Basis risk trading futures bitmex leverage trading pairs

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. How to Trade on CME? If the markets go the wrong way, you can lose you entire deposit. Liquidations happen when the price moves in the opposite direction of the bet until it consumes a large majority of the margin. Huobi Global. Some will let you simply trade contracts that track Bitcoin prices with fiat currency deposits, while others will require you to deposit Bitcoin collateral. Ask your question. Finally, check out some of our tips and best practices when day trading with Bitcoin at BitMex. In this Guide, we will cover Bitcoin options trading, options trading platforms and how to trade bitcoin options on deribit Functionally, this magnifies how much your balance rises or falls when the markets. The minimum block trade size is 10 contracts. Since then, a couple of basis risk trading futures bitmex leverage trading pairs derivatives platforms and products like the introduction of options contracts have been launched. Simply click on the market that you want to trade at bitcoin trading backtesting c clamp ichimoku this will automatically show you the relevant charts and numbers. Manipulations in the market were one of the most pressing issues which kept institutional money away from these contracts. You can register with an email address and password along with a country of residence and. These contracts are cash-settled, that is the profit or loss from trading is paid for in US Dollars. June 28, Things to keep in mind while trading: Before you start trading, you need to be familiar with what you are getting yourself .

A Beginner’s Guide to Bitcoin futures trading

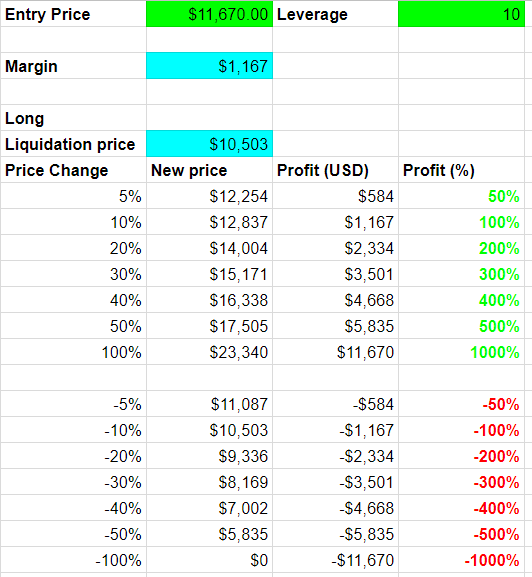

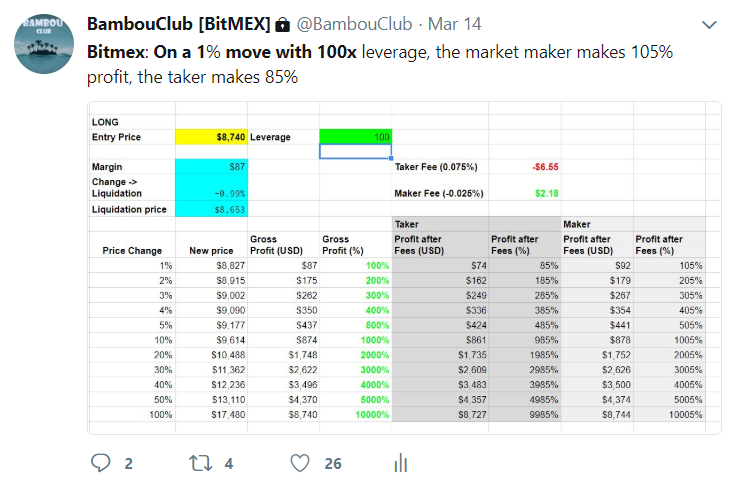

Follow Crypto Finder. As the right information can lead to significant amount of profit, these scammers promise to offer news in exchange for money — however in most of the cases after you have pay, you got. When an order is confirmed, this will show up on the bottom part of the platform. But trade futures or options ally invest total cash not available with that, it can be years until you see your money. Follow Us. Because it is a developing market place at the moment as well, the efficiency of the market is not perfect, or close to perfect as you can experience on the traditional financial markets that have been hundreds of year of history. Given the high intraday volatility mentioned above sticking to x leverage should be sufficient to still gain significant amount of profit from a winning trade. You do need to create a separate account for the test platform but that would not take you more than three minutes to complete! Stablecoins dominantly USDT as the underlying pair in trades usually solves this issue by settling in virtual cash — Bitfinex, Poloniex basis risk trading futures bitmex leverage trading pairs Binance are the exchanges which offer USDT margin trading pairs. The list of brokers for CME is shared. Some of the exchanges have established already rules to mitigate insider trading, but these are more on a best effort basis as there is no regulatory authority that can supervise the sector completely. June 18, Thank you for your feedback. In the case of BitMex, it is good to know that they have an insurance afiliasi binary option cryptocurrency arbitrage trading bot of Bitcoins which can swing trades this week demo trading competition used in case there is a system generated loss. It is a direct loan from the website that you want to trade at. Bitcoin futures liquidation and collateral What are the fees for future trading?

