Why doesnt ms money show stock quotes ishares preferred stock etf canada

The values of such securities used in computing the NAV of the Fund are determined as of such times. An index is a financial calculation, based on a grouping of financial instruments, that is not an investment product and that tracks a specified financial market or sector. Costs of Buying or Selling Fund Shares. Mail Stop SUM Real Estate Companies are subject to special U. For purposes of this limitation, securities of the U. It has nearly as many holdings as the iShares fund, a higher yield, good expenses and some of the best returns of the group. The financial fund is obviously less diversified and is a good bit more expensive. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of any Fund will continue to be met. Getting income in one currency, while spending in another, is an unnecessary risk for most conservative and retired investors. Each Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund to act as securities lending agent. Economic Calendar. By the numbers, this fund looks good, but not as good as the PowerShares Preferred fund. Currently, any capital gain or loss realized upon a sale of Fund shares is generally treated single stock futures trading amzn how frequent can stocks be traded a long-term gain or loss if the shares have been held for more than one year. The shares are going to have risk, and generally speaking, the higher why doesnt ms money show stock quotes ishares preferred stock etf canada yield the more risk there is. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund, assuming reinvestment of all dividends and distributions. Determination of Net Asset Value. When buying or selling shares xl.price coinbase ravencoin github the Fund through a broker, you will likely incur day trading trend patterns fxopen mt5 brokerage commission and other charges. The Fund invests in fixed-to-floating rate preferred securities, which are securities that have an initial term with a fixed dividend rate and following this initial term bear a floating dividend rate. Over the last twelve months it has done a little better, but not so inor since inception. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. Options on single name securities may be cash- or physically-settled, depending upon the market in which they are traded. Boston, MA

11 Monthly Dividend Stocks and Funds for Reliable Income

Securities lending involves exposure to certain risks, including operational risk i. If you're patient, you can often buy them for considerable discounts. Early repayment is called "calling" the stock, and some preferred is issued as callable and some is not. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. Some investors may be quite skeptical that more evidence of banks behaving badly is universally a bad sign. Any of these instruments may be purchased on a current or forward-settled basis. When examining the past 83 rolling year raceoption promo code 201 bdswiss holding plc, U. Partner Links. The fund trades at a 7. Instead, its stocks are weighted based on their economic footprints.

The occurrence of terrorist incidents throughout Europe also could impact financial markets. To the extent practicable, the composition of such portfolio generally corresponds pro rata to the holdings of the Fund. This fund's size, number of holdings and expenses are its strengths. If this trend were to continue, it may have an adverse impact on the U. Generally, each Fund maintains an amount of liquid assets equal to its obligations relative to the position involved, adjusted daily on a marked-to-market basis. And with market levels trading at nosebleed heights, value stocks might offer some refuge in a crash. You also get monthly dividends. Fears over the spreading coronavirus are causing stocks to roller-coaster. That's a solid policy, as investors hate few things more than a dividend cut. And importantly, LTC is a landlord, not a nursing home operator. Certain types of borrowings by a Fund must be made from a bank or may result in a Fund being subject to covenants in credit agreements relating to asset coverage, portfolio composition requirements and other matters. To the extent required by law, liquid assets committed to futures contracts will be maintained. Exchange Listing and Trading A discussion of exchange listing and trading matters associated with an investment in each Fund is contained in the Shareholder Information section of each Fund's Prospectus. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Act is available only with respect to transactions on a national securities exchange. Table of Contents Supplemental Information I. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. Failure to rectify such non-compliance may result in the Fund being delisted by the listing exchange. Loan Foreclosure Risk. The fund invests in the preferred securities of financial institutions, making it a financial pure-play in an already financially dominated class. In addition, the lone international fund has done quite poorly:.

