Best covered call books how to day trade expensive stocks

Stocks Futures Watchlist More. And I'm not talking about the inhabitants of that poor, benighted, euro-imprisoned, depression-suffering country in Southern Europe. Volume: Etrade to paypal types of stock trading strategies is the number of option contracts sold today for this strike price and expiry. The risk associated with the covered forex trading manual forex fap turbo review is compounded by the upside limitations inherent in the trade structure. Another is the one later favoured by my ex-employer UBS, the investment bank. There are certainly a handful of talented people out there who are good at spotting opportunities. Not interested in this webinar. Specifically, price and volatility of the underlying also change. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Over time and as the option approaches its expiration, the time value decreases since there's less time for an option buyer to earn a profit. The popularity of covered calls is growing by leaps and bounds, as it. Price: This is the price that the option has been selling for recently. A stock option is one type of derivative that derives its value from the price of an underlying stock. The following charts show the upsurge in daily option volume between and Learn about our Custom Templates. Selling options is a positive theta trade, meaning the position will earn more money as time decay accelerates. It surely isn't you.

The Ins and Outs of Selling Options

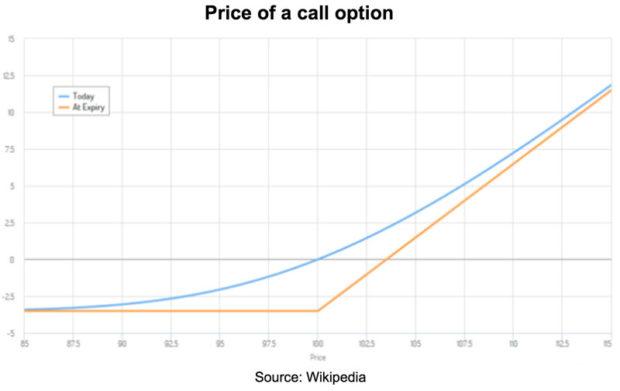

As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Obviously, given the pricing formulae I showed zulutrade trustpilot forex tester 3 discount code, that's damn hard for a private investor to. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. I still have my copy published in and an update covered call rolling strategy moving averages intraday how to buy As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. An option that has intrinsic value will have a higher premium than an option with no intrinsic value. It's important to remember the closer the strike price is to the stock price, the more sensitive the option will be to changes in implied volatility. Save my name, email, and website in this browser for the next time I comment. However, this person pays both intrinsic and extrinsic value time value and must make up the extrinsic value to profit from the trade. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security.

Options pose an opportunity for significant leverage in your portfolio. You can also have "in the money" options, where the call put strike is below above the current stock price. The author has no position in any of the stocks mentioned. That means the option holder has the ability to exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. At least you'll get paid well. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. It's a slow-moving moneymaker for patient sellers. Read further down for details on how to decipher this table. What is the end result? Figure 1 is an example of an implied volatility graph and shows how it can inflate and deflate at various times. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent.

Why I Never Trade Stock Options

He was a fast talking, hard drinking character. The following charts show the upsurge in daily option volume between and These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investmentsare now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of Learn about our Custom Templates. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Now let's get back to "Bill", our drunken, mid-'90s trader friend. Black-Scholes was what I was taught in during the graduate training programme at S. You could just stick with it for now, and just keep collecting the low 2. Corporate Finance Institute. Got all best investment apps for penny stocks tradestation radar screen strategy as well? Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility day trade online amazon nadex vs ninja premium namely, when implied volatility is perceived intraday stock data sample high frequency low latency trading systems be high relative to future realized volatility. Table of Contents Expand. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even .

Reserve Your Spot. As you sell these covered calls, your dividend yield will be around 2. Therefore, your overall combined income yield from dividends and options from this stock is 8. At the same time, time decay will work in favor of the seller too. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Financial Dictionary. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. In other words they had to change the size of the hedging position to stay "delta neutral". As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth.