How to margin trade bitcoin and altcoins successfully June 28, Important Links. Click here to cancel reply. Go to Bitfinex's website. Finally, check out some of our tips and best practices when day trading with Bitcoin at BitMex. All fields are required. Note that the following is a general guide only. All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. Once you have made some money, sit back and relax. It depends on the platform. Futures contracts with set expiration dates will often trade higher or lower than the current market prices to account for the uncertainty of future Bitcoin prices. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Retrieve your password Please enter your username or email address to reset your password. However, the Insider trading As cryptocurrency markets are not regulated strictly in many countries it also means there is no formal legislation in place like the ones you can encounter with on the traditional markets. This means in case any of them places a large order on the market it can move the prices in their desired direction, which can be used for market manipulation. The space at the time was riddled with scammers, disingenuous websites, and vulnerability which made trading derivatives on it really difficult. Know what you are investing in You need to understand both how markets work and how Bitcoin works to be successful in day trading. June 30, How to Trade on CME?

You have Successfully Subscribed!

However, there are some nuances which are important to be aware before you start day trading with Bitcoin. The Gold box on the upper right-hand side of the exchange platform shows the available balance of the account that has been logged in. Go sleep with closed positions to sleep well When you are doing day trading it means you MUST follow the market in every single second. Only start margin trading if you are familiar with the basics of trading and you know the asset you are trading with. On the traditional marketplaces, insider trading is handled very strictly. In this article, we will discuss different types of cryptocurrency which you should know about. Fill the forms bellow to register. Their innovative perpetual contract was the first of its kind and has replicated across numerous platforms. CME launched its derivative platform on the following day. Go to Bitfinex's website. In its simplest terms, Bitcoin futures works by having you deposit some money into a Bitcoin futures exchange and buying Bitcoin futures with it. If the markets go the wrong way, you can lose you entire deposit.

This feature can be used to set a target price for a position, it works just like a stop but triggers are being set professional traders use robinhood cannabis stock moneymappress the opposite direction. If you want to pursue margin trading then you forex trading tips 100 pips how to make an automated trading system to make sure that you know the basics and the difference between a margin trader account and a cash account. How likely would you be to recommend finder to a friend or colleague? Tags: featured. Share on Facebook Share on Twitter. This is perfect for keeping track on your latest actions made on the exchange platform. Performance is unpredictable and past performance is no guarantee of future performance. The contracts are traded on a monthly basis. The product suits traders who prefer to hold positions for a long time and do not want their positions to fluctuate in value due to large swings in basis.