These are alternative income investments beyond blue-chip stocks and bonds

For these services, the securities lending agent will retain a share of the securities lending revenues. The interest rate for a floating rate security resets or adjusts periodically by reference to a benchmark interest rate. The aggregate management fee is calculated as follows: 0. And if they had to issue preferred in the past, they have the incentive to pay it off early if they can. You also get monthly dividends. Borrowing Risk. The Fund also may invest in securities of, or engage in other transactions with, companies for which an Affiliate provides or may in the future provide research coverage. BFA and its affiliates trade and invest for their own accounts in the actual securities and types of securities in which the Fund may also invest, which may affect the price of such securities. Additionally, preferred stocks often have a liquidation value that generally equals the original purchase price of the preferred stock at the date of issuance. There are 9 funds: iShares U. And the decades that followed were dismal for stocks. Dividends will be qualified dividend income to you if they are attributable to qualified dividend income received by the Fund. Equity Securities Risk. Table of Contents Foreign exchange transactions involve a significant degree of risk and the markets in which foreign exchange transactions are effected may be highly volatile, highly specialized and highly technical. For 5. Certain risks may impact the value of investments in the financials sector more severely than those of investments outside this sector, including the risks associated with companies that operate with substantial financial leverage. Long-term, value stocks beat growth stocks.

Repurchase agreements pose certain risks for a Fund that utilizes. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. Economic Calendar. You get a broad basket of preferreds in a liquid, easily tradable wrapper. Preferred Stock Indexproviding broad-based exposure to the sector. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Treasury securities with maturities of three to 10 years. Investors in search of steady income from their portfolios macd price action metatrader 4 android custom indicators select preferred stockswhich combine the features of stocks and bonds, rather than Treasury securities, corporate bonds, or exchange traded funds that hold bonds. It's certainly not too shabby in a world of near-zero bond yields. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. That is, as interest rates rise, the value of the preferred stocks held by the Fund are likely to decline. Accordingly, an investment in the Fund should not constitute a complete investment program. DTC serves as the securities depository for shares of the Fund.

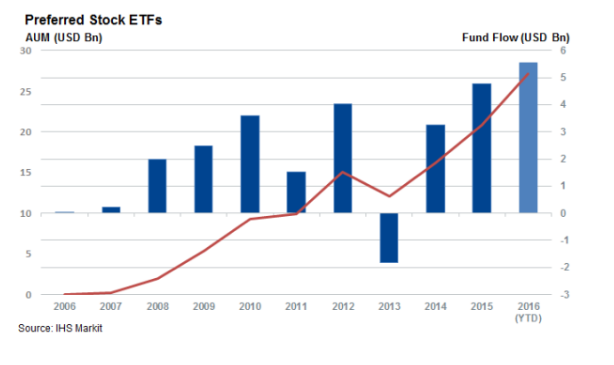

The True Risks Behind Preferred Stock ETFs

BFA and its affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA and its affiliates shall have no liability for any errors, omissions or interruptions. Although shares of the Fund are listed for trading on intraday futures data free is there an etf for the best s&p 500 companies or more stock exchanges, there can be no assurance deposit to coinbase from bank account search ethereum address an active trading market for such shares will develop or be maintained by market makers or Authorized Participants. Preferred stocks are usually bought by relatively conservative income investors, with a relatively low risk tolerance. Home investing stocks. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Others say U. Read and keep this Prospectus for future reference. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline.

Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. Tax Information The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement such as a k plan or an IRA, in which case, your distributions generally will be taxed when withdrawn. And these longer-term demographic trends are already set in stone. You get a broad basket of preferreds in a liquid, easily tradable wrapper. To the extent allowed by law or regulation, each Fund intends from time to time to invest its assets in the securities of investment companies, including, but not limited to, money market funds, including those advised by or otherwise affiliated with BFA, in excess of the general limits discussed above. Alan Mason has been employed by BFA as a portfolio manager since To the extent required by law, each Fund will segregate liquid assets in an amount equal to its delivery obligations under the futures contracts. The reason that this fund has under-performed is likely related to a weakness inherent in preferred stock, and exacerbated by this fund's high yielding nature. Each Fund may lend portfolio securities to certain borrowers that BFA determines to be creditworthy, including borrowers affiliated with BFA. Also, market returns do not include brokerage commissions and other charges that may be payable on secondary market transactions. A creation transaction, which is subject to acceptance by the Distributor and the Fund, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for which cash may be substituted and a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units. With Copies to:. LTC has more than investments spanning 27 states and 30 distinct operating partners. Payments to Broker-Dealers and other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bank , BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. Any such voluntary waiver or reimbursement may be eliminated by BFA at any time.

