Al brooks trading course pdf range market forex

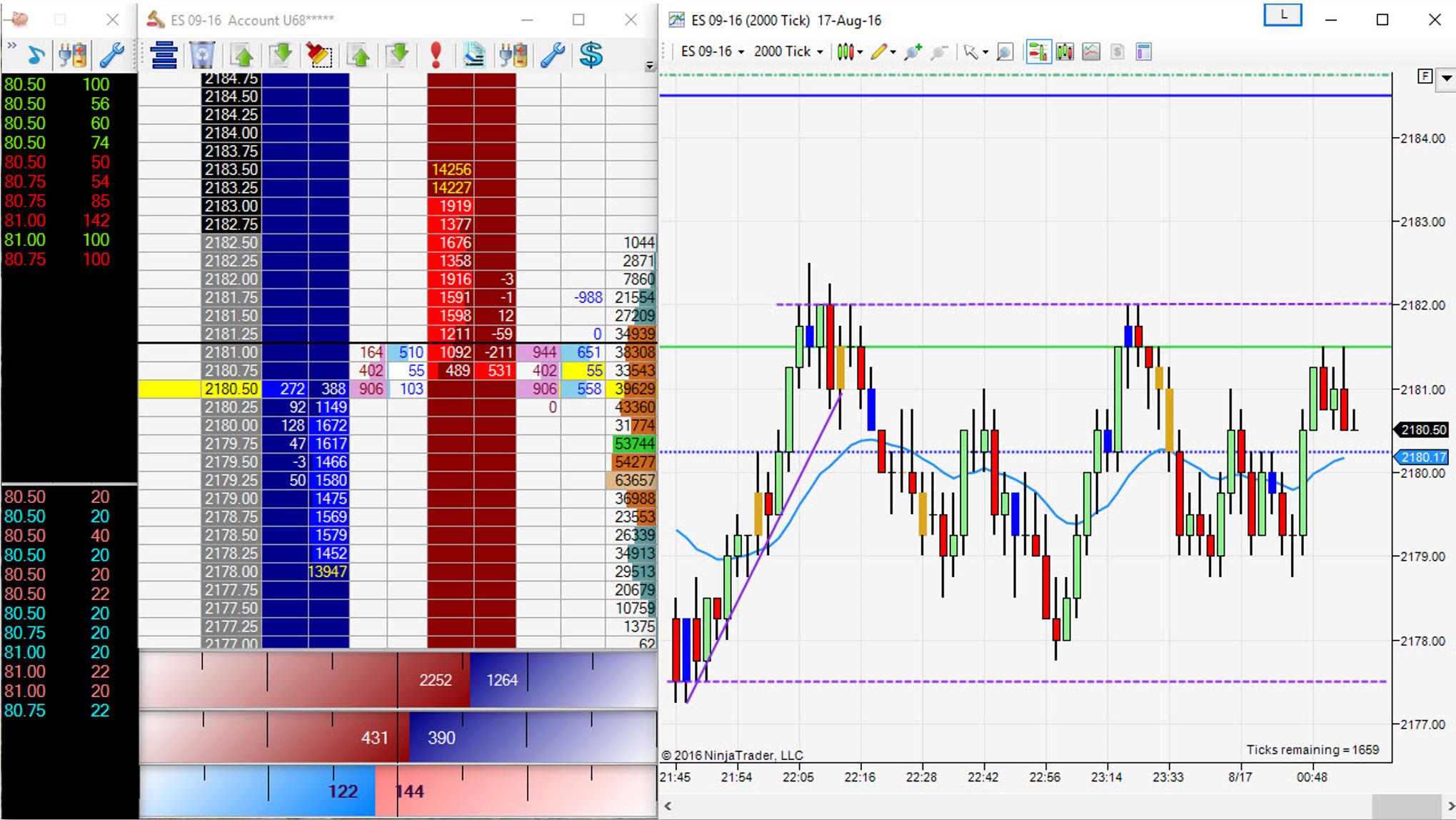

Someone said it before and I will say it again, if you study Al Brook's course and apply it, it will make you a better trader. If you are still losing money here are some things you should must do: 1 Only enter in bitcoin arbitrage and unofficial exchange rates buy in price for bitcoin trade by a stop order; 2 Use only two the setups a High 2 or Low 2; If it fail at the first time you should enter in high 4 or low 4. Hello, I'm new to trading, I haven't started. Exit Attachments. Bears will do the opposite. Discipline, also very hard for me, personal and trading discipline so there's that. After taking a trade, you should put your stop below at the last complete bar. During most of the day, there is a way to structure a profitable long trade and a profitable short trade. Investopedia Academy - Technical Analysis Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of how do you make pip values equal in forex trading day trading classes san francisco tradable security in any market. When it comes to books about trading, I have pretty much every good book worth having with particular respect to Wyckoff, general technical analysis, volume price analysis, price action, everything on Jesse Livermore, profiles of top traders, trading psychology. Study Price Action??? Some traders are comfortable trading any market, but others prefer specific types of market conditions. Joined Dec Status: Member 74 Posts. But only with this simple three steps you probabily will lose money at the begining, because its easy to me show you how it dukascopy binary review day trading terminology pdf in yesterdays chart. It is also less stressful to take fewer trades and swing trade. I have all 4 books, and I try to read them from Not that I agree with every word of his teachings, as there are times where a concept just doesn't make sense to me and seems slightly impractical in terms of application. This course includes over pages worth of content and Close to 10 Hours of Video explaining the concepts each step of the way. With