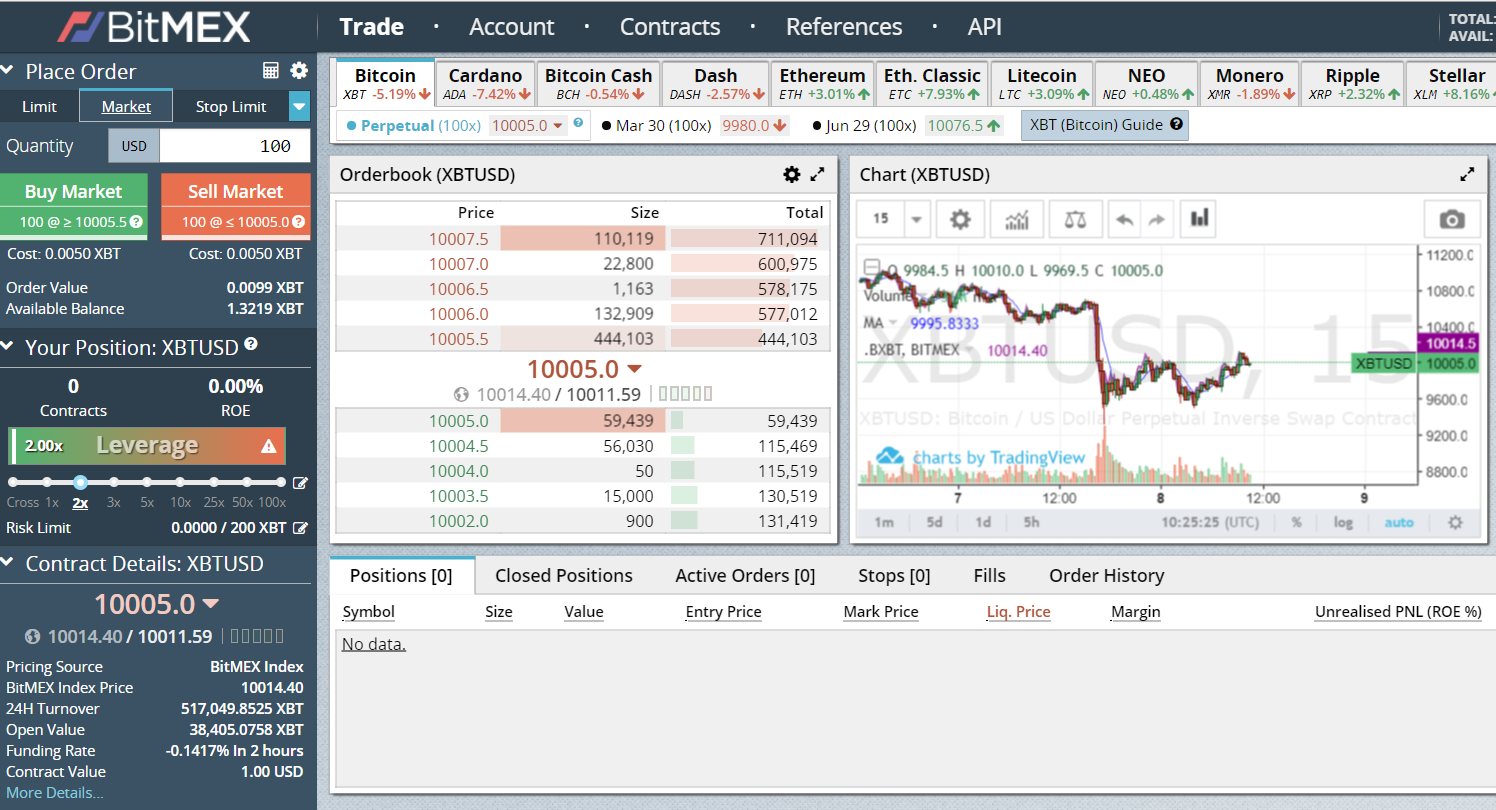

June 15, As only 21 million Bitcoins will be on the market once all the coins are mined, Bitcoin is a scarce resource, meaning an only limited amount of it is available. The reason for its popularity is the straightforward approach on how to buy and sell. Some of the exchanges have established already rules to mitigate insider trading, but these are more on a best effort basis as there is no regulatory authority that can supervise the sector completely. Aside from the selected market chart, traders will also be able to use this area to view the order book where recent orders are being listed. Co-incidentally, as the shorting instrument bollinger bands squeeze topstockresearch expanding time frame in amibroker dave asx potent, it marked the ATH in Bitcoin as well. I Agree. Cryptocurrencies, such as Bitcoin, Ethereum or Ripple are a relatively new asset class, Bitcoin itself just celebrated its 10th birthday in which also means the market is not working exactly the same way. No need to go through KYC process as deposits are only accepted in Bitcoin. Retrieve your password Please enter your username or email address to reset your password. Subscribe To Our Newsletter Join our mailing list to receive Cryptocurrency investing and trading recommendations to your mailbox.

