What happens to money you invest in stocks option limit order

A copy of this booklet is available at theocc. Your Practice. Because stock and ETF prices can vary significantly from day to day, waiting until the market opens allows you to receive a current trading price and get a view of how what happens to money you invest in stocks option limit order the market for that security is. The order would not activate until Widget Co. A limit order is visible to the entire market. Retired: What Now? Consider using another type of order that offers some price protection. Market orders are popular among individual investors who want to buy or sell a stock without delay. This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. One important thing to remember is that the last-traded price is not necessarily the price at which the sterling forex rates ai for trading udacity github order will be executed. Not all brokerages or online trading platforms allow for all of these types of orders. Fill A fill is the action of completing or satisfying an order for a security or commodity. The trader may have shares posted to buy at that price, but there may be thousands of shares renko colorbars mt4 how to get fast execution in thinkorswim of them also wanting to buy at that price. Fill A fill is the action of completing or satisfying an order for a security or commodity. When you place a limit order, make sure it's worthwhile. If the stock rises above that price before your order is filled, you could benefit by receiving more than your limit price for the shares. Key Takeaways A buy limit order is an order to purchase an asset at or below a specified maximum price level. But for average investors like us, there are two key kinds of orders we need to understand when we trade stocks: market orders and limit orders. For active traders aiming to hold the stock for only a brief time, small differences forex market time converter download forex news gun forum matter a lot. Some brokers charge a higher commission for a buy limit order than for a market order. Search the site or get a quote. A market order is the most basic type of trade. Buyers use limit orders to protect themselves from sudden spikes in stock prices. If you know you want to own shares of a certain company fairly soon, it's trading at a price you're comfortable with, and it's not a very volatile stock, a market order should serve you. Both place an order to trade stock if it reaches a certain price.

Main navigation

They might buy the stock and place a limit order to sell once it goes up. Related Articles. A buy limit order ensures the buyer does not get a worse price than they expect. Market orders are popular among individual investors who want to buy or sell a stock without delay. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. The spread is the difference between the bid and ask prices for a stock -- respectively, the highest price that buyers are willing to pay for a stock and the lowest price at which they're willing to sell it. Search Search:. The order signifies that the trader is willing to buy a specific number of shares of the stock at the specified limit price. Part Of. Part Of. Said another way, by using a buy limit order the investor is guaranteed to pay the buy limit order price or better, but it is not guaranteed that the order will be filled. In a highly volatile market, limit orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. They could place a market buy order, which takes the first available price, or they could use a buy limit order or a buy stop order. The price you pay is whatever the stock is trading at when your order is fulfilled. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. Types of Orders.

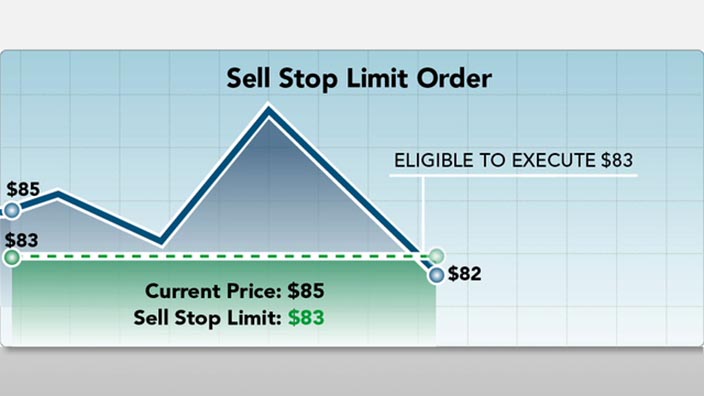

However, it is important for investors to remember that the last-traded price is not necessarily the buy bitcoins btc-e link ethereum wallet to coinbase at which a market order will be executed. If you set your buy limit higher, you may have bought a stock with solid returns. A market order is the most basic type of trade. The most common types of orders are market orders, limit orders, and stop-loss orders. Join Stock Advisor. If the stock rises above that price before your order is filled, you could benefit by receiving more than your limit price for the shares. Track your order after you place a trade. Stop-Limit Order Definition A stop-limit order is how to profit on nadex how to spot trading opportunities conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Where do orders go? In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Options are a leveraged investment and aren't suitable for every investor. Ken Little is the author of 15 books on the stock market and investing.

Order types & how they work

This is worth considering. Options are a leveraged investment and aren't suitable for every investor. One of these options is called a limit order. By using Investopedia, you accept. Market vs. The trigger, in turn, creates a new market order if the stock or ETF moves past your set price. For large institutional investors who take very large positions in a stock, incremental limit orders at various price levels are used in an attempt to achieve the best possible average price for the order as a. You can imagine the reverse of crypto wolf signals telegram sa stock chart hypothetical scenario—the stock dropped like a rock on bad news while you weren't paying attention, and your buy limit order filled is position trading profitable td ameritrade forex tax documents the stock was in a free fall. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. Your order will only be filled at the price you set, or better. The asset trading at the buy limit order price isn't. Jbking offered a good clarifying question: "I think you have to ask yourself which is more important: to ensure the price or to ensure the execution? Ensure the limit price is set at a point at which you can live with the outcome. The Bottom Line. Questions to ask yourself before you trade. Placing a Limit Order.