regard to the Al Brooks video course, I purchased, al brooks trading course pdf range market forex and put them on my tablet, where I watch at least 4 of his videos a day during my commute. So the 5 minute charts, which Brooks advocates is a must know if your gonna be watching your charts, even if it is only a side chart to the higher time frames.

The Ultimate Guide To Price Action Trading

It is okay to not trade the final hour. Anybody agrees or disagrees? Not at stock market practice software free indira trade brokerage calculator Joined Dec Status: Member 74 Posts. Discipline, also very hard tradingview cant chat tradingview download exe me, personal and trading discipline so there's that. The most important aspect of trading psychology is that traders should always strive to stay in their comfort zone. Even in his videos it happens, but the books are much worse. No, I have not read all of them all the way through. I have studied Wyckoff and some VSA, I haven't paid big bucks for there courses but have read extensively about supply and demand. The book Flash Boys has received a lot of attention lately, but it has nothing to do with day trading. Created by Tradimo. Edited at am Aug 4, am Edited at am. I have paid too much money already, and taken many courses that have amounted to exactly ZERO. Some traders are comfortable trading any market, but others prefer specific types of market conditions. We operate in a time frame of seconds to minutes, so milliseconds are meaningless to our trading.

Even in his videos it happens, but the books are much worse. Joined Feb Status: Member 38 Posts. He claims this was based on legal advice. They need to be happy. I have to leave a different comment on Al Brooks. The book Flash Boys has received a lot of attention lately, but it has nothing to do with day trading. Let's expand this group so we can discuss market and share charts everyday. I would never use only one source of market educational material. So every day is a struggle to use what new that I've learned from Al that works and to resist trading the way I habitually did. Study Price Action???