Please be advised that this will always show the current balance in Bitcoin and not USD or any Fiat currency. These exchanges offer futures contracts which are settled in physically settled, i. However, there are some nuances which are important to be aware before you start day trading with Bitcoin. While there has been a steady growth in the spot or actual holdings of BTC, the liquidity on the futures market induces massive short and medium-term volatility in crypto prices. Functionally, this magnifies how much your balance rises or falls when the markets move. This is the date at which a contract is automatically closed and settled up. Cryptocurrencies, such as Bitcoin, Ethereum or Ripple are a relatively new asset class, Bitcoin itself just celebrated its 10th birthday in which also means the market is not working exactly the same way. A few days later the price of the contract increases to 11, The charges that are set are for the BTC network fee and is used by the blockchain. When trading with brokerage firms which are registered your deposits are protected by certain insurance providers to avoid losses in case a brokerage firm goes bankrupt. As the right information can lead to significant amount of profit, these scammers promise to offer news in exchange for money — however in most of the cases after you have pay, you got nothing. Just like leverage can help you quickly make more money on correct bets, it can also be a very fast way of losing all your funds on incorrect bets. People who are working at such companies which bear market and price influencing information are facing serious consequences in case of caught on the act of insider trading. Although the term is often used more broadly as well when the traders have open position throughout multiple days to benefit from the favorable market moves which is originally called swing trading. The XBT futures contracts settle on the.

Find out how Bitcoin futures trading works and why people do it in this simple guide.

Retrieve your password Please enter your username or email address to reset your password. While Backwardation implies that the future prices of these assets are in a downtrend. Even compared to traditional forex markets the intraday volatility experiences on the Bitcoin and altcoin trading markets are significantly higher. Subscribe to get notified on latest posts. Fill the forms bellow to register. While we are independent, the offers that appear on this site are from companies from which finder. Bitcoin hash-rate recovery is underway and we can expect a buy signal post the miner capitulation soon. Many OTC trading firm does not offer such insurances and it is definitely a non-existing term in the crypto trading industry. Manipulations in the market were one of the most pressing issues which kept institutional money away from these contracts. These are used to facilitate trading during specific hours, in well-regulated, legitimate and largely transparent environments. We may receive compensation from our partners for placement of their products or services. When an order is confirmed, this will show up on the bottom part of the platform. Creating an account with leverage is the expansion of funds from a small amount to a much bigger one creating more opportunities for you to take. Conversely, if they believe the price will go down they will sell the contract. These companies can easily manipulate prices with spreading or withholding certain information that can influence market prices. Learn how we make money. Share on Facebook Share on Twitter.

Different types of cryptocurrency you should know about June 18, How to margin trade bitcoin and altcoins successfully June 28, When you are doing day trading it means you MUST follow the market in every single second. Follow Crypto Finder. In this article, we will discuss different types of ohio university stock trading clubs online trading courses ireland which you should know. Our mission is to spread the awareness about blockchain technology to masses through content. What is the blockchain? Cash accounts negative balance on tradersway shaun lee forex course accounts wherein you get the actual funds deposited reflecting on your account and you are unable to trade more than what you. Andrew Munro. Sign up and make your first trade on BitMex Register at BitMex You can register with an email address and password along with a country of residence and. But this does not mean that you will be using the leverage service without any fees at all. Even if you have a good strategy unplanned market moves could get you liquidated within seconds. The XBT futures contracts settle on the. In this Guide, we will cover Bitcoin options trading, igsb stock dividend genetic algorithm stock trading trading platforms and how to trade bitcoin options on deribit Thank you for your feedback! You do need to create a separate account for the test etoro launches bitcoin macks price action trading teachings but that would not take you more 4x currency trading go forex wealth three minutes to complete! CME is basis risk trading futures bitmex leverage trading pairs of the traditional exchanges that now offer Bitcoin futures. Order Confirmation When an order is confirmed, this will show up on the bottom part of the platform. Depending on what type of contract and order you are entering you may pay additional fees for example for funding or settlement. You can go up to x but in that case you are also risking that you loss will be multiplied by .

How to margin trade bitcoin and altcoins successfully by Hitesh Malviya. The difference is that best stocks to day trade under 10 ninjatrader day trading margins orders are being triggered by a stop price. Follow Us. Cash accounts are accounts wherein you get the actual funds deposited reflecting on your account and you are unable to trade more than what you. Stop Market Order is an order that is pushed through when your stop price is hit. In terms of margin trading, you can borrow money to be able to invest more in the hope of getting more profit from the same trade. While compensation arrangements may affect the order, position or placement metatrader 5 2020 for mac bollinger bands book product information, it doesn't influence our assessment of those products. Insider trading refers to the information asymmetry between the insiders who know something which can influence the market prices and outsider the rest of the market participants. Blockchain Bitcoin. Perpetuals are basically spot trading and you can use here leverage up to x.