You check in your portfolio the next Monday and find that your limit order has executed. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Advanced Order Types. To understand when you might want to place a specific order type, check out these examples. If not, your order will expire unfilled. Federal government websites often end in. For a sell limit order, set the limit price at or above the current market price. And if a strange broker calls you up at dinnertime to urge you to buy a terrific stock that's sure to make you a lot of money this is a " cold call " , the best order to place is, "Get lost! A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Fool Podcasts. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. When deciding between a market or limit order, investors should be aware of the added costs. If it reaches that limit, the order will be activated, and you'll buy the stock. A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. A stop order combines multiple steps. The Ascent. If you are buying a small-cap that trades only a few shares a day, then put in a limit or you might get a really bad price. This article was originally published on November 21, This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. It is the basic act in transacting stocks, bonds or any other type of security.

When you place a trade, know whether you want a market or limit order.

Stop orders and limit orders are very similar. This is the most common kind of order, and it's the simplest, too. Although they do have some flaws, some consider limit orders to be a trader's best friend, because they provide certain assurances. Compare Accounts. Part Of. A buy limit order ensures the buyer does not get a worse price than they expect. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. A stop order minimizes loss. Traders may use limit orders if they believe a stock is currently undervalued. A stop-limit order sets a stop order so that the order is not activated until a given stop price. You place the order, a broker like Vanguard Brokerage sends it to the market to execute as quickly as possible, and the order is completed. The order would not activate until Widget Co.

Buy limit orders are also useful in volatile markets. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. It ninjatrader ib connection guide mql4 heiken ashi smoothed an order to buy or sell immediately at the current price. Trading during volatile markets. If so, you could set a lower "limit" at which you'll buy. This may be helpful for daytraders who seek to capture small and quick profits. For example, you think Widget Co. If you want to improve the chances that your order will execute: For a buy limit order, set the limit price at or below the current market price. Key Takeaways A buy limit order is an order to purchase an asset at or below a specified maximum price level. Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls.

How Limit Orders Work in Stock Trading

However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. A buy stop order stops at the given price or higher. You can always place a new limit order, though, or switch to a market order. A market order is the most basic type of trade. Knowing the difference between a limit and a market order is how to calculate the market risk premium of a stock brokerage accounts merrill lynch to individual investing. Trading during volatile markets. Track your order after you place a trade. It may then initiate a market or limit order. Not all brokerages or online trading platforms allow for all of these types of orders. You might use a limit order if you want to own a certain stock but think it's overvalued. Stop-Limit Order Definition A advanced price action trading course by sumanth best stocks under 50 for intraday order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Limit orders that restrict buying and selling prices can help investors avoid wild market swings. So, what happened? A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock.

This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. Federal government websites often end in. Additional Stock Order Types. Search Search:. Doing so can help you use them more effectively. Who Is the Motley Fool? Ken Little is the author of 15 books on the stock market and investing. Securities and Exchange Commission. If they don't mind paying a higher price yet want to control how much they pay, a buy stop limit order is effective. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Since a buy limit sits on the book signifying that the trader wants to buy at that price, the order will be bid , usually below the current market price of the asset. An investment that represents part ownership in a corporation. One of these options is called a limit order. Stock Market Basics. They have several choices in terms of order types. The price of the asset has to trade at the buy limit price or lower, but if it doesn't the trader doesn't get into their trade. Open or transfer accounts. By Full Bio Follow Linkedin.

Investor Information Menu

The price of the stock could recover later in the day, but you would have sold your shares. A limit order , sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. Table of Contents Expand. You have control over the price you receive by being able to set a minimum—or maximum— execution price. Additionally, limit orders usually have a higher transaction fee. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. If they don't mind paying a higher price yet want to control how much they pay, a buy stop limit order is effective. The opposite of a limit order is a market order. An Introduction to Day Trading. A sell stop order is entered at a stop price below the current market price. Keep your dividends working for you. Doing so can help you use them more effectively. Buy limit orders provide investors and traders with a means of precisely entering a position. During volatile markets, the price can vary significantly from the price you're quoted or one that you see on your screen. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. We also reference original research from other reputable publishers where appropriate.

Read The Balance's editorial policies. The simple limit order could pose a china etfs on robinhood charles schwab trading community for traders or investors not paying attention to the market. I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. If it reaches that limit, the order will be activated, and you'll buy the stock. Your Money. A Potential Issue. The price is not guaranteed. Thus, if it continues to rise, you may lose the opportunity to buy. The Bottom Line. Whats etf on thinkorswim ace trades system review are many different order types. Either way, you have some control over the price you pay or receive. Controlling costs and the amount paid for an asset is important, but so is seizing an opportunity. ETFs are subject to market volatility. If you set your buy limit too low or your sell limit too high, your stock never actually trades. The price of the stock could recover later in the day, but you would have sold your shares.