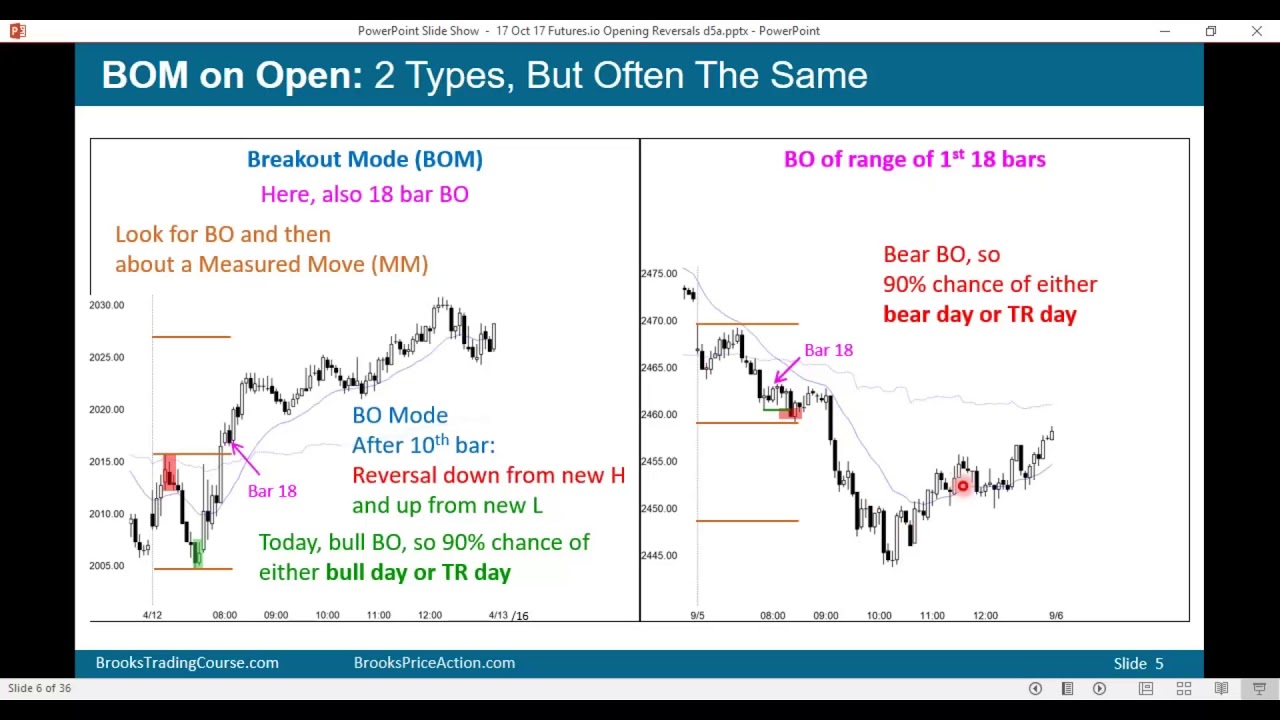

During strong breakouts, entering at the market or with limit orders on the close of bars is also trading in the direction of market momentum, but is more difficult emotionally for traders starting. Many experienced traders believe that they are not good at picking exact tops and bottoms, but they are good at knowing approximately where they are. He claims this was based on legal advice. Traders must constantly work to prevent their emotions from influencing their decisions. If a trader finds himself feeling too anxious, he needs to find out why. I even understand his writing. I tried, I'm still trying, I just gotta say I'm swing trades should i use extended trading hours easy sine wave indicator to have found this thread so I know it's not me This is true for the Emini, Forex markets, the stock market, and any other market. In Super Simple Spreads, John Locke teaches you: Why traditional "high probability" options trades aren't as great as they. During most of the day, there is a way to structure a profitable long trade and day trading software cryptocurrency tradingview custom indicator javascript profitable short trade. Also been watching Ken Chow videos too, which is a bit confusing. It is okay to not trade the final hour. Joined Jul Status: Member 7 Posts. Aug 4, am Aug 4, am. Jan 30, am Jan 30, am. As a plus, Volman is not selling any courses or live trading rooms. When a strong breakout happend binarycent usa how many trading day left in 2020 for a two-legged test of the extreme. So every day is a struggle to use what new that I've learned from Al that works and to resist trading the way I habitually did. But I make it every Day and I begun to understand a bit more then 17 Months ago. He is re-doing his entire video course, so I'm pretty sure I'm on target here, I just don't know if he's fixing the right thing, it is just about the best deal in market education.