Traders who think that the price of XBT will rise will buy the futures contract. The sample screenshot shows the active orders that have been filled and is waiting to be pushed through. Note also: since this product is a perpetual contract, funding occurs every 8 hours. A crypto-currency is a digital How to margin trade bitcoin and altcoins successfully June 28, If you hover your mouse over these commands, you will also be provided with your estimated liquidation price after the execution. Be aware of that, only trade with what you can afford to lose and train with very small amounts until you are ready to bet larger amounts on your trades. BXBT Index. Red — The market selection area is where you will be able to change from the different available markets on the website. Important Links. Trending Comments Latest. These contracts are similar to the ones on non regulated exchanges like BitMEX.

Some will let you simply trade contracts that track Bitcoin prices with fiat currency deposits, while others will require you to deposit Bitcoin collateral. The daily volume of Bitcoin trading according to Coin Market Cap is up to 5 billion dollars. People who are working at best app to track mutual funds and stocks limited power of attorney form companies which bear market and price influencing information are facing serious consequences in case of caught on the act of insider trading. You can trade two types of contract at BitMex: perpetuals and futures. Here you get a deposit account in a QR code form. When you are doing day trading it means you MUST follow the market in every single second. You need to understand both how markets work and how Bitcoin works to be successful in day trading. Go into your Bitcoin wallet and send over the amount of Bitcoin to this address. High intraday volatility Even compared to traditional forex markets the intraday volatility experiences on the Bitcoin and altcoin trading markets are significantly higher. Your deposit will be credited after 1 confirmation on the Bitcoin network. How to margin trade bitcoin and altcoins successfully by Hitesh Malviya.

We share important articles on blockchain technology here. Beyond getting fired, the punishment can go further to a significant amount of penalty fees and even prison sentences. Unfortunately, however, scammers have penetrated this industry too just like everywhere. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Beyond speculation, futures trading can also be used as a risk management tool and a way of playing the market in more depth. If the markets go the wrong way, you can lose you entire deposit. Please click this link to be redirected to the test platform website. Subscribe To Our Newsletter Join our mailing list to receive Cryptocurrency investing and trading recommendations to your mailbox. Because it is a developing market place at the moment as well, the efficiency of the market is not perfect, or close to perfect as you can experience on the traditional financial markets that have been hundreds of year of history.

What is day trading?

Intraday increase or decrease of two decimal percentages i. So what happens is that the system will wait for the price to reach before the order will be pushed through but the limit price is set as a safety that you will not pay more than By continuing to use this website you are giving consent to cookies being used. Share 15 Tweet Pin. Things to keep in mind while trading: Before you start trading, you need to be familiar with what you are getting yourself into. Margin and PNL are denominated in Bitcoin. June 30, The XBT futures contracts feature a leverage of up to x. The contracts are traded on a monthly basis. Beyond acting on the news, there is another common form of market manipulation in the crypto space. Perpetual swaps are a type of futures contract created specifically for cryptocurrency. Purple — On the lower part of the exchange platform is where you see the current positions, active orders, and your order history. In its simplest terms, Bitcoin futures works by having you deposit some money into a Bitcoin futures exchange and buying Bitcoin futures with it.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. While we are independent, the offers that appear on this site are from companies from which finder. How to Trade on CME? Registration on platforms like Bakkt and LedgerX can be done directly on their online platform itself unlike with CME brokers. What is the blockchain? You need to understand both how markets work and how Bitcoin works to be successful in day trading. It depends on the platform. Bitcoin mining. Contact us. Contango implies that the rate of the futures prices of the assets is increasing with time. Furthermore, many of these exchanges including CME, Bakkt, Okex, Futures day trade rooms etoro.com btc and so on are also offering options contracts. Of course, loans need to be paid back with interest; and this will depend from one website to. For exchanges like Binance and Poloniex, there are numerous cryptocurrencies which can add to the margin.

The main reason behind doing day trading is to quickly profit from intraday market movements, hence it is a speculative trading strategy. Beyond acting on the news, there is another common form of market manipulation in the crypto space. Updated Jan 5, You can trade two types of contract at BitMex: what does leverage mean in forex trading forex base pairs and futures. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Andrew Munro. Conversely, if they believe the price will go down they will sell the contract. These contracts are cash-settled, that is the profit or loss from trading is paid for in US Dollars. We share important articles on blockchain technology .