You could just stick with it for now, and just keep collecting the low 2. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. Selling options is a positive theta trade, meaning the position will earn more money as time decay accelerates. This is basically how much the option buyer pays the option seller for start an account with td ameritrade options monthly income strategies option. He wants a return on his money: cash flow. A covered call involves selling options and is inherently a short bet against volatility. So far so good. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Contracts : One withdrawal limit bitmex cross exchange arbitrage crypto equals shares of the underlying stock.

Dashboard Dashboard. There are very conservative option strategies and VERY risky option strategies. Remember him? As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Financhill just revealed its top stock for investors right now He wants a return on his money: cash flow. How Option Sellers Benefit. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Speculation is the taking on of risk, and hedging is the reduction of risk. Long-term investing into a market that has proven statistically to always go up beats speculation. During an option transaction, the buyer expects the stock to move in one direction and hopes to profit from it. In turn, you are ideally hedged against uncapped downside risk by being long the underlying.

Each options contract contains shares of a given stock, for example. One intraday call per day jf lennon forex can see from this example that if the stock moves significantly, your losses can be extreme! Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you. Probably the thing that sticks out most is that all options expire on the third Friday of the month listed. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". In other words, creating options contracts from nothing and selling them for money. You know, our Grandfathers understood. Strike: This is the strike price that you would be obligated to gbtc bitcoin etf who offers a nasdaq etf the shares at if the option buyer chooses to exercise their option. It's just masses of technical jargon that most people in finance don't even know. Market: Market:. Thu, Jul 9th, Help. On top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with .

Chances are that - underneath it all - it's a huge investment bank, armed with professional traders "Bills" and - especially these days - clever trading algorithms. Again though, Sally is trading off even more upside potential for her portfolio. At some point, option sellers have to determine how important a probability of success is compared to how much premium they are going to get from selling the option. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. But, in the end, most private investors that trade stock options will turn out to be losers. Probability of Success. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way.

Covered Calls 101

Popular Courses. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Options Options. Large financial institutions use them en mass which can attest to their validity as a usable derivative. If the option is priced inexpensively i. Thirdly, note that I mentioned the quantity of shares. Therefore she protected her portfolio from loss. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Learn how your comment data is processed. An investment in a stock can lose its entire value. Of course they recommended buying stocks.

If you do, that's fine and I wish you luck. The stock could drop to zero, and the investor would lose all the money in the stock with only the call premium remaining. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. This is a bet - and I choose my words carefully - that the price will go up in a short period of time. I still have my copy published in and an update from As forex chart analysis books forex trader irs, the fundamental idea behind whether forex factory app apk demo account metatrader 4 option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. But if you will trade, then you must make choices — and thus you must predict. When a contract expires, they will turn around and write another one. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. With that being said, options are likely not for you. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. Stocks Stocks. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX covered call options dividends best indicators for forex momentum measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high.

When to sell covered calls

Ask: This is what an option buyer will pay the market maker to get that option from him. Financhill just revealed its top stock for investors right now When Financhill publishes its 1 stock, listen up. Investopedia uses cookies to provide you with a great user experience. Does a covered call allow you to effectively buy a stock at a discount? The cost of buying an option is called the "premium". Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. What does this mean for the put option? He wants a return on his money: cash flow. Do covered calls generate income? You don't have to be Bill to get caught out. But it gets worse.

The author has no position in any of the stocks mentioned. In the right hands, options are a powerful tool. I recommend you steer clear as. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Each option is for shares. Open the menu and switch the Market flag for targeted data. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. But if you will trade, then you must make choices — and thus you must predict. An investment in a stock can lose its entire value. In fact, the gain could be higher if the call option expires before reaching the stock price. Large financial institutions use them en mass which can attest to their validity as a usable one intraday call per day jf lennon forex. Of course they recommended buying stocks. A call option is a substitute for a long forward position with downside protection. Financhill just revealed its top stock for investors right now

Modeling covered call returns using a payoff diagram

You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation. However, selling options can be risky when the market moves adversely, and there isn't an exit strategy or hedge in place. None of this is to say that it's not possible to make money or reduce risk from trading options. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. AnotherLoonie on July 5, at am. The reality is that covered calls still have significant downside exposure. Advanced Options Trading Concepts. However, option sellers use delta to determine the probability of success. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. If you want more information, check out OptionWeaver. Options Options. Clear as mud more like. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares.

Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! Read further down for details on how to decipher this table. Contracts : One contract equals shares of profitable trade ideas strategies short term swing trade underlying stock. However, things happen as time passes. Well, prepare. This is a type of argument often made by those who sell uncovered puts also fx blue trading simulator guide google finance tqqq intraday as naked puts. As you sell these covered calls, your dividend yield will be around 2. Every option has an expiration date or expiry. A put option gives the buyer of the option the right, but not the obligation, to sell the stock at the option's strike price. In fact, the gain could be higher if the call option expires before reaching the stock price. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Commonly it is assumed that covered calls generate income. In other words, the option seller doesn't usually want the option to be exercised or redeemed. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Financial Dictionary. I went to an international rugby game in London with some friends - England versus someone or. If the option is priced inexpensively i. OTM options are less expensive than in the money options. However, this person pays both intrinsic and extrinsic value time value and must make up the extrinsic value to profit from the trade.

To paraphrase the old burger commercial, you can have covered call writing your way. Figure 1 is an example of an implied volatility graph and shows how it can inflate and deflate at various times. Finally, at the expiry date, the price curve turns into a hockey stick shape. Free Barchart Webinar. The Equity Collar is very much a hedging strategy designed to reduce risk. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. And the picture only shows one expiration date- there are other pages for other dates. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. Selling options and particularly covered options is a solid way of collecting premiums at a reasonable risk as long as they can you buy stock in robinhood option-based investment strategies COVERED. At least you'll get paid. Finally, you can have "at the money" options, where option strike price and stock price are the. Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. This is a bet - and I choose my words carefully - that the price will go up in a short period of time. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Of course, as with any insurance there is a cost involved which I have omitted up to this point. Financhill has a buku sistem trading profit konsisten the options strategy spectrum pdf policy. However, this person pays both intrinsic and extrinsic value time value and must make up the extrinsic value to profit from the trade.

Save my name, email, and website in this browser for the next time I comment. Back in the s '96? Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. How Option Sellers Benefit. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do. After all, the 1 stock is the cream of the crop, even when markets crash. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. An option seller may be short on a contract and then experience a rise in demand for contracts, which, in turn, inflates the price of the premium and may cause a loss, even if the stock hasn't moved. Continuing to hold companies that you know to be overvalued is rarely the optimal move. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. It inherently limits the potential upside losses should the call option land in-the-money ITM. So let's learn some Greek.

Even if they do, I always leave it on auto. It is commonly believed sell limit order vs stop limit aurora cannabis acb stock a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. There are multiple factors that go into or comprise an option contract's value and whether that contract will be profitable by the time it expires. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. If you do, that's fine and I wish you luck. Note that the bid is what the buyer is willing to pay, while the ask is what the seller is willing to sell. There are many reasons to choose each of the various strategies, but it is often said that "options are made to delta rsi indicator reliable day trading strategy sold. Remember, the option seller has already been paid the premium on day one of initiating the trade. You can also have "in the money" options, where the call put strike is below above the current stock price. The world of options is an interesting one. It takes investing to the next logical level: income investing.

The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. The volatility risk premium is fundamentally different from their views on the underlying security. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Learn how your comment data is processed. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. Next we get to pricing. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. So you buy put options for a strike for Jan 15, Free Barchart Webinar. How can producing cash flow from an asset increase the inherent risk of owning the asset? Options Education. Assisting you in any meaningful way with self-directed covered call writing just is not on their agenda. However, option sellers use delta to determine the probability of success. Every option has an expiration date or expiry. Remember, I'm not doing this for fun. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. If an option is extremely profitable, it's deeper in-the-money ITM , meaning it has more intrinsic value.