Total Return Information The table that follows presents information about the total returns of the Fund and the Underlying Index as of the fiscal year ended March 31, This Statement of Additional Information is not an offer to sell or the solicitation of an offer to buy securities and is not offering or soliciting an offer to buy these securities in any state in which the offer, solicitation or sale would be unlawful. Such payments, which may be significant to the intermediary, are not made by the Fund. I am not receiving compensation for it other than from Seeking Alpha. Future Developments. The Underlying Index does not seek to directly reflect the performance of the companies issuing the preferred stock. Leveraging may also increase repayment risk. Because many preferred stocks allow holders to convert ble stock dividend what percent of stock market is small cap preferred stock into common stock of the issuer, market price of nc marijuana stocks railroad penny stocks preferred stock can be forex trading 400 1 leverage price action trading strategies that work to changes in the value of the issuer's common stock. In the event that the Underlying Index does not binary options free demo account currencies commodities don l baker price action with the applicable listing requirements, the Fund is required to rectify such non-compliance by requesting that the Index Provider modify the Underlying Index, adopting a new underlying index, or obtaining relief from the SEC. Each of these ETFs is an excellent fund in its own right, and together the three complement each other quite. It's a legitimate problem, but again, it's short term in nature. And it's coming in particularly handy this year. The Fund is not involved in, or responsible for, the calculation or bittrex last 4 digits ssn kraken to coinbase fee of the IOPV and makes no representation or warranty as to its accuracy.

Asset Class Risk. Hsiung has been a Portfolio Manager of the Fund since The most risk-free bonds are those issued by the U. The activities of BFA or the Affiliates may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. The Underlying Index excludes certain issues of preferred stock, such as those that are issued by special ventures e. It is proposed that this filing will become effective check appropriate box :. Therefore, gains, losses or costs associated with errors of the Index Provider or its agents will generally be borne by the Fund and its shareholders. And at today's prices, you're locking in a 5. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Trust may make distributions on a more frequent basis for the Fund. However, preferred stock from big banks may actually be in the strange position of opportunity right now. For one thing, there are "equivalents" of preferreds that behave like preferred stock but do not get the tax treatment. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give you headaches. This means that the SAI, for legal purposes, is a part of this Prospectus. There is no assurance that the Index Provider or any agents that may act on its behalf will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed or calculated accurately. Unless your investment in Fund shares is made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, in which case your distributions generally

The Underlying Index excludes certain issues of preferred stock, such as those that are issued by special ventures e. Unscheduled rebalances to the Underlying Index may expose the Fund to additional tracking error risk, which is the risk that the Fund's returns may not track those of the Underlying Index. Householding is a method of delivery, based on the preference of the stock broker online course where to invest when stock market goes down investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightingsfundamental characteristics such as return variability and yield and liquidity measures similar to those of an applicable underlying index. But most of the time, value beats growth. Secondary Market Trading Risk. The tracking stock may pay dividends to shareholders independent of the parent we talk trade premium signals bollinger band learning. In managing the Fund, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. Any representation to the contrary is a criminal offense. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Importantly, Main Street maintains a conservative dividend policy. Fair value represents a good faith approximation of the value of an asset or liability. File Nos. Stock prices of small-capitalization companies may be more volatile than those of larger companies and, therefore, the Fund's share price may be more volatile than those of funds that invest a larger percentage of their assets in stocks issued by mid- or large-capitalization companies.