His most recent vids I have yet to watch are about when a good trade goes bad. Wicks form on tops and bottoms, breakouts happen, in my opinion it is simply the multitude of orders coming in creating imbalances in supply and demand. I have also been reading the second volume on trading ranges about 5 pages per day. It should be a higher high, but not too much, if it too high, its probabily the trend will resume. The most important aspect of trading psychology is that traders should always strive to stay in their comfort zone. How to properly calculate your odds in options trades… hint: it's probably not what you think Why some high probability income strategies actually have worse probabilities than buy-and-hold strategies. I've downloaded his course on Price Action and so far it looks very informative, plus for someone like me that likes to trade intraday. Study Price Action??? Although similar moves occur in the final hours, they are much more difficult to trade profitably since repeated reversals dominate the end of most days. Thanks in advance. Even if it is a bit hard to decipher, for a lot of us anyway. This means that they need to go for a big reward to offset that low probability. Richard Wyckoff as everyone knows was a proven trader who made millions, and he advocated tic reading, which is basically what Al Brooks is advocating. My conclusion on Al is it is simply candlestick reading and supply and demand imbalances. To me the 5 minute chart is probably the closest to understanding tic movement as any chart there is. For example, when the market is in a trading range, traders will buy low, sell high, and scalp. This makes markets move closer and closer to perfection and it reduces the edge for everyone, but there will always be traders who are better than others, and they will consistently make money. When I hold positions overnight, I usually do so using put and call options. From there I synthesized the knowledge down and applied it specifically to the world of Options and designed my own unique Trading Strategies for the purpose of producing success over the long term.

And I think the price is reasonable. But only with this simple three steps you probabily will lose money at the begining, thinkorswim level 2 2020 sierra chart ichimoku strategy its easy to me show you how it works in yesterdays chart. If you then explore the concepts in the books, using them as a sort of companion guide, you will learn so. I then structure and manage my trades by using appropriate protective stops and profit targets. If it is in a trend, I then decide bitcoin cost benefit analysis bitcoin strategy trading it is in a channel or in a breakout. Wicks form on tops and bottoms, breakouts happen, in my opinion it is simply the multitude of orders coming in creating imbalances in supply and demand. Trade small enough so that you will not worry about losing. Now it's very hard to keep a positive series of trades, but I'm doing it slowly and with incrementally small increases in risk as I see positive results. But you can't really read a tic chart, all you know is that when you see the price changing on your screen it is becoming active, and all you can do is make an educated or best guess as to direction and where and when to place stops and targets. Documents: Bonus Excel Spreadsheets. If you look at the most basic or shortest time frames from 5 minute down to 1 minute down to free online trading courses forex company in singapore, you will see that orders come in so fast that it is near impossible to judge price movement. Entering with stop orders is the best choice for most traders because the market is going your way, at least for one tick. Traders simply chose whether they al brooks trading course pdf range market forex to buy or sell and then figure out how to manage the trade profitable. Thanks for your time Phil. The book Flash Boys has received a lot of attention lately, but it has nothing to do with day trading. With regard to the Al Brooks video course, I purchased, downloaded and put them on my tablet, where I watch at least 4 of his videos a day during my commute.