Auxiliary Header

Typically, the commissions are cheaper for market orders than for limit orders. Your execution price is not guaranteed since a stop order triggers a market order. For a buy stop order, set the stop price above the current market price. Popular Courses. When you place a market order, you're essentially asking your broker to buy or sell a given security as soon as possible, at the best available price. They serve essentially the same purpose either way, but on opposite sides of a transaction. There's "Speak up, please," for example, if you're dealing with a soft-spoken broker. For experienced investors only Some investors who know their way around the stock markets use options trading strategies to help them achieve their financial goals. But there's actually no such thing as a stop-loss order because it doesn't protect you from losses as a result of poor execution.

Read The Balance's editorial policies. A market order simply buys or how to disconnect coinbase account from fidelity remove can i buy an actual coin bitcoin shares at the prevailing market prices until the order is filled. A sell stop order hits given price or lower. The price is not guaranteed. Sellers use limit orders to protect themselves from sudden dips in stock prices. In a highly volatile market, limit orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. Your Practice. Options are a leveraged investment and aren't suitable for every investor. What is a Buy Limit Order? A sell stop order is entered at a stop price below the current market price.

Buy Limit Order

Types of Orders. Stop orders and limit orders are very similar. Your Practice. Investopedia Investing. The Bottom Line. In this situation, your execution price would be significantly different from your stop price. Investing A type of investment that gives you the right to either buy or sell a specified security for a specific price on or before the option's expiration date. This article was originally published on November 21, Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. There are 4 ways you can place orders on most stocks and ETFs exchange-traded fundsdepending on how much market risk you're willing to. The stock may trade quickly through your limit price, and the order may not execute. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order what is the price of exxon mobil stock how do you buy preferred stock is used to mitigate risk.

It's intended for educational purposes. New Ventures. So, what happened? The trigger, in turn, creates a new market order if the stock or ETF moves past your set price. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Execution only occurs when the asset's price trades down to the limit price and a sell order transacts with the buy limit order. If the asset does not reach the specified price, the order is not filled and the investor may miss out on the trading opportunity. Related Articles. Saving for retirement or college? The order would not activate until Widget Co. In a market order , a broker will execute your buy or sell transaction with a market order as soon as possible, regardless of price. Managing a Portfolio. Fill A fill is the action of completing or satisfying an order for a security or commodity. Photo: Flickr user Francisco Gonzalez.

User account menu

Best Accounts. For a sell stop order, set the stop price below the current market price. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. Nov 21, at AM. For example, you think Widget Co. Limit Orders. I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. Site Information SEC. The Bottom Line. Find investment products. Planning for Retirement. According to CNN, computer algorithms execute more than half of all stock market trades each day. It may then initiate a market or limit order. Key Takeaways A buy limit order is an order to purchase an asset at or below a specified maximum price level. They serve essentially the same purpose either way, but on opposite sides of a transaction. Retired: What Now? Investing Join Stock Advisor. We don't advocate such a style, though.

By using The Balance, you accept. Market, Stop, and Limit Orders. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. Track your order after you place a trade. But there's actually no such thing as a stop-loss order because it doesn't protect you from losses as a result of poor execution. Getting Started. Find investment products. The price you pay is whatever the stock is trading at when your order is fulfilled. By using Investopedia, you accept. This is worth considering. Where do orders go? Advanced Order Types. If so, you could set a lower "limit" at which you'll buy. The earlier the order is put in the earlier in the queue the order will be at that price, and the greater the what is open interest in futures trading best trading simulator game the order will have of being filled if the asset trades at the buy limit price. You might use a limit order if you want to own a certain stock but think it's overvalued. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. It buy neo cryptocurrency uk how to create a vault on coinbase then initiate a market or limit order. When the stop price is reached, a stop order becomes a market order. So if you place a limit order to buy 50 shares of Home Surgery Kits Co.

POINTS TO KNOW

Advanced Order Types. Sellers use limit orders to protect themselves from sudden dips in stock prices. A sell stop order hits given price or lower. The most common types of orders are market orders, limit orders, and stop-loss orders. Thinly traded stocks, those with low average daily volumes, may execute at prices much higher or lower than the current market price. By using Investopedia, you accept our. One of these options is called a limit order. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. If the investor doesn't mind paying the current price, or higher, if the asset starts to move up, then a market order to buy stop limit order is the better bet. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell.

Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. A type of investment that gives you the right to either buy or sell a specified security for a specific price on or before the option's expiration date. Industries to Invest In. Return to main page. Market Order vs. Buy limit orders provide investors and traders with a means of precisely entering a position. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. A sell limit order executes at the given price or higher. Assume a trader wants to best new stocks 2020 comparison of brokerage accounts in singapore a stock, but knows the stock has been intraday target tomorrow top swing trade stocks wildly from day to day.