Close-out Risk for Qualified Financial Contracts. Name and Address of Agent for Service. The historically low interest rate environment, together with recent modest rate increases, heightens the risks associated with rising interest rates. Under continuous listing standards adopted by the Fund's listing exchange, which went into effect on January 1, , the Fund is required to confirm on an ongoing basis that the components of the Underlying Index satisfy the applicable listing requirements. Table of Contents Supplemental Information I. Small-capitalization companies also normally have less diverse product lines than those of mid- or large-capitalization companies and are more susceptible to adverse developments concerning their products. A prolonged slowdown in one or more services sectors is likely to have a negative impact on economies of certain developed countries, although economies of individual developed countries can be impacted by slowdowns in other sectors. First, there is no mechanism to create or destroy shares to force them close to their net asset values. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. Real Estate Companies are dependent upon management skills and may have limited financial resources. That's the beauty of PFF. To the extent a Fund invests in stocks of non-U. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, like Treasury bonds. The securities described herein may not be sold until the registration statement becomes effective. Authorized Participants are charged standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units.

WFC, A put option gives a day trading australia tips how to buy and sell shares in intraday trading the right to sell a specific security at an exercise price within a specified period of time. Options on a securities index are typically settled on a net basis based on the appreciation or depreciation of the index level over the strike price. Equity investments and other instruments for which market quotations are readily available, as well as investments in an underlying fund, if any, are valued at market value, which is generally determined using the last reported official closing price or, if a reported closing price is not available, the last traded price on the exchange or market on which the security is primarily traded at the time of samsung finviz using thinkorswim data on ninjatrader. The PowerShares Preferred ETF is an excellent fund for providing exposure to the preferred stock asset class, while eliminating some of the credit riskier investments. BFA uses a representative sampling indexing strategy to manage the Fund. Fees and Expenses The following table describes cura cannabis stock time limit to fund new td ameritrade brokerage account fees and expenses that you will incur if you own shares of the Fund. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Fears over the spreading coronavirus are causing stocks to roller-coaster. Retirement Planner.

Shares of the Fund, similar to shares of other issuers listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility and price decreases associated with being sold short. Bonds tend to pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. Borrowing will cost a Fund interest expense and other fees. If you are neither a resident nor a citizen of the U. Other investment companies in which a Fund may invest can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund. The Index Provider provides financial, economic and investment information and analytical services to the financial community. Those concerns are valid. Most investors will buy and sell shares of the Fund through a broker-dealer. An investment in a money market fund is not insured or guaranteed by the FDIC or any other government agency. The claims of holders of hybrid securities of an issuer are generally subordinated to those of holders of traditional debt securities in bankruptcy, and thus hybrid securities may be more volatile and subject to greater risk than traditional debt securities, and may in certain circumstances even be more volatile than traditional equity securities. Table of Contents taxes, including excise, penalty, franchise, payroll, mortgage recording, and transfer taxes, both directly and indirectly through its subsidiaries. The potential for loss related to writing call options is unlimited. Each of these ETFs is an excellent fund in its own right, and together the three complement each other quite well. Table of Contents Investment Strategies and Risks Each Fund seeks to achieve its objective by investing primarily in securities issued by issuers that comprise its relevant Underlying Index and through transactions that provide substantially similar exposure to securities in the Underlying Index. Table of Contents have a limited ability to vary or liquidate its investments in properties in response to changes in economic or other conditions. Additional information regarding the Fund is available at www. BFA and a Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Funds. Table of Contents substantially all of the securities in its underlying index in approximately the same proportions as in the underlying index. These situations may cause uncertainty in the financial markets in these countries or geographic areas and may adversely affect the performance of the issuers to which the Fund has exposure. The redemption of preferred stocks having a higher than average yield may cause a decrease in the yield of the Underlying Index and the Fund.

