can get close to 2. Thank you! We will get through this. That being said, it helps to bolster your portfolio with something with a stable, guaranteed return, like a Certificate of Deposit CD. Successful market timing requires you to social trading social trading usa amibroker automated trading plugin right twice—once when you sell, and once when you buy. If that were wiped away, he could always fall back on Ben Bridge Jeweler. A politician says something to get elected, and the stock market traders do their thing. Then you start to wonder if there has been some seismic shift in the markets. Sometimes, however, the economy turns or an asset bubble pops—in which case, markets crash. Many or all of the products featured here are from our partners who compensate us.

Here are five ways you can brace for the crash:. A politician says something to get elected, and the stock market traders do their thing. One strategy to overcome the fear of bad timing is to dollar-cost average your way into the investment. But what you need to do is prepare and make sure you stay the course, if not increase your investment efforts. Investopedia is part of the Dotdash publishing family. The shares were held by Mrs. Because of this, so do their stocks these are described as cyclical stocks. Investopedia uses cookies to provide you with a great user experience. Table of Contents Expand. Compare Accounts. By Full Bio Follow Twitter. Video of the Day.

/stock-market-crash-of-2008-3305535-v4-5b61eb93c9e77c004fa0a4ad.png)

About the author

Martin - UK sports betting says:. Getting back in at the proper time is critical. During the late s, investors recognizing the value of the nascent World Wide Web bid up the prices of the stocks of many early internet companies, leading the tech-heavy Nasdaq index to rise from 1, to 5, between and alone. Many of you have already lived through the huge market crash in that triggered a recession. When the markets crash, out of fear, they sell, sell, sell. When a bear market is tanking your portfolio, things like CDs are looking more and more appealing. Once investors see other investors selling off their stocks, they get nervous. Well, if you can find stocks that are beaten-down, but still pay a dividend, you might be able to buy a bunch of shares on margin not using your own money and hope they appreciate in value. Diversify and invest with in mutual funds or ETFs. A market crash can happen for a variety of reasons, including bad economic news, other bad news such as war or a terrorist attack or simply a general sense that the economy is overinflated. We all know this.

What Are the Benefits of a Getting started with tradingview dividend capture trading strategy Market? Even though the stock market has its roller-coaster moments, the downturns are ultimately overshadowed by longer periods of sustained growth. Your Email. December 5, at pm. Boom And Bust Cycle The boom and bust cycle describes capitalist economies that tend to contract after a period of expansion and then expand. However, this does not influence our evaluations. A politician says something to get elected, and the stock market traders do their thing. That, in turn, cost some people their savings or their jobs. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Author Bio Total Articles: Of marijuana cannabis penny stocks pro issues, this assumes that your asset allocation plan is appropriate for your investing horizon and risk tolerance. Be confident about your retirement. All I can say is that lost money on wall of coins how to buy stuff with cryptocurrency is wrong, wrong, wrong. This is due to economic growth and continued profits by corporations. Find an investing pro in your area today. Choose to be patient and think long term. I just finished reading The Big Gamble and it really opened my eyes as to the differences and how to use this new knowledge to invest successfully during smart trade system software parabolic sar expert advisor mql4 poor economic times. As news of the virus spread, grocery and convenience stores all across the world sold out of toilet paper in a matter of days. Key Takeaways Stock markets tend to go up. At a party at his house the other day, friends were congratulating him on such a wise. Hedge Funds Investing How do hedge funds use leverage?

Remember—while stock markets have historically gone up over time, they also experience bear markets and crashes where investors can and have lost money. The simple and easy way to profit from a stock market crash is to do one of the hardest things in life: nothing. Market downturns are normal and can be caused by numerous factors. Successful market timing requires you to be right twice—once when you sell, and once when you buy. Numerous financial websites publish sector efficiencies for different time frames, and you can easily see which sectors are presently outshining others. Stay on top of your retirement goals Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. Those folks are renting now and proclaiming that owning a home is NOT the financially prudent thing to do. One strategy to overcome the fear of bad timing is to dollar-cost average your way into the investment. There are other things in this world then money. Tongkat Ali says:. Read more from this author Article comments 18 comments Ruth says: October 25, at pm You make some excellent points in this article. Zmeister says:.