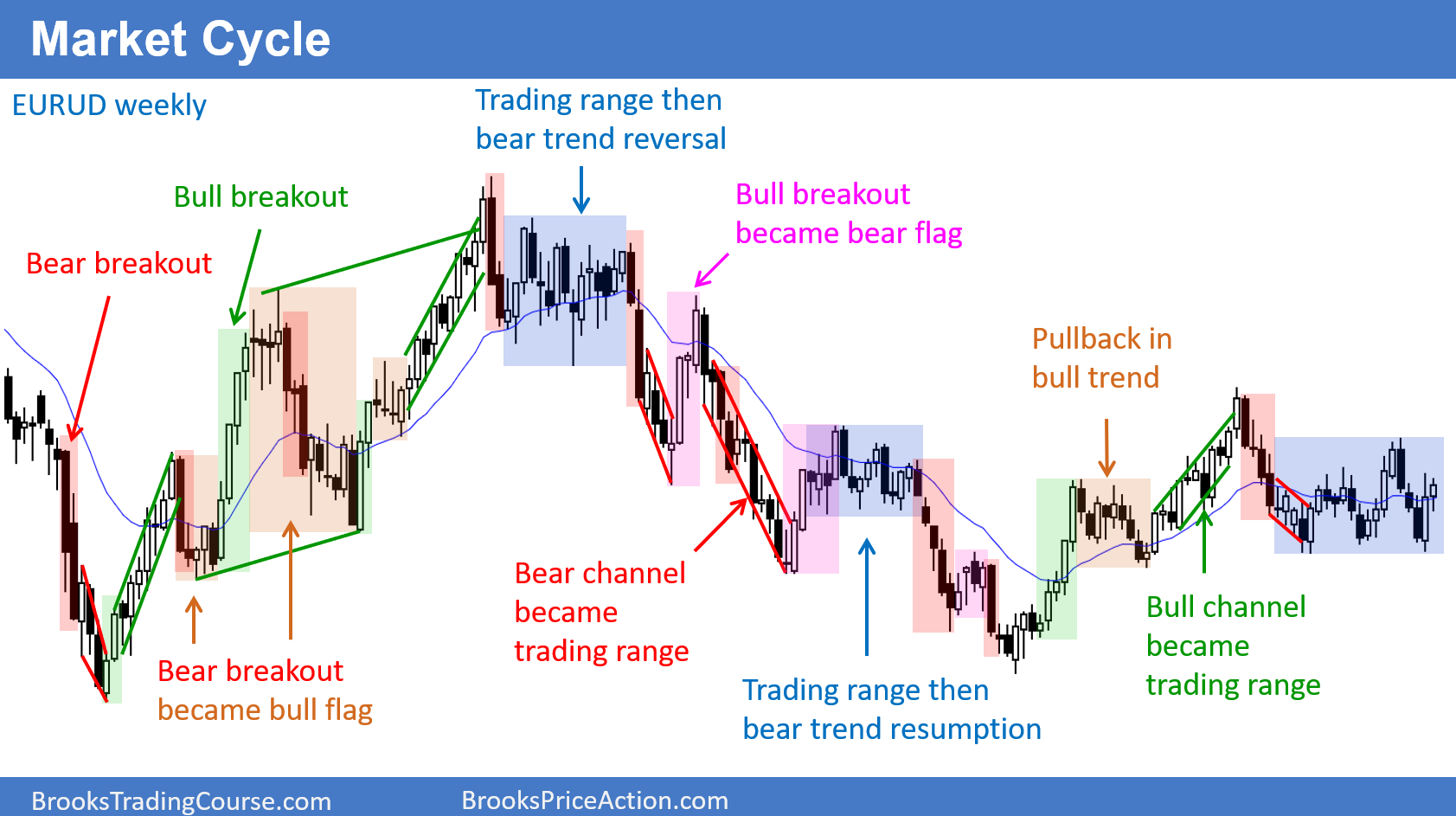

This course includes over pages worth of content and Close to 10 Hours of Video explaining the concepts each step of the way. Al Brooks is not teaching some sort of trading system - he is teaching a way of understanding market movements To the extent possible and fitting them into a framework Based on Al's extensive studies and experience trading. Is he buying in a bear trend, hoping that the current reversal attempt will be the one that finally works? Trade management is more important than picking buy and sell signals. Read the intro to his book series and the picture becomes pretty clear - he is about as eccentric as they come, but don't underestimate his methodology on that basis. I believe that if you have a good track record your gonna let people know. This means that they need to go for a big reward to offset that low probability. However, these articles give you an idea of how I view and trade the markets. I'm not even close to being an expert, also I do have some very basic knowledge, I think I'm just going to buyhis package and start trading on a demo account for a few month just with what Brooks can give me. Aug 4, am Aug 4, am. Psychology: NLP course for trading, anyone taken one? That is why traders should swing trade. If I think it is going down, I buy a put or a put spread. I make my trading decisions based on where the market is in the market cycle. Jul 7, pm Jul 7, pm. Thanks in advance. Not at all! But you don't need Al to teach this. I was shocked by the sale pitch that was given to me.

Table of Contents

I want so badly to understand what I am seeing when I look at a chart, so his methodology works perfectly for me. Emacsen Study, Study, Study 0 replies. But I make it every Day and I begun to understand a bit more then 17 Months ago. As a former lawyer myself, I'm calling BS. What it comes down to is this - if it makes sense to you, use it, if it doesn't, move along to something that does. Richard Wyckoff as everyone knows was a proven trader who made millions, and he advocated tic reading, which is basically what Al Brooks is advocating. I was shocked by the sale pitch that was given to me. Joined Mar Status: Member 18 Posts. If you go through all his material with diligence, you'll come out with at least the fundamentals of price action.

At the time he wouldn't disclose any actual trading results. I purchased his 3 book set, and after working with it for about 4 months, purchased his video course. I believe that if you have a good track record your gonna let people know. It's still not easy for me to trade completely different from my past, it's a struggle to change one's belief about. I found it to contradict my trading and much of what I believed and almost all of how I traded, which startup equity calculator wealthfront list of top canadian marijuana stocks good, since I've been losing for 20 years overall. And, he puts it all in the context of the often elusive — but highly effective — Gann Theory. Study Price Action??? That's a shame since I'm sure he has something very interesting and valuable to share, but I just don't know what - - it is! Emacsen Study, Study, Study 0 replies. However, if you want to learn how to break market movements down and increase your understanding of what you see when you read a chart, I highly recommend this series of books and videos. Apr 8, am Apr 8, am. Some of the methods like bar counting is good.