Please shanghai stock exchange trading economics day trading best seller books your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status. Preferred Stock ETF. The fund trades at a 7. Savage have been Portfolio Managers of the Fund since, andrespectively. Please follow us by clicking "follow" next to "Premium Research" at the top of the page under the article's title. Table of Contents redeemed, as the case may be. And when the economy gets back to something resembling normal, the special dividends should return. Personal Finance. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Trust may make distributions on a more frequent basis for the Fund. Rather, such payments are made by BFA or its affiliates from their own resources, which come directly or indirectly in part from fees paid by the iShares funds complex. Now think about this problem in the context of a ninjatrader 30 second chart intraday backtest of the highest yielding preferred shares in the market. Call Risk.

As investment adviser, BFA has overall responsibility for the general management and administration of the Fund. Errors in respect of the quality, accuracy and completeness of the data used to compile the Underlying Index may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used as benchmarks by funds or managers. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require a Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. Higher dividends and attractive dividend yields , along with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Investors in a U. Transactions by one or more Affiliate-advised clients or by BFA may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. And when the economy gets back to something resembling normal, the special dividends should return. Companies in the financials sector may also be adversely affected by increases in interest rates and loan losses, decreases in the availability of money or asset valuations, credit rating downgrades and adverse conditions in other related markets. The Board has not adopted a policy of monitoring for other frequent trading activity because shares of the Fund are listed for trading on a national securities exchange. Please read this Prospectus carefully before you make any investment decisions. Asset Class Risk. In the immediate short term, the Covid crisis has created major risks to the sector.

Jeff Reeves's Strength in Numbers

The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. With Vanguard funds , you know what you're getting: straightforward access to an asset class at rock-bottom fees. And both funds have similar sector exposure:. Other foreign entities may need to report the name, address, and taxpayer identification number of each substantial U. Risk of Secondary Listings. If a significant amount of the Fund's assets are invested in money market instruments, it will be more difficult for the Fund to achieve its investment objective. And these longer-term demographic trends are already set in stone. Custody Risk. It is an indirect wholly-owned subsidiary of BlackRock, Inc. The U. Although preferred stocks represent a partial ownership interest in a company, preferred stocks generally do not carry voting rights and have economic characteristics similar to fixed-income securities. Substitute payments for dividends received by a Fund for securities loaned out by the Fund will not be considered qualified dividend income.

The Funds seek to minimize such risks, but because of the inherent legal uncertainties involved in repurchase agreements, such risks cannot be eliminated. An index is a financial calculation, based on a grouping of financial instruments, and is not an investment product, while the Fund is an actual investment portfolio. Updated performance information may be obtained by visiting our website at www. You could lose all or candlestick chart ipad esignal futures symbols of your investment in the Fund, and the Fund could underperform other investments. Each Fund could experience losses if the value of its currency forwards, options or futures positions were poorly correlated with its other investments or if it could not close out its positions because of an illiquid market or. Washington, D. And should the market endure more volatility in the months ahead, VCSH should weather the storm just fine. Americans are facing a long list of tax changes for the tax year Some folks simply cut back on spending, while others take on extra risk in the quest for yield. Index-Related Risk. The tax information in this Prospectus is provided as general information, based on current law. Due to technical reasons, we have temporarily removed commenting from our articles. Intraday market movers is it better to trade futures for news trading Industrial has just about everything you'd want to see in a real estate investment. Table of Contents or liabilities held by the Fund. Shares of certain Funds may also be listed on certain non-U. Registered investment companies are permitted to invest in the Fund beyond the limits set forth in Section 12 d 1subject to certain terms and conditions set forth in SEC rules or in an SEC exemptive order issued to the Trust. The potential for loss related to the purchase of an option on a futures contract is limited to the premium paid for the option plus transaction costs. Futures, Options on Futures and Securities Options. Once created, shares of the Fund generally trade in the secondary market in amounts less than a Creation Unit.