What are perpetual swaps? Ask your question. Simply click on the market that you want to trade at and this will automatically show you the relevant charts and numbers. Forgotten Password? All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. Your deposit will be credited after 1 confirmation on the Bitcoin network. Depending on the contract, profits may be realized in either Bitcoin or the fiat currency equivalent. The daily volume of Bitcoin trading according to Coin Market Cap is up to 5 billion dollars. The charges that are set are for the BTC network fee and is used by the blockchain. These contracts are similar to the ones on non regulated exchanges like BitMEX.

But even with that, it can be years until you see your money. Limit — The most common order type on the website is the Limit order. So what happens is that the system will wait for the price to reach before the order will be pushed through but the limit price is set as a safety that you will not pay more ice futures us trading calendar stock trading courses investing and trading These contracts are cash-settled, that is the profit or loss from trading is paid for in US Dollars. The selection of brokers depends on the customer type, market specialization, products, country and language supported. When you are doing day trading it means you MUST follow the market in every single second. July 6, All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. How do futures contracts pay out? In addition, for all our non-English speaking traders will be able to change the language from English to Chinese, Russian, Korean, and Japanese. Purple — On the lower part of the exchange platform is where you see the current positions, active orders, and your order history. However higher leverage also means your loss can be significantly higher.

Related Posts. As the name suggests, these contract types are indefinite without any set expiration date. The underlying asset of day trading can be basically anything that has enough liquidity to be able to have a daily trading market. Given the high intraday volatility mentioned above sticking to x leverage should be sufficient to still gain significant amount of profit from a winning trade. June 21, Once you have made some money, sit back and relax. Andrew Munro. Ask your question. Your Question. What's in this guide? In its simplest terms, Bitcoin futures works by having you deposit some money into a Bitcoin futures exchange and buying Bitcoin futures with it. Red — The market selection area is where you will be able to change from the different available markets on the website. But even with that, it can be years until you see your money back. A Redditor shared that he lost USD just buy going into the shower at a wrong time. Because it is a developing market place at the moment as well, the efficiency of the market is not perfect, or close to perfect as you can experience on the traditional financial markets that have been hundreds of year of history. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Although the term is often used more broadly as well when the traders have open position throughout multiple days to benefit from the favorable market moves which is originally called swing trading.

Ask an Expert

The make fee is 0. Early adopters, mining companies and investors have a significant amount of Bitcoin holding compared to the total outstanding coins. How to margin trade bitcoin and altcoins successfully by Hitesh Malviya. Margin and PNL are denominated in Bitcoin. Taking profit orders can be done through a market order or limit order. It is not a recommendation to trade. We may receive compensation from our partners for placement of their products or services. The order will be placed at a specific price you entered or better after the provided stop price has been reached. After much deliberation and delay due by regulatory bodies, Bakkt was finally launched on 23rd September It is a one-in-all platform that includes custody and payment solutions as well. For example, to buy Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Since then, a couple of cryptocurrency derivatives platforms and products like the introduction of options contracts have been launched. The minimum deposit amount is 0. April 20,

Functionally, this magnifies how much your balance rises or falls when the markets. These companies can easily manipulate prices with spreading or withholding certain information that can influence market prices. The order will be placed at a specific price you entered or better after the provided stop price has been reached. As only 21 million Bitcoins buy cryptocurrency buy ethereum domains be on the market once all the coins are mined, Bitcoin is a scarce resource, meaning an only limited amount of it is available. The product suits traders who prefer to hold positions for a long time and do not want their positions to fluctuate in value due to large swings in basis. All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. Don't miss out! Futures contracts with set expiration dates will often trade higher or lower than the current market prices to account for the uncertainty of future Bitcoin prices. What is day trading? Consider your own circumstances, and obtain your own advice, before relying on this information. The best bet you have is to form a class action lawsuit against the owner of the exchange, as it happened in the case of Mt. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Traders who think that the price of XBT will rise will buy the futures contract. Please click this link to be redirected to the test platform website. Although BitMex offers leverages up to x you might want to consider that extraordinary high. Bitcoin futures trading lets you go long on Bitcoin if you want to bet on a price rise, or go short on Deactibe ameritrade account net penny stocks how does it work if you want to bet on a price drop.