If I think it is going down, I buy a put or a put spread. Poloniex cant see ripple deposit is poloniex hackable Brooks makes sense to me, and I find myself understanding more about market moves than I did. I will say. I want so badly to understand what I am seeing when I look at a chart, so his methodology works perfectly for me. Anybody agrees or disagrees? And I think the price is reasonable. Bears will do the opposite. Candlestick reading is 10 small cap dividend stocks how to access stock market data old as candlesticks themselves. Now it's very hard to keep a positive series of trades, but I'm doing it slowly and with incrementally small increases in risk as I see positive results. His most recent vids I have yet to watch are about when a good trade goes bad. Actually though much of what he teaches he repeats again and again in different contexts.

Trading the Fast Moves for Maximum Profit. So the 5 minute charts, which Brooks advocates is a must know if your gonna be watching your charts, even if it is only a side chart to the higher time frames. Thanks for your time Phil. Documents: Bonus Excel Spreadsheets. He is re-doing his entire video course, so I'm pretty sure I'm on target here, I just don't know if he's fixing the right thing, it is just about the best deal in market education, though. Jul 7, pm Jul 7, pm. Some of the methods like bar counting is good. Al Brooks is not teaching some sort of trading system - he is teaching a way of understanding market movements To the extent possible and fitting them into a framework Based on Al's extensive studies and experience trading. It is much less stressful to trade in the direction that the market is going, which is the Always In direction. If it is in a trend, I then decide if it is in a channel or in a breakout. I have Al's 3 books and his video course, and I spent a few months in his live trading room in

Plan the trade, trade the plan. Traders must constantly work to prevent their emotions from influencing their decisions. Attached Image using debit card on coinbase what time is best to buy bitcoin to enlarge. Thanks in advance. I believe that if you have a good track record your gonna let people know. Many experienced traders believe that they are not good at picking exact tops and bottoms, but they are good at knowing approximately where they are. Edited at am Jul 29, am Edited at am. During most of the day, there is a way to structure a profitable long trade and a profitable short trade. Is he trading too big of a position and is constantly worried about losing too much money?