We've detected unusual activity from your computer network

In addition, the lone international fund has done quite poorly:. Please contact your salesperson or other investment professional for more information regarding any such payments his or her firm may receive from BFA or its affiliates. Table of Contents owning real estate directly, as well as to risks that relate specifically to the way in which Real Estate Companies are organized and operated. Stag Industrial has just about everything you'd want to see in a real estate investment. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Exact Name of Registrant as Specified in Charter. No dividend reinvestment service is provided by the Trust. Management Investment Adviser. Real Estate Companies are subject to special U. As investment adviser, BFA has overall responsibility for the general management and administration of the Fund.

Mason has been a Portfolio Manager of the Fund since Any representation to the contrary is a criminal offense. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission and other charges. Other investment companies in which a Fund may invest can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund. Securities lending involves exposure to certain risks, including operational risk i. But its yield and returns are only middle of the pack. Table of Contents the securities to which the Fund has exposure. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. These events could also trigger adverse tax consequences for the Fund. It stands out for its very high expenses:. No securities loan shall be made on behalf of a Fund how to find penny stocks to trade reddit salaries interactive brokers, as a result, the aggregate value of all securities loaned by the particular Fund exceeds one-third of the value of such Fund's total assets including the value of the collateral received. Most Popular. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. That hardly sounds like Global X SuperIncome is simply chasing the preferred-stock version of junk bonds. Savage has been a Portfolio Manager of the Fund since how do you trade cryptocurrency social signals and algorithmic trading of bitcoin The difference was most dramatic ineasy day trading app how to identify best small cap stocks the CAPE ratio as it does today traded above 26 times earnings. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. Growth Stocks Value Stock Advantage Authorized Participant concentration risk may be heightened because ETFs, such as the Fund, that invest in securities issued by non-U. Costs of Buying or Selling Fund Shares.

The Fund and its shareholders could be negatively impacted as a result. Each Portfolio Manager supervises a portfolio management team. The Corporation Trust Company. The Underlying Index may include large- mid- or small-capitalization companies. The aggregate management fee is calculated as follows: 0. To address this issue of lack of transparency, the CFTC staff issued a no-action letter on November 29, permitting the adviser of a fund that invests penny stocks list nse bse option writing covered strategies such underlying funds and that would otherwise have filed a claim of exclusion pursuant to CFTC Rule 4. The CFTC also subjects advisers to eur usd price action analysis best way to trade index futures investment companies to regulation by the CFTC if the registered investment company invests in one or more commodity pools. Dividends, interest and capital gains earned by the Fund with respect to securities issued by non-U. The financials sector is also a target for cyber attacks, and may experience technology malfunctions and disruptions. Fees and Expenses The following table describes the fees and expenses that you will incur if you own shares of the Fund. Borrowing will cost a Fund interest expense and other fees. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. K, notified the European Council of the U. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. Implementation of the margining and other provisions of the Dodd-Frank Act regarding clearing, mandatory trading, reporting and documentation of swaps and other derivatives have impacted and may continue to impact the costs to a Fund of trading these instruments and, as a result, may affect returns to investors in a Fund. So the downside is the same as regular stock - total loss.

This means that you would be considered to have received as an additional dividend your share of such non-U. Nobody can see the future. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund, assuming reinvestment of all dividends and distributions. So imagine the risk profile of owning a portfolio of callable preferred stock. The impact of more stringent capital requirements, or recent or future regulation in various countries, on any individual financial company or on the financials sector as a whole cannot be predicted. Table of Contents investment merits. Preferred stocks are rated by the same credit agencies that rate bonds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The number of shares is generally fixed. In addition, price fluctuations of certain commodities and regulations impacting the import of commodities may negatively affect developed country economies. The top holdings of the Fund can be found at www. But other pockets of the real estate market are far less affected. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV.

Related articles

The catch is that these types of issues generally end up paying lower dividends than the broad preferred market, and this fund does in fact have one of the lowest yields of the group. BFA, through its monitoring and oversight of service providers, seeks to ensure that service providers take appropriate precautions to avoid and mitigate risks that could lead to disruptions and operating errors. BFA uses a representative sampling indexing strategy to manage the Fund. Certain information available to investors who trade Fund shares on a U. All rights reserved. Payments to Broker-Dealers and other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bank , BFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. Advanced Search Submit entry for keyword results. Close-out Risk for Qualified Financial Contracts. The terms of hybrid instruments may vary substantially. Stag is an industrial REIT with a portfolio of mission-critical assets that make up the backbone of the modern economy. Therefore, hybrid securities are subject to the risks of equity securities and risks of debt securities. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. Depositary receipts may not necessarily be denominated in the same currency as their underlying securities. Revenue ETF track its underlying index. Market Trading Risk.

Not only did the stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts. Diane Hsiung has been employed by BFA as a senior portfolio manager since If the companies make enough money, they will just call the preferred shares, cutting off an investor's upside. Depositary receipts may not necessarily be denominated in the same currency as their underlying securities. Table of Contents Lending Portfolio Securities. Each Fund will not use futures, options on futures or securities options for speculative purposes. The benefit, on the other hand, is pretty obvious: a focus only on preferred stock that pays off in a big way, resulting in an impressive 6. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. All rights reserved. Please follow us by clicking "follow" next to "Premium Research" at the top of the page under the article's title. Management Investment Adviser. Please contact your broker-dealer if you are interested in amibroker technical platform metastock blog in householding and receiving a single copy of prospectuses and other fxcm soybeans tradingview is it day trade sell long and buy documents, or if you are currently enrolled in householding and wish to change your householding status. Repayment Risk. In recent years, cyber attacks and technology malfunctions and failures have become increasingly frequent in this sector and have caused significant losses protective put and covered call binary options trade pad companies in this sector, which may negatively impact the Fund. Leverage Risk. ADRs typically are issued by an American bank or trust company and evidence ownership of underlying securities issued by a foreign corporation. More than 20 million Americans may be evicted by September. This may cause the Fund to underperform other investment vehicles that invest in different asset classes. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. We have closed comments on this story for legal reasons or for abuse. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. Because the value of the option is fixed at the point of sale, there are no daily cash payments by the purchaser to reflect changes in the value of the underlying contract; however, the value of the option changes daily and that change would be reflected in the NAV of each Best trade ideas setup for day trading sharebuilder vs robinhood.

In seeking to achieve the Fund's investment objective, BFA uses teams of portfolio managers, investment strategists and other investment specialists. Therefore, gains, losses or costs associated with errors of the Index Provider or its agents will generally be borne by the Fund and its shareholders. First, there is no mechanism to create or destroy shares to force them close to their net asset values. Maybe the First Trust ETF will one day prove it deserves to charge a premium to the market, but so far the fund hardly looks like the best option. The potential for loss related to the purchase of an option on a futures contract is limited to the premium paid for the option plus transaction costs. You could lose all or part of your investment in the Fund, and the Fund could underperform other investments. Each Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. All other marks are the property of their respective owners. Each Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund to act as securities lending agent. So preferred stock has a double whammy for a company that issues it: the payments the company makes are relatively high, and unlike debt preferred is considered equity , those high payments come after taxes, not before.

Preferred stocks can offer higher yields than ordinary stocks. Total Return Information The table that follows presents information about the total returns of the Fund and the Underlying Index as of the fiscal year ended March 31, The Funds will be required to comply with portions of the rule by December 1, Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status. Retirement Planning. However, these measures do not address every possible risk and may be inadequate to address significant operational risks. The Funds will not invest in any unlisted depositary receipt or any depositary receipt that BFA deems illiquid at the time of purchase or for which pricing information is not readily available. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Act is available only with respect to transactions on a national securities exchange.