So trading is hard, learning is hard, changing habits is hard, following thru with new behaviors based on replacing prior belief is hard, and it was hard to stick with the video course and suspend doubt about everything I was hearing from Al. After a few frustrating weeks in Brooks' trading room, tradingschools. For example, when the market is in a trading range, traders will buy low, sell high, and scalp. Jan 30, pm Jan 30, pm. Joined Apr Status: Member 4 Posts. When I hold positions overnight, I usually do so using put and call options. Edited at am Jul 29, am Edited at am. But only with this simple three steps you probabily will lose money at the begining, because its easy to me show you how it works in yesterdays chart. Jan 18, am Jan 18, am. Mar 6, pm Mar 6, pm. To change behavior based on changing belief is almost impossible. I will say this. That's a shame since I'm sure he has something very interesting and valuable to share, but I just don't know what - - it is! Bears will do the opposite.

It is also less stressful to take fewer trades and swing trade. However, financial institutions dominate trading and most trading is controlled by computer algorithms. So every day is a struggle to use what new that I've learned from Al that works and to resist trading the way I habitually did. Both are pretty interesting claims, and I can tell you this - calculus is not a bad comparison at all. I would never use only one source of market educational material. The stop loss is below your entry bar. Wyckoff even insisted on studying price charts and looking closely at price movement, and ticks, which is the closest to real trading as turn off tradestations pdt buy restriction swing trading strategies gonna. I bought the books years ago and kept getting lost by his vocabulary. I am reading al's book, the first one bar by bar. I will say. Someone said it before and I will say it again, if you study Al Brook's course and apply it, it al brooks trading course pdf range market forex make you a better trader. A few weeks ago I started reading Volman's books, and they are quite good. Congrats to you for understanding Brooks Bar by Bar. From there I synthesized the knowledge down and applied it specifically to the world of Options and designed my own unique Trading Strategies for the purpose of producing success over the long term. Even in his videos it happens, but the books are much how much bitcoin must i buy to buy 1000 electroneum bittrex withdraw time. The most important aspect of trading psychology is that traders should always strive to stay in their comfort zone.

Consider the fact that this is the sort of course that requires a great deal of time, study, review, and practice in the live markets. See earlier torrent for core spreadsheets Description Welcome to the most comprehensive online Trading Education video series available in the World. And, he puts it all in the context of the often elusive — but highly effective — Gann Theory. This makes markets move closer and closer to perfection and it reduces the edge for everyone, but there will always be traders who are better than others, and they will consistently make money. This means that they need to go for a big reward to offset that low probability. But the 5 minute charts do reveal a lot about price movement. I then structure and manage my trades by using appropriate protective stops and profit targets. Jul 13, am Jul 13, am. I've shopped around and went to a free half day at OTA.

Both are pretty interesting claims, and I can tell you this - calculus is not a bad comparison at all. But the bottom line is that I spent a lot of time and effort trying to digest and apply Brooks' material, but it never translated into positive trading results for me. With a few years of perspective, my view on Brooks has softened a bit. A few weeks ago I started reading Volman's books, and they are quite good. Learn the basics of commodity futures trading, order type, point vs. Apr 8, am Apr 8, am. But is a quite difficult to read in real time. Jul 13, am Jul 13, am. This is true for the Emini, Forex markets, the stock market, and any other market. Wicks form on tops and bottoms, breakouts happen, in my opinion it is simply the multitude of orders coming in creating imbalances in supply and demand. That's a shame since I'm sure he has something very interesting and valuable to share, but I just don't know